Académique Documents

Professionnel Documents

Culture Documents

Basic Tax Computation

Transféré par

Idsil Cabredo0 évaluation0% ont trouvé ce document utile (0 vote)

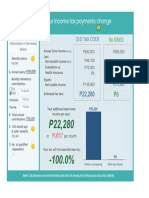

8 vues3 pagesThe document details compensation and tax withholding for an employee from January to December 2016. It shows that from January to September the employee received a gross compensation of PHP 126,000 with a taxable amount of PHP 76,000 resulting in a tax due of PHP 9,700 but PHP 15,200 was withheld, so PHP 5,500 will be refunded. It also shows that from September to December the employee received a gross compensation of PHP 81,927.49 with a taxable amount of PHP 31,927.49 resulting in a tax due of PHP 2,789.12 but PHP 7,967.22 was withheld, so PHP 5,178.10 will be refunded.

Description originale:

BIR standard tax computation

Titre original

basic tax computation

Copyright

© © All Rights Reserved

Formats disponibles

XLSX, PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentThe document details compensation and tax withholding for an employee from January to December 2016. It shows that from January to September the employee received a gross compensation of PHP 126,000 with a taxable amount of PHP 76,000 resulting in a tax due of PHP 9,700 but PHP 15,200 was withheld, so PHP 5,500 will be refunded. It also shows that from September to December the employee received a gross compensation of PHP 81,927.49 with a taxable amount of PHP 31,927.49 resulting in a tax due of PHP 2,789.12 but PHP 7,967.22 was withheld, so PHP 5,178.10 will be refunded.

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme XLSX, PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

8 vues3 pagesBasic Tax Computation

Transféré par

Idsil CabredoThe document details compensation and tax withholding for an employee from January to December 2016. It shows that from January to September the employee received a gross compensation of PHP 126,000 with a taxable amount of PHP 76,000 resulting in a tax due of PHP 9,700 but PHP 15,200 was withheld, so PHP 5,500 will be refunded. It also shows that from September to December the employee received a gross compensation of PHP 81,927.49 with a taxable amount of PHP 31,927.49 resulting in a tax due of PHP 2,789.12 but PHP 7,967.22 was withheld, so PHP 5,178.10 will be refunded.

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme XLSX, PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 3

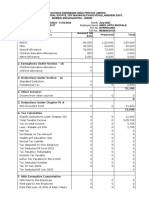

2016

Total compensation received from Jan 1- Aug 30 112000

Add: Compensation to be received on Sept 14000

Gross Compensation Jan-Sept 2016 126000

Less: personal exemption 50000

Taxable Compensation 76000

Tax Due* 9700

Tax Withheld from Jan to Aug 15200

Excess tax withheld to be refunded by

employer on or before Sept 30, 2016 of the 5500

current year

*Tax due on 70,000 8500

Tax excess(6000*20%) 1200

Tax on 6000 9700

Total compensation received from Sept 1- Nov 30 PHP 58,805.66

Add: Compensation to be received on Dec PHP 23,121.83

Gross Compensation Sept-Dec 2016 PHP 81,927.49

Less: personal exemption PHP 50,000.00

Taxable Compensation PHP 31,927.49

Tax Due* PHP 2,789.12

Tax Withheld from Sept to Nov PHP 7,967.22

Excess tax withheld to be refunded PHP (5,178.10)

by employer on or before Dec salary

*Tax due on 30,000 PHP 2,500.00

Tax excess(6000*20%) PHP 289.12

Tax on 12000 PHP 2,789.12

23121.83 1984.28

Vous aimerez peut-être aussi

- Income Tax Individual Sample ProblemsDocument13 pagesIncome Tax Individual Sample Problemscharlene marie goPas encore d'évaluation

- Accounting For Income TaxDocument6 pagesAccounting For Income TaxRyll BedasPas encore d'évaluation

- Assessment 4 Tax 1Document3 pagesAssessment 4 Tax 1Judy Ann Gaceta0% (1)

- Tutorial 9 - PIT1-Summer 2023-Sample AnswerDocument4 pagesTutorial 9 - PIT1-Summer 2023-Sample Answerkien tran100% (1)

- As 22Document1 pageAs 22Sajish RaiPas encore d'évaluation

- Problems and Solutions On Advance Tax: Problem No. 1Document8 pagesProblems and Solutions On Advance Tax: Problem No. 1NishantPas encore d'évaluation

- Aecom SalarySlipwithTaxDetails March 2018Document1 pageAecom SalarySlipwithTaxDetails March 2018Anil PuvadaPas encore d'évaluation

- Cost Residual Value Expected LifeDocument2 pagesCost Residual Value Expected LifeMandil BhandariPas encore d'évaluation

- 9.1 INCOME FROM PROPERTY Notes Questions With SolutionsDocument5 pages9.1 INCOME FROM PROPERTY Notes Questions With SolutionsHASNAT SABIRPas encore d'évaluation

- Mahnia Wala Chak No 190 JB Post Office Khas Tehsil Chiniot Distt Muhammad Saleem Raza ShahDocument4 pagesMahnia Wala Chak No 190 JB Post Office Khas Tehsil Chiniot Distt Muhammad Saleem Raza ShahMUHAMMAD SALEEM RAZAPas encore d'évaluation

- Income Tax ExercisesDocument3 pagesIncome Tax ExercisesLaguna HistoryPas encore d'évaluation

- Preliminary Assessment NoticeDocument3 pagesPreliminary Assessment NoticeHanabishi RekkaPas encore d'évaluation

- Accrued Liabilities: Problem 3-1 (AICPA Adapted)Document15 pagesAccrued Liabilities: Problem 3-1 (AICPA Adapted)Nila FranciaPas encore d'évaluation

- Actual Revenue 20,910: Assignment 1Document6 pagesActual Revenue 20,910: Assignment 1BhavikPas encore d'évaluation

- A-15 Block - 7/8 Kchs Union Karachi-78400 Karachi Usman Shahid KhanDocument2 pagesA-15 Block - 7/8 Kchs Union Karachi-78400 Karachi Usman Shahid KhanAnjum RasheedPas encore d'évaluation

- Annual Compensation and Business TaxesDocument21 pagesAnnual Compensation and Business TaxesRyDPas encore d'évaluation

- Interim 7 Consolidation AFAR1Document7 pagesInterim 7 Consolidation AFAR1Bea Tepace PototPas encore d'évaluation

- Task Performance 1Document1 pageTask Performance 1JanixxxPas encore d'évaluation

- INCOME TAX CALCULATION For Year 2008-2009: Male Per Year Per YearDocument1 pageINCOME TAX CALCULATION For Year 2008-2009: Male Per Year Per Yearpintoo23Pas encore d'évaluation

- Tax Calculator AY 2021-22Document1 pageTax Calculator AY 2021-22mehedi hasanPas encore d'évaluation

- Janus Elizalde Income Tax Liability For The Year Will Be Computed As FollowsDocument2 pagesJanus Elizalde Income Tax Liability For The Year Will Be Computed As FollowsCHARMAINE ROSE CABLAYANPas encore d'évaluation

- Axis Bank LTD Payslip For The Month of July - 2019Document1 pageAxis Bank LTD Payslip For The Month of July - 2019Rohit Kumar33% (3)

- TAX ANSWER-R4Tanyag KeyDocument5 pagesTAX ANSWER-R4Tanyag KeyCheska JaplosPas encore d'évaluation

- Tutorial 9 PIT1 Summer 2023 Sample AnswerDocument6 pagesTutorial 9 PIT1 Summer 2023 Sample Answernewgen2173Pas encore d'évaluation

- R2. TAX (M.L) Solution CMA May-2023 ExamDocument5 pagesR2. TAX (M.L) Solution CMA May-2023 ExamSharif MahmudPas encore d'évaluation

- Book 3Document1 pageBook 3Quincy Lawrence DimaanoPas encore d'évaluation

- Faq'S & Guidlines On Income TaxDocument50 pagesFaq'S & Guidlines On Income TaxRavikarthik GurumurthyPas encore d'évaluation

- Advance Tax ExampleDocument2 pagesAdvance Tax ExampleRitsikaGurramPas encore d'évaluation

- Formal Letter of Demand: Republic of The Philippines Department of Finance Bureau of Internal RevenueDocument3 pagesFormal Letter of Demand: Republic of The Philippines Department of Finance Bureau of Internal RevenueDominic Dela VegaPas encore d'évaluation

- Activity 1Document4 pagesActivity 1Louisa de VeraPas encore d'évaluation

- Assignment E & L Env 4 BusiDocument9 pagesAssignment E & L Env 4 BusiSyed Hamza RasheedPas encore d'évaluation

- Salary PDFDocument83 pagesSalary PDFGaurav BeniwalPas encore d'évaluation

- Tax Planning For IndividualDocument2 pagesTax Planning For IndividualJaynil ShahPas encore d'évaluation

- New Tax Certi PDFDocument1 pageNew Tax Certi PDFAli Azhar KhanPas encore d'évaluation

- Declaration 3310586406613Document4 pagesDeclaration 3310586406613Muhammad WaqasPas encore d'évaluation

- Answer: The Company Remitted P 22,400 VAT To The BIR. SolutionDocument3 pagesAnswer: The Company Remitted P 22,400 VAT To The BIR. SolutionGreyzon AbdonPas encore d'évaluation

- IGA69636 SalSlipWithTaxDetailsMiscDocument1 pageIGA69636 SalSlipWithTaxDetailsMiscHrithik ghoshPas encore d'évaluation

- Tax Midterm Practise SolutionsDocument5 pagesTax Midterm Practise SolutionsShan Ali ShahPas encore d'évaluation

- BSMA Taxation of IndividualsDocument32 pagesBSMA Taxation of IndividualsAngela CanayaPas encore d'évaluation

- Module 4 IntaxDocument14 pagesModule 4 IntaxPark MinyoungPas encore d'évaluation

- Tax Endterm Business Taxes: ExampleDocument4 pagesTax Endterm Business Taxes: ExampleCharmaine ChuaPas encore d'évaluation

