Académique Documents

Professionnel Documents

Culture Documents

ANNEXURE 4 - Q4 FY08-09 Consolidated Results

Transféré par

PGurusCopyright

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

ANNEXURE 4 - Q4 FY08-09 Consolidated Results

Transféré par

PGurusDroits d'auteur :

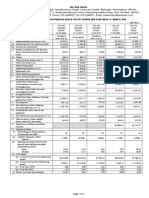

NEW DELHI TELEVISION LIMITED Annexure 4

Regd Office :

207,Okhla Industrial Estate, Phase-III

(Rs. in Lacs except per share data)

New Delhi - 110020

AUDITED CONSOLIDATED FINANCIAL RESULTS FOR THE QUARTER AND YEAR ENDED MARCH 31, 2009

Consolidated

A B C D

Three months Three months Audited Year Audited Year

Ended March 31- Ended March 31- Ended Ended

09 08 Mar 31 -09 Mar 31 -08

Sl No Particulars Audited Audited Audited Audited

1 Income from Operations 12,330 12,221 49,232 36,613

2 Expenditure

a.Production Expenses 9,732 6,400 31,382 12,050

b.Personnel Expenses 8,120 4,526 23,456 14,771

c.Special employee bonus - 15 65 906

d.Marketing, Distribution & Promotional Expenses 5,463 7,411 22,773 12,560

e.Operating & Administrative Expenses 5,282 4,156 16,910 10,114

f.Depreciation 821 679 3,086 2,309

Total Expenditure 29,418 23,187 97,672 52,710

3 Profit/(Loss) From Operations Before Other Income, Interest & Exceptional Items(1-2) (17,088) (10,966) (48,440) (16,097)

4 Other Income 378 606 1,737 2,181

5 Profit/(Loss) Before Interest & Exceptional Items (3+4) (16,710) (10,360) (46,703) (13,916)

6 Interest Cost 1,482 763 5,299 2,419

7 Profit/(Loss) After Interest But Before Exceptional Items (5-6) (18,192) (11,123) (52,001) (16,335)

8 Exceptional Items - - - -

9 Profit/(Loss) From Ordinary Activities Before Tax (7+8) (18,192) (11,123) (52,001) (16,335)

10 Cost of stock options/(Write Back) (See Note - 2&3) (1,992) 374 (129) 1,350

11 Amount arising on dilution of stake in a subsidiary (See Note -5 ) - - 64,254 -

12 Tax Expense - - - -

- Current (201) 78 2 390

- Tax for Earlier Years - - 22 -

- Deferred (174) 48 (650) 179

- Fringe Benefit Tax 211 121 1,024 312

13 Net Profit/(Loss) From Ordinary Activities after Tax Before Minority Interest and Share in

Associate (9-10+11-12) (16,036) (11,744) 11,984 (18,566)

14 Share of Minority Interest (1,171) (91) (1,453) (21)

15 Share in Profit/(Loss) of Associate (See Note -6) 518 - 864 (313)

16 Net Profit/(Loss) From Ordinary Activities After Tax (13-14+15) (14,347) (11,653) 14,301 (18,858)

17 Extraordinary Item - - - -

18 Net Profit/(Loss) For The Period (16-17) (14,347) (11,653) 14,301 (18,858)

19 Paid -up Equity Share Capital 2,509 2,503 2,509 2,503

(Face value Rs 4/- per share)

20 Reserves (Excluding Revaluation Reserve) - - 24,106 23,558

21 Earnings Per Share (of Rs.4/-each)

Before Extraordinary Items

- Basic (22.88) (18.83) 22.83 (30.16)

- Diluted (22.88) (18.83) 22.15 (30.16)

After Extraordinary Items

- Basic (22.88) (18.83) 22.83 (30.16)

- Diluted (22.88) (18.83) 22.15 (30.16)

22 Dividend per share (face value of Rs.4 per share)

Final Dividend (Rs. per share) - - - 0.80

Dividend percentage - - - 20%

23 Aggregate of Public Shareholding

- No. of equity shares of Rs 4/- each 23,097,924 2,44,39,017 23,097,924 2,44,39,017

- percentage of Shareholding 36.83% 39.05% 36.83% 39.05%

24 Promoters and promoter group Shareholding

a. Pledge/Encumbered

- Number of Shares NIL N.A. NIL N.A.

