Académique Documents

Professionnel Documents

Culture Documents

Desarrollo de Ejercicios S4

Transféré par

SMITH LOPEZDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Desarrollo de Ejercicios S4

Transféré par

SMITH LOPEZDroits d'auteur :

Formats disponibles

Ejemplo Bancoldex

la empresa opta por un crdito de $ 100.000.000 a 24 meses, periodo de gracia con cuota parcial (solo paga intereses) para

los primeros 6 periodos, abono constante a capital y se maneja una tasa Bancoldex de 9.2% ms 3 puntos adicionales que

equivale a una tasa peridica mensual del 0.98%, esta tasa se obtiene con el siguiente clculo:

Solucin:

Debemos hallar una tasa que consolide las tasa del 9,2% mas los 3 puntos adicionales

Tasa 9.20% 0.092

Ptos adc 3% 0.03

Para ello debemos aplicar la formula de tasa conjugada:

i = ((1 + i) x (1 + ptos adc)) - 1

Noten que al consolidar dos tasas, estas no se suman, se multiplican, con lo que tendriamos:

i= 1 0.092 x 1 0.03

1.092 x 1.03

1.12476

12.476% 0.124760

Teniendo la tasa EA procedemos a hallar su equivalente nominal:

Efectiva 0.12476 EA

Nominal 11.81% NMV

Y con esta, hallamos la tasa periodica

11.81% 0.98% Mensual

12

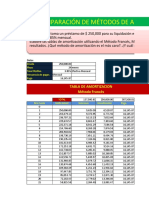

Con estos datos, la tabla de amortizacin queda de la siguiente manera:

VP 100,000,000.00

n 24 18

Periodo Cuota Interes Amortizacin Saldo

0 100,000,000.00

1 984,562.57 984,562.57 - 100,000,000.00

2 984,562.57 984,562.57 - 100,000,000.00

3 984,562.57 984,562.57 - 100,000,000.00

4 984,562.57 984,562.57 - 100,000,000.00

5 984,562.57 984,562.57 - 100,000,000.00

6 984,562.57 984,562.57 - 100,000,000.00

7 6,540,118.12 984,562.57 5,555,555.56 94,444,444.44

8 6,485,420.20 929,864.65 5,555,555.56 88,888,888.89

9 6,430,722.28 875,166.73 5,555,555.56 83,333,333.33

10 6,376,024.36 820,468.81 5,555,555.56 77,777,777.78

11 6,321,326.44 765,770.89 5,555,555.56 72,222,222.22

12 6,266,628.52 711,072.96 5,555,555.56 66,666,666.67

13 6,211,930.60 656,375.04 5,555,555.56 61,111,111.11

14 6,157,232.68 601,677.12 5,555,555.56 55,555,555.56

15 6,102,534.76 546,979.20 5,555,555.56 50,000,000.00

16 6,047,836.84 492,281.28 5,555,555.56 44,444,444.44

17 5,993,138.92 437,583.36 5,555,555.56 38,888,888.89

18 5,938,441.00 382,885.44 5,555,555.56 33,333,333.33

19 5,883,743.08 328,187.52 5,555,555.56 27,777,777.78

20 5,829,045.16 273,489.60 5,555,555.56 22,222,222.22

21 5,774,347.24 218,791.68 5,555,555.56 16,666,666.67

22 5,719,649.32 164,093.76 5,555,555.56 11,111,111.11

23 5,664,951.40 109,395.84 5,555,555.56 5,555,555.56

24 5,610,253.48 54,697.92 5,555,555.56 0.00

115,260,719.78 15,260,719.78 100,000,000.00

solo paga intereses) para

puntos adicionales que

Valor 48,000,000.00

Plazo 5 aos equivalente a 60 meses

Amortizacin Mensual

Tasa 15% EA

Opcin de C. 12% que equivale a 5,760,000.00

Comisin desemb 1% 480,000.00

Conversin de tasa

15% EA

Tasa de int nominal

= m x ((1 + i ef)^(1/m)) - 1 x 100

12 1.0117149169 1

12 0.0117149169

14.06% MV

Tasa periodica

1.17% Mesual

Hallamos el valor presente VP sobre el valor de opcin de compra

VP = 5,760,000.00

2.0113571875

VP = 2,863,738.00

Entonces, valor a financiar:

45,136,262.00

Cuota a pagar:

A= P.i

1-(1+i)-n

A= 528,767.56

0.5028

A= 1,051,597.24

Tabla de amortizacin:

Periodo saldo a capital Abono a capital Intereses comisiones total cuota

0 48,000,000.00 0 0 480,000.00 480,000.00

1 48,000,000.00 489,281.23 562,316.01 1,051,597.24

2 47,510,718.77 495,013.12 556,584.12 1,051,597.24

3 47,015,705.65 500,812.16 550,785.09 1,051,597.24

4 46,514,893.49 506,679.13 544,918.11 1,051,597.24

5 46,008,214.36 512,614.84 538,982.41 1,051,597.24

6 45,495,599.52 518,620.08 532,977.17 1,051,597.24

7 44,976,979.45 524,695.67 526,901.58 1,051,597.24

8 44,452,283.78 530,842.43 520,754.81 1,051,597.24

9 43,921,441.35 537,061.21 514,536.04 1,051,597.24

10 43,384,380.14 543,352.84 508,244.41 1,051,597.24

11 42,841,027.30 549,718.17 501,879.08 1,051,597.24

12 42,291,309.14 556,158.07 495,439.17 1,051,597.24

13 41,735,151.06 562,673.42 488,923.83 1,051,597.24

14 41,172,477.65 569,265.09 482,332.16 1,051,597.24

15 40,603,212.56 575,933.98 475,663.26 1,051,597.24

16 40,027,278.58 582,681.00 468,916.24 1,051,597.24

17 39,444,597.57 589,507.06 462,090.18 1,051,597.24

18 38,855,090.51 596,413.09 455,184.16 1,051,597.24

19 38,258,677.43 603,400.02 448,197.23 1,051,597.24

20 37,655,277.41 610,468.80 441,128.45 1,051,597.24

21 37,044,808.61 617,620.39 433,976.86 1,051,597.24

22 36,427,188.22 624,855.76 426,741.48 1,051,597.24

23 35,802,332.46 632,175.89 419,421.35 1,051,597.24

24 35,170,156.57 639,581.78 412,015.46 1,051,597.24

25 34,530,574.79 647,074.43 404,522.81 1,051,597.24

26 33,883,500.36 654,654.85 396,942.39 1,051,597.24

27 33,228,845.51 662,324.08 389,273.16 1,051,597.24

28 32,566,521.43 670,083.15 381,514.09 1,051,597.24

29 31,896,438.27 677,933.12 373,664.12 1,051,597.24

30 31,218,505.16 685,875.05 365,722.19 1,051,597.24

31 30,532,630.11 693,910.02 357,687.23 1,051,597.24

32 29,838,720.09 702,039.12 349,558.13 1,051,597.24

33 29,136,680.97 710,263.45 341,333.80 1,051,597.24

34 28,426,417.52 718,584.12 333,013.12 1,051,597.24

35 27,707,833.40 727,002.28 324,594.97 1,051,597.24

36 26,980,831.12 735,519.05 316,078.19 1,051,597.24

37 26,245,312.07 744,135.59 307,461.65 1,051,597.24

38 25,501,176.48 752,853.08 298,744.16 1,051,597.24

39 24,748,323.40 761,672.69 289,924.55 1,051,597.24

40 23,986,650.70 770,595.62 281,001.62 1,051,597.24

41 23,216,055.08 779,623.09 271,974.16 1,051,597.24

42 22,436,431.99 788,756.31 262,840.94 1,051,597.24

43 21,647,675.69 797,996.52 253,600.72 1,051,597.24

44 20,849,679.16 807,344.98 244,252.26 1,051,597.24

45 20,042,334.18 816,802.96 234,794.28 1,051,597.24

46 19,225,531.21 826,371.74 225,225.50 1,051,597.24

47 18,399,159.47 836,052.62 215,544.62 1,051,597.24

48 17,563,106.85 845,846.91 205,750.34 1,051,597.24

49 16,717,259.94 855,755.93 195,841.31 1,051,597.24

50 15,861,504.01 865,781.04 185,816.20 1,051,597.24

51 14,995,722.97 875,923.60 175,673.65 1,051,597.24

52 14,119,799.37 886,184.97 165,412.28 1,051,597.24

53 13,233,614.41 896,566.55 155,030.69 1,051,597.24

54 12,337,047.86 907,069.75 144,527.49 1,051,597.24

55 11,429,978.10 917,696.00 133,901.24 1,051,597.24

56 10,512,282.10 928,446.73 123,150.51 1,051,597.24

57 9,583,835.37 939,323.41 112,273.84 1,051,597.24

58 8,644,511.96 950,327.50 101,269.74 1,051,597.24

59 7,694,184.46 961,460.51 90,136.73 1,051,597.24

60 6,732,723.94 972,723.94 78,873.30 1,051,597.24

P. compra 5,760,000.00 5,760,000.00 0 5,760,000.00

Nvo saldo a capital

48,000,000.00

47,510,718.77

47,015,705.65

46,514,893.49

46,008,214.36

45,495,599.52

44,976,979.45

44,452,283.78

43,921,441.35

43,384,380.14

42,841,027.30

42,291,309.14

41,735,151.06

41,172,477.65

40,603,212.56

40,027,278.58

39,444,597.57

38,855,090.51

38,258,677.43

37,655,277.41

37,044,808.61

36,427,188.22

35,802,332.46

35,170,156.57

34,530,574.79

33,883,500.36

33,228,845.51

32,566,521.43

31,896,438.27

31,218,505.16

30,532,630.11

29,838,720.09

29,136,680.97

28,426,417.52

27,707,833.40

26,980,831.12

26,245,312.07

25,501,176.48

24,748,323.40

23,986,650.70

23,216,055.08

22,436,431.99

21,647,675.69

20,849,679.16

20,042,334.18

19,225,531.21

18,399,159.47

17,563,106.85

16,717,259.94

15,861,504.01

14,995,722.97

14,119,799.37

13,233,614.41

12,337,047.86

11,429,978.10

10,512,282.10

9,583,835.37

8,644,511.96

7,694,184.46

6,732,723.94

5,760,000.00

-

Una empresa muy reconocida a nivel mundial le fue dada una prima de riesgo del mercado

de un 6%, beta de riesgo asignada a la empresa directamente de 1.4 y se toma una tasa

libre de riesgo de 4%. Calcular la rentabilidad total esperada.

Ei = Rf + Bi*(Em - Rf)

Rf 4%

Bi 1.4

Em 6%

Ei= 4% 1.4 2%

Ei= 4% 0.028

Ei= 6.80% Tasa mnima de rentabilidad esperada de inversin para cubrir todos los riesgos

implcitos. Una vez aplicado este clculo los inversionistas exigirn como mnimo una

rentabilidad de 6.80% adicional a la tasa libre de riesgo de 4%. Esto para compensar el

riesgo sistemtico a los cuales est expuesta la compaa. Por lo tanto el total de la

rentabilidad mnima esperada por los inversionistas es de 10.80%.

Vous aimerez peut-être aussi

- Tabla de Sueldos AleatoreosDocument6 pagesTabla de Sueldos AleatoreosDaniela Casandra Salamanca VelazquezPas encore d'évaluation

- Mate Kathe 3Document11 pagesMate Kathe 3Dora Luz Carcamo RodriguezPas encore d'évaluation

- Tarea Academica 4 - Grupo 3Document16 pagesTarea Academica 4 - Grupo 3Jesús Vladimir Quiroz ReyesPas encore d'évaluation

- Caso Deuda Con Cronograma WaccDocument16 pagesCaso Deuda Con Cronograma WaccEulaliaPas encore d'évaluation

- Taller Matematica FinancieraDocument16 pagesTaller Matematica FinancieraJesus HigginsPas encore d'évaluation

- Amortizacion de PrestamosDocument11 pagesAmortizacion de PrestamosMibzar Andres Cornelio Pino100% (1)

- Banco Artful Loyalty - Prestamo No. 1 Préstamo Tasa Plazo Anuaiidad Tabla de Deuda Año Interes Anualidad Pago Principal DeudaDocument10 pagesBanco Artful Loyalty - Prestamo No. 1 Préstamo Tasa Plazo Anuaiidad Tabla de Deuda Año Interes Anualidad Pago Principal DeudaCRISTHIAN DANIEL VARGAS LOPEZPas encore d'évaluation

- Taller Amortizaciones y Capitalizaciones SRLDocument18 pagesTaller Amortizaciones y Capitalizaciones SRLSORAIDA RAMOS LIãANPas encore d'évaluation

- GurrionAvila JazminDelAngel MFU2A2Document5 pagesGurrionAvila JazminDelAngel MFU2A2Carlos JaureguiPas encore d'évaluation

- Semana 4 MFDocument7 pagesSemana 4 MFPaola PadillaPas encore d'évaluation

- Tarea Vi Matematica FinancieraDocument5 pagesTarea Vi Matematica FinancieraStephanie MatosPas encore d'évaluation

- Ejercicios Anualidades Parte Dos 06-04-2020Document2 pagesEjercicios Anualidades Parte Dos 06-04-2020Lina PadillaPas encore d'évaluation

- Dia 7Document6 pagesDia 7Jv FuvasquezPas encore d'évaluation

- Cronograma de Descuento de Deuda - 3 Tipos y Cuotas Dobles VFDocument118 pagesCronograma de Descuento de Deuda - 3 Tipos y Cuotas Dobles VFEd SarPas encore d'évaluation

- Tarea Unp-1Document16 pagesTarea Unp-1Javier LuisPas encore d'évaluation

- Flujo de Caja ProyectadoDocument16 pagesFlujo de Caja Proyectadoelivelasquezb90Pas encore d'évaluation

- Actividad 6 Matematicas FinancierasDocument7 pagesActividad 6 Matematicas FinancierasJacob PalomoPas encore d'évaluation

- Analisis Financiero. Clases y Talleres 27 OctubreDocument30 pagesAnalisis Financiero. Clases y Talleres 27 OctubreAngelica Julieth Gutierrez JimenezPas encore d'évaluation

- Tabla AmortizacionDocument5 pagesTabla AmortizacionJose Araujo SolartePas encore d'évaluation

- Flujo MYPEDocument11 pagesFlujo MYPELuiguiHuamanEstevesPas encore d'évaluation

- Metodos de Evaluacion Financiera 3Document4 pagesMetodos de Evaluacion Financiera 3Victor GonzalezPas encore d'évaluation

- Unidad 3 Matematicas FinancieraDocument28 pagesUnidad 3 Matematicas FinancieraKarina M Vergara CastañedaPas encore d'évaluation

- 142b23035 Baños Cruz Alejandra Del Carmen U2 A10Document9 pages142b23035 Baños Cruz Alejandra Del Carmen U2 A10MauricioD.Méndez100% (1)

- Semana 5 - Credito Cuotas ConstantesDocument14 pagesSemana 5 - Credito Cuotas ConstantesJeanPaulFloresVilcapomaPas encore d'évaluation

- 3 Wuilian Torres Trabajo No. 27Document7 pages3 Wuilian Torres Trabajo No. 27wuiliantorresfinazasprPas encore d'évaluation

- Clase Valorizacion Caso Real (Empresa Manufactura)Document147 pagesClase Valorizacion Caso Real (Empresa Manufactura)Damaris Caminero GarabandalPas encore d'évaluation

- Caso Práctico N.º 05: Sumas Del Mayor 10 11 12 14 165 167 201 33 37 39 40 403 41 42 45 50 52 57 58 59 60 61 62Document13 pagesCaso Práctico N.º 05: Sumas Del Mayor 10 11 12 14 165 167 201 33 37 39 40 403 41 42 45 50 52 57 58 59 60 61 62Edu LopePas encore d'évaluation

- 3-Cronograma de Pagos-SoluciónDocument23 pages3-Cronograma de Pagos-SoluciónMarita Bellido MelletPas encore d'évaluation

- AmortizacionDocument10 pagesAmortizacionManuel Siles MelgaraPas encore d'évaluation

- Casos Prácticos Niif 16Document6 pagesCasos Prácticos Niif 16Frithz RamirezPas encore d'évaluation

- Caso 3 Evaluacion Financiera de Proyectos PDFDocument7 pagesCaso 3 Evaluacion Financiera de Proyectos PDFtatiana alzatePas encore d'évaluation

- Práctica 2 en Excel - EjemplosDocument19 pagesPráctica 2 en Excel - EjemplosJORGE ANDRES MIRANDA MERCADOPas encore d'évaluation

- Tablas AmortizaciónDocument15 pagesTablas AmortizaciónDavid Perez LondoñoPas encore d'évaluation

- Punto Extra 1Document5 pagesPunto Extra 1Alejandro León GoveaPas encore d'évaluation

- Balance Agricola Jul 2022Document8 pagesBalance Agricola Jul 2022DavidPas encore d'évaluation

- Arrendamiento-Niif 16Document14 pagesArrendamiento-Niif 16De La Cruz AyalaPas encore d'évaluation

- Calculo ISR Honorarios 10%Document5 pagesCalculo ISR Honorarios 10%Alejandro RamosPas encore d'évaluation

- Ejercicios - Yolima - Murillo - OrtizDocument6 pagesEjercicios - Yolima - Murillo - OrtizYolimaPas encore d'évaluation

- Solucion Primer ExamenDocument9 pagesSolucion Primer ExamenAldo Fernando TaipePas encore d'évaluation

- Trabajo Matematica Financiera Cuarto CorteDocument3 pagesTrabajo Matematica Financiera Cuarto CorteClaudia RosatiPas encore d'évaluation

- Arrendamiento FinancieroDocument7 pagesArrendamiento FinancierohhuspaPas encore d'évaluation

- DesvolDocument1 pageDesvolCARLOS ADRIAN PEREZ TREJOPas encore d'évaluation

- 1 Periodos de Gracia y Ab ExtraDocument5 pages1 Periodos de Gracia y Ab ExtraLaura Sofia Figueroa ContrerasPas encore d'évaluation

- E09-Alum-Calculo Tablas de AmortizacionDocument30 pagesE09-Alum-Calculo Tablas de AmortizacionMarcela Sarmiento DargentPas encore d'évaluation

- 8 PLANILLAS DE AMORTIZACIÓN DE CRÉDITOS (Resuelto)Document9 pages8 PLANILLAS DE AMORTIZACIÓN DE CRÉDITOS (Resuelto)jose miguel aduviri cariPas encore d'évaluation

- Alegria Pereda Patricia OAGT06 TareaDocument4 pagesAlegria Pereda Patricia OAGT06 TarealolaPas encore d'évaluation

- EJERCICIO SECCION 20 - g5Document23 pagesEJERCICIO SECCION 20 - g5aidaly olivarPas encore d'évaluation

- C.F Amortización de Cuota Fija Con Plazo de AmortizaciónDocument6 pagesC.F Amortización de Cuota Fija Con Plazo de AmortizaciónLeydi Diana Alvarez ApPas encore d'évaluation

- En Clases - 2022 BDocument3 pagesEn Clases - 2022 BerikalvagomePas encore d'évaluation

- Actividad1 - Matematicas Financieras Mildrehoyos-Estrellaburbano-LeidylopezDocument46 pagesActividad1 - Matematicas Financieras Mildrehoyos-Estrellaburbano-LeidylopezLiam ManrriquePas encore d'évaluation

- Información Créditos ActivosDocument2 pagesInformación Créditos ActivosSergio Daniel Yat YatPas encore d'évaluation

- Tarea Mat FinDocument9 pagesTarea Mat FinBrianna FlamencoPas encore d'évaluation

- ACT.3 Flujo ProyectadoDocument11 pagesACT.3 Flujo Proyectadotatiana escobar100% (1)

- Analisis de Capital de Trabajo 05052017 CLASE3Document24 pagesAnalisis de Capital de Trabajo 05052017 CLASE3Dannis Omar Campos ZavaletaPas encore d'évaluation

- Ejemplo Instrumentos FinancierosDocument15 pagesEjemplo Instrumentos FinancierosksofiavegaPas encore d'évaluation

- Valor Economico AgregadoDocument2 pagesValor Economico AgregadoAngélica AragonPas encore d'évaluation

- UntitledDocument14 pagesUntitledNuria Belen Melgar DuranPas encore d'évaluation

- Amortizacion 1Document12 pagesAmortizacion 1ricardoPas encore d'évaluation

- Trabajo Final Analisis DupontDocument44 pagesTrabajo Final Analisis DupontRAQUEL NOEMI MORALES GARCIAPas encore d'évaluation

- Entrega 3 Gerencia de ProduccionDocument37 pagesEntrega 3 Gerencia de ProduccionSMITH LOPEZPas encore d'évaluation

- Segunda Entrega Gerencia de ProduccionDocument30 pagesSegunda Entrega Gerencia de ProduccionSMITH LOPEZPas encore d'évaluation

- Gerencia de Produccion Parcial Semana 4Document13 pagesGerencia de Produccion Parcial Semana 4Kmilo Andres Caballero80% (5)

- Desarrollo de Ejercicios S3Document10 pagesDesarrollo de Ejercicios S3sindy castillo100% (1)

- 1-Guia Bastidor y CarroceriaDocument4 pages1-Guia Bastidor y CarroceriaSMITH LOPEZ0% (1)

- Embrague para Que y Como FuncionanDocument9 pagesEmbrague para Que y Como FuncionanSMITH LOPEZPas encore d'évaluation

- Quiz 1 Liderazgo y PensamientoDocument10 pagesQuiz 1 Liderazgo y PensamientoSMITH LOPEZ100% (4)

- Resumen Costos UDPDocument9 pagesResumen Costos UDPVíctor Estefane LeytonPas encore d'évaluation

- Plan de CuentasDocument5 pagesPlan de CuentasIsmael CodePas encore d'évaluation

- Certificacion Form 610 JunioDocument2 pagesCertificacion Form 610 JunioMaria Eugenia Vargas ChoquePas encore d'évaluation

- Curso Análisis Práctico Plan General Contable IEF 2012Document552 pagesCurso Análisis Práctico Plan General Contable IEF 2012Jesus RoldanPas encore d'évaluation

- Hechos Posteriores Al Cierre Del EjercicioDocument7 pagesHechos Posteriores Al Cierre Del EjercicioFernando Mendez100% (2)

- Universidad Nacional Del Altiplano Inversion 2Document7 pagesUniversidad Nacional Del Altiplano Inversion 2edgarPas encore d'évaluation

- Tarea Evaluable 2Document9 pagesTarea Evaluable 2Karina MartinezPas encore d'évaluation

- Finanzas CorporativasDocument4 pagesFinanzas CorporativasRobert AbadPas encore d'évaluation

- cASO PRACTICO aNALISIS RATIOS Y BALANCESDocument4 pagescASO PRACTICO aNALISIS RATIOS Y BALANCESElsa ClarkPas encore d'évaluation

- Capacidad OciosaDocument2 pagesCapacidad OciosaKevrofa NetworkPas encore d'évaluation

- Medidas FinancierasDocument36 pagesMedidas FinancierasPriscila EstradaPas encore d'évaluation

- LABORATORIOSDocument6 pagesLABORATORIOSPaul David Valverde QuintanaPas encore d'évaluation

- Presentación - Plan de Negocio Salón de UñasDocument15 pagesPresentación - Plan de Negocio Salón de UñasCarlos0% (1)

- Proyecto de Introduccion y Comercialización de Snacks Saludables en Los Bares de Escuelas y Colegios de La Ciudad de GuayaquilDocument9 pagesProyecto de Introduccion y Comercialización de Snacks Saludables en Los Bares de Escuelas y Colegios de La Ciudad de Guayaquilrapsody23Pas encore d'évaluation

- Reformas Mk1, Mk2, Mk3Document3 pagesReformas Mk1, Mk2, Mk3jurai198967% (6)

- Costos-Económicos TerminadoDocument14 pagesCostos-Económicos TerminadoJose LeivaPas encore d'évaluation

- Notigraf No 64 AndigrafDocument60 pagesNotigraf No 64 AndigrafAnonymous RC9hBTMw100% (1)

- DesconcentraciónDocument5 pagesDesconcentraciónDiego UrtadoPas encore d'évaluation

- RESUMEN SOCIEDADES AbreviadoDocument192 pagesRESUMEN SOCIEDADES AbreviadoCamilo Andres Alvarez LobatonPas encore d'évaluation

- Balance General IntroduccionDocument4 pagesBalance General IntroduccionTelesup IsPas encore d'évaluation

- Check List NIIF 1Document13 pagesCheck List NIIF 1jesuscapPas encore d'évaluation

- Matematica FinancieraDocument13 pagesMatematica Financierakatherine martinezPas encore d'évaluation

- Errores Potenciales en EEFFDocument1 pageErrores Potenciales en EEFFEduardo MezaPas encore d'évaluation

- Colección Ejercicios Examenes Matemáticas Aplicadas IDocument6 pagesColección Ejercicios Examenes Matemáticas Aplicadas IproyectointegradoPas encore d'évaluation

- Entidades Reguladoras e Intermediarios FinancierosDocument3 pagesEntidades Reguladoras e Intermediarios FinancierosSilvanaPas encore d'évaluation

- Practica de EconomiaDocument4 pagesPractica de EconomiaJeraldine Aquino VilcaPas encore d'évaluation

- Contabilidad BasicaDocument347 pagesContabilidad BasicaAnonymous U3u4Xb2N9100% (5)

- PARCIAL 1 Derecho BancarioDocument6 pagesPARCIAL 1 Derecho BancarioalanPas encore d'évaluation

- Mapa Conceptual Sistema Financiero en Colombia PDFDocument1 pageMapa Conceptual Sistema Financiero en Colombia PDFanuarPas encore d'évaluation