Académique Documents

Professionnel Documents

Culture Documents

Alphanumeric Tax Codes (Atc) Industries Covered by Vat ATC Industries Covered by Vat ATC Industries Covered by Vat ATC

Transféré par

bekbek120 évaluation0% ont trouvé ce document utile (0 vote)

26 vues1 pagedffyhdfydyy

Titre original

sdrydt

Copyright

© © All Rights Reserved

Formats disponibles

PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentdffyhdfydyy

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

26 vues1 pageAlphanumeric Tax Codes (Atc) Industries Covered by Vat ATC Industries Covered by Vat ATC Industries Covered by Vat ATC

Transféré par

bekbek12dffyhdfydyy

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 1

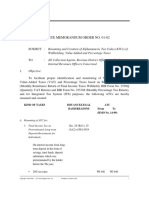

BIR Form 2550M (ENCS) - Page 2

ALPHANUMERIC TAX CODES (ATC)

INDUSTRIES COVERED BY VAT ATC INDUSTRIES COVERED BY VAT ATC INDUSTRIES COVERED BY VAT ATC

1. Mining and Quarrying VQ010 4. Lending Investors/Dealer In securites/ VB 102 8.6 Other Franchise VB 112

2. Manufacturing Pawnshops/Pre-need Co./ 9. Real Estate, Renting &

2.1 Tobacco VM 040 5. Construction VC 010 Business Activity

2.2 Alcohol VM 110 6. Wholesale & Retail VT 010 9.1 Sale of Real Property VP 100

2.3 Petroleum VM 120 7. Hotel & Restaurants 9.2 Lease of Real Property VP 101

2.4 Automobiles VM 130 7.1 Hotels, Motels VB100 9.3 Sale/Lease of Intangible Property VP 102

2.5 Non-Essentials (Excisable Goods) VM 140 7.2 Restaurants, Caterers VB101 10. Compulsory Social Security

2.6 Cement VM 030 8. Transport Storage and Communications Public Administration & Defense VD 010

2.7 Food Products and Beverages VM 020 8.1 Land Transport-Cargo VB105 11. Other Community Social and

2.8 Pharmaceuticals VM 150 8.2 Water Transport-Cargo Personal Service Activity VH 010

2.9 Flour VM 050 8.2.1 Domestic Ocean Going Vessels VB106 12. Others:

2.10 Sugar VM 160 8.2.2 Inter Island Shipping Vessels VB 107 12.1 Storage & Warehousing VS 010

2.11 Pesticides VM 100 8.3 Air Transport-Cargo VB108 12.2 Business Services

2.12 Others (General) VM 010 8.4 Telephone & Telegraph VB109 (In General) VB 010

3. Non Life Insurance VB 113 8.5 Radio/TV Broadcasting VB 111 12.3 Importation of Goods VI 010

BIR FORM NO. 2550M - Monthly Value-Added Tax Declaration

Guidelines and Instructions

Who shall file The Quarterly Summary List of Sales must contain the monthly total sales generated

This return/declaration shall be filed in triplicate by the following taxpayers: from regular buyers/customers regardless of the amount of sale per buyer/customer, as well as

1. A VAT-registered person; from casual buyers/customers with individual sales amounting to P100,000.00 or more. For

2. A person required to register as a VAT taxpayer this purpose, the term regular buyers/customers shall refer to buyers/customers who are

but failed to register; and engaged in business or exercise of profession and those with whom the taxpayer has transacted

3. A person who imports goods. at least six (6) transactions regardless of the amount per transaction either in the previous year

This return/declaration must be filed by the aforementioned taxpayers for as long as the or current year. The term casual buyers/customers shall refer to buyers/customers who are

VAT registration has not yet been cancelled, even if there is no taxable transaction during the engaged in business or exercise of profession but did not qualify as regular buyers/customers

month or the aggregate sales/receipts for any 12-month period did not exceed the P550,000.00 as defined in the preceding statement.

threshold. The names of sellers/suppliers/service-providers and the buyers/customers shall be

When and Where to file alphabetically arranged and presented in the schedules. All the summary lists or schedules

th

The returns/declarations must be filed not later than the 20 day following the mentioned above for submission to the BIR shall mention as heading or caption of the

end of each month; provided, however, that with respect to taxpayers enrolled with the report/list/schedule BIR-registered name, trade name, address and TIN of the taxpayer-filer

Electronic Filing and Payment System (EFPS), the deadline for e-filing the monthly VAT and the covered period of the report/list/schedule.

