Académique Documents

Professionnel Documents

Culture Documents

The Importance of Corporate Governance in Public Sector: January 2012

Transféré par

Yuvin YaNnTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

The Importance of Corporate Governance in Public Sector: January 2012

Transféré par

Yuvin YaNnDroits d'auteur :

Formats disponibles

See

discussions, stats, and author profiles for this publication at: https://www.researchgate.net/publication/275956337

The importance of corporate governance in

public sector

Article January 2012

CITATIONS READS

0 830

1 author:

Martin Surya Mulyadi

Binus University

37 PUBLICATIONS 70 CITATIONS

SEE PROFILE

Some of the authors of this publication are also working on these related projects:

Create new project "Intellectual capital disclosures" View project

All content following this page was uploaded by Martin Surya Mulyadi on 30 January 2016.

The user has requested enhancement of the downloaded file.

Global Business and Economics Research Journal

ISSN: 2302-4593

Vol. 1 (1): 25-31

The importance of corporate governance in public

sector

Martin Surya Mulyadi

Bina Nusantara University, Jakarta and MY Consulting Center, Jakarta

martin@binus.ac.id, martin@my-consulting.org

Yunita Anwar

Bina Nusantara University, Jakarta and MY Consulting Center, Jakarta

Muhammad Ikbal

Bina Nusantara University, Jakarta

Abstract:

Public sector and private sector are two different entities with different responsibility. In

relation to corporate governance, despite of this difference, there are corporate governance

principles applicable for both entities: accountability, transparency, etc. The first guideline on

public sector corporate governance is developed in the UK based on The Cadbury Report.

The most important thing in the public sector corporate governance is performance aspect

and conformance aspect is equally important. In this paper we analyze whether the citizen

and community perceived this public corporate governance as an important thing. We

conduct the research in Indonesian tax office, using taxpayer as our research object. And

from the statitiscal analysis, we found out that public sector corporate governance is essential

to improve service quality.

Keywords: Corporate governance, public governance, accountability, transparency. 25

Citation:

Mulyadi, M. S., Anwar, Y., and Ikbal, M. (2012). The importance of corporate governance in public sector. Global Business and Economics

Page

Research Journal, 1(1): 25-31.

Global Business and Economics Research Journal. Available online at http://www.globejournal.org

Mulyadi, Anwar and Ikbal Global Business and Economics Research Journal

Vol 1 (1): 25-31 ISSN: 2302-4593

1. INTRODUCTION

Usually corporate governance is associated with private sector entity. The collapse and

scandal of many big corporation trigger the emergence of Sarbanes-Oxley Act showed there

is a need to improve a corporate governance practice. While a private sector corporate

governance is common discussion and research topic, we also need to pay attention to public

sector corporate governance.

According to Ryan and Ng (2000), there has been increasing worldwide attention to

corporate governance in the public sector. UK and Australia, for example, issued a

framework of corporate governance in the public sector and guideline of how to apply

principles and practice of corporate governance in the public sector.

Even more, Benz and Frey (2007) suggested that to improve the weakness and failures of

private sector practice as shown by the collapse and scandal of big corporation, corporate

governance (private sector corporate governance) can learn from public governance. Public

governance could give a new insight to improve governance of the corporation.

Although there is no example of spectacular public governance failures, the importance of

public governance is crucial. Key to better practice of public governance lies in the effective

integration of the main elements of corporate governance within a holistic framework, which

need an effective communication throughout the entire organization and supported by a

corporate culture of accountability, transparency, commitment and integrity (Barrett, 2002).

In this paper, we are going to research whether the community and citizen also have the

same perception that public governance is important. Public sector as our research object in

this paper is Indonesian tax office. We used a questionnaire distributed to taxpayer to

measure their perception on this public governance and a statistical analysis.

2. LITERATURE REVIEW

2.1 The differences between private and public sector

As mentioned earlier, private sector governance is a common discussion and research

topic. But there is also an increasing attention to public sector corporate governance as well.

In this section, we discuss what is the differences between private and public sector. Example

of distinctive nature of public sector for example: many objectives, minister(s) as

shareholder(s) and different types of accountability (Edwards and Clough, 2005). More

detail on this differences could be seen in table 1.

