Académique Documents

Professionnel Documents

Culture Documents

Discuss How Firms Within An Oligopolistic Market Compete.

Transféré par

Viren SamaniTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Discuss How Firms Within An Oligopolistic Market Compete.

Transféré par

Viren SamaniDroits d'auteur :

Formats disponibles

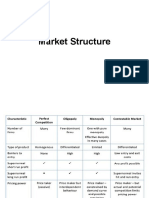

An oligopolistic market structure is such that the top 5 firms have a combined

concentration ratio of over 50% of the entire market. This leads to high barriers to

entry and/or exit as they intend to maintain their high market share, preventing new

entrants in the market. Also as a result of their differentiated products, they have

price setting power, enabling them to choose pricing of products. However, due to

existence of other large rivals they are forced to set prices in accordance to

competitors and so the market structure is said to be that of interdependence.

The manner in which firms are likely to compete is dependent on certain factors. If

long run average costs of the firms are extremely different and products are fairly

similar, with relatively low barriers to entry and exit and potential constant

regulation by gov. on collusive behaviour, the oligopolistic market is likely to be

competitive oriented, both regarding price and non-price factors. The factors

mentioned make it highly contestable and less difficult for competitors to enter the

market, so if prices are kept high to attain supernormal profits, competitors may hit-

and-run, entering the market to make supernormal profits, than leaving when it

returns to long run state similar to that of monopolistic competition as illustrated on

the diagram above.

This however does not occur as large incumbent firms within the market, have due

to large market share and large levels of output already exploited economies of scale

to ensure massive reduction in long run average costs. As a result, existent firms by

setting market prices are limit pricing whereby prices set are below costs for new

entrants, and so lack incentive to enter the market with unlikelihood of attaining

supernormal profits incumbent firms are making.

Another form of competition is when a collusive oligopoly exists. This is when due to

product differentiation, and therefore brand loyalty, and relatively high barriers to

entry firms have much greater market price setting power able to set prices above

allocative efficiency by restricting their levels of output, in the long term very similar

to a monopoly. As illustrated on the payoff matrix, the dominant strategy for two

firms competing with one another with no contact would be high output, high

output both making revenues of 80 million. However, if they were to collude, which

we assume they do due to low regulation existent in a market and inelastic demand

for the product, they could make revenues of 100 million each if they were to

collaborate to reduce output. This greatly incentivises collusion in the market, by

fixing prices through the reduction of output.

However, price fixing in such manner, overt collusion is illegal. The formation of a

cartel is greatly against consumer interests as although in the short run they may

offer lower prices, they tend to profit maximize in the long term.

Vous aimerez peut-être aussi

- Porter's Five Forces: Understand competitive forces and stay ahead of the competitionD'EverandPorter's Five Forces: Understand competitive forces and stay ahead of the competitionÉvaluation : 4 sur 5 étoiles4/5 (10)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Forex News Trading StrategiesDocument11 pagesForex News Trading Strategiesgaurav gupte100% (1)

- Internal Audit of Retail Industry Technical Guidance ICAIDocument160 pagesInternal Audit of Retail Industry Technical Guidance ICAIThayyathPas encore d'évaluation

- Physical EducationDocument79 pagesPhysical EducationViren Samani100% (1)

- The Pursuit of Happynes-CBDocument13 pagesThe Pursuit of Happynes-CBTanzeela Muhammad100% (3)

- Reckitt Benckiser Case Study Ed 7Document2 pagesReckitt Benckiser Case Study Ed 7Mickie DeWet0% (1)

- Definitions For Edexcel Economics Unit 3 6EC03 (St. Paul's)Document9 pagesDefinitions For Edexcel Economics Unit 3 6EC03 (St. Paul's)EzioAudi77100% (1)

- MA Co Expansion Project Analysis and CAPM Model EvaluationDocument16 pagesMA Co Expansion Project Analysis and CAPM Model EvaluationGeo DonPas encore d'évaluation

- Perfect CompetitionDocument3 pagesPerfect CompetitionShreejit MenonPas encore d'évaluation

- FINALThe Oligopolistic MarketDocument12 pagesFINALThe Oligopolistic MarketLeyCodes LeyCodesPas encore d'évaluation

- Revised Case Study (Rubi's Group)Document34 pagesRevised Case Study (Rubi's Group)Elven P. Barnayja100% (1)

- Market PowerDocument3 pagesMarket PowerApurva SharmaPas encore d'évaluation

- Physics Factsheet on Wave ExperimentsDocument4 pagesPhysics Factsheet on Wave ExperimentsViren SamaniPas encore d'évaluation