Declaration and e-paying the tax due thereon shall be five (5) days later than the deadline set The quarterly summary lists shall reflect the consolidated monthly transactions per

above. The declaration shall be accomplished only for the first two (2) months of each seller/supplier or buyer for each of the three (3) months of the VAT taxable quarter of the

taxable quarter. taxpayer as reflected in the quarterly VAT return except the summary list of importation which

The returns/declarations must be filed with any Authorized Agent Bank (AAB) within shall show the individual transactions for the month for each month of the taxable

the jurisdiction of the Revenue District Office where the taxpayer is required to register. In quarter/VAT quarter. Thus, the period covered by the summary list required to be submitted

places where there are no Authorized Agent Bank (AAB), the returns/declarations shall be to the BIR shall be the covered period of the corresponding quarterly VAT return.

filed with the Revenue Collection Officer or duly Authorized City or Municipal Treasurer The Quarterly Summary List of Sales and Purchases shall be submitted in magnetic

located within the revenue district where the taxpayer is required to register. form using 3.5-inch floppy diskettes following the format prescribed by the Bureau. The

Taxpayers with branches shall file only one consolidated return/declaration for his P2,500,000.00/P1,000,000.00 threshold shall refer not only to sales/purchases subject to VAT

principal place of business or head office and all branches. but shall likewise include exempt and zero-rated sales/purchases.

Submission of said summary lists in diskette form shall be required for the taxable

When and Where to Pay quarter where the total sales (taxable net of VAT, zero-rated, exempt) exceed P2,500,000.00

Upon filing this return/declaration, the total amount payable shall be paid to the or total purchases (taxable-net of VAT, zero-rated, exempt) exceed P1,000,000. Thus, if the

Authorized Agent Bank (AAB) where the return/declaration is filed. In places where there are total quarterly sales amounted to P3,000,000.00 and the total purchases amounted to

no AABs, payment shall be made to the Revenue Collection Officer or duly Authorized City P900,000.00, the quarterly summary list to be submitted shall only be for sales and not for

or Municipal Treasurer who shall issue a Revenue Official Receipt (ROR) therefore. purchases. On the other hand, if the total quarterly sales amounted to P2,000,000.00 and the

Where the return/declaration is filed with an AAB, the lower portion of the total quarterly purchases amounted to P1,500,000.00 then the quarterly summary list to be

return/declaration must be properly machine-validated and stamped by the Authorized Agent submitted shall only be for purchases and not for sales. Once any of the taxable quarters total

Bank to serve as the receipt of payment. The machine validation shall reflect the date of sales and/or purchases exceed the threshold, the VAT taxpayer shall, in addition to the

payment, amount paid and transaction code, and the stamped mark shall show the name of the requirement that the summary list for such quarter be submitted in accordance with the

bank, branch code, teller's code and teller's initial. The AAB shall also issue an official receipt prescribed electronic format, be further required to submit the summary lists for the next three

or bank debit advice or credit document, whichever is applicable, as additional proof of

(3) succeeding quarters, still in accordance with the prescribed electronic format, regardless of

payment.

whether or not such succeeding taxable quarter sales and/or purchases exceed the threshold

Rates and Bases of Tax amount of P2,500,000.00 for sales and P1,000,000.00 for purchases.

A. On Sale of Goods and Properties ten percent (10%) of the gross selling price or gross Only diskettes readable upon submission shall be considered as duly filed/submitted

value in money of the goods or properties sold, bartered or exchanged. Quarterly Summary List of Sales and Output Tax/Purchases and Input Tax/Importations.

B. On Sale of Services and Use or Lease of Properties ten percent (10%) of gross receipts Failure to submit the quarterly summary list in the manner prescribed shall be punishable

derived from the sale or exchange of services, including the use or lease of properties. under the pertinent provisions of the Tax Code and existing regulations.