- Percentage of Share (as a % of the total shareholding of promoter and promoter group) NIL N.A. NIL N.A.

- Percentage of Share (as a % of the total share capital of the company) NIL N.A. NIL N.A.

b. Non -encumbered

- Number of Shares 39,615,168 N.A. 39,615,168 N.A.

- Percentage of Share (as a % of the total shareholding of promoter and promoter group) 100.00% N.A. 100.00% N.A.

- Percentage of Share (as a % of the total share capital of the company) 63.17% N.A. 63.17% N.A.

N.A. - Not Applicable

Notes :

1. The Board of Directors at their meeting held on October 1, 2008 had approved the Scheme of Arrangement ('the Scheme') for demerger of the news businesses of the Company. Accordingly, the

Company will be split into two groups of companies: one group of companies will carry out 'News and other businesses' and the other group of companies will carry out 'Entertainment and specified

allied businesses'. This demerger will be carried out pursuant to Section 391 to 394 read with sections 78, 100 to 103 of the Companies Act, 1956. After the demerger, for every one share currently held

in the Company, a shareholder will hold one share in the holding company whose subsidiaries will carry out the 'News and other businesses' and one share in the holding company whose subsidiaries

will carry out the 'Entertainment and specified allied businesses'. The Appointed Date for the Scheme has been specified as April 1, 2009. The Appointed Date for the Scheme has been specified as

April 1, 2009. The Scheme is subject to the approval of the High Court Of Delhi and the Company has filed the same with the High Court of Delhi for obtaining such approval. The meeting of the

shareholders and the creditors (other than trade) of the Company held on March 24, 2009, pursuant to the orders of the Honble High Court of Delhi, have approved the scheme. The final approval of

the Honble High Court of Delhi of the scheme is awaited.

2. In view of the proposed demerger of the Company and its subsidiaries, the Company has amended the ESOP 2004 scheme incorporating a clause giving the employees a right to surrender their

options. Consequently, employees holding options equivalent to 1,801,925 have exercised their right to surrender. The Company instituted the Employee Stock Purchase Scheme 2009 (the ESPS-

2009) for compensating the employees by grant of shares who have surrendered their stock vested/unvested/unexercised options, granted to them under ESOP 2004. Accordingly, the Company has

issued 1,764,425 shares to the eligible employees under "ESPS-2009".

3. The Company also issued 131,625 shares to eligible employees during the year ended March 31,2009 pursuant to exercise of stock options under the ESOP scheme.

4 Keeping the current economic environment and other factors in mind, the company and its subsidiaries have recast their business plans and streamlined operations. Based on these actions and its

business plans, the Company is confident of its ability to continue operations for the foreseeable future and accordingly the accounts of the Company and the group are prepared.

5. As per the terms of Clause 41 of the Listing Agreement, given below is the information on investor complaints for the quarter ended March 31, 2009:

Pending at the beginning of the quarter Received during the quarter Disposed of during the quarter

Nil 6 6

6. During the year, shareholders agreement dated 23 May, 2008 was entered into by the Group with Universal Studios International B.V. and NBC Universal Inc. for subscription of 915,498 shares into the

said overseas subsidiary for an amount of US$ 150 million (Rs,64,254 lacs) resulting in effective dilution of the Groups stake in the downstream subsidiaries from 100% to 74%.

7. During the year, on September 29, 2008 the Company through one of its overseas subsidiary NDTV Mauritius Media Limited (NDTV Mauritius Media) has invested to obtain 49% stake in NDTV Studios

Limited (NDTV Studios), an associate of the Company. NDTV Studios is engaged in building studios, production facilities etc. Further NDTV Mauritius Media has also invested US$ 83,900,000 (Rs.

3,875,969,500) in 12% Non Cumulative 38,759,695 Compulsorily Convertible Preference Shares (CCPS) of Rs. 10 each at a premium of Rs. 90 per share. The CCPS are convertible at the sole option

of NDTV Mauritius Media anytime within 20 years in accordance with the prevailing RBI regulations. The unutilized monies of NDTV Studios as at March 31, 2009 amounting to Rs 34,384 lacs have

been kept with banks in deposit accounts. During the period NDTV studios has earned Rs 2,155 Lacs as interest on these deposits.

