Académique Documents

Professionnel Documents

Culture Documents

Net Debt As A Percentage of Total Capitalization

Transféré par

joeydanzaDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Net Debt As A Percentage of Total Capitalization

Transféré par

joeydanzaDroits d'auteur :

Formats disponibles

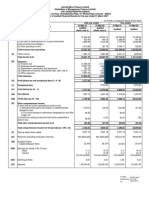

Net debt as a percentage of total capitalization (debt to capital)

From a creditors point of view, the net debt as a percentage of total capitalization ratio is extremely

important. It measures to percentage of debt that makes up a companys total capitalization. A high

debt to capital ratio means that the company finances its operations mostly through debt as opposed to

equity. If a company is financed entirely through debt, then depending on their interest coverage, they

may not be able to make interest payments on their loans if there is a decline in revenue.

Le Chateaus ratio is 55.56%. this means that for every $10 in total capitalization, the company has $5.55

in debt. The majority of their financing comes from debt as opposed to equity. A high ratio makes the

company vulnerable in times of declining sales because the company still has to pay fixed interest

payments on all the debt it has.

The debt to capital ratio enhances comparability for financial statement users since it looks at debt as a

percentage of its capitalization. This makes comparing companies of different market caps easier.

$100,000 in loans for a $500,000 company will have a much bigger impact on it than on a company

thats worth $1,000,000. Creditors want companies with a lower ratio because this means they use less

leverage and thus there is less chance the company will default on its obligations. Net debt is used in the

calculation as opposed to gross debt because it is assumed that all cash and cash equivalents can be

used to pay off that debt.

Net debt as a percentage of total capitalization = (net debt)/(shareholders equity + net debt)

Net debt = all interest-bearing debt cash and cash equivalents

Net debt = Credit facility + long term debt + bank indebtedness + current portion of credit facility +

current portion of long term debt cash = $61,132,000 (long term debt) + $14,337,000 (short term

debt) cash = $75,469,000

Shareholders equity = $60,354,000

Net debt as a percentage of total capitalization = $75,469,000/($60,354,000 + $75,469,000) = 55.56%

Vous aimerez peut-être aussi

- CORPORATION LAW 2019 Case ListDocument2 pagesCORPORATION LAW 2019 Case ListJose Ramir LayesePas encore d'évaluation

- Accounting Rate of ReturnDocument3 pagesAccounting Rate of ReturnDeep Debnath100% (1)

- SEC Opinion 11-44 PDFDocument11 pagesSEC Opinion 11-44 PDFJf ManejaPas encore d'évaluation

- Republic of The Philippines Quezon City: Court AppealsDocument38 pagesRepublic of The Philippines Quezon City: Court AppealsHerzl Hali V. HermosaPas encore d'évaluation

- Legal Review VICARIOUS LIABILITY AN EMPLOYERS BURDEN PDFDocument3 pagesLegal Review VICARIOUS LIABILITY AN EMPLOYERS BURDEN PDFshaniahPas encore d'évaluation

- Dissolution of PartnershipDocument22 pagesDissolution of PartnershipschafieqahPas encore d'évaluation

- A.6 Cancellation of RegistrationDocument15 pagesA.6 Cancellation of RegistrationJOSHUA KENNETH LAZAROPas encore d'évaluation

- 9367 1178283 Draft of Board Resolution For Authority For Legal MattersDocument1 page9367 1178283 Draft of Board Resolution For Authority For Legal MattersHimanshu SinghPas encore d'évaluation

- Pacquiao v. MilabaoDocument26 pagesPacquiao v. Milabaoaudreydql5Pas encore d'évaluation

- Chapter 1 Cases RianoDocument479 pagesChapter 1 Cases RianoAnonymous 4WA9UcnU2XPas encore d'évaluation

- Requirements Merger-ConsolidationDocument1 pageRequirements Merger-ConsolidationmarjPas encore d'évaluation

- Cash FlowDocument12 pagesCash FlowRozaimie Anzuar0% (1)

- Waiver of Rights With AcknowledgmentDocument2 pagesWaiver of Rights With AcknowledgmentBeadle KentotPas encore d'évaluation

- GIS or GENERAL INFORMATION SHEETDocument2 pagesGIS or GENERAL INFORMATION SHEETJohnryan BacusPas encore d'évaluation

- Risk Committee Charter Approved by Board 11-5-2015Document2 pagesRisk Committee Charter Approved by Board 11-5-2015JJ Moore100% (1)

- Partnership: Termination Effect of Death of Agent (1997)Document2 pagesPartnership: Termination Effect of Death of Agent (1997)Catherine MerillenoPas encore d'évaluation

- DLSU Grad Activities 2018Document4 pagesDLSU Grad Activities 2018Darren Goldwin DavidPas encore d'évaluation

- Chap3 Present ValueDocument26 pagesChap3 Present ValueGonzalo Martinez100% (1)

- Salary Authorization & AgreementDocument2 pagesSalary Authorization & AgreementMiles LabadoPas encore d'évaluation

- Practice Multiple Choice Questions For First Test PDFDocument10 pagesPractice Multiple Choice Questions For First Test PDFBringinthehypePas encore d'évaluation

- Secretary-Certificate LetterDocument2 pagesSecretary-Certificate Letterteresa bautista0% (1)

- Bir Ruling No. 508-12: Deguzman Celis & Dionisio Law OfficesDocument3 pagesBir Ruling No. 508-12: Deguzman Celis & Dionisio Law OfficesThe GiverPas encore d'évaluation

- BSP Pawnshop RegistrationDocument3 pagesBSP Pawnshop RegistrationGeneral DuPas encore d'évaluation

- Confidentiality and Non-Disclosure Agreement: WitnessethDocument4 pagesConfidentiality and Non-Disclosure Agreement: WitnessethVinnetCaluyaPas encore d'évaluation

- What Is Separation PayDocument2 pagesWhat Is Separation PayMartin SandersonPas encore d'évaluation

- Agreement Paper For Internal AuditDocument2 pagesAgreement Paper For Internal AuditSubashSangraulaPas encore d'évaluation

- Notice To Explain EmployeeDocument1 pageNotice To Explain EmployeeJa VillamontePas encore d'évaluation

- Watered StockDocument4 pagesWatered StockAnugrah EdoPas encore d'évaluation

- DocxDocument4 pagesDocxKimmy Shawwy0% (1)

- Final Advisory18-02 6.26.18Document8 pagesFinal Advisory18-02 6.26.18mark john batingalPas encore d'évaluation

- Appealing BIR Assessment at The CTADocument1 pageAppealing BIR Assessment at The CTAhenzencameroPas encore d'évaluation

- Motion For Reconsideration Allow Payment of Filing Fee - Maria Cecilia P. LambatinDocument1 pageMotion For Reconsideration Allow Payment of Filing Fee - Maria Cecilia P. LambatinTere TongsonPas encore d'évaluation

- Fundamentals of AcctgDocument4 pagesFundamentals of AcctgIts meh SushiPas encore d'évaluation

- Atty. S. C. Madrona, JR.: Juris Doctor College of Law University of The Philippines Diliman, Quezon CityDocument17 pagesAtty. S. C. Madrona, JR.: Juris Doctor College of Law University of The Philippines Diliman, Quezon Citydarren chenPas encore d'évaluation

- Verification NLRCDocument2 pagesVerification NLRCAndre CruzPas encore d'évaluation

- 048 Ang Vs CADocument12 pages048 Ang Vs CACeslhee AngelesPas encore d'évaluation

- Trademark Application FormDocument2 pagesTrademark Application FormlemmorepisacPas encore d'évaluation

- Share For Share Under Section 40 CDocument13 pagesShare For Share Under Section 40 CCkey ArPas encore d'évaluation

- Extension of Probationary Period LetterDocument1 pageExtension of Probationary Period LetterMichele McmillanPas encore d'évaluation

- Affidavit of Undertaking For AEP Format 16dec2020 Rev.1Document2 pagesAffidavit of Undertaking For AEP Format 16dec2020 Rev.1Princess GarciaPas encore d'évaluation

- Trustees CertificateDocument1 pageTrustees Certificatespy sorianoPas encore d'évaluation

- BIR RMC No. 62-2005Document15 pagesBIR RMC No. 62-2005dencave1Pas encore d'évaluation

