Académique Documents

Professionnel Documents

Culture Documents

Ecological Econ

Transféré par

romwama0 évaluation0% ont trouvé ce document utile (0 vote)

23 vues1 pageghvb

Copyright

© © All Rights Reserved

Formats disponibles

PDF ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentghvb

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

23 vues1 pageEcological Econ

Transféré par

romwamaghvb

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 1

396 A. Barancini et al. ; Ecological Economies 32 (2000) 395-412

clean development mechanism—but these mecha-

nisms shall be supplemental to domestic actions.

Domestic policies will thus still have an impor-

tant role to play in reaching any country commit-

ment. However, there is an ongoing lively debate

‘on how they will be implemented: either by eco-

nomic or quasi-economic policies (e.g. taxes, sub-

sidies, price supports) or regulatory” and

quasi-regulatory policies (e.g. government regula

tions, performance standards, voluntary pro-

grams) (Skinner, 1994). Domestic actions will thus

have to weigh the advantages and disadvantages

of carbon/energy taxes as compared to command-

and-control measures and other economic instru-

ments (Bohm and Russel, 1985; Stavins, 1997),

Carbon taxes have been frequently advocated

by economists and international organisations

(EEA, 1996; OECD, 1996). However, in the prac-

tice of environmental policies, only five countries

(Sweden, Norway, The Netherlands, Denmark

and Finland), and most recently Italy, have imple-

mented taxes based on the carbon content of the

energy products.’ Austria and Germany lately

introduced energy taxes, which do not consider

the carbon content of the energy products. Several

other countries, like Switzerland and the United

Kingdom, are currently discussing proposals for

implementing carbon or energy taxes. In the

meantime, carbon or energy taxes proposals in

some other countries have failed, sometimes quite

disasirously (e.g. in the United States).

In this paper, we will focus on the empirical

assessment of the main impacts of carbon taxes,

which may give some insights into the political

debate. Section 2 introduces the rationale of car-

bon taxes and some of the actual features in those

countries that have implemented them. In Sec

tions 3-5 we assess the competitiveness, distribu-

tional and environmental effectiveness of carbon

taxes, respectively. Section 6 concludes,

i also confirms the widening gap between the political

dlscourse and the policy practice. For instance. a recent study

(Eurostat. 1997), shows that in 1995 “environmental” tance in

the European Union (EU) made up just 1.7% of all EU

taxation, or 0.7% of gross domestic product (GDP), These

figures have barely changed over the last 25 years, In contrast,

taxes on labour grew from 14.5% of GDP in 1970 to 21 4% in

1995 (representing 51.4% of all taxation in that year),

2. Carbon taxes: an overview of their rationale

and current implementation

Emissions taxes are market-based instruments

because, once the administrative authority has set

the tax rates, emissions-intensive goods will have

higher market prices and/or lower profits. Conse-

quently, market forces will spontaneously work in

a cost-effective way to reduce the quantity of

emissions.* More precisely. taxes possess two i

centive effects. A ‘direct effect’, through price

increases, stimulating conservation measures, en-

ergy efficient investments, fuel and product

switching, and changes in the economy's produ

tion and consumption structures. An ‘indirect ef-

fect’, through the recycling of the collected fiscal

revenues, reinforcing the previous effects, by

changing investment and consumption patterns.

However, the final impact on emissions de-

pends, among other factors, on the tax base (i.e.

what is exactly taxed) and the tax rate (ie. how

much to pay). The tax base will also define differ-

ent kinds of emission taxes":

© A ‘carbon tax’ is a charge to be paid on each

fossil fuel, proportional to the quantity of car-

bon emitted when it is bummed?

© A ‘CO, tax’ is specified per ton of CO, emitted.

It can be easily translated into a carbon tax, by

knowing that a ton of carbon corresponds to

3.67 tons of CO,.

* Costffectivencss means that the ‘global’ total cost of

reducing emissions to achieve a specific environmental objec-

tive is minimised. An emissions tax is cost-effective, because

since the tax rate is the same for each polluter, (marginal)

abatement costs are implicitly equalised between polluters, and

thus polluters with relatively low costs will make greater

abatement efforts, and vice versa.

Marginal abatement cost represents the increase in total

abatement cost when abatement effort (resulting from, e.g. fuel

switching and output reduction) is increased by one unit.

“A true emissions tax would impose a charge per unit of

‘greenhouse gas released. However, since emissions are difficult

to measure directly, the only types of implemented taxes are

those listed.

*Carbon taxes could be coupled with sequestration tax

credits, to take advantage of the sometimes lower (marginal)

abatement costs in forestry. However, implemented carbon

taxes have never been combined with sequestration (Baron,

1996),

Vous aimerez peut-être aussi

- A9131o14d 1a40mgy Ato - TMP Part6Document1 pageA9131o14d 1a40mgy Ato - TMP Part6romwamaPas encore d'évaluation

- A9131o14d 1a40mgy Ato - TMP Part7Document1 pageA9131o14d 1a40mgy Ato - TMP Part7romwamaPas encore d'évaluation

- A9131o14d 1a40mgy Ato - TMP Part5Document1 pageA9131o14d 1a40mgy Ato - TMP Part5romwamaPas encore d'évaluation

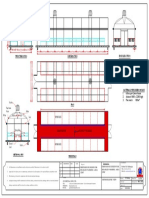

- Green House Layout - Fin 10-03-21-3Document1 pageGreen House Layout - Fin 10-03-21-3romwamaPas encore d'évaluation

- No: UON/OP/11 Issue No: 01 Rev No: 02Document4 pagesNo: UON/OP/11 Issue No: 01 Rev No: 02romwamaPas encore d'évaluation

- No: UON/OP/11 Issue No: 01 Rev No: 02Document3 pagesNo: UON/OP/11 Issue No: 01 Rev No: 02romwamaPas encore d'évaluation

- Green House Layout-For Disabled Farmers - 2021Document2 pagesGreen House Layout-For Disabled Farmers - 2021romwamaPas encore d'évaluation

- Green House Layout-For Disabled Farmers 2Document1 pageGreen House Layout-For Disabled Farmers 2romwamaPas encore d'évaluation

- New Doc 2018-10-05Document1 pageNew Doc 2018-10-05romwamaPas encore d'évaluation

- Transmi Ssi Onchai Ns Chai NDR I Vesandtypesofchai NsDocument7 pagesTransmi Ssi Onchai Ns Chai NDR I Vesandtypesofchai NsromwamaPas encore d'évaluation

- Btech Past PapersDocument5 pagesBtech Past PapersromwamaPas encore d'évaluation

- Clutches Types 2Document7 pagesClutches Types 2romwamaPas encore d'évaluation

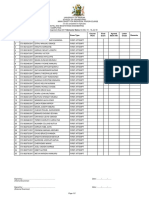

- Marksheet 20172018 F21 1 2 20 FEB116 0025Document2 pagesMarksheet 20172018 F21 1 2 20 FEB116 0025romwamaPas encore d'évaluation

- Shortlisting Summaries For Technologist Grade ABC, Ebe - Ad-2!25!21 - Applicants (23!03!2021)Document2 pagesShortlisting Summaries For Technologist Grade ABC, Ebe - Ad-2!25!21 - Applicants (23!03!2021)romwamaPas encore d'évaluation

- V6 Vs StraightDocument13 pagesV6 Vs StraightromwamaPas encore d'évaluation

- Prolific Mothers Who Literally Filled The WorldDocument1 pageProlific Mothers Who Literally Filled The WorldromwamaPas encore d'évaluation

- Centrifugal Pump Components and Working PrincipleDocument26 pagesCentrifugal Pump Components and Working PrincipleromwamaPas encore d'évaluation

- Sol IntegralsDocument18 pagesSol IntegralsEstefi PeñalozaPas encore d'évaluation

- 4th Teaching TimetableDocument2 pages4th Teaching TimetableromwamaPas encore d'évaluation

- A Letter To The President PDFDocument1 pageA Letter To The President PDFromwamaPas encore d'évaluation

- Vacancies May 2017 Description 2 PDFDocument15 pagesVacancies May 2017 Description 2 PDFromwamaPas encore d'évaluation

- Conditions For RevivalDocument1 pageConditions For RevivalromwamaPas encore d'évaluation

- Centrifugal Pumps - Pumps - Machines - Fluid Mechanics - Engineering Reference With Worked ExamplesDocument1 pageCentrifugal Pumps - Pumps - Machines - Fluid Mechanics - Engineering Reference With Worked ExamplesromwamaPas encore d'évaluation

- Gakuru Feared For His Life', Reveals Successor: Starehe Poll Loser Alleges Vote Stuffing in PetitionDocument1 pageGakuru Feared For His Life', Reveals Successor: Starehe Poll Loser Alleges Vote Stuffing in PetitionromwamaPas encore d'évaluation

- Double IntegralDocument1 pageDouble IntegralromwamaPas encore d'évaluation

- Explanation of Pressure SensorsDocument3 pagesExplanation of Pressure SensorsromwamaPas encore d'évaluation

- Knec Technical Exam Timetable - July 2017Document18 pagesKnec Technical Exam Timetable - July 2017romwama100% (1)

- Force required to hold pipe reducer positionDocument1 pageForce required to hold pipe reducer positionromwamaPas encore d'évaluation

