Académique Documents

Professionnel Documents

Culture Documents

TRU Tax Rates 2016 17

Transféré par

swizar pradhanCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

TRU Tax Rates 2016 17

Transféré par

swizar pradhanDroits d'auteur :

Formats disponibles

Income Tax Rates FY 2016-17

1. Personal Income Tax

1.1 For Residents: Natural Person

Tax Banding Tax Rates

Individual FY 2016-17 FY 2015-16 FY 2014-15

(a) First Slab 350,000 1%* 250,000 1%* 250,000 1%*

(b) Second Slab 100,000 15% 100,000 15% 100,000 15%

Upto Upto Upto

(c) Third Slab 25% 25% 25%

2,500,000 2,500,000 2,500,000

(d) Balance Exceeding Rs 2,500,000 > 2,500,000 35% > 2500,000 35% > 2,500,000 35%

Couple

(a) First Slab 400,000 1%* 300,000 1%* 300,000 1%*

(b) Second Slab 100,000 15% 100,000 15% 100,000 15%

500,001 to 400,001 to 400,001 to

(c) Third Slab 25% 25% 25%

2,500,000 2,500,000 2,500,000

(d) Balance Exceeding Rs 2,500,000 > 2,500,000 35% > 2,500,000 35% > 2,500,000 35%

Note

A. Additional Deductions Remarks

Natural person working at remote Additional deduction from taxable amount up to Rs 50,000.

areas Remote Area Allowance (A-50,000, B-40,000, C-30,000, D-20,000, E-10,000)

Natural person with pension income Additional deduction from taxable amount equal to 25% of amount prescribed

included in the taxable income under first tax band

Incapacitated natural person Additional deduction from taxable amount equal to 50% of amount prescribed

under first tax band

B. Deduction on Income

Life Insurance Premium A natural person who has procured life insurance and paid premium amount

thereon shall be entitled to a reduction of actual annual insurance premium or

Rs 20,000 whichever is less from taxable income

Medical Insurance A natural person insured in resident insurer for health insurance shall be

entitled to a reduction of actual premium paid or Rs 20,000 whichever is less

Contribution to Retirement Fund 1/3 of taxable income or Rs 300,000 which-ever is lower;

C. Rebate on Tax Rates

In case of resident individual women Rebate of 10% on the tax liability calculated as other natural person. i.e. not

having only remuneration income applicable for women with couple status.

Retirement payment resulting from In case of decision of the organization to provide group retirement to its

Merger employees (in the event of merger or acquisition) except to the payment

made as per the employment term or the payment made by retirement fund, a

rebate of 50% on withholding tax.

D. Foreign Allowances

In case of the employee employed at Only 25% of the foreign allowances are to be included in the income from

the foreign diplomatic mission of employment

Nepal

E. Tax Exemption

Compensation received against Compensation received against the deceased of natural person is not

deceased natural person required to be included in income

F. Compulsory Filing

Natural Person Having Taxable A natural person having taxable income exceeding Rs 4 million during an

Income exceeding Rs 4 million Income Year shall submit income return u/s 96

* This is the Social Security Tax to be deposited in a separate revenue account (11211) provided for this purpose. However tax

payer registered as sole proprietorship or on Pension Income shall not be taxed at 1 %.

TR Upadhya & Co., All Rights Reserved

This document has been compiled in summary form exclusively for the information of clients and staff of T R Upadhya & Co.

It should not be relied upon as a substitute for detailed advice or a basis for formulating business decisions.

Income Tax Rates FY 2016-17

1.2 For Non Residents

Nature of Transaction FY 2016/17 FY 2015/16 FY 2014/15

a) Income earned from normal transactions 25% flat rate 25% flat rate 25%flat rate

b) Income earned providing shipping, air or telecom services, 5% 5% 5%

postage, satellite in FY 2015-16 and optical fiber project

c) Income earned providing shipping, air or telecom services 2% 2% 2%

through the territory of Nepal.

d) Repatriation of profit by Foreign Permanent Establishment. 5% 5% 5%

1.3 Special provisions for Resident Natural Person

Particulars FY 2016/17 FY 2015/16

a) Income earned by natural person engaged on special industry Tax @ 20% on taxable

under sec(11) for whole year income for which tax rate -do-

of 25% is applicable

b) Income earned from export by natural person Tax @ 15% on taxable

income for which tax rate -do-

of 25% is applicable

-do-

c) Income of trust Tax rate as applicable to

Natural Person

1.4 Special Provision for resident natural person having income exceeding Rs 2 Million but less than

Rs 5 Million

Natural person those who meet following criteria shall be taxed on the basis of turnover as follows:

Natural person engaged in FY2016/17 2015/16 2014/15

a) Gas, cigarette business doing transaction with 3% margin or 0.25 % of

commission Transaction 0.5% NA

amount

b) Other person except those involved in business as above (a) 0.75 % of 1.5% NA

Transaction

c) Person engaged in service business except doctor, engineer, auditor, layer, 2% of

player, actor or consultants. Transaction -do- NA

amount

Note: If income tax calculated is below Rs 5,000 then above person shall pay Rs 5,000 instead of tax at above rate.

Conditions for turnover taxation:

a) Person having income from business only.

b) Person not claiming medical tax credit u/s 51 and advance tax u/s 93.

c) Person not claiming Advance income tax under section 93.

d) Having turnover of business more than 2 million but not exceeding Rs 5 million.

e) Person not registered in VAT.

f) Natural person not having income from consultancy or specialized services such as those provided by doctor, engineer,

auditor, layer, player, actor or consultants.

TR Upadhya & Co., All Rights Reserved

This document has been compiled in summary form exclusively for the information of clients and staff of T R Upadhya & Co.

It should not be relied upon as a substitute for detailed advice or a basis for formulating business decisions.

Income Tax Rates FY 2016-17

2. Corporate Income Tax

2.1 Tax rates for Entity- Company/Firm/Industry

S.No. Particulars FY 2016/17 FY 2015/16 FY 2014/15

A Tax rate @ 25%

Normal business 25 % 25% 25%

B Tax rate @ 20%

I Entity operating Special Industry under section 11 for

whole year

Ii Other entities involved in business of construction of

roads, bridges, tunnels, rope-ways, suspension bridges

Iii Entity operating trolley bus or tramps

Iv On transactions of cooperatives (other than tax exempted

transactions) of registered under Cooperative Act, 2048 20% 20% 20%

V Taxable income Export of entity having income source from

Nepal

Vi Entity those involved in construction or operation of public

infrastructure and to be transferred to Nepal Government or

involved in construction of hydropower house and its

generation and transmission.

C Tax Rate @ 30%

I Banks and financial institutions (Commercial Banks,

Development Banks and Finance Companies)

Ii Entity carrying General insurance business (Non life

Insurance)

30% 30% 30%

Iii Entity engaged in petroleum business under Nepal

Petroleum Act, 2040

Iv Entity engaged in business of cigarette, tobacco, cigar,

chewing tobacco, alcohol and beer

TR Upadhya & Co., All Rights Reserved

This document has been compiled in summary form exclusively for the information of clients and staff of T R Upadhya & Co.

It should not be relied upon as a substitute for detailed advice or a basis for formulating business decisions.

Income Tax Rates FY 2016-17

2.2 Tax Concessions and Rebate on Corporate Tax

S.No. Particulars FY 2016/17 FY 2015/16 FY 2014/15

1. Concessions based on employment provided

90% of normal

Special industries and information technology industries rate (NR)

providing direct employment to 300 or more Nepalese -do- -do-

citizens throughout the year

Special industries providing direct employment to 1200 or

-do- -do-

more Nepalese citizens throughout the year 80% of NR

Industries providing direct employment to 100 or more

Nepalese citizens through the year of which at least 33% 80% of NR -do- -do-

represented by women, dalit and handicapped.