26

Although there are differences between private and public sector, there are corporate

Page

governance principle applicable for both private and public sector. For example:

Global Business and Economics Research Journal. Available online at http://www.globejournal.org

Mulyadi, Anwar and Ikbal Global Business and Economics Research Journal

Vol 1 (1): 25-31 ISSN: 2302-4593

accountability, transparency, a focus on performance, commitment and integrity; with the

first three become main research object in this paper.

Private Sector Public Sector

Mandate Profit maximisation, considering Welfare maximisation, considering community

corporate interests only interests, involving trade-offs

Goals Generally clear Often deliberately vague to satisfy different

stakeholders

Performance Standardised financial ratios Financial ratios meaningless. Other performance

metrics indicators used

Efficiency Technical efficiency basic requirement Economic efficiency is often at cost of technical

efficiency. Effectiveness often more important

Costs Firms own costs used for decision- Community costs, including externalities,

making deadweight losses

Prices Generally constrained by market Dependent on policy from free provision

through to prohibitive

Allocation on ability to pay Allocation often on welfare grounds

Revenue From sales Mainly from tax, also from some natural

monopolies

Investment Based on firms interests and cost of Community interests and unclear cost of capital

criteria capital

Financial Often through profit centres Because revenue and expenses are separated,

controls most control is through cost centres

Cash flow crucial to survival Cash not an operating constraint, but government

has a macro monetary role

Sovereign risk External Internal

Product Decided by corporation Mandated by government cannot abandon loss-

choice making activities

Products Goods & Services At Commonwealth level, mainly monetary

transfers

Policy Incidental activity (marketing, product Core activity

changes)

Organization Often defined by core or distinctive Often pieced together from bits and pieces of

definition competencies market failure departments have to house many

disparate activities

Ownership Often complex with partially owned Usually simple, but relation to assets complex

entities many assets held in trust rather than outright

ownership

Unique asset of taxation authority

Power Related to economic strength, checked Strong coercive power, capacity to change own

by government and the law rules

Stakeholders Shareholders, free to own or dispose of Voters, with limited capacity to opt in or out

legally shares, with power related to holding (Migration)

defined

Other Employees, creditors, suppliers, Same set of stakeholders, but weighting of

stakeholders communities communities much heavier

System Well-defined corporation and its Poorly defined public policy reaching into all

boundaries environment areas of life complex systems

Governance Directors and managers Agency heads, ministers, executive government,

parliament tensions between loci of authority

Continuity Occasional takeovers, mergers Regular hostile takeover bid, sometimes

successful

Accountability Defined by standards, generally for Wide, more open, fluid

shareholders and creditors, otherwise

27

closed to public

Legal Binding Can change legislation

Page

constraints

Global Business and Economics Research Journal. Available online at http://www.globejournal.org

Mulyadi, Anwar and Ikbal Global Business and Economics Research Journal

Vol 1 (1): 25-31 ISSN: 2302-4593

Motivation Instrumental, personal Public service

assumption Generally lower pay

Legacy Protection, highly regulated economy Job security, many GBEs overstaffed with low

productivity

Source: Ian McAuley as cited from Edwards and Clough (2005)

Table 1. Public sector and private sector differences

2.2 Public sector corporate governance

According to Tricker (1994), there are two aspects of corporate governance: conformance

and performance. Conformance consists of two elements: monitoring and supervising

executive performance; and maintaining accountability. While performance consists of

strategy formulation and policy making.

In private sector, more emphasis is given to conformance aspect. But in the public sector,

performance aspect is as important as conformance aspect (Hodges et al., 1996). Therefore,

public sector corporate governance basically concerned with structures and processes for

decision-making and with the controls and behaviour that support effective accountability for

performance outcomes (Barrett, 1998).

Cadbury Report in the UK (1992) identified three important principles of corporate

governance: openness, integrity and accountability. This Cadbury Report is a report to

Cadbury Committee, a formal committee which was set up to address financial aspects of UK

private sector corporate governance. This report was used as foundation for the first public

sector corporate governance framework developed by British Chartered Institute of Public

Finance and Accountancy in 1995 (Percy, 1994; Whiteoak, 1994). One of the weakness of

this framework is that they are based on broad principles (openness, integrity and

accountability) instead the detailed one.

