Académique Documents

Professionnel Documents

Culture Documents

Hindustan Tin Work

Transféré par

Debjit AdakCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Hindustan Tin Work

Transféré par

Debjit AdakDroits d'auteur :

Formats disponibles

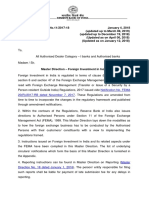

FINANCE - COMPANY AT A GLANCE - Hindustan Tin Works Ltd (Curr: Rs in Cr.

Capital Market Publishers Pvt Ltd

Chembur

Hindustan Tin Works Ltd 488 Bartan Market,Sardar Bazar, New Delhi, 110006

INDUSTRY : Packaging HOUSE : Indian Private TEL : 91-011-23679016/3645 FAX : 91-011-23550405

Financial Performance MARKET DATA (AS ON 06 Oct 2017 )

Year End 201703 201603 201503 201403 201303 Price (Rs) 104.40 52 W H/L(Rs) 116.80/57.10

Equity 10.40 10.40 10.40 10.40 10.40 Lat. P/E 18.35 Lat. EPS(Rs) 5.69

Networth 127.88 122.01 109.24 104.00 96.57 Mkt. Cap.(Rs ... 108.58 Lat.Eqty (Rs ... 10.40

Enterprise Value 141.86 145.14 157.82 109.41 89.92 Lat. BV(Rs) 122.96 Div. Yield (%) 0.96

Capital Employed 205.15 226.77 213.40 188.43 166.27 Lat. Face Value 10.00 Beta-Sensex 1.64

Gross Block 151.76 147.18 127.02 115.23 104.87 Share Price Graph

Sales 290.70 321.60 342.76 340.21 294.36

Other Income 3.47 11.92 4.79 2.47 2.68

PBIDT 27.40 36.20 30.94 28.53 25.27

PBDT 18.43 26.72 20.49 18.19 15.22

PBIT 19.44 28.34 23.65 23.82 21.08

PBT 10.47 18.86 13.20 13.48 11.03

RPAT 7.12 14.02 8.56 8.41 7.35

APAT 7.27 7.16 8.57 8.46 7.21

CP 15.08 21.88 15.85 13.12 11.54

Rev. Earnings in FE 52.40 71.88 67.11 67.63 47.43

Rev. Expenses in FE 31.21 43.97 79.62 51.87 49.20

Book Value (Rs) 122.96 117.32 105.04 100.01 92.86

EPS (Rs.) 6.65 13.28 8.03 7.95 6.98 Latest Results

Dividend (%) 10.00 10.00 10.00 8.00 5.00 Period-Ended 201706.00 201606.00 Var. (%)

Payout (%) 15.05 7.53 12.46 10.04 7.16 Sales 85.52 82.67 3.45

Ratio Analysis Other Income 0.41 0.45 -8.89

Debt-Equity 0.73 0.90 0.88 0.77 0.70 PBIDT 6.36 8.44 -24.64

Current Ratio 1.53 1.44 1.35 1.34 1.35 PBDT 4.24 5.97 -28.98

Invtry Turnover 6.29 6.89 7.26 8.54 6.97 PBIT 4.43 6.50 -31.85

Debtors Turnover 3.02 3.16 3.55 4.02 4.33 PBT 2.31 4.03 -42.68

Interest Cover 2.17 2.02 2.26 2.30 2.10 RPAT 1.41 2.62 -46.18

PBIDTM (%) 9.43 8.39 9.03 8.39 8.58 Extra-ord. Items 0.00 0.00 NA

PBDTM (%) 6.34 5.44 5.98 5.35 5.17 APAT 1.41 2.62 -46.18

APATM (%) 2.45 2.23 2.50 2.47 2.50 CP 3.34 4.56 -26.75

ROCE (%) 9.00 8.68 11.77 13.43 13.30 Shareholding Pattern

RONW (%) 5.70 6.19 8.03 8.39 7.89 (AS ON 30 Jun 2017) Shares (%)

EV/EBIDTA 5.18 4.01 5.10 3.83 3.56 Foreign 0.00 0.00

Rate of Growth (%) Institutions 1023579.00 9.84

Net Worth 4.81 11.69 5.04 7.69 7.50 Govt Holding 0.00 0.00

Sales -9.61 -6.17 0.75 15.58 12.24 Non Promoter Corp. Hold. 0.00 0.00

PAT -49.22 63.79 1.78 14.42 29.17 Promoters 4207804.00 40.46

M Cap 35.21 -18.00 89.34 44.77 -66.40 Public & Others 5168300.00 49.70

Totals 10399683.00 100.00

Capitaline Plus - 16/10/2017 11:36 AM - Page : 1 of 1

Vous aimerez peut-être aussi

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Vanguard InvestingDocument40 pagesVanguard InvestingrasmussenmachinePas encore d'évaluation