- WTAXESDocument31 pagesWTAXESlance757Pas encore d'évaluation

- 12lpa Tax ComputationDocument1 page12lpa Tax ComputationSai KrishnaPas encore d'évaluation

- Suggested Solution I.P.C.C Nov. 2017 EXAM Taxation Test Code - INJ4007Document9 pagesSuggested Solution I.P.C.C Nov. 2017 EXAM Taxation Test Code - INJ4007Ravi SinghPas encore d'évaluation

- Method of Calculation of Relief U/s 89 (I)Document3 pagesMethod of Calculation of Relief U/s 89 (I)ssvrPas encore d'évaluation

- TaxComputation SYEDL PUN0157 2023 2024Document2 pagesTaxComputation SYEDL PUN0157 2023 2024nitin patilPas encore d'évaluation

- Null 3Document2 pagesNull 3bibhuti bhusan routPas encore d'évaluation

- Unit 6-Computation of Total Income and Tax LiabilityDocument23 pagesUnit 6-Computation of Total Income and Tax LiabilityDisha GuptaPas encore d'évaluation

- 3rd Quizzer TAX 2nd Sem SY 2019 2020Document4 pages3rd Quizzer TAX 2nd Sem SY 2019 2020Ric John Naquila CabilanPas encore d'évaluation

- Luminous Power Technologies Private Limited: Earnings DeductionsDocument1 pageLuminous Power Technologies Private Limited: Earnings Deductionssathish kumar.kPas encore d'évaluation

- Icct Coleges Foundation, Inc. Income Taxation - CBTAX01 Chapter 2-Activity/ AssignmentDocument2 pagesIcct Coleges Foundation, Inc. Income Taxation - CBTAX01 Chapter 2-Activity/ AssignmentJ LagardePas encore d'évaluation

- Advanced Taxation: Page 1 of 8Document8 pagesAdvanced Taxation: Page 1 of 8Muhammad Usama SheikhPas encore d'évaluation

- LECTURE - 9 - TAX - COMPUTATION Year 2024 RateDocument14 pagesLECTURE - 9 - TAX - COMPUTATION Year 2024 RateArnold BucudPas encore d'évaluation

- Assignment 2 Property TaxDocument5 pagesAssignment 2 Property TaxAHMAD ALIPas encore d'évaluation

- How Will Your Income Tax Payments Change How Will Your Income Tax Payments ChangeDocument1 pageHow Will Your Income Tax Payments Change How Will Your Income Tax Payments ChangeTin PortuzuelaPas encore d'évaluation

- 2019 Declaration PDFDocument4 pages2019 Declaration PDFIkramPas encore d'évaluation

- Advanced Tax (Math)Document1 pageAdvanced Tax (Math)Engr. Md. Ishtiak HossainPas encore d'évaluation

- He Is Not Subject To Basic Income Tax. However, His 13th Month Pay Exceeds 90,000. ThereforeDocument15 pagesHe Is Not Subject To Basic Income Tax. However, His 13th Month Pay Exceeds 90,000. ThereforeEarl Daniel RemorozaPas encore d'évaluation

- Compensation Income - (250,000 - 400,000) : Dazai OsamuDocument5 pagesCompensation Income - (250,000 - 400,000) : Dazai OsamuGideon Tangan Ines Jr.Pas encore d'évaluation

- Florentino Vs Florentino: Reserva TroncalDocument5 pagesFlorentino Vs Florentino: Reserva TroncalIdsil CabredoPas encore d'évaluation

- Birthday Form PDFDocument1 pageBirthday Form PDFIdsil CabredoPas encore d'évaluation

- CBN Approved FrameworkDocument244 pagesCBN Approved FrameworkIdsil CabredoPas encore d'évaluation

- Repatriation of Foreign2investmentDocument4 pagesRepatriation of Foreign2investmentIdsil CabredoPas encore d'évaluation

- CENOMAR Application Form PDFDocument1 pageCENOMAR Application Form PDFIdsil Cabredo100% (1)

- Pro Forma SPA (For Beginners Only)Document1 pagePro Forma SPA (For Beginners Only)Idsil CabredoPas encore d'évaluation

- CENOMAR Application Form PDFDocument1 pageCENOMAR Application Form PDFIdsil Cabredo0% (1)

- Pro Forma SPADocument2 pagesPro Forma SPAIdsil CabredoPas encore d'évaluation

- Contract of Lease (With Addendum)Document6 pagesContract of Lease (With Addendum)Idsil CabredoPas encore d'évaluation

- 11.28.16 My SPADocument1 page11.28.16 My SPAIdsil CabredoPas encore d'évaluation

- Special Power of Atty NewDocument2 pagesSpecial Power of Atty NewIdsil CabredoPas encore d'évaluation

- Special Power of AttyDocument2 pagesSpecial Power of AttyIdsil CabredoPas encore d'évaluation

- Pro Forma SPADocument2 pagesPro Forma SPAIdsil Cabredo100% (1)

- Confidentiality AgreementDocument2 pagesConfidentiality AgreementIdsil Cabredo100% (1)