Special Industry, Agro-based industry and industry related

with Tourism sector providing direct employment to only 70 % of Normal

-do- NA

Nepalese citizens provided that number of employees shall Rate

be at least 100 throughout the year

2. Concessions to Special industries based on locations

- Special industries established in very under developed 10% of the NR (for

areas 10 yrs from the

-do- -do-

year of

establishment)

20% of the NR (for

10 yrs from the

- Special industries established in under developed areas -do- -do-

year of

establishment)

30% of the NR (for

10 yrs from the

- Special industries established in undeveloped areas -do- -do-

year of

establishment)

3. Concessions to Special industries based on investment amount

100% exemption

for first five years

- Special industry with capital of Rs 1 billion and providing from the date of

direct employment to more than 500 persons throughout operation of -do- -do-

the year business and 50%

concession for next

3 years

100% concession

for 5 years and

- For those Entities in operation, if capital is increased to

50% concession for

Rs 1 billion, Installed capacity is increased by 25% and

next 3 years on -do- -do-

provided employment is more than 500 persons

income generated

throughout the year

due to increased

capacity

100% concession

for 5 years from

- Industry related to tourism industry or international flight

commencement

operation entity established with capital investment of -do- -do-

of business and

more than Rs 2 billion

50% concession

for next 3 years

100% concession

for 5 years and

- For those entities in operation, if capital is increased to 50% concession -do- -do-

Rs 2 billion and installed capacity is increased by 25% for next 3 years

on income

generated due to

TR Upadhya & Co., All Rights Reserved

This document has been compiled in summary form exclusively for the information of clients and staff of T R Upadhya & Co.

It should not be relied upon as a substitute for detailed advice or a basis for formulating business decisions.

Income Tax Rates FY 2016-17

S.No. Particulars FY 2016/17 FY 2015/16 FY 2014/15

increased

capacity

4. Concessions to industry established in special economic zone

Up to 10 yrs

100% exempt

- Industry established in 'Special Economic Zone'

and 50% rebate -do- -do-

recognized in mountain areas or hill areas by the GON

in subsequent

years

100% exempt up

- Industry established in 'Special Economic Zone' other to first 5 yrs and

-do -do-

than above locations 50% rebate in

subsequent years

100% exempt for

- Dividend distributed by the industry established in first 5 years and

-do- -do-

special economic zone 50% rebate in

subsequent 3

- Income derived by the foreign investors from investment

50% of applicable

in Special Economic Zone (Source of income-use of -do- -do-

tax rate

foreign technology, management service fee and royalty)

- On capitalization of accumulated profit through bonus

share by Special Industry, Agro-based industry or

No dividend tax -do- NA

industry related with tourism for expansion of capacity of

industry

5. Concessions based on establishment in special area

- Entity established in Technology park, Bio tech park and 50% rebate on

IT Park engaged in Software development or, data applicable tax -do- -do-

processing or, Cyber Caf or, Digital Mapping rate

6. Concession related to hydropower project

- Institution having license to generate, transmit or

distribute electricity shall be provided concession if the 100% exempt up

commercial electricity generation, transmission or to 10 years and

distribution commences before BS 2080 Chaitra End. 50% rebate in -do- -do-

subsequent 5

(Provisions shall be applicable for electricity generated years

from solar, wind or organic material)

7. Concession to Petroleum Industry

100% exempt up

- If person involved in exploration and extraction of to 7 years and

petroleum and natural gas starts commercial operation 50% rebate in -do- -do-

by BS 2075 Chaitra end. subsequent 3

years

8. Other Specific concessions

- Income from export of manufactured goods by

75% of NR -do- -do-

Manufacturing Industries

- Income from construction and operation of Bridge,

60% of applicable

Airport and Tunnel and income from investment in tram -do- -do-

tax rate (20%)

and trolley bus

- Income of Manufacturing Industry, tourism service 90% of

85% of

industry and hydropower generation, distribution and applica

applicable tax -do-

transmission industry listed in capital market and entities ble tax

rate

mentioned in section 11 (3 Ga) rate

- Industry established in least developed areas producing 40% exempt up

-do- -do-

brandy, wine, cider from fruits to ten years

- Royalty from export of intellectual asset by a person 25% exempt -do- -do-

TR Upadhya & Co., All Rights Reserved

This document has been compiled in summary form exclusively for the information of clients and staff of T R Upadhya & Co.

