Académique Documents

Professionnel Documents

Culture Documents

Article in Petrominer, Oct 2009

Transféré par

Benny LubiantaraCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Article in Petrominer, Oct 2009

Transféré par

Benny LubiantaraDroits d'auteur :

Formats disponibles

Opinion

PSC Standard has the Most ‘Win-

Standard Win’ Solution

‘Win-Win’

By: Benny Lubiantara

Alternative method good, it would be good for the RI govern-

Several alternatives have been put ment but bad for the contractor. Why?

forward by my friends in their effort to Because the gross revenue is small, the

‘eliminate’ cost recovery with various share obtained by the IOC ‘doesn’t kick’

terms and names. So far the proposals to recover cost, because said alternative

D

Discussions on oil and gas con- have not been satisfactory because they model indirectly has a very big ‘cost re-

tracts in the mailing list remain were unable to prove that the proposed covery limit’ for the contractor (IOC).

up to date. Friends’ efforts to look mode is better than our PSC standard, The consequences: IOC should be

for a good model deserve appreciation. unless with a promise that the model is patient in carrying over their cost into

But after some alternatives are put for- far more simple and far from slander. the years that follow, further implica-

ward, and then tested, it seems that the I will follow the internationally tion clearly it has to do with ‘time value

model that is meant to be simple (in my valid rule, the good and the bad of a of money’ reflected by the low eco-

opinion) is still not better than the PSC model, the gauge is: Government Take nomic parameter such as ROR and its

we are using. A colleague asks, is there (GT) and other economic parameters. I companions. If ROR is below MARR,

something wrong with our current PSC also don’t see the connection that a only two choices is left: cancelled or

model? Or there is nothing wrong, but simple model guarantees no slander. If renegotiation.

only us who have the perception that currently the source of the commotion Conversely, if the price of oil is

there is something wrong. is cost recovery, probably with the good (or very good), gross revenue is

simple model the source of the commo- high, contractor’s share is also high, cost

Cost recovery tion is the sharing split. Who knows? spent by the contractor becomes insig-

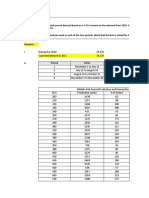

Undoubted, the trigger of the wish From the outcome of simulation by nificant compared to their revenue share,

to soon get a new model is the disap- a mailing list friend proves that the ‘non as a consequence: ‘excessive profit’ for

pointment toward what is called cost recovery’ model they proposed is only the contractor, therefore the simulation

recovery. From the first time I wrote in good at the time when the price of oil is shows that government take will be bad

the blog about cost recovery, I said this low and will be worse than the PSC stan- (compared with PSC standard) at the

terminology often trigger laities to be dard model at the time the price of oil is time when the price of oil is good.

mistaken in its use. So don’t be surprised high,. (See illustration) I once said that in fact the current

when people rush in search of a system PSC has a ‘win-win’ solution, it means

that has no cost recovery. that at the time when the condition of

In one of his writings, Prof. oil price is not so good, the contractor

Wdjajono Partowidagdo, wrote: could still carry on for the project is still

…An opinion that says that a Con- economic (ROR>=MARR). This is be-

ROR (%)

cession or Contract of Work is non-Cost cause their cost recovery limit is only

Recovery is wrong. As long as there is limited by FTP, while at the time when

MARR

tax, there is cost recovery, because tax the price of oil is high the GT will be

is calculated from revenue minus recov- better compared with the alternative

erable cost…. Price models. Of course the contractor’s ROR

I think in this context Wid wished also rises, but not excessively as the al-

to say that all contracts have their cost The logic is this: Non cost recovery ternative model mentioned above.

recovery. Whatever model to apply (as model that takes the share direct from

long as there is tax), there is always cost gross revenue and another alternative Fiscal Policy Analyst of OPEC,

recovery. Of course the term is not spe- model that has a similarity. During a con- Doctoral Candidate,

cifically cost recovery. International University (IU), Vienna.

dition when the price of oil is not too

67 PETROMINER No. 10/October 20, 2009

Vous aimerez peut-être aussi

- Article in Petrominer, August 2009Document2 pagesArticle in Petrominer, August 2009Benny LubiantaraPas encore d'évaluation

