Académique Documents

Professionnel Documents

Culture Documents

Case 5

Transféré par

grfCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Case 5

Transféré par

grfDroits d'auteur :

Formats disponibles

Case 5:

Issue: In this case two parties are involved, Plentiff Mrs Smith 72 -year-old widow who owns a freehold

hourse and Defendant Mr Jone, whos taken as a lodger by Mrs Smith. She soon entrusted him and let

him handle her financial affair. Later on, she found out that he had been prisoned for 10 years in the

case of theft. After a span of two years at the house of Mrs Smith, he persuaded her to tranfer one third

of the share of the house to him. She did tranfer despite knowing of the theft case. Next, Mr Jones

wanted to start a business but he was unable to raise the required start-up capital on his own, he again

pursudaed Mrs Smith to put her remaining two third share of the house as security against a bank in his

favour. She signed the documents at the bank in the presence of Mr Jones for the bank loan. Seven

months later, Mr Jones business went to bankrupcy, and he is no longer able to make payment on the

bank loan. .Whether she is able to sue against Mr Jones for the damages?

Relevant Case Laws: Donoghue v Stevenson(1932); Commericial Bank of Australia v Amadio(1983)

Application: Based on the case study mentioned above, Mrs Smith may be liabe for her damages as she

could have reasonably researched about his past life before taking him as alodger in her house. In this

scenerio, she may be liabe as she has breached the duty of care as in the case of Donghue V Stenvenson.

The facts involved Mrs Donoghue drinking a bottle of ginger beer in a caf in Paisley,

Renfrewshire. A dead snail was in the bottle. She fell ill, and she sued the ginger beer

manufacturer, Mr Stevenson. The House of Lords held that the manufacturer owed a duty of

care to her, which was breached, because it was reasonably foreseeable that failure to

ensure the product's safety would lead to harm of consumers.

I second scenario, it seems that Mr Jones may take advantage over weaker party as she is a widow and

its a possibilty that she may not be aware of the banking system. Mr jones may have not explained to

her about the cosequeces of loan if it is not returned back on time. Based on CBA v amadio, Mr Jones

can be personally liable as he tried to took advantage over widow Mrs Smith, signing for the necessary

documents for the bank loan.

unconscionable conduct' is usually taken to refer to the class of case in which a party makes

unconscientious use of his superior position or bargaining power to the detriment of a party who

suffers from some special disability or is placed in some special situation of disadvantage."[1]

What distinguishes unconscionable dealing from undue influence is that in unconscionable

dealing "advantage is taken of an innocent party who, though not deprived of an independent

and voluntary will, is unable to make a worthwhile judgment as to what is in his best interest.

The Respondents [Amadio] signed a mortgage for the Appellant [Bank of

Australia] to secure loans for their son.

They were not well informed about the details of the mortgage, and clearly had no

idea what's going on.

They were both Italian and spoke very little English, being pretty much illiterate.

When the Appellant attempted to seize the house, the Respondents attempted to

challenge the validity of the of the mortgage

An elderly Italian migrant couple, Mr. and Mrs. Amadio stood as guarantors against their sons loan for

his construction business from the Commercial Bank of Australia. The bank manager, Mr. Virgo, who

was in close communication with the son, Vincenzo Amadio, had better understanding of the business

reality and knew that the son had probably misrepresented facts in a bid to get his parents to stand as

guarantors. Subsequently, when Vincenzo Amadios business failed, the bank was required to enforce

the guarantee by mortgaging the building owned by Amadios.

In coming to their decision, the Court took into consideration the special disadvantage suffered

by the Amadios as a result of their minimal ability to speak English, lack of formal education

and business experience, and old age. This special disadvantage suffered in conjunction with the

failure of the bank to disclose the necessary facts that would allow the Amadios to make their

own informed judgment about the transaction was held to amount to unconscionable

conduct. Ultimately, the Amadios would not have signed the documents, had they been aware of

the effect of the terms they were agreeing to.

In cases of unconscionable conduct, the court will focus on the bargaining power of the parties

and in particular that of the stronger party and their conduct. The onus of proof will be upon the

stronger party to show that the transaction was fair, just and reasonable. If the stronger party is

unable to bear proof that the transaction was fair, just and reasonable, their conduct will be held

to have been unconscionable and the transaction will be set aside.

Conclusion,Mrs Jones has done necessary search research before choosing Mr Jones for managing the

business.She can be responislbe personally as she breached the duty of care.Mr

Jones in the second scenerio of the case may be accountable for the uncosciousable conduct where she

took advatge over weaker part Mrs Smith

Vous aimerez peut-être aussi

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Sole Proprietorship Partnership CorporationDocument90 pagesSole Proprietorship Partnership CorporationPauline CasquejoPas encore d'évaluation

- Part III. Sale of Goods Chapter I. General Provisions Article 25Document86 pagesPart III. Sale of Goods Chapter I. General Provisions Article 25ammaraPas encore d'évaluation

- License AgreementDocument8 pagesLicense AgreementIonut FloricaPas encore d'évaluation

- General DefencesDocument13 pagesGeneral DefencesAnimesh OmprakashPas encore d'évaluation

- Deed of ExchangeDocument4 pagesDeed of ExchangeSonny Xavier AbellaPas encore d'évaluation

- Transpo Submission 1Document3 pagesTranspo Submission 1Ayen Rodriguez MagnayePas encore d'évaluation

- Tupaz v. CA, 475 SCRA 398 24. American Home Insurance v. FF. Cruz & Co., G.R. No. 174926Document36 pagesTupaz v. CA, 475 SCRA 398 24. American Home Insurance v. FF. Cruz & Co., G.R. No. 174926yodachanPas encore d'évaluation

- Sale of Immovable Property ProjectDocument20 pagesSale of Immovable Property ProjectSyed renobaPas encore d'évaluation

- CBTL Crammers - Civil Law II (Answers)Document3 pagesCBTL Crammers - Civil Law II (Answers)EJ PlanPas encore d'évaluation

- Sandejas V LinaDocument2 pagesSandejas V LinavalkyriorPas encore d'évaluation

- Contract - II FinalDocument244 pagesContract - II FinalakashPas encore d'évaluation

- 648190081831076280413$5 1REFNOLaw of Tort Including Consumer Protection Laws and Motor Vehicles ActDocument15 pages648190081831076280413$5 1REFNOLaw of Tort Including Consumer Protection Laws and Motor Vehicles ActHaritha DharmarajanPas encore d'évaluation

- Example Employment Contract PDFDocument2 pagesExample Employment Contract PDFErickPas encore d'évaluation

- LawDocument1 pageLawRhap SodyPas encore d'évaluation

- Group 4 Chapter 4. Sec 3 6 FinalDocument84 pagesGroup 4 Chapter 4. Sec 3 6 FinalTresbelle VuePas encore d'évaluation

- Common Law Copyright NoticeDocument4 pagesCommon Law Copyright Noticekeith_alden100% (20)

- Credtrans DigestDocument4 pagesCredtrans DigestBLACK mamba100% (1)

- My Commercial Law 1 NotesDocument97 pagesMy Commercial Law 1 NotesBidemah RaymondPas encore d'évaluation

- Oblicon - Week 1 To 3Document13 pagesOblicon - Week 1 To 3joyfandialanPas encore d'évaluation

- Bir Ruling 332-12Document3 pagesBir Ruling 332-12Neil MayorPas encore d'évaluation

- 2017版银皮书中英文对照翻译稿Document136 pages2017版银皮书中英文对照翻译稿lv huanPas encore d'évaluation

- Commercial Purcha E Letter of IntentDocument2 pagesCommercial Purcha E Letter of IntentMichelle GozonPas encore d'évaluation

- Dissolution CasesDocument17 pagesDissolution CasesTen LaplanaPas encore d'évaluation

- CIvil Law ReviewerDocument204 pagesCIvil Law ReviewerBernadette Lou Lasin100% (8)

- Edlington Properties LTD V JH Fenner and CoDocument14 pagesEdlington Properties LTD V JH Fenner and CoClerkBeanJPas encore d'évaluation

- UP Canonical Doctrines - Civil LawDocument24 pagesUP Canonical Doctrines - Civil LawSheilaPas encore d'évaluation

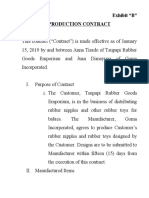

- Exhibit B - Production ContractDocument7 pagesExhibit B - Production ContractJennifer Kate AtilanoPas encore d'évaluation

- Capacity of Minor in Contracts and PartnershipsDocument20 pagesCapacity of Minor in Contracts and PartnershipsDannana Tarun NaiduPas encore d'évaluation

- God Bless! Law On ObligationsDocument10 pagesGod Bless! Law On ObligationsMa. Kristine Laurice AmancioPas encore d'évaluation

- HR - Lifting The Corporate VeilDocument3 pagesHR - Lifting The Corporate VeilSaidur Rahman (202051003)Pas encore d'évaluation