Académique Documents

Professionnel Documents

Culture Documents

Faros Morning Update 082510

Transféré par

api-31029184Description originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Faros Morning Update 082510

Transféré par

api-31029184Droits d'auteur :

Formats disponibles

1 Dock Street

Stamford, CT 06902

www.farostrading.com

www.twitter.com/FarosTradingLLC

FAROS TRADING | FX MORNING UPDATE

Market Summary – 08/25/2010

Good Morning. close below 0.7000 will be very bearish. NZD/JPY also holding

well below 60.00 with a Faros expectation of a test of 50.00 in

Please see our new attachment of “Trade Recommendations” the next 6 to 9 months.

for your guide. Although we do not make explicit currency

forecasts at Faros, we do highlight themes that we see occurring EUR/USD under pressure late in NY as Ireland’s debt rating was

in the markets and those currencies that are likely to benefit. downgraded by S&P and we sent out a note highlighting the

need for a ratings ‘catch up’ across the board needed by the

JPY again the focus early in the Asian session as the market was ratings agencies given current CDS spreads. Another bank we

looking for a further response from Fin Min Noda and PM Kan speak to did a similar analysis indicating that Asian ratings are

and got a little more of the same in terms of quotes. Noda under-represented and European ratings are higher than they

declined to comment on a report that he was going to meet should be based upon CDS.

with US Treas Sec Geithner, but indicated “to respond

appropriately to JPY rise if needed” while PM Kan “want to show German IFO lifted EUR/USD off its post Ireland downgrade lows

a response to strong JPY soon”. Japanese exports did little to and we tested up towards the stops at 1.2730 without touching

help their case for intervention as exports beat expectations them. A Portuguese debt auction was blamed for renewed

with a 23.5% print vs. 21.8% expected while the trade balance weakness in EUR/USD taking it back to 1.2626 with the 1.2606

mushroomed to 804bn JPY vs. 466.3bn JPY expected. 50% fibo level still key. GBP a notable outperformer as

EUR/GBP gets hit this morning and we look for support in the

USD/JPY rallied up to 84.68 from 83.90 as there was demand for cross at 0.8150.

cross JPY from real money types after the Tokyo fixing which

also saw buying demand for USD/JPY. Talk of decent sized HUF under pressure again as the Economic Ministry reversed

Tokyo cut 84.50 and 84.30 strikes also helped to contain its IMF attitude yet again and we trade up to 284.50 area in

USD/JPY price action. Interesting to note that one of the banks EUR/HUF.

we speak to highlighted current JPY positioning as not nearly as

extreme as it has been in the past. Hedge funds dominate USD/TRY rejected the 1.5370 trend line and we held below the

positioning with asset managers absent and they estimate the 100 day at 1.5367 and the 50 day at 1.5342 as well, support

current position is only 30% of crisis levels. seen at 1.5225 the 200 day.

CNY/JPY also appears to be very key to USD/JPY these days with USD/KRW is jumping early in the US time zone up to 1207 in

the pair down to 12.42 there is talk that 12.30 is the key level. 1m as the market seems a little nervous right now. 1207 is the

With USD/CNY at 6.7960 currently, that would imply a USD/JPY resistance zone to watch for any signs of locals.

rate of 83.60 as an area where intervention concerns will

increase with the likely outlet still USD/CNY over USD/JPY EUR/CHF sitting on top of 1.3000 now as CHF and JPY are the

intervention. preferred ‘safe haven’ currencies of late with the USD a close

rd

3 . USD/CHF looks for support around the 1.0270 area.

AUD/USD rallied back towards 0.8900 on cross JPY buying and

the recovery in EUR but ran into some offers as 3 out of 4 MPs In USD/CAD the 1.0750 level is key and the likely area where

that could sway the hung Parliament indicated they are in favor models may flip to long USD/CAD

of the mining tax.

Good Luck

NZD/USD is failing to perform on risk rallies these days as it

continues to flirt with the 0.7000 level, now trading 0.6968, a

© Copyright 2010, Faros Trading, LLC. All rights reserved. This message is intended solely for the individual(s) named, and may contain confidential or privileged information of

Faros Trading, LLC. Any unauthorized review, dissemination, distribution or copying is strictly prohibited. If you have received this message in error, please notify the sender

immediately and permanently delete both the message and any attachments. We do not waive confidentiality by mistransmission. This communication is not investment advice,

an offer, or solicitation of any offer to buy or sell any security, investment or other product.

Vous aimerez peut-être aussi

- Faros Morning Update 083110Document1 pageFaros Morning Update 083110api-31029184Pas encore d'évaluation

- FarosMorningUpdate080510 v3Document1 pageFarosMorningUpdate080510 v3api-31029184Pas encore d'évaluation

- Faros Morning Update 081110Document1 pageFaros Morning Update 081110api-31029184Pas encore d'évaluation

- Forex Market Report 25 July 2011Document4 pagesForex Market Report 25 July 2011International Business Times AUPas encore d'évaluation

- Faros Morning Update 082310Document1 pageFaros Morning Update 082310api-31029184Pas encore d'évaluation

- FX Weekly Commentary - Nov 06 - Nov 12 2011Document5 pagesFX Weekly Commentary - Nov 06 - Nov 12 2011James PutraPas encore d'évaluation

- Faros Morning Update 080910Document1 pageFaros Morning Update 080910api-31029184Pas encore d'évaluation

- FX Weekly - Sep 4 - Sep 10 2011Document5 pagesFX Weekly - Sep 4 - Sep 10 2011James PutraPas encore d'évaluation

- FarosMorningUpdate080310 v3Document1 pageFarosMorningUpdate080310 v3api-31029184Pas encore d'évaluation

- FX Weekly Commentary Aug 21 - Aug 27 2011 Elite Global TradingDocument5 pagesFX Weekly Commentary Aug 21 - Aug 27 2011 Elite Global TradingJames PutraPas encore d'évaluation

- FX Weekly Commentary July 17 - July 23 2011 - Elite Global TradingDocument4 pagesFX Weekly Commentary July 17 - July 23 2011 - Elite Global TradingJames PutraPas encore d'évaluation

- FX Weekly Commentary - Sep 11 - Sep 17 2011 Elite Global TradingDocument5 pagesFX Weekly Commentary - Sep 11 - Sep 17 2011 Elite Global TradingJames PutraPas encore d'évaluation

- Forex Market Report 26 July 2011Document4 pagesForex Market Report 26 July 2011International Business Times AUPas encore d'évaluation

- Forex Market Insight 15 June 2011Document3 pagesForex Market Insight 15 June 2011International Business Times AUPas encore d'évaluation

- FX Weekly Commentary - Aug 28 - Sep 03 2011 Elite Global TradingDocument5 pagesFX Weekly Commentary - Aug 28 - Sep 03 2011 Elite Global TradingJames PutraPas encore d'évaluation

- Running Head USD/JPYDocument4 pagesRunning Head USD/JPYMacharia NgunjiriPas encore d'évaluation

- Forex Brotherhood Daily Hot Reports: USD Mixed, Two-Way Trade, RBA Cuts RatesDocument7 pagesForex Brotherhood Daily Hot Reports: USD Mixed, Two-Way Trade, RBA Cuts RatesSam OswaldPas encore d'évaluation

- Market Drivers - Currencies: Today's Comment Today's Chart - EUR/JPYDocument5 pagesMarket Drivers - Currencies: Today's Comment Today's Chart - EUR/JPYMiir ViirPas encore d'évaluation

- 2011 12 02 Migbank Daily Technical Analysis ReportDocument15 pages2011 12 02 Migbank Daily Technical Analysis ReportmigbankPas encore d'évaluation

- 2011 12 06 Migbank Daily Technical Analysis ReportDocument15 pages2011 12 06 Migbank Daily Technical Analysis ReportmigbankPas encore d'évaluation

- Global FX StrategyDocument4 pagesGlobal FX StrategyllaryPas encore d'évaluation

- FX TacticalsDocument6 pagesFX TacticalsodinPas encore d'évaluation

- FX Weekly Commentary - Oct 9 - Oct 15 2011Document5 pagesFX Weekly Commentary - Oct 9 - Oct 15 2011James PutraPas encore d'évaluation

- FX Weekly Commentary Aug 14 - Aug 20 2011 Elite Global TradingDocument6 pagesFX Weekly Commentary Aug 14 - Aug 20 2011 Elite Global TradingJames PutraPas encore d'évaluation

- Foreign Exchange OutlookDocument17 pagesForeign Exchange Outlookdey.parijat209Pas encore d'évaluation

- EUR poised to recover, DXY pullback | Trading plans Jan 2023Document14 pagesEUR poised to recover, DXY pullback | Trading plans Jan 2023Hồng NgọcPas encore d'évaluation

- Ridethepig - G10 & EM FX CommentaryDocument2 pagesRidethepig - G10 & EM FX CommentarySpeculation OnlyPas encore d'évaluation

- FX Weekly Commentary June 12 - June 18 2011Document1 pageFX Weekly Commentary June 12 - June 18 2011James PutraPas encore d'évaluation

- 2011 12 05 Migbank Daily Technical Analysis ReportDocument15 pages2011 12 05 Migbank Daily Technical Analysis ReportmigbankPas encore d'évaluation

- FX Weekly Commentary July 24 - July 30 2011 - Elite Global TradingDocument4 pagesFX Weekly Commentary July 24 - July 30 2011 - Elite Global TradingJames PutraPas encore d'évaluation

- G-7 F/X Weekly Report: HighlightsDocument15 pagesG-7 F/X Weekly Report: HighlightsAaron UitenbroekPas encore d'évaluation

- FX Weekly July 10 - 16 2011 Elite Global TradingDocument4 pagesFX Weekly July 10 - 16 2011 Elite Global TradingJames PutraPas encore d'évaluation

- Fed To Eventually Remove The Punch Bowl: Global FX WeeklyDocument28 pagesFed To Eventually Remove The Punch Bowl: Global FX Weeklygerrich rusPas encore d'évaluation

- Chapter - 1: An Analytical Study On Gold On Commodity MarketDocument90 pagesChapter - 1: An Analytical Study On Gold On Commodity MarketGauravsPas encore d'évaluation

- HSBC - Currency Outlook DecemberDocument46 pagesHSBC - Currency Outlook Decembermgroble3Pas encore d'évaluation

- Holborn Currency View SEP11Document3 pagesHolborn Currency View SEP11petbarrPas encore d'évaluation

- FX Weekly Commentary - Nov 13 - Nov 19 2011Document5 pagesFX Weekly Commentary - Nov 13 - Nov 19 2011James PutraPas encore d'évaluation

- FX Weekly Commentary June 26 - July 2 2011Document1 pageFX Weekly Commentary June 26 - July 2 2011James PutraPas encore d'évaluation

- FX Outlook: The World Takes A Turn For The BetterDocument44 pagesFX Outlook: The World Takes A Turn For The BetterAnurag NauriyalPas encore d'évaluation

- Etoro Daily Dec16Document3 pagesEtoro Daily Dec16Poa PmyPas encore d'évaluation

- JYSKE Bank AUG 09 Market Drivers CurrenciesDocument5 pagesJYSKE Bank AUG 09 Market Drivers CurrenciesMiir ViirPas encore d'évaluation

- Forex Market Insight 10 June 2011Document3 pagesForex Market Insight 10 June 2011International Business Times AUPas encore d'évaluation

- Top Trading Opportunities 2017Document35 pagesTop Trading Opportunities 2017Max KennedyPas encore d'évaluation

- Daily Markets UpdateDocument35 pagesDaily Markets Updateapi-25889552Pas encore d'évaluation

- Australian Dollar Outlook 24 May 2011Document1 pageAustralian Dollar Outlook 24 May 2011International Business Times AUPas encore d'évaluation

- FX Weekly Commentary - Oct 30 - Nov 05 2011Document5 pagesFX Weekly Commentary - Oct 30 - Nov 05 2011James PutraPas encore d'évaluation

- 2011 08 08 Migbank Daily Technical Analysis Report+Document15 pages2011 08 08 Migbank Daily Technical Analysis Report+migbankPas encore d'évaluation

- Reading A Forex Quote and Understanding The JargonDocument18 pagesReading A Forex Quote and Understanding The JargonprasannarbPas encore d'évaluation

- Daily Technical Analysis Report 20/october/2015Document14 pagesDaily Technical Analysis Report 20/october/2015Seven Star FX LimitedPas encore d'évaluation

- Forex Market Insight 09 June 2011Document3 pagesForex Market Insight 09 June 2011International Business Times AUPas encore d'évaluation

- Daily Technical Analysis Report 23/october/2015Document14 pagesDaily Technical Analysis Report 23/october/2015Seven Star FX LimitedPas encore d'évaluation

- Market Drivers - Currencies: Today's Comment Today's Chart - EUR/USDDocument5 pagesMarket Drivers - Currencies: Today's Comment Today's Chart - EUR/USDMiir ViirPas encore d'évaluation

