Académique Documents

Professionnel Documents

Culture Documents

Wyckoff Terms and Their Definitions

Transféré par

bestniftyDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Wyckoff Terms and Their Definitions

Transféré par

bestniftyDroits d'auteur :

Formats disponibles

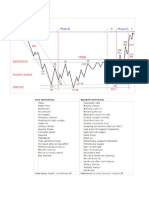

Wyckoff Terms and their definitions

Term: Definition:

Accumulation An area where Informed forces buy stocks or futures with the

(Acc.) intention to mark-up prices. At the same time less informed forces

tend to sell in that area.

Automatic The rally that occurs after a Selling Climax. It occurs without

Rally (AR) previous preparation, hence the word “automatic.” The top of an

AR usually marks the beginning of the coming creek.

Automatic The reaction that occurs after a Buying Climax. It occurs without

Reaction previous preparation, hence the word “automatic.” The bottom of

(AR) an Automatic Reaction usually marks the beginning of the coming

ice.

Bar Charts Vertical charts of price movement (OHLC) and their corresponding

volume. Wyckoff only discussed linear price axes.

A major panic that occurs at the end of a steep ascent in prices. In

Buying

its classical form it is typified by large range reversal in prices

Climax (BC)

accompanied by large volume.

Continuation In commodities—long-term charts that are constructed by

Charts concatenating expiring contracts with front month contracts to

create continuity over time.

Composite Wyckoff’s name to the total sum of more informed forces that

Man (C.M.) move the market. Akin to “The market,” or “They” in other

parlance.

Creek A general area of resistance. It indicates the band of prices at the

top of accumulation area.

Demand Buying power.

Distribution An area where informed forces sell stocks or futures with the

intention to mark-down prices. At the same time less informed

forces tend to buy in that area.

“Falling” A vigorous penetration of the ice area (support) that held prices

(breaking) throughout the process of distribution. Usually associated with a

thru the Ice wide price range, weak closes and large volume

Four phases Any market according to Wyckoff is in one of four phases:

of the market Accumulation; Mark-up; Distribution; Mark-down.

Ice The mirror image of a creek. It is a general area of support. It

indicated the band of prices at the bottom of distribution area.

Jump Across A vigorous penetration of a creek (resistance) that was capping

the Creek prices throughout the process of accumulation. Usually associated

with wide price range, strong closes and large volume.

(JAC)

Last Point of A point at the end of the process of distribution where the CM

Supply recognizes that demand forces have exhausted themselves and it

(LPSY) is safe to start marking down prices.

Last Point of A point at the end of the process of accumulation where the CM

Support recognizes that supply forces have exhausted themselves and it is

(LPS) safe to start marking up prices.

Mark Down The phase of the market where prices decline, from the beginning

of a bear market to its bottom.

Mark up The phase of the market where prices rise, from the beginning of a

bull market to its top.

News Wyckoff said: “Unless you completely discard all news, reports,

tips, corporate statements, crop situations and other types of

news-you will be unable to get the best results from your market

operation.”

Preliminary The first significant reaction that occurs after a prolonged rally that

Supply (PSY) indicates budding supply showing up. It is usually associated with a

minor buying climax.

Preliminary The first significant rally that occurs after a prolonged decline that

Support (PS) indicates budding demand showing up. It is usually associated with

a minor panic preceding that rally.

Point and A chart that records price reversals of a predefined magnitude. It

Figure charts records up-moving prices in a box called “X” and down-moving

prices in a box called “O”. The box is the minimum price

(P&F) fluctuation. The reversal is the size of the predefined magnitude. It

is indicated as the number of boxes. E.g. if the box size is 2 cents

than a reversal of 3 boxes will be 6 cents. According to Wyckoff,

P&F charts measure the energy stored in trading ranges and is

often correlated with the extent of the ensuing move.

Rally A phase in the market that experiences rise in price. That is, higher

highs and higher lows.