- Oligopoly Market Structure CharacteristicsDocument3 pagesOligopoly Market Structure CharacteristicsHeoHamHốPas encore d'évaluation

- A2 OligopolyDocument6 pagesA2 Oligopolypunte77Pas encore d'évaluation

- Unilateral Deed of Absolute SaleDocument2 pagesUnilateral Deed of Absolute SaleSarah Nengasca50% (4)

- BiologyDocument116 pagesBiologyViren SamaniPas encore d'évaluation

- Physics 2011 Edexcel Igcse SpecificationDocument124 pagesPhysics 2011 Edexcel Igcse SpecificationFuwad Abdul Muyeed100% (1)

- A Case Study in Perfect CompetitionDocument7 pagesA Case Study in Perfect CompetitionAddy Elia83% (6)

- Evaluating A Company's External EnvironmentDocument47 pagesEvaluating A Company's External EnvironmentHong JunPas encore d'évaluation

- Supply Chain Management Final AssignmentDocument12 pagesSupply Chain Management Final AssignmentAlexChenPas encore d'évaluation

- Gcse Int History Issue 4 For WebDocument186 pagesGcse Int History Issue 4 For Webapi-298584351Pas encore d'évaluation

- Notes On Managerial EconomicsDocument7 pagesNotes On Managerial EconomicsRonn Briane AtudPas encore d'évaluation

- Firms' Pricing and Output Decisions Depend On Barriers To Entry and The Behaviour of Competitors. Discuss.Document4 pagesFirms' Pricing and Output Decisions Depend On Barriers To Entry and The Behaviour of Competitors. Discuss.Elliott Chow RandomishingerPas encore d'évaluation

- Firm Competition and Market StructureDocument55 pagesFirm Competition and Market StructureCham PiPas encore d'évaluation

- Give An Example of A Government-Created Monopoly. Is Creating This Monopoly Necessarily Bad Public Policy? ExplainDocument8 pagesGive An Example of A Government-Created Monopoly. Is Creating This Monopoly Necessarily Bad Public Policy? ExplainMasri Abdul Lasi100% (1)

- Market Structures: BarriersDocument4 pagesMarket Structures: BarriersAdelwina AsuncionPas encore d'évaluation

- How Oligopolies Function and Are ModeledDocument16 pagesHow Oligopolies Function and Are ModeledJhonabie Suligan CadeliñaPas encore d'évaluation

- oligopolyDocument3 pagesoligopolyRokaia MortadaPas encore d'évaluation

- OligopolyDocument4 pagesOligopolyMacky EvanchezPas encore d'évaluation

- What Government Policies Might Be Used To Counteract The Problems That Result From High Barriers To Entry?Document3 pagesWhat Government Policies Might Be Used To Counteract The Problems That Result From High Barriers To Entry?Trisha VelascoPas encore d'évaluation

- Group4 BSA 1A Monopolistic Competition Research ActivityDocument11 pagesGroup4 BSA 1A Monopolistic Competition Research ActivityRoisu De KuriPas encore d'évaluation

- Market Power & SourcesDocument4 pagesMarket Power & SourcesApurva SharmaPas encore d'évaluation

- Collusion Evaluation EconomicsDocument2 pagesCollusion Evaluation Economicschrisw0512Pas encore d'évaluation

- Topic No. 4-Defenition of Market StructureDocument5 pagesTopic No. 4-Defenition of Market StructureKristy Veyna BautistaPas encore d'évaluation

- Monopolistic Competition:: Large Number of Small FirmsDocument7 pagesMonopolistic Competition:: Large Number of Small FirmsSohaib SangiPas encore d'évaluation

- Oligopoly Market Structure ExplainedDocument57 pagesOligopoly Market Structure ExplainedHarshita ChhabraPas encore d'évaluation

- NOVA Business School Strategy Problem Set on Industry and CompetitionDocument13 pagesNOVA Business School Strategy Problem Set on Industry and CompetitionJoseOlleroOliveiraPas encore d'évaluation

- Monopolistic Competition and Oligopoly ExplainedDocument6 pagesMonopolistic Competition and Oligopoly ExplainedKatrina LabisPas encore d'évaluation

- Oligopoly Market Dominated by Few SellersDocument3 pagesOligopoly Market Dominated by Few SellersMohammad Rysul IslamPas encore d'évaluation

- Market StructureDocument3 pagesMarket StructureJoshua CaraldePas encore d'évaluation

- Perfect Competition EssayDocument3 pagesPerfect Competition Essaybeyondcool0% (1)

- Market StructureDocument2 pagesMarket StructureAnkit AroraPas encore d'évaluation

- Market Structure and Firm CompetitionDocument14 pagesMarket Structure and Firm Competitionhonney lascanoPas encore d'évaluation

- Firm Competition and Market Structure ExplainedDocument10 pagesFirm Competition and Market Structure ExplainedMaria Teresa VillamayorPas encore d'évaluation

- Monopolies That Make Super Normal Profits Are Always Against Public Interest Because They Could Charge A Lower Price Than They DoDocument4 pagesMonopolies That Make Super Normal Profits Are Always Against Public Interest Because They Could Charge A Lower Price Than They DohotungsonPas encore d'évaluation

- Market Structure: Umang GhildyalDocument12 pagesMarket Structure: Umang GhildyalShiv ShankarPas encore d'évaluation

- Policies Which A UK Government Could Use To Control The Activities of OligopolistsDocument4 pagesPolicies Which A UK Government Could Use To Control The Activities of OligopolistsSMEBtheWizard100% (2)

- Market FailureDocument8 pagesMarket Failurerangapathirana76Pas encore d'évaluation

- Q1) Assess The Differences and The Similarities in Characteristics, Pricing and Output Between Perfect Competition and Monopolistic Competition.Document6 pagesQ1) Assess The Differences and The Similarities in Characteristics, Pricing and Output Between Perfect Competition and Monopolistic Competition.Sumble NaeemPas encore d'évaluation

- Business Pricing BookDocument29 pagesBusiness Pricing BookProtyay DasPas encore d'évaluation

- Key Characteristics Barriers To Entry: Economies of Large Scale ProductionDocument7 pagesKey Characteristics Barriers To Entry: Economies of Large Scale ProductionHalal BoiPas encore d'évaluation

- Oriented Company PointDocument95 pagesOriented Company Pointraenee_0410Pas encore d'évaluation

- Comments and SuggestionsDocument4 pagesComments and SuggestionsIsa MlqPas encore d'évaluation

- What's So Bad About Monopoly Power?: by Mark ThomaDocument13 pagesWhat's So Bad About Monopoly Power?: by Mark ThomaRAYCAMMELA ANTONIOPas encore d'évaluation

- N2011 Market StructureDocument4 pagesN2011 Market StructuredavidbohPas encore d'évaluation

- Me Market-StructureDocument3 pagesMe Market-Structurebenedick marcialPas encore d'évaluation

- Market StructureDocument19 pagesMarket StructureSri HarshaPas encore d'évaluation

- Basic Concepts OligopolyDocument18 pagesBasic Concepts Oligopolyshikhakhandelia1992100% (2)

- Perfect and Imperfect CompetitionDocument7 pagesPerfect and Imperfect CompetitionShirish GuthePas encore d'évaluation

- The Prisoner's Dilemma, Prce and Non-Price Competition and Cartel Cheating FINALDocument8 pagesThe Prisoner's Dilemma, Prce and Non-Price Competition and Cartel Cheating FINALjsemlpzPas encore d'évaluation

- Chapter Review 15Document4 pagesChapter Review 15Tória RajabecPas encore d'évaluation

- E. Break-Even PointDocument2 pagesE. Break-Even PointMarfe BlancoPas encore d'évaluation

- A Market Structure Characterized by A Large Number of Small FirmsDocument9 pagesA Market Structure Characterized by A Large Number of Small FirmsSurya PanwarPas encore d'évaluation

- Economics AssignmentDocument4 pagesEconomics AssignmentFarman RazaPas encore d'évaluation

- Economics Exam Notes - MonopolyDocument5 pagesEconomics Exam Notes - MonopolyDistingPas encore d'évaluation

- Perfect Competition Describes Markets Such That No Participants Are Large Enough To HauctDocument17 pagesPerfect Competition Describes Markets Such That No Participants Are Large Enough To HauctRrisingg MishraaPas encore d'évaluation

- Economies of Scale: Sellers in MarketsDocument3 pagesEconomies of Scale: Sellers in MarketslarizaPas encore d'évaluation

- Collusive Oligopoly and OPEC. What Are The Possible Cartel Formation in Petroleum Companies in India?Document24 pagesCollusive Oligopoly and OPEC. What Are The Possible Cartel Formation in Petroleum Companies in India?Suruchi GoyalPas encore d'évaluation

- Diagram of MonopolyDocument3 pagesDiagram of MonopolysanaakramtufailPas encore d'évaluation

- Models of Price Leadership: (Referred To in Paragraph 7.181)Document4 pagesModels of Price Leadership: (Referred To in Paragraph 7.181)Novi Hendra SaputraPas encore d'évaluation

- Oligopoly NotesDocument4 pagesOligopoly NotesHarry FishPas encore d'évaluation

- CP 8Document3 pagesCP 8lykaquinn.25Pas encore d'évaluation

- Industrial Economics Project - The Dominant Firm, A Game of Luck and StrategyDocument11 pagesIndustrial Economics Project - The Dominant Firm, A Game of Luck and StrategyRichard ConwayPas encore d'évaluation

- Edexcel C4 Integration & DifferentiationDocument8 pagesEdexcel C4 Integration & DifferentiationlukasPas encore d'évaluation

- Edexcel C4 Integration & DifferentiationDocument8 pagesEdexcel C4 Integration & DifferentiationlukasPas encore d'évaluation

- EconomicsDocument57 pagesEconomicsViren SamaniPas encore d'évaluation

- Biology Booklet Format IGCSEDocument30 pagesBiology Booklet Format IGCSEViren SamaniPas encore d'évaluation

- ChemistryDocument23 pagesChemistryViren SamaniPas encore d'évaluation

- History Cold WarDocument3 pagesHistory Cold WarViren SamaniPas encore d'évaluation

- Sales Forecast - predict revenues for Ezra's RestaurantDocument12 pagesSales Forecast - predict revenues for Ezra's RestaurantKathleen Galit ApiladoPas encore d'évaluation

- Ms SalesDocument41 pagesMs Salesalyza burdeosPas encore d'évaluation

- Sop Replacements Parts and Refunds 2Document11 pagesSop Replacements Parts and Refunds 2api-249252656Pas encore d'évaluation

- Merchandise Presentation GuideDocument5 pagesMerchandise Presentation GuideROHIT AGARWAL-RMPas encore d'évaluation

- Advertising Strategy and Effectiveness of KingfisherDocument53 pagesAdvertising Strategy and Effectiveness of Kingfisherimad50% (2)

- Different Brands Analysis of Women's Ethnic Wear in EBO and MBODocument31 pagesDifferent Brands Analysis of Women's Ethnic Wear in EBO and MBOsaumya srivastavaPas encore d'évaluation

- 1 VitalVitamins CaseDocument26 pages1 VitalVitamins CaseKarina FuelPas encore d'évaluation

- TIDE HistoryDocument3 pagesTIDE HistoryCatarina ReisPas encore d'évaluation

- MergerDocument41 pagesMergerarulselvi_a9100% (1)

- Estimating working capital requirementsDocument21 pagesEstimating working capital requirementsLakhan Sharma100% (1)

- Advanced AuditingDocument358 pagesAdvanced AuditingAnuj MauryaPas encore d'évaluation

- Kara Wipes Project FinalDocument46 pagesKara Wipes Project FinalSoumik SettPas encore d'évaluation

- Storiqa Token White PaperDocument41 pagesStoriqa Token White Papermarabest3Pas encore d'évaluation

- Planning Assortments Chapter 12Document34 pagesPlanning Assortments Chapter 12denise_pimentel100% (1)

- Bellaire Clinical Labs Case Study on Management Control SystemsDocument2 pagesBellaire Clinical Labs Case Study on Management Control SystemsNirali Shah100% (2)

- Harris BuysellDocument72 pagesHarris BuysellJohn RockefellerPas encore d'évaluation

- Apple Inc, the iconic tech company known for iPhone and Mac computersDocument4 pagesApple Inc, the iconic tech company known for iPhone and Mac computersAronAbadillaPas encore d'évaluation

- Marketing strategies of two wheelers dealers in Bangalore analyzedDocument48 pagesMarketing strategies of two wheelers dealers in Bangalore analyzedSandeep KumarPas encore d'évaluation

- 321 33 Powerpoint Slides Chapter 2 Retail OrganizationDocument18 pages321 33 Powerpoint Slides Chapter 2 Retail OrganizationAjit JainPas encore d'évaluation

- MCI14026 - Tetrapacked Fruit Drink: 1.2. Types of BeverageDocument6 pagesMCI14026 - Tetrapacked Fruit Drink: 1.2. Types of Beveragepadum chetryPas encore d'évaluation