C. On Importation of Goods ten percent (10%) based on the total value used by the

Penalties

Bureau of Customs in determining tariff and customs duties, plus customs duties, excise There shall be imposed and collected as part of the tax:

taxes, if any, and other charges, such tax to be paid by importer prior to the release of 1. A surcharge of twenty five percent (25%) for each of the following violations:

such goods from customs custody: Provided, That where the customs duties are a. Failure to file any return and pay the amount of tax or installment due on or before the due

determined on the basis of quantity or volume of the goods, the value added tax shall be date;

based on the landed cost plus excise taxes, if any. b. Unless otherwise authorized by the Commissioner, filing a return with a person or office other

D. On Export Sales and Other Zero-rated Sales - 0%. than those with whom it is required to be filed;

c. Failure to pay the full or part of the amount of tax shown on the return, or the full amount of

Computation of Tax tax due for which no return is required to be filed on or before the due date;

d. Failure to pay the deficiency tax within the time prescribed for its payment in the notice of

Output Tax (total invoice amount in sales invoices/official

assessment.

receipts for the month x 1/11) xxx 2. A surcharge of fifty percent (50%) of the tax or of the deficiency tax, in case any payment has been

Less: Input tax (total invoice amount in purchase made on the basis of such return before the discovery of the falsity or fraud, for each of the

invoices/receipts for the month x 1/11) xxx following violations:

VAT Payable (Excess Input Tax) xxx a. Willful neglect to file the return within the period prescribed by the Code or by rules and

=== regulations; or

Definition of Terms b. In case a false or fraudulent return is willfully made.

Input Tax means the value-added tax due from or paid by a 3. Interest at the rate of twenty percent (20%) per annum, or such higher

VAT-registered person in the course of his trade or business on importation of goods or local rate as may be prescribed by rules and regulations, on any unpaid amount

of tax, from the date prescribed for the payment until the amount is fully

purchase of goods or services, including lease or use of property, from a VAT-registered

paid.

person. It shall also include the transitional input tax determined in accordance with Section 4. Compromise penalty.

111 of the National Internal Revenue Code.

Output Tax means the value-added tax due on the sale or lease of taxable Attachments

goods or properties or services by any person registered or required to 1. Duly issued Certificate of Creditable VAT Withheld at Source, if applicable;

register under Section 236 of the National Internal Revenue Code. 2. Duly approved Tax Debit Memo, if applicable;

3. Duly approved Tax Compliance Certificate, if applicable.

Schedules

All persons liable to VAT, such as manufacturers, wholesalers, service-providers, among others, with Note: All background information must be properly filled up.

total quarterly sales/receipts (net of VAT) exceeding P2,500,000.00 and/or quarterly purchases (net of VAT) All returns filed by an accredited tax representative on behalf of a taxpayer shall bear the following

exceeding P1,000,000.00, shall submit to the RDO or LTDO or LTAD having jurisdiction over the taxpayer, information:

on or before the 25th day of the month following the close of the VAT taxable quarter calendar or fiscal A. For CPAs and others (individual practitioners and members of GPPs);

quarter, whichever is applicable 1) Quarterly Summary List of Sales to Regular Buyers/Customers and a.1 Taxpayer Identification Number (TIN); and

Casual Buyers/Customers and Output Tax reflecting BIR-registered name of the buyer who is engaged in a.2 Certificate of Accreditation Number, Date of Issuance,

business/exercise of profession, TIN of the buyer (only for sales that are subject to VAT), exempt sales, zero- and Date of Expiry.

rated sales, sales subject to VAT and Output Tax (VAT on sales); 2) Quarterly Summary List of Local B. For members of the Philippine Bar (individual practitioners, members of GPPs):

Purchases and Input Tax showing BIR-registered name of the seller/supplier/service-provider, address of b.1 Taxpayer Identification Number (TIN); and

seller/supplier/service-provider, TIN of the seller, exempt purchases, zero-rated purchases, purchases of

b.2 Attorneys Roll Number or Accreditation Number, if any.

services, capital goods and goods other than capital goods subject to VAT (exclusive of VAT), and creditable

Box No. 1 refer to transaction period and not the date of filing this return

input tax and non-creditable input tax to be computed not on a per supplier basis but on a per month basis;

and 3) Quarterly Summary List of Importations indicating the import entry declaration number, The last 3 digits of the 12-digit TIN refers to the branch code.

assessment/release date, date of importation, name of the seller, country of origin, dutiable value, all TIN = Taxpayer Identification Number. ENCS

charges before release from the Customs custody, VAT-exempt and taxable landed cost, VAT paid,

Official Receipt (OR) number of the official receipt evidencing payment of the tax, and date of VAT payment.