- Cost Plus Incentive Fee Calculations For PMP ExamDocument6 pagesCost Plus Incentive Fee Calculations For PMP ExamMahnooranjumPas encore d'évaluation

- Pages 417-418 Chapter 10: Special Pricing Practices.: (DONE)Document14 pagesPages 417-418 Chapter 10: Special Pricing Practices.: (DONE)DuncanPas encore d'évaluation

- Activity Number 5: Explain The Difference Between Marginal Cost and Incremental CostDocument2 pagesActivity Number 5: Explain The Difference Between Marginal Cost and Incremental CostMarkJoven BergantinPas encore d'évaluation

- Economics 10th Edition Sloman Solutions ManualDocument4 pagesEconomics 10th Edition Sloman Solutions Manualashleyfuentesdvm13051997noj100% (19)

- Ebook Economics 10Th Edition Sloman Solutions Manual Full Chapter PDFDocument25 pagesEbook Economics 10Th Edition Sloman Solutions Manual Full Chapter PDFkhondvarletrycth100% (9)

- Depletion Premium ApplicationDocument10 pagesDepletion Premium Applicationahmad faisalPas encore d'évaluation

- The Business Case For Lowest Price Tendering May-2011 PDFDocument6 pagesThe Business Case For Lowest Price Tendering May-2011 PDFahtin618Pas encore d'évaluation

- Victoria Chemicals Plc. (A) The Merseyside ProjectDocument9 pagesVictoria Chemicals Plc. (A) The Merseyside ProjectAs17 As17Pas encore d'évaluation

- Class Case 5thDocument13 pagesClass Case 5thAngelica B. PatagPas encore d'évaluation

- A Beginner's Guide To Credit Default Swaps (Part 3) - Rich NewmanDocument5 pagesA Beginner's Guide To Credit Default Swaps (Part 3) - Rich NewmanOUSSAMA NASRPas encore d'évaluation

- UAE Laws Related To ConstructionDocument74 pagesUAE Laws Related To ConstructionAravindanPas encore d'évaluation

- Khanh Van Individual AssignmentDocument6 pagesKhanh Van Individual AssignmentToànn PhanPas encore d'évaluation

- COST OF CAPITAL Notes QnsDocument17 pagesCOST OF CAPITAL Notes QnschabePas encore d'évaluation

- CAPMDocument43 pagesCAPMEsha TibrewalPas encore d'évaluation

- Capital BugetingDocument6 pagesCapital BugetingAmit Dubey0% (1)

- Lecture 5: Market Structure - Monopoly: I. The Definition of MonopolyDocument6 pagesLecture 5: Market Structure - Monopoly: I. The Definition of MonopolyMehboob MandalPas encore d'évaluation

- Ross Chapter 9 NotesDocument11 pagesRoss Chapter 9 NotesYuk Sim100% (1)

- General Discussion On Capital Budgeting Decision MethodsDocument3 pagesGeneral Discussion On Capital Budgeting Decision MethodsZeeshan SardarPas encore d'évaluation

- Opportunity Cost For Decision MakingDocument5 pagesOpportunity Cost For Decision MakingAthar AhmadPas encore d'évaluation

- Regulating Natural MonopoliesDocument5 pagesRegulating Natural MonopoliesCarla Mae F. DaduralPas encore d'évaluation

- RWJ Chapter 6Document39 pagesRWJ Chapter 6Yustiara Izmi DamayantiPas encore d'évaluation

- DlerDocument7 pagesDlerRose DallyPas encore d'évaluation

- Lesson Four Present Worth AnalysisDocument5 pagesLesson Four Present Worth AnalysisGrantham UniversityPas encore d'évaluation

- Cap 5Document21 pagesCap 5IvanaPas encore d'évaluation

- The Type of Contract You Bid On Can Be Risky 1657773170Document5 pagesThe Type of Contract You Bid On Can Be Risky 1657773170scottigiancarloPas encore d'évaluation

- Delivering Value in A PSC Environment: IPA14-BC-013Document7 pagesDelivering Value in A PSC Environment: IPA14-BC-013TRI DEWI KURNIA SARIPas encore d'évaluation

- Roles of An Effective ManagerDocument15 pagesRoles of An Effective ManagerMarin, Nicole DondoyanoPas encore d'évaluation

- Chapter 13: Risk, Cost of Capital, and Capital BudgetingDocument35 pagesChapter 13: Risk, Cost of Capital, and Capital BudgetingKoey TsePas encore d'évaluation

- Key Ratios For Analyzing Oil and Gas Stocks - Measuring PerformanceDocument3 pagesKey Ratios For Analyzing Oil and Gas Stocks - Measuring Performancek7hussainPas encore d'évaluation

- Theory of Yardstick CompetitionDocument9 pagesTheory of Yardstick CompetitionjarameliPas encore d'évaluation

- Benefit/Cost Analysis and Public Sector ProjectsDocument4 pagesBenefit/Cost Analysis and Public Sector ProjectsGrantham UniversityPas encore d'évaluation

- Managerial Economics: An Analysis of Business IssuesDocument19 pagesManagerial Economics: An Analysis of Business IssuesblumymanjuPas encore d'évaluation

- Jetco Report by Alvina Mehdi Muhammad Rafeu Haider Akhtar Ali Ali Hyder Najeebullah BakhtyarDocument8 pagesJetco Report by Alvina Mehdi Muhammad Rafeu Haider Akhtar Ali Ali Hyder Najeebullah BakhtyarAliPas encore d'évaluation

- Valuation of Non-Conventional Cash Flows PaperDocument10 pagesValuation of Non-Conventional Cash Flows PaperRonaldoDamascenoPas encore d'évaluation

- Construction ContractsDocument2 pagesConstruction ContractsJoshua LisingPas encore d'évaluation

- E10 Cost of Capital Gearing and CAPM Part 2Document6 pagesE10 Cost of Capital Gearing and CAPM Part 2TENGKU ANIS TENGKU YUSMAPas encore d'évaluation

- Present Worth Analysis of Equal-Life Alternatives: ExampleDocument13 pagesPresent Worth Analysis of Equal-Life Alternatives: ExamplePA SampaioPas encore d'évaluation

- Competitive AdvantageDocument6 pagesCompetitive AdvantagedstokesjPas encore d'évaluation

- Capm:: Cost of Equity 9.811%Document3 pagesCapm:: Cost of Equity 9.811%Eva LeePas encore d'évaluation

- Cost of Capital Compute The Cost of Debt Compute The Cost of Preferred StockDocument58 pagesCost of Capital Compute The Cost of Debt Compute The Cost of Preferred StockAerial DidaPas encore d'évaluation

- NPV Rule in Comparison To Payback and IRR MethodsDocument6 pagesNPV Rule in Comparison To Payback and IRR MethodsSonal Power UnlimitdPas encore d'évaluation

- International Capital Burgeting AssignmentDocument22 pagesInternational Capital Burgeting AssignmentHitesh Kumar100% (1)

- Assignment Solution Finance 29-9-16Document16 pagesAssignment Solution Finance 29-9-16Mudassir AliPas encore d'évaluation

- Key Ratios For Analyzing Oil and Gas Stocks: Measuring Performance - InvestopediaDocument3 pagesKey Ratios For Analyzing Oil and Gas Stocks: Measuring Performance - Investopediapolobook3782Pas encore d'évaluation

- Treasury Management: Week-12, Capital Structure and Company ValuationDocument52 pagesTreasury Management: Week-12, Capital Structure and Company ValuationPrince WamiqPas encore d'évaluation

- Macroeconomics Fourteenth Canadian Edition Canadian 14th Edition Ragan Solutions ManualDocument11 pagesMacroeconomics Fourteenth Canadian Edition Canadian 14th Edition Ragan Solutions Manualadelaideoanhnqr1v100% (21)

- Econ ReviewerDocument7 pagesEcon ReviewerGennie AndresPas encore d'évaluation

- Capital Budgeting Mini CaseDocument5 pagesCapital Budgeting Mini CaseHari Cahyo100% (1)

- PSC Sliding Scale As A Fiscal Model For Marginal Fields in IndonesiaDocument10 pagesPSC Sliding Scale As A Fiscal Model For Marginal Fields in IndonesiaAnonymous 1pblc2YPas encore d'évaluation

- Total Cost of Ownership:: Application in Supply Chain ManagementDocument22 pagesTotal Cost of Ownership:: Application in Supply Chain ManagementusmanPas encore d'évaluation

- Estimating Customer Lifetime Value Using Machine Learning TechniquesDocument18 pagesEstimating Customer Lifetime Value Using Machine Learning TechniquesPrince P AppiahPas encore d'évaluation

- Construction Contracts - Important Terms - PRICEDocument5 pagesConstruction Contracts - Important Terms - PRICEdvduronPas encore d'évaluation

- Lecture No. 10 Making Choices: The Method, MARR and Multiple Attributes 1. Comparing Mutually Exclusive AlternativesDocument4 pagesLecture No. 10 Making Choices: The Method, MARR and Multiple Attributes 1. Comparing Mutually Exclusive AlternativesjrklingPas encore d'évaluation

- Types of Contract in Procurement Management According To Pmbok 6 EditionDocument3 pagesTypes of Contract in Procurement Management According To Pmbok 6 EditionM Baqir IsmailPas encore d'évaluation

- MEATDocument8 pagesMEATHaitham SaidPas encore d'évaluation

- Chartered Accountants: Hospitality - Conract SynopsisDocument7 pagesChartered Accountants: Hospitality - Conract Synopsisabdullahsaleem91Pas encore d'évaluation

- CVP Analysis - International Finance and AccountingDocument14 pagesCVP Analysis - International Finance and AccountingJamesPas encore d'évaluation

- Pricing Model For Expense OptimizationDocument4 pagesPricing Model For Expense OptimizationSrikant RajanPas encore d'évaluation

- Kisruh Migas Dan Keberpihakan PemerintahDocument3 pagesKisruh Migas Dan Keberpihakan PemerintahBenny LubiantaraPas encore d'évaluation

- Upstream Petroleum Contract and Fiscal AttractivenessDocument26 pagesUpstream Petroleum Contract and Fiscal AttractivenessBenny Lubiantara100% (2)

- Worldwide Petroleum Fiscal Regimes Development: Observations and TrendsDocument63 pagesWorldwide Petroleum Fiscal Regimes Development: Observations and TrendsBenny Lubiantara100% (7)

- Comment On Opinion in Jakarta Post "Turning Petro Dollars Back On - A Game Theory ApproachDocument4 pagesComment On Opinion in Jakarta Post "Turning Petro Dollars Back On - A Game Theory ApproachBenny Lubiantara100% (1)

- The Economics of Upstream Petroleum ProjectDocument18 pagesThe Economics of Upstream Petroleum ProjectBenny Lubiantara89% (9)

- Petroleum Fiscal System, The Trends and The ChallengesDocument44 pagesPetroleum Fiscal System, The Trends and The ChallengesBenny Lubiantara100% (4)

- Application of Porttfolio Management To Optimize Capital Allocation in Oil and Gas Projects (OGEL, 2006)Document13 pagesApplication of Porttfolio Management To Optimize Capital Allocation in Oil and Gas Projects (OGEL, 2006)Benny LubiantaraPas encore d'évaluation

- Decommissioning Cost Allocation Methods & Alternative Financial AssuranceDocument32 pagesDecommissioning Cost Allocation Methods & Alternative Financial AssuranceBenny LubiantaraPas encore d'évaluation

- The Development of Incentive For Marginal OilfieldsDocument9 pagesThe Development of Incentive For Marginal OilfieldsBenny LubiantaraPas encore d'évaluation

- Valuation of Undeveloped Oil Reserves With Option Pricing Model (OGEL 2006)Document10 pagesValuation of Undeveloped Oil Reserves With Option Pricing Model (OGEL 2006)Benny LubiantaraPas encore d'évaluation

- Should We Leave The PSC Model?Document3 pagesShould We Leave The PSC Model?Benny LubiantaraPas encore d'évaluation

- Real Option - An Alternative Approach of Oil and Gas Investment ValuationDocument28 pagesReal Option - An Alternative Approach of Oil and Gas Investment ValuationBenny LubiantaraPas encore d'évaluation

- Economic Evaluation of Undeveloped Reserves Using The Binomial Tree ApproachDocument9 pagesEconomic Evaluation of Undeveloped Reserves Using The Binomial Tree ApproachBenny LubiantaraPas encore d'évaluation

- Catalogue of Khalsa Darbar Records Vol.1 - Compiled by Sita Ram KohliDocument180 pagesCatalogue of Khalsa Darbar Records Vol.1 - Compiled by Sita Ram KohliSikhDigitalLibrary100% (1)

- News Item GamesDocument35 pagesNews Item GamesUmi KuswariPas encore d'évaluation

- TRUE/FALSE. Write 'T' If The Statement Is True and 'F' If The Statement Is FalseDocument44 pagesTRUE/FALSE. Write 'T' If The Statement Is True and 'F' If The Statement Is FalseYukiPas encore d'évaluation

- Four Year Plan DzenitaDocument4 pagesFour Year Plan Dzenitaapi-299201014Pas encore d'évaluation

- Administrative Clerk Resume TemplateDocument2 pagesAdministrative Clerk Resume TemplateManuelPas encore d'évaluation

- Determination of Royalty Rates For Trademarks and BrandsDocument31 pagesDetermination of Royalty Rates For Trademarks and BrandsNicole EstefaniePas encore d'évaluation

- A Manual For A Laboratory Information Management System (Lims) For Light Stable IsotopesDocument131 pagesA Manual For A Laboratory Information Management System (Lims) For Light Stable IsotopesAlvaro Felipe Rebolledo ToroPas encore d'évaluation

- Practice Ch5Document10 pagesPractice Ch5Ali_Asad_1932Pas encore d'évaluation

- Plessy V Ferguson DBQDocument4 pagesPlessy V Ferguson DBQapi-300429241Pas encore d'évaluation

- Keong Mas ENGDocument2 pagesKeong Mas ENGRose Mutiara YanuarPas encore d'évaluation

- Upload A Document To Access Your Download: Social Studies of HealthDocument3 pagesUpload A Document To Access Your Download: Social Studies of Health1filicupEPas encore d'évaluation

- Your Song.Document10 pagesYour Song.Nelson MataPas encore d'évaluation

- A Virtue-Ethical Approach To Education (By Pieter Vos)Document9 pagesA Virtue-Ethical Approach To Education (By Pieter Vos)Reformed AcademicPas encore d'évaluation

- Review - ChE ThermoDocument35 pagesReview - ChE ThermoJerome JavierPas encore d'évaluation

- Bos 22393Document64 pagesBos 22393mooorthuPas encore d'évaluation

- Liddell Hart PDFDocument5 pagesLiddell Hart PDFMohamed Elkhder100% (1)

- BeneHeart D3 Defibrillator Product BrochureDocument4 pagesBeneHeart D3 Defibrillator Product BrochureJasmine Duan100% (1)

- Electronic Form Only: Part 1. Information About YouDocument7 pagesElectronic Form Only: Part 1. Information About YourileyPas encore d'évaluation

- The Foundations of Ekistics PDFDocument15 pagesThe Foundations of Ekistics PDFMd Shahroz AlamPas encore d'évaluation

- Past Paper1Document8 pagesPast Paper1Ne''ma Khalid Said Al HinaiPas encore d'évaluation

- CEO - CaninesDocument17 pagesCEO - CaninesAlina EsanuPas encore d'évaluation

- Athletic KnitDocument31 pagesAthletic KnitNish A0% (1)

- Practice For Those Who Are DyingDocument10 pagesPractice For Those Who Are DyingBecze István / Stephen Becze100% (1)

- Reading 7.1, "Measuring and Managing For Team Performance: Emerging Principles From Complex Environments"Document2 pagesReading 7.1, "Measuring and Managing For Team Performance: Emerging Principles From Complex Environments"Sunny AroraPas encore d'évaluation

- Chap 1 WK 1Document20 pagesChap 1 WK 1kamarul azrilPas encore d'évaluation

- Bartolome vs. MarananDocument6 pagesBartolome vs. MarananStef OcsalevPas encore d'évaluation

- W1 MusicDocument5 pagesW1 MusicHERSHEY SAMSONPas encore d'évaluation

- Spoken Word (Forever Song)Document2 pagesSpoken Word (Forever Song)regPas encore d'évaluation

- M. J. T. Lewis - Surveying Instruments of Greece and Rome (2001)Document410 pagesM. J. T. Lewis - Surveying Instruments of Greece and Rome (2001)Jefferson EscobidoPas encore d'évaluation

- Rhipodon: Huge Legendary Black DragonDocument2 pagesRhipodon: Huge Legendary Black DragonFigo FigueiraPas encore d'évaluation