Rally back to The rally that follows breaking (falling) through the Ice. The nature

the Ice of that rally should indicate whether demand is indeed scarce and

it is safe to sell.

Reaction A phase in the market that experiences decline in prices. That is

,lower highs and lower lows.

Reaction The reaction that follows Jump across the creek. The nature of that

back to the reaction should indicate whether supply is indeed scarce and it is

creek safe to buy.

Resistance An area where supply overcomes demand.

Right Hand A time zone when the processes of accumulation or distribution are

Side likely to terminate.

Risk Part and parcel of the business of good trading. Each trade should

Management be evaluated by its risk reward ratio. The convention says that if

reward is 3 times the risk involved-then the trade has business

merit.

Secondary A name given by Wyckoff to the reaction following Automatic Rally,

Test (ST) (or rally following the Automatic reaction.) If that test is associated

with small range and light volume—it increases the likelihood that

the previous trend is over.

Selling A major panic that occurs at the end of a steep decline in prices. In

Climax (SC) its classical form it is typified by large range reversal in prices

accompanied by large volume.

Sign of A rally towards the creek during the process of accumulation that is

Strength associated with wide range, strong close and higher volume.

(SOS)

Sign of A reaction towards the ice during the process of distribution that is

Weakness associated with wide range, weak close and higher volume.

(SOW)

Spring A form of a test of a trading range. Characterized by pushing prices

below support by the CM in order to check the status of supply.

The market’s response to the spring indicates the nature of supply

and demand forces for the near future.

Stop Loss An order to exit a trade if the market does something that proves

your initial decision to enter the trade as wrong. According to

Wyckoff stop losses are best placed at points where previous

market definitions fail to materialize.

Supply Selling power.

Support An area where demand is overcoming supply.

Terminal A decline below area of accumulation, which reverses itself rather

Shakeout quickly and vigorously back into the accumulation area. A true TSO

(TSO) is followed by a strong rally back to the creek.

Terminal A poke above the area of distribution, which reverses itself rather

Upthrust quickly, and vigorously back into the distribution area. A true TUT

(TUT) is followed by a strong reaction back to the ice area.

Trading A period of balance between supply and demand forces. Prices

Range (TR) move within a range where the bottom represents demand and the

top represents supply forces.

Trend-lines Oblique (diagonal, not horizontal) lines combining important points

of extreme support or resistance. According to Wyckoff, the way a

(TL) market reacts and responds to trend-lines is a good indication of

the status of supply and demand forces. It is not what the market

does around a trend-line, but how it does it that counts.

Upthrust The mirror of a spring. It is a form of a test of a trading range.

Characterized by pushing prices above resistance by the CM in

order to check the status of demand. The market response to the

upthrust indicates the nature of supply and demand forces for the

near future.

Volume Number of units bought and sold, or the quantity of trading.

According to Wyckoff it is the force which moves the market. An

(VOL) essential component in any Wyckoff analysis.

Wyckoff Richard D. Wyckoff lived around the turn of the 20th century. He

(W) was a bond trader who was curious about the logic behind market

action. Thru conversations with successful traders of his time he

arrived at his methodolgy which concentrated on Volume-Price

analysis, Point and Figure analysis and a process of sifting and

ranking among sectors and individual stocks or commodities within

each sector (relative strength) for the best trade possible. He

wrote his original thesis, which turned into the Wyckoff course.

Wyckoff A proprietary indicator (of SMI). It is a bar chart of an index

Wave (WW) comprised of a few selected stocks (he called them “the most

sensitive”) with their combined volume. It is somewhat similar to

the Dow Jones averages when plotted with bar chart and volume.

There is no Wyckoff wave for commodities. You have to comprise it

yourself.

