Académique Documents

Professionnel Documents

Culture Documents

Rights of heirs upon death of stockholder

Transféré par

Jeorge Ryan Mangubat0 évaluation0% ont trouvé ce document utile (0 vote)

118 vues1 pagesuccession

Titre original

KULANI.1

Copyright

© © All Rights Reserved

Formats disponibles

DOCX, PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentsuccession

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme DOCX, PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

118 vues1 pageRights of heirs upon death of stockholder

Transféré par

Jeorge Ryan Mangubatsuccession

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme DOCX, PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 1

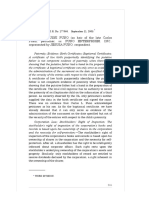

KULANI.1 PUNO V PUNO ENTERPRISES, INC.

, 599 SCRA 585

FACTS: Carlos L. Puno, the decedent, was an incorporator of respondent Puno Enterprises, Inc.

Petitioner Joselito Musni Puno, claiming to be an heir of Carlos L. Puno, initiated a complaint for

specific performance against respondent. As surviving heir, he claimed entitlement to the rights

and privileges of his late father as stockholder of respondent. The complaint thus prayed that

respondent allow petitioner to inspect its corporate book, render an accounting of all the

transactions, and give petitioner all the profits, earnings, dividends, or income pertaining to the

shares of Carlos L. Puno. The lower court ruled in favor of the petitioner.

On appeal, the CA ordered the dismissal of the complaint because the petitioner was not

able to establish the paternity of and his filiation to Carlos L. Puno. Accordingly, the CA said that

petitioner had no right to demand that he be allowed to examine respondents books. Moreover,

petitioner was not a stockholder of the corporation but was merely claiming rights as an heir of

Carlos L. Puno, an incorporator of the corporation.

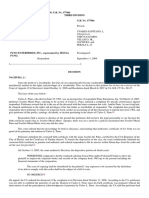

ISSUE: Whether the honorable court of appeals erred in not ruling that the Joselito Puno is entitled

to the reliefs demanded he being the heir of the late Carlos Puno, one of the incorporators of

respondent corporation.

RULING: Upon the death of a shareholder, the heirs do not automatically become stockholders

of the corporation and acquire the rights and privileges of the deceased as shareholder of the

corporation. The stocks must be distributed first to the heirs in estate proceedings, and the transfer

of the stocks must be recorded in the books of the corporation. The Corporation Code provides

that no transfer shall be valid, except as between the parties, until the transfer is recorded in the

books of the corporation. During such interim period, the heirs stand as the equitable owners of

the stocks, the executor or administrator duly appointed by the court being vested with the legal

title to the stock. Until a settlement and division of the estate is effected, the stocks of the decedent

are held by the administrator or executor.[18] Consequently, during such time, it is the

administrator or executor who is entitled to exercise the rights of the deceased as stockholder.

MAIN POINT: Upon the death of a stockholder, the heirs do not automatically become

stockholders of the corporation; neither are they mandatorily entitled to the rights and privileges

of a stockholder.

Vous aimerez peut-être aussi

- Rights of Heirs of Deceased StockholdersDocument1 pageRights of Heirs of Deceased StockholdersKelsey Olivar MendozaPas encore d'évaluation

- 21 - Puno v. Puno Enterprises, Inc.Document2 pages21 - Puno v. Puno Enterprises, Inc.Janice KimayongPas encore d'évaluation

- Puno Vs Puno EnterprisesDocument1 pagePuno Vs Puno EnterprisesAthena Santos100% (1)

- Rights of Heirs vs CorporationDocument2 pagesRights of Heirs vs Corporationjenny martinezPas encore d'évaluation

- Puno vs. Puno EnterprisesDocument2 pagesPuno vs. Puno EnterprisesRobPas encore d'évaluation

- Rights of heirs to inspect corporate books upon death of shareholderDocument20 pagesRights of heirs to inspect corporate books upon death of shareholderRaymarc Elizer AsuncionPas encore d'évaluation

- Heirs Not Automatically Entitled to Rights of Deceased Stockholder (35 charactersDocument5 pagesHeirs Not Automatically Entitled to Rights of Deceased Stockholder (35 charactersAnna NicerioPas encore d'évaluation

- Yujuico vs. QuiambaoDocument2 pagesYujuico vs. QuiambaosaraPas encore d'évaluation