- BNP FX WeeklyDocument22 pagesBNP FX WeeklyPhillip HsiaPas encore d'évaluation

- ScotiaBank AUG 04 Daily FX UpdateDocument3 pagesScotiaBank AUG 04 Daily FX UpdateMiir ViirPas encore d'évaluation

- Research Report 20 Dec 2023Document21 pagesResearch Report 20 Dec 2023tanmaymaltarPas encore d'évaluation

- Market Drivers - Currencies: Today's Comment Today's Chart - EUR/USDDocument5 pagesMarket Drivers - Currencies: Today's Comment Today's Chart - EUR/USDMiir ViirPas encore d'évaluation

- SEB Report: Investors To Move Away From Dollar, EuroDocument44 pagesSEB Report: Investors To Move Away From Dollar, EuroSEB GroupPas encore d'évaluation

- FX Strategy: Summer Dull With EUR/USD Rangebound But Upside BiasDocument9 pagesFX Strategy: Summer Dull With EUR/USD Rangebound But Upside Biasjesus davidPas encore d'évaluation

- Australian Dollar Outlook 19 May 2011Document1 pageAustralian Dollar Outlook 19 May 2011International Business Times AUPas encore d'évaluation

- Current Trade Ideas Analysis:: 1 Dock Street Stamford, CT 06902Document3 pagesCurrent Trade Ideas Analysis:: 1 Dock Street Stamford, CT 06902api-31029184Pas encore d'évaluation

- Current Trade Ideas Analysis:: 1 Dock Street Stamford, CT 06902Document3 pagesCurrent Trade Ideas Analysis:: 1 Dock Street Stamford, CT 06902api-31029184Pas encore d'évaluation

- Faros Morning Update 082410Document1 pageFaros Morning Update 082410api-31029184Pas encore d'évaluation

- Faros Morning Update 081810Document2 pagesFaros Morning Update 081810api-31029184Pas encore d'évaluation

- Faros Morning Update 081610Document1 pageFaros Morning Update 081610api-31029184Pas encore d'évaluation

- Faros Morning Update 082710Document1 pageFaros Morning Update 082710api-31029184Pas encore d'évaluation

- Current Trade Ideas Analysis:: 1 Dock Street Stamford, CT 06902Document3 pagesCurrent Trade Ideas Analysis:: 1 Dock Street Stamford, CT 06902api-31029184Pas encore d'évaluation

- Faros Morning Update 083010Document1 pageFaros Morning Update 083010api-31029184Pas encore d'évaluation

- Faros Morning Update 082610Document1 pageFaros Morning Update 082610api-31029184Pas encore d'évaluation

- Faros Special Report 082210Document2 pagesFaros Special Report 082210api-31029184Pas encore d'évaluation

- Faros Morning Update 081210Document1 pageFaros Morning Update 081210api-31029184Pas encore d'évaluation

- Faros Morning Update 081310Document1 pageFaros Morning Update 081310api-31029184Pas encore d'évaluation

- Faros Morning Update 081010Document1 pageFaros Morning Update 081010api-31029184Pas encore d'évaluation

- Faros Morning Update 080910Document1 pageFaros Morning Update 080910api-31029184Pas encore d'évaluation

- FAROS TRADING - Special Report: Source: Ministry of Commerce, The People's Republic of China. Published Jan 2009Document8 pagesFAROS TRADING - Special Report: Source: Ministry of Commerce, The People's Republic of China. Published Jan 2009api-31029184100% (1)

- Faros Morning Update 080610Document1 pageFaros Morning Update 080610api-31029184Pas encore d'évaluation

- FarosMorningUpdate080310 v3Document1 pageFarosMorningUpdate080310 v3api-31029184Pas encore d'évaluation

- Faro Seven Ing Update 080510Document1 pageFaro Seven Ing Update 080510api-31029184Pas encore d'évaluation

- FarosMorningUpdate073010 v3Document1 pageFarosMorningUpdate073010 v3api-31029184Pas encore d'évaluation

- FarosMorningUpdate080210 v3Document1 pageFarosMorningUpdate080210 v3api-31029184Pas encore d'évaluation

- FarosMorningUpdate072810 v2Document1 pageFarosMorningUpdate072810 v2api-31029184Pas encore d'évaluation

- FarosMorningUpdate080410 v3Document1 pageFarosMorningUpdate080410 v3api-31029184Pas encore d'évaluation

- Faro Seven Ing Update 072910Document1 pageFaro Seven Ing Update 072910api-31029184Pas encore d'évaluation