Vous aimerez peut-être aussi

- Summary of Rubén Villahermosa Chaves's The Wyckoff Methodology in DepthD'EverandSummary of Rubén Villahermosa Chaves's The Wyckoff Methodology in DepthPas encore d'évaluation

- The Wyckoff Methodology in Depth: How to trade financial markets logicallyD'EverandThe Wyckoff Methodology in Depth: How to trade financial markets logicallyÉvaluation : 4.5 sur 5 étoiles4.5/5 (65)

- San Francisco Technical Securities Analysts Association: Wyckoff's WorldDocument2 pagesSan Francisco Technical Securities Analysts Association: Wyckoff's Worldlasithah100% (3)

- Wyckoff Bar by Bar AnalysisDocument4 pagesWyckoff Bar by Bar AnalysisIgor Shishkin91% (11)

- Wyckoff MethodsDocument5 pagesWyckoff Methodsanalyst_anil1485% (13)

- Volume Spread Analysis Improved With Wyckoff 2Document3 pagesVolume Spread Analysis Improved With Wyckoff 2ngocleasing86% (7)

- The Visual Investor: How to Spot Market TrendsD'EverandThe Visual Investor: How to Spot Market TrendsÉvaluation : 4 sur 5 étoiles4/5 (1)

- Technical Analysis and Stock Market Profits (Harriman Definitive Edition)D'EverandTechnical Analysis and Stock Market Profits (Harriman Definitive Edition)Évaluation : 5 sur 5 étoiles5/5 (2)

- High-Probability Trade Setups: A Chartist�s Guide to Real-Time TradingD'EverandHigh-Probability Trade Setups: A Chartist�s Guide to Real-Time TradingÉvaluation : 4 sur 5 étoiles4/5 (1)

- The Volatility Course Workbook: Step-by-Step Exercises to Help You Master The Volatility CourseD'EverandThe Volatility Course Workbook: Step-by-Step Exercises to Help You Master The Volatility CoursePas encore d'évaluation

- The StockTwits Edge: 40 Actionable Trade Set-Ups from Real Market ProsD'EverandThe StockTwits Edge: 40 Actionable Trade Set-Ups from Real Market ProsÉvaluation : 5 sur 5 étoiles5/5 (1)

- Wyckoff Price and Market StructuresDocument2 pagesWyckoff Price and Market StructuresSeo Soon Yi100% (10)

- Wyckoff - 9 Classic Tests For Accumulation PDFDocument16 pagesWyckoff - 9 Classic Tests For Accumulation PDFpt100% (5)

- Reading Price & Volume Across Multiple Timeframes - Dr. Gary DaytonDocument7 pagesReading Price & Volume Across Multiple Timeframes - Dr. Gary Daytonmr1232375% (8)

- Richard Wyckoff False BreakoutsDocument4 pagesRichard Wyckoff False Breakoutsdaviduk95% (20)

- Wyckoff Tests - Nine Classic Tests For Accumulation (Pruden)Document6 pagesWyckoff Tests - Nine Classic Tests For Accumulation (Pruden)patus1986100% (8)

- Wyckoff VolumeDocument6 pagesWyckoff VolumeMarcianopro183% (6)

- Price VolumeDocument3 pagesPrice VolumeCryptoFX96% (24)

- Wyckoff MethodDocument14 pagesWyckoff MethodAnonymous rPnAUz47Fe100% (6)

- WyckoffDocument3 pagesWyckoff'Izzad Afif100% (5)

- The Wyckoff MethodDocument7 pagesThe Wyckoff MethodWuU234575% (4)

- Wyckoff MethodDocument19 pagesWyckoff MethodAlan Foong50% (2)

- Wyckoff Method - Law+TestDocument6 pagesWyckoff Method - Law+Testallegre100% (3)

- Richard Wyckoff MethodDocument10 pagesRichard Wyckoff MethodPratik Chheda100% (1)

- Vsa Basics From MTMDocument32 pagesVsa Basics From MTMHafeezah Ausar100% (3)

- Volume Spread Analysis ExamplesDocument55 pagesVolume Spread Analysis Examplesthinkscripter82% (11)