- Digest 3rd BatchDocument22 pagesDigest 3rd BatchMaine Antonio GuzmanPas encore d'évaluation

- Case No. 21Document4 pagesCase No. 21Janice KimayongPas encore d'évaluation

- SuccessionCaseDigest DelarosaDocument25 pagesSuccessionCaseDigest DelarosaSab dela RosaPas encore d'évaluation

- 084-Joselito Musni Puno vs. Puno Enterprises, Inc. G.R. No. 177066 September 11, 2009Document4 pages084-Joselito Musni Puno vs. Puno Enterprises, Inc. G.R. No. 177066 September 11, 2009wewPas encore d'évaluation

- Joselito Puno vs. Puno Enterprises PDFDocument2 pagesJoselito Puno vs. Puno Enterprises PDFAustine Clarese VelascoPas encore d'évaluation

- 11.puno v. Puno Enterprises, Inc., G.R. No. 177066, September 11, 2009, 599 SCRA 585Document4 pages11.puno v. Puno Enterprises, Inc., G.R. No. 177066, September 11, 2009, 599 SCRA 585Karyl Ann Aquino-CaluyaPas encore d'évaluation

- Puno CaseDocument9 pagesPuno CaseRA De JoyaPas encore d'évaluation

- Puno Vs PunoDocument9 pagesPuno Vs PunoTesa ManuelPas encore d'évaluation

- Petitioner Vs Vs Respondent: Third DivisionDocument5 pagesPetitioner Vs Vs Respondent: Third DivisionVener MargalloPas encore d'évaluation

- Corpo Law 101Document27 pagesCorpo Law 101Miguel Lorenzo AlvarezPas encore d'évaluation

- Puno V Puno Enterprises Inc. G.R. No. 177066, Sep 11, 2009Document4 pagesPuno V Puno Enterprises Inc. G.R. No. 177066, Sep 11, 2009mae ann rodolfoPas encore d'évaluation

- Case DigestDocument11 pagesCase DigestMaLizaCainapPas encore d'évaluation

- Puno V Puno Enterprises Inc.Document4 pagesPuno V Puno Enterprises Inc.Kathleen Joy GarciaPas encore d'évaluation

- Custom Search: Today Is Saturday, April 14, 2018Document4 pagesCustom Search: Today Is Saturday, April 14, 2018Ruth GaleraPas encore d'évaluation

- G.R. No. 177066 September 11, 2009 JOSELITO MUSNI PUNO (As Heir of The Late Carlos Puno), Petitioner, PUNO ENTERPRISES, INC., Represented by JESUSA PUNO, RespondentDocument4 pagesG.R. No. 177066 September 11, 2009 JOSELITO MUSNI PUNO (As Heir of The Late Carlos Puno), Petitioner, PUNO ENTERPRISES, INC., Represented by JESUSA PUNO, RespondentBryle DrioPas encore d'évaluation

- Third Division Joselito Musni Puno (As Heir of The Late Carlos Puno), G.R. No. 177066Document6 pagesThird Division Joselito Musni Puno (As Heir of The Late Carlos Puno), G.R. No. 177066ecinue guirreisaPas encore d'évaluation

- Board of DirectorsDocument44 pagesBoard of DirectorsDiana Rose DalitPas encore d'évaluation

- Considerations for Issuances of SharesDocument58 pagesConsiderations for Issuances of SharesDM PagdalianPas encore d'évaluation

- Corporation Must Yield to Court OrderDocument3 pagesCorporation Must Yield to Court OrdermaggiPas encore d'évaluation

- CASESDocument10 pagesCASESAngelaPas encore d'évaluation

- Gokongwei v. SEC Right to Inspect Subsidiary RecordsDocument2 pagesGokongwei v. SEC Right to Inspect Subsidiary RecordsAlexandraSoledadPas encore d'évaluation

- Cases 14-17Document8 pagesCases 14-17Iylegwapa2Pas encore d'évaluation

- Mercrev Stockholders DigestsDocument50 pagesMercrev Stockholders DigestsaugustofficialsPas encore d'évaluation

- Corporation Law Digested CasesDocument11 pagesCorporation Law Digested CasesKarl Jason JosolPas encore d'évaluation

- Araneta V Sulo NG Bayan W ExplanationDocument1 pageAraneta V Sulo NG Bayan W ExplanationBea TumulakPas encore d'évaluation

