Académique Documents

Professionnel Documents

Culture Documents

HO4

Transféré par

Emily Dela CruzCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

HO4

Transféré par

Emily Dela CruzDroits d'auteur :

Formats disponibles

HO4 (Shareholders Equity) AUDITING PROBLEMS

1. Cyprus Company began operations on January 1. Authorized were 20,000 shares of P10 par,

ordinary share and 40,000 shares of 10%, P100 par convertible preference share. The

following transactions occurred during the first year of operations.

Issued 500 shares of ordinary share to the corporation promoters in exchange

1.1 for property valued at P170,000 and services valued at P70,000

Issued 10,000 shares of convertible preference shares with a par value of P100.

Each share can be converted to 5 ordinary shares. The share was issued at a

price of P150 per share and the company paid P75,000 to an agent for selling

2.28 the shares

3.31 Sold 3,000 ordinary shares for P390 per share. Issue costs were P25,000

4.30 4,000 ordinary shares were sold under share subscriptions at P450 per share

Exchanged 700 ordinary shares and 1,400 preference shares for a building with

a fair value of P510,000. In addition, 600 ordinary shares were sold for

7.30 P240,000 cash.

Received payments in full for half of the share subscriptions and payments on

8.30 account on the rest of the subscriptions. Total cash received was P1,400,000

Declared a cash dividend of P10 per share on preference share payable on

December 31 to shareholders of record on December 15 and a P20 per share

cash dividend on ordinary share, payable on January 5 of the following year to

12.1 shareholders of record on December 15

12.31 Paid the dividend to preference shares

12.31 Net income was 600,000

Compute the balances of each of the following accounts:

a) Preference shares= 1,140,000

b) Share premiumpreference shares= 515,000

c) Ordinary share= 68,000

d) Share premiumordinary shares= 3,617,000

e) Accumulated profits= 310,000

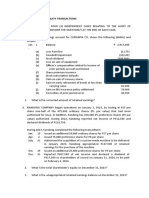

2. The Accumulated Profits account of Billy Jean Corp. shows the following debits and credits

for the year 2011:

UNAPPROPRIATED ACCUMULATE PROFIT

Date Debit Credit Balance

Jan

1 Balance 565,500

(a) Gain on life insurance policy settlement 50,000 615,500

(b) Write off of intangibles (goodwill) 30,000 585,500

Effect of a change in accounting principle (from FIFO to

(c) weighted average) 100,000 685,500

Loss on sale of treasury shares (APIC from treasury share

(d) transactions is enough to cover the loss) 20,000 665,500

10% share dividends on 100,000, P10 par value shares

(e) issued and outstanding (FMV at the same date at P12.50) 100,000 565,500

(f) 2010 unaccrued employee compensation 160,000 405,500

(g) Premium on ordinary shares issued 65,000 470,500

Stock issuance expenses related to ordinary shares issued

(h) above 5,000 465,500

(i) Defaults on ordinary share subscription 15,000 480,500

(j) Loss on sale of an equipment 25,000 455,500

Gain on retirement of preference shares at less than issue

(k) price 35,000 490,500

(l) Gain on early retirement of bonds 12,500 503,000

(m) Correction of a prior period error 45,000 548,000

HO4 (Shareholders Equity) AUDITING PROBLEMS

(n) Cash dividends payable 75,000 473,000

(o) Inventory loss from flood 10,500 462,500

(p) Proceeds from sale of donated shares 37,500 500,000

(q) Revaluation increase in land 150,000 650,000

(r) Appropriations for plant expansion 100,000 550,000

(s) Net income for the period 175,000 725,000

Required:

a) Adjusted net income= 172,000

b) Corrected unappropriated profits restated beginning balance= 550,500

c) Corrected unappropriated profits ending balance= 422,500

3. Nevada Square has the following selected accounts in its shareholders equity section as of

December 31, 2013:

Preference shares, P100 par, 10% cumulative, 100,000

shares issued and outstanding P10,000,000

Ordinary shares, P20 par, 1,000,000 shares authorized,

700,000 shares issued and outstanding 14,000,000

Share Premium 8,000,000

Accumulated Profits 30,000,000

There are no dividends in arrears on the preference shares. During 2014, the following

transactions occurred:

The board of directors declared a cash dividend totalling to P2,800,000 to be paid to

preference and ordinary shareholders. Later, a share dividend of 100,000 ordinary

shares were declared on ordinary shares. The market value of ordinary shares is P68

per share on the date the share dividends were declared.