- VSA - Cheat SheetDocument18 pagesVSA - Cheat SheetAriel Devulsky90% (20)

- Wychoff WorkbookDocument31 pagesWychoff Workbookhemsvg100% (5)

- VSA PrinciplesDocument4 pagesVSA PrinciplesCryptoFX82% (11)

- The Wyckoff Method Session 5Document24 pagesThe Wyckoff Method Session 5Upasara Wulung100% (1)

- Wyckoff - Pt. 2Document10 pagesWyckoff - Pt. 2Vincent Sampieri100% (1)

- Earl The Complete Volume Spread Analysis System ExplainedDocument7 pagesEarl The Complete Volume Spread Analysis System ExplainedSardar Amrik Singh MallPas encore d'évaluation

- VSA Bar Definitions V 2Document1 pageVSA Bar Definitions V 2No Name89% (9)

- Wyckoff Support Level Auction TheoryDocument65 pagesWyckoff Support Level Auction Theorymoby_rahman100% (8)

- Wave SetupsDocument15 pagesWave SetupsRhino382100% (9)

- WYCKOFFDocument9 pagesWYCKOFFtasmanoptions67% (3)

- Volume Spread Analysis by Kartik MararDocument47 pagesVolume Spread Analysis by Kartik MararNam Chun Tsang100% (3)

- Wyckoff WorkbookDocument33 pagesWyckoff WorkbookSergey Khaidukov73% (11)

- VSA Distribution2Document17 pagesVSA Distribution2ehayy100% (1)

- Follow The Smart Money VSADocument10 pagesFollow The Smart Money VSADavid Gordon100% (2)

- VSA Cheat SheetDocument5 pagesVSA Cheat Sheetbabasolai83100% (3)

- Trades About to Happen: A Modern Adaptation of the Wyckoff MethodD'EverandTrades About to Happen: A Modern Adaptation of the Wyckoff MethodÉvaluation : 4 sur 5 étoiles4/5 (3)

- The Trader's Book of Volume: The Definitive Guide to Volume Trading: The Definitive Guide to Volume TradingD'EverandThe Trader's Book of Volume: The Definitive Guide to Volume Trading: The Definitive Guide to Volume TradingÉvaluation : 4.5 sur 5 étoiles4.5/5 (20)

- Granville’s New Key to Stock Market ProfitsD'EverandGranville’s New Key to Stock Market ProfitsÉvaluation : 5 sur 5 étoiles5/5 (1)

- How I Trade and Invest in Stocks and Bonds: Being Some Methods Evolved and Adopted During My Thirty-Three Years Experience in Wall StreetD'EverandHow I Trade and Invest in Stocks and Bonds: Being Some Methods Evolved and Adopted During My Thirty-Three Years Experience in Wall StreetÉvaluation : 5 sur 5 étoiles5/5 (3)

- Two Roads Diverged: Trading DivergencesD'EverandTwo Roads Diverged: Trading DivergencesÉvaluation : 4 sur 5 étoiles4/5 (23)

- Pring on Price Patterns: The Definitive Guide to Price Pattern Analysis and IntrepretationD'EverandPring on Price Patterns: The Definitive Guide to Price Pattern Analysis and IntrepretationPas encore d'évaluation

- Wouldn't You Like to Know Where the Stock Market is Heading?D'EverandWouldn't You Like to Know Where the Stock Market is Heading?Pas encore d'évaluation

- The Secret Science of Price and Volume: Techniques for Spotting Market Trends, Hot Sectors, and the Best StocksD'EverandThe Secret Science of Price and Volume: Techniques for Spotting Market Trends, Hot Sectors, and the Best StocksÉvaluation : 5 sur 5 étoiles5/5 (1)

- The Market Taker's Edge: Insider Strategies from the Options Trading FloorD'EverandThe Market Taker's Edge: Insider Strategies from the Options Trading FloorPas encore d'évaluation