Vous aimerez peut-être aussi

- Equity Valuation: Models from Leading Investment BanksD'EverandEquity Valuation: Models from Leading Investment BanksJan ViebigPas encore d'évaluation

- VAT-guide-englisch Österreichische USt Auf Englisch (PWC)Document52 pagesVAT-guide-englisch Österreichische USt Auf Englisch (PWC)Aline Henrique LimaPas encore d'évaluation

- Bir Form 1600Document3 pagesBir Form 1600Joseph Rod Allan AlanoPas encore d'évaluation

- Educated REIT Investing: The Ultimate Guide to Understanding and Investing in Real Estate Investment TrustsD'EverandEducated REIT Investing: The Ultimate Guide to Understanding and Investing in Real Estate Investment TrustsPas encore d'évaluation

- Coa-Prescribed Account Codes Per Uacs Per Tax Type: Tax On Income and ProfitDocument10 pagesCoa-Prescribed Account Codes Per Uacs Per Tax Type: Tax On Income and ProfitCarlos Ryan RabangPas encore d'évaluation

- Summary of Important Changes Introduced by The Finance Act, 2020 PDFDocument38 pagesSummary of Important Changes Introduced by The Finance Act, 2020 PDFMasum BillahPas encore d'évaluation

- RMO 01-02 - ATCsDocument2 pagesRMO 01-02 - ATCsCkey ArPas encore d'évaluation

- Chart of Account: Abadi Malioboro HotelDocument15 pagesChart of Account: Abadi Malioboro HotelMarsya RossarziPas encore d'évaluation

- Rhi Po10000106Document21 pagesRhi Po10000106kkkashif0% (1)

- Return For Remittance of Value Added TaxDocument2 pagesReturn For Remittance of Value Added TaxDSM DRIVING SCHOOLPas encore d'évaluation

- Swift-Tt-Copy - P.T Bank Negara Indonesia (Persero) - P.T CilegonDocument2 pagesSwift-Tt-Copy - P.T Bank Negara Indonesia (Persero) - P.T Cilegonedi hendrikus100% (1)

- Monthly Remittance Return of Final Income Taxes Withheld: Kawanihan NG Rentas InternasDocument2 pagesMonthly Remittance Return of Final Income Taxes Withheld: Kawanihan NG Rentas InternasAlfred BryanPas encore d'évaluation

- 2021 - Robinhood Securities 1099Document8 pages2021 - Robinhood Securities 1099Estranged GedPas encore d'évaluation

- Schedules of Alphanumeric Tax CodesDocument5 pagesSchedules of Alphanumeric Tax CodesKatherine YuPas encore d'évaluation

- Release Order Notification (Inward Processing) and Bonded TransportationDocument10 pagesRelease Order Notification (Inward Processing) and Bonded TransportationAung LattPas encore d'évaluation

- Brokerage Account Xxx9881 Consolidated Form 1099 2023Document10 pagesBrokerage Account Xxx9881 Consolidated Form 1099 2023gabriela.paradaPas encore d'évaluation

- Tariff Ind en External 03072023Document13 pagesTariff Ind en External 03072023youbitalieturinPas encore d'évaluation

- Acorns Securities LLC: Tax Information Account 01233072633386B1Document8 pagesAcorns Securities LLC: Tax Information Account 01233072633386B1Silvia GloverPas encore d'évaluation

- BIR RMC 28-2017 Annex ADocument1 pageBIR RMC 28-2017 Annex AAnonymous yKUdPvwjPas encore d'évaluation

- SWİFT Fin MT-760Document3 pagesSWİFT Fin MT-760Murat BıçakPas encore d'évaluation

- Pa Tax Brief - November 2019Document10 pagesPa Tax Brief - November 2019Teresita TibayanPas encore d'évaluation

- Accounting Systems and ProcessesDocument22 pagesAccounting Systems and ProcessesDrNaveed Ul HaqPas encore d'évaluation