- Investor Curriculum PDFDocument22 pagesInvestor Curriculum PDFutsav100% (2)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- Pidllite Training FinalDocument94 pagesPidllite Training FinalChandan SrivastavaPas encore d'évaluation

- RBI Guidelines Mapping With COBIT 5 Res Eng 1013Document194 pagesRBI Guidelines Mapping With COBIT 5 Res Eng 1013KenChenPas encore d'évaluation

- Payment Approval FormDocument1 pagePayment Approval FormMaleki B0% (1)

- Indian Banks (Cracking Code 7.18 in Depth Analysis of Annual Reports) 20181109Document188 pagesIndian Banks (Cracking Code 7.18 in Depth Analysis of Annual Reports) 20181109Debjit AdakPas encore d'évaluation

- Indian Banking - Sector Report - 15-07-2021 - SystematixDocument153 pagesIndian Banking - Sector Report - 15-07-2021 - SystematixDebjit AdakPas encore d'évaluation

- 1 - Project Selection I - V22Document81 pages1 - Project Selection I - V22Chiara Del PizzoPas encore d'évaluation

- Asset Valuation: Basic Bond Andstock Valuation ModelsDocument23 pagesAsset Valuation: Basic Bond Andstock Valuation ModelsMa Via Bordon SalemPas encore d'évaluation

- Core Competencies 2012Document223 pagesCore Competencies 2012Zahirul HaqPas encore d'évaluation

- Sugar Sector by Icici DirectDocument24 pagesSugar Sector by Icici DirectpradeepthitePas encore d'évaluation

- Sugar Sector by Icici DirectDocument24 pagesSugar Sector by Icici DirectpradeepthitePas encore d'évaluation

- Sugar Sector by Icici DirectDocument24 pagesSugar Sector by Icici DirectpradeepthitePas encore d'évaluation

- Filling Penalties and Remedies CparDocument7 pagesFilling Penalties and Remedies CparGelyn CruzPas encore d'évaluation

- Learning Hub CatalogueDocument1 990 pagesLearning Hub Cataloguepraty8880% (1)

- RESOLVED THAT Pursuant To The Provisions of Sections 23 (1) (B), 42, 55, 62 (1) (C)Document40 pagesRESOLVED THAT Pursuant To The Provisions of Sections 23 (1) (B), 42, 55, 62 (1) (C)Debjit AdakPas encore d'évaluation

- India Banks: EquitiesDocument42 pagesIndia Banks: EquitiesDebjit AdakPas encore d'évaluation

- Bfsi - Icici Direct (Su - Oct 2020)Document14 pagesBfsi - Icici Direct (Su - Oct 2020)Debjit AdakPas encore d'évaluation

- Indian Banks: A Time To Reform? PDFDocument35 pagesIndian Banks: A Time To Reform? PDFmanikant kumarPas encore d'évaluation

- Bfsi - Icici Direct (Su - Oct 2020)Document14 pagesBfsi - Icici Direct (Su - Oct 2020)Debjit AdakPas encore d'évaluation

- Bfsi - Icici Direct (Su - Oct 2020)Document14 pagesBfsi - Icici Direct (Su - Oct 2020)Debjit AdakPas encore d'évaluation

- Ethanol A Renaissance For Sugar Industry in India: Ravi GuptaDocument31 pagesEthanol A Renaissance For Sugar Industry in India: Ravi GuptaDebjit AdakPas encore d'évaluation

- Ethanol A Renaissance For Sugar Industry in India: Ravi GuptaDocument31 pagesEthanol A Renaissance For Sugar Industry in India: Ravi GuptaDebjit AdakPas encore d'évaluation

- Ethanol A Renaissance For Sugar Industry in India: Ravi GuptaDocument31 pagesEthanol A Renaissance For Sugar Industry in India: Ravi GuptaDebjit AdakPas encore d'évaluation

- Balrampur Chini: Moving To Next OrbitDocument9 pagesBalrampur Chini: Moving To Next OrbitDebjit AdakPas encore d'évaluation

- Balrampur Chini: Moving To Next OrbitDocument9 pagesBalrampur Chini: Moving To Next OrbitDebjit AdakPas encore d'évaluation

- Sept2020 PMS Performance NewsletterDocument5 pagesSept2020 PMS Performance NewsletterDebjit AdakPas encore d'évaluation

- Master Direction - Foreign Investment in India 2018Document63 pagesMaster Direction - Foreign Investment in India 2018Manvendra SinghPas encore d'évaluation

- Happiest Minds LTD IPO: Reason For Subscribing To The IPODocument3 pagesHappiest Minds LTD IPO: Reason For Subscribing To The IPODebjit AdakPas encore d'évaluation