8. The audited financial results have been taken on record by the Board of Directors in its meeting held on April 30, 2009. The auditors' report on the Consolidated financial statements and the

consolidated financial statements for the year ended March 31, 2009 contains no qualification except for remuneration of Rs. 488.25 lacs and Rs. 49.95 lacs paid respectively for the year ended March

31,2009 and for previous years to the directors including directors of its subsidiaries which is subject to Central Government approval due to inadequacy of profits for which the Company has initiated

the process of obtaining the necessary approvals. Additionally, the Company has issued 137,500 shares to a whole time director under ESPS-2009, subject to Central Government approval.Further, the

subsidiaries of the Company have issued 428,798 shares to an employee trust for the benefit of the directors of the Company and subsidiaires, subject to the Central Government approval.

9. The Company currently operates primarily in a single segment of television media and accordingly, there is no separate reportable segment.

10. Previous period figures have been regrouped/recast wherever considered necessary.

For and on behalf of Board of Directors

Place: New Delhi

Date: April 30, 2009 Chairman

Vous aimerez peut-être aussi

- Schaum's Outline of Principles of Accounting I, Fifth EditionD'EverandSchaum's Outline of Principles of Accounting I, Fifth EditionÉvaluation : 5 sur 5 étoiles5/5 (3)

- NDTV Q2-09 ResultsDocument8 pagesNDTV Q2-09 ResultsmixedbagPas encore d'évaluation

- Schaum's Outline of Bookkeeping and Accounting, Fourth EditionD'EverandSchaum's Outline of Bookkeeping and Accounting, Fourth EditionÉvaluation : 5 sur 5 étoiles5/5 (1)

- Annexure 7 - Audited Financial Results For The Year Ended March 31 2011Document3 pagesAnnexure 7 - Audited Financial Results For The Year Ended March 31 2011PGurusPas encore d'évaluation

- Statement of Standalone Unaudited Results For The Quarter Ended December 31, 2012Document3 pagesStatement of Standalone Unaudited Results For The Quarter Ended December 31, 2012Ravi AgarwalPas encore d'évaluation

- Kci-Ufr Q3fy11Document1 pageKci-Ufr Q3fy11Shashi PandeyPas encore d'évaluation

- The Catholic Syrian Bank LimitedDocument2 pagesThe Catholic Syrian Bank Limitedsaravanan aPas encore d'évaluation

- TML q4 Fy 21 Consolidated ResultsDocument6 pagesTML q4 Fy 21 Consolidated ResultsGyanendra AryaPas encore d'évaluation

- Rl1Chfilzri (Indlll) LTDDocument4 pagesRl1Chfilzri (Indlll) LTDJigneshPas encore d'évaluation

- Unaudited Consolidated Financial Results For The Quarter Ended 31 March 2010Document4 pagesUnaudited Consolidated Financial Results For The Quarter Ended 31 March 2010poloPas encore d'évaluation

- RCOM 4thconsoliated 09-10Document3 pagesRCOM 4thconsoliated 09-10Goutam YenupuriPas encore d'évaluation

- National Stock Exchange of India LimitedDocument2 pagesNational Stock Exchange of India LimitedAnonymous DfSizzc4lPas encore d'évaluation

- Deleum Q2 2019Document43 pagesDeleum Q2 2019DiLungBanPas encore d'évaluation

- Website Public Disclosure Mar-2022 BupaDocument101 pagesWebsite Public Disclosure Mar-2022 BupaYash DoshiPas encore d'évaluation

- Audited Financial Result 2019 2020Document22 pagesAudited Financial Result 2019 2020Avrajit SarkarPas encore d'évaluation

- Jet Airways Financial Report-2008Document2 pagesJet Airways Financial Report-2008RKMPas encore d'évaluation

- Colgate-Palmolive (India) Limited Registered Office: Colgate Research Centre, Main Street, Hiranandani Gardens, Powai, Mumbai 400 076Document2 pagesColgate-Palmolive (India) Limited Registered Office: Colgate Research Centre, Main Street, Hiranandani Gardens, Powai, Mumbai 400 076Yash ModiPas encore d'évaluation

- Standalone & Consolidated Financial Results, Limited Review Report, Results Press Release For December 31, 2016 (Result)Document9 pagesStandalone & Consolidated Financial Results, Limited Review Report, Results Press Release For December 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- KPI Q1 FY24 June2023Document12 pagesKPI Q1 FY24 June2023tapas.patel1Pas encore d'évaluation

- Published Results 31 March 2010Document2 pagesPublished Results 31 March 2010Ravi ChaturvediPas encore d'évaluation

- Income Statements: Group Company 2009 2008 2009 2008 Note RM'000 RM'000 RM'000 RM'000Document6 pagesIncome Statements: Group Company 2009 2008 2009 2008 Note RM'000 RM'000 RM'000 RM'000Praveen PintoPas encore d'évaluation

- (Lacs) Statement of Standalone Unaudited Results For The Quarter Ended March 31, 2013Document4 pages(Lacs) Statement of Standalone Unaudited Results For The Quarter Ended March 31, 2013Ravi AgarwalPas encore d'évaluation

- KPIs Bharti Airtel 04022020Document13 pagesKPIs Bharti Airtel 04022020laksikaPas encore d'évaluation

- CAL BankDocument2 pagesCAL BankFuaad DodooPas encore d'évaluation

- Zensar Standalone Clause 33 Results Mar2023Document3 pagesZensar Standalone Clause 33 Results Mar2023Pradeep KshatriyaPas encore d'évaluation

- Financial Report Q1 2021Document21 pagesFinancial Report Q1 2021FiestaPas encore d'évaluation

- Annual Report 2019 Financial Statements and Notes PDFDocument124 pagesAnnual Report 2019 Financial Statements and Notes PDFArti AtkalePas encore d'évaluation

- Beg A Cheese 2016Document4 pagesBeg A Cheese 2016杨子偏Pas encore d'évaluation

- PETROBRASDocument5 pagesPETROBRASNacho DiazPas encore d'évaluation

- ad792e0f-bd98-4e82-ad2d-738edd542bb3Document17 pagesad792e0f-bd98-4e82-ad2d-738edd542bb3Raj EevPas encore d'évaluation

- Annual Report 2018 PDFDocument288 pagesAnnual Report 2018 PDFАндрей СилаевPas encore d'évaluation

- Standalone Financial Results, Limited Review Report, Results Press Release For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report, Results Press Release For December 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Afr Q4fy20Document8 pagesAfr Q4fy20Abhilash ABPas encore d'évaluation

- Audited Financial Results For The Quarter and Financial Year Ended 31st March 2021Document12 pagesAudited Financial Results For The Quarter and Financial Year Ended 31st March 2021Abhilash ABPas encore d'évaluation

- Group Income StatementDocument1 pageGroup Income StatementAJNAZ PACIFICPas encore d'évaluation

- Financial ResultsDocument44 pagesFinancial ResultshousePas encore d'évaluation

- Unilever Annual Report and Accounts 2016 Tcm244 498880 enDocument1 pageUnilever Annual Report and Accounts 2016 Tcm244 498880 enMuntasir Alam EmsonPas encore d'évaluation

- Q2 09 ConsolidateDocument1 pageQ2 09 ConsolidatecayogeshguptaPas encore d'évaluation

- Assignment 2. Estimating Adidas' Equity ValueDocument4 pagesAssignment 2. Estimating Adidas' Equity Valuefasihullah1995Pas encore d'évaluation

- Case Study Part 1 Financial AnalysisDocument4 pagesCase Study Part 1 Financial AnalysisNikola PavlovskaPas encore d'évaluation

- Revised Standalone Financial Results For December 31, 2016 (Result)Document4 pagesRevised Standalone Financial Results For December 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Mq-18-Results-In-Excel - tcm1255-522302 - enDocument5 pagesMq-18-Results-In-Excel - tcm1255-522302 - enbhavanaPas encore d'évaluation