Sometime after the above dividends were declared and settled, the board of directors

declared as property dividends one share of its investment in Bingo Corp. stocks being

held by the company as trading securities for every two ordinary shares outstanding.

Bingo Corp. stocks were originally purchased by the company at P12 per share and

have a carrying value based on their fair value as per the last remeasurement (balance

sheet) date, at P20 per share. Bingo Corp. shares were selling at P24 when the

property dividends were declared and were selling at P25 when the property dividends

were settled. The company had a total of 500,000 shares of Bingo Corp. shares.

At the end of 2014, the board declares a four-for-one share split. With the split, the

number of ordinary shares authorized to be issued increased to 4,000,000. At the date

of the share split, the market value of ordinary shares is P75 per share.

Net earnings during 2014 total P6,000,000.

Required:

a) Adjusted balance of the Accumulated Profit= P16,400,000

b) Balance of ordinary shares account= P16,000,000

c) Balance of share premium= P12,800,000

d) Adjusted balance of shareholders equity= P55,200,000

Vous aimerez peut-être aussi

- Equity Valuation: Models from Leading Investment BanksD'EverandEquity Valuation: Models from Leading Investment BanksJan ViebigPas encore d'évaluation

- Audit of EquityDocument6 pagesAudit of EquityEdmar HalogPas encore d'évaluation

- CFASDocument3 pagesCFASataydeyessaPas encore d'évaluation

- ReSA AP Quiz 2 B43Document13 pagesReSA AP Quiz 2 B43Rafael BautistaPas encore d'évaluation

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsD'EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsPas encore d'évaluation

- T R S A: Ap-200Q: Quizzer On Financing Cycle: Audit of Stockholders' EquityDocument12 pagesT R S A: Ap-200Q: Quizzer On Financing Cycle: Audit of Stockholders' Equityprincess sibugPas encore d'évaluation

- Intermediate Accounting 2: a QuickStudy Digital Reference GuideD'EverandIntermediate Accounting 2: a QuickStudy Digital Reference GuidePas encore d'évaluation

- BSA2BQuiz 3Document19 pagesBSA2BQuiz 3Monica Enrico0% (1)

- Auditing ProblemsDocument5 pagesAuditing ProblemsJayr BVPas encore d'évaluation

- Pract 1 - Exam2Document2 pagesPract 1 - Exam2Sharmaine Rivera MiguelPas encore d'évaluation

- HW On Statement of Changes in EquityDocument2 pagesHW On Statement of Changes in EquityCharles TuazonPas encore d'évaluation

- Corporation ReviewerDocument5 pagesCorporation ReviewerKara GamerPas encore d'évaluation

- Audit of SHEDocument13 pagesAudit of SHEChristian QuintansPas encore d'évaluation

- CorpoDocument16 pagesCorpoErica JoannaPas encore d'évaluation

- BE - Stockholders' Equity ADocument5 pagesBE - Stockholders' Equity ALuis JosePas encore d'évaluation

- Quiz 4 Ch7 Questions SentDocument2 pagesQuiz 4 Ch7 Questions SentLiandra AmorPas encore d'évaluation

- FAR-02 Retained EarningsDocument5 pagesFAR-02 Retained EarningsKim Cristian MaañoPas encore d'évaluation

- Sw01 Shareholders Equity Key PDF FreeDocument5 pagesSw01 Shareholders Equity Key PDF FreePola PolzPas encore d'évaluation

- Acctg 13 - Unit Test Final Answer KeyDocument4 pagesAcctg 13 - Unit Test Final Answer Keyjohn.18.wagasPas encore d'évaluation

- AP-100Q: Financing Cycle: A S ' E: Udit of Tockholders QuityDocument12 pagesAP-100Q: Financing Cycle: A S ' E: Udit of Tockholders QuityShiela RengelPas encore d'évaluation

- Oria, Maybelyn S. Cfas - Sec 10: What Total Amount Should Be Reported As Shareholders' Equity?Document52 pagesOria, Maybelyn S. Cfas - Sec 10: What Total Amount Should Be Reported As Shareholders' Equity?May OriaPas encore d'évaluation

- Name: - Score: - Year/Course/Section: - ScheduleDocument10 pagesName: - Score: - Year/Course/Section: - ScheduleYukiPas encore d'évaluation

- Financing Equity ProblemsDocument14 pagesFinancing Equity ProblemsIris MnemosynePas encore d'évaluation

- SheDocument5 pagesSheLorie Jae Domalaon0% (1)

- Shareholder's Equity - Practice SetsDocument6 pagesShareholder's Equity - Practice SetsGian GarciaPas encore d'évaluation