It should not be relied upon as a substitute for detailed advice or a basis for formulating business decisions.

Income Tax Rates FY 2016-17

S.No. Particulars FY 2016/17 FY 2015/16 FY 2014/15

- Income from sale of intellectual asset by a person

50% exempt -do- -do-

through transfer

Note:

1. If any entity is entitled to more than one privilege U/S-11 only one will be entitled as opted by the entity.

2. Special industry refers to all the manufacturing industries as classified in section 3 of Industrial Enterprises Act, 2049 except the industry related to the

manufacturing of cigarette, bidi, cigar, chewing tobacco, tobacco, gutkha, pan masala other products having main ingredient as tobacco, alcohol, beer and other

such related products but includes agriculture, forestry and mineral industries.

TR Upadhya & Co., All Rights Reserved

This document has been compiled in summary form exclusively for the information of clients and staff of T R Upadhya & Co.

It should not be relied upon as a substitute for detailed advice or a basis for formulating business decisions.

Income Tax Rates FY 2016-17

3. Special Provisions to those affected by Earthquake (Under Finance Act, 2015)

Particulars Remarks

Additional Repairs and The limit of 7% of Depreciable Base is not applicable till Fiscal Year 2073/74 on the

Maintenance Expenses than repair and maintenance expenses incurred for damaged assets located at

limit of 7% earthquake affected areas prescribed by GON, in case the person desires to apply

this provision

4. Special Provisions introduced by Finance Act, 2016

Particulars Remarks

A. Waiver of fine, interest and Waiver of fine, interest and penalty has been provided if tax payment and their

penalty on default to filing return is made within 2073 Asoj in connection to following defaults:

Tax Return and its payment Default in Income Tax Return filing & tax payment for FY 2014/15;

Default in Estimated tax return filing & first installment payment for FY 2015/16;

Default in tax payment and return filing from 2072 Shrawan to 2072 Falgun

month for TDS, VAT, Excise Duty, Health Tax, Education tax, Chalchitra tax.

B. Demurrage, detention charge In case of Import examined by Custom from the period 2072 Bhadra to 2072 Falgun

and parking expense of but not cleared timely, their demurrage, detention charge and parking expense of

foreign land in connection to foreign land have not been included in custom valuation and their cost are allowed

import as deduction in tax calculation of FY 2015/16 on basis of evidence of incurred

expense.

C. Tax waiver to Cooperative Saving and credit co-operative that are formed in FY 2014/15 and operating in

municipality is exempt from Income tax for that fiscal year. If taxes are already paid,

it can be set off with tax payable for FY 2015/16.

D. Wavier from audit to Small Small and medium tax payer, having annual turnover not exceeding Rs 10 Million,

and medium tax payer are waived from audit and they can self attest their Income tax return.

E. Financial statement to be Financial Statements of taxpayer having earning exceeding Rs 4 Million shall be

stored in Information centre stored in Information centre.