- January-December. All Values PHP MillionsDocument19 pagesJanuary-December. All Values PHP MillionsJPIA Scholastica DLSPPas encore d'évaluation

- Section 6 Financial 1.1 Financial PlanDocument14 pagesSection 6 Financial 1.1 Financial PlanPutri NickenPas encore d'évaluation

- Top Glove 2020, 2021Document3 pagesTop Glove 2020, 2021nabil izzatPas encore d'évaluation

- Microsoft Corporation Financial Statements and Supplementary DataDocument43 pagesMicrosoft Corporation Financial Statements and Supplementary DataDylan MakroPas encore d'évaluation

- WIL-Result-30 06 2020Document4 pagesWIL-Result-30 06 2020Ravi Kiran MeesalaPas encore d'évaluation

- Quarter1 2008Document2 pagesQuarter1 2008Raghavendra DevadigaPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Quarter1 2010Document2 pagesQuarter1 2010DhruvRathorePas encore d'évaluation

- Fa I HoecDocument32 pagesFa I HoecBunny SethiPas encore d'évaluation

- Renuka Foods PLC: Interim Financial Statements - For The Period Ended 31 December 2021Document11 pagesRenuka Foods PLC: Interim Financial Statements - For The Period Ended 31 December 2021hvalolaPas encore d'évaluation

- Financial Statements: For The Year Ended 31 December 2019Document11 pagesFinancial Statements: For The Year Ended 31 December 2019RajithWNPas encore d'évaluation

- Silver Pearl - H2FY23Document3 pagesSilver Pearl - H2FY23rpschandelPas encore d'évaluation

- Consolidated Statement of Comprehensive Income: For The Year Ended 31 DecemberDocument5 pagesConsolidated Statement of Comprehensive Income: For The Year Ended 31 DecemberVajri Varun GuturuPas encore d'évaluation

- q1 09 IOL Netcom ResultsDocument1 pageq1 09 IOL Netcom ResultsmixedbagPas encore d'évaluation

- P-H-O-E-N-I-X Petroleum Philippines, Inc. (PSE:PNX) Financials Income StatementDocument12 pagesP-H-O-E-N-I-X Petroleum Philippines, Inc. (PSE:PNX) Financials Income StatementDave Emmanuel SadunanPas encore d'évaluation

- Arss Infrastructure Projects Limited: (Rs. in Crores Except For Shares & EPS)Document2 pagesArss Infrastructure Projects Limited: (Rs. in Crores Except For Shares & EPS)Likun sahooPas encore d'évaluation

- Financial - Result - For The Financial Year Ended 31st March 2021Document20 pagesFinancial - Result - For The Financial Year Ended 31st March 2021Priyanshu PalPas encore d'évaluation

- Letter To Prime Minister On AIIMS Investigation of SSRDocument3 pagesLetter To Prime Minister On AIIMS Investigation of SSRPGurusPas encore d'évaluation

- Swamy Legal Notice To Indian ExpressDocument12 pagesSwamy Legal Notice To Indian ExpressPGurusPas encore d'évaluation

- Subramanian Swamy's Letter To Speaker On Sonia Faking Qualifications Sept 28, 2020Document3 pagesSubramanian Swamy's Letter To Speaker On Sonia Faking Qualifications Sept 28, 2020PGurusPas encore d'évaluation

- Madurai HC Palani Temple JudgmentDocument22 pagesMadurai HC Palani Temple JudgmentPGurus100% (2)

- Letter To Prime MinisterDocument2 pagesLetter To Prime MinisterPGurus100% (1)

- Section 144 DetailsDocument2 pagesSection 144 DetailsPGurusPas encore d'évaluation

- Dr. K Kathirvel vs. CBI (Status Report)Document20 pagesDr. K Kathirvel vs. CBI (Status Report)PGurus100% (1)

- CFD factFindingCommittee ReportDocument49 pagesCFD factFindingCommittee ReportPGurus100% (1)

- APPWW Opposition To St. Paul ResolutionDocument3 pagesAPPWW Opposition To St. Paul ResolutionPGurusPas encore d'évaluation

