Académique Documents

Professionnel Documents

Culture Documents

Basic Accounting Tutorials

Transféré par

Jasper Andrew AdjaraniCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Basic Accounting Tutorials

Transféré par

Jasper Andrew AdjaraniDroits d'auteur :

Formats disponibles

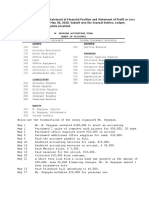

Basic Accounting

Comprehensive Problem II

After considering the costs and benefits of your options, you finally decided to quit school and establish

your own business. You have entered into the following transactions from January 1 to March 31, 2015:

Jan. 1 Invested P455,000 cash and your personal computer worth P45,000 in your business. The

computer has a useful life of 3 years.

Jan. 1 Loaned P250,000 cash from the bank with your house as collateral. 2% annual interest will be

charged by the bank on this loan arrangement. The first interest payment is due on December

31 of this year.

Jan. 1 Purchased land for P230,000, paying 60% cash and the balance by issuing a note payable.

Jan. 1 Bought an equipment costing P50,000 for cash. You have ascertained that the equipment has a

useful life of 4 years and a salvage value of 10% of its cost.

Jan. 1 Hired 10 persons as your personal staff in your business. Each employee is entitled to P7,000

monthly salary.

Jan. 1 Purchased supplies worth P15,000 on account. The supplies are good for one year.

Jan. 15 Rendered services to your clients for P200,000. Your clients paid half the amount and the other

half was on account.

Jan. 15 Paid the mid-month salaries of your employees.

Jan. 31 Purchased a two-year insurance policy for P20,000.

Jan. 31 Accrued the month-end salaries of your employees to be paid in 3 days.

Feb. 2 Collected 40% of the balance from your customers on the services rendered on January 15.

Feb. 3 Paid the accrued salaries from last month.

Feb. 5 Paid the balance of the note payable that you issued to acquire the land on January 1.

Feb. 7 Rendered services to your clients for P80,000 on account. On the same day, one of your clients

gave you P3,000 in advance for services to be rendered next month.

Feb. 10 Paid your suppliers for the supplies purchased on January 1.

Feb. 15 Paid the mid-month salaries of your employees.

Feb. 20 Paid administrative expenses totaling P80,000.

Feb. 27 Collected the following from your customers: (1) the balance for the services rendered on

January 15, and (2) 50,000 on the services rendered on February 7.

Feb. 28 Accrued the month-end salaries of your employees to be paid in 2 days.

Mar. 1 One of your friends borrowed money from your business amounting to P35,000 to be paid

exactly one year from this date. You agreed to charge 5% annual interest to your friend.

Interest is payable every month-end.

Mar. 2 Paid the accrued salaries from the previous month.

Mar. 7 Rendered the services to the client who paid you in advance last month. An extra P1,000 was

billed and collected on the same day.

Mar. 10 Rendered services to your clients for P75,000 cash.

Mar. 15 Purchased a delivery truck for P80,000 cash. The delivery truck has a useful life of 10 years.

Mar. 15 Paid the mid-month salaries of your employees.

Mar. 28 Received P8,000 from a client as payment for services to be rendered next month.

Mar. 29 Paid administrative expenses totaling P60,000.

Mar. 31 Accrued the month-end salaries of your employees to be paid in 5 days.

Mar. 31 Collected interest from your friend who borrowed money from your business.

Mar. 31 Withdrew P10,000 from your business for personal use.

Using your basic accounting knowledge, do the following on separate sheets of paper and on a 10-

column worksheet:

1. Prepare the journal entries to record the aforementioned transactions.

2. Post the journal entries on the ledger accounts and obtain the balances of each account.

3. Prepare the unadjusted trial balance.

4. Prepare the necessary adjusting entries and the adjusted trial balance.

5. Prepare the income statement.

6. Prepare the closing entries to close the nominal accounts.

7. Prepare the balance sheet.

Prepared by: JACA

Vous aimerez peut-être aussi

- Indian Horary Shatpanchashika VAKAyer PDFDocument46 pagesIndian Horary Shatpanchashika VAKAyer PDFSunPas encore d'évaluation

- Petition For Habeas Corpus PleadingDocument4 pagesPetition For Habeas Corpus PleadingRaePas encore d'évaluation

- Philippine Financial Reporting Standards 1Document4 pagesPhilippine Financial Reporting Standards 1Ricky MadrasoPas encore d'évaluation

