Académique Documents

Professionnel Documents

Culture Documents

Practice Problems Risk and Demand For Insurance

Transféré par

Shubham JainTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Practice Problems Risk and Demand For Insurance

Transféré par

Shubham JainDroits d'auteur :

Formats disponibles

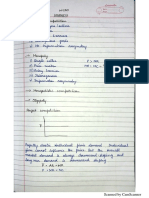

Practice problems

1. Suppose that Natashas utility function is given by u(I) 10I , where I represents annual income in thousands of

dollars.

a. Is Natasha risk loving, risk neutral, or risk averse? Explain.

b. Suppose that Natasha is currently earning an income of $40,000 (I = 40) and can earn that income next year with

certainty. She is offered a chance to take a new job that offers a .6 probability of earning $44,000 and a .4

probability of earning $33,000. Should she take the new job?

Note that Income I is measured in 000.

Solution: Natasha is Risk Averse. Risk Averse individuals have diminishing Marginal utility of wealth. This implies

that the second order derivative with respect to wealth must be <0.

2 U

2

= 10 I 3 /2 <0

I

(b) EU(job) > U(certain income) for Natasha to take up the job. In this case, EU(job)=

0.6 1044+0.4 1033=19.85

Which is less than U(40) =20. Hence she will not take up the job.

2. Buck Columbus is thinking of starting a pinball palace near a large Midwestern university. Buck is an expected

utility maximizer with a von Neuman-Morgenstern utility function, U(W) = 1 ( ), where W is his

wealth. Bucks total wealth is $12,000. With probability .2 the palace will be a failure and hell lose $9,000, so

that his wealth will be just $3,000. With probability .8 it will succeed and his wealth will grow to $ x. What is the

smallest value of x that would be sufficient to make Buck want to invest in the pinball palace rather than have a

wealth of $12,000 with certainty?

Solution:

We want to find the minimum income above which Expected utility from palace is greater than Utility from

certain wealth.

U(12000) EU(Palace). From the Expected utility function, solve for x.

3. Joes wealth is $100 and he is an expected utility maximizer with a von Neumann-Morgenstern utility function

Joe is afraid of oversleeping his economics exam. He figures there is only a 1 in 10 chance that he

will, but if he does, it will cost him $100 in fees to the university for taking an exam late. Joes neighbor, Mary,

never oversleeps. She offers to wake him one hour before the test, but he must pay her for this service. What is the

most that Joe would be willing to pay for this wake-up service?

4. A person has an expected utility function of the form . He initially has wealth of $4. He has a

lottery ticket that will be worth $12 with probability 1/2 and will be worth $0 with probability 1/2. What is his

expected utility? What is the lowest price p at which he would part with the ticket?

5. Socrates owns just one ship. The ship is worth $200 million dollars. If the ship sinks, Socrates loses $200 million.

The probability that it will sink is .02. Socrates total wealth including the value of the ship is $225 million. He is

an expected utility maximizer with von Neuman-Morgenstern utility What is the maximum amount

that Socrates would be willing to pay in order to be fully insured against the risk of losing his ship

Vous aimerez peut-être aussi

- Tower Crane Planning and Liaison ProcessDocument30 pagesTower Crane Planning and Liaison ProcessArun VasanPas encore d'évaluation

- 2 6 Risk Management PolicyDocument47 pages2 6 Risk Management PolicyRaja ManiPas encore d'évaluation

- Choicesvalues PDFDocument11 pagesChoicesvalues PDFisaac setabiPas encore d'évaluation

- Csol 560-Final-Assignment 7-Enterprise Information Security Risk Assessment-Aris Nicholas-4-17-2023Document29 pagesCsol 560-Final-Assignment 7-Enterprise Information Security Risk Assessment-Aris Nicholas-4-17-2023api-654754384Pas encore d'évaluation

- Solving Problems Involving Mean and Variance of Probability DistributionsDocument18 pagesSolving Problems Involving Mean and Variance of Probability DistributionsSansay SaylonPas encore d'évaluation

- Shariff, Zaini - 2013 - Inherent Risk Assessment Methodology in Preliminary Design Stage A Case Study For Toxic ReleaseDocument9 pagesShariff, Zaini - 2013 - Inherent Risk Assessment Methodology in Preliminary Design Stage A Case Study For Toxic ReleaseYusuf IskandarPas encore d'évaluation