- Subramanian Swamy's Letter To Foreign Sec On Defmation Action Against UN Under Sec May 20, 2013Document3 pagesSubramanian Swamy's Letter To Foreign Sec On Defmation Action Against UN Under Sec May 20, 2013PGurus100% (2)

- Subramanian Swamy's Letter To PM On Uttarakhand Temple Board May 27, 2020Document2 pagesSubramanian Swamy's Letter To PM On Uttarakhand Temple Board May 27, 2020PGurusPas encore d'évaluation

- MHA Order Dt. 30.5.2020 With Guidelines On Extension of LD in Containment Zones and Phased ReopeningDocument8 pagesMHA Order Dt. 30.5.2020 With Guidelines On Extension of LD in Containment Zones and Phased ReopeningPGurusPas encore d'évaluation

- Delhi Govt SuggestionsDocument7 pagesDelhi Govt SuggestionsPGurusPas encore d'évaluation

- MHA Order Dt. 17.5.2020 On Extension of Lockdown Till 31.5.2020 With Guidelines On Lockdown MeasuresDocument9 pagesMHA Order Dt. 17.5.2020 On Extension of Lockdown Till 31.5.2020 With Guidelines On Lockdown MeasuresThe Indian Express75% (16)

- Press Note 1Document6 pagesPress Note 1PGurusPas encore d'évaluation

- CM Letter PalgharDocument4 pagesCM Letter PalgharPGurusPas encore d'évaluation

- Lockdown Extension & Guidelines - Press Release - 1st MayDocument7 pagesLockdown Extension & Guidelines - Press Release - 1st MayPGurusPas encore d'évaluation

- Telegraph 1Document1 pageTelegraph 1PGurusPas encore d'évaluation

- The Hindu Group Salary Cuts LetterDocument2 pagesThe Hindu Group Salary Cuts LetterPGurus100% (1)

- Press Note 2Document7 pagesPress Note 2PGurusPas encore d'évaluation

- Tax Department Notice To NDTVDocument32 pagesTax Department Notice To NDTVThe WirePas encore d'évaluation

- Journalist UnionsDocument6 pagesJournalist UnionsPGurusPas encore d'évaluation

- CommerceMin DirectiveDocument4 pagesCommerceMin DirectivePGurusPas encore d'évaluation

- Dr. Shiva Ayyadurai's Letter To President Donald TrumpDocument4 pagesDr. Shiva Ayyadurai's Letter To President Donald TrumpPGurus96% (24)

- HMO Directives On The 21-Day Lock DownDocument1 pageHMO Directives On The 21-Day Lock DownPGurusPas encore d'évaluation

- Indian Express CEO LetterDocument3 pagesIndian Express CEO LetterPGurusPas encore d'évaluation

- GuidelinesDocument6 pagesGuidelinesThe Indian ExpressPas encore d'évaluation

- PM Speech On March 24, 2020Document6 pagesPM Speech On March 24, 2020PGurusPas encore d'évaluation

- DR Swamy S Letter To PM 2020 03 20Document6 pagesDR Swamy S Letter To PM 2020 03 20PGurus100% (3)

- 04 - Press Release On FM's Comments On SBI ChairmanDocument2 pages04 - Press Release On FM's Comments On SBI ChairmanPGurus0% (2)

- CAPM and Alpha - Practice Problems - SOLUTIONSDocument2 pagesCAPM and Alpha - Practice Problems - SOLUTIONSAlexa WilcoxPas encore d'évaluation

- Working Capital ManagementDocument27 pagesWorking Capital ManagementNamir RafiqPas encore d'évaluation

- Module 5A CBO Corporate Banking Topic 1Document17 pagesModule 5A CBO Corporate Banking Topic 1RajabPas encore d'évaluation

- Pail BankruptcyDocument12 pagesPail BankruptcyZerohedgePas encore d'évaluation

- Negotiations, Deal StructuringDocument30 pagesNegotiations, Deal StructuringVishakha PawarPas encore d'évaluation

- Accounting For Not-for-Profit and Public Sector OrganizationsDocument55 pagesAccounting For Not-for-Profit and Public Sector OrganizationsAshley Cleveland100% (4)