In Australia, Australian National Audit Office (ANAO) focused on the corporate

governance structures within Commonwealth Budget-funded agencies. They developed five

key operating principles which consist of: leadership, management environment, risk

management, monitoring and accountability. The inclusion of leadership and risk

management in the key operating principles measure performance aspect of corporate

governance. This is in line with Hodges et al. (1996) who argued that performance aspect is

as important as conformance aspect in the public sector. Previously, framework used in the

UK only put emphasise to conformance aspect. Although this is a framework for public

28

sector, ANAO believe that this framework is also useful for management of public sector

who is close in purpose and structure to private sector (ANAO, 1997).

Page

Global Business and Economics Research Journal. Available online at http://www.globejournal.org

Mulyadi, Anwar and Ikbal Global Business and Economics Research Journal

Vol 1 (1): 25-31 ISSN: 2302-4593

2.3 Complexity of public sector corporate governance

Most corporate governance literature concluded that corporate governance framework

must be tailored to each organization, as there is difference need between one and another

organization. The complexity arised in public sector corporate governance as there will be a

more complex relationships between those with primary accountability responsibilities

(parliament, ministers) as opposed with private sector.

Private sector corporate governance often relatively more straightforward as the roles and

responsibilities are more clearly defined and generally involve a narrower range of active

stakeholders (Barrett, 2002).

2.4 Key principles and steps to enable effective public sector corporate governance

Public sector must adhere to six main elements to apply an effective public sector

corporate governance. These six main elements could be divided by two, related to personal

quality and non-personal quality. The first three main elements which is related to personal

quality of those in the organization are: leadership, integrity and commitment. And the other

three elements are product of strategies, systems, policies and processes which are:

accountability, integration and transparency (Barrett, 2002).

To reach an effective public sector corporate governance, each public entities must ensure

these six main elements. From these six elements, it is understandable that to reach an

effective public sector corporate governance and even better practice will need collaboration

from both sides: improvement of personal quality and also improvement of the strategies,

systems, policies and processes. Without improvement from both sides, there wont be an

effective public governance.

3. METHODOLOGY

The equation used for statistical analysis in this paper is:

y = + 1X1 + 2X2 + 3X3

where y is service quality (community and citizen perception on public sector corporate

governance), x1 is accountability, x2 is transparency and x3 is efficiency and effectivity.

According to previous literature review, it is said that in public sector corporate governance

performance aspect and conformance aspect is equally important. Therefore, we measure

efficiency and effectivity as performance aspect measurement while accountability and

29

transparency used to measure conformance aspect. In order to measure these variables, we

Page

used questionnaire distributed to taxpayer and we use likert scale.

Global Business and Economics Research Journal. Available online at http://www.globejournal.org

Mulyadi, Anwar and Ikbal Global Business and Economics Research Journal

Vol 1 (1): 25-31 ISSN: 2302-4593

4. DISCUSSION

The result of regression analysis from the equation used as mentioned in methodology

section could be seen in table 2.

Unstandardized Standardized

Coefficients Coefficients

Model B Std. Error Beta t Sig.

1 (Constant) 4.918 1.891 2.601 .011

X1 .120 .052 .143 3.343 .002

X2 .205 .058 .375 3.541 .001

X3 .137 .037 .316 3.718 .000

Source: Data processed

Table 2. Result of regression analysis

From table 2, it can be seen that all variables are significant in 1% (accountability,

transparency and efficiency and effectivity). This means all variables positively contributed

to service quality. And also community and citizen believe that all aspects of public sector

corporate governance is important to be implemented for an effective public governance.

From this result, it could also learned that in order to improve public sector service, quality

and perception it is really important for them to improve on their corporate governance

aspects (leadership, integrity, commitment, accountability, integration and transparency).

5. CONCLUSION

Public sector corporate governance is discussed in this paper. As opposed to private sector

governance, public sector corporate governance is more complex due to its relationships

between those with primary accountability responsibilities. First guideline for public

governance set up by UK adopted The Cadbury Report. Core corporate governance principle

applied to private sector applied as well to public sector, such as: accountability and

transparency.

From our research, we found out that community and citizen perceive that public sector

corporate governance is essential in determining its service quality. Using three variables

(accountability, transparency and efficiency and effectivity) to measure both conformance

and performance aspect, we find all aspects have a positive and significant correlation to

30

service quality (perception on public sector corporate governance).

Page

Global Business and Economics Research Journal. Available online at http://www.globejournal.org

Mulyadi, Anwar and Ikbal Global Business and Economics Research Journal

Vol 1 (1): 25-31 ISSN: 2302-4593

REFERENCES

Australian National Audit Office. (1997). Applying principles and practice of corporate

governance in budget funded agencies. ANAO.

Barrett, P. (1998, July). Corporate governance. In Official address to the Defence Audit and

Program Evaluation committee, Canberra 28th July.

Barrett, P. (2002, June). Achieving better practice corporate governance in the public sector.

In Address to international Quality and Productivity Centre Seminar, 26th June.

Barrett, P. (2002, September). Expectation, and perception, of better practice corporate

governance in the public sector from an audit perspective. In Address to CPA Australia's

Government Business Symposium, Melbourne 20th September.

Benz, M. and Frey, B. S. (2007). Corporate governance: what can we learn from public

governance? Academy of Management Review, 32(1): 92-104.

Edwards, M. and Clough, R. (2005). Corporate governance and performance: an exploration

of the connection in a public sector context. Canberra: University of Canberra.

Hodges, R., Wright, M. and Keasey, K. (2006). Corporate governance in the public services:

concepts and issues. Public Money and Management, April-June: 7-13.

Percy, I. (1994). Principles of corporate governance and the public services. London: British

Chartered Institute of Public Finance and Accountancy.

Ryan, C. M. and Ng, C. (2000). Public sector corporate governance disclosures: an

examination of annual reporting practices in Queensland. Australian Journal of Public

Administration, 59(2): 11-23.

Tricker, R. I. (1984). Corporate governance: practices, procedures and powers in British

companies and their board of directors. Vermont: Gower Publishing Company.

Whiteoak, J. (1994). CIPFA Kickstarts Corporate Governance Debate. Local Government

Chronicle, 8.

31

Page

Global Business and Economics Research Journal. Available online at http://www.globejournal.org

View publication stats

Vous aimerez peut-être aussi

- Professional Ethics and EtiquetteDocument14 pagesProfessional Ethics and EtiquetteArunshenbaga ManiPas encore d'évaluation

- Differece Between Public and Private SectorDocument9 pagesDifferece Between Public and Private SectorJishan GautamPas encore d'évaluation

- BSCh2C3-4 Business Studies Notes Igcse by Abhilash SirDocument3 pagesBSCh2C3-4 Business Studies Notes Igcse by Abhilash SirAbhilashPandaPas encore d'évaluation

- Class 12 Businessstudy Notes Chapter 3Document21 pagesClass 12 Businessstudy Notes Chapter 3KUNAl SinghPas encore d'évaluation

- Business Environment 1Document13 pagesBusiness Environment 1psePas encore d'évaluation

- 1047 FileDocument206 pages1047 FileFïston BonheurPas encore d'évaluation

- The Ethical Difference Between Private and Public SectorDocument4 pagesThe Ethical Difference Between Private and Public SectorHabiba KashifPas encore d'évaluation

- Eae 404 Economics of Public Enterprises-1Document86 pagesEae 404 Economics of Public Enterprises-1janePas encore d'évaluation

- Corporate Sustainability ReportingDocument20 pagesCorporate Sustainability ReportingAnkur Agrawal100% (1)

- Unit IDocument8 pagesUnit Irishab khanujaPas encore d'évaluation

- Chapter 7Document42 pagesChapter 7Apef Yok100% (1)

- 1.2 Types of OrganisationsDocument18 pages1.2 Types of OrganisationsPhuong NguyễnPas encore d'évaluation