- FarosMorningUpdate072910 v3Document1 pageFarosMorningUpdate072910 v3api-31029184Pas encore d'évaluation

- Abb Drives: User'S Manual Flashdrop Mfdt-01Document62 pagesAbb Drives: User'S Manual Flashdrop Mfdt-01Сергей СалтыковPas encore d'évaluation

- Department Order No 05-92Document3 pagesDepartment Order No 05-92NinaPas encore d'évaluation

- Self-Assessment On Accountability: I. QuestionsDocument2 pagesSelf-Assessment On Accountability: I. QuestionsAjit Kumar SahuPas encore d'évaluation

- Civil Aeronautics BoardDocument2 pagesCivil Aeronautics BoardJayson AlvaPas encore d'évaluation

- Geneva IntrotoBankDebt172Document66 pagesGeneva IntrotoBankDebt172satishlad1288Pas encore d'évaluation

- Organisation Study Report On Star PVC PipesDocument16 pagesOrganisation Study Report On Star PVC PipesViswa Keerthi100% (1)

- BUSINESS FINANCE - Activity 2Document3 pagesBUSINESS FINANCE - Activity 2Airish PascualPas encore d'évaluation

- Case Analysis - Compania de Telefonos de ChileDocument4 pagesCase Analysis - Compania de Telefonos de ChileSubrata BasakPas encore d'évaluation

- Craft's Folder StructureDocument2 pagesCraft's Folder StructureWowPas encore d'évaluation

- BRD TemplateDocument4 pagesBRD TemplateTrang Nguyen0% (1)

- Area Access Manager (Browser-Based Client) User GuideDocument22 pagesArea Access Manager (Browser-Based Client) User GuideKatherinePas encore d'évaluation

- C79 Service Kit and Parts List GuideDocument32 pagesC79 Service Kit and Parts List Guiderobert100% (2)

- KSRTC BokingDocument2 pagesKSRTC BokingyogeshPas encore d'évaluation

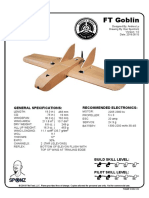

- FT Goblin Full SizeDocument7 pagesFT Goblin Full SizeDeakon Frost100% (1)

- Planning For Network Deployment in Oracle Solaris 11.4: Part No: E60987Document30 pagesPlanning For Network Deployment in Oracle Solaris 11.4: Part No: E60987errr33Pas encore d'évaluation

- ZOOLOGY INTRODUCTIONDocument37 pagesZOOLOGY INTRODUCTIONIneshPas encore d'évaluation

- NEW CREW Fast Start PlannerDocument9 pagesNEW CREW Fast Start PlannerAnonymous oTtlhP100% (3)

- Journal Publication FormatDocument37 pagesJournal Publication FormatAbreo Dan Vincent AlminePas encore d'évaluation

- MsgSpec v344 PDFDocument119 pagesMsgSpec v344 PDFqwecePas encore d'évaluation

- 50TS Operators Manual 1551000 Rev CDocument184 pages50TS Operators Manual 1551000 Rev CraymondPas encore d'évaluation

- Novirost Sample TeaserDocument2 pagesNovirost Sample TeaserVlatko KotevskiPas encore d'évaluation

- E-TON - Vector ST 250Document87 pagesE-TON - Vector ST 250mariusgrosyPas encore d'évaluation

- 4.5.1 Forestry LawsDocument31 pages4.5.1 Forestry LawsMark OrtolaPas encore d'évaluation

- Backup and Recovery ScenariosDocument8 pagesBackup and Recovery ScenariosAmit JhaPas encore d'évaluation

- Group 4 HR201 Last Case StudyDocument3 pagesGroup 4 HR201 Last Case StudyMatt Tejada100% (2)

- Code Description DSMCDocument35 pagesCode Description DSMCAnkit BansalPas encore d'évaluation

- Indian Institute of Management KozhikodeDocument5 pagesIndian Institute of Management KozhikodepranaliPas encore d'évaluation

- Employee Central Payroll PDFDocument4 pagesEmployee Central Payroll PDFMohamed ShanabPas encore d'évaluation

- 2006-07 (Supercupa) AC Milan-FC SevillaDocument24 pages2006-07 (Supercupa) AC Milan-FC SevillavasiliscPas encore d'évaluation

- Emperger's pioneering composite columnsDocument11 pagesEmperger's pioneering composite columnsDishant PrajapatiPas encore d'évaluation