5. Allowable Donations

S. No. Particulars FY 2016/17 FY 2015/16

a. To tax exempt organization - Up to Rs 100,000 or 5% of -do-

adjusted taxable income

whichever is lower

b. For conservation or promotion of historical, - On prior approval of department -do-

religious or cultural heritage, or for - Actual up to Rs 1 million or 10% of

construction of public sports infrastructure. assessable income whichever is

lower

C Contribution to Prime Minister Relief Fund or

National Reconstruction Fund established Actual Amount of contribution -do-

by Nepal Government

6. Tax Payment

6.1 Advance Tax to Normal taxpayer

S. No. Particulars Installment Amount

a. Up to end of Poush Remaining amount of 40% of estimated tax

b. Up to end of Chaitra Remaining amount of 70% of estimated tax

c. Ashad End Remaining amount of 100% of estimated tax

TR Upadhya & Co., All Rights Reserved

This document has been compiled in summary form exclusively for the information of clients and staff of T R Upadhya & Co.

It should not be relied upon as a substitute for detailed advice or a basis for formulating business decisions.

Income Tax Rates FY 2016-17

6.2 Advance Tax to taxpayer based on turnover

S. No. Particulars Installment Amount

a. Up to end of Poush Tax at the rate specified on transaction up to 20th Poush

b. Up to end of Ashad Remaining Amount of Tax calculated at the rate specified on estimated

transaction amount at Ashad End based on actual transaction up to 20th

Ashad

Note: It shall not be required to pay advance tax if tax payable is less than Rs 5,000.

6.3 Rental tax payment

S. No. Particulars Remarks

a. Rental Tax by Natural Person

Tax applicable on house rent Tax applicable on house rent income of a natural person which is not

income of a natural person related to the operation of business shall be payable within Ashad end

of the particular Income Year

b. Rental Tax payable turnover basis

Tax withheld by the person paying Payable at the time of payment of installment tax

tax based on turnover (U/S 4 4 (ka)*

*This includes the resident natural person meeting the following criteria:

- Annual business over Rs 2 million and less than Rs 5 million

- Not registered in VAT

- Only Nepal source income from business in that FY

- Medical tax credit not claimed under Section 51

- Advance tax not claimed under Section 93

- Not having income arising from consultancy and specialist services such as of a doctor, engineer,

auditor, lawyer, sportsperson, artist, consultant,

7. Taxation to Small Taxpayer

7.1 Presumptive Taxation

Particulars FY FY FY

2016/17 2015/16 2014/15

Vehicle Tax (shall be final tax for natural person)

Minibus, Mini Truck, Truck and Bus Rs 3,000 -do- Rs 1,500

Car, Jeep, Van, Micro Bus Rs 2,400 -do- Rs 1,200

Three Wheeler, Auto Rickshaw, Tempo Rs 1,550 -do- Rs 850

Tractor and Power Tiller Rs 1,000 -do- Rs 750

Small Tax Payer having turnover not exceeding Rs 2 Million and

taxable income not exceeding Rs 200,000**

Metropolitan, Sub-Metropolitan Rs 5,000 -do- Rs 5,000

Municipal Areas Rs 2,500 -do- Rs 2,500

Other than municipal areas Rs 1,500 -do- Rs 1,500

Note:

Small taxpayer means natural person whose annual turnover is not more than Rs 2 million and income not exceeding Rs 200,000.

** w.e.f. FY 2015/16 such taxpayers are not required to register with VAT.

TR Upadhya & Co., All Rights Reserved

This document has been compiled in summary form exclusively for the information of clients and staff of T R Upadhya & Co.

It should not be relied upon as a substitute for detailed advice or a basis for formulating business decisions.

Income Tax Rates FY 2016-17

8. Tax Withholdings

8.1 TDS withholding Rate

FY FY FY

S. No. Nature of Transaction

2016/17 2015/16 2014/15

i Interest income from deposit under 'Micro Finance Program', 'Rural

Development Bank', 'Postal Saving Bank & Co- operative (u/s-11(2)) in Up to Rs Up to Rs Up to Rs

rural areas is exempted from tax 25,000 25,000 10,000

ii Windfall gains 25%* 25%* 25%*

iii Payment of rent made by resident person having source in Nepal 10% -do- -do-

iv Payment for vehicle rent to VAT registered service provider 1.5% -do- -do-

v Profit and gain from transaction of commodity future market 10% -do- -do-

vi On returns to be distributed by Mutual Fund:

- Natural person 5% -do- -do-

- Other than Natural Person 15%

vii On Dividend paid by the resident company and partnership firm

- To Resident person

5% -do-

- To Non-resident Person -do-

for both (

(Note: partnership firm inserted by Finance Act 2073)

viii On payment of gain on investment insurance 5% -do- -do-

ix On payment of gain from unapproved retirement fund 5% -do- -do-

x On payment of interest or similar type having source in Nepal to natural

person [not involved in any business activity] by Resident Bank, financial 5% -do- -do-

institutions or debenture issuing entity, or listed company

xi On payment of premium to non- resident insurance company 1.5% -do- -do-

xii Contract payments exceeding Rs 50,000 1.5% -do- -do-

Payment of consultancy fee:

xiii

- by resident person against VAT invoice 1.5% -do- -do-

- by resident person against Non-VAT invoice 15% -do- -do-

xiv Payment on contract to Non-Resident person

- On repair of aircraft & other contract 5% -do- -do-

xv Gain on disposal of Interests in any resident entity (listed) exchange

(Taxable

amount is gain calculated under section37)

- To resident natural person 5% -do- -do-

- To others including nonresident 10% -do- -do-

Gain on disposal of Interests in any resident entity (unlisted) exchange

(Taxable amount is gain calculated under section 37)

- To resident natural person 10% -do- -do-

- To others including non resident 15% -do- -do-

xvi Gain on Disposal of land or land & building:

2.5% -do- -do-

- Owned by individual over 5 years

- Owned by individual up to 5 years 5% -do- -do-

- Owned by person other than individual 10% NA NA

xvii -On payment for use of Satellite, Bandwidth, Optical fibre, telecommunication

equipments or electricity transmission by resident irrespective of its 10% NA NA

-

location

*Windfall tax of 25% will be exempted for the reward up to Rs 500,000 received on behalf of contribution in the field of literature, art, culture,

sports, journalism, science and technology and general administration

TR Upadhya & Co., All Rights Reserved

This document has been compiled in summary form exclusively for the information of clients and staff of T R Upadhya & Co.

It should not be relied upon as a substitute for detailed advice or a basis for formulating business decisions.

Income Tax Rates FY 2016-17

8.2 TDS not applicable payments

S. No. Nature of transaction FY FY FY

2016/17 2015/16 2014/15

i Payment made by natural person relating to business activity or No TDS -do- -do-

other payments relating to house rental except house rent

ii Payment for articles published in Newspaper, question setting, No TDS -do- -do-

answer evaluation

iii Interest payment to resident bank, other financial institutions No TDS -do- -do-

iv Interregional interchange fee paid to credit card issuing bank No TDS -do- -do-

v Interest or fees paid by GON under bilateral agreement No TDS -do- -do-

vi Tax Exempt payment or TDS deductible u/s 87 No TDS -do- -do-

vii Dividend or interest paid to Mutual Fund/ Collective Investment No TDS -do- -do-

Fund

8.3 Final Withholding Payments

S. No. Nature of transaction FY FY FY

2016/17 2015/16 2014/15

-i On Dividend paid by the resident company and Partnership firm

- To Resident person 5% for both -do- -do-

- To Non- resident Person

(Note: partnership firm inserted by Finance Act 2073)