- Uson Vs DiosomitoDocument1 pageUson Vs DiosomitoCJPas encore d'évaluation

- Corporation Code - Prelim To BODDocument183 pagesCorporation Code - Prelim To BODAlfonse100% (1)

- Olaguer V PurunggananDocument3 pagesOlaguer V PurunggananJc IsidroPas encore d'évaluation

- Court upholds attachment lien over unregistered stock transferDocument1 pageCourt upholds attachment lien over unregistered stock transferJuni VegaPas encore d'évaluation

- 10 and 19Document4 pages10 and 19Karl Marxcuz ReyesPas encore d'évaluation

- Facts: in 1993, BF Corporation Filed A Collection Complaint With The Regional TrialDocument3 pagesFacts: in 1993, BF Corporation Filed A Collection Complaint With The Regional Trialmaginoo69Pas encore d'évaluation

- Puno V PunoDocument2 pagesPuno V PunoVener Angelo MargalloPas encore d'évaluation

- Capital structure of stock corporationsDocument39 pagesCapital structure of stock corporationsIm reinePas encore d'évaluation

- Corporation Code Notes - Part VDocument6 pagesCorporation Code Notes - Part VMPLPas encore d'évaluation

- G.R. No. L-770 April 27, 1948 ANGEL T. LIMJOCO, Petitioner, INTESTATE ESTATE OF PEDRO O. FRAGRANTE, Deceased, RespondentDocument24 pagesG.R. No. L-770 April 27, 1948 ANGEL T. LIMJOCO, Petitioner, INTESTATE ESTATE OF PEDRO O. FRAGRANTE, Deceased, RespondentAnisah AquilaPas encore d'évaluation

- Corpo Digests TorresDocument23 pagesCorpo Digests TorresKaren Torres100% (3)

- Case Digest On Corporation LawDocument30 pagesCase Digest On Corporation LawJaeho Sani Dalidig Sabdullah100% (1)

- Puno vs. Puno Ent. Inc.Document8 pagesPuno vs. Puno Ent. Inc.Aji AmanPas encore d'évaluation

- Ponce vs. AlsonsDocument2 pagesPonce vs. AlsonsjohnmiggyPas encore d'évaluation

- Philippine Supreme Court Rules on Use of Aliases in IncorporationDocument5 pagesPhilippine Supreme Court Rules on Use of Aliases in IncorporationSandy Boy DitaloPas encore d'évaluation

- Sulo NG Bayan V Araneta FactsDocument3 pagesSulo NG Bayan V Araneta FactsArlan De LeonPas encore d'évaluation

- Section 18 - Section 21Document46 pagesSection 18 - Section 21AnnJeanetteGuardamePas encore d'évaluation

- Corpo Summaries 1Document12 pagesCorpo Summaries 1Angelo BasaPas encore d'évaluation

- Ponce V Alsons CementDocument1 pagePonce V Alsons CementAndrew Neil R. NinoblaPas encore d'évaluation

- Corpo 9 OctoberDocument16 pagesCorpo 9 OctobermilleranPas encore d'évaluation

- Court Affirms Merger of Corporation and Deceased OwnerDocument16 pagesCourt Affirms Merger of Corporation and Deceased OwnerJohny TumaliuanPas encore d'évaluation

- Transfer of SharesDocument9 pagesTransfer of SharessalinaPas encore d'évaluation

- TRANSFER OF SHARES CompleteDocument9 pagesTRANSFER OF SHARES CompletesalinaPas encore d'évaluation

- MERCY VDA Vs Our Lady S Foundation Inc Case DigestDocument2 pagesMERCY VDA Vs Our Lady S Foundation Inc Case DigestArah Salas PalacPas encore d'évaluation

- David C. Lao and Jose C. Lao vs. Dionisio Lao, G.R. No. 170585, October 6, 2008 FactsDocument98 pagesDavid C. Lao and Jose C. Lao vs. Dionisio Lao, G.R. No. 170585, October 6, 2008 FactsWilfredo Guerrero IIIPas encore d'évaluation

- Missionary Sisters of Our Lady of Fatima vs. AlzonaDocument4 pagesMissionary Sisters of Our Lady of Fatima vs. AlzonaMariaFaithFloresFelisartaPas encore d'évaluation

