Académique Documents

Professionnel Documents

Culture Documents

Seven Eleven

Transféré par

TunENSTAB0 évaluation0% ont trouvé ce document utile (0 vote)

148 vues7 pagesSeven Eleven

Copyright

© © All Rights Reserved

Formats disponibles

PDF ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentSeven Eleven

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

148 vues7 pagesSeven Eleven

Transféré par

TunENSTABSeven Eleven

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 7

SEVEN-ELEVEN JAPAN CO.

Established in 1973, Seven-Bleven Japan set up its first

store in Koto-ku, Tokyo, in May 1974. The company was

first listed on the Tokyo Stock Exchange in October 1979.

in 2004 it was owned by the Ito-Yokado group, which also

managed a chain of supermarkets in Japan and owned a

‘majority share in Southland, the company menaging Seven-

Eleven in the United States. Seven-Eleven Japan realized @

phenomenal growth between the years of 1985 and 2008.

During that period, the number of stores increased from

2,299 to 10,303; anal sales increased from 386 billion to

2,343 billion yen;and net income increased from 9 billion to

915 billion yen. Additionally, the company's return on

(ROE) averaged around 14 percent between 2000

and 2004, In 2004, Seven-Fleven Japan represented Japan's

rin terms of operating income and number of

jores Customer visits to Seven-Eleven outlets toisled 3.6

person in Jepan.

COMPANY HISTORY AND PROFILE

Both Ito-Yokado and Seven-Eleven Japan were founds

by Mesatoshi ito, He started his retail empice after World

War il, wher he joined his mother and elder brother and

began to work in 2 small clothing store in Tokyo, By 1950

he wasn sole control, and the single store had grovin into

2 $3 million company. After a tip to the United States in

1961, Ito beceme convinced that superstores were the

wave of the future At that time, Japan was still domi-

rated by Mom-and-Pop stores. Ito's chain of superstores

in the Tokyo area was instantly popular and soon const-

tuted the core of Ito-Yokado's retail operations

In 1972, To first approached the Southland

Corporation about the possiblity of opening Seven-Eleven

convenience stores in Japan. After rejecting his initial

request, Southland agreed in 1973 toa licensing agreement.

In exchange for 0.6 percent of total sales, Southland gave

To cxclusive rights throughout Japan. Ia May 1974, the frst

Seven-Eleven convenience ste opened in Tokya.

‘This new concept was an immediate hit in Jepan,and

Seven-Eleven Japan experienced tremendous growth. By

1979 there were already 591 Seven-Eleven stores in

Japan; by 198¢ there were 2,001. Rapid growth continued

(cee Table 3-1) resulting in 10,356 stores by 200s,

On October 24, 1990, the Southland Corporation

entered into bankruptcy protection. Southlend esked for

Ito-Yokado’s help, and on Merch 5, 1991, TYG Holding

was formed by Seven-Eleven Japan (48 percent) and Ito-

‘Yokado (52 percent). IYG acquired 70 percent of Sout

land's common stock fora total price of $430 millon,

Jn 2004, convenience store operations from Seven-

Eleven Jepan and 7-Eleven Inc. in the United States con-

tributed 43.2 percent of total revenues and $0.2 percent

of total consolidated operating income f

group. Seven-Eleven Japan contribut

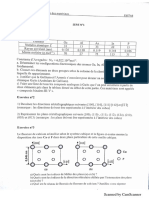

‘Annual

Sales

(billion yen)

Number of

Year Stores

15

°

199

395

591

301

4,059

41,305

1,683

Annual Sates

‘billion yen)

Number

Year of Stores

1989 3.954

1990

1991

1992

1993,

1994

1995

1996

1997

1998

1999

2000

2001

2002

2003

o

PTE

= CONVENIENCE STORE INDUSTRY

SEVEN-ELEVEN IN JAPAN

a, the convenience store sector Was one ofthe few

S areas that continued to grow during the pro-

GE; 1980s downturn, From 1991 to 2002 the number of

tence stores in Japan increased from 19,603 to

Ee: 10,000. Asa percentage ofall retail storesinJepan,

presented an increase from 1.2 percent to 3.2 per-

Bi Dusing that period, annual sales at convenience

fore than doubled, from just over 3 tilion to 6.7

mayen. As a percentage of al retail salesin Japan, this

sented an increase from 2.2 percent to 5.0 percent.

Tapan’s convenience store sector gradually consol

fed, with larger players growing and smaller operators

Ehucting down. In 2004, the top 10 convenience store

Pinus accounted for approximately 90 percent of Japan's

Savenience stores. As the chains improved their operat-

ag structures and better leveraged economies of scale,

aller operators found it hard to compete

Seven-Eleven Japan had increased its share of the

‘venience store martet since it opened. In 2002, Seven-

Eleven was Japan's leading convenience store operster,

‘counting for 21.7 percent of all eonvenience stores and

31.5 porcent of total sales. Seven-Eleven was very eff

tive in terms of same-store sales, In 2004 average daily

sales at the four major convenience stoze chains excluding

Seven-Eleven Japan totaled 434,000 yen. Sever-Eleven

stores in contrast, had daily sales of 647,000 yen—more

than 30 pereent higher than 2

112004, Seven-Elaven's oper

yen p ly of the convenience

Score sector but also of Japan's retail industry as a whole,

In terms of growth, its performanc

impressive, In 2004 Se for 60 per-

cent of the total net increase in the number of stores

among the top 10 convenience store chains in Japan. This

grovth had been very carefully planned, exploiting the

core strengths that Seven-Eleven Japan had developed in

28 of information systems and distribution systems,

THE SEVEN-ELEVEN JAPAN

FRANCHISE SYSTEM

Seven-Eleven Japan developed an extensive franchise

network and performed a key role in the daily operations

cf this network. The Seven-Eleven Japan network

included both company-owned stores and third-party-

owned franchises. In 2004, franchise commissions

accounted for over 68 percent of revenue from opera-

tions. To ensure efficiency, Seven-Eleven Japan based its

fandamental network expansion policy on a market-

dominance strategy. Entry into any new market was built

8 © Supply Ohain Drivers ancl Metrics 67

around a claster of 50 to 60 stores supported by « cists

bution center. Such clustering gave Seven-Bleven Japan a

high-density market presence and allowed it to operate

an efficient distribution system. Seven-Fleven Japan, in

its 1994 annual report listed the following six advantages

of the market-dominance strategy:

Boosted distribution efficiency

Improved brand awareness

Increased system efficiency

Enhanced efficiency of franchise support services

Improved advertising effectiveness

Provented competitors’ entrance into the dorainant

‘Ahering to its dominant strategy, Sever-Eleven

Japan opened the majority of its new stores in areas with

existing clusters of stores For example, the Aichi prefec-

ture, where Seven-Eleven began opening stores in 2002,

savy alarge increase in 2004, with 108 new store cpeni

‘This represented more ther. 15 percent of the new Seven-

Eleven stores opened in Jepan that yea,

Geographically, Seven-Eleven has limited presence

in Japan. In 2004 the company had stores in about 0 per-

‘ent (32 of 47) of the prefectures within Japan. However,

within prefectures where they were present, stores

tended to be dense, As the 200¢ anaual report stated,

“Filling in the entize map of Jopan is not our priority:

Instead, we look for demend waere Seven-Eleven stoves

already exis, based on our fundamental area-dom

ogy of concentrating stores ir specific

‘With Seven-Eleven franchises being highly sought

after, fewer than one of 100 applicants were awarded 4

franchise (a testament to store profitability). The fran

hice ovner was required to put st amount of

money up front, Half of this amoun: was used to prepare

store and train the owner. The rest was used for pu

chasing the inital stock forthe st P

cf total gross profits ata store went to Sever-Fleven

Japan, and the rest went to th

bilities ofthe two perties were as

‘Seven-Eleven Japan responsibilities:

Develop supply and merchandise

Provide the ordering system

Pay for the system operation

Supply accounting services

Provide advertising

Install and remodel facilites

Pay 80 percent of utility costs

Franchise owner responsibilts

(Operate and manage store

Hire and pay staff

Order supplies

Maintain store appearance

Provide customer service

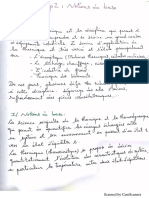

Gla EIQUIES Toes

Ending February 28/29 2000 2001200220320

Net sales (billion yen) 19640-20166 2140 2.2133 2,343.

Revenue (bilion yen) 32103693659 4007 «a4 4

Ordinary income (bilion yen) «140214721538 «1596 1689

Net income (billion yen) 682 784 3.2 865 a5

Number of siores 8453860294060 9,690 10,503

STORE INFORMATION AND CONTENTS

Seven-Eleven had 10,303 stores in Japan and Hawaii as of

2003 (see Table 3.2). In 2004, Seven-Eleven Japan

changed the standard size of new stores from 125 square

meters to 150 square meters, still significantly smaller

than the size of most US. 7-Blevenstores, Daily sales at a

store averaged 647,000 yen (about $6,100), which was

out twice the average at a US. store

Seven-Eleven Japan offered its stores 3 choice from

‘set of 5,000 SKUs (stock keeping units). Each store car-

ried on average about 3,000 SKUs depending on local

customer demand, Seven-Eleven emphasized regional

merchandizing to eater precisely to local preferences.

Each store carried food items, beverages, magazines, and

consumer items such as soaps and detergents. Sales

‘across product categories from 2002 to 200 are given in

Table 3.

«The food items were classified in four broad cate-

‘gories: (1) chilled-temperature items including sandwiches,

Gelicatessen products, and milk; (2) warm-temperature

items including box lunches, rice balls, and fresh breads

(@) frozen items including ice cream, frozen foods,and ice

cubes; (4) and room-temperature items including canned

food, instant noodles, and seasonings. Processed food and

food items were big seliers for the stores. In 2004,

processed ard fast foods contributed about 60 percent of

the total sales at each store. Over 1 biliion rice balls w

sold in 2004; this amounted to each Japanese citizen eat

ing approximately eight Seven-Fleven rice balis a year.

‘The top-selling products in the fast-food category were

lunch boxes, rice balls, bread-based products, and pasta,

‘As of February 2004, Seven-Eleven Japan had 290 dedi-

ted manufacturing plants that produced only fast food

for their stores.

Other products sold at Seven-Fleven stores included

soft drinks, nutritional drinks, alcoholic beverages

such as beer and wine, game software, music CDs, and

magazines.

In 2008, Seven-Eleven was focused on increasing the

number of original items that were available only at their

stores, At that time, original items accounted for roughly

‘52 percent of total store sales. The company aimed to

increase the percentage to 60 percent in the medium to

Jong term.

STORE SERVICES

Besides products, Seven-Fleven Japan gradually added a

variety of services that customers could obtain at its

stores. The first service, added in October 1987, was the

instore payment of Tokyo Electric Power bills. The com-

pany later expanded the set of utilities for which cus-

tomers could pay their bills in the stores to include gas,

insurance premiums, and telephone. With moze conve-

nient operating hours and Jocations than banks or other

financial institutions, the bill payment service attracted

millions of additional customers every year. In April

1994, Seven-Eleven Japan began accepting installment

payments on behalf of credit companies It started selling

ski-lift pass vouchers in November 1994. In 1995 it began

to accept payment for mail-order purchases. This was

expaaded to include pzyment for Internet shopping in

Noveraber 1999. In August 2000, a meal delivery

company, Seven-Meal Service Co. Ltd., was established to

serve the aging Japanese population. In 2001, 1YBank Co,

‘was established through a joint investment with Ito

‘Yokado. By April 2004, ATMs had been installed in stout

75 percent of the total stare network in Japan, with the

goal to achieve 100 percent ATM installstion.