ii Payment of rent made to resident natural person having source in

10% -do- -do-

Nepal

iii On payment of gain in investment insurance by resident natural

5% -do- -do-

person

iv On payment of gain from unapproved retirement fund 5% -do- -do-

v On payment of interest or similar type having source in Nepal to

natural person [not involved in any business activity] by Resident

5% -do- -do-

Bank, financial institutions or debenture issuing entity, or listed

company

vi Windfall gains 25%* -do- -do-

Contact for further information

Shashi Satyal

Managing Partner

T R Upadhya & Co. Chartered Accountants ssatyal@trunco.com.np

124 Lal Colony Marg, Lal Durbar

P. O. Box 4414

Sanjeev Kumar Mishra

Kathmandu, Nepal

Partner

smishra@trunco.com.np

Phone: +977 1 4410927, 4420026

Fax: +977 1 4413307

Santosh Lamichhane

Email: trunco@ntc.net.np

Director

santosh@trunco.com.np

TR Upadhya & Co., All Rights Reserved

This document has been compiled in summary form exclusively for the information of clients and staff of T R Upadhya & Co.

It should not be relied upon as a substitute for detailed advice or a basis for formulating business decisions.

Vous aimerez peut-être aussi

- Nepali Layout KBDocument1 pageNepali Layout KBswizar pradhanPas encore d'évaluation

- 35 Good Catchy Beauty Salon SlogansDocument3 pages35 Good Catchy Beauty Salon Slogansswizar pradhanPas encore d'évaluation

- Catalogue Modular KitchenDocument88 pagesCatalogue Modular Kitchenswizar pradhanPas encore d'évaluation

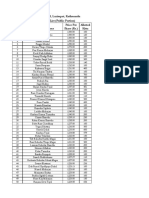

- Everest Bank Auction Allottee List NIBL CapitalDocument9 pagesEverest Bank Auction Allottee List NIBL Capitalswizar pradhanPas encore d'évaluation

- SyllabusDocument5 pagesSyllabusswizar pradhanPas encore d'évaluation

- Septic Tank Sizing CalculatorDocument1 pageSeptic Tank Sizing Calculatorswizar pradhanPas encore d'évaluation

- Nepali Unicode Romanized KeyboardDocument1 pageNepali Unicode Romanized Keyboardswizar pradhanPas encore d'évaluation

- TerexDocument4 pagesTerexswizar pradhanPas encore d'évaluation

- Activated NewDocument1 pageActivated Newswizar pradhanPas encore d'évaluation

- South Asia MapDocument1 pageSouth Asia Mapswizar pradhanPas encore d'évaluation

- China Sinlge Jet Water Meter Test Bench Dn15-Dn25 - China Water Meter Test Bench, Meter Test BenchDocument3 pagesChina Sinlge Jet Water Meter Test Bench Dn15-Dn25 - China Water Meter Test Bench, Meter Test Benchswizar pradhanPas encore d'évaluation

- Water Test BenchDocument3 pagesWater Test Benchswizar pradhanPas encore d'évaluation

- Tadano TR150 XL-4Document13 pagesTadano TR150 XL-4swizar pradhan100% (1)

- 3dx SuperDocument2 pages3dx Superswizar pradhanPas encore d'évaluation

- DesignDocument1 pageDesignswizar pradhanPas encore d'évaluation

- New WWTPDocument1 pageNew WWTPswizar pradhanPas encore d'évaluation

- Nepal AssessingimplementationDocument1 pageNepal Assessingimplementationswizar pradhanPas encore d'évaluation

- Nepal AssessingimplementationDocument1 pageNepal Assessingimplementationswizar pradhanPas encore d'évaluation

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Exemption From Taxation: Tax ExemptionsDocument31 pagesExemption From Taxation: Tax ExemptionsJulius SisraconPas encore d'évaluation

- Marketing Plan Report - FinalDocument14 pagesMarketing Plan Report - FinalhasanalsalamPas encore d'évaluation

- Resume Ed TechDocument2 pagesResume Ed Techapi-369827779Pas encore d'évaluation

- P6mys 2013 Dec QDocument11 pagesP6mys 2013 Dec QAtiqah DalikPas encore d'évaluation

- JAIIB Exam Previous Year Question Papers Free Download - 2014-2015 StudyChaChaDocument7 pagesJAIIB Exam Previous Year Question Papers Free Download - 2014-2015 StudyChaChaவன்னியராஜா78% (9)

