Académique Documents

Professionnel Documents

Culture Documents

Feroze1888 Mills Limited: Formerly: Karachi Stock Exchange Limited

Transféré par

Hussain Ali0 évaluation0% ont trouvé ce document utile (0 vote)

12 vues1 pageThis document provides financial and operational information for Feroze1888 Mills Limited from 2012-2015. It shows that the company's sales, profits, assets and share prices increased over this period. The company produces and exports towels and its shares are traded on the Pakistan Stock Exchange. It includes data on the company's leadership, facilities, production capacity, and dividend distributions.

Description originale:

Final results of feroz mills limited

Titre original

FML

Copyright

© © All Rights Reserved

Formats disponibles

PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentThis document provides financial and operational information for Feroze1888 Mills Limited from 2012-2015. It shows that the company's sales, profits, assets and share prices increased over this period. The company produces and exports towels and its shares are traded on the Pakistan Stock Exchange. It includes data on the company's leadership, facilities, production capacity, and dividend distributions.

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

12 vues1 pageFeroze1888 Mills Limited: Formerly: Karachi Stock Exchange Limited

Transféré par

Hussain AliThis document provides financial and operational information for Feroze1888 Mills Limited from 2012-2015. It shows that the company's sales, profits, assets and share prices increased over this period. The company produces and exports towels and its shares are traded on the Pakistan Stock Exchange. It includes data on the company's leadership, facilities, production capacity, and dividend distributions.

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 1

Pakistan Stock Exchange Limited

Formerly: Karachi Stock Exchange Limited

S.No.

Feroze1888 Mills Limited

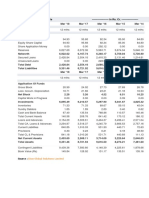

CHAIRMAN 2012 2013 2014 2015

KHALEEQUR RAHMAN FINANCIAL POSITION (Rs. In Million)

Paid-Up Capital 3768.01 3768.01 3768.01 3768.01

CHIEF EXECUTIVE/MANAGING DIRECTOR Reserves & Surplus 953.22 1896.70 3292.02 5164.62

ANAS RAHMAN Sharholder's Equity 4721.23 5664.71 7060.03 8932.63

Deferred Taxation / Liabilities 0.00 0.00 0.00 0.00

BOARD OF DEIRECTORS: Long Term Loans / Deposits 795.83 606.25 472.09 383.25

Current Liabilities 3592.79 3963.69 4027.76 2308.21

JAVED YUNUS TABBA

Total Assets 10190.50 11315.31 12640.55 12704.75

SHABBIR AHMED Fixed Assets (Gross) 7266.60 7350.52 7860.74 8835.81

PERVEZ SAEED Accumulated Depreciation / 12631.62 2950.42 3248.30 3616.12

JONATHAN R. SIMON Amortization

Fixed Assets (Net) 4634.98 4400.10 4612.44 5219.69

KHALEEQUR RAHMAN

Capital work in Progress 44.23 126.10 582.31 535.60

PERWEZ AHMED 0.01 0.01 0.01 0.01

Long Term Investment

SHEIKH ZAFAR AHMED Current Assets 5459.26 6749.34 7414.04 6918.26

ANAS RAHMAN OPERATING POSITION (Rs. In Million)

REGISTERED OFFICE: Sales (Net) / Revenues 13272.20 13484.14 17697.27 17533.23

Cost of Sales 11373.91 10917.66 14351.70 13622.71

H-23/4-A, Scheme 3,

Gross Profit 1898.29 2566.48 3345.57 3910.52

Landhi Industrial Area, Operating Expenses 874.75 963.36 1122.35 1350.63

Karachi Operating Profit / (Loss) 1023.54 1603.12 2223.22 2559.89

HEAD OFFICE: Financial Charges 345.79 217.05 331.55 32.28

Other Income 0.00 0.00 0.00 0.00

H-23/4-A, Scheme 3, Prior Year Adjustment 0.00 0.00 0.00 0.00

Landhi Industrial Area, Profit / (Loss) Before Taxation 677.74 1386.08 1891.68 2527.61

Taxation Current & Deff 142.60 140.45 194.21 198.38

Karachi Prior Years 0.00 0.00 0.00 3.61

Total 142.60 140.45 194.21 201.99

AUDITORS:

Profit / (Loss) After Taxation 534.14 1245.63 1697.47 2325.62

Rehman Sarfaraz Rahim Iqbal Rafiq RATIOS

LOCATION OF FACTORY / PLANT

Book Value 12.53 15.03 18.74 23.71

H-23/4-A, Landhi, Assets Turnover 1.30 1.19 1.40 1.38

Karachi. 1.52 1.70 1.84 3.00

Current Ratio

YEAR ENDING: Earning Per Share Pre Tax 1.80 3.68 5.02 6.71

Earning Per Share After Tax 1.42 3.31 4.50 6.17

June Payout Ratio After Tax 140.85 90.63 88.89 81.04

AUTHORISED CAPITAL: Market Capitalization 9834.51 13225.72 22280.24 22438.50

Rs: 4000 mil DISTRIBUTION

Cash Dividend % 20.00 30.00 40.00 50.00

PAID VALUE:

Stock Dividend % 0.00 0.00 0.00 0.00

Rs: 10 Total % 20.00 30.00 40.00 50.00

SHARES TRADED: SHARE PRICE Rs.

High 37.15 39.69 83.26 63.50

0.018 mil

Low 15.05 30.51 35.00 55.60

No.of SHAREHOLDERS: Average 26.10 35.10 59.13 59.55

523

CAPACITY UTILISATION:

Installed Capacity = 106,673,278 meter

Actual Production = 97,680,567

COMPANY INFORMATION

The Company was incorporated in Pakistan as a public

limited company.

The shares of the Company are quoted on Karachi

Stock Exchange.

The Company is principally engaged in production and

export of towels.

Vous aimerez peut-être aussi

- Pakistan Stock Exchange Listed Company FinancialsDocument1 pagePakistan Stock Exchange Listed Company FinancialserfanxpPas encore d'évaluation

- Analysis ReportsDocument1 pageAnalysis ReportsMuiz SaddozaiPas encore d'évaluation

- Pakistan Stock Exchange Limited: D. G. Khan Cement Company LimitedDocument1 pagePakistan Stock Exchange Limited: D. G. Khan Cement Company LimitederfanxpPas encore d'évaluation

- Location of Factory / PlantDocument1 pageLocation of Factory / PlantGhulam AhmadPas encore d'évaluation

- Atlas HondaDocument2 pagesAtlas HondasaranidoPas encore d'évaluation

- Pakistan Stock Exchange Listed Maple Leaf Cement Factory FinancialsDocument1 pagePakistan Stock Exchange Listed Maple Leaf Cement Factory FinancialsHussain AliPas encore d'évaluation

- Analysis Reports PDFDocument1 pageAnalysis Reports PDFFaizan AhmadPas encore d'évaluation

- Pakistan Stock Exchange Limited: The Searle Company LimitedDocument1 pagePakistan Stock Exchange Limited: The Searle Company LimitederfanxpPas encore d'évaluation

- Bestway Cement Limited: Location of Factory / PlantDocument1 pageBestway Cement Limited: Location of Factory / PlantBurhan Ahmed MayoPas encore d'évaluation

- Analysis ReportsDocument1 pageAnalysis Reportsfari khPas encore d'évaluation

- BNWMDocument1 pageBNWMHussain AliPas encore d'évaluation

- Pakistan Stock Exchange LimitedDocument1 pagePakistan Stock Exchange LimitederfanxpPas encore d'évaluation

- Pakistan Stock Exchange Limited: Indus Motor Company LimitedDocument1 pagePakistan Stock Exchange Limited: Indus Motor Company Limitedmusab nawazPas encore d'évaluation

- Analysis Report PsoDocument3 pagesAnalysis Report PsoMuhammad Waqas HafeezPas encore d'évaluation

- Pakistan Stock Exchange LimitedDocument1 pagePakistan Stock Exchange LimitedayazPas encore d'évaluation

- Pakistan CablesDocument2 pagesPakistan CablesSaad SiddiquiPas encore d'évaluation

- MCBDocument1 pageMCBAbdul Habib MirPas encore d'évaluation

- Financial Management II ProjectDocument11 pagesFinancial Management II ProjectsimlimisraPas encore d'évaluation

- CashFlow - StandaloneDocument3 pagesCashFlow - StandaloneSourav RajeevPas encore d'évaluation

- A Summer Project Report OnDocument17 pagesA Summer Project Report OnHarsh MidhaPas encore d'évaluation

- Industry Segment of Bajaj CompanyDocument4 pagesIndustry Segment of Bajaj CompanysantunusorenPas encore d'évaluation

- Dalmia Bharat Sugar and Industries Ltd.Document19 pagesDalmia Bharat Sugar and Industries Ltd.Shweta GargPas encore d'évaluation

- Financials of Canara BankDocument14 pagesFinancials of Canara BankSattwik rathPas encore d'évaluation

- Jubilant CompleteDocument16 pagesJubilant CompleteShivamKharePas encore d'évaluation

- Key Financial Ratios of HCL TechnologiesDocument9 pagesKey Financial Ratios of HCL TechnologiesshirleyPas encore d'évaluation

- Company Info - Print FinancialsDocument2 pagesCompany Info - Print FinancialsDhruv NarangPas encore d'évaluation

- Suzlon Energy Balance Sheet, P&L Statment, CashflowDocument10 pagesSuzlon Energy Balance Sheet, P&L Statment, CashflowBharat RajputPas encore d'évaluation

- Cairns India Private LimitedDocument25 pagesCairns India Private LimitedSuruchi GoyalPas encore d'évaluation

- Birla CableDocument4 pagesBirla Cablejanam shahPas encore d'évaluation

- HDFC Bank LTD.: Profit and Loss A/CDocument4 pagesHDFC Bank LTD.: Profit and Loss A/CsureshkarnaPas encore d'évaluation

- Finance Satyam AnalysisDocument12 pagesFinance Satyam AnalysisNeha AgarwalPas encore d'évaluation

- Ch-3 Finance Department Trading & P&L AccountDocument4 pagesCh-3 Finance Department Trading & P&L AccountMit MehtaPas encore d'évaluation

- Antony Waste Handling Cell Ltd. Company OverviewDocument19 pagesAntony Waste Handling Cell Ltd. Company OverviewSarthak TinguriyaPas encore d'évaluation

- Balance Sheet of Indiabulls - in Rs. Cr.Document3 pagesBalance Sheet of Indiabulls - in Rs. Cr.MubeenPas encore d'évaluation

- Presented by Harichandana Y (2001MBA018) Sanskriti Bharti (2001MBA022) Pragati Upadhya (2001MBA110)Document23 pagesPresented by Harichandana Y (2001MBA018) Sanskriti Bharti (2001MBA022) Pragati Upadhya (2001MBA110)Harichandana YPas encore d'évaluation

- Al Fajar Ply Board Factory OrgDocument22 pagesAl Fajar Ply Board Factory OrgFINAC GROUPPas encore d'évaluation

- Comprehensive IT Industry Analysis - ProjectDocument52 pagesComprehensive IT Industry Analysis - ProjectdhruvPas encore d'évaluation

- (XI) Bibliography and AppendixDocument5 pages(XI) Bibliography and AppendixSwami Yog BirendraPas encore d'évaluation

- Transport Logistics Profitability and Cost Efficiency Over TimeDocument13 pagesTransport Logistics Profitability and Cost Efficiency Over TimeAninda DuttaPas encore d'évaluation

- Queen SouthDocument16 pagesQueen SouthMohammad Sayad ArmanPas encore d'évaluation

- Financial Statement AnalysisDocument18 pagesFinancial Statement AnalysisEashaa SaraogiPas encore d'évaluation

- Nippon Life India Asset Management Profit & Loss Account, Nippon Life India Asset Management Financial Statement & AccountsDocument1 pageNippon Life India Asset Management Profit & Loss Account, Nippon Life India Asset Management Financial Statement & AccountsToxic MaviPas encore d'évaluation

- ITM MaricoDocument8 pagesITM MaricoAdarsh ChaudharyPas encore d'évaluation

- Moneycontrol P&LDocument2 pagesMoneycontrol P&Lveda sai kiranmayee rasagna somaraju AP22322130023Pas encore d'évaluation

- Bank's Quarterly Financial Parameters and YoY Growth RatesDocument20 pagesBank's Quarterly Financial Parameters and YoY Growth Ratesdominic wurdaPas encore d'évaluation

- Raymond P&LDocument2 pagesRaymond P&LSJPas encore d'évaluation

- Consolidated Balance Sheet: Wipro TCS InfosysDocument4 pagesConsolidated Balance Sheet: Wipro TCS Infosysvineel kumarPas encore d'évaluation

- Relaxo Footwears financial analysis from Mar-14 to Mar-20Document86 pagesRelaxo Footwears financial analysis from Mar-14 to Mar-20Pragati AgarwalPas encore d'évaluation

- 34 - Neha Sabharwal - Panacea BiotechDocument10 pages34 - Neha Sabharwal - Panacea Biotechrajat_singlaPas encore d'évaluation

- Ratio Analysis Ibrahim Fibres LTDDocument4 pagesRatio Analysis Ibrahim Fibres LTDanon_607941Pas encore d'évaluation

- 17 - Manoj Batra - Hero Honda MotorsDocument13 pages17 - Manoj Batra - Hero Honda Motorsrajat_singlaPas encore d'évaluation

- Welspun India: PrintDocument2 pagesWelspun India: PrintSJPas encore d'évaluation

- Agency ProblemDocument10 pagesAgency ProblemKARNATI CHARAN 2028331Pas encore d'évaluation

- Assingment SCM SEM4 - 1Document17 pagesAssingment SCM SEM4 - 1KARTHIYAENI VPas encore d'évaluation

- Bank Performance AnalysisDocument4 pagesBank Performance AnalysisSurbhî GuptaPas encore d'évaluation

- Company Info - Print Financials2Document2 pagesCompany Info - Print Financials2rojaPas encore d'évaluation

- Profit Loss AccountDocument8 pagesProfit Loss AccountAbhishek JenaPas encore d'évaluation

- Ceat Balance SheetDocument2 pagesCeat Balance Sheetkcr kc100% (2)

- LIC Housing Finance Ltd. - Research Center: Balance SheetDocument3 pagesLIC Housing Finance Ltd. - Research Center: Balance Sheetpriyankaanu2345Pas encore d'évaluation

- Schaum's Outline of Bookkeeping and Accounting, Fourth EditionD'EverandSchaum's Outline of Bookkeeping and Accounting, Fourth EditionÉvaluation : 5 sur 5 étoiles5/5 (1)

- Contract O2672 1548Document1 pageContract O2672 1548Hussain AliPas encore d'évaluation

- The Organic Meat Company Limited: Half Yearly Progress ReportDocument7 pagesThe Organic Meat Company Limited: Half Yearly Progress ReportHussain AliPas encore d'évaluation

- 181656Document42 pages181656Hussain AliPas encore d'évaluation

- Suraj Cotton Mills curtails production by 40Document1 pageSuraj Cotton Mills curtails production by 40Hussain AliPas encore d'évaluation

- CDA Release Order No.40 - Road-III Short Tender Notice February 2023Document1 pageCDA Release Order No.40 - Road-III Short Tender Notice February 2023Hussain AliPas encore d'évaluation

- ND Acc 202329marDocument1 pageND Acc 202329marHussain AliPas encore d'évaluation

- CDA Release Order No.40 - Road-III Short Tender Notice February 2023Document1 pageCDA Release Order No.40 - Road-III Short Tender Notice February 2023Hussain AliPas encore d'évaluation

- LESCO Tenders NoticeDocument2 pagesLESCO Tenders NoticeHussain AliPas encore d'évaluation

- Interim Financial Information: Quarter Ended September 30, 2022 (Unaudited)Document42 pagesInterim Financial Information: Quarter Ended September 30, 2022 (Unaudited)Hussain AliPas encore d'évaluation

- Investor insights on India's growth potentialDocument51 pagesInvestor insights on India's growth potentialPavan VasaPas encore d'évaluation

- Quarter Ended: (Un-Audited) For TheDocument27 pagesQuarter Ended: (Un-Audited) For TheHussain AliPas encore d'évaluation

- Annual Report 2022Document222 pagesAnnual Report 2022Hussain AliPas encore d'évaluation

- Afghanistan Economic Monitor 25 August 2022Document7 pagesAfghanistan Economic Monitor 25 August 2022Hussain AliPas encore d'évaluation

- 201550Document1 page201550Hussain AliPas encore d'évaluation

- Kohinoor Mills Lic ModificationDocument14 pagesKohinoor Mills Lic ModificationHussain AliPas encore d'évaluation

- JS-TPLP 12oct22Document3 pagesJS-TPLP 12oct22Hussain AliPas encore d'évaluation

- Account Activity Generated Through HBL MobileDocument1 pageAccount Activity Generated Through HBL MobileHussain AliPas encore d'évaluation

- Quote 202108decDocument43 pagesQuote 202108decHussain AliPas encore d'évaluation

- 195240Document2 pages195240Hussain AliPas encore d'évaluation

- 195320Document2 pages195320Hussain AliPas encore d'évaluation

- FarsiDocument102 pagesFarsiHussain AliPas encore d'évaluation

- First Quarter Report March 2022: Enabling A Digital TomorrowDocument43 pagesFirst Quarter Report March 2022: Enabling A Digital TomorrowHussain AliPas encore d'évaluation

- Board and Management of Lucky Cement CompanyDocument43 pagesBoard and Management of Lucky Cement CompanyHussain AliPas encore d'évaluation

- 193721Document4 pages193721Hussain AliPas encore d'évaluation

- Industrial Component CatalogueDocument103 pagesIndustrial Component CatalogueHussain AliPas encore d'évaluation

- VedicReport5 22 20225 22 01PMDocument55 pagesVedicReport5 22 20225 22 01PMHussain AliPas encore d'évaluation

- GHGL and GVGL: Steadily Expanding Portfolios: GHGL - Further Diversifying Its Product PortfolioDocument3 pagesGHGL and GVGL: Steadily Expanding Portfolios: GHGL - Further Diversifying Its Product PortfolioHussain AliPas encore d'évaluation

- GEM Board PresentationDocument18 pagesGEM Board PresentationHussain AliPas encore d'évaluation

- 187006Document19 pages187006Hussain AliPas encore d'évaluation

- Posts Detail: Pakistan Aeronautical ComplexDocument41 pagesPosts Detail: Pakistan Aeronautical ComplexHussain AliPas encore d'évaluation