- Privatisation Review LessonDocument9 pagesPrivatisation Review LessonreaandoesntwanttogethackedPas encore d'évaluation

- Indian EconomyDocument14 pagesIndian EconomyRibhav AgrawalPas encore d'évaluation

- Executives-Entrepreneurs en 1568336Document6 pagesExecutives-Entrepreneurs en 1568336sujaysarkar85Pas encore d'évaluation

- Good Governance: Key To Sustainability: Better Companies, Better SocietiesDocument26 pagesGood Governance: Key To Sustainability: Better Companies, Better SocietiessizziPas encore d'évaluation

- Reading - Session 2Document45 pagesReading - Session 2Abhilasha BagariyaPas encore d'évaluation

- The Influence of Consumer Behavior, Competitive Advantages On The Performance of MSMEs During Covid-19Document5 pagesThe Influence of Consumer Behavior, Competitive Advantages On The Performance of MSMEs During Covid-19International Journal of Innovative Science and Research TechnologyPas encore d'évaluation

- Minding Your Stakeholders BusinessDocument8 pagesMinding Your Stakeholders BusinessJacdiapo100% (1)

- Corporate Social Responsibility and SustainabilityDocument32 pagesCorporate Social Responsibility and SustainabilityAnonymous VcVh5kPas encore d'évaluation

- Business Activities, Objectives, Strategies and The Business EnvironmentDocument53 pagesBusiness Activities, Objectives, Strategies and The Business EnvironmentMohamed LisaamPas encore d'évaluation

- Stakeholder and The Social ContractDocument12 pagesStakeholder and The Social ContractYzapplePas encore d'évaluation

- Class 4: Conceptual Clarity of CSR/Sustainability Related TermsDocument34 pagesClass 4: Conceptual Clarity of CSR/Sustainability Related TermsAnshuman DashPas encore d'évaluation

- Slide F1Document335 pagesSlide F1Lê Hồng ThuỷPas encore d'évaluation

- Insight of Corporate Governance Theories: December 2012Document13 pagesInsight of Corporate Governance Theories: December 2012LelouchPas encore d'évaluation

- Unit 10Document27 pagesUnit 10EYOB AHMEDPas encore d'évaluation

- Mpu2222 - CH2Document45 pagesMpu2222 - CH2Harith TsaqifPas encore d'évaluation

- 10 Business Models KubzanskyDocument8 pages10 Business Models KubzanskyFungai MuganhuPas encore d'évaluation

- Us Financial Services Esg InitiativesDocument12 pagesUs Financial Services Esg InitiativesHansani AmarasinghePas encore d'évaluation

- EY Integrated ReportingDocument52 pagesEY Integrated ReportingMahmudi AccountantPas encore d'évaluation

- Besd 702Document13 pagesBesd 702Sweta BastiaPas encore d'évaluation

- Microeconomics: Key IdeasDocument9 pagesMicroeconomics: Key Ideaslily chanPas encore d'évaluation

- BOM - Chapter 4 OrganizingDocument6 pagesBOM - Chapter 4 OrganizingEtnad SebastianPas encore d'évaluation

- Chapter 3 Business EnvironmentDocument10 pagesChapter 3 Business EnvironmentSHUBHAM SHEKHAWATPas encore d'évaluation

- Business Environment and EthicsDocument253 pagesBusiness Environment and EthicsSyamraj JayarajanPas encore d'évaluation

- Eng 30 AngDocument19 pagesEng 30 AngMOHIT KUMARPas encore d'évaluation

- Module 1 Wed Bsa Core 1Document4 pagesModule 1 Wed Bsa Core 1Kryzzel Anne JonPas encore d'évaluation

- Laffont y Tirole 1991 764959Document45 pagesLaffont y Tirole 1991 764959osiris reyesPas encore d'évaluation

- Corporate Governance and Corporate Social Responsibility: Learning ObjectivesDocument15 pagesCorporate Governance and Corporate Social Responsibility: Learning ObjectivesSimul MondalPas encore d'évaluation