Other services offared at stores include photocopy

ing, ticket sales using multifunctional copiers, and being @

pick-up location for parcel delivery companies that typi-

cally do not leave the parcel outside ifthe customer is not,

‘st home, The major thrust for offering thess services was to

make Seven-Eleven stores in Japan more convenient places

to shop. Several of these services exploited the existing

‘Total Information System (sec text following) in the store.

In February 2000, Seven-Eleven Japan establish

7dream.com, an e-commerce company. The goal was to

exploit the existing distribution system and the fact that

stores were easily accessible to most Japanese, Stores

served as drop-off and collection points for Japanese

customers, A survey by eSBook (a joint venture among

Softbank, Seven-Eleven Japan, YahoolJapan, and

‘Tohan, a publisher) discovered that 92 percent of its cus-

tomers preferred to pick up their online purchases at

the local convenience store, rather than have them

delivered to their homes. This was understandable given

the frequency with which Japanese customers visit their

Jocal convenience store. 7éream hoped to build on this

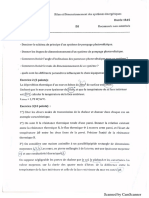

oF ‘coor (UE oP wat Se ~~COOOTSC OSC WT TRG,

88 v9 Te 9 gees a vs 6% — TOWS ——_SPOOFUON

vt ou ris tL ove re var SOE GFN —_ SPOOF TOL

ve 66 wee rs v9 re cue eee TEP ——_Spooprsea

wr soe ove 1 969 ss ote spooy

eee isstii passaoid

aS wok Sang Guaaazay wong Sa

song we Per une dong yma

wot fo ‘018) fo I mosf fo

ssmenuy —momag esmosany peasy every pnsang

EER aay moan

= RRR ica Shs | * t

70 PARTI @ Building a SI

preference along with the synergies from the existing

distribution system.

SEVEN-ELEVEN JAPAN'S INTEGRATED

STORE INFORMATION SYSTEM

From is stert, Seven-Eleven Japan sought to simplify its

operations by using advanced information technology.

Seven-Eleven Japan attributed a significant part ofits

success to the Total Information System installed in every

outlet and linked to headquarters, suppliers, and the

Seven-Eleven distribution centers. The first online net~

work linking the head office, stores, and vendors was

established in 1979, though the company did not collect

point-of-seles (POS) information at that time. In 1982,

Sever-Eleven became the first company in Japan to

introduce a POS system comprising POS cash registers

aad terminal control equipment. In 1985 the company

developed, jointly with NEC, personal computers using

color graphics thet ware instal at each store and linked

to the POS ash registers These computers were also on

the network Enking the store to the head office as well

2s the vendors. Until July 1981, head office, stores. dis-

tribution centers, and suppliers were linked only by a

traditional analog network. At that time, an integrated

services digital network (ISDN) was installed. Linking

‘more thar. 5,000 stores, it became one of the world’s,

largest ISDN systems at that time

The two-way, high-speed, online communication

cepability of ISDN enabled Seven-Elever Japan to col-

lect, process, and feed back POS data quickly. Sales date

sgethered in each store by 11:00 ea, were processed and

ready for analysis the next morning, In 1997, Seven-

Eleven Jepen introduced its fifth generation of the Totel

Tformation System, which was stil in se in 2004

‘The kardv

included the following:

store

© Graphic order terminal: This was 2 hand-held

device with 2 wide-soreen graphic display, used by

the store owner or manager to place orders. The

items were recorded and brought up in the order in

which they were arranged on the shelves. The store

manager/owner walked down the aisles and placed

orders by item, When placing an order, the stor=

manager had access (from the store computer) to

detailed analysis of POS data related to the particu

Jar item This included sales analysis of product eate-

gories and SKUs over time, analysis of waste, 10-week

sales trends by SKU, 10-day sales trends by SKU,

sales trends for new products, sales analysis by da

and time list of slow-moving items, analysis of sales

‘and number of customers over time, contribution of

product to sections in store display, and sales growth

by product categories The store manager used this,

information when placing his order, which was

centered directly into the terminal. Once all the

ategic Framework to Analyze Supply Chains

orders were placed, the terminal was returned to it

slot, at which point the orders were relayed by the

store computer to both the appropriate vendor and

the Seven-Eleven distribution center.

+ Scanner terminal: These scanners read bar codes

and recorded inventory. They were used to receive

products coming in from a distribution center. This

‘was automatically checked against a previously

placed order, and the two were reconciled. Before

the scanner terminals were introduced, truck drivers

‘waited in the store until the delivery was checked

Once they were introduced, the driver simply

dropped the delivery in the store, and a store clerk

received it at a suitable time when there were few

customers, The scanner terminals were also used

when examining inventory at stores.

© Store computer: This linked to the ISDN network,

the POS register, the graphic order terminal, and

the scanner terminal. It communicated among the

various input sources, tracked store inventory and

sales, placed orders, provided detailed analysis of

POS data, and maintained and regulated store

equipment.

+ POS register: To better understand the functioning

£ this information network, ane needs to consider @

sempling of daily operations. As soon 2s a customer

purchased an item and paid at the POS register, the

item information wes retrieved from the store

computer and the time of sale was automatically

recorded. In addition, the cashier recorded the age

‘and sex of the customer. To do this, the cashier used

five register keys for the cetegories: under 13, 13-19,

20-29, 30-49, and 50+. This POS data was automati-

cally transmitted online to 2 host computer,

sales date collected by 11:00 rat. were orga!

and ready for anelysis by the next morning,

data were evaluated on a company-wide, dis

and store basis,

“The anslyzed and updated data were then sent back

to the Seven-Eleven Japan stores via the network. Each

store computer automatically updated its product master

file to analyze its recent seles and stock movements, The

main objective of the enzlysis was to improve the order-

ing process. All this information was aveilable on the

graphic order terminal used for order placement.

‘The information system allowed Seven-Fleven

stores to better match supply with demand, Store stall

could adjust the merchandising mix on the shelves

according to consumption patterns throughout the day.

For example, popular breakisst items were stocked ear-

lier during the day, while popular dinner items were

stocked later in the evening. The identification of slow

and nonmoving items allowed a store to convert shelf

space to introduce new items. More than 50 percent of

the items sold at 2 Seven-Eleven store changed in the

partly to seasonal demand

end partly to new products. When a new product wes

introduced, the decision whether to continue stocking it

‘was made within the first three weeks, Each item on the

shelf contributed to sales and margin and did not waste

valuable shelf space.

SEVEN-ELEVEN’S DISTRIBUTION

SYSTEM

‘The Seven-Eleven distribution system tightly linked the

entire supply chain for all product categories. The Seven-

Eleven distribution centers and the information network

played a key role in that regard. The major objective was

to carefully track sales of items and offer short replenish-

ment cycle times. This allowed a store manager to fore-

‘ast sales corresponding to each order accurately.

From March 1987, Seven-Eleven, offered three-

times-a-day store delivery of all rice dishes (which com-

prised most of the fast-food items sold). Bread and other

resh food were delivered twice 2 day, The distribution

system mas flexible enough to alter delivery schedules

depending on customer demand, For example, ice eream

was Celivered daily during the summer but only three

imes_ week at other times The replenishment cycle time

{for fresh and fast-food items had been sh to

than 12 hours. A store order for rice balls by 10:00 A.M.

ves delivered before the dinner rush.

As discussed earlier, the store maneger used 2

graphic order terminal to place an order. All stores were

giver cutoff times for breakfast, lunch, end dinner ox

ing. When a store placed an order, it was immediately

transmitted to the supplier as well as the distribution c=n-

ter. The supplier received orders from all Seven-Eleven

stores and started production to fll the orders. The sup-

plies then sent the orders by truck to the distribution cen-

ter. Each store order was separated so the distribution

ret could easily assign it to the appropriate store truck,

using the order information it already hed, The key 19

store delivery was what Seven-Eleven called the con

bined delivery system. At the distribution eenter, delivery

of like products from different supplicrs (for example, milk

and sandwiches) was directed into a single temperature-

controlled truck. There were four categories of tempera-

ture-controlled trucks: frozen foods, chilled foods, soom-

temperature processed foods, and warm foods. Each

truck made deliveries to multiple retail stores. The num-

‘of stores per truck depended on the sales volume. All

deliveries were made during off-peak hours and were

received using the scanner terminals. The system worked

on trust and did not require the delivery parson to be pre-

sent when the store personnel scanned in the delivery.

‘That reduced the delivery time spent at each store,

‘This distribution system enabled Seven-Bleven to

reduce the number of vehicles required for daily delivery

service to each store, even though the delivery frequency

APTER 8 4 Supply Chain Drivers and Metrics 71

of each item was quite high. In 1974, 70 vehicles visited

ccach store every day-In 1994, only 11 were necessary This

dramatically reduced delivery costs and enabled rapid

deliver of a variety of fresh foods.

Asof February 2004, Seven-Eleven Japan had a total

of 290 dedicated manufacturing plants throughout the

country that produced only fast food for Seven-Eleven

stores, These items were distributed through 293 dedi-

cated distribution centers (DCs) that ensured rapid, reli-

able delivery. None of these DCs carried any inventory;

they merely transferred inventory from supplier trucks to

Seven-Bleven distribution trucks, The transportation was

provided by Transfleet Ltd.,2 company set up by Mitsui

and Co. for the exclusive use of Seven-Eleven Japan.

7-ELEVEN IN THE UNITED STATES.

Seven-Eleven had expanded rapidly around the world

(sce Table 3-4), The major growth vas in Asia, though the

United States continued to be the second largest market

for Seven-Eleven. Once Seven-Eleven Japan acquire

Southland Cosporstion, it set about improving opere-

tions in the United States. In the initiel years, several

7-Eleven stores in the United States were shut down, The

number of stores started to grow beginning in 1998,

Historically, the distribution structure in the United

States was completely different from that of Jepan. Stores

in the United States were replenished using direct store

very (DSD) by some manufactur

Thailand

South Korea

China

Mexico

Canada

Malaysia

‘Australia 3H

‘Singapore 261

Philippines 257

Norvay 8

Sweden “

Turkey 65

Denmark 46

Puerto Rico 12

Guam 8

Total 7.526

72 PART! ¢ Building @ Strategic Framework to Analyze Supply Chains

4, products delivered by wholesalers, DSD accounted

bout half the total volume, with the rest coming from

wholesalers

With the goal of introducing “fresh” products,

7-Bleven introduced the concep of combined distribu-

tion centers (CDCs) around 2000. By 2003,7-Eleven had

23 CDC located throughout North America supporting

about 80 percent of the store network, CDCs delivered

fresh items such as sandwiches, bakery products, bread,

produce, and other perishables once a day. A variety of

fresh-food suppliers sent product to the CDC throughout

the day, where they were sorted for delivery to stores at

night. Requests from store managers were sent to the

nearest CDC, and by 10:00 ea. the products were en

route 10 the stores, Fresh-food sales in North America

ceeded $450 million in 2005. During this period, DSD

by manufacturers and wholesaler delivery to stores also

continued.

“This was 2 period when 7-Eleven worked very hard

to iniroduce new feeshfood items with a goal of compet

ing more directly with the likes of Starbucks than with

traditional gas station food marts. 7-Blevem in the United

. hed over 68 percent of its sales from nongasoline

products compared to the rest of the industry. for which

this number was closer to 35 percent. The goal was to

continue to increase sales inthe fresh-food and fastfood

categories

Tn 2003 United States and Canada

led $10.9 billion, with about 69 percent coming from

merchandise and the rest from the sele of gasoline. The

North American inventory turnover rete in 2004 was

about 19, compared to over 50 in Japan. This pert

‘mance, however, represented a significent improveme

ja North Am ance, where inventory turns

STUDY QUESTIONS

4. A convenience store chain attempts to be responsive

and provide customers what they need, when they

need it, where they need it. What are some different

ways thst a convenience store supply chain can be

responsive? What are some risks in each case?