- Jomar V. Villena, Cpa, Mba: Accounting and Auditing Assurance ServicesDocument2 pagesJomar V. Villena, Cpa, Mba: Accounting and Auditing Assurance ServicesJM Valonda Villena, CPA, MBAPas encore d'évaluation

- FC0PR003 Procedure (Original)Document30 pagesFC0PR003 Procedure (Original)hasan sohailPas encore d'évaluation

- Impairment of Assets Solutions PDF FreeDocument7 pagesImpairment of Assets Solutions PDF FreeJohn Miguel GordovePas encore d'évaluation

- International Energy Efficiency Certificate: Karadeniz Powership Asim BeyDocument3 pagesInternational Energy Efficiency Certificate: Karadeniz Powership Asim BeyVirtual Extrovert100% (1)

- RMO No 19-2015 PDFDocument10 pagesRMO No 19-2015 PDFEcarg EtrofnomPas encore d'évaluation

- 0605 Master EditDocument3 pages0605 Master Editray acainPas encore d'évaluation

- SWAZI+ONE Accounting ExerciseDocument2 pagesSWAZI+ONE Accounting Exercisekj98mcqc5zPas encore d'évaluation

- Shell 2009 Annual Report 20f SecDocument195 pagesShell 2009 Annual Report 20f SecpriagnPas encore d'évaluation

- Application FormDocument27 pagesApplication FormSaurabh GoyalPas encore d'évaluation

- Sea Waybill: Non-Negotiable Sea Waybill For Combined Transport or Port To PortDocument1 pageSea Waybill: Non-Negotiable Sea Waybill For Combined Transport or Port To PortBozidar Davidovski100% (1)

- Robinhood Securities LLC: Tax Information Account 636338105Document8 pagesRobinhood Securities LLC: Tax Information Account 636338105Sam BufordPas encore d'évaluation

- Itr 3 InstructionsDocument30 pagesItr 3 Instructionssidharth singhPas encore d'évaluation

- ACC 6050 Milestone 1 FinalDocument14 pagesACC 6050 Milestone 1 FinalvertmeddPas encore d'évaluation

- Equity and Liabilities Part 2Document3 pagesEquity and Liabilities Part 2Kgothatso ArnanzaPas encore d'évaluation

- VAT General GuidelineDocument67 pagesVAT General Guidelineeinvoiceme testPas encore d'évaluation

- Robinhood Markets Inc 85 Willow Road Menlo Park, CA 94025 650-940-2700Document10 pagesRobinhood Markets Inc 85 Willow Road Menlo Park, CA 94025 650-940-2700maicolo1Pas encore d'évaluation

- Iff 09avjps6011k1z7 012022Document2 pagesIff 09avjps6011k1z7 012022KaminariPas encore d'évaluation

- Robinhood Securities LLC: Tax Information Account 161786165Document8 pagesRobinhood Securities LLC: Tax Information Account 161786165Matthew Stacy0% (1)

- Sales Tax Withholding Rate CardDocument1 pageSales Tax Withholding Rate CardQausainPas encore d'évaluation

- Bir For Private Poll Clerk and Third MemberDocument14 pagesBir For Private Poll Clerk and Third MemberDeanna TrinidadPas encore d'évaluation

- Delivery/ Packing List: ConfidentialDocument1 pageDelivery/ Packing List: ConfidentialA TurkiPas encore d'évaluation

- Ajmer Vidyut Vitran Nigam LTDDocument1 pageAjmer Vidyut Vitran Nigam LTDgovt job postgyyPas encore d'évaluation

- Key Terms in BankingDocument12 pagesKey Terms in BankingsagortemenosPas encore d'évaluation

- Instructions For Filling Out FORM ITR-4Document14 pagesInstructions For Filling Out FORM ITR-4Srinivasan ParthasarathyPas encore d'évaluation

- UntitledDocument10 pagesUntitledJosh SofferPas encore d'évaluation

- ZMP19278 - Fragata Uniao - Mil-Tek 102HD PDFDocument6 pagesZMP19278 - Fragata Uniao - Mil-Tek 102HD PDFLeandro_BarjonasPas encore d'évaluation

- Release Order Notification (Inward Processing) and Bonded TransportationDocument14 pagesRelease Order Notification (Inward Processing) and Bonded TransportationAung LattPas encore d'évaluation