- Auditing Problems: RequiredDocument2 pagesAuditing Problems: RequiredvhhhPas encore d'évaluation

- Aud3 Chapter 8 11Document80 pagesAud3 Chapter 8 11Werpa PetmaluPas encore d'évaluation

- FAR-01 Contributed CapitalDocument3 pagesFAR-01 Contributed CapitalKim Cristian MaañoPas encore d'évaluation

- Compre Problems REDocument3 pagesCompre Problems REGegante Shayne SarahPas encore d'évaluation

- Aud1 Prelim Exercises 1Document4 pagesAud1 Prelim Exercises 1skyvy27Pas encore d'évaluation

- Chapter 8-SHEDocument77 pagesChapter 8-SHEVip Bigbang100% (1)

- QuestionnaireDocument5 pagesQuestionnaireAlex OzfordPas encore d'évaluation

- Equity Exercises 1Document3 pagesEquity Exercises 1alcazar rtuPas encore d'évaluation

- Unit 9 Retained Earnings: Topic 2 - Appropriation and Quasi-ReorganizationDocument4 pagesUnit 9 Retained Earnings: Topic 2 - Appropriation and Quasi-ReorganizationRey HandumonPas encore d'évaluation

- Sample Problems For Intermediate Accounting 3Document2 pagesSample Problems For Intermediate Accounting 3Luxx LawlietPas encore d'évaluation

- Ap She Exam ProbDocument3 pagesAp She Exam Problois martinPas encore d'évaluation

- Drill Problems - ConsolidationDocument6 pagesDrill Problems - Consolidationgun attaphanPas encore d'évaluation

- Simulated Qualifying Exam ReviewerDocument10 pagesSimulated Qualifying Exam ReviewerJanina Frances Ruidera100% (1)

- ParCor Corpo EQ Set ADocument3 pagesParCor Corpo EQ Set AMara LacsamanaPas encore d'évaluation

- Toyota CompanyDocument2 pagesToyota Companykel data100% (2)

- Toyota CompanyDocument2 pagesToyota Companykel dataPas encore d'évaluation

- Quiz - 4B UpdatesDocument7 pagesQuiz - 4B UpdatesAngelo HilomaPas encore d'évaluation

- AP 2007 (Shareholder's Equity) v.20Document4 pagesAP 2007 (Shareholder's Equity) v.20jalrestauroPas encore d'évaluation

- FAR-05 Book Value Per ShareDocument2 pagesFAR-05 Book Value Per ShareKim Cristian MaañoPas encore d'évaluation

- Book Value Per Share PracticeDocument5 pagesBook Value Per Share PracticeRUNEL J. PACOTPas encore d'évaluation

- Coneptual Frameworks and Accounting Standards Probs and TheoriesDocument17 pagesConeptual Frameworks and Accounting Standards Probs and TheoriesIris MnemosynePas encore d'évaluation

- Acc 124 - Week 13-14 - Ulob - Investment in Equity Securities - Assignment - CainDocument3 pagesAcc 124 - Week 13-14 - Ulob - Investment in Equity Securities - Assignment - Cainslow dancer50% (4)

- BusCom Seatwork - 05 15 2021Document4 pagesBusCom Seatwork - 05 15 2021Joshua UmaliPas encore d'évaluation

- Basic Earnings Per ShareDocument20 pagesBasic Earnings Per ShareDJ Nicart100% (3)

- Basic Eps Praac Valix 2018pdf DDDocument20 pagesBasic Eps Praac Valix 2018pdf DDCaptain ObviousPas encore d'évaluation

- Basic Earnings Per ShareDocument20 pagesBasic Earnings Per Sharemaria evangelistaPas encore d'évaluation

- ProblemsDocument4 pagesProblemsUNKNOWNNPas encore d'évaluation

- ProblemsDocument1 132 pagesProblemsUNKNOWNNPas encore d'évaluation

- Shareholder's Equity 2 - PracAccDocument19 pagesShareholder's Equity 2 - PracAccClyn CFPas encore d'évaluation

- Shareholders EquityDocument6 pagesShareholders EquityLhea VillanuevaPas encore d'évaluation

- IA3 Chapter 12 21Document12 pagesIA3 Chapter 12 21ZicoPas encore d'évaluation

- Accounting Review-Activity 1 Answers 1. B. 2,200,000Document6 pagesAccounting Review-Activity 1 Answers 1. B. 2,200,000Junvy AbordoPas encore d'évaluation