- SUMMARY OF OPERATION NewDocument34 pagesSUMMARY OF OPERATION NewRenli MP EspePas encore d'évaluation

- NPS Investigation Form No. 01, S. 2008Document2 pagesNPS Investigation Form No. 01, S. 2008Tim ArroyoPas encore d'évaluation

- 2 7Document35 pages2 7Kiran VaykarPas encore d'évaluation

- 6-Motion To Plead As IndigentDocument1 page6-Motion To Plead As IndigentAnob EhijPas encore d'évaluation

- 1905 (Encs) 2000Document4 pages1905 (Encs) 2000Loss Pokla100% (1)

- Date - : RE: Notice of Returned Check With Demand To Settle Outstanding ObligationDocument1 pageDate - : RE: Notice of Returned Check With Demand To Settle Outstanding ObligationRomak TrancePas encore d'évaluation

- Client Monies Audit Engagement LetterDocument4 pagesClient Monies Audit Engagement LetterKSeegurPas encore d'évaluation

- SEC Memorandum 7 Series 2019 (OPC) PDFDocument19 pagesSEC Memorandum 7 Series 2019 (OPC) PDFJustice PajarilloPas encore d'évaluation

- Memo Circular SBM 2014 001Document2 pagesMemo Circular SBM 2014 001Thelma EvangelistaPas encore d'évaluation

- Moyer Agreement of SaleDocument4 pagesMoyer Agreement of SaleElizabeth ScheinbergPas encore d'évaluation

- Opposition To Motion Quash Information - Back UpDocument4 pagesOpposition To Motion Quash Information - Back Upmerlyn gutierrezPas encore d'évaluation

- Personal and Additional ExemptionsDocument17 pagesPersonal and Additional ExemptionsJamela Ybiernas CalicaPas encore d'évaluation

- 1 Introduction To Business TaxesDocument69 pages1 Introduction To Business TaxesJannet OmolonPas encore d'évaluation

- DRAFT AMLA QandADocument24 pagesDRAFT AMLA QandAMamabetPas encore d'évaluation

- What Is A Debt RatioDocument11 pagesWhat Is A Debt RatioshreyaPas encore d'évaluation

- Financial Analysis Tools - HandoutsDocument2 pagesFinancial Analysis Tools - HandoutsJohna Mae Dolar EtangPas encore d'évaluation

- FSA Chapter 7Document3 pagesFSA Chapter 7Nadia ZahraPas encore d'évaluation

- Shoiab Finance AssignmentDocument6 pagesShoiab Finance AssignmentAbhishek GokhalePas encore d'évaluation

- Case 1: C Case 2: Cap Market, No Production. CDocument1 pageCase 1: C Case 2: Cap Market, No Production. CjoeydanzaPas encore d'évaluation

- Under ArmourDocument1 pageUnder ArmourjoeydanzaPas encore d'évaluation

- Romeo and Juliet Study GuideDocument9 pagesRomeo and Juliet Study GuidejoeydanzaPas encore d'évaluation

- Great Gatsby Essay OutlineDocument2 pagesGreat Gatsby Essay Outlinejoeydanza50% (6)

- Biniyam Yitbarek Article Review On Financial AnalysisDocument6 pagesBiniyam Yitbarek Article Review On Financial AnalysisBiniyam Yitbarek100% (1)

- C C CCC C CCCCCCCC CDocument45 pagesC C CCC C CCCCCCCC Cdevraj537853Pas encore d'évaluation

- Using DuPont Analysis To Assess The Financial Perf PDFDocument16 pagesUsing DuPont Analysis To Assess The Financial Perf PDFKhusboo ChowdhuryPas encore d'évaluation

- Kiểm tra LMS - lần 2Document17 pagesKiểm tra LMS - lần 2Kotoru HanoelPas encore d'évaluation

- Drill 3 AK FSUU AccountingDocument15 pagesDrill 3 AK FSUU AccountingRobert CastilloPas encore d'évaluation

- ch05 ReceivablesDocument51 pagesch05 ReceivableszedingelPas encore d'évaluation

- Financial Asset at Amortized CostDocument27 pagesFinancial Asset at Amortized CostRegene May TrinidadPas encore d'évaluation

- Bond Portfolio Management StrategiesDocument5 pagesBond Portfolio Management StrategiesBarno NicholusPas encore d'évaluation

- 5 6 7 Management of International Business ActivitiesDocument41 pages5 6 7 Management of International Business ActivitiesQuynh Anh NguyenPas encore d'évaluation

- E/o C V/M: (A1) (A2) (A3) (A4) A6) (A7)Document17 pagesE/o C V/M: (A1) (A2) (A3) (A4) A6) (A7)Krisha Lei SanchezPas encore d'évaluation

- 2019 UVA-FRS AND All HC ContractsDocument241 pages2019 UVA-FRS AND All HC ContractsMatt BrownPas encore d'évaluation

- Uhm Early Pay OffDocument3 pagesUhm Early Pay OffDeanne Mitzi SomolloPas encore d'évaluation

- (In Lakhs, Except Per Equity Share Data) : Digitally Signed Bysvraja VaidyanathanDocument9 pages(In Lakhs, Except Per Equity Share Data) : Digitally Signed Bysvraja VaidyanathanAnamika NandiPas encore d'évaluation

- Investment Banking Reference GuideDocument34 pagesInvestment Banking Reference GuideDavid Bonnemort100% (6)

- Time Value of Money: - PV FV/ (1+r) - PVA AMT ( (1 - (1+r) ) /R) - FV PV (1+r) - FVA AMT ( ( (1+r) - 1) /R)Document16 pagesTime Value of Money: - PV FV/ (1+r) - PVA AMT ( (1 - (1+r) ) /R) - FV PV (1+r) - FVA AMT ( ( (1+r) - 1) /R)waqas ahmedPas encore d'évaluation

- Chapter 09 Installment PurchaseDocument37 pagesChapter 09 Installment PurchasefatinPas encore d'évaluation

- W 13-14 Collection and Repayment (Autosaved)Document17 pagesW 13-14 Collection and Repayment (Autosaved)Akii WingPas encore d'évaluation

- Clarkson LumberDocument3 pagesClarkson Lumbermds89Pas encore d'évaluation

- Assessing Dividend PolicyDocument40 pagesAssessing Dividend PolicyMohsin Ul Amin KhanPas encore d'évaluation

- List of Financing and Lending Companies Registered With The SEC and Their Online Lending Platforms As Reported Pursuant To SEC MC 19, Series of 2019Document3 pagesList of Financing and Lending Companies Registered With The SEC and Their Online Lending Platforms As Reported Pursuant To SEC MC 19, Series of 2019lykyan54 EspinosaPas encore d'évaluation

- Level1 - CFA - Mock 2016 - Version1 - JunePM - QuestionsDocument39 pagesLevel1 - CFA - Mock 2016 - Version1 - JunePM - QuestionsaPas encore d'évaluation

- Business Finance: Short Term and Long Term FundsDocument14 pagesBusiness Finance: Short Term and Long Term FundsJanna GunioPas encore d'évaluation

- Mortgage Rates 10-24-2007Document1 pageMortgage Rates 10-24-2007ConsumerMortgageReports100% (1)

- Solutions Manual: Tax Consequences of Home OwnershipDocument52 pagesSolutions Manual: Tax Consequences of Home Ownershipkaka2015Pas encore d'évaluation

- General Mathematics LAS Q2 WK 6Document18 pagesGeneral Mathematics LAS Q2 WK 6Prince Joshua SumagitPas encore d'évaluation

- Session 2Document132 pagesSession 2marcchamiehPas encore d'évaluation

- Chapter 15 - Working Capital and The Financing Decision Problem 1Document8 pagesChapter 15 - Working Capital and The Financing Decision Problem 1Jelay QuilatanPas encore d'évaluation

- Lecture5 6 Ratio Analysis 13Document39 pagesLecture5 6 Ratio Analysis 13Cristina IonescuPas encore d'évaluation

- Chapter 4 - Sources and Uses of FundsDocument17 pagesChapter 4 - Sources and Uses of Fundsmarissa casareno almuetePas encore d'évaluation

- Accounting 3Document20 pagesAccounting 3Nigussie BerhanuPas encore d'évaluation