Académique Documents

Professionnel Documents

Culture Documents

Marketing Mix

Transféré par

Himanshu PaliwalCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Marketing Mix

Transféré par

Himanshu PaliwalDroits d'auteur :

Formats disponibles

Q.

Analyse and recommend branding strategies for health insurance industry for

enhanced customer engagement.

The Life Assurance Industry has started in India way back in the 17th Century and has gone to various levels

of change and After Independence an Ordinance was issued on 19th January, 1956 nationalizing the Life

Insurance sector and Life Insurance Corporation came into existence in the same year. The LIC absorbed

154 Indian, 16 non-Indian insurers as also 75 provident societies245 Indian and foreign insurers in all.

The LIC had a monopoly till the late 90s when the Insurance sector was reopened to the private sector India

the Insurance Industry came out more policies and also Amended Insurance Act in 1968 to regulate

investments and set minimum solvency margins. In 1972 with the passing of the General Insurance Business

(Nationalization) Act, general insurance business was nationalized with effect from 1st January, 1973. 107

insurers were amalgamated and grouped into four companies, namely National Insurance Company Ltd.,

The New India Assurance Company Ltd., The Oriental Insurance Company Ltd and the United India

Insurance Company Ltd. The General Insurance Corporation of India was incorporated as a company in

1971 and it commences business on January 1st 1973. In 1993, the Government set up a committee under

the chairmanship of RN Malhotra, former Governor of RBI, to propose recommendations for reforms in the

insurance sector. The objective was to complement the reforms initiated in the financial sector. The

committee submitted its report in 1994 wherein, among other things, it recommended that the private sector

be permitted to enter the insurance industry. They stated that foreign companies are allowed to enter by

floating Indian companies, preferably a joint venture with Indian partners.

Insurance industry in India has undergone drastic changes in terms of regulation, product innovation,

promotional techniques, pricing norms and distribution means since1999 after the establishment of IRDA

and opening up of the sector to private players. The opening up of the insurance sector has brought in many

innovative practices and policies in the sector as to product, pricing, distribution, promotion and standards of

service, i.e., process, physical evidence and people services. At present there are 24 insurance companies

operating in India with 1 (LIC) as PUBLIC SECTOR and remaining 23 as insurance industry but under

PRIVATE SECTOR. The prime objective is study the various strategies adopted by the following insurance

companies in order to sell health insurance and create permanent customer engagement in their companies:

STRATEGIES ADOPTED BY LIFE INSURANCE INDUSTRIES IN INDIA:

NEW MARKETING STRATEGY BY LIC:

The LIC of India, being old brand and Govt. owned insurer in the market its market share is large as

compared to private players. But the consumer perception of the insurance is that of an investment rather

than as a risk cover. They expect prompt service. The LIC of India has been facing competition pressure, so

it has been reorganized itself in order to perform better and to compete private players. LIC has been

formulating new strategies and plans from time to time. LIC has been taken following steps to increase its

market competitiveness and retains its dominant position in the insurance market.

PRODUCT DEVELOPMENT

Life Insurance Corporation introduced traditional insurance schemes. To cater consumers needs about

protection against risk factor, provision for future, old age provision, by launching whole life plans,

Endowment plans, Term insurance plans and pensions plans over a period. Every year by taking market

review it introduces new innovative plans and also withdraws those plans which have less market response.

Now, LIC of India has been changing its products to meet the varied needs of the customers. It has been

a. Competitive pressure

b. Changing behaviour of consumers.

In the competitive market there is a greater need to provide insurance products that meet the needs of the

customers. Therefore, LIC offers wide variety of products which fulfils the needs of different segments of

the society. As at the end of financial years 2010-2011 the corporