Académique Documents

Professionnel Documents

Culture Documents

Accounting

Transféré par

EuniceJulianne Dela Peña AlbisoCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Accounting

Transféré par

EuniceJulianne Dela Peña AlbisoDroits d'auteur :

Formats disponibles

lOMoARcPSD|1872561

Lecture notes, Management Accounting, Lecture 1-12

Management Accounting (Vrije Universiteit Amsterdam)

Distributing prohibited | Downloaded by EuniceJulianne Albiso (eunicejulianne13@yahoo.com)

lOMoARcPSD|1872561

Week 1

Strategy specifies how an organization matches its own capabilities with the

opportunities in the marketplace to accomplish its objectives.

Value Chain is the sequence of business functions in which customer usefulness is

added to products or services

Cost:

Cost sacrificed resource to achieve a specific objective.

Actual cost a cost that has occurred.

Budgeted cost a predicted cost.

Cost object anything of interest for which a cost is desired.

Cost assignment a general term that includes gathering accumulated costs to a cost

object. This includes:

- Tracing accumulated costs with a direct relationship to the cost object and

- Allocating accumulated costs with an indirect relationship to a cost object.1

Direct costs:

can be conveniently and economically traced (tracked) to a cost object (source

document).

Indirect costs: cannot be conveniently or economically traced to a cost object. Instead

of being traced, these costs are allocated to a cost object in a rational and

systematic manner (no source document).

Costs are fixed or variable only with respect to a specific activity or a given time period

Cost Driver a variable that causally affects costs over a given time span.

Relevant Range the band of normal activity level (or volume) in which there is a

specific relationship between the level of activity (or volume) and a given cost.

For example, fixed costs are considered fixed only within the relevant range.

Inventoriable costs:

These costs are capitalized as assets, work in process and finished goods

inventory, until they are sold and transferred to Cost of Goods Sold.

Period costs:

have no future value and are expensed as incurred.

Also known as Product Costs (Fin. Acc.)

1. Direct Materials

2. Direct Labor

3. Indirect Manufacturing costs. (Manufacturing Overhead / Factory Overhead)

Prime cost: all direct manufacturing costs (labor and materials).

Conversion cost: direct labor and factory overhead costs, collectively.

1

Distributing prohibited | Downloaded by EuniceJulianne Albiso (eunicejulianne13@yahoo.com)

lOMoARcPSD|1872561

Cost Volume Profit analysis

CVP analyses help managers planning by evaluating various alternatives.

Assumptions in CVP

Total costs consist of fixed and variable costs;

Changes in production/sales volume are the sole cause

for cost and revenue changes;

Revenue and costs behave and can be graphed as a

linear function (a straight line);

Selling price, variable cost per unit and fixed costs are all

known and constant;

If multiple products are studied, their relative sales proportions (sales-mix) are

known and constant;

The time value of money (interest) is ignored.

The Margin of Safety (MOS), an indicator of risk, measures the distance between

budgeted sales and breakeven sales

The degree of OL at a given sales volume helps managers predict the effect of changes

in sales volume on operating income. Organizations with a high proportion of

fixed costs have high operating leverage.

Sales mix:

To this point assumed that a single product is produced and sold.

A more realistic scenario involves multiple products sold, in different volumes, with

different costs.

The same formulae are used, but instead use average contribution margins for

bundles of products.

Week 2

- Job-costing system: Distinct units of a product or service

- Process-costing system: Masses of identical or similar units of a product or

service

Cost Pool: Any logical grouping of related cost objects

Cost-Allocation Base: A cost driver is used as a basis upon which to build a systematic

method of distributing indirect costs

Fe. Lets say that direct labour hours cause indirect costs to change. Accordingly,

direct hours will be used to distribute or allocate costs among objects based on

their usage of that cost driver

Seven step approach to Job Costing:

1. Identify the chosen cost object. (Job 650)

2. Identify the direct costs of the job

3. Identify cost allocation base: Machine-Hours

4. Identify the indirect cost amount

5. Compute the indirect cost rate

6. Compute the indirect job costs

7. Compute the total job costs (of job 650)

Distributing prohibited | Downloaded by EuniceJulianne Albiso (eunicejulianne13@yahoo.com)

lOMoARcPSD|1872561

Actual costing:

Actual costing is a system that uses actual costs to determine the cost of individual jobs.

It allocates indirect costs based on the actual indirect-cost rate times the actual

quantity of the cost-allocation base. (Problem, how frequently does the rate

change? Therefore normal costing)

Normal Costing

Normal Costing is a method that allocates indirect costs based on the budgeted

indirect cost rate times the actual quantity of the cost allocation bases.

Journal entries

- Journal entries are made at each step of the production process

- The purpose to have the accounting system closely effect the actual state of the

business, its inventories and its production processes.

- All inventoriable costs are accumulated in the WIP account

o Direct materials used

o Direct labour incurred

o Manufacturing overhead (MOH) allocated or applied

Accounting for overhead

- Under/over allocated overhead will be eliminated in the end-of-periode adjusting

entry process, using one of the three possible methods.

- The choice of method should be based on such issues as materiality, consistency

and industry practice.

o Adjusted allocation Rate approach All allocations are recalculated

with the actual, exact allocation rate.

o Write Off approach the difference is simply written off the COGS

o Proration approach the differences is allocated between COGS, WIP

and Finished Goods, based on their relative sizes.

Over- and Undercosting

- Overcosting A product consumes a low level of resources but is allocated high

costs per unit

- Undercosting A product consumes a high level of resources but is allocated low

costs per unit

Cross-subsidization

- The results of overcosting one product and undercosting another

- The overcosted product absorbs too much cost, making it seem less profitable

than it really is

- The undercosted product is left with too little cost, making it seem more

profitable than it really is.

Activity- Based Costing

1. Overhead is accumulated in cost pools

2. Overhead in the cost pools is assigned to products using cost drivers which

represent and measure the number of individual activities undertaken or

performed to produce products or render services

Activity: Any event, action, transaction, or work sequence that causes a cost to be

incurred in producing a product or providing a service.

Distributing prohibited | Downloaded by EuniceJulianne Albiso (eunicejulianne13@yahoo.com)

lOMoARcPSD|1872561

ABC vs Simple:

- Each method yields a different cost figure, which will lead to different Gross

Margins calculations

- Only overhead is involved. Total costs for the firm remain the same they are

just allocated to different cost objects within the firm

- Selection of the appropriate method and cost-drivers should be based on

experience, industry practices, as well as a cost-benefit analysis of each option

under consideration.

Hierarchy of Activity levels: (not all activity costs are driven by output units)

1. Unit-level costs are performed for each unit of production

2. Batch-level costs are performed for each batch of products

3. Product-sustaining costs are performed in support of an entire product line

4. Facility-sustaining costs are required to support an entire production facility

Benefits of ABC

- The primary benefit of ABC is more accurate product costing because ABC leads

to more cost pools used to assign overhead costs to products

- ABC leads to better pricing and product mix decisions

- ABC leads to enhanced control over overhead costs. Many overhead costs can be

traced directly to activities

- Thus, managers become more aware of their responsibility to control the

activities that generate costs (ABM)

ABC vs Simple costing Schemes

ABC is only as goods as the drivers selected, and their actual relationship to costs

Poorly chosen cost-drivers will produces inaccurate costs, even with ABC

Budgeting Basics: A budget is a formal written summary (or statement) of

managements plans for a specified time period, expressed in financial and non-

financial terms.

Benefits of budgeting:

- It requires all levels of management to plan ahead

- It provides definite objectives for evaluating performance

- It creates an early warning system for potential problems

- It facilitates the coordination of activities within the business

- It contributes to positive behaviour patterns throughout the organization

Master budget: is a set of interrelated budgets that constitutes a plan of action for a

specified time period

Sales or revenue budget

- The sales budget is the first budget prepared

- All other budgets depend on the sales budget

- It is derived from the sales forecast, and it represents managements best

estimate of sales revenue for the budget period

Distributing prohibited | Downloaded by EuniceJulianne Albiso (eunicejulianne13@yahoo.com)

lOMoARcPSD|1872561

Production requirements: The production budget shows the units that must be

produced to meet anticipated sales.

Direct materials purchases budget: This contains both the quantity and cost of direct

materials to be purchased.

Kaizen Budgeting A kaizen budgeting approach would incorporate future

improvements: continuous improvement.

Budget Controllability

- It is the degree of influence that a specific manager has over costs, revenues, or

related items for which he is being held responsible.

- A controllable cost is any cost that is primarily subject to the influence of a

given responsibility center manager for a given time period

Responsibility center: It is any part, segment, or subunit of a business whose manager

is accountable for specified set of activities

- Cost center

- Revenue center

- Profit center

- Investment center

Budgeting and Human Behaviour (budgeting abused by:)

- Superiors may dominate the budget process or hold subordinates accountable for

events they have no control over.

- Subordinates may build budgetary slack into their budgets.

Budgetary slack: The practice of underestimating budgeted revenues, or

overestimating budgeted expenses, to make the resulting budgeted goals

(profits) more easily attainable.

Chapter 7: flexible budgets, direct-cost variances and management control

Manufacturing cost:

- Direct materials

- Direct Labour

- Variable Overhead (VOH)

- Fixed Overhead (FOH)

Distributing prohibited | Downloaded by EuniceJulianne Albiso (eunicejulianne13@yahoo.com)

lOMoARcPSD|1872561

Input costing systems:

- Actual costing (All actual costs)

- Normal costing (Budgeted MOH)

- Standard Costing (Standard/Budgeted cost):

Traces direct costs to output by multiplying the standard prices or

rate by the standard quantities of inputs allowed for actual outputs

produced.

Allocates overhead costs on the basis of the standard overhead-

cost rates time the standard quantities of the allocation bases

allowed for the actual outputs produced.

Basic Concepts

- Static budget Variance The difference between actual result and the

corresponding static budget amount

- Favorable Variance (F) has the effect of increasing operating income relative to

the budget amount

- Unfavourable Variance (U) has the effect of decreasing operating income

relative to the budget amount

Flexible budget Shifst budgeted revenues and costs up and down based on actual

activities (operating results) and budgeted dollar amounts. (Why were we off?)

Price variance: (Budgeted Price of input SP Actual Price of input AP) x Actual

Quantity of input AQ

Efficiency variance: (Budgeted Q of input SQ Actual Q of input AQ) x Budgeted Price

of Input

Management Uses of variances:

- Performance measurement, Ability to be effective and efficient

- Only significant variances should be analyzed

- To understand underlying causes of variances

- Recognition of inter-relatedness of variances

Planning and overhead

- Variable overhead as efficiently as possible, plan only essential activities

- Fixed overhead as efficiently as possible, plan only essential activities,

especially since fixed costs are predetermined well before the budget period

begins (capacity costs)

Distributing prohibited | Downloaded by EuniceJulianne Albiso (eunicejulianne13@yahoo.com)

lOMoARcPSD|1872561

Variable overhead variances

Fixed overhead variances

Distributing prohibited | Downloaded by EuniceJulianne Albiso (eunicejulianne13@yahoo.com)

lOMoARcPSD|1872561

Details variable OH variances

Variable overhead flexible-budget variance: Measures the difference between actual

variable overhead costs incurred and flexible-budget variable overhead amounts.

Variable overhead Efficiency Variance: the difference between actual quantity of the

cost-allocation base used and budgeted quantity times the budgeted cost per

unit of the cost-allocation base

Efficiency variance = (Budgeted Q of Allocation Base(SQ) Actual Q of allocation Base

(AQ)) x Budgeted Price of allocation base (SP) (SQ AQ) x SP

Variable Overhead Spending variance: The difference between actual and budgeted

variable overhead cost per unit of the cost-allocation base, multiplied by actual

quantity of variable overhead cost-allocation based used for actual output.

Spending Variance = (budgeted Price of alloc. Base (SP) Actual price of alloc. Base

(AP)) x Actual Quantity of Alloc. Base (AQ) (SP - AP) x AQ

Fixed OH variances: The difference between actual fixed overhead costs and fixed

overhead costs in the flexible budget. (This is the same amount as for the Fixed

Overhead Spending Variance)

(Fixed OH flexible budget variance = Actual costs flexible budget amount)

Production- Volume variance: The difference between budgeted fixed overhead and

fixed overhead allocated on the basis of actual output produced. This Variance is

also known as the Denominator-Level variance or the Output-Level Overhead

Variance.

Production volume variance

- Interpretation of this variance is difficult due to the nature of the costs

involved and how they are budgeted.

- Fixed costs are by definition somewhat inflexible. While market conditions may

cause production to flex up or down, the associated fixed costs remain the same.

- Fixed costs may be set years in advance, and may be difficult to change quickly.

- Contradiction: despite this, it is allocated similar to a variable cost.

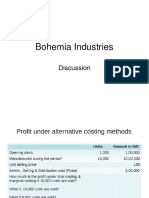

Chapter 9 Inventory Costing and Capacity Analysis

Absorption Costing:

- All manufacturing costs are inventoriable

- Period costs are expensed

- This method is mandatory for financial accounting purposes

Variable Costing

- Variable manufacturing costs are inventoriable

- Fixed manufacturing costs and period costs are expensed

Throughput Costing

- Only direct material costs are inventoriable

- All other (manufacturing) costs are expensed (period costs)

Distributing prohibited | Downloaded by EuniceJulianne Albiso (eunicejulianne13@yahoo.com)

lOMoARcPSD|1872561

Costing Comparison

Differences in Income

- Operating income may differ between absorption Costing and variable Costing

- The amount of the difference represents the amount of fixed manufacturing costs

Capitalized as inventory under Absorption Costing, and

Expensed as a period costs under Variable Costing

- Inventory: finished goods and WIP

Performance issues and Absorption Costing

- Managers may seek to manipulate income by producing too many units

- Production beyond demand will increase the amount of inventory on hand

- This will result in more fixed costs being capitalized as inventory

- That will leave a smaller amount of fixed costs to be expensed during the period

- Profit increases, and potentially so does a managers bonus

Chapter 10 Determing how costs behave

Linear cost function

Y = a + b*X

H (Y,X) L(Y,X)

A = y/x Solve as a normal equation.

Chapter 11 Decision Making and Relevant Information

A decision model is a formal method of making a choice, often involving both

quantitative and qualitative analyses

Irrelevance

- Sunk Costs past costs that are irrelevant to decision making

- Unavoidable costs Will be incurred regardless of the decision, see adding or

dropping customers/branches

Relevance, terminology

- Incremental Cost The additional total cost incurred for an activity

- Incremental Revenue The additional revenue from an activity

- Differential Cost the difference in total cost between two alternatives

- Differential Revenue the difference in total revenue between two alternatives

Distributing prohibited | Downloaded by EuniceJulianne Albiso (eunicejulianne13@yahoo.com)

lOMoARcPSD|1872561

Types of decisions

- One-Time-Only Special Orders

Accepting or rejecting special orders when there is idle production

capacity and the special orders has no long-run implications

Decision rule: does the special order generate additional OI

Compares relevant revenues and relevant costs to determine

profitability

- Insourcing vs. outsourcing

Insourcing producing goods or services within the organisation

Outsourcing purchasing goods or services from outside vendors

Also called make or buy decision

Select the option that will provide the firm with the lowest cost,

and therefore the highest profit

Opportunity Costs is the contribution to OI that is foregone by

not using a limited resource in its next-best alternative use. How

much profit did the firm lose out on by not selecting this

alternative?

- Product-Mix decisions

The decisions made by a company about which products to

produce and in what quantities (mix)

Decision rule(with a constraint): Choose the product that

produces the highest contribution margin per unit (Of the

constraining resource)

- Adding or Dropping Customers

Decision Rule: Does adding or dropping a customer add OI to the

firm?

Decision is based on profitability of the customer, not how much

revenue a customer generates

Pitfall: Avoidable and unavoidable costs!

- Equipment Replacement decisions

Cost, Accumulated depreciation (=Book Value) of existing

equipment

Any potential Gain or Loss on the transaction a financial

accounting phenomenon only

Decision rule: Select the alternative that will generate the highest

operating income.

Chapter 12 Pricing Decisions and Cost management

Pricing: Long Run vs. Short Run

- Short run pricing Fixed costs that cannot be changed, are generally irrelevant

in the short run

- Long run pricing Target to earn a reasonable return on investment, prices

may be decreased when demand is weak and increased when demand is strong

Distributing prohibited | Downloaded by EuniceJulianne Albiso (eunicejulianne13@yahoo.com)

lOMoARcPSD|1872561

Long-Run Pricing Approaches

- Market-Based Price charged is based on what customers want and how

competitors react

- Cost-Based Price charged is based on what it cost to produce, coupled with the

ability to recoup the costs and still achieve a required rate of return.

Market Based: Target Costing

1. Develop a product that satisfies the needs of potential customers

2. Choose a target price (customers, competitors)

3. Derive a target cost per unit, (Target Price per unit minus Target Operating

income per unit

4. Perform cost analysis

5. Perform value engineering to achieve target cost

Market Based: Value Engineering

- Value Engineering: A systematic evaluation of all aspects of the value-chain,

with the objective of reducing costs while improving quality and satisfying

customer needs

- Managers must distinguish value-added activities and costs from non-value-

added activities and costs

Value Engineering Terminology

- Value-Added Costs A cost that, if eliminated, would reduce the products actual

or perceived value or utility for customers

- Non-value-Added Costs A cost that, if eliminated, would not reduce the

products actual or perceived value or utility

- Cost incurrence When a resource is consumed to meet a specific objective

- Locked-in Costs (Designed-in Costs) Costs that have not yet been incurred but,

based on decisions that have already been made, will be incurred in the future

Target Costing & Value engineering problems:

1. Employees may feel frustrated if they fail to attain targets

2. A cross-functional team (value chain) may add too many features

3. Development time increases as alternative designs are repeatedly evaluated

4. Organizational conflicts may develop as the burden of cutting costs falls

unequally on different business functions in the value chain

Cost-Based (Cost-Plus) Pricing

- The general formula adds a markup component to the cost base to determine a

selling price.

- Usually only a starting point in the price-setting

- Mark up is somewhat flexible (market conditions)

Forms of Cost-Plus Pricing

- Return on investments (Assets) Pricing

Markup = Target (desired) Rate of Return x Invested Capital

- Gross Margin Pricing = Markup = Desired Operating Income

- Markup may be related to

Variable Manufacturing cost

Variable Cost

Manufacturing Cost

Full Cost

Distributing prohibited | Downloaded by EuniceJulianne Albiso (eunicejulianne13@yahoo.com)

lOMoARcPSD|1872561

Chapter 13 Strategy, Balanced Scorecard and Strategic Profitability Analysis

Strategy Specifies how an organization matches its own capabilities with the

opportunities in the marketplace to accomplish its objectives

Balanced scorecard perspectives:

- The learning & growth perspective Identifies the capabilities the

organization must excel at to achieve superior internal processes that create

value for customers and shareholders

- The internal business Prospective Focuses on internal operations that create

value for customers that, in turn, furthers the financial aspect by increasing

shareholder value. 1. Innovation. 2. Operations. 3. Post-sales service

- The Customer perspective Identifies targeted customer and market segments

and measures the companys success in these segments

- The Financial Perspective Create shareholders value, profitability of the

strategy, Most objective measures in the scorecard, the other three perspectives

eventually feed back into this dimension

Features of a Good Balanced Scorecard

- Shows cause and effect relationships: the links among the various perspectives

that describe how strategy will be implemented

- Helps communicate the strategy to all members of the organization by translating

the strategy into a coherent and linked set of understandable and measurable

operational targets

- Motivates managers to take actions that eventually result in improvements in

financial performance

- Limits the number of measures, identifying only the most critical ones

- Highlights less-than-optimal tradeoffs that managers may make when they fail to

consider operational and financial measures together

Evaluating Strategy Strategic analysis of Changes in OI

1. Growth Component the change in OI attributable solely to the change in the Q of

output

2. Price recovery Component The change in operating income attributable solely

to changes in prices of inputs and outputs

3. Productivity Component the change in costs due to a change in the Q of inputs

The management of capacity

- Managers can reduce capacity-based fixed costs by measuring and managing

unused capacity

- Unused capacity is the amount of productive capacity available over and above

the productive capacity employed to meet consumer demand

- Downsizing (rightsizing) is an integrated approach of configuring processes,

products, and people to match costs to the activities that need to be performed to

operate effectively and efficiently in the present and future.

Analysis of Unused capacity

A. Engineered costs Result from a cause-and-effect relationship between input

and output

B. Discretionary costs They arise from periodic decisions & dont have measurable

cause-and-effect relationship between input and output

Distributing prohibited | Downloaded by EuniceJulianne Albiso (eunicejulianne13@yahoo.com)

lOMoARcPSD|1872561

Chapter 14 Cost allocation, Customer Profitability Analysis, and Sales-Variance Analysis

Purpose of Cost Allocation

1. Decision making: Selling Price; Sales-mix; make or buy; Special order; Add/drop

a customer/division

2. Motivate employees: Simpler design (prod/service) Sell higher margin sales-

mix

3. Measure income/assets: COGS; WIP; Finished Goods

Criteria for Cost-Allocation decisions

- Cause and effect most credible to operating managers and integral part of ABC

- Benefits Received costs are charged in proportion to the benefits received

- Ability to Bear larger or more profitable objects receive proportionally more

of the allocated costs

- Fairness (Equity) Basis for a satisfactory reasonable selling price

(government)

Customer-Profitability Analysis Is the reporting and analysis of revenues earned

from customers and costs incurred to earn those revenues

Factors

- Likehood of customer retention

- Potential for sales growth

- Increases in demand from having famous customers

- Ability to learn from customers

An analysis of customer differences in revenues and costs can provide insight into why

differences exist in the operating income earned from different customers

Flexible budget and Sales-volume variances:

Actual results: Actual units sold x Actual sales mix x Actual CMu

Flexible budget: Actual units sold x Actual sales mix x Budgeted CMu

Static Budget: Budgeted units Sold x budgeted sales mix x budgeted CMu

Distributing prohibited | Downloaded by EuniceJulianne Albiso (eunicejulianne13@yahoo.com)

lOMoARcPSD|1872561

Sales-mix and Quantity Variances:

Flexible budget: Actual units Sold x Actual sales mix x budgeted CMu

tussen ding: Actual units Sold x budgeted sales mix x budgeted CMu

Static Budget: Budgeted Units sold x Budgeted sales mix x Budgeted CMu

Market-Share and market-size variances Reliable information on the actual size and

share various markets is not always available.

Actual market size x Actual market share x Budgeted Average CMu

Actual market size x budgeted Market share x Budgeted Average CMu

Static budget: Budgeted market size x budgeted market share x budgeted average CMu

Chapter 16 Cost allocation: Joint Products and Byproducts

Joint Cost Terminology:

- Joint Costs Costs of a single production process that yields multiple products

simultaneously

- Splitoff Point the place in a joint production process where two or more

products become separately identifiable

- Separable costs all costs incurred beyond the splitoff point that are assignable

to each of the now-identifiable specific products

- Joint (main) Products outputs of a joint production process that yields two or

more products with a high sales value compared to the sales values of any other

outputs

- Byproducts outputs of a joint production process that have low sales values

compare to the sales values of the other outputs

Sales Value at Splitoff Method

Uses the sales value of the entire production of the accounting period to

allocate joint-costs (ignores inventories)

Net Realizable value method

Allocates joint costs on the basis of relative NRV of total production of the joint

products. NRV = Final Sales Value Separable Costs

Physical-Measure Method Allocates joint costs to joint products on the basis of the

relative weight, volume, or other physical measure at the split off point of

total production of the products

Method selection

- If selling price at splitoff is available, use the Sales value at Splitoff method

- If selling price at splitoff is not available, use the NRV method

- If simplicity is the primary consideration, Physical-Measures Method or the

constant Gross-Margin Method could be used

- Some firms choose not to allocate joint costs at all

Distributing prohibited | Downloaded by EuniceJulianne Albiso (eunicejulianne13@yahoo.com)

lOMoARcPSD|1872561

Chapter 17 Process Costing

Transferred-in costs

- In process costing, costs are accumulated by department and are passed to each

subsequent department as the product is made

- Costs incurred in previous departments (chopping) that are carried forward as

the products cost when it moves to a subsequent department (mixing&Bottling)

- Treated as if they are a separate type of direct material added at the beginning of

the (mixing&bottling) process

Equivalent Production

- Equivalent production is a measure of the number of equivalent whole units

produced in a period of time.

- Partly completed units are restated in terms of equivalent whole units

Five-Step Process-Costing Allocation

1. Summarize the flow of physical units of output

2. Compute output in terms of equivalent units

3. Summarize total costs to assign/to account for

4. Compute cost per equivalent unit

5. Assign total costs to units transferred out and to units in ending WIP

Weighted-Average Process-Costing

- Calculates cost per equivalent unit of all work done to date (regardless of the

accounting period in which it was done).

- Weighted-average cost is the total of all costs in the WIP Account divided by the

total equivalent units of work done to date

- Current period costs are mixed with costs from prior periods (cost of WIP

beginning)

First-in, First out Process costing

- Assigns the production cost of current period first to complete beginning WIP,

next to start and complete new units, and lastly to start units in ending WIP

inventory

- The beginning balance of the WIP account (costs of work done in a prior

period) is kept separate from current period costs

Hybrid Costing System

- A Hybrid-Costing System blends characteristics from both job-costing and

process-costing systems

- Many actual production systems are in fact hybrids

- Examples include manufacturers of televisions, dishwashers and washing

machines, as well as adidas.

Distributing prohibited | Downloaded by EuniceJulianne Albiso (eunicejulianne13@yahoo.com)

lOMoARcPSD|1872561

Distributing prohibited | Downloaded by EuniceJulianne Albiso (eunicejulianne13@yahoo.com)

Vous aimerez peut-être aussi

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Profit and LossDocument51 pagesProfit and LossDin Dupur100% (1)

- Safi Airways In-Flight Magazine Issue 17th May-June 2013Document88 pagesSafi Airways In-Flight Magazine Issue 17th May-June 2013Said Zahid DanialPas encore d'évaluation

- Security Analysis and Portfolio Management: Master of Business AdministrationDocument80 pagesSecurity Analysis and Portfolio Management: Master of Business AdministrationSagar Paul'gPas encore d'évaluation

- Cost - Estimation Chem PlantDocument39 pagesCost - Estimation Chem PlantriffPas encore d'évaluation

- Sales Force Management Final ProjectDocument9 pagesSales Force Management Final ProjectahmedPas encore d'évaluation

- MKT 304 Chapter17Document35 pagesMKT 304 Chapter17duldulPas encore d'évaluation

- Ghalayini - The Changing Basis of Performance MeasurementDocument18 pagesGhalayini - The Changing Basis of Performance MeasurementalbchilePas encore d'évaluation

- Chapter 1 - Introduction ToDocument30 pagesChapter 1 - Introduction ToCostAcct1Pas encore d'évaluation

- CIMA Process Costing Sum and AnswersDocument4 pagesCIMA Process Costing Sum and AnswersLasantha PradeepPas encore d'évaluation

- F & M AccountingDocument6 pagesF & M AccountingCherry PiePas encore d'évaluation

- Evaluation CriteriaDocument6 pagesEvaluation Criteriabahaman417Pas encore d'évaluation

- Chapter 1Document43 pagesChapter 1Saket BhobooPas encore d'évaluation

- Asset Light ModelDocument15 pagesAsset Light ModelNguyen Hoang AnhPas encore d'évaluation

- Comparison of 3 Competitors of UnileverDocument2 pagesComparison of 3 Competitors of UnileverMuhammad JunaidPas encore d'évaluation

- 7Document7 pages7anon1Pas encore d'évaluation

- Business ProposalDocument13 pagesBusiness ProposalSatyrKuangPas encore d'évaluation

- Assignment 3Document1 pageAssignment 3MISS_ARORAPas encore d'évaluation

- Policy & Procedure ManualDocument18 pagesPolicy & Procedure ManualmutamanthecontractorPas encore d'évaluation

- Industrial Management NotesDocument301 pagesIndustrial Management NotesVidhya Ds75% (4)

- Sample CEO ResumeDocument3 pagesSample CEO ResumejstillwaPas encore d'évaluation

- Chapter 5 - Building Profit PlanDocument28 pagesChapter 5 - Building Profit Plansiyeni100% (2)

- Case Study On Absorption CostingDocument12 pagesCase Study On Absorption CostingTushar BallabhPas encore d'évaluation

- Finance Project On Working Capital Management in BirlaDocument9 pagesFinance Project On Working Capital Management in BirlaAmol DahiphalePas encore d'évaluation

- Internship Report On ZTBLDocument87 pagesInternship Report On ZTBLShabnam Naz100% (3)

- Cost Analysis: Dr. Pushparaj Kulkarni Asst. Professor M. Com., MBA, ICWADocument27 pagesCost Analysis: Dr. Pushparaj Kulkarni Asst. Professor M. Com., MBA, ICWACma Pushparaj KulkarniPas encore d'évaluation

- 16 - Analysis of Pomelo VC in Ben Tre Province-EnGDocument28 pages16 - Analysis of Pomelo VC in Ben Tre Province-EnGViet Suu NguyenPas encore d'évaluation

- PorterDocument4 pagesPorterSandy WasfyPas encore d'évaluation

- Functional Level StrategyDocument32 pagesFunctional Level StrategyAmit Yadav100% (2)

- SAPexperts - Calculate Actual Costs Across Multiple Company Codes Using A New Business Function in SAP Enhancement Package 5 For SAP ERP 6Document12 pagesSAPexperts - Calculate Actual Costs Across Multiple Company Codes Using A New Business Function in SAP Enhancement Package 5 For SAP ERP 6MaheshJMPas encore d'évaluation

- PGDFE Distance LearningDocument21 pagesPGDFE Distance Learningraveeshmittal_07Pas encore d'évaluation