- Sleep Deprivation PowerpointDocument24 pagesSleep Deprivation Powerpointapi-302310876100% (1)

- Hazard Identification of ConstructionDocument29 pagesHazard Identification of ConstructionPintu Jaiswal100% (1)

- Mba Project TitlesDocument24 pagesMba Project TitlesSandip82% (11)

- Audit of Vehicle Lien Sales Report HighlightsDocument65 pagesAudit of Vehicle Lien Sales Report HighlightsLong Beach PostPas encore d'évaluation

- The Lost Ancient World of Zanterian d20 Role Playing Game Book: The World's Dangerous DungeonD'EverandThe Lost Ancient World of Zanterian d20 Role Playing Game Book: The World's Dangerous DungeonPas encore d'évaluation

- The Principles of Effective OHS Risk Management OHS 61 Dec05Document24 pagesThe Principles of Effective OHS Risk Management OHS 61 Dec05Muhammad Suhaib100% (3)

- Hospital Emergency Operations Plan TemplateDocument53 pagesHospital Emergency Operations Plan Templateleonardo trancoso100% (2)

- John Campbell, David Foskett, Neil Rippington, Patricia Paskins-Practical Cookery, Level 3-Hodder Education (2011)Document427 pagesJohn Campbell, David Foskett, Neil Rippington, Patricia Paskins-Practical Cookery, Level 3-Hodder Education (2011)Narendra100% (2)

- Bsbinm601 Assignmnt Task 2Document18 pagesBsbinm601 Assignmnt Task 2Sahiba SahibaPas encore d'évaluation

- EC203 - Problem Set 9Document3 pagesEC203 - Problem Set 9Yiğit KocamanPas encore d'évaluation

- Week 13 Practice Problems SolutionsDocument5 pagesWeek 13 Practice Problems SolutionsRico BartmanPas encore d'évaluation

- Seem4480 - Decision Methodology & Applications: Assignment 2Document2 pagesSeem4480 - Decision Methodology & Applications: Assignment 2xieguagua0% (1)

- Choice Under Uncertainty: ExercisesDocument3 pagesChoice Under Uncertainty: Exercisespayal gargPas encore d'évaluation

- Expected Utility Theory: Behavioral Economics Patrick McalvanahDocument28 pagesExpected Utility Theory: Behavioral Economics Patrick McalvanahKübra ÇakırPas encore d'évaluation

- Behavioral Finance - Tutorial2Document4 pagesBehavioral Finance - Tutorial2imran_omiPas encore d'évaluation

- Exercise 6 UncertaintyDocument3 pagesExercise 6 UncertaintyChuang VisoldilokPas encore d'évaluation

- Af PS1 2014 15Document5 pagesAf PS1 2014 15rtchuidjangnanaPas encore d'évaluation

- Uncertainty: Choose The One Alternative That Best Completes The Statement or Answers The QuestionDocument18 pagesUncertainty: Choose The One Alternative That Best Completes The Statement or Answers The QuestionArturoMartínezPas encore d'évaluation

- Problem Set 8 - SOLUTIONDocument3 pagesProblem Set 8 - SOLUTIONBill BillsonPas encore d'évaluation

- Problem Set 2Document2 pagesProblem Set 2Akshit GaurPas encore d'évaluation

- Problem Set - 6Document5 pagesProblem Set - 6aldiPas encore d'évaluation

- KUL Advanced Microeconomics 2019 Problem Set 1Document4 pagesKUL Advanced Microeconomics 2019 Problem Set 1Fedor DostPas encore d'évaluation

- HW 5 AkDocument5 pagesHW 5 AkUnusualSkillPas encore d'évaluation

- PS 2 Fall2022Document4 pagesPS 2 Fall20221227352812Pas encore d'évaluation

- API 111 Solutions 7Document8 pagesAPI 111 Solutions 76doitPas encore d'évaluation

- Lecture 9Document10 pagesLecture 9ZUHAL TUGRULPas encore d'évaluation

- Homework 5 AnswersDocument5 pagesHomework 5 AnswersSophia SeoPas encore d'évaluation

- SCCFVDocument6 pagesSCCFVbb23bbPas encore d'évaluation

- Midterm: Multiple Choice (Each Question Has Only One Correct Answer: 3pt 15 45pt)Document8 pagesMidterm: Multiple Choice (Each Question Has Only One Correct Answer: 3pt 15 45pt)Алина АмерхановаPas encore d'évaluation