- Public SectorDocument17 pagesPublic SectorTRYANAPas encore d'évaluation

- Business Environment PDFDocument9 pagesBusiness Environment PDFAbhinav GoyalPas encore d'évaluation

- The Need For and Nature of Business Activity CH 1: Needs Wants Basic Economic ProblemDocument5 pagesThe Need For and Nature of Business Activity CH 1: Needs Wants Basic Economic Problemmeelas123Pas encore d'évaluation

- Industrial Ownership Shaping The Present and Future of EconomiesDocument2 pagesIndustrial Ownership Shaping The Present and Future of EconomiesSuhailShaikhPas encore d'évaluation

- Group 1 - Chapter 3 - Social Responsibility and Ethics in Strategic ManagementDocument33 pagesGroup 1 - Chapter 3 - Social Responsibility and Ethics in Strategic ManagementĐỗ Thị Thu HuyềnPas encore d'évaluation

- Minor Project (Rohit)Document43 pagesMinor Project (Rohit)Parth TayalPas encore d'évaluation

- AU12HCM - Ethics, Services & Society - GroupDocument16 pagesAU12HCM - Ethics, Services & Society - GroupNguyễn Minh ThànhPas encore d'évaluation

- Chapter 3 (Week 3 & 4) AmendedDocument50 pagesChapter 3 (Week 3 & 4) AmendedHafiz HishamPas encore d'évaluation

- Part C: Accounting For Triple Bottom Line (TBL)Document28 pagesPart C: Accounting For Triple Bottom Line (TBL)kalsjuniorPas encore d'évaluation

- BUS407 Chapter 04 Stakeholder Management and CommunicationDocument35 pagesBUS407 Chapter 04 Stakeholder Management and CommunicationsaidahPas encore d'évaluation

- BTF chapter1.SVDocument34 pagesBTF chapter1.SVAnh PhamPas encore d'évaluation

- Chap-05 The Environmental Context of BusinessDocument24 pagesChap-05 The Environmental Context of BusinessSiffat Bin AyubPas encore d'évaluation

- Corporate Governance CommunicationDocument15 pagesCorporate Governance Communicationeng6532497Pas encore d'évaluation

- Corporate Social Responsibility: Moving Beyond Investment Towards Measuring OutcomesDocument9 pagesCorporate Social Responsibility: Moving Beyond Investment Towards Measuring Outcomesዝምታ ተሻለPas encore d'évaluation

- Corporate Social DisclosureDocument11 pagesCorporate Social Disclosureshweta_46664100% (3)

- Corporate Governance Practices in Indian BanksDocument15 pagesCorporate Governance Practices in Indian BanksSaurabh RajPas encore d'évaluation

- Privatization in India Issues and EvidenceDocument18 pagesPrivatization in India Issues and EvidencePradeep Kumar RevuPas encore d'évaluation

- How State-owned Enterprises Drag on Economic Growth: Theory and Evidence from ChinaD'EverandHow State-owned Enterprises Drag on Economic Growth: Theory and Evidence from ChinaPas encore d'évaluation

- Integrated Model for Sound Internal Functioning and Sustainable Value Creat: A Solution for Corporate Environments: Post Covid-19 PandemicD'EverandIntegrated Model for Sound Internal Functioning and Sustainable Value Creat: A Solution for Corporate Environments: Post Covid-19 PandemicPas encore d'évaluation

- In The United States District Court For The District of ColoradoDocument16 pagesIn The United States District Court For The District of ColoradoMichael_Lee_RobertsPas encore d'évaluation

- Binani Industries Ltd. V. Bank of Baroda and Another - An AnalysisDocument4 pagesBinani Industries Ltd. V. Bank of Baroda and Another - An AnalysisJeams ZiaurPas encore d'évaluation

- Covered California Grants: For Outreach To IndividualsDocument2 pagesCovered California Grants: For Outreach To IndividualsKelli RobertsPas encore d'évaluation

- Conroy InformationDocument25 pagesConroy InformationAsbury Park PressPas encore d'évaluation

- TERGITOLTM TMN-100X 90% Surfactant PDFDocument4 pagesTERGITOLTM TMN-100X 90% Surfactant PDFOnesany TecnologiasPas encore d'évaluation