- The Three Skills of Top Trading: Behavioral Systems Building, Pattern Recognition, and Mental State ManagementD'EverandThe Three Skills of Top Trading: Behavioral Systems Building, Pattern Recognition, and Mental State ManagementÉvaluation : 3.5 sur 5 étoiles3.5/5 (4)

- In The Trading Cockpit with the O'Neil Disciples: Strategies that Made Us 18,000% in the Stock MarketD'EverandIn The Trading Cockpit with the O'Neil Disciples: Strategies that Made Us 18,000% in the Stock MarketPas encore d'évaluation

- Wyckoff 2.0: Structures, Volume Profile and Order FlowD'EverandWyckoff 2.0: Structures, Volume Profile and Order FlowÉvaluation : 4 sur 5 étoiles4/5 (28)

- HowToAutomateAmibrokerStrategy v2Document17 pagesHowToAutomateAmibrokerStrategy v2ramanathansesha0% (1)

- Volatility Simplified 1Document2 pagesVolatility Simplified 1bestnifty100% (2)

- Cheque Bounce OffenceDocument1 pageCheque Bounce OffencebestniftyPas encore d'évaluation

- Non Payment of Maintenance Is Not An OffenceDocument8 pagesNon Payment of Maintenance Is Not An OffencebestniftyPas encore d'évaluation

- Cluster AnalysisDocument8 pagesCluster AnalysisbestniftyPas encore d'évaluation

- Nest Options SuiteDocument19 pagesNest Options Suitebestnifty100% (1)

- Domestic Violence Act LimitationDocument2 pagesDomestic Violence Act LimitationbestniftyPas encore d'évaluation

- Domestic Violence Act Judgement 1Document4 pagesDomestic Violence Act Judgement 1bestniftyPas encore d'évaluation

- Live XL To FchartsDocument1 pageLive XL To FchartsbestniftyPas encore d'évaluation

- Youngest EntreprenuerDocument5 pagesYoungest EntreprenuerbestniftyPas encore d'évaluation

- Resources For Technical StrategiesDocument3 pagesResources For Technical StrategiesbestniftyPas encore d'évaluation

- Domestic ViolenceDocument13 pagesDomestic ViolencebestniftyPas encore d'évaluation

- The Murrey Math Trading SystemDocument12 pagesThe Murrey Math Trading Systemscribdxwz67% (3)

- Will The First Indian Billionaire Sign The Giving Pledge in 2012?Document2 pagesWill The First Indian Billionaire Sign The Giving Pledge in 2012?bestniftyPas encore d'évaluation

- Cheese Making PDFDocument126 pagesCheese Making PDFpierresandrePas encore d'évaluation

- List Data VendorsDocument1 pageList Data VendorsbestniftyPas encore d'évaluation

- Put Call RatioDocument3 pagesPut Call Ratiobhavnesh_muthaPas encore d'évaluation

- PSINDocument46 pagesPSINTaeyeon KimPas encore d'évaluation

- I.C. Chadda Deputy General Manager (Tech) Central Warehousing Corporation New DelhiDocument32 pagesI.C. Chadda Deputy General Manager (Tech) Central Warehousing Corporation New DelhimindpeacePas encore d'évaluation

- Miner R. Form and Pattern As A Trading Tool 1991Document9 pagesMiner R. Form and Pattern As A Trading Tool 1991Om PrakashPas encore d'évaluation

- Al Brooks - Trading Price Action Ranges-7Document2 pagesAl Brooks - Trading Price Action Ranges-7André Vitor Favaro Medes de Oliveira0% (2)

- Chapter - 5 Currency DerivativesDocument14 pagesChapter - 5 Currency DerivativesAbhishek MkPas encore d'évaluation

- Jiangsu Senolo Medical Technology Co., LTD.: NO.88 4 Road, Private Venture Park, Jianhu Contry JiangsuDocument2 pagesJiangsu Senolo Medical Technology Co., LTD.: NO.88 4 Road, Private Venture Park, Jianhu Contry JiangsuPedro Ant. Núñez UlloaPas encore d'évaluation