- AF PS1 2014 15 SolutionDocument9 pagesAF PS1 2014 15 SolutionrtchuidjangnanaPas encore d'évaluation

- Chapter1 Decision Theory Under UncertaintyDocument27 pagesChapter1 Decision Theory Under UncertaintydianazokhrabekovaPas encore d'évaluation

- Microeconomics Tutorial Exercise #4 (Uncertainty and Consumer Behavior)Document5 pagesMicroeconomics Tutorial Exercise #4 (Uncertainty and Consumer Behavior)Dibya AdhikaPas encore d'évaluation

- ECON 312 Microeconomics Uncertainty and Risks 2021Document48 pagesECON 312 Microeconomics Uncertainty and Risks 2021Mary AmoPas encore d'évaluation

- Solved Hugo Has A Concave Utility Function of U W w0 5Document1 pageSolved Hugo Has A Concave Utility Function of U W w0 5M Bilal SaleemPas encore d'évaluation

- Rec 07Document9 pagesRec 07Trang LePas encore d'évaluation

- Economics 302Document13 pagesEconomics 302Rana AhmedPas encore d'évaluation

- Prospect Theory & Reference-Dependent Preferences: AE6307 Behavioral Economics For Policy AnalysisDocument97 pagesProspect Theory & Reference-Dependent Preferences: AE6307 Behavioral Economics For Policy AnalysisHeidy JNUPas encore d'évaluation

- Web Additional ExercisesDocument14 pagesWeb Additional ExercisesLeticia RoccaPas encore d'évaluation

- Chapter 16 Uncertainty: Microeconomics: Theory and Applications With Calculus, 4e, Global Edition (Perloff)Document14 pagesChapter 16 Uncertainty: Microeconomics: Theory and Applications With Calculus, 4e, Global Edition (Perloff)kang100% (1)

- ProblemsDocument1 pageProblemsdandiaconeasaPas encore d'évaluation

- Problems Sessions 1-4Document5 pagesProblems Sessions 1-4Vivek KumarPas encore d'évaluation

- Problem Set 1: BE 510 Business Economics 1 - Autumn 2021Document2 pagesProblem Set 1: BE 510 Business Economics 1 - Autumn 2021Creative Work21stPas encore d'évaluation

- Info Lec 2Document3 pagesInfo Lec 2mostafa abdoPas encore d'évaluation

- Decision UncertaintyDocument19 pagesDecision Uncertaintycrinaus2003Pas encore d'évaluation

- HW 2Document6 pagesHW 2sippylicious0% (1)

- Handout 9: Choice Under UncertaintyDocument6 pagesHandout 9: Choice Under UncertaintyRaulPas encore d'évaluation

- Problem Set #1Document2 pagesProblem Set #1Besmullah FrazmandPas encore d'évaluation

- Unit 21Document20 pagesUnit 21Mais OmerPas encore d'évaluation

- Review Problems 1Document31 pagesReview Problems 1san miyaPas encore d'évaluation

- Irish Potato Famine, Network Externalities and Uncertainty: Example. Ipod: Buy To Be in StyleDocument5 pagesIrish Potato Famine, Network Externalities and Uncertainty: Example. Ipod: Buy To Be in StyledijojnayPas encore d'évaluation

- Introduction To Risk Premium and Markowitz-BBDocument22 pagesIntroduction To Risk Premium and Markowitz-BBCarla SolerPas encore d'évaluation

- MIT18 440S14 ProblemSet4Document4 pagesMIT18 440S14 ProblemSet4Naty Dasilva Jr.Pas encore d'évaluation

- MCQ Risk and Consumer BehaviourDocument4 pagesMCQ Risk and Consumer BehaviourCarine TeePas encore d'évaluation

- Total Earnings $12M + 0.2 (Gross)Document3 pagesTotal Earnings $12M + 0.2 (Gross)Ss AaPas encore d'évaluation

- Chapter 5 Utility FunctionDocument32 pagesChapter 5 Utility FunctionNermine LimemePas encore d'évaluation

- Assign 1Document3 pagesAssign 1Hrishikesh KasatPas encore d'évaluation

- Total Earnings $12M + 0.2 (Gross)Document3 pagesTotal Earnings $12M + 0.2 (Gross)Ss AaPas encore d'évaluation

