Académique Documents

Professionnel Documents

Culture Documents

Tax Strategy

Transféré par

Roy HodgsonTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Tax Strategy

Transféré par

Roy HodgsonDroits d'auteur :

Formats disponibles

Tax Strategy

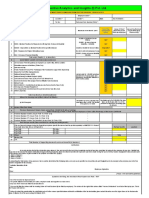

In income tax planning, the tax strategy is to pay the taxes and plan the income to minimize

the tax payable. An individual has several ways to reduce their tax bill which include relief

and tax rebates. A relief is a deduction from the total income, reducing chargeable income,

and a tax rebate is a deduction of tax payable.

1. Donation

No. Contribution Notes

1 Gift of money to the Subsection 44(6)

Government, State

Government or Local

Authorities.

2 Gift of money to Approved Subsection 44(6)

Institutions or

Organisations.

(Amount is limited to 7% of

aggregate income)

3 Gift of money or cost of Subsection 44(11B)

contribution in kind for any

Approved Sports Activity or

Sports Body.

(Amount is limited to 7% of

aggregate income)

4 Gift of money or cost of Subsection 44(11C)

contribution in kind for any

Approved Project of

National Interest Approved

by Ministry of Finance.

(Amount is limited to 7% of

aggregate income)

5 Gift of artifacts, Subsection 44(6A)

manuscripts or paintings.

6 Gift of money for provision Subsection 44(8)

of Library Facilities or to

Libraries.

7 Gift of money or Subsection 44(9)

contribution in kind for the

provision of facilities in

Public Places for the

benefit of disabled persons.

8 Gift of money or medical Subsection 44(10)

equipment to any

healthcare facility approved

by the Ministry of Health.

9 Gift of paintings to the Subsection 44(11)

National Art Gallery or any

State Art Gallery.

2. Tax Relief

Year 2016

No. Individual Relief Types Amount (RM)

1 Self and Dependent 9,000

2 Medical expenses for parents 5,000 (Limited)

OR OR

Parent

Limited 1,500 for only one mother 3000 (Limited)

Limited 1,500 for only one father

3 Basic supporting equipment 6,000 (Limited)

4 Disabled Individual 6,000

5 Education Fees (Individual) 7,000 (Limited)

6 Medical expenses for serious diseases 6,000 (Limited)

7 Complete medical examination 500 (Limited)

8 Purchase of books, journals, magazines and publications 1,000 (Limited)

9 Purchase of personal computer (once in every 3 years) 3,000 (Limited)

10 Net saving in SSPN's scheme (with effect from year 6,000 (Limited)

assessment 2012 until year assessment 2017)

11 Purchase of sport equipment for sport activities 300 (Limited)

12 Interest expended to finance purchase of residential property. 10,000

Relief of up to RM10, 000 a year for three consecutive years (Limited)

from the first year the interest is paid.

Subject to the following conditions:

(i) The taxpayer is a Malaysian citizen and a resident;

(ii) limited to one residential unit;

(iii) the sale and purchase agreement is signed between 10th

March 2009

and 31st December 2010; and

(iv) the residential property is not rented out.

Where:

(a) 2 or more individuals are eligible to claim relief for the same

property ; and

(b) total interest expended by those individuals exceeds the

allowable amount for that year. Each individual is allowed an

amount of relief for each year based on the following formula:

AxB

C

where;

A = total interest allowable in the relevant year;

B = total interest expended by the relevant individual in the

relevant year;

C = total interest expended by all the individuals.

13 Husband/Wife/Alimony Payments 4,000 (Limited)

14 Disable Wife/Husband 3,500

15 Ordinary Child relief 2,000

16 Each unmarried child of 18 years and above who is receiving 2,000

full-time education ("A-Level", certificate, matriculation or

preparatory courses).

17 Each unmarried child of 18 years and above that:

(i) receiving further education in Malaysia in respect of an 8,000

award of diploma or higher (excluding matriculation/preparatory

courses).

(ii) Receiving further education outside Malaysia in respect of

an award of degree or its equivalent (including Master or

Doctorate).

(iii) The instruction and educational establishment shall be

approved by the relevant government authority.

18 Disabled child 6,000

Additional exemption of RM8,000 disable child age 18 years old

and above, not married and pursuing diplomas or above

qualification in Malaysia @ bachelor degree or above outside

Malaysia in program and in Higher Education Institute that is

accredited by related Government authorities

19 Life insurance and EPF 6,000 (Limited)

20 Deferred Annuity and Private Retirement Scheme (PRS) - with 3,000 (Limited)

effect from year assessment 2012 until year assessment 2021

21 Insurance premium for education or medical benefit 3,000 (Limited)

22 Contribution to the Social Security Organization (SOCSO) 250 (Limited)

3. Tax Rebate

Income Tax Rebates For Resident Individual with Chargeable Income Less Than

RM35, 000

Year Of Year Of

Assessment Assessment

2001 - 2008 2009

No. Tax Rebate Onwards

(RM) (RM)

a Separate Assessment - -

Wife 350 400

Husband 350 400

b Combined Assessment - -

Wife 350 400

Husband 350 400

Total 700 800

b Assessment Where Husband Or Wife Does - -

Not Has Any Total Income 350 400

Wife 350 400

Husband

Total 700 800

Other Tax Rebates

No. Tax Rebate (RM)

a Zakat/Fitrah Subject to the maximum of tax charged

b Fees/Levy on Foreign Subject to the maximum of tax charged

Workers ( deleted from year

assessment 2011 )

Tax Schedule

Assessment Year 2016

Chargeable Income Calculations (RM) Rate % Tax(RM)

0 - 5,000 On the First 2,500 0 0

On the First 5,000 0

5,001 - 20,000 Next 15,000 1 150

On the First 20,000 150

20,001 - 35,000 Next 15,000 5 750

On the First 35,000 900

35,001 - 50,000 Next 15,000 10 1,500

On the First 50,000 2,400

50,001 - 70,000 Next 20,000 16 3,200

On the First 70,000 5,600

70,001 - 100,000 Next 30,000 21 6,300

On the First 100,000 11,900

100,001 - 250,000 Next 150,000 24 36,000

On the First 250,000 47,900

250,001 - 400,000 Next 150,000 24.5 36,750

On the First 400,000 84,650

400,001 - 600,000 Next 200,000 25 50,000

On the First 600,000 134,650

600,001 - 1,000,000 Next 400,000 26 104,00

On the First 1,000,000 238,650

Exceeding 1,000,000 Next ringgit 28 ..........

Conclusion

In income tax planning, the tax strategy is to pay the taxes and to be smart in filing the tax

returns in order to minimize the tax payable. For a tax payer, his employer will automatically

deduct the tax from his monthly salary under the scheme of Schedular Tax Deduction

(STD).

A tax payer needs to file a completed BE Form, which determines whether a sufficient

amount of taxes was already withheld from our paycheck, whether we still owe some taxes,

or whether the government owes us a refund. A tax return is based on Self-Assessment

System (SAS), in which a tax payer is given the responsibility to compute his own tax

liability. In order to reduce the amount of taxes to be paid, a tax payer needs to know the

types of income that need to be declared and also about his deductions.

A tax payer needs to make sure that he submits his income tax returns by 30th April. In

addition, a responsible tax payer needs to always check with the latest National Budget

Announcement in August for any amendments.

Vous aimerez peut-être aussi

- 3-Personal Taxation (Planning Your Tax Strategy)Document21 pages3-Personal Taxation (Planning Your Tax Strategy)Farahliza RosediPas encore d'évaluation

- Malaysia tax planning guideDocument32 pagesMalaysia tax planning guideHairani ArisPas encore d'évaluation

- Explanatory Notes BE 2008 by Inland Revenue BoardDocument9 pagesExplanatory Notes BE 2008 by Inland Revenue Boardzarfarie aronPas encore d'évaluation

- Chapter 5 DDR A231Document14 pagesChapter 5 DDR A231Patricia TangPas encore d'évaluation

- Chapter 5 Donation Relief Rebate - LatestDocument55 pagesChapter 5 Donation Relief Rebate - LatestKailing KhowPas encore d'évaluation

- Calculate total income and deductions for donationsDocument1 pageCalculate total income and deductions for donationshfdghdhPas encore d'évaluation

- Business Taxation 5445Document9 pagesBusiness Taxation 5445Muhammad Saleem MushtaqPas encore d'évaluation

- ATax - 03Document29 pagesATax - 03Haseeb Ahmed ShaikhPas encore d'évaluation

- LHDN Tax Relief 2021 GuideDocument21 pagesLHDN Tax Relief 2021 GuideJeffrey YeePas encore d'évaluation

- Investment Declaration Form-2Document2 pagesInvestment Declaration Form-2Pramod KumarPas encore d'évaluation

- Chap 6 Relief and RebateDocument15 pagesChap 6 Relief and RebateKelvin OngPas encore d'évaluation

- Srimadh BhagavathamDocument2 pagesSrimadh Bhagavathamprabha sureshPas encore d'évaluation

- Under Section Id) : Unit 4 Exempted IncomesDocument8 pagesUnder Section Id) : Unit 4 Exempted IncomesAmritPas encore d'évaluation

- Income Under The Head Salaries Assignment EscholarsDocument38 pagesIncome Under The Head Salaries Assignment EscholarspuchipatnaikPas encore d'évaluation

- Deductions from GTI under Sections 80C to 80DDDocument7 pagesDeductions from GTI under Sections 80C to 80DDBrinda RPas encore d'évaluation

- Atc AtuDocument9 pagesAtc AtuKeshav SagarPas encore d'évaluation

- Investment Declaration Form For FY - 2017-18Document2 pagesInvestment Declaration Form For FY - 2017-18arunPas encore d'évaluation

- BB SIR QUESTION BANK DT May 22Document216 pagesBB SIR QUESTION BANK DT May 22Srushti AgarwalPas encore d'évaluation

- PDS (OTO360) Form PDFDocument2 pagesPDS (OTO360) Form PDFcikgutiPas encore d'évaluation

- GIT - Total Income Exam QP - 18-3-2020Document18 pagesGIT - Total Income Exam QP - 18-3-2020geddadaarunPas encore d'évaluation

- Adv. Accountancy Paper-3Document22 pagesAdv. Accountancy Paper-3Avadhut PaymallePas encore d'évaluation

- Oto 360 Takaful Product Disclosure SheetDocument2 pagesOto 360 Takaful Product Disclosure SheetSara AriffPas encore d'évaluation

- PDS (OTO360) FormDocument2 pagesPDS (OTO360) Formawang naziroolPas encore d'évaluation

- Taxation Direct and IndirectDocument6 pagesTaxation Direct and Indirectdivyakashyapbharat1Pas encore d'évaluation

- Genesis 64-11 PDFDocument1 pageGenesis 64-11 PDFRebuild BoholPas encore d'évaluation

- Chapter 13-B (Asenjo, Inso, Jacomilla)Document31 pagesChapter 13-B (Asenjo, Inso, Jacomilla)Gwyneth Inso100% (1)

- Deductions 2021 22Document5 pagesDeductions 2021 22Karan RajakPas encore d'évaluation

- Income Tax DepartmentDocument4 pagesIncome Tax Departmentmansi joshiPas encore d'évaluation

- THE State University of Zanzibar: Lecturer: Cpa Masoud Rashid Course: Taxation Group No: 3Document24 pagesTHE State University of Zanzibar: Lecturer: Cpa Masoud Rashid Course: Taxation Group No: 3tembo groupPas encore d'évaluation

- Income Tax Rates (For Individuals, Hufs, Association of Persons, Body of Individuals) Assessment Year 2011-2012 Relevant To Financial Year 2010-2011Document6 pagesIncome Tax Rates (For Individuals, Hufs, Association of Persons, Body of Individuals) Assessment Year 2011-2012 Relevant To Financial Year 2010-2011jhancyPas encore d'évaluation

- Income Tax Guide FY 2023-24Document11 pagesIncome Tax Guide FY 2023-24akshay yadavPas encore d'évaluation

- CA. AJAY JAIN, 9310167881: Time Allowed - 3 Hours Maximum Marks - 100Document14 pagesCA. AJAY JAIN, 9310167881: Time Allowed - 3 Hours Maximum Marks - 100RishabPas encore d'évaluation

- Special Deductions ReviewerDocument4 pagesSpecial Deductions ReviewerPunkkaroPas encore d'évaluation

- Finals Quiz No. 1 W AnswerDocument4 pagesFinals Quiz No. 1 W AnswerLouris DanielPas encore d'évaluation

- CLUBBING OF INCOME AND DEDUCTIONS UNDER CHAPTER VI-ADocument8 pagesCLUBBING OF INCOME AND DEDUCTIONS UNDER CHAPTER VI-ASiddharth VaswaniPas encore d'évaluation

- Deductions To Be Made in Computing Total IncomeDocument15 pagesDeductions To Be Made in Computing Total IncomeAbey FrancisPas encore d'évaluation

- Exempted Incomes For Different CategoriesDocument10 pagesExempted Incomes For Different Categorieskmr_arnPas encore d'évaluation

- Income Tax Form 2020 IDocument1 pageIncome Tax Form 2020 ISuvashreePradhanPas encore d'évaluation

- PGBP QuestionsDocument6 pagesPGBP QuestionsHdkakaksjsb100% (2)

- Jurnal Organisasi Nonlaba ISAK 35 - Semester Genap 2022-2023 - MHSWDocument7 pagesJurnal Organisasi Nonlaba ISAK 35 - Semester Genap 2022-2023 - MHSWraihandam2005Pas encore d'évaluation

- Salary TaxDocument4 pagesSalary Taxapi-3810632Pas encore d'évaluation

- Tax AmendmentDocument10 pagesTax AmendmentVinay BoradPas encore d'évaluation

- FICO Compensation Details - FTE ConversionDocument1 pageFICO Compensation Details - FTE ConversionNiteshPas encore d'évaluation

- DeductionsDocument20 pagesDeductionsKartikPas encore d'évaluation

- M012-Consumer Mathematics (Taxation)Document5 pagesM012-Consumer Mathematics (Taxation)Tan Jun YouPas encore d'évaluation

- IT Declaration Form 2014-15 - After BudgetDocument2 pagesIT Declaration Form 2014-15 - After BudgetAkram M. AlmotaaPas encore d'évaluation

- Income Tax ProjectDocument26 pagesIncome Tax ProjectVinay KumarPas encore d'évaluation

- Tax Planning Through Permissible DeductionsDocument33 pagesTax Planning Through Permissible DeductionsNuhman.MPas encore d'évaluation

- Income TAX CalculationDocument33 pagesIncome TAX CalculationTaharat Ahmed ChowdhuryPas encore d'évaluation

- Income Taxation ExamDocument2 pagesIncome Taxation ExamyezaqueraPas encore d'évaluation

- RP and EB Vishnu Kant BhadauriaDocument6 pagesRP and EB Vishnu Kant Bhadauriavishnu bhadauriaPas encore d'évaluation

- PDF Document 50fdc8ce3d82 1Document20 pagesPDF Document 50fdc8ce3d82 120BRM051 Sukant SPas encore d'évaluation

- ACC221Document5 pagesACC221Hilarie JeanPas encore d'évaluation

- Deductions Under Chapter VI A - d17d562d b594 4627 9fb3 E1efc2352b13Document37 pagesDeductions Under Chapter VI A - d17d562d b594 4627 9fb3 E1efc2352b13Subiksha LakshPas encore d'évaluation

- Income Exempt From TaxDocument4 pagesIncome Exempt From TaxKartikPas encore d'évaluation

- Final Individual Assignment - 4 Nov 2022Document6 pagesFinal Individual Assignment - 4 Nov 2022Vernice CuffyPas encore d'évaluation

- PDS Boost ProtectActiveDocument4 pagesPDS Boost ProtectActiveAizat HermanPas encore d'évaluation

- Wiley GAAP for Governments 2012: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsD'EverandWiley GAAP for Governments 2012: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsPas encore d'évaluation

- Direct Property & Casualty Insurance Carrier Revenues World Summary: Market Values & Financials by CountryD'EverandDirect Property & Casualty Insurance Carrier Revenues World Summary: Market Values & Financials by CountryPas encore d'évaluation

- One Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020D'EverandOne Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020Pas encore d'évaluation

- ELC501Document5 pagesELC501Roy HodgsonPas encore d'évaluation

- All Components of M1, M2 and M3Document4 pagesAll Components of M1, M2 and M3Roy HodgsonPas encore d'évaluation

- Income Tax Planning: Muhammad Syazwan Bin Jaslen Muhammad Tarmizi Binmd AkairDocument8 pagesIncome Tax Planning: Muhammad Syazwan Bin Jaslen Muhammad Tarmizi Binmd AkairRoy HodgsonPas encore d'évaluation

- Income Tax Planning: Muhammad Syazwan Bin Jaslen Muhammad Tarmizi Binmd AkairDocument8 pagesIncome Tax Planning: Muhammad Syazwan Bin Jaslen Muhammad Tarmizi Binmd AkairRoy HodgsonPas encore d'évaluation

- Understanding MacroeconomicsDocument36 pagesUnderstanding Macroeconomicsrahul191991Pas encore d'évaluation

- Tanzania Revenue Authority's Direct Tax Laws on Determining Year of IncomeDocument64 pagesTanzania Revenue Authority's Direct Tax Laws on Determining Year of IncomeBISEKOPas encore d'évaluation

- 2013 NGC Annual ReportDocument162 pages2013 NGC Annual ReportCurtis DookiePas encore d'évaluation

- Advanced Finacial ModellingDocument1 pageAdvanced Finacial ModellingLifeis BeautyfulPas encore d'évaluation

- Ramlal Jewellers PVT LTD ITAT ORDERDocument17 pagesRamlal Jewellers PVT LTD ITAT ORDERUmashankar SinhaPas encore d'évaluation

- Fa2 Final Final ReportDocument15 pagesFa2 Final Final ReportMohammadPas encore d'évaluation

- The Wealth of Nations SummaryDocument2 pagesThe Wealth of Nations SummaryAnonymous nhhYbFwjPas encore d'évaluation

- List of Purpose Codes 1: (For Use in Forms P/R Only)Document25 pagesList of Purpose Codes 1: (For Use in Forms P/R Only)Siti CleaningPas encore d'évaluation

- Accounting Policies ProceduresDocument62 pagesAccounting Policies ProceduresLaurice MelepyanoPas encore d'évaluation

- CUSTOMS LAW MANUAL - NotesDocument10 pagesCUSTOMS LAW MANUAL - NotesChetanya KapoorPas encore d'évaluation

- Evaluation of StakeholderDocument3 pagesEvaluation of StakeholderTalha KhanPas encore d'évaluation

- Module 1.3 - Other Percentage Taxes Notes and Exercises - My Students'Document10 pagesModule 1.3 - Other Percentage Taxes Notes and Exercises - My Students'Jann Exequiel FranciscoPas encore d'évaluation

- CPE520 - Site SelectionDocument3 pagesCPE520 - Site SelectionJaymacPas encore d'évaluation

- Forms of Business Ownership & Factors to ConsiderDocument47 pagesForms of Business Ownership & Factors to ConsiderHamidul IslamPas encore d'évaluation

- FSA ASSIGNMENT-3 AnchalDocument4 pagesFSA ASSIGNMENT-3 AnchalAnchal ChokhaniPas encore d'évaluation

- Analisis Perpajakan Terhadap Bentuk Usaha Tetap Berbasis Layanan AplikasiDocument23 pagesAnalisis Perpajakan Terhadap Bentuk Usaha Tetap Berbasis Layanan AplikasiNidha NianPas encore d'évaluation

- Gross Income 2b Received by or Accrued NotesDocument27 pagesGross Income 2b Received by or Accrued Notestumonekongo02Pas encore d'évaluation

- Data 789 111Document74 pagesData 789 111Ram CherryPas encore d'évaluation

- BDO vs. Republic, G.R. No. 198756, January 13, 2015Document26 pagesBDO vs. Republic, G.R. No. 198756, January 13, 2015Your Public ProfilePas encore d'évaluation

- Petroleum Regulation No. 9 Covers Financial, Administrative ControlsDocument22 pagesPetroleum Regulation No. 9 Covers Financial, Administrative ControlsbennyusPas encore d'évaluation

- Donors TaxDocument16 pagesDonors TaxNikkolae LibreaPas encore d'évaluation

- Notice: Health Insurance Portability and Accountability Act of 1996 Implementation: Taxpayer Advocacy PanelsDocument1 pageNotice: Health Insurance Portability and Accountability Act of 1996 Implementation: Taxpayer Advocacy PanelsJustia.comPas encore d'évaluation

- DeanDocument16 pagesDeanJames De TorresPas encore d'évaluation

- Chapter Four FundDocument13 pagesChapter Four FundnaodbrtiPas encore d'évaluation

- International Trade Theories: Course Pack - Unit II - IBEDocument29 pagesInternational Trade Theories: Course Pack - Unit II - IBESagar BhardwajPas encore d'évaluation

- Dilg Joincircular 2016815 81d0d76d7eDocument16 pagesDilg Joincircular 2016815 81d0d76d7eRaidenAiPas encore d'évaluation

- Assessment ProcedureDocument8 pagesAssessment ProcedureAbhishek SharmaPas encore d'évaluation

- Zeian Cover RevisedDocument13 pagesZeian Cover Revisedcherry valePas encore d'évaluation

- Substitute Form W-8BEN: (Certificate of Foreign Status of Beneficial Owner For United States Tax Withholding)Document1 pageSubstitute Form W-8BEN: (Certificate of Foreign Status of Beneficial Owner For United States Tax Withholding)Manuel Aguilar100% (1)

- Case Digest on Contex Corporation v. CIR examines VAT exemptionsDocument3 pagesCase Digest on Contex Corporation v. CIR examines VAT exemptionsTimothy Joel CabreraPas encore d'évaluation