- Shawnee Rd.9.16.21Document1 pageShawnee Rd.9.16.21WGRZ-TVPas encore d'évaluation

- Flag of Southeast Asian CountriesDocument6 pagesFlag of Southeast Asian CountriesbaymaxPas encore d'évaluation

- The Federalist PapersDocument262 pagesThe Federalist PapersKaren Faglier PaulPas encore d'évaluation

- Mockbar 2018 Criminal-Law GarciaDocument9 pagesMockbar 2018 Criminal-Law GarciasmileycroixPas encore d'évaluation

- Letter of IntentDocument3 pagesLetter of Intentthe next miamiPas encore d'évaluation

- Crochet Polaroid Case: Bear & RabbitDocument8 pagesCrochet Polaroid Case: Bear & RabbitSusi Susi100% (1)

- Corruption and Indonesian CultureDocument6 pagesCorruption and Indonesian CultureRopi KomalaPas encore d'évaluation

- Lesson 5-Kartilya NG KatipunanDocument12 pagesLesson 5-Kartilya NG KatipunanKhyla ValenzuelaPas encore d'évaluation

- House Site Pattas Details - Bogole MandalDocument36 pagesHouse Site Pattas Details - Bogole MandalnikhileshkumarPas encore d'évaluation

- The Art of Using Paper Space in AutoCAD, All Secrets of Using Layout Tab and Paper Space in AutoCAD 2010 To 2020 PDFDocument218 pagesThe Art of Using Paper Space in AutoCAD, All Secrets of Using Layout Tab and Paper Space in AutoCAD 2010 To 2020 PDFKyaw ZinPas encore d'évaluation

- Day 1 Newsela Article Systematic OppressionDocument6 pagesDay 1 Newsela Article Systematic Oppressionapi-315186689Pas encore d'évaluation

- Safety Data Sheet: Magnafloc LT25Document9 pagesSafety Data Sheet: Magnafloc LT25alang_businessPas encore d'évaluation

- G.R. No. 203610, October 10, 2016Document7 pagesG.R. No. 203610, October 10, 2016Karla KatigbakPas encore d'évaluation

- Test Series - Test No. - 5. Advanced Accounting120413115441Document5 pagesTest Series - Test No. - 5. Advanced Accounting120413115441Kansal AbhishekPas encore d'évaluation

- Legal Basis of International RelationsDocument22 pagesLegal Basis of International RelationsCyra ArquezPas encore d'évaluation

- SDS Salisbury Rub Out TowellettesDocument8 pagesSDS Salisbury Rub Out TowellettesMarco Bonilla MartínezPas encore d'évaluation

- Complaint About A California Judge, Court Commissioner or RefereeDocument1 pageComplaint About A California Judge, Court Commissioner or RefereeSteven MorrisPas encore d'évaluation

- Unit 1 - The Crisis of The Ancien Régime and The EnlightenmentDocument2 pagesUnit 1 - The Crisis of The Ancien Régime and The EnlightenmentRebecca VazquezPas encore d'évaluation

- Flexible Pavement: National Institute of Technology, HamirpurDocument127 pagesFlexible Pavement: National Institute of Technology, HamirpurArchan ChakrabortyPas encore d'évaluation

- Quota Merit List (Cholistan Area) For DVM (Morning) PDFDocument1 pageQuota Merit List (Cholistan Area) For DVM (Morning) PDFadeelPas encore d'évaluation

- SCHENCK Vs USADocument3 pagesSCHENCK Vs USADanny QuioyoPas encore d'évaluation

- The Media As Watchdog: Sheila S. CoronelDocument18 pagesThe Media As Watchdog: Sheila S. Coroneldistinct86Pas encore d'évaluation

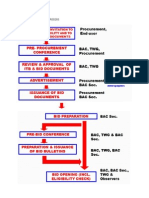

- Bidding Process For Procurement Process and DPWHPDFDocument9 pagesBidding Process For Procurement Process and DPWHPDFGerardoPas encore d'évaluation

- Galt 500Document2 pagesGalt 500satishPas encore d'évaluation