Académique Documents

Professionnel Documents

Culture Documents

Time-1 HR Accountancy - Cash Flow Statements Max. Marks-36

Transféré par

swati82Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Time-1 HR Accountancy - Cash Flow Statements Max. Marks-36

Transféré par

swati82Droits d'auteur :

Formats disponibles

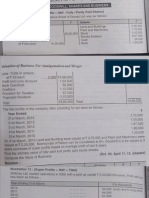

Time- 1 hr ACCOUNTANCY- CASH FLOW STATEMENTS Max.

Marks-36

1. Mutual Fund Company receives a dividend of Rs.50,00,000 on its investment in other companys shares.

Why is it a cash inflow from operating activities for this company? (2)

2. What is meant by the term cash and Cash Equivalent as per AS-3? (2)

3. The Skylark purchased machinery for Rs.5,00,000 for manufacturing shoes. State giving reason whether the

cash flow due to purchase of machinery will be cash flow from operating, investing or financing activities? (2)

4. Classify the following into cash Flows from operating activities, investing activities and financing activities

while preparing the cash flow statement: (4)

(i)Purchase of goodwill, (ii) dividend received, (iii) redemption of debentures, (iv) borrowing of long term

loan, (v) Purchase of machinery, (vi) Payment of dividend, (vii) Issue of debentures; and, (viii) Payment of

long term loan.

5. Calculate the cash flow from operating activities from the following information: (8)

st st

Particulars 1 April 31 March

2012 2013

(Rs.) (Rs.)

Balance in statement of profit & loss 30,000 35,000

General reserve 10,000 15,000

Accumulated depreciation on plant 30,000 35,000

Outstanding expenses 5,000 3,000

Goodwill 20,000 10,000

Trade Receivables 40,000 35,000

An item of plant costing Rs.20,000 having book value Rs.14,000 was sold for Rs.18,000 during the year.

6. Calculate the cash flow from operating activities from the following information: (8)

st st

Particulars 1 April 31 March

2012 2013

(Rs.) (Rs.)

Machinery (gross block) 40,000 50,000

Capital 30,000 35,000

Provision for depreciation on machinery 10,000 12,000

Bank Loan 10,000 Nil

During the year, machine costing Rs.10,000 was sold at a loss of Rs.2,000. Depreciation charged during the

year on machinery is Rs.6,000.

Vous aimerez peut-être aussi

- CFS-1 Shot - (C)Document4 pagesCFS-1 Shot - (C)xjnk6fwfvhPas encore d'évaluation

- Business Accounting and Analysis (Semester I) q1xAKCGPn2Document3 pagesBusiness Accounting and Analysis (Semester I) q1xAKCGPn2PriyankaPas encore d'évaluation

- Valuation of Goodwill & Shares 45Document6 pagesValuation of Goodwill & Shares 45Sumeet KanojiaPas encore d'évaluation

- Financial Statement Anaysis-Cat1 - 2Document16 pagesFinancial Statement Anaysis-Cat1 - 2cyrusPas encore d'évaluation

- Class 12 Accountancy CBSE Cash Flow StatementDocument7 pagesClass 12 Accountancy CBSE Cash Flow StatementSarvesh SreedharPas encore d'évaluation

- CASH FLOW Revision-1 PDFDocument12 pagesCASH FLOW Revision-1 PDFBHUMIKA JAINPas encore d'évaluation

- Financial Reporting - Consolidated Statement of Financial PositionDocument9 pagesFinancial Reporting - Consolidated Statement of Financial PositionMîñåk ŞhïïPas encore d'évaluation

- Cash Flow StatementDocument7 pagesCash Flow StatementRheetwick Bharadwaj100% (1)

- F.Y Test SeriesDocument16 pagesF.Y Test SeriesAkki GalaPas encore d'évaluation

- Cash Flow StatementDocument19 pagesCash Flow StatementROHIT SHAPas encore d'évaluation

- Punjab Univ B.Com Past Papers Qs Advanced Financial Accounting 2010-18Document3 pagesPunjab Univ B.Com Past Papers Qs Advanced Financial Accounting 2010-18irfanPas encore d'évaluation

- 232 FM AssignmentDocument17 pages232 FM Assignmentbhupesh joshiPas encore d'évaluation

- 1st Sem Accounting PDFDocument5 pages1st Sem Accounting PDFJeevan karkiPas encore d'évaluation

- Financial Reporting (International) : Wednesday 5 June 2013Document9 pagesFinancial Reporting (International) : Wednesday 5 June 2013Ruslan LamievPas encore d'évaluation

- College Business Exam Covers Key Accounting ConceptsDocument9 pagesCollege Business Exam Covers Key Accounting ConceptsNicole TaylorPas encore d'évaluation

- Fs Preparation 3Document9 pagesFs Preparation 3Davis Deo KagisaPas encore d'évaluation

- Ned University of Engineering & Technology: Opening Stock Closing Stock RsDocument4 pagesNed University of Engineering & Technology: Opening Stock Closing Stock RsFarjad ArifPas encore d'évaluation

- Afa Unit 5 Tutorial Sheet 3 Acca Past PapersDocument5 pagesAfa Unit 5 Tutorial Sheet 3 Acca Past PapersJust for Silly UsePas encore d'évaluation

- Accounts Important Questions by Rajat Jain SirDocument31 pagesAccounts Important Questions by Rajat Jain SirRajiv JhaPas encore d'évaluation

- MCS-035 Accounting and Financial Management Exam QuestionsDocument4 pagesMCS-035 Accounting and Financial Management Exam QuestionsAnishia KuriakosePas encore d'évaluation

- CA-Inter New Course: Advanced AccountingDocument121 pagesCA-Inter New Course: Advanced AccountingPankaj MeenaPas encore d'évaluation

- Additional Questions 5Document13 pagesAdditional Questions 5Sanjay SiddharthPas encore d'évaluation

- Problem SolutionsDocument5 pagesProblem Solutionsmd nayonPas encore d'évaluation

- Financial Reporting and AnalysisDocument10 pagesFinancial Reporting and AnalysisSagarPirtheePas encore d'évaluation

- Et BM 20Document4 pagesEt BM 20deliciousfood463Pas encore d'évaluation

- CO517 - Financial AccountingDocument4 pagesCO517 - Financial Accountingmiciker416Pas encore d'évaluation

- FINANCIAL REPORTING - PDF May 2012Document9 pagesFINANCIAL REPORTING - PDF May 2012Catherine dumenuPas encore d'évaluation

- Intermediate - Accounts (19.07.2019)Document10 pagesIntermediate - Accounts (19.07.2019)Åådil MirPas encore d'évaluation

- Test Series: April, 2021 Mock Test Paper 2 Intermediate (New) : Group - I Paper - 1: AccountingDocument7 pagesTest Series: April, 2021 Mock Test Paper 2 Intermediate (New) : Group - I Paper - 1: AccountingHarsh KumarPas encore d'évaluation

- Financial AccountingDocument2 pagesFinancial AccountingKartik GurmulePas encore d'évaluation

- CMAC Section A, B Mid-Term Q.PaperDocument5 pagesCMAC Section A, B Mid-Term Q.PaperWaseim khan Barik zaiPas encore d'évaluation

- Financial Reporting and Analysis (OUpm001111)Document10 pagesFinancial Reporting and Analysis (OUpm001111)SagarPirtheePas encore d'évaluation

- Module 1Document3 pagesModule 1Alina SerdiukPas encore d'évaluation

- Ratio Analysis-1Document3 pagesRatio Analysis-1Ramakrishna J RPas encore d'évaluation

- This Paper Is Not To Be Removed From The Examination HallsDocument82 pagesThis Paper Is Not To Be Removed From The Examination HallsPutin PhyPas encore d'évaluation