- Ffcii Ot 018Document1 pageFfcii Ot 018Silver Ian Aguilar Umali0% (1)

- CurrentBill PDFDocument1 pageCurrentBill PDFSumit SharmaPas encore d'évaluation

- Schedules of Alphanumeric Tax Codes Nature of Income Payment TAX Rate ATC Nature of Income Payment TAX Rate ATC IND Corp Ind CorpDocument1 pageSchedules of Alphanumeric Tax Codes Nature of Income Payment TAX Rate ATC Nature of Income Payment TAX Rate ATC IND Corp Ind CorpMhyckee GuinoPas encore d'évaluation

- Reporting WJJDocument2 pagesReporting WJJOscar GarroPas encore d'évaluation

- Golden Shipping and Trading Company IncDocument8 pagesGolden Shipping and Trading Company IncSkyline Music GroupPas encore d'évaluation

- 125 15tgDocument5 pages125 15tgNeelamSharmaPas encore d'évaluation

- 115 Faisal Saif Introduction To Economics and Accounting 158 1202799125Document7 pages115 Faisal Saif Introduction To Economics and Accounting 158 1202799125Sidra SaifPas encore d'évaluation

- 2020 - Robinhood Securities 1099Document8 pages2020 - Robinhood Securities 1099Ashim DhakalPas encore d'évaluation

- Yes Securites Form Details PDFDocument28 pagesYes Securites Form Details PDFShoaib AnsariPas encore d'évaluation

- Financial Accounting An Introduction 2nd Edition Benedict Solutions ManualDocument41 pagesFinancial Accounting An Introduction 2nd Edition Benedict Solutions ManualJordanGibsonmzwyo100% (15)

- Installments SalesDocument21 pagesInstallments Salesbekbek12Pas encore d'évaluation

- FGHDocument1 pageFGHbekbek12Pas encore d'évaluation

- Accounting Review Part 2: Partnership Liquidationproblem ADocument14 pagesAccounting Review Part 2: Partnership Liquidationproblem Abekbek12Pas encore d'évaluation

- PU85452T 2 Report EN45545 Bel+Power PDFDocument10 pagesPU85452T 2 Report EN45545 Bel+Power PDFbekbek12Pas encore d'évaluation

- AreDocument6 pagesArebekbek12Pas encore d'évaluation

- Chapter 7 - Test BankDocument94 pagesChapter 7 - Test Bankbekbek12100% (2)

- Local Government (General) Amendment Regulations 2016: S.R. No. 18/2016Document6 pagesLocal Government (General) Amendment Regulations 2016: S.R. No. 18/2016bekbek12Pas encore d'évaluation

- Ronivhyl C. Estrella: Educational BackgroundDocument3 pagesRonivhyl C. Estrella: Educational Backgroundbekbek12Pas encore d'évaluation

- Do Not DeleteDocument12 pagesDo Not Deletebekbek12Pas encore d'évaluation

- Chapter 16: Test Bank Some Answers and Comments On The Text Discussion QuestionsDocument9 pagesChapter 16: Test Bank Some Answers and Comments On The Text Discussion Questionsbekbek12Pas encore d'évaluation

- Philippine LiteratureDocument24 pagesPhilippine Literaturebekbek12100% (2)

- Ch7 CVPDocument26 pagesCh7 CVPbekbek12Pas encore d'évaluation

- Chapter 16: Test Bank Some Answers and Comments On The Text Discussion QuestionsDocument9 pagesChapter 16: Test Bank Some Answers and Comments On The Text Discussion Questionsbekbek12Pas encore d'évaluation

- Gr9 12lesson9 PDFDocument10 pagesGr9 12lesson9 PDFbekbek12Pas encore d'évaluation

- Three Statement Financial ModelingDocument13 pagesThree Statement Financial ModelingJack Jacinto100% (1)

- Management Equity Incentives and Corporate Tax AvoDocument13 pagesManagement Equity Incentives and Corporate Tax AvoWenXingyue ArielPas encore d'évaluation

- Week 10B Corporate Tax RatesDocument4 pagesWeek 10B Corporate Tax RatesCrizzalyn CruzPas encore d'évaluation

- Province of Abra Vs Judge Hernando (Case Digest)Document2 pagesProvince of Abra Vs Judge Hernando (Case Digest)Johney Doe100% (2)