- Kansai Nerolac - IC - HSIE-202009071343515091199 PDFDocument22 pagesKansai Nerolac - IC - HSIE-202009071343515091199 PDFDebjit AdakPas encore d'évaluation

- HindalcoLimited PDFDocument64 pagesHindalcoLimited PDFDebjit AdakPas encore d'évaluation

- Kansai Nerolac - IC - HSIE-202009071343515091199 PDFDocument22 pagesKansai Nerolac - IC - HSIE-202009071343515091199 PDFDebjit AdakPas encore d'évaluation

- Balrampur Chini: Moving To Next OrbitDocument9 pagesBalrampur Chini: Moving To Next OrbitDebjit AdakPas encore d'évaluation

- Tejas - September Edition - Interview 2 PDFDocument7 pagesTejas - September Edition - Interview 2 PDFDebjit AdakPas encore d'évaluation

- Balrampur Chini: Moving To Next OrbitDocument9 pagesBalrampur Chini: Moving To Next OrbitDebjit AdakPas encore d'évaluation

- Call For Research Projects: Sector-29, Gandhinagar, Gujarat-382030Document17 pagesCall For Research Projects: Sector-29, Gandhinagar, Gujarat-382030Debjit AdakPas encore d'évaluation

- Tejas - September Edition - Interview 2 PDFDocument7 pagesTejas - September Edition - Interview 2 PDFDebjit AdakPas encore d'évaluation

- Tejas - September Edition - Interview 2 PDFDocument7 pagesTejas - September Edition - Interview 2 PDFDebjit AdakPas encore d'évaluation

- Tejas - September Edition - Interview 2 PDFDocument7 pagesTejas - September Edition - Interview 2 PDFDebjit AdakPas encore d'évaluation

- AccountingDocument23 pagesAccountingTEJASWINIPas encore d'évaluation

- Resolution 2021 - 53 Re Privatization - Calapan DPPDocument6 pagesResolution 2021 - 53 Re Privatization - Calapan DPPPatrick MabbaguPas encore d'évaluation

- Estimating Earnings and Cash FlowDocument38 pagesEstimating Earnings and Cash FlowashuuuPas encore d'évaluation

- Individual Assignment Task 2Document15 pagesIndividual Assignment Task 2Zahirul IslamPas encore d'évaluation

- Xoom Transaction ReceiptDocument2 pagesXoom Transaction Receiptchowdhury sunnyPas encore d'évaluation

- Strategic Call CentersDocument17 pagesStrategic Call CentersAnonymous ztFU1l8HxyPas encore d'évaluation

- Resolving Economic DeadlockDocument27 pagesResolving Economic DeadlockPlutopiaPas encore d'évaluation

- Challnenegeof What Is A Balanced Scorecard (BSC) ?: Key TakeawaysDocument18 pagesChallnenegeof What Is A Balanced Scorecard (BSC) ?: Key TakeawaysMalede WoledePas encore d'évaluation

- China: To Float or Not To Float?: Case Submission - International FinanceDocument3 pagesChina: To Float or Not To Float?: Case Submission - International Financemayankj_147666100% (1)

- KALYAN JEWELLERS - PPTX ASSIGNMENTDocument17 pagesKALYAN JEWELLERS - PPTX ASSIGNMENTaryansachdeva2122002Pas encore d'évaluation

- Thq002-Inst. Sales PDFDocument2 pagesThq002-Inst. Sales PDFAndrea AtendidoPas encore d'évaluation

- Strategy + BusinessDocument100 pagesStrategy + BusinessSilvia Palasca100% (1)

- WFDSA Annual Report 112718Document17 pagesWFDSA Annual Report 112718Oscar Rojas GuerreroPas encore d'évaluation

- EDI Manual PDFDocument119 pagesEDI Manual PDFLuis SousaPas encore d'évaluation

- 06.1 - Liabilities PDFDocument5 pages06.1 - Liabilities PDFDonna AbogadoPas encore d'évaluation

- Implementing Total Quality Management at WiproDocument4 pagesImplementing Total Quality Management at WiproDullStar MOTOPas encore d'évaluation

- Guia de Investimento em Mocambique FinalDocument66 pagesGuia de Investimento em Mocambique FinalPreciosa LemosPas encore d'évaluation

- Determinants of Exchange Rate ThesisDocument6 pagesDeterminants of Exchange Rate Thesisgloriamoorepeoria100% (1)

- Challenges and Barriers of European Young EnterpreneursDocument25 pagesChallenges and Barriers of European Young EnterpreneursKule89Pas encore d'évaluation

- 02-18-005 BIM Revit Modeling RFP FinalDocument12 pages02-18-005 BIM Revit Modeling RFP FinalSantosh NathanPas encore d'évaluation

- What Is An EventDocument22 pagesWhat Is An EventMosul Victoria0% (2)