- 25 Question PaperDocument4 pages25 Question PaperPacific Tiger0% (1)

- Management Accounitng - 104 (I)Document4 pagesManagement Accounitng - 104 (I)Rudraksh PareyPas encore d'évaluation

- F7 Mock Exam QuestionsDocument9 pagesF7 Mock Exam Questionssweeto2012Pas encore d'évaluation

- Financial Statement Analysis Funds FlowDocument15 pagesFinancial Statement Analysis Funds FlowSAITEJA ANUGULAPas encore d'évaluation

- Accountancy Practical Examination Class XII (2021-22) Practice SET ADocument4 pagesAccountancy Practical Examination Class XII (2021-22) Practice SET AAyush ChauhanPas encore d'évaluation

- Consolidated Financial Statements of Parent LtdDocument10 pagesConsolidated Financial Statements of Parent LtdMîñåk ŞhïïPas encore d'évaluation

- Analysis of Financial Statements and Direct Tax Case StudiesDocument31 pagesAnalysis of Financial Statements and Direct Tax Case StudiesAvishi KushwahaPas encore d'évaluation

- MTP20MAY201420GROUP20120SERIES202.pdf 3Document85 pagesMTP20MAY201420GROUP20120SERIES202.pdf 3Dipen AdhikariPas encore d'évaluation

- Retirment of PartnerDocument30 pagesRetirment of PartnerRoozbeh ElaviaPas encore d'évaluation

- Ratio AnalysisDocument2 pagesRatio AnalysisRamakrishna J RPas encore d'évaluation

- BFC 3225 Intermediate Accounting I - 5Document4 pagesBFC 3225 Intermediate Accounting I - 5karashinokov siwoPas encore d'évaluation

- Accounting for business decisionsDocument96 pagesAccounting for business decisionsRahul Ghosale100% (1)

- Sample QuestionsDocument3 pagesSample QuestionstulikaPas encore d'évaluation

- VELLORE, CHENNAI-632 002: Answer The Following QuestionsDocument5 pagesVELLORE, CHENNAI-632 002: Answer The Following QuestionsJayanthiPas encore d'évaluation

- AC22Document4 pagesAC22Pavan BachaniPas encore d'évaluation

- Excel Academy of CommerceDocument2 pagesExcel Academy of CommerceHassan Jameel SheikhPas encore d'évaluation

- Preparation of Financial Statements - QBDocument26 pagesPreparation of Financial Statements - QBHindutav arya100% (1)

- Financial Statement AnalysisDocument3 pagesFinancial Statement AnalysisAsad Rehman100% (1)

- © The Institute of Chartered Accountants of IndiaDocument7 pages© The Institute of Chartered Accountants of IndiaRahul AgrawalPas encore d'évaluation

- Ratio Analysis-1Document4 pagesRatio Analysis-1Aakash RamakrishnanPas encore d'évaluation

- Icma.: PakistanDocument3 pagesIcma.: Pakistangfxexpert36Pas encore d'évaluation

- Ayeesha - Principles of Management AccountingDocument5 pagesAyeesha - Principles of Management AccountingMahesh KumarPas encore d'évaluation

- Pyramid's Consolidated SOFPDocument10 pagesPyramid's Consolidated SOFPhokagePas encore d'évaluation

- LXL Gr12Accounting 08 Revision Interpretation-of-Financial-Statements 27mar2014 PDFDocument5 pagesLXL Gr12Accounting 08 Revision Interpretation-of-Financial-Statements 27mar2014 PDFNezer Byl P. VergaraPas encore d'évaluation

- Corporate Actions: A Guide to Securities Event ManagementD'EverandCorporate Actions: A Guide to Securities Event ManagementPas encore d'évaluation

- Top 4 Mobile Operators in IndiaDocument2 pagesTop 4 Mobile Operators in Indiaswati82Pas encore d'évaluation

- SavingsDocument1 pageSavingsswati82Pas encore d'évaluation

- Cash flow statement practice test questionsDocument2 pagesCash flow statement practice test questionsswati82Pas encore d'évaluation

- Nmba 043: Hospitality & Tourism Management Max. Hours: 40 Course ObjectiveDocument2 pagesNmba 043: Hospitality & Tourism Management Max. Hours: 40 Course Objectiveswati82Pas encore d'évaluation

- MDocument5 pagesMswati82Pas encore d'évaluation

- UNIT IV (08 Sessions)Document1 pageUNIT IV (08 Sessions)swati82Pas encore d'évaluation

- EDocument1 pageEswati82Pas encore d'évaluation

- Tourism products, trends, agencies and hospitality industryDocument1 pageTourism products, trends, agencies and hospitality industryswati82Pas encore d'évaluation

- BDocument1 pageBswati82Pas encore d'évaluation

- Nmba 044: Behavioural Finance Max. Hours: 40Document2 pagesNmba 044: Behavioural Finance Max. Hours: 40swati82Pas encore d'évaluation

- Indian Tax Planning and Management CourseDocument1 pageIndian Tax Planning and Management Courseswati82Pas encore d'évaluation

- Unit II (08 Sessions)Document1 pageUnit II (08 Sessions)swati82Pas encore d'évaluation

- UNIT V (06 Sessions)Document1 pageUNIT V (06 Sessions)swati82Pas encore d'évaluation

- NegDocument8 pagesNegswati82Pas encore d'évaluation

- NEDocument7 pagesNEswati82Pas encore d'évaluation

- Unit I (8 Sessions)Document2 pagesUnit I (8 Sessions)swati82Pas encore d'évaluation

- NEDocument7 pagesNEswati82Pas encore d'évaluation

- Unit IV (06 Sessions)Document1 pageUnit IV (06 Sessions)swati82Pas encore d'évaluation

- Nmba 031: Entrepreneurship Development Max. Hours: 40 Objective: The Objective of The Section Is To Develop Conceptual Understanding of The TopicDocument1 pageNmba 031: Entrepreneurship Development Max. Hours: 40 Objective: The Objective of The Section Is To Develop Conceptual Understanding of The Topicswati82Pas encore d'évaluation

- SDocument1 pageSswati82Pas encore d'évaluation

- UNIT V (06 Sessions)Document1 pageUNIT V (06 Sessions)swati82Pas encore d'évaluation

- Unit IV (06 Sessions)Document1 pageUnit IV (06 Sessions)swati82Pas encore d'évaluation

- MDocument1 pageMswati82Pas encore d'évaluation

- Unit I (8 Sessions)Document1 pageUnit I (8 Sessions)swati82Pas encore d'évaluation

- Unit I (8 Sessions)Document1 pageUnit I (8 Sessions)swati82Pas encore d'évaluation

- Unit I (8 Sessions)Document2 pagesUnit I (8 Sessions)swati82Pas encore d'évaluation

- Unit I (8 Sessions)Document1 pageUnit I (8 Sessions)swati82Pas encore d'évaluation

- Suggested ReadingDocument1 pageSuggested Readingswati82Pas encore d'évaluation

- Unit III (08 Sessions) Unit V (08 Sessions)Document1 pageUnit III (08 Sessions) Unit V (08 Sessions)swati82Pas encore d'évaluation

- Acknowledgement of DebtDocument3 pagesAcknowledgement of DebtEsme SmithPas encore d'évaluation

- Measuring a Nation's Income: GDP and the Circular FlowDocument9 pagesMeasuring a Nation's Income: GDP and the Circular FlowAl Arafat RummanPas encore d'évaluation

- Relative Value Methodologies For Global Credit Bond Portfolio ManagementDocument13 pagesRelative Value Methodologies For Global Credit Bond Portfolio ManagementeucludePas encore d'évaluation