- Law On Partnership and Corporation by Hector de LeonDocument113 pagesLaw On Partnership and Corporation by Hector de LeonShiela Marie Vics75% (12)

- SUBDDocument3 pagesSUBDJeorge Ryan MangubatPas encore d'évaluation

- SUBDDocument3 pagesSUBDJeorge Ryan MangubatPas encore d'évaluation

- SUBDDocument3 pagesSUBDJeorge Ryan MangubatPas encore d'évaluation

- SUBDDocument3 pagesSUBDJeorge Ryan MangubatPas encore d'évaluation

- SUBDDocument3 pagesSUBDJeorge Ryan MangubatPas encore d'évaluation

- SUBDDocument3 pagesSUBDJeorge Ryan MangubatPas encore d'évaluation

- How A Corporation Is CreatedDocument2 pagesHow A Corporation Is CreatedJeorge Ryan MangubatPas encore d'évaluation

- Halili Transit Workers Overtime Dispute Contempt RulingDocument2 pagesHalili Transit Workers Overtime Dispute Contempt RulingJeorge Ryan Mangubat100% (1)

- How to Form a Corporation in the PhilippinesDocument2 pagesHow to Form a Corporation in the PhilippinesJeorge Ryan MangubatPas encore d'évaluation

- SUBDDocument3 pagesSUBDJeorge Ryan MangubatPas encore d'évaluation

- Matalin Coconut Co., Inc. vs. The Municipal Council of MalabangDocument1 pageMatalin Coconut Co., Inc. vs. The Municipal Council of MalabangJeorge Ryan MangubatPas encore d'évaluation

- Rule 71 15Document2 pagesRule 71 15Jeorge Ryan MangubatPas encore d'évaluation

- How A Corporation Is CreatedDocument2 pagesHow A Corporation Is CreatedJeorge Ryan MangubatPas encore d'évaluation

- Halili Transit Workers Overtime Dispute Contempt RulingDocument2 pagesHalili Transit Workers Overtime Dispute Contempt RulingJeorge Ryan Mangubat100% (1)

- 73 80Document7 pages73 80Jeorge Ryan MangubatPas encore d'évaluation

- Law On InsuranceDocument2 pagesLaw On InsuranceJeorge Ryan MangubatPas encore d'évaluation

- Nieva V AlcalaDocument1 pageNieva V AlcalaJeorge Ryan Mangubat100% (1)

- Seangio V ReyesDocument3 pagesSeangio V ReyesJeorge Ryan MangubatPas encore d'évaluation

- Succession For Sept. 29, 2018Document7 pagesSuccession For Sept. 29, 2018Jeorge Ryan MangubatPas encore d'évaluation

- Cruz V VillasorDocument1 pageCruz V VillasorJeorge Ryan MangubatPas encore d'évaluation

- P13 3Document1 pageP13 3Jeorge Ryan MangubatPas encore d'évaluation

- Doctrine of Constitutional Supremacy and Effectivity of the 1987 ConstitutionDocument12 pagesDoctrine of Constitutional Supremacy and Effectivity of the 1987 ConstitutionJeorge Ryan MangubatPas encore d'évaluation

- 73 80Document7 pages73 80Jeorge Ryan MangubatPas encore d'évaluation

- 73 80Document7 pages73 80Jeorge Ryan MangubatPas encore d'évaluation

- 73 80Document7 pages73 80Jeorge Ryan MangubatPas encore d'évaluation

- Guerrero V BihisDocument1 pageGuerrero V BihisJeorge Ryan MangubatPas encore d'évaluation

- Property CasesDocument2 pagesProperty CasesJeorge Ryan MangubatPas encore d'évaluation

- Wills and Succession Batch 1Document29 pagesWills and Succession Batch 1Jeorge Ryan MangubatPas encore d'évaluation

- p13 3Document2 pagesp13 3Jeorge Ryan MangubatPas encore d'évaluation

- Valuation and Cost of CapitalDocument11 pagesValuation and Cost of CapitalHenok FikaduPas encore d'évaluation

- 'Vault Guide To The Top 25 Investment Management EmployersDocument449 pages'Vault Guide To The Top 25 Investment Management EmployersPatrick AdamsPas encore d'évaluation