- Centrifugal Pump Components and Working PrincipleDocument26 pagesCentrifugal Pump Components and Working PrincipleromwamaPas encore d'évaluation

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5784)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (890)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (72)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- International and Global StrategiesDocument43 pagesInternational and Global StrategiesDayu IsmieyPas encore d'évaluation

- Eun8e Chapter06 TB AnswerkeyDocument28 pagesEun8e Chapter06 TB AnswerkeyshouqPas encore d'évaluation

- European Spatial Planning Systems, Social Models and Learning 2012Document14 pagesEuropean Spatial Planning Systems, Social Models and Learning 2012Lu PoPas encore d'évaluation

- Bài tập Unit 6Document5 pagesBài tập Unit 6Nguyễn Trúc QuỳnhPas encore d'évaluation

- Problem 1-3 and Problem 1-4 CarinoDocument2 pagesProblem 1-3 and Problem 1-4 Carinoschool worksPas encore d'évaluation

- but usually late: ngơi vào buổi chiều không?)Document12 pagesbut usually late: ngơi vào buổi chiều không?)Lê Thanh Tú Uda100% (1)

- Câu Hỏi chap 23,24,28,29 in marcoeconomicsDocument23 pagesCâu Hỏi chap 23,24,28,29 in marcoeconomicschang vicPas encore d'évaluation

- Presentation 5 - Credit Risk ManagementDocument6 pagesPresentation 5 - Credit Risk ManagementMai ChiPas encore d'évaluation

- Partial Financial Statement and Analysis of San Miguel CorporationDocument3 pagesPartial Financial Statement and Analysis of San Miguel CorporationKaithleen Coreen EbaloPas encore d'évaluation

- Eco101 MonopolyDocument22 pagesEco101 MonopolyEmmanuella Affiong EtukPas encore d'évaluation

- Microeconomics: Scarcity, Opportunity Cost & PPFDocument6 pagesMicroeconomics: Scarcity, Opportunity Cost & PPFNeeladri SarkerPas encore d'évaluation

- ACKNOWLEDGMENTDocument12 pagesACKNOWLEDGMENTDALJIT SODHIPas encore d'évaluation

- ECO102 - Principles of Microeconomics - SyllabusDocument3 pagesECO102 - Principles of Microeconomics - SyllabusShagnik RoyPas encore d'évaluation

- Rennes Welcome BookletDocument25 pagesRennes Welcome BookletSri YogeshPas encore d'évaluation

- Od 329347391899682100Document2 pagesOd 32934739189968210099rakeshghotiyaPas encore d'évaluation

- Numerical 1Document7 pagesNumerical 1Krishnendu NayekPas encore d'évaluation

- BAL1103, BBA1103, Principles of EconomicsDocument4 pagesBAL1103, BBA1103, Principles of EconomicsACADEMICS007Pas encore d'évaluation

- Lecture Notes: Theory of MarketsDocument24 pagesLecture Notes: Theory of MarketsAdruffPas encore d'évaluation

- Stripe Tax Invoice NOZUAJK4-2024-01Document1 pageStripe Tax Invoice NOZUAJK4-2024-011flailstarPas encore d'évaluation

- Gujarat Technological University: Integrated Master of Business AdministrationDocument3 pagesGujarat Technological University: Integrated Master of Business AdministrationNiyati KotechaPas encore d'évaluation

- E L F T: Xchange Isted Unds RustDocument25 pagesE L F T: Xchange Isted Unds RustFooyPas encore d'évaluation

- Assignment Cover Sheet: Accounting and Costing For BusinessDocument35 pagesAssignment Cover Sheet: Accounting and Costing For BusinessTharushi HettiarachchiPas encore d'évaluation

- LRDocument7 pagesLRDhaval SolankiPas encore d'évaluation

- It 000144384093 2024 10Document1 pageIt 000144384093 2024 10Sheeraz AhmedPas encore d'évaluation

- System: Fort Worth Central StationDocument2 pagesSystem: Fort Worth Central StationbenPas encore d'évaluation

- Volatility Index 75 Macfibonacci Trading PDFDocument3 pagesVolatility Index 75 Macfibonacci Trading PDFTiebaPas encore d'évaluation

- Pension and Social Insurance ACS 420 - INS 423 - Lecture Material 4Document9 pagesPension and Social Insurance ACS 420 - INS 423 - Lecture Material 4Yomi BrainPas encore d'évaluation

- Galiani - On Money PDFDocument165 pagesGaliani - On Money PDFDavid Sargsyan100% (1)

- Sankofa Group Consolidated Financial PositionDocument5 pagesSankofa Group Consolidated Financial PositionLaud ListowellPas encore d'évaluation

- Webinar 6 - Reflective EssayDocument4 pagesWebinar 6 - Reflective Essay뿅아리Pas encore d'évaluation