- Sri Chaitanya Iit Academy: Isomersism - Work SheetDocument39 pagesSri Chaitanya Iit Academy: Isomersism - Work SheetUppu EshwarPas encore d'évaluation

- DailyFX Guide The Fundamentals of Range TradingDocument10 pagesDailyFX Guide The Fundamentals of Range TradingAugustoPas encore d'évaluation

- Cost & RevenueDocument13 pagesCost & RevenueDeepikaa PoobalarajaPas encore d'évaluation

- Felo 4Document9 pagesFelo 4Felix OdhiamboPas encore d'évaluation

- Currency Futures NivDocument37 pagesCurrency Futures Nivpratibhashetty_87Pas encore d'évaluation

- Economics Mcqs With Solved Microeconomics and Macroeconomics Questions and Answers For Exams Like NTS, SPSC, PPSC and FPSCDocument31 pagesEconomics Mcqs With Solved Microeconomics and Macroeconomics Questions and Answers For Exams Like NTS, SPSC, PPSC and FPSCMaham Nadir MinhasPas encore d'évaluation

- Price Action Analysis Using The Wyckoff Trading MethodDocument2 pagesPrice Action Analysis Using The Wyckoff Trading MethodSkate DudePas encore d'évaluation

- Commodity Market, Commodity Exchange and Commodity DerivativesDocument21 pagesCommodity Market, Commodity Exchange and Commodity DerivativesRenuka NayakPas encore d'évaluation

- IFMDocument1 pageIFMskalidasPas encore d'évaluation

- Chapter 2 Complete SolutionsDocument9 pagesChapter 2 Complete SolutionsVictor64% (14)

- Lumanog, Ronalyn L. BEE EGE 2-1 (ACTIVITY 2)Document3 pagesLumanog, Ronalyn L. BEE EGE 2-1 (ACTIVITY 2)Ronalyn LumanogPas encore d'évaluation

- Coco Products PriceDocument2 pagesCoco Products PriceAlmira Ivy PazPas encore d'évaluation

- David Ricardo: The Exchangeable Value of All Commodities Rises As The Difficulties of Their Production IncreaseDocument8 pagesDavid Ricardo: The Exchangeable Value of All Commodities Rises As The Difficulties of Their Production IncreaseGiovanni RomanoPas encore d'évaluation

- Consumer's EquilibriumDocument7 pagesConsumer's EquilibriumAryan JainPas encore d'évaluation

- Diploma in Commodity TradingDocument4 pagesDiploma in Commodity TradingSharbandi RyePas encore d'évaluation

- Micro - CH-9 SupplyDocument21 pagesMicro - CH-9 SupplyLalitKukrejaPas encore d'évaluation

- Shooting StarDocument2 pagesShooting Starlaba primePas encore d'évaluation

- The Power of The Pull Back Forex Trading StrategyDocument17 pagesThe Power of The Pull Back Forex Trading StrategyMoha FxPas encore d'évaluation

- Individual & Market DemandDocument61 pagesIndividual & Market DemandWahyuningtyasPas encore d'évaluation

- Currency DerivativesDocument33 pagesCurrency DerivativesSubhan ImranPas encore d'évaluation

- Option SupertraderDocument10 pagesOption SupertraderJunedi dPas encore d'évaluation

- Forex Currency Correlation Indicator - What It Is and How It Works - 1610129024373Document9 pagesForex Currency Correlation Indicator - What It Is and How It Works - 1610129024373SamsonPas encore d'évaluation

- Williams Larry - Trade Stocks and Commodities With The InsidersDocument224 pagesWilliams Larry - Trade Stocks and Commodities With The InsidersNguyen Hoa100% (16)

- BMO AxD Weekly - VF - 2020-01-13Document15 pagesBMO AxD Weekly - VF - 2020-01-13Alex WangPas encore d'évaluation