- Instructors Manual 6th EditionDocument120 pagesInstructors Manual 6th EditionSean BokelmannPas encore d'évaluation

- Digest of Valenzuela Hardwood and Industrial Supply, Inc. v. CA (G.R. No. 102316)Document2 pagesDigest of Valenzuela Hardwood and Industrial Supply, Inc. v. CA (G.R. No. 102316)Rafael Pangilinan0% (1)

- International Travel Insurance - Future GeneraliDocument6 pagesInternational Travel Insurance - Future GeneraliRizwan KhanPas encore d'évaluation

- Cii If4Document164 pagesCii If4rebekah navarathnePas encore d'évaluation

- Long-Term Disability Insurance: Benefits: PurposeDocument7 pagesLong-Term Disability Insurance: Benefits: Purpose1990sukhbirPas encore d'évaluation

- CV Niapolicyschedulecirtificatecv 69914386Document3 pagesCV Niapolicyschedulecirtificatecv 69914386anshuexperiencerPas encore d'évaluation

- Purchase Airbus 330 NeoDocument10 pagesPurchase Airbus 330 NeoTria Amalia AtiKaPas encore d'évaluation

- HCB 0207 Insurance and Risk ManagementDocument2 pagesHCB 0207 Insurance and Risk Managementcollostero6Pas encore d'évaluation

- In The District Court of The Hong Kong Special Administrative Region Matrimonial CausesDocument32 pagesIn The District Court of The Hong Kong Special Administrative Region Matrimonial CausesSean YauPas encore d'évaluation

- Chunli Application ProofDocument588 pagesChunli Application ProofDamon MengPas encore d'évaluation

- HomeProtectPolicyWording enDocument15 pagesHomeProtectPolicyWording enKarl ToPas encore d'évaluation

- Revanth ResumeDocument2 pagesRevanth Resumep revanthPas encore d'évaluation

- Insurance Brokers in FranceDocument41 pagesInsurance Brokers in FranceEva RouchutPas encore d'évaluation

- PolicySchedule - 2022-07-22T092734.862Document3 pagesPolicySchedule - 2022-07-22T092734.862Blaster-brawl starsPas encore d'évaluation

- National Urban Health Mission - VL PDFDocument42 pagesNational Urban Health Mission - VL PDFAshu AmmuPas encore d'évaluation

- Risk Management Solution Chapters Seven-EightDocument9 pagesRisk Management Solution Chapters Seven-EightBombitaPas encore d'évaluation

- RNA RTK-Resi 8209SVanNessAve GaskinsDocument14 pagesRNA RTK-Resi 8209SVanNessAve GaskinsCYNTHIA CORNATTPas encore d'évaluation

- Esic FormatDocument43 pagesEsic Format98404636300% (1)

- Strahlenfolter Stalking - TI - Baker - The Truth About Electronic Harassment - ThetargetedtruthDocument29 pagesStrahlenfolter Stalking - TI - Baker - The Truth About Electronic Harassment - ThetargetedtruthKarl-Hans-RohnPas encore d'évaluation

- BAGIC Group Mediclaim - BrochureDocument38 pagesBAGIC Group Mediclaim - BrochureVisakh MahadevanPas encore d'évaluation

- Policy Terms and ConditionsDocument48 pagesPolicy Terms and ConditionsNopePas encore d'évaluation

- Buy Iphone 13 and Iphone 13 Mini - AppleDocument1 pageBuy Iphone 13 and Iphone 13 Mini - AppleSanty PerezPas encore d'évaluation

- PDFDocument3 pagesPDFAshika MuraliPas encore d'évaluation

- Banking & Insurance IMP QuestionsDocument2 pagesBanking & Insurance IMP QuestionsAkshay InamdarPas encore d'évaluation

- Tata Steel Rights Issue Letter of OfferDocument14 pagesTata Steel Rights Issue Letter of OfferRameshPas encore d'évaluation