- How To Post Bail For Your Temporary Liberty?Document5 pagesHow To Post Bail For Your Temporary Liberty?Ruel Benjamin Bernaldez100% (1)

- Sample Financial Management ProblemsDocument8 pagesSample Financial Management ProblemsJasper Andrew AdjaraniPas encore d'évaluation

- Maple Tree Accessory ShopDocument6 pagesMaple Tree Accessory ShopJasper Andrew Adjarani80% (5)

- Comprehensive Problem - Merchandising BusinessDocument1 pageComprehensive Problem - Merchandising BusinessJasper Andrew Adjarani80% (5)

- Types of Business in The PhilippinesDocument6 pagesTypes of Business in The PhilippinesBelle JizPas encore d'évaluation

- Rmyc Cup 1 Addtl QuestionsDocument15 pagesRmyc Cup 1 Addtl QuestionsJasper Andrew AdjaraniPas encore d'évaluation

- Financial Management LectureDocument14 pagesFinancial Management LectureJasper Andrew AdjaraniPas encore d'évaluation

- Engagement Letter (Coop)Document2 pagesEngagement Letter (Coop)Jasper Andrew Adjarani100% (1)

- MS Review 1Document5 pagesMS Review 1KIM RAGAPas encore d'évaluation

- Gen. Math. Periodical Exam. 2nd QuarterDocument4 pagesGen. Math. Periodical Exam. 2nd Quarterhogmc media100% (1)

- Management Science: Course Code: 13HM1102 L TPC 4 0 0 3Document2 pagesManagement Science: Course Code: 13HM1102 L TPC 4 0 0 3Praveen PvsmPas encore d'évaluation

- Lorenzo M. Tañada Vs - Hon. Juan C. Tuvera G.R. No. L-63915 April 24, 1985Document1 pageLorenzo M. Tañada Vs - Hon. Juan C. Tuvera G.R. No. L-63915 April 24, 1985LouPas encore d'évaluation

- Audit and Assurance Concept and Application Chapter 1Document12 pagesAudit and Assurance Concept and Application Chapter 1Ceejay FrillartePas encore d'évaluation

- Inventory List SubmissionDocument2 pagesInventory List SubmissionLevi Lazareno EugenioPas encore d'évaluation

- DIGEST - Sitel Philippines Corp. v. CIRDocument3 pagesDIGEST - Sitel Philippines Corp. v. CIRAgatha ApolinarioPas encore d'évaluation

- Hiring List FGDocument6 pagesHiring List FGFaisal Aziz Malghani100% (1)

- Liabilities 1 For Intermediate Accounting 2Document24 pagesLiabilities 1 For Intermediate Accounting 2Barredo, Joanna M.Pas encore d'évaluation

- Tax Alert (December 2020)Document10 pagesTax Alert (December 2020)Rheneir MoraPas encore d'évaluation

- Statement of MGT Responsibility ITRDocument1 pageStatement of MGT Responsibility ITRJasper Andrew AdjaraniPas encore d'évaluation

- Philpotts vs. Philippine Manufacturing Co. and Berry FactsDocument2 pagesPhilpotts vs. Philippine Manufacturing Co. and Berry Factswmovies18Pas encore d'évaluation

- Chapter 3 - The Government ProcessDocument48 pagesChapter 3 - The Government ProcessJoyce CandelariaPas encore d'évaluation

- Malbarosa v. CADocument18 pagesMalbarosa v. CAslashPas encore d'évaluation

- Trustees CertificateDocument1 pageTrustees CertificateJasper Andrew Adjarani100% (1)

- Why Do We Need AccountingDocument4 pagesWhy Do We Need Accountinglaxmi300Pas encore d'évaluation

- Formula of Cash Flow Direct MethodDocument2 pagesFormula of Cash Flow Direct MethodAshiq HossainPas encore d'évaluation

- Benguet Corporation vs. Central Board of Assessment Appeal (GR No. 106041, January 29,1993)Document4 pagesBenguet Corporation vs. Central Board of Assessment Appeal (GR No. 106041, January 29,1993)Kimberly SendinPas encore d'évaluation

- Code of Corporate Governance For Publicly Listed CompaniesDocument7 pagesCode of Corporate Governance For Publicly Listed CompaniesJoyce Cagayat100% (1)

- RPA For FinanceDocument17 pagesRPA For FinanceHakki ArpaciogluPas encore d'évaluation

- Diversity and Inclusion (PPT Outline)Document5 pagesDiversity and Inclusion (PPT Outline)Jasper Andrew AdjaraniPas encore d'évaluation

- Usage of Word SalafDocument33 pagesUsage of Word Salafnone0099Pas encore d'évaluation

- Ricarze vs. Court of Appeals, 515 SCRA 302, G.R. No. 160451 February 9, 2007Document22 pagesRicarze vs. Court of Appeals, 515 SCRA 302, G.R. No. 160451 February 9, 2007Lester AgoncilloPas encore d'évaluation

- Accounting Practice ExercisesDocument2 pagesAccounting Practice ExercisesRussell FernandezPas encore d'évaluation

- B.H. Berkenkotter v. Cu Unjieng, 61 Phil 663Document3 pagesB.H. Berkenkotter v. Cu Unjieng, 61 Phil 663Sandra SEPas encore d'évaluation

- Hitt Chapter 1Document21 pagesHitt Chapter 1Ami KallalPas encore d'évaluation

- Opinion LetterDocument3 pagesOpinion LetterCher MadridPas encore d'évaluation

- SMR - ItrDocument1 pageSMR - ItrJasper Andrew AdjaraniPas encore d'évaluation

- Gacad vs. ClapisDocument1 pageGacad vs. ClapismwaikePas encore d'évaluation

- Diversity and InclusionDocument23 pagesDiversity and InclusionJasper Andrew Adjarani83% (6)

- Azucena Labor Case DigestDocument37 pagesAzucena Labor Case DigestCarlMarkInopiaPas encore d'évaluation

- Benin vs. Tuason, 57 SCRA 531Document3 pagesBenin vs. Tuason, 57 SCRA 531May RMPas encore d'évaluation

- Teehankee V MadayagDocument2 pagesTeehankee V MadayagsyhyyhPas encore d'évaluation

- PPSAS 32 - Service Concession Oct - 18 2013Document3 pagesPPSAS 32 - Service Concession Oct - 18 2013Ingrid CaobleclolalPas encore d'évaluation

- Tax2 - Estate TaxDocument29 pagesTax2 - Estate TaxMelady Sison CequeñaPas encore d'évaluation

- CONFRASDocument68 pagesCONFRASLorraine Mae RobridoPas encore d'évaluation

- Updates From The PRBoADocument68 pagesUpdates From The PRBoAJofritz VallePas encore d'évaluation

- NFCCDocument4 pagesNFCCShaunPlays GamesPas encore d'évaluation

- RVRCOB Course Checklist 113Document32 pagesRVRCOB Course Checklist 113Bettina MangubatPas encore d'évaluation

- G.R. No. 131457Document11 pagesG.R. No. 131457Bianca BncPas encore d'évaluation

- RMC No. 77-2008Document3 pagesRMC No. 77-2008James Susuki100% (1)

- Module 2 CatapusanDocument215 pagesModule 2 CatapusanPau SaulPas encore d'évaluation

- New Tax Rates (TRAIN LAW) PDFDocument1 pageNew Tax Rates (TRAIN LAW) PDFphoebemariealhambra1475Pas encore d'évaluation

- Statement of ManagementDocument7 pagesStatement of ManagementlorrainePas encore d'évaluation

- QB 2015 CH 1 Lecture - Introduction To QuickBooks and Company FilesDocument102 pagesQB 2015 CH 1 Lecture - Introduction To QuickBooks and Company FilesFadi Alshiyab100% (1)

- Application FormDocument2 pagesApplication FormJulius Espiga ElmedorialPas encore d'évaluation

- RMC 35-06Document18 pagesRMC 35-06Aris Basco DuroyPas encore d'évaluation

- Accounting DictionaryDocument11 pagesAccounting DictionaryKhan MohammadPas encore d'évaluation

- Computerized Accounting SystemDocument12 pagesComputerized Accounting SystemBernadette LlanetaPas encore d'évaluation

- Financial Accounting 1 Course OutlineDocument3 pagesFinancial Accounting 1 Course Outlinexandercage100% (1)

- Bersamin Dicta in Disini v. Sandiganbayan PDFDocument28 pagesBersamin Dicta in Disini v. Sandiganbayan PDFirwinarielmielPas encore d'évaluation

- Digest All Cases From Reliable SourceDocument10 pagesDigest All Cases From Reliable SourceJasper PelayoPas encore d'évaluation

- Azarcon. Balanay. Dumapias. Hipolito. Lubay. Zaragoza - Non-Stock Corporations & Close CorporationsDocument14 pagesAzarcon. Balanay. Dumapias. Hipolito. Lubay. Zaragoza - Non-Stock Corporations & Close CorporationsAnonymous Egm4bfnFkiPas encore d'évaluation

- Shareholders' EquityDocument6 pagesShareholders' EquityralphalonzoPas encore d'évaluation

- Manual On Financial Manager of Barangays Module 3Document11 pagesManual On Financial Manager of Barangays Module 3vicsPas encore d'évaluation

- ITAD BIR RULING NO. 026-18, March 5, 2018Document10 pagesITAD BIR RULING NO. 026-18, March 5, 2018Kriszan ManiponPas encore d'évaluation

- VAT ExercisesDocument3 pagesVAT ExercisesMarie Tes LocsinPas encore d'évaluation

- Law On Obligations and ContractDocument14 pagesLaw On Obligations and ContractJaselle SanchezPas encore d'évaluation

- People v. VeraDocument3 pagesPeople v. VeraJastine Mae DugayoPas encore d'évaluation

- Taxation Review Course Syllabus PDFDocument21 pagesTaxation Review Course Syllabus PDFJordan ChavezPas encore d'évaluation

- Be It Enacted by The National Assembly of The PhilippinesDocument7 pagesBe It Enacted by The National Assembly of The PhilippinesLevi L. BinamiraPas encore d'évaluation

- Tax 1 Cases - Government Remedies Batch 2Document24 pagesTax 1 Cases - Government Remedies Batch 2Krissie GuevaraPas encore d'évaluation

- Labor Standards SSS CasesDocument77 pagesLabor Standards SSS CasesCharenz Santiago SantiagoPas encore d'évaluation

- Revalida - Fria - 2. Viva Shipping Lines Vs Keppel PhilippinesDocument4 pagesRevalida - Fria - 2. Viva Shipping Lines Vs Keppel PhilippinesACPas encore d'évaluation

- PCU 2018 Criminal Law ReviewerDocument22 pagesPCU 2018 Criminal Law ReviewerSJ LiminPas encore d'évaluation

- Business CorrespondenceDocument58 pagesBusiness CorrespondenceCarllee ManaloPas encore d'évaluation

- Sidel RulingDocument6 pagesSidel RulingMarc Exequiel TeodoroPas encore d'évaluation

- ACCOUNTING 101 - No.2 - ProblemsDocument2 pagesACCOUNTING 101 - No.2 - ProblemslemerlePas encore d'évaluation

- Merchandising Bus Prub Periodic MethodDocument2 pagesMerchandising Bus Prub Periodic MethodChristopher Keith BernidoPas encore d'évaluation

- ABM2 ProjectDocument2 pagesABM2 ProjectJR pristoPas encore d'évaluation

- Max S Group Inc PSE MAXS FinancialsDocument36 pagesMax S Group Inc PSE MAXS FinancialsJasper Andrew AdjaraniPas encore d'évaluation

- DOLE (3!8!19) - ComputationDocument5 pagesDOLE (3!8!19) - ComputationJasper Andrew AdjaraniPas encore d'évaluation

- Jollibee Foods Corporation PSE JFC FinancialsDocument38 pagesJollibee Foods Corporation PSE JFC FinancialsJasper Andrew AdjaraniPas encore d'évaluation

- SEED Seminar - Program FlowDocument1 pageSEED Seminar - Program FlowJasper Andrew AdjaraniPas encore d'évaluation

- Acknowledgment ReceiptDocument1 pageAcknowledgment ReceiptJasper Andrew AdjaraniPas encore d'évaluation

- Case Answer: Nordic Foot BridgeDocument3 pagesCase Answer: Nordic Foot BridgeJasper Andrew Adjarani100% (1)

- Authorization LetterDocument1 pageAuthorization LetterJasper Andrew AdjaraniPas encore d'évaluation

- Chap 4 Report - Demand EstimationDocument24 pagesChap 4 Report - Demand EstimationJasper Andrew AdjaraniPas encore d'évaluation

- Key Performance Indicators To Track Smart VillagesDocument1 pageKey Performance Indicators To Track Smart VillagesJasper Andrew AdjaraniPas encore d'évaluation

- I. Problem: Lapses in CommunicationDocument2 pagesI. Problem: Lapses in CommunicationJasper Andrew AdjaraniPas encore d'évaluation

- RMYC Cup 2 - RevDocument9 pagesRMYC Cup 2 - RevJasper Andrew AdjaraniPas encore d'évaluation

- Workshop - Financial ReportingDocument1 pageWorkshop - Financial ReportingJasper Andrew AdjaraniPas encore d'évaluation

- Case 2 - Mr. AranetaDocument3 pagesCase 2 - Mr. AranetaJasper Andrew AdjaraniPas encore d'évaluation

- Case 1 - Mr. ReyesDocument3 pagesCase 1 - Mr. ReyesJasper Andrew AdjaraniPas encore d'évaluation

- 442 MCAdam WAC FinalDocument11 pages442 MCAdam WAC FinalJasper Andrew Adjarani100% (16)

- Strategic Goals:: Social DevelopmentDocument4 pagesStrategic Goals:: Social DevelopmentJasper Andrew AdjaraniPas encore d'évaluation

- Appreciative Inquiry: "Asking The Right Questions "Document26 pagesAppreciative Inquiry: "Asking The Right Questions "Jasper Andrew AdjaraniPas encore d'évaluation

- Autocorp Case Analysis (Final)Document3 pagesAutocorp Case Analysis (Final)Jasper Andrew AdjaraniPas encore d'évaluation

- Acctg630 - ICMA 1st Sem SY2013-14 - With AnswerDocument35 pagesAcctg630 - ICMA 1st Sem SY2013-14 - With AnswerJasper Andrew AdjaraniPas encore d'évaluation

- People v. Taperla Case DigestDocument2 pagesPeople v. Taperla Case DigestStef BernardoPas encore d'évaluation

- Part 1: An Old Question Asked Anew: Francis FukuyamaDocument3 pagesPart 1: An Old Question Asked Anew: Francis FukuyamaLola LolaPas encore d'évaluation

- Trans PenaDocument3 pagesTrans Penavivi putriPas encore d'évaluation

- The Three Stages of PreservationDocument2 pagesThe Three Stages of PreservationQazi Saad100% (2)

- Pains of Imprisonment: University of Oslo, NorwayDocument5 pagesPains of Imprisonment: University of Oslo, NorwayFady SamyPas encore d'évaluation

- Understanding Construction Insurance Rates and PremiumsDocument4 pagesUnderstanding Construction Insurance Rates and PremiumsBRGRPas encore d'évaluation

- Cimpor 2009 Annual ReportDocument296 pagesCimpor 2009 Annual Reportrlshipgx1314Pas encore d'évaluation

- Assignment 1Document3 pagesAssignment 1Anirban ChaudhuryPas encore d'évaluation

- Static Banking by StudynitiDocument80 pagesStatic Banking by StudynitiSaurabh SinghPas encore d'évaluation

- 43146039dft-Notifying FDA of A Discontinuance or Interruption in ManufacturingDocument17 pages43146039dft-Notifying FDA of A Discontinuance or Interruption in Manufacturingdrs_mdu48Pas encore d'évaluation

- Persons and Family Relationship Assign CasesDocument6 pagesPersons and Family Relationship Assign Casessheridan DientePas encore d'évaluation

- EJP Resolutionsheft NAS Wiesbaden 2017Document32 pagesEJP Resolutionsheft NAS Wiesbaden 2017margriet1971Pas encore d'évaluation

- Louis Noronha: EducationDocument2 pagesLouis Noronha: EducationLouis NoronhaPas encore d'évaluation

- 8e Daft Chapter 06Document24 pages8e Daft Chapter 06krutikdoshiPas encore d'évaluation

- 2014 Texas Staar Test - End of Course - English IDocument69 pages2014 Texas Staar Test - End of Course - English IManeet MathurPas encore d'évaluation

- 2013 E.C Grade 12 History Model ExaminationDocument34 pages2013 E.C Grade 12 History Model ExaminationErmiasPas encore d'évaluation

- NATO's Decision-Making ProcedureDocument6 pagesNATO's Decision-Making Procedurevidovdan9852100% (1)

- America The Story of Us Episode 3 Westward WorksheetDocument1 pageAmerica The Story of Us Episode 3 Westward WorksheetHugh Fox III100% (1)

- Tendernotice 1Document4 pagesTendernotice 1alokPas encore d'évaluation