- Book OldDocument22 pagesBook OldRana AhmedPas encore d'évaluation

- Midterm2 Solu PDFDocument11 pagesMidterm2 Solu PDFalexanderkyasPas encore d'évaluation

- Chapter 5 Utility FunctionDocument28 pagesChapter 5 Utility FunctionsarraPas encore d'évaluation

- QF2104 Tutorial - Assignment 5 (Discussion Q4 II Rephased)Document3 pagesQF2104 Tutorial - Assignment 5 (Discussion Q4 II Rephased)igndunnoPas encore d'évaluation

- Notes On UncertaintyDocument8 pagesNotes On UncertaintySameen SakeebPas encore d'évaluation

- An Introduction To Utility Theory - JohnNorstadDocument27 pagesAn Introduction To Utility Theory - JohnNorstadwagndavePas encore d'évaluation

- ProblemSet5 SolutionsDocument11 pagesProblemSet5 SolutionsJatin100% (1)

- Total Earnings $12M + 0.2 (Gross)Document2 pagesTotal Earnings $12M + 0.2 (Gross)Ss AaPas encore d'évaluation

- Assignment Micro II 2023Document3 pagesAssignment Micro II 2023Albert AmpomahPas encore d'évaluation

- RFGJFKJSD Iksfjdfsajkjkfds) / Kwep JP WF OjfeolnlkaefiDocument1 pageRFGJFKJSD Iksfjdfsajkjkfds) / Kwep JP WF OjfeolnlkaefiShubham JainPas encore d'évaluation

- FriedmanAndSchwartzsMonetaryExplana PreviewDocument9 pagesFriedmanAndSchwartzsMonetaryExplana PreviewBen SteigmannPas encore d'évaluation

- The Great Depression of The 1930sDocument2 pagesThe Great Depression of The 1930sShubham JainPas encore d'évaluation

- Economic Survey Volume 1 2018Document162 pagesEconomic Survey Volume 1 2018Siva RenjithPas encore d'évaluation

- Auction Theory For Auction DesignDocument57 pagesAuction Theory For Auction DesignShubham JainPas encore d'évaluation

- Anatomy of Genius Inspiration Through Ba PDFDocument14 pagesAnatomy of Genius Inspiration Through Ba PDFShubham JainPas encore d'évaluation

- Consulting Guesstimate Cases - Street of WallsDocument8 pagesConsulting Guesstimate Cases - Street of WallsShubham JainPas encore d'évaluation

- Business Cycle Synchronization Since 1880Document40 pagesBusiness Cycle Synchronization Since 1880Shubham JainPas encore d'évaluation

- Anatomy of Genius Inspiration Through Ba PDFDocument14 pagesAnatomy of Genius Inspiration Through Ba PDFShubham JainPas encore d'évaluation

- Highlights of PMMY Performance During FY 2015-16Document20 pagesHighlights of PMMY Performance During FY 2015-16Nikhil YadavPas encore d'évaluation

- Federal Reserve Bank of San Francisco - NAIRU - Is It Useful For Monetary PolicyDocument11 pagesFederal Reserve Bank of San Francisco - NAIRU - Is It Useful For Monetary PolicyShubham JainPas encore d'évaluation

- Auction Theory PDFDocument7 pagesAuction Theory PDFShubham JainPas encore d'évaluation

- Micro MarketsDocument8 pagesMicro MarketsShubham JainPas encore d'évaluation

- Lecture 9 Rational ExpectationsDocument45 pagesLecture 9 Rational ExpectationsShubham JainPas encore d'évaluation

- A Model of Growth Through Creative DestructionDocument30 pagesA Model of Growth Through Creative DestructionShubham JainPas encore d'évaluation

- LPP NotesDocument9 pagesLPP NotesShubham JainPas encore d'évaluation

- Strategic Form GamesDocument15 pagesStrategic Form GamesShubham JainPas encore d'évaluation

- A Model of Growth Through Creative DestructionDocument30 pagesA Model of Growth Through Creative DestructionShubham JainPas encore d'évaluation

- How To Crack The DSE Entrance For EconomicsDocument4 pagesHow To Crack The DSE Entrance For EconomicsShubham JainPas encore d'évaluation