- CPUR Liquidation SampleDocument21 pagesCPUR Liquidation SampleRuzzel Diane Irada OducadoPas encore d'évaluation

- The 300 Hours Study Planner - Time Check: Start Date Exam Date Practice Papers Start DateDocument13 pagesThe 300 Hours Study Planner - Time Check: Start Date Exam Date Practice Papers Start DateHassan SoomroPas encore d'évaluation

- Dow Chemical Company Annual Report - 1945Document17 pagesDow Chemical Company Annual Report - 1945fresnoPas encore d'évaluation

- Florete vs. Florete (2016)Document2 pagesFlorete vs. Florete (2016)mjpjore60% (5)

- Essentials of Treasury Management - Working Capital Class Final OutlineDocument32 pagesEssentials of Treasury Management - Working Capital Class Final OutlinePablo VeraPas encore d'évaluation

- Bond-CDS Basis Trading HandbookDocument92 pagesBond-CDS Basis Trading HandbookFutrbllnr75% (4)

- Cheung Kong and The Apex Horizon HotelDocument1 pageCheung Kong and The Apex Horizon HotelTinPas encore d'évaluation

- AAA AUTO Group EGM Draft MinutesDocument9 pagesAAA AUTO Group EGM Draft Minutessmart investorsPas encore d'évaluation

- GAAP: Understanding It and The 10 Key Principles: U.S. Public Companies Must Follow GAAP For Their Financial StatementsDocument1 pageGAAP: Understanding It and The 10 Key Principles: U.S. Public Companies Must Follow GAAP For Their Financial StatementsThuraPas encore d'évaluation

- Tutorial1 SolutionsDocument5 pagesTutorial1 Solutionsfgdfdfgd3Pas encore d'évaluation

- Demand and Supply of MoneyDocument12 pagesDemand and Supply of MoneyAmal Raj SinghPas encore d'évaluation

- 1516352333813Document3 pages1516352333813gullipalli srinivasa raoPas encore d'évaluation

- MCQDocument19 pagesMCQMhiletPas encore d'évaluation

- Third Point 2011 ADV Part 2a BrochureDocument23 pagesThird Point 2011 ADV Part 2a BrochureWho's in my FundPas encore d'évaluation

- Adani Group Stock Manipulation Scheme ExposedDocument150 pagesAdani Group Stock Manipulation Scheme Exposedsunita singhaniaPas encore d'évaluation

- Introduction To Financial Management FIN 254 (Assignment) Spring 2014 (Due On 24th April 10-11.00 AM) at Nac 955Document10 pagesIntroduction To Financial Management FIN 254 (Assignment) Spring 2014 (Due On 24th April 10-11.00 AM) at Nac 955Shelly SantiagoPas encore d'évaluation

- A Project On Recruitment and Selection in Axis BankDocument59 pagesA Project On Recruitment and Selection in Axis BankGovinda Kadve64% (11)

- Surviving The Economic CollapseDocument3 pagesSurviving The Economic CollapseEden BakerPas encore d'évaluation

- Session 11 Risk and Return in Capital MarketsDocument51 pagesSession 11 Risk and Return in Capital MarketsYOGINDRE V PAIPas encore d'évaluation

- CRG - ManualDocument24 pagesCRG - ManualshapnokoliPas encore d'évaluation

- Case Study On CRB SCAMDocument4 pagesCase Study On CRB SCAMthevampireboyPas encore d'évaluation

- Annual Report 2013 - Olympic IndustriesDocument26 pagesAnnual Report 2013 - Olympic IndustriesAlif RussellPas encore d'évaluation

- Determinants of Price Earnings RatioDocument13 pagesDeterminants of Price Earnings RatioFalguni ChowdhuryPas encore d'évaluation

- India BullsDocument12 pagesIndia Bullswww_roopk4u74220% (1)

- Finance 2021 23Document16 pagesFinance 2021 23GAURAV UPADHYAYPas encore d'évaluation

- The Nature of Project Selection ModelsDocument13 pagesThe Nature of Project Selection ModelsGopalsamy SelvaduraiPas encore d'évaluation

- Bonos Del Enemigo 1851 Al 1952 - Part6Document4 pagesBonos Del Enemigo 1851 Al 1952 - Part6josealberroPas encore d'évaluation

- Assignment P&O 1Document8 pagesAssignment P&O 1Saad ImranPas encore d'évaluation