2, Seven-Eleven’s supply chain strategy in Japan can be

described as attempting to micro-match supply and

demand using repid replenishment. What are some

risks associated with this choice?

3, What has Seven-Eleven done in its choice of facility

location, inventory management, transportation, and

information infrastructure to develop capabilities

that support its supply chain strategy in Japan?

4, Seven-Eleven does not allow direct store delivery i

Jepan but has all products flow throught its distribu-

tion center. What benefit does Seven-Eleven deriv

from this policy? When is direct store delivery more

appeopziste?

What do you think about the Tdream concept for

Seven-Eleven Japan? From a supply chain perspec-

tive, is it Hikely to be more successful in Jepsn or the

United States? Why?

6, Seven-Eleven is attempting to duplicate the supply

chain structure that hes succeeded in Japan in the

United States with the introduction of CDCs What,

are the pros and cons of this approach? Keep in

‘mind that stores are alsa replenished by wholeselers

and DSD by manufectus

7. The United States has food service distributors that

also replenish convenience stores What are the pros

nd cons to having a distributor replenish conve-

nience stores versus @ company like Seven-Eleven,

managing its own distribution function?

Vous aimerez peut-être aussi

- Capteurs SolairesDocument6 pagesCapteurs SolairesTunENSTABPas encore d'évaluation

- PDM Part2Document24 pagesPDM Part2TunENSTABPas encore d'évaluation

- PDM Part1Document21 pagesPDM Part1TunENSTABPas encore d'évaluation

- IntegrationDocument7 pagesIntegrationTunENSTABPas encore d'évaluation

- Language VHDLDocument14 pagesLanguage VHDLTunENSTABPas encore d'évaluation

- DS Modélisation 2016Document5 pagesDS Modélisation 2016TunENSTABPas encore d'évaluation

- Notions de BaseDocument10 pagesNotions de BaseTunENSTABPas encore d'évaluation

- Seven Eleven - AnswersDocument3 pagesSeven Eleven - AnswersTunENSTABPas encore d'évaluation

- Cours Jacobi Gaussseidel Gradients PDFDocument4 pagesCours Jacobi Gaussseidel Gradients PDFMerryLovellyPas encore d'évaluation

- Conduction ThermiqueDocument29 pagesConduction ThermiqueTunENSTABPas encore d'évaluation

- Examen Composites 2016Document1 pageExamen Composites 2016TunENSTABPas encore d'évaluation

- Convection ThermiqueDocument20 pagesConvection ThermiqueTunENSTABPas encore d'évaluation

- Supply Chain Management - ENSTABDocument208 pagesSupply Chain Management - ENSTABTunENSTABPas encore d'évaluation

- Journal of Loss Prevention in The Process IndustriesDocument11 pagesJournal of Loss Prevention in The Process IndustriesTunENSTABPas encore d'évaluation

- Riba Guide Urm April 2015Document4 pagesRiba Guide Urm April 2015TunENSTABPas encore d'évaluation

- DS Composites 2016Document2 pagesDS Composites 2016TunENSTAB100% (4)

- Examen Modelisation 2016Document2 pagesExamen Modelisation 2016TunENSTABPas encore d'évaluation

- Mckinsey GuideDocument18 pagesMckinsey GuideTunENSTABPas encore d'évaluation

- Examen Capteurs 2016Document3 pagesExamen Capteurs 2016TunENSTABPas encore d'évaluation

- Ds DimensionnementDocument2 pagesDs DimensionnementTunENSTABPas encore d'évaluation

- DS FluidDocument2 pagesDS FluidTunENSTABPas encore d'évaluation

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5795)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)