- Business Combination 2Document3 pagesBusiness Combination 2Jamie RamosPas encore d'évaluation

- Assignment StakeholdersDocument2 pagesAssignment StakeholdersRus Denisa100% (2)

- Business Ethics - WhistleblowingDocument14 pagesBusiness Ethics - WhistleblowingPepedPas encore d'évaluation

- Review of LiteratureDocument9 pagesReview of LiteratureananthakumarPas encore d'évaluation

- BUS 393 - Exam 2 - Chapter 4-9Document13 pagesBUS 393 - Exam 2 - Chapter 4-9Nerdy Notes Inc.Pas encore d'évaluation

- Prada CaseDocument12 pagesPrada CaseNam Pham100% (1)

- Definitive Information StatementDocument148 pagesDefinitive Information StatementWiam-Oyok B. AmerolPas encore d'évaluation

- Tybcom - Share NotesDocument749 pagesTybcom - Share NotesManojj21Pas encore d'évaluation

- Nif 50Document8 pagesNif 50Aneesh ViswanathanPas encore d'évaluation

- Re BVPS EpsDocument4 pagesRe BVPS EpsVeron BrionesPas encore d'évaluation

- Economics For Managers: Mcguigan, Moyer, & HarrisDocument18 pagesEconomics For Managers: Mcguigan, Moyer, & HarrisfizalazuanPas encore d'évaluation

- Risk and Rates of Return: Stand-Alone Risk Portfolio Risk Risk & Return: CAPM / SMLDocument39 pagesRisk and Rates of Return: Stand-Alone Risk Portfolio Risk Risk & Return: CAPM / SMLMaricar BesaPas encore d'évaluation

- Cost IM - CH 14Document23 pagesCost IM - CH 14Mr. FoxPas encore d'évaluation

- Nestor Ching V Subic Bay Golf and Country Club G.R. 174353Document8 pagesNestor Ching V Subic Bay Golf and Country Club G.R. 174353Dino Bernard LapitanPas encore d'évaluation

- Wipro WInsights Sustainability ReportingDocument3 pagesWipro WInsights Sustainability ReportingHemant ChaturvediPas encore d'évaluation

- FM AppleDocument12 pagesFM AppleREJISH MATHEWPas encore d'évaluation

- 1 - 9. The Nature of Corporate GovernanceDocument13 pages1 - 9. The Nature of Corporate GovernanceyesbudPas encore d'évaluation

- Mergers and AcquisitionsDocument40 pagesMergers and AcquisitionsAn DoPas encore d'évaluation

- CH 6Document6 pagesCH 6rachelohmygodPas encore d'évaluation

- Ananthasayanam Co-Operative Bank LTD.Document23 pagesAnanthasayanam Co-Operative Bank LTD.SANJU8795Pas encore d'évaluation

- A 2009Document88 pagesA 2009heroic_aliPas encore d'évaluation

- Balanced Score Card: DR A. P. Dash Power Management InstituteDocument32 pagesBalanced Score Card: DR A. P. Dash Power Management InstitutePankaj KaliaPas encore d'évaluation

- Essentials For Financial Statement AnalysisDocument5 pagesEssentials For Financial Statement AnalysisVIRTUAL UNIVERSITYPas encore d'évaluation

- Case Briefs On Comparative Company Law (US, UK and Germany)Document13 pagesCase Briefs On Comparative Company Law (US, UK and Germany)Zokirjon AbdusattarovPas encore d'évaluation

- Lesson 1business EthicsDocument19 pagesLesson 1business EthicsNiña Gloria Acuin ZaspaPas encore d'évaluation

- Financial Planning and Forecasting ProForma Financial StatementsDocument9 pagesFinancial Planning and Forecasting ProForma Financial StatementsLm MuhammadPas encore d'évaluation

- Quiz 2 - A SampleDocument2 pagesQuiz 2 - A Samplerohit_sethi89Pas encore d'évaluation

- ACC 430 HW QUESTIONS Mod 1Document2 pagesACC 430 HW QUESTIONS Mod 1Shannon0% (1)

- Real, Personal and Nominal AccountsDocument3 pagesReal, Personal and Nominal Accountsarsalan ShahzadPas encore d'évaluation

- Smart Summary Income Taxes CFADocument3 pagesSmart Summary Income Taxes CFAKazi HasanPas encore d'évaluation

- Qualifications To The Rule On The Pre-Emptive Right of Shareholders PDFDocument17 pagesQualifications To The Rule On The Pre-Emptive Right of Shareholders PDFRona RubinosPas encore d'évaluation