- The CirculationDocument18 pagesThe Circulationalaa alaaPas encore d'évaluation

- CBSE XII Economics NotesDocument165 pagesCBSE XII Economics NoteschehalPas encore d'évaluation

- Provisions: B22 Major Changes in TaxDocument9 pagesProvisions: B22 Major Changes in TaxasdjkfnasdbifbadPas encore d'évaluation

- At December 31 2014 The Records of Nortech Corporation Provided PDFDocument1 pageAt December 31 2014 The Records of Nortech Corporation Provided PDFFreelance WorkerPas encore d'évaluation

- Sh. Satya Dev Sharma, Jaipur Vs Assessee On 23 January, 2014Document15 pagesSh. Satya Dev Sharma, Jaipur Vs Assessee On 23 January, 2014sunPas encore d'évaluation

- Form ITR-VDocument2 pagesForm ITR-VSumit ManglaniPas encore d'évaluation

- Assignment - Mandalika Land ConflictDocument3 pagesAssignment - Mandalika Land Conflictwahyu sulistya affarahPas encore d'évaluation

- Tax Management - Lesson PlanDocument4 pagesTax Management - Lesson PlanChakravarti ChakriPas encore d'évaluation

- 1997 SADEQ Development and Finance in IslamDocument7 pages1997 SADEQ Development and Finance in IslamDiaz HasvinPas encore d'évaluation

- HWK - 6Document3 pagesHWK - 6Karen Nicole Lopez0% (1)

- Alkurdi (2020) - Ownership and The Board of Directors On Tax AvoidanceDocument18 pagesAlkurdi (2020) - Ownership and The Board of Directors On Tax AvoidanceAhmad RifaiPas encore d'évaluation

- Library Services Internal Audit ReportDocument23 pagesLibrary Services Internal Audit Reportbahria libPas encore d'évaluation

- Tax Updates BGC Jekell Dec13, 2019Document115 pagesTax Updates BGC Jekell Dec13, 2019Darlene GanubPas encore d'évaluation

- Canada Tax SetupDocument41 pagesCanada Tax SetupRajendran SureshPas encore d'évaluation

- Bengal Tiger Line Pte Ltd. Vs DCIT ITAT ChennaiDocument40 pagesBengal Tiger Line Pte Ltd. Vs DCIT ITAT ChennaiArulnidhi Ramanathan SeshanPas encore d'évaluation

- 05 - Ratio and ProportionDocument17 pages05 - Ratio and ProportionRupesh RoshanPas encore d'évaluation

- Manila Bankers Life Insurance Corp v. CIRDocument16 pagesManila Bankers Life Insurance Corp v. CIRjoselle torrechillaPas encore d'évaluation

- DOCTRINES IN TAXATION: Escape From Taxation (Willful Blindness Doctrine)Document4 pagesDOCTRINES IN TAXATION: Escape From Taxation (Willful Blindness Doctrine)ybunPas encore d'évaluation

- PA2 X ESP HW9 G1 Revanza TrivianDocument9 pagesPA2 X ESP HW9 G1 Revanza TrivianRevan KonglomeratPas encore d'évaluation

- Group Activity Mina HanDocument4 pagesGroup Activity Mina HanLevi's DishwasherPas encore d'évaluation

- Introduction To AccountingDocument6 pagesIntroduction To AccountingKathlyn BesaPas encore d'évaluation

- Basilan V CIRDocument2 pagesBasilan V CIRReinier Jeffrey AbdonPas encore d'évaluation

- RMC No 24-18 - Annexes B1-B5 - Required AttachmentsDocument3 pagesRMC No 24-18 - Annexes B1-B5 - Required AttachmentsGil PinoPas encore d'évaluation

- Solved MR and Mrs Janus Operate A Restaurant Business As ADocument1 pageSolved MR and Mrs Janus Operate A Restaurant Business As AAnbu jaromiaPas encore d'évaluation

- Customs Act 4Document12 pagesCustoms Act 4Sheetal SaylekarPas encore d'évaluation

- Chapter 12: Assessment of Various Entities: Section - A: Statutory UpdateDocument49 pagesChapter 12: Assessment of Various Entities: Section - A: Statutory UpdateAmol TambePas encore d'évaluation