- UntitledDocument9 pagesUntitledĐăng Nguyễn HảiPas encore d'évaluation

- RMC No 10-2018 - Wholding Tax On CreditorsDocument2 pagesRMC No 10-2018 - Wholding Tax On CreditorsMinnie JulianPas encore d'évaluation

- Chapter Four: Mcgraw-Hill/Irwin 4-1Document18 pagesChapter Four: Mcgraw-Hill/Irwin 4-1John SnowPas encore d'évaluation

- UntitledDocument14 pagesUntitledGen BPas encore d'évaluation

- Financial Institutions Management A Risk Management Approach 8th Edition Saunders Solutions Manual 1Document17 pagesFinancial Institutions Management A Risk Management Approach 8th Edition Saunders Solutions Manual 1iva100% (35)

- Group 1 - International Accounting Comparative Accounting The Americas and AsiaDocument23 pagesGroup 1 - International Accounting Comparative Accounting The Americas and AsiaAlmaliyana BasyaibanPas encore d'évaluation

- Bruner-2004-Journal of Applied Corporate FinanceDocument16 pagesBruner-2004-Journal of Applied Corporate FinancePablo Natán González CastilloPas encore d'évaluation

- Philippine Trust Company. FinalDocument3 pagesPhilippine Trust Company. FinalmaxregerPas encore d'évaluation

- Assignment 5 (Financial Management)Document3 pagesAssignment 5 (Financial Management)Nurhani SyafinaPas encore d'évaluation

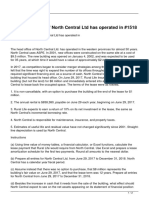

- The Head Office of North Central LTD Has Operated in PDFDocument2 pagesThe Head Office of North Central LTD Has Operated in PDFTaimur TechnologistPas encore d'évaluation

- Questions On Preparation of Financial Statements 1-4Document4 pagesQuestions On Preparation of Financial Statements 1-4LaonePas encore d'évaluation

- Pengaruh Profitabilitas, Time Interest Earned, Pertumbuhan Aset, Pertumbuhan Penjualan, Dan Operating Leverage Terhadap Struktur ModalDocument22 pagesPengaruh Profitabilitas, Time Interest Earned, Pertumbuhan Aset, Pertumbuhan Penjualan, Dan Operating Leverage Terhadap Struktur ModalDebbie Cynthia WijayaPas encore d'évaluation

- Untitled DocumentDocument2 pagesUntitled DocumentPeter Jun ParkPas encore d'évaluation

- Business Laws and Regulations No. IiDocument131 pagesBusiness Laws and Regulations No. IiEdrian CabaguePas encore d'évaluation

- Project Report-Corporate RestructuringDocument26 pagesProject Report-Corporate Restructuringchahvi bansal100% (1)

- Best 5 Mid Cap Stocks To BuyDocument13 pagesBest 5 Mid Cap Stocks To BuydesikanttPas encore d'évaluation

- 2023 ASSIGNMENT BBA - Accounting 732 Assign 1Document8 pages2023 ASSIGNMENT BBA - Accounting 732 Assign 1sunjna sunjna chainPas encore d'évaluation

- MercedesDocument138 pagesMercedesMihaela DavidoaiaPas encore d'évaluation

- Final AccountsDocument9 pagesFinal AccountsAbhinav Kumar YadavPas encore d'évaluation

- T2 Corporation Income Tax Return (2019 and Later Tax Years) : IdentificationDocument9 pagesT2 Corporation Income Tax Return (2019 and Later Tax Years) : IdentificationBryan WilleyPas encore d'évaluation

- San Beda College Alabang: INSTRUCTION: Worksheet PreparationDocument1 pageSan Beda College Alabang: INSTRUCTION: Worksheet PreparationMarriel Fate CullanoPas encore d'évaluation

- Soal Latihan Chapter 01Document3 pagesSoal Latihan Chapter 01Indrian Sibi todingPas encore d'évaluation

- Lokesh Chhajed BBA Project On Axis BankDocument44 pagesLokesh Chhajed BBA Project On Axis BankHarsh KumarPas encore d'évaluation

- 2 Past Year Q'sDocument7 pages2 Past Year Q'sJhagantini PalaniveluPas encore d'évaluation