- CT6 QP 0416Document6 pagesCT6 QP 0416Shubham JainPas encore d'évaluation

- JEE Questions ProbabilityDocument16 pagesJEE Questions ProbabilityShubham JainPas encore d'évaluation

- CT6 QP 0511Document5 pagesCT6 QP 0511Shubham JainPas encore d'évaluation

- Federal Reserve Bank of San Francisco - Interest Rates and Monetary PolicyDocument10 pagesFederal Reserve Bank of San Francisco - Interest Rates and Monetary PolicyShubham JainPas encore d'évaluation

- Irctcs E Ticketing Service Electronic Reservation Slip (Personal User)Document1 pageIrctcs E Ticketing Service Electronic Reservation Slip (Personal User)Shubham JainPas encore d'évaluation

- Development-Alternative Post and Reflexive-Jan Petrse PDFDocument31 pagesDevelopment-Alternative Post and Reflexive-Jan Petrse PDFlylan muslimPas encore d'évaluation

- Will The Fed Raise Interest Rates Just Once, Like in 1997Document3 pagesWill The Fed Raise Interest Rates Just Once, Like in 1997Shubham JainPas encore d'évaluation

- Second Call For Counselling 2017 19Document5 pagesSecond Call For Counselling 2017 19Shubham JainPas encore d'évaluation

- MA 1st List 2017Document12 pagesMA 1st List 2017Shubham JainPas encore d'évaluation

- Perspectives On Safety Culture: A. I. Glendon and N. A. StantonDocument18 pagesPerspectives On Safety Culture: A. I. Glendon and N. A. StantonAmanda WillPas encore d'évaluation

- Case Study Louis The ChildDocument7 pagesCase Study Louis The Childapi-678580280Pas encore d'évaluation

- FHP Lec 4Document91 pagesFHP Lec 4Rameez ShamounPas encore d'évaluation

- A Beginner's Guide To Fragility, Vulnerability and Risk-PorterDocument50 pagesA Beginner's Guide To Fragility, Vulnerability and Risk-PorterSUDHARMA RAJA REDDY SANAPUREDDYPas encore d'évaluation

- Understanding The Concept of Occupational Health and SafetyDocument3 pagesUnderstanding The Concept of Occupational Health and Safetyjoyouslyjoyce16Pas encore d'évaluation

- Aud1207 Module 3 (A5)Document16 pagesAud1207 Module 3 (A5)Mairene CastroPas encore d'évaluation

- Gembong Baskoro - 2023 - From VUCA To BANI, A Challenge of Strategic Environtment For Higher EducationDocument7 pagesGembong Baskoro - 2023 - From VUCA To BANI, A Challenge of Strategic Environtment For Higher Educationlpm.umnu.kebumenPas encore d'évaluation

- CM Kiem Toan Viet Nam - EngDocument213 pagesCM Kiem Toan Viet Nam - EngDiep NguyenPas encore d'évaluation

- Presentation 1Document28 pagesPresentation 1Kalyan BVPas encore d'évaluation

- NEHAP Malaysia Part 2 - Strategic Plan (Draft 19 May 2010)Document33 pagesNEHAP Malaysia Part 2 - Strategic Plan (Draft 19 May 2010)Amir IejiePas encore d'évaluation

- Unit 1Document14 pagesUnit 1Mohammed HussainPas encore d'évaluation

- Resume Varun RaiDocument1 pageResume Varun RaiVarun RaiPas encore d'évaluation

- Internal Audit Checksheet 2014 (API 9th Ed)Document22 pagesInternal Audit Checksheet 2014 (API 9th Ed)dekengPas encore d'évaluation

- Lonmin Stakeholder ManagementDocument24 pagesLonmin Stakeholder ManagementNisar KhanPas encore d'évaluation

- GrECo Offshore Wind PL 2807 SpreadsDocument7 pagesGrECo Offshore Wind PL 2807 SpreadsvigambetkarPas encore d'évaluation

- Chapter 8 Unit 8Document47 pagesChapter 8 Unit 8cutefeetPas encore d'évaluation

- Montly Fund Fact SheetDocument2 pagesMontly Fund Fact SheetAaron FooPas encore d'évaluation

- UNICEF RITEC Responsible Innovation in Technology For Children Digital Technology Play and Child Well Being SpreadsDocument37 pagesUNICEF RITEC Responsible Innovation in Technology For Children Digital Technology Play and Child Well Being Spreadssofiabloem100% (1)