- DBP Vs CADocument2 pagesDBP Vs CAPaolo BrillantesPas encore d'évaluation

- Hedging 1Document28 pagesHedging 1Sadaquat HusainPas encore d'évaluation

- Marathon Tea Company Pvt. Ltd. Ashram Para, Siliguri Annexure-19Document8 pagesMarathon Tea Company Pvt. Ltd. Ashram Para, Siliguri Annexure-19RajibDebPas encore d'évaluation

- Werner Textile Labour CostsDocument6 pagesWerner Textile Labour Costsaichaanalyst4456Pas encore d'évaluation

- True Discount (Ch16)Document8 pagesTrue Discount (Ch16)Vishal JalanPas encore d'évaluation

- Financial Statement PreparationDocument60 pagesFinancial Statement PreparationAngel Anne De JuanPas encore d'évaluation

- Spouses Reyes Vs BPI GR 149840Document2 pagesSpouses Reyes Vs BPI GR 149840Maridel Pozas0% (1)

- FE Review: Engineering EconomicsDocument41 pagesFE Review: Engineering EconomicsNana BaPas encore d'évaluation

- OverviewDocument2 pagesOverviewapi-255050349Pas encore d'évaluation

- Answer All: TEST 2 FIN 542 International Financial Management 2012Document5 pagesAnswer All: TEST 2 FIN 542 International Financial Management 2012Janeahmadzack100% (1)

- Tax Motivated Film Financing at Rexford StudiosDocument12 pagesTax Motivated Film Financing at Rexford StudiosJustin SelvarajPas encore d'évaluation

- Edexcel IGCSE Accounting Mark Scheme SummaryDocument15 pagesEdexcel IGCSE Accounting Mark Scheme SummarySimra RiyazPas encore d'évaluation

- Spouses Noynay vs. Citihomes Builder and Development Inc. (Sales)Document1 pageSpouses Noynay vs. Citihomes Builder and Development Inc. (Sales)Elijah Lungay Sales100% (2)

- LC RemittanceDocument3 pagesLC Remittancemuhammad shahid ullahPas encore d'évaluation

- 3 How To Prepare A Balance SheetDocument4 pages3 How To Prepare A Balance Sheetapi-299265916Pas encore d'évaluation

- Types of MoneyDocument2 pagesTypes of MoneyE-kel Anico Jaurigue0% (1)

- NetflixDocument3 pagesNetflixNikkii SharmaPas encore d'évaluation

- Inflation AccountingDocument9 pagesInflation AccountingyasheshgaglaniPas encore d'évaluation

- SavingsDocument3 pagesSavingsevaPas encore d'évaluation

- Guide To Creating A Capital Campaign PlanDocument11 pagesGuide To Creating A Capital Campaign PlanBetsheell BillietheBeauty MetayerPas encore d'évaluation

- Is-LM Open EconomyDocument16 pagesIs-LM Open EconomyAppan Kandala VasudevacharyPas encore d'évaluation

- 12 Accountancy Accounting For Share Capital and Debenture Impq 1Document8 pages12 Accountancy Accounting For Share Capital and Debenture Impq 1Aejaz MohamedPas encore d'évaluation

- Difference BTW Micro & Macro EconDocument5 pagesDifference BTW Micro & Macro EconshyasirPas encore d'évaluation

- Accounting Chapter 1Document30 pagesAccounting Chapter 1Jitendra NagvekarPas encore d'évaluation

- 2016 SP Global Corporate Default StudyDocument191 pages2016 SP Global Corporate Default StudypravinshirnamePas encore d'évaluation

- Winding Up of A Company Is The StageDocument8 pagesWinding Up of A Company Is The StageroutraykhushbooPas encore d'évaluation

- Comprehensive Income Statement: Particulars 2007-2008Document34 pagesComprehensive Income Statement: Particulars 2007-200812xxx12Pas encore d'évaluation