Académique Documents

Professionnel Documents

Culture Documents

Letter To NYS Comptroller DiNapoli 10-30-2017

Transféré par

Nick Reisman0 évaluation0% ont trouvé ce document utile (0 vote)

3K vues2 pagesletter

Titre original

Letter to NYS Comptroller DiNapoli 10-30-2017

Copyright

© © All Rights Reserved

Formats disponibles

PDF ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentletter

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

3K vues2 pagesLetter To NYS Comptroller DiNapoli 10-30-2017

Transféré par

Nick Reismanletter

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 2

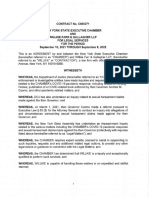

~ COUNTY OF SUFFOLK

OFFICE OF THE COUNTY EXECUTIVE

Steven Bellone

SUFFOLK COUNTY EXECUTIVE,

October 30, 2017

Hon. Thomas P. DiNapoli

New York State Comptroller

Office of the State Comptroller

10 State Street

Albany, New York, 12236

Dear Honorabie Sir:

We recently became aware that bonuses were paid to certain employees of the District Attomey’s

office. It is my understanding that there were no available appropriations for these bonuses and that

the bonuses resulted in salaries being paid to employees that were greater than the salaries authorized

by the legislature. In essence, these bonus payments were not authorized by the county legislature

pursuant to any legal process or authority that I am aware of.

As you know, state and local law requires that there be appropriations for an item before municipal

spending can take place. As per the County Attorney’s office, under County Law §362, there can be

no expenditure of money “.,.unless an amount has been appropriated and is available.”

Additionally, pursuant to section 888-4 of the County Code, the County has a salary plan that sets the

salary for each title in the classification plan, which consists of minimum rates and intermediate steps,

Salary grades are established by the Legislature pursuant to section $88-4(B). Pursuant to section 888-

4(G), no salary, wage or other compensation may be paid unless the County Personnel Officer certifies

that the salary rates are those authorized by the Salary Plan. Further section 888-4(1) states that

exempt employees annual step shail be determined by the County Executive and the Presiding

Officer. ‘There is no authority in section 888-4 for bonuses to be paid to county employees.

was also surprised to lear that asset forfeiture funds were used as the source of bonus payments.

State law is fairly clear that those funds are to be used to pay expenses on a priority basis. Salary is

allowed as a possible item of payment, but it is to reimburse the County for actual expenses incurred.

The law states specifically that a proportionate share of seized money can be used “in satisfaction of

actual costs and expenses” incurred in litigation and protecting and maintaining forfeited property.

‘That means recovery is for salary expenses, not for the seizing agency's personal benefit. Spending

forfeited money for bonuses does not appear to be a permitted expenditure.

If federal forfeiture funds have been used, payments for salaries are disallowed with few exceptions,

United States Departments of Justice and Treasury guidance documents state that payments for salaries

(not bonuses) can be made for law enforcement officers, but only in very limited circumstances and for

LEE DENNISOM BLDG w 109 VETERANS MEMORIAL MIVY m P.0, HOX 6100 # MAUPPALIGE, 11789-0089 (621 882-4000

very limited durations of time. I am not aware of a permitted bonus payment under the federal

guidelines.

Ihave asked the County Comptroller, by letter dated October 20, 2017, to explain what authority

existed for his office to make bonus payments to District Attorney employees without legislative

approval, however, as of the writing of this leter, I have not received a response.

Tam respectfully requesting that your office review and, if necessary, investigate the circumslances

involving the payment and reimbursement and the legality of same.

I thank you in advance for your assistance and cooperation.

Sincerely,

6. Slt

Steven Bellone

County Executive

Vous aimerez peut-être aussi

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5795)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- OCM LawsuitDocument29 pagesOCM LawsuitNick Reisman100% (1)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Cuomo ReportDocument63 pagesCuomo ReportCasey Seiler100% (2)

- EndorsementsDocument4 pagesEndorsementsNick ReismanPas encore d'évaluation

- Accountability Waiver Announcement Memo 062221Document5 pagesAccountability Waiver Announcement Memo 062221Nick ReismanPas encore d'évaluation

- E2022 0116cv Tim Harkenrider Et Al V Tim Harkenrider Et Al Decision After Trial 243Document18 pagesE2022 0116cv Tim Harkenrider Et Al V Tim Harkenrider Et Al Decision After Trial 243Nick ReismanPas encore d'évaluation

- Amy Brignall Et Al V New York State Unified Court System Et Al - Filed PETITIONDocument56 pagesAmy Brignall Et Al V New York State Unified Court System Et Al - Filed PETITIONNick ReismanPas encore d'évaluation

- Amy Brignall Et Al V New York State Unified Court System Et Al - Filed PETITIONDocument56 pagesAmy Brignall Et Al V New York State Unified Court System Et Al - Filed PETITIONNick ReismanPas encore d'évaluation

- Matter of Demetriou V New York State Department of Health 2022-00532Document2 pagesMatter of Demetriou V New York State Department of Health 2022-00532Nick ReismanPas encore d'évaluation

- Letter - FL Region - Booster Healthcare Mandate 1-12-22Document2 pagesLetter - FL Region - Booster Healthcare Mandate 1-12-22Nick ReismanPas encore d'évaluation

- Contract c000271Document21 pagesContract c000271Nick ReismanPas encore d'évaluation

- Lottery Commission Increase Letter To Governor HochulDocument3 pagesLottery Commission Increase Letter To Governor HochulNick ReismanPas encore d'évaluation

- SaveNYsSafetyNet SignOnLetter 02Document4 pagesSaveNYsSafetyNet SignOnLetter 02Nick ReismanPas encore d'évaluation

- Notice of Appeal Nassau County Mask RulingDocument8 pagesNotice of Appeal Nassau County Mask RulingNick ReismanPas encore d'évaluation

- Covid 19 Executive Order To Limit Non Essential Elective Procedures 12-3-21Document3 pagesCovid 19 Executive Order To Limit Non Essential Elective Procedures 12-3-21News10NBCPas encore d'évaluation

- News Release Redistricting August 2021 FinalDocument2 pagesNews Release Redistricting August 2021 FinalNick ReismanPas encore d'évaluation

- Hochul Housing Coalition Letter PrsDocument4 pagesHochul Housing Coalition Letter PrsNick ReismanPas encore d'évaluation

- CFNY CAC Letter FinalDocument8 pagesCFNY CAC Letter FinalNick ReismanPas encore d'évaluation

- NY Gig Labor Clergy LetterDocument3 pagesNY Gig Labor Clergy LetterNick ReismanPas encore d'évaluation

- Letter To Gov Hochul 8.31Document2 pagesLetter To Gov Hochul 8.31Nick Reisman100% (1)

- CDPAP Budget Letter SigsDocument4 pagesCDPAP Budget Letter SigsNick ReismanPas encore d'évaluation

- Cannabis and Scaffold LawDocument4 pagesCannabis and Scaffold LawNick ReismanPas encore d'évaluation

- OGS ResponseDocument1 pageOGS ResponseNick ReismanPas encore d'évaluation

- SNY0121 Crosstabs011921Document8 pagesSNY0121 Crosstabs011921Nick ReismanPas encore d'évaluation

- DeRosa TranscriptDocument40 pagesDeRosa TranscriptNick ReismanPas encore d'évaluation

- AQE BuildingBackBetterDocument12 pagesAQE BuildingBackBetterNick ReismanPas encore d'évaluation

- Assembly Senate Response.2.10.21. Final PDFDocument16 pagesAssembly Senate Response.2.10.21. Final PDFZacharyEJWilliamsPas encore d'évaluation