Académique Documents

Professionnel Documents

Culture Documents

Tax Digest (Manila Gas)

Transféré par

Cass Catalo0 évaluation0% ont trouvé ce document utile (0 vote)

390 vues1 pageThis case involves Manila Gas Corporation challenging taxes withheld on interest payments made to foreign corporations. The Collector of Internal Revenue withheld taxes on interest payments to non-resident corporations, citing authority under the Income Tax Law. The court upheld the Collector's actions, finding that income derived from sources within the Philippines is subject to taxation, even if the interest payments were delivered outside the country. As the earnings came from Manila Gas Corporation's operations within Philippines, the court affirmed that the source, or origin, of the income was within the Philippines, justifying withholding of income taxes.

Description originale:

Tax Digest

Copyright

© © All Rights Reserved

Formats disponibles

DOCX, PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentThis case involves Manila Gas Corporation challenging taxes withheld on interest payments made to foreign corporations. The Collector of Internal Revenue withheld taxes on interest payments to non-resident corporations, citing authority under the Income Tax Law. The court upheld the Collector's actions, finding that income derived from sources within the Philippines is subject to taxation, even if the interest payments were delivered outside the country. As the earnings came from Manila Gas Corporation's operations within Philippines, the court affirmed that the source, or origin, of the income was within the Philippines, justifying withholding of income taxes.

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme DOCX, PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

390 vues1 pageTax Digest (Manila Gas)

Transféré par

Cass CataloThis case involves Manila Gas Corporation challenging taxes withheld on interest payments made to foreign corporations. The Collector of Internal Revenue withheld taxes on interest payments to non-resident corporations, citing authority under the Income Tax Law. The court upheld the Collector's actions, finding that income derived from sources within the Philippines is subject to taxation, even if the interest payments were delivered outside the country. As the earnings came from Manila Gas Corporation's operations within Philippines, the court affirmed that the source, or origin, of the income was within the Philippines, justifying withholding of income taxes.

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme DOCX, PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 1

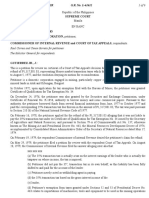

D.

Territoriality of Situs of Taxation withholding income taxes on interest on

Manila Gas vs. Collector bonds and other indebtedness paid to non-

62 Phil 895 resident corporations because this income

was received from sources within the

FACTS: Philippine Islands as authorized by the

This is an action brought by the Manila Gas Income Tax Law.

Corporation against the Collector of Internal

Revenue for the recovery of P56,757.37, which

the plaintiff was required by the defendant to

deduct and withhold from the various sums

paid it to foreign corporations as dividends

and interest on bonds and other indebtedness

and which the plaintiff paid under protest.

ISSUES: Won the Collector of Internal Revenue

was justified in withholding income taxes on

interest on bonds and other indebtedness

paid to nonresident corporations

HELD: YES. The approved doctrine is that no

state may tax anything not within its

jurisdiction without violating the due process

clause of the constitution. The taxing power of

a state does not extend beyond its territorial

limits, but within such it may tax persons,

property, income, or business. If an interest in

property is taxed, the situs of either the

property or interest must be found within the

state. If an income is taxed, the recipient

thereof must have a domicile within the state

or the property or business out of which the

income issues must be situated within the

state so that the income may be said to have a

situs therein. Personal property may be

separated from its owner, and he may be taxed

on its account at the place where the property

is although it is not the place of his own

domicile and even though he is not a citizen or

resident of the state which imposes the tax.

But debts owing by corporations are

obligations of the debtors, and only possess

value in the hands of the creditors. The Manila

Gas Corporation operates its business entirely

within the Philippines. Its earnings, therefore

come from local sources. The place of material

delivery of the interest to the foreign

corporations paid out of the revenue of the

domestic corporation is of no particular

moment. The place of payment even if

conceded to be outside of the country cannot

alter the fact that the income was derived

from the Philippines. The word "source"

conveys only one idea, that of origin, and the

origin of the income was the Philippines. The

Collector of Internal Revenue was justified in

Vous aimerez peut-être aussi

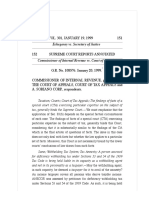

- CIR vs. ENRON Subic Power Corp, GR No. 166368, January 19, 2009Document2 pagesCIR vs. ENRON Subic Power Corp, GR No. 166368, January 19, 2009Aldrin TangPas encore d'évaluation

- U.S. Individual Income Tax Return: Filing StatusDocument3 pagesU.S. Individual Income Tax Return: Filing StatuspyatetskyPas encore d'évaluation

- Tax Case DigestsDocument116 pagesTax Case DigestsWnz NaivePas encore d'évaluation

- NotepadDocument24 pagesNotepadheberdonPas encore d'évaluation

- International Corporate Bank v. Sps. Gueco, G.R. No. 141968, February 12, 2001Document12 pagesInternational Corporate Bank v. Sps. Gueco, G.R. No. 141968, February 12, 2001Krister VallentePas encore d'évaluation

- 100 Defined Terms Doctrines and Principles in PilDocument14 pages100 Defined Terms Doctrines and Principles in PilErmi YamaPas encore d'évaluation

- Tax Digest Finals RevisedDocument26 pagesTax Digest Finals RevisedronasoldePas encore d'évaluation

- 19 Al RichardsDocument12 pages19 Al RichardsRiriPas encore d'évaluation

- W9-990 Tax Form 2016 MEDLIFE (2016-2017) PDFDocument1 pageW9-990 Tax Form 2016 MEDLIFE (2016-2017) PDFAnonymous 6ZE5pGPas encore d'évaluation

- Myreviewer Notes Criminal Law 1Document53 pagesMyreviewer Notes Criminal Law 1c116269686% (7)

- Canon 1-4Document2 pagesCanon 1-4ConnieAllanaMacapagaoPas encore d'évaluation

- Tax Evasion-Cir v. TodaDocument4 pagesTax Evasion-Cir v. TodaPax YabutPas encore d'évaluation

- PAT Bar QuestionsDocument8 pagesPAT Bar QuestionsCass Catalo100% (1)

- CIR vs. CA 271 SCRA 605 (1997)Document4 pagesCIR vs. CA 271 SCRA 605 (1997)Ronnel Serato CuestaPas encore d'évaluation

- Salary SlipDocument1 pageSalary SlipAbhishek BabalPas encore d'évaluation

- Salary Slip May 2019Document1 pageSalary Slip May 2019Lalsiemlien HmarPas encore d'évaluation

- 016-United States v. Molina, 29 Phil 119Document6 pages016-United States v. Molina, 29 Phil 119Jopan SJPas encore d'évaluation

- ObliconNotes Updated 072413Document364 pagesObliconNotes Updated 072413Cass CataloPas encore d'évaluation

- CIR V British Overseas Airways CorporationDocument4 pagesCIR V British Overseas Airways CorporationcelinekdeguzmanPas encore d'évaluation

- CIR vs. Burroghs, G.R. No. 66653, June 19, 1986Document1 pageCIR vs. Burroghs, G.R. No. 66653, June 19, 1986Oro ChamberPas encore d'évaluation

- Creba Vs Romulo TaxDocument3 pagesCreba Vs Romulo TaxNichole LanuzaPas encore d'évaluation

- MGC Vs Collector SitusDocument5 pagesMGC Vs Collector SitusAira Mae P. LayloPas encore d'évaluation

- Extra Judicial Activities of JudgesDocument44 pagesExtra Judicial Activities of JudgesNabby MendozaPas encore d'évaluation

- Province of BulacanDocument3 pagesProvince of BulacanjilliankadPas encore d'évaluation

- BIR Ruling No. 051 2000 PDFDocument3 pagesBIR Ruling No. 051 2000 PDFVina CeePas encore d'évaluation

- TAXATION 1-People v. Castaneda, 165 SCRA 327 (1988)Document4 pagesTAXATION 1-People v. Castaneda, 165 SCRA 327 (1988)Arthur John GarratonPas encore d'évaluation

- Bicolandia Drug Corp Vs CIRDocument1 pageBicolandia Drug Corp Vs CIRDPMPascuaPas encore d'évaluation

- CIR v. Smith Kline / G.R. No. L-54108 / January 17, 1984Document1 pageCIR v. Smith Kline / G.R. No. L-54108 / January 17, 1984Mini U. SorianoPas encore d'évaluation

- Conwi v. Court of Tax Appeals, G.R. No. 48532, August 31, 1992Document6 pagesConwi v. Court of Tax Appeals, G.R. No. 48532, August 31, 1992zac100% (1)

- The Philippine Guaranty Co., Inc. Vs CirDocument2 pagesThe Philippine Guaranty Co., Inc. Vs CirBryne Angelo BrillantesPas encore d'évaluation

- People Vs Castaneda Tax 1 DigestDocument2 pagesPeople Vs Castaneda Tax 1 DigestMarilyn Padrones PerezPas encore d'évaluation

- Jurisdiction of The Courts SimplifiedDocument4 pagesJurisdiction of The Courts SimplifiedDexter G. Batalao100% (1)

- Jurisdiction of The Courts SimplifiedDocument4 pagesJurisdiction of The Courts SimplifiedDexter G. Batalao100% (1)

- Alcan Packaging Starpack Corp. v. The Treasurer of The City of ManilaDocument2 pagesAlcan Packaging Starpack Corp. v. The Treasurer of The City of ManilaCharles Roger RayaPas encore d'évaluation

- 143-Western Minolco Corp. v. CIR, Et. Al. 124 SCRA 121Document6 pages143-Western Minolco Corp. v. CIR, Et. Al. 124 SCRA 121Jopan SJPas encore d'évaluation

- ROHQ ClosureDocument1 pageROHQ ClosureVeron AGPas encore d'évaluation

- Bagatsing Vs San Juan (Simbillo)Document3 pagesBagatsing Vs San Juan (Simbillo)Joshua Rizlan SimbilloPas encore d'évaluation

- City of Lapu Lapu V PEZADocument3 pagesCity of Lapu Lapu V PEZAjuan aldabaPas encore d'évaluation

- CIR Vs HantexDocument20 pagesCIR Vs HantexDarrel John SombilonPas encore d'évaluation

- Philippine Bank of Communications Vs CIRDocument1 pagePhilippine Bank of Communications Vs CIRLisley Gem AmoresPas encore d'évaluation

- 8 Sison Vs AnchetaDocument1 page8 Sison Vs AnchetarjPas encore d'évaluation

- Case Digest Remedies Part 1Document23 pagesCase Digest Remedies Part 1Aprille S. AlviarnePas encore d'évaluation

- 13 Vegetable Oil Corp V TrinidadDocument2 pages13 Vegetable Oil Corp V TrinidadRocky GuzmanPas encore d'évaluation

- Commissioner of Internal Revenue vs. Court of Appeals 301 SCRA 152Document43 pagesCommissioner of Internal Revenue vs. Court of Appeals 301 SCRA 152fritz frances daniellePas encore d'évaluation

- Mangwang - Deutsche Knowledge Services Vs Cir - GR No 197980Document1 pageMangwang - Deutsche Knowledge Services Vs Cir - GR No 197980トレンティーノ アップルPas encore d'évaluation

- Province of Abra Vs Judge Hernando, The Roman Catholic Bishop of Bangued, Inc. 107 SCRA 104Document1 pageProvince of Abra Vs Judge Hernando, The Roman Catholic Bishop of Bangued, Inc. 107 SCRA 104lexxPas encore d'évaluation

- CIR Vs BinalbaganDocument2 pagesCIR Vs BinalbaganjohnkylePas encore d'évaluation

- GR No. L-18840 Kuenzle & Streiff V CirDocument7 pagesGR No. L-18840 Kuenzle & Streiff V CirRene ValentosPas encore d'évaluation

- Drucker Vs CommissionerDocument1 pageDrucker Vs CommissionerAthena SantosPas encore d'évaluation

- People vs. Kintanar Case DigestDocument4 pagesPeople vs. Kintanar Case DigestKatPas encore d'évaluation

- Joint-Judicial Affidavit (Arresting Officers)Document11 pagesJoint-Judicial Affidavit (Arresting Officers)Josman MandalPas encore d'évaluation

- Cir Vs San Roque 690 Scra 336Document5 pagesCir Vs San Roque 690 Scra 336Izzy Martin MaxinoPas encore d'évaluation

- Sample Pre-Trial BriefDocument6 pagesSample Pre-Trial BriefFarid Eshwer C. DeticioPas encore d'évaluation

- Syllabus TaxDocument19 pagesSyllabus TaxJulio Palma Gil Bucoy0% (1)

- 32 College of Oral & Dental Surgery V CTADocument2 pages32 College of Oral & Dental Surgery V CTAReinier Jeffrey AbdonPas encore d'évaluation

- XXII. CIR vs. Procter & GambleDocument12 pagesXXII. CIR vs. Procter & GambleStef OcsalevPas encore d'évaluation

- Eastern Telecommunications Philippines v. CIRDocument1 pageEastern Telecommunications Philippines v. CIRMarcella Maria KaraanPas encore d'évaluation

- 001 Chan Vs Chan 702 Scra 76Document10 pages001 Chan Vs Chan 702 Scra 76Maria Jeminah TurarayPas encore d'évaluation

- Tax Remedies J. DimaampaoDocument28 pagesTax Remedies J. DimaampaoEvielyn MateoPas encore d'évaluation

- Tax Digest 51 55Document11 pagesTax Digest 51 55glaiPas encore d'évaluation

- Admin - Eminent-AuthorityDocument95 pagesAdmin - Eminent-AuthorityKPas encore d'évaluation

- Meralco Vs BarlisDocument22 pagesMeralco Vs BarlischarmssatellPas encore d'évaluation

- Section 4.110-4 of RR 16-05Document4 pagesSection 4.110-4 of RR 16-05fatmaaleahPas encore d'évaluation

- Victory+Liner+v +raceDocument2 pagesVictory+Liner+v +raceRégine Naldo0% (1)

- 8 RCBC Vs CIR 2007Document9 pages8 RCBC Vs CIR 2007BLNPas encore d'évaluation

- Position PaperDocument1 pagePosition PaperAlvy Faith Pel-eyPas encore d'évaluation

- Pcib Vs AlejandroDocument3 pagesPcib Vs AlejandroGenalyn Española Gantalao DuranoPas encore d'évaluation

- List of Constitutional Law Cases (CHAPS 4 and 5)Document3 pagesList of Constitutional Law Cases (CHAPS 4 and 5)Carlota Nicolas VillaromanPas encore d'évaluation

- Civ Pro CasesDocument5 pagesCiv Pro CasesClaudine SumalinogPas encore d'évaluation

- Reyes Vs YsipDocument1 pageReyes Vs YsipKim Lorenzo CalatravaPas encore d'évaluation

- Manila Gas VsDocument1 pageManila Gas VsHarry PeterPas encore d'évaluation

- Manila Gas CorpDocument10 pagesManila Gas CorpBernadeth BasalPas encore d'évaluation

- 169386-2014-Mirant Philippines Corp. v. CaroDocument18 pages169386-2014-Mirant Philippines Corp. v. CaroCass CataloPas encore d'évaluation

- Maria Cassandra Catalo VP For Academic OperationsDocument9 pagesMaria Cassandra Catalo VP For Academic OperationsCass CataloPas encore d'évaluation

- 188606-2015-Unknown Owner of The Vessel M V China Joy V.Document12 pages188606-2015-Unknown Owner of The Vessel M V China Joy V.Cass CataloPas encore d'évaluation

- Nego Case DigestDocument5 pagesNego Case DigestCass CataloPas encore d'évaluation

- Update 2 Unictral Model Law On International ArbitrationDocument70 pagesUpdate 2 Unictral Model Law On International ArbitrationCass CataloPas encore d'évaluation

- Torts Case DigestDocument5 pagesTorts Case DigestCass CataloPas encore d'évaluation

- Torts Case DigestDocument5 pagesTorts Case DigestCass CataloPas encore d'évaluation

- Sales Full TextDocument48 pagesSales Full TextCass CataloPas encore d'évaluation

- 2017 Bar Exam Syllabus Criminal LawDocument4 pages2017 Bar Exam Syllabus Criminal LawCarolina Lim GambanPas encore d'évaluation

- R.A. No. 8371: Indigenous Peoples' Rights Act of 1997Document19 pagesR.A. No. 8371: Indigenous Peoples' Rights Act of 1997Cass CataloPas encore d'évaluation

- 188606-2015-Unknown Owner of The Vessel M V China Joy V.Document12 pages188606-2015-Unknown Owner of The Vessel M V China Joy V.Cass CataloPas encore d'évaluation

- IPRA EnviDocument19 pagesIPRA EnviCass CataloPas encore d'évaluation

- RP-China Final Arbitration Award (J. Carpio)Document31 pagesRP-China Final Arbitration Award (J. Carpio)Gai Flores100% (1)

- San Beda College Alabang School of Law Chorale: January 19, 2017Document1 pageSan Beda College Alabang School of Law Chorale: January 19, 2017Cass CataloPas encore d'évaluation

- Attorney ClientDocument2 pagesAttorney ClientCass CataloPas encore d'évaluation

- BLE Cosico NotesDocument18 pagesBLE Cosico NotesLeandro CataloPas encore d'évaluation

- Darvin Crim Pro DiagramDocument1 pageDarvin Crim Pro DiagramJenica TiPas encore d'évaluation

- Petitioners Vs Vs Respondents Office of The Provincial Legal Officer Edgardo B. ArellanoDocument9 pagesPetitioners Vs Vs Respondents Office of The Provincial Legal Officer Edgardo B. ArellanoCass CataloPas encore d'évaluation

- InvoiceDocument1 pageInvoicejaatpiyuushPas encore d'évaluation

- August 2017: Aryaomnitalk Wireless Solutions PVT - Ltd. Pay SlipDocument1 pageAugust 2017: Aryaomnitalk Wireless Solutions PVT - Ltd. Pay SlipArya OmnitalkPas encore d'évaluation

- P 11 DBDocument2 pagesP 11 DBLynsay SmithPas encore d'évaluation

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Sushma KumariPas encore d'évaluation

- Medical Premium Receipt SelfDocument1 pageMedical Premium Receipt SelfRakesh AggarwalPas encore d'évaluation

- Mepco Online BilllDocument1 pageMepco Online BilllRizwan Zahid Abdul LatifPas encore d'évaluation

- Swiggy Lunch HDLBDocument1 pageSwiggy Lunch HDLBskhPas encore d'évaluation

- Pay Slip Components: Covance Pty LimitedDocument1 pagePay Slip Components: Covance Pty LimitedAndrés PatiñoPas encore d'évaluation

- 2019-0443 - Osorio, Pauline - II-12 - ACED 18 - Reinforcement 4Document3 pages2019-0443 - Osorio, Pauline - II-12 - ACED 18 - Reinforcement 4Keddy GorospePas encore d'évaluation

- Сorporate Income Tax (Cit) : Dinara Mukhiyayeva, PhdDocument24 pagesСorporate Income Tax (Cit) : Dinara Mukhiyayeva, PhdAruzhan BekbaevaPas encore d'évaluation

- Assignment 1Document4 pagesAssignment 1Rozina TabassumPas encore d'évaluation

- Basilan V CIRDocument2 pagesBasilan V CIRReinier Jeffrey AbdonPas encore d'évaluation

- Tax TipsDocument15 pagesTax Tipsmaruthappan sundaramPas encore d'évaluation

- Salary: What Is Salary Structure?Document3 pagesSalary: What Is Salary Structure?Sri SubhaPas encore d'évaluation

- Faisalabad Electric Supply Company: Say No To CorruptionDocument2 pagesFaisalabad Electric Supply Company: Say No To CorruptionHabib Ur RehmanPas encore d'évaluation

- HSRPDocument1 pageHSRPRakesh SinghPas encore d'évaluation

- Commissioner of Internal Revenue v. E. J. Zongker and Charleen Zongker, 334 F.2d 44, 10th Cir. (1964)Document3 pagesCommissioner of Internal Revenue v. E. J. Zongker and Charleen Zongker, 334 F.2d 44, 10th Cir. (1964)Scribd Government DocsPas encore d'évaluation

- Railwire Subscriber InvoiceDocument1 pageRailwire Subscriber InvoiceChinnu SalimathPas encore d'évaluation

- Review of Indian Tax SystemDocument9 pagesReview of Indian Tax Systembcomh01097 UJJWAL SINGHPas encore d'évaluation

- Refund of Franking Credits Instructions and Application For IndividualsDocument16 pagesRefund of Franking Credits Instructions and Application For Individualsuly01 cubillaPas encore d'évaluation

- Acorns Securities LLC 5300 California Avenue IRVINE, CA 92617Document12 pagesAcorns Securities LLC 5300 California Avenue IRVINE, CA 92617Nicole AndersonPas encore d'évaluation

- Internet BillDocument2 pagesInternet Billshiva ramPas encore d'évaluation

- TAX.2814 Community-Taxes AnswersDocument1 pageTAX.2814 Community-Taxes AnswersCams DlunaPas encore d'évaluation

- Balance Sheet: Ruchi Soya Industries Ltd. - Research CenterDocument3 pagesBalance Sheet: Ruchi Soya Industries Ltd. - Research CenterAjitesh KumarPas encore d'évaluation