Académique Documents

Professionnel Documents

Culture Documents

202 Cases Partnership Dissolution

Transféré par

Anonymous LusWvyCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

202 Cases Partnership Dissolution

Transféré par

Anonymous LusWvyDroits d'auteur :

Formats disponibles

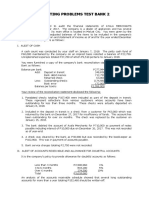

Accounting 202 (by RRDO)

PARTNERSHIP DISSOLUTION

Illustrative Cases: Supply what is required by the problem.

CASE 1 Comprehensive Problem. On January 1, 2016, Manuelo and Ingrid formed MI

partnership upon capital contribution of P12,000,000 and P8,000,000 respectively with capital

interest ratio of 3:7. Based on the articles of co-partnership, they agreed to bring their capital

balances in accordance with their capital interest ratio without the necessity of withdrawals or

additional investment because Ingrid contributed special skills. The articles of co-partnership

provides that profit or loss shall be distributed under the following terms:

40,000 monthly salary for Manuelo and 60,000 monthly salary for Ingrid.

The remainder on the basis of capital interest ratio.

For the year ended December 31,2016, the partnership reported net income of P500,000.

During 2016, the partners regularly withdraw 20% of their monthly salary.

On January 1, 2017, Lorna was admitted to the newly formed MIL partnership by paying

personally the partners in the amount of P6,000,000 for 20% of their capital interest. As a

result of the dissolution, the new MIL partnership fully amended the profit or loss agreement.

Lorna will have 20% share in the profit or loss while the original partners will share on the

remainder based on their original capital interest ratio.

For the year ended December 31, 2017, the partnership reported a net loss of P1,000,000.

Manuelo, Ingrid and Lorna made P200,000, P300,000, and P400,000 withdrawals,

respectively during 2017.

On January 1, 2018, Omiberto was admitted to the newly formed MILO Partnership by investing

P4,000,000 for 25% interest in the partnership. The new articles of co-partnership provides

that the new agreed capitalization should be P20,000,000. The profit or loss agreement was also

fully amended and will be in the ratio of 3:2:4:1 respectively for Manuelo, Ingrid, Lorna, and

Omiberto.

For the year ended December 31, 2018, the partnership reported net income of P2,000,000.

Manuelo, Ingrid, Lorna, and Omiberto made P500,000, P200,000, P300,000, and P400,000

withdrawals respectively.

On January 1, 2019, Ingrid retires from the partnership with the partnership paying P6,000,000

cash and a company car costing P5,000,000 in the books but has a fair value of P2,000,000.

REQUIRED: Journalize the transactions from 2016 to 2019.

CASE 2 Asset Revaluation and Bonus. Felicity (60%), Blissfulness (20%) and Happiness

(20%) are partners with present capital balances of P60,000, 72,000, and 24,000 respectively.

Gladness is to join the partnership upon contributing P72,000 to the partnership in exchange

for a 25% interest in capital and a 20% interest in profit and losses. The existing assets of the

original partnership are undervalued by 26,400. The original partners will share the balances of

profits and losses in proportion to their original percentages.

REQUIRED: What are the capital balances of the partners after the admission of Gladness?

Vous aimerez peut-être aussi

- Quiz - 5B 2Document3 pagesQuiz - 5B 2Jao FloresPas encore d'évaluation

- Ellen Company Cash Bank ReconciliationDocument8 pagesEllen Company Cash Bank ReconciliationShaine PacsonPas encore d'évaluation

- Chapter6 Matematika BusinessDocument17 pagesChapter6 Matematika BusinessKarlina DewiPas encore d'évaluation

- Statement of Comprehensive Income Part 2Document8 pagesStatement of Comprehensive Income Part 2AG VenturesPas encore d'évaluation

- Practical AccountingDocument13 pagesPractical AccountingDecereen Pineda RodriguezaPas encore d'évaluation

- Peer Quiz No.1: Partnership Formation: TotalDocument13 pagesPeer Quiz No.1: Partnership Formation: Totaldianel villaricoPas encore d'évaluation

- FAR2 CHAPTER 1 (PG 1-13)Document13 pagesFAR2 CHAPTER 1 (PG 1-13)Layla MainPas encore d'évaluation

- 06 - Bank Reconciliation - Problem SolvingDocument6 pages06 - Bank Reconciliation - Problem SolvingaragonkaycyPas encore d'évaluation

- Accounting - Inventory Test BankDocument3 pagesAccounting - Inventory Test BankAyesha RGPas encore d'évaluation

- Requirement: A New Set of Books Will Be Opened by The Partnership Roces' Books Sales' BooksDocument7 pagesRequirement: A New Set of Books Will Be Opened by The Partnership Roces' Books Sales' BooksJunzen Ralph YapPas encore d'évaluation

- Notes PayableDocument4 pagesNotes PayableShilla Mae BalancePas encore d'évaluation

- Home Office & Branch Accounting Problems SolvedDocument3 pagesHome Office & Branch Accounting Problems SolvedChristianAquinoPas encore d'évaluation

- Understanding Financial InstrumentsDocument11 pagesUnderstanding Financial InstrumentsMaria G. BernardinoPas encore d'évaluation

- Receivable Financing Qualifying Exam Review Sample QuestionsDocument4 pagesReceivable Financing Qualifying Exam Review Sample QuestionsHannah Jane Umbay0% (1)

- Chapt 4 Partnership Dissolution - Asset Revaluation & BonusDocument8 pagesChapt 4 Partnership Dissolution - Asset Revaluation & BonusDaenaPas encore d'évaluation

- PRELIM Chapter 9 10 11Document37 pagesPRELIM Chapter 9 10 11Bisag AsaPas encore d'évaluation

- Ia-Chap 4&5 SolutionsDocument18 pagesIa-Chap 4&5 SolutionsRoselyn IgartaPas encore d'évaluation

- (Solution Answers) Advanced Accounting by Dayag, Version 2017 - Chapter 1 (Partnership) - Answers On Multiple Choice Computation #21 To 25Document1 page(Solution Answers) Advanced Accounting by Dayag, Version 2017 - Chapter 1 (Partnership) - Answers On Multiple Choice Computation #21 To 25John Carlos DoringoPas encore d'évaluation

- MidtermsDocument8 pagesMidtermsRhea BadanaPas encore d'évaluation

- 06M Midterm Quiz No. 2 Income Tax On CorporationsDocument4 pages06M Midterm Quiz No. 2 Income Tax On CorporationsMarko IllustrisimoPas encore d'évaluation

- Discussion 2 CHAPDocument4 pagesDiscussion 2 CHAPHannah LegaspiPas encore d'évaluation

- Partnership FormationDocument3 pagesPartnership FormationJules AguilarPas encore d'évaluation

- Zabala Auto Supply General JournalDocument3 pagesZabala Auto Supply General JournalDavid Bermudez0% (1)

- Chapter 11 - Inventory Cost FlowDocument6 pagesChapter 11 - Inventory Cost FlowLorence IbañezPas encore d'évaluation

- Petty Cash and Cash Reconciliation ProblemsDocument9 pagesPetty Cash and Cash Reconciliation ProblemsKenncyPas encore d'évaluation

- Estimated Liabilities TQMDocument4 pagesEstimated Liabilities TQMA cPas encore d'évaluation

- Tigg Mortgage's Accrued Interest Receivable on $200K LoanDocument4 pagesTigg Mortgage's Accrued Interest Receivable on $200K LoanMelody BautistaPas encore d'évaluation

- Inventory Estimation Techniques and Financial Accounting TheoriesDocument3 pagesInventory Estimation Techniques and Financial Accounting TheoriesJorufel PapasinPas encore d'évaluation

- PROBLEMS - Partnership DissolutionDocument4 pagesPROBLEMS - Partnership DissolutionA. MagnoPas encore d'évaluation

- Cce Prob DiscussionDocument6 pagesCce Prob DiscussionTrazy Jam BagsicPas encore d'évaluation

- Proof of Cash SolutionsDocument4 pagesProof of Cash SolutionsyowatdafrickPas encore d'évaluation

- Answer Key Far Assessment Questionairre 1Document22 pagesAnswer Key Far Assessment Questionairre 1Johnfree VallinasPas encore d'évaluation

- Partnership Operations ProblemsDocument2 pagesPartnership Operations ProblemsAilene MendozaPas encore d'évaluation

- AC 3 - Intermediate Acctg' 1 (Ate Jan Ver)Document119 pagesAC 3 - Intermediate Acctg' 1 (Ate Jan Ver)John Renier Bernardo100% (1)

- Caltech Ventures Performance AgreementDocument3 pagesCaltech Ventures Performance AgreementAnita WilliamsPas encore d'évaluation

- Prequalifying ExaminationDocument7 pagesPrequalifying Examinationablay logenePas encore d'évaluation

- Cash and Cash EquivalentsDocument408 pagesCash and Cash EquivalentsJanea ArinyaPas encore d'évaluation

- AFAR06-01 Partnership AccountingDocument8 pagesAFAR06-01 Partnership AccountingEd MendozaPas encore d'évaluation

- FAR 103 ACCOUNTING FOR RECEIVABLES AND NOTES RECEIVABLE PDF PDFDocument4 pagesFAR 103 ACCOUNTING FOR RECEIVABLES AND NOTES RECEIVABLE PDF PDFvhhhPas encore d'évaluation

- Expenditures: V-Audit of Property, Plant and EquipmentDocument24 pagesExpenditures: V-Audit of Property, Plant and EquipmentKirstine DelegenciaPas encore d'évaluation

- 1 Cash and Cash EquivalentsDocument3 pages1 Cash and Cash EquivalentsJohn Aries Reyes100% (1)

- SimexDocument3 pagesSimexRoland Ron BantilanPas encore d'évaluation

- Exercise - Estate Tax 2Document2 pagesExercise - Estate Tax 2Mark Edgar De GuzmanPas encore d'évaluation

- TAX-304 (VAT Compliance Requirements)Document5 pagesTAX-304 (VAT Compliance Requirements)Edith DalidaPas encore d'évaluation

- Problem Set 2Document4 pagesProblem Set 2Michael Jay LingerasPas encore d'évaluation

- Computation For Formation of PartnershipDocument10 pagesComputation For Formation of PartnershipErille Julianne (Rielianne)Pas encore d'évaluation

- Attestation vs Advisory Services: Key DifferencesDocument11 pagesAttestation vs Advisory Services: Key DifferencesKrizza TerradoPas encore d'évaluation

- Cash and Cash Equivalent LatestDocument54 pagesCash and Cash Equivalent LatestSafe PlacePas encore d'évaluation

- Chapter 1&2 Introduction To Business Taxes & Vat On Sale of Goods or PropertiesDocument6 pagesChapter 1&2 Introduction To Business Taxes & Vat On Sale of Goods or PropertiesBSA3Tagum Marilet100% (1)

- Management Advisory Services - FinalDocument8 pagesManagement Advisory Services - FinalFrancis MateosPas encore d'évaluation

- CAE 10 CG Strategic Cost ManagementDocument23 pagesCAE 10 CG Strategic Cost ManagementAmie Jane MirandaPas encore d'évaluation

- Financial Statement Analysis Group Exercise: InstructionsDocument1 pageFinancial Statement Analysis Group Exercise: InstructionsMARY ACOSTAPas encore d'évaluation

- Activity 2Document3 pagesActivity 2kathie alegarmePas encore d'évaluation

- Cash & Cash EquivalentsDocument5 pagesCash & Cash EquivalentsJenna BanganPas encore d'évaluation

- EXAM About INTANGIBLE ASSETS 2Document3 pagesEXAM About INTANGIBLE ASSETS 2BLACKPINKLisaRoseJisooJenniePas encore d'évaluation

- ACC 106 Intermediate Accounting 1 Cash and Cash EquivalentsDocument12 pagesACC 106 Intermediate Accounting 1 Cash and Cash Equivalentshello milliePas encore d'évaluation

- FINACC-Homework Exercise 2Document3 pagesFINACC-Homework Exercise 2Jomel BaptistaPas encore d'évaluation

- Understanding The SelfDocument9 pagesUnderstanding The SelfNatalie SerranoPas encore d'évaluation

- Partnership Operations Enabling AssessmentDocument3 pagesPartnership Operations Enabling AssessmentVon Andrei MedinaPas encore d'évaluation

- Partnership Operations Enabling AssessmentDocument6 pagesPartnership Operations Enabling AssessmentVon Andrei MedinaPas encore d'évaluation

- Identifying Types of VariablesDocument5 pagesIdentifying Types of VariablesAnonymous LusWvyPas encore d'évaluation

- Cash and Cash Equivalents Sample ProblemsDocument6 pagesCash and Cash Equivalents Sample ProblemsAmabie De Chavez50% (2)

- ADocument1 pageAAnonymous LusWvyPas encore d'évaluation

- BagoboDocument1 pageBagoboAnonymous LusWvyPas encore d'évaluation

- APC Ch11sol.2014Document5 pagesAPC Ch11sol.2014Anonymous LusWvyPas encore d'évaluation

- APC Ch5solDocument7 pagesAPC Ch5solAnonymous LusWvy0% (3)

- Auditing Problems Test Bank 2Document15 pagesAuditing Problems Test Bank 2Mark Jonah Bachao80% (5)

- CHAPTER 7 - Products, Services and BrandsDocument58 pagesCHAPTER 7 - Products, Services and BrandsAnonymous LusWvyPas encore d'évaluation

- Auditing Theory Test BankDocument32 pagesAuditing Theory Test BankJane Estrada100% (2)

- APC Ch6solDocument22 pagesAPC Ch6solAnonymous LusWvy100% (8)

- The Binomial DistributionDocument19 pagesThe Binomial DistributionK Kunal RajPas encore d'évaluation

- Intext CitationDocument3 pagesIntext CitationAnonymous LusWvyPas encore d'évaluation

- Share Capital Transactions and CalculationsDocument9 pagesShare Capital Transactions and CalculationsAnonymous LusWvy0% (1)

- Partnership and Corp - Ch12solman.2011Document16 pagesPartnership and Corp - Ch12solman.2011Shealalyn1Pas encore d'évaluation

- APC Ch1solDocument7 pagesAPC Ch1solAnonymous LusWvyPas encore d'évaluation

- 4.5.2.2 Final Report of Bagobo DavaoDocument108 pages4.5.2.2 Final Report of Bagobo DavaoAnonymous LusWvyPas encore d'évaluation

- Econ Problem PracticeDocument5 pagesEcon Problem PracticeAnonymous LusWvy100% (2)

- Chapter 2 Multiple Choice Answers and SolutionsDocument25 pagesChapter 2 Multiple Choice Answers and SolutionsMendoza KlarisePas encore d'évaluation

- Partnership Accounting GuideDocument34 pagesPartnership Accounting Guideايهاب غزالةPas encore d'évaluation

- When He Who Demands Rescission Can Return Whatever He May Be Obliged To RestoreDocument3 pagesWhen He Who Demands Rescission Can Return Whatever He May Be Obliged To RestoreAnonymous LusWvyPas encore d'évaluation

- Moor, The - Nature - Importance - and - Difficulty - of - Machine - EthicsDocument4 pagesMoor, The - Nature - Importance - and - Difficulty - of - Machine - EthicsIrene IturraldePas encore d'évaluation

- Unit-1: Introduction: Question BankDocument12 pagesUnit-1: Introduction: Question BankAmit BharadwajPas encore d'évaluation

- "Behind The Times: A Look at America's Favorite Crossword," by Helene HovanecDocument5 pages"Behind The Times: A Look at America's Favorite Crossword," by Helene HovanecpspuzzlesPas encore d'évaluation

- GIS Multi-Criteria Analysis by Ordered Weighted Averaging (OWA) : Toward An Integrated Citrus Management StrategyDocument17 pagesGIS Multi-Criteria Analysis by Ordered Weighted Averaging (OWA) : Toward An Integrated Citrus Management StrategyJames DeanPas encore d'évaluation

- BPL Millipacs 2mm Hardmetrics RarDocument3 pagesBPL Millipacs 2mm Hardmetrics RarGunter BragaPas encore d'évaluation

- Dole-Oshc Tower Crane Inspection ReportDocument6 pagesDole-Oshc Tower Crane Inspection ReportDaryl HernandezPas encore d'évaluation

- National Standard Examination in Astronomy 2018-19 (NSEA) : Question Paper Code: A423Document1 pageNational Standard Examination in Astronomy 2018-19 (NSEA) : Question Paper Code: A423VASU JAINPas encore d'évaluation

- 15142800Document16 pages15142800Sanjeev PradhanPas encore d'évaluation

- 08 Sepam - Understand Sepam Control LogicDocument20 pages08 Sepam - Understand Sepam Control LogicThức Võ100% (1)

- Biology Mapping GuideDocument28 pagesBiology Mapping GuideGazar100% (1)

- Main Research PaperDocument11 pagesMain Research PaperBharat DedhiaPas encore d'évaluation

- 20 Ua412s en 2.0 V1.16 EagDocument122 pages20 Ua412s en 2.0 V1.16 Eagxie samPas encore d'évaluation

- 4 Wheel ThunderDocument9 pages4 Wheel ThunderOlga Lucia Zapata SavaressePas encore d'évaluation

- Chennai Metro Rail BoQ for Tunnel WorksDocument6 pagesChennai Metro Rail BoQ for Tunnel WorksDEBASIS BARMANPas encore d'évaluation

- Reflection Homophone 2Document3 pagesReflection Homophone 2api-356065858Pas encore d'évaluation

- Report Emerging TechnologiesDocument97 pagesReport Emerging Technologiesa10b11Pas encore d'évaluation

- Passenger E-Ticket: Booking DetailsDocument1 pagePassenger E-Ticket: Booking Detailsvarun.agarwalPas encore d'évaluation

- Logic and Set Theory PropositionDocument3 pagesLogic and Set Theory PropositionVince OjedaPas encore d'évaluation

- Onan Service Manual MDJA MDJB MDJC MDJE MDJF Marine Diesel Genset Engines 974-0750Document92 pagesOnan Service Manual MDJA MDJB MDJC MDJE MDJF Marine Diesel Genset Engines 974-0750GreenMountainGenerators80% (10)

- Origins and Rise of the Elite Janissary CorpsDocument11 pagesOrigins and Rise of the Elite Janissary CorpsScottie GreenPas encore d'évaluation

- GATE ECE 2006 Actual PaperDocument33 pagesGATE ECE 2006 Actual Paperkibrom atsbhaPas encore d'évaluation

- ServiceDocument47 pagesServiceMarko KoširPas encore d'évaluation

- Philippine Coastal Management Guidebook Series No. 8Document182 pagesPhilippine Coastal Management Guidebook Series No. 8Carl100% (1)

- Last Clean ExceptionDocument24 pagesLast Clean Exceptionbeom choiPas encore d'évaluation

- 2023 Test Series-1Document2 pages2023 Test Series-1Touheed AhmadPas encore d'évaluation

- Audit Acq Pay Cycle & InventoryDocument39 pagesAudit Acq Pay Cycle & InventoryVianney Claire RabePas encore d'évaluation

- International Certificate in WealthDocument388 pagesInternational Certificate in Wealthabhishek210585100% (2)

- Table of Specification for Pig Farming SkillsDocument7 pagesTable of Specification for Pig Farming SkillsYeng YengPas encore d'évaluation

- DLL - The Firm and Its EnvironmentDocument5 pagesDLL - The Firm and Its Environmentfrances_peña_7100% (2)

- Guiding Childrens Social Development and Learning 8th Edition Kostelnik Test BankDocument16 pagesGuiding Childrens Social Development and Learning 8th Edition Kostelnik Test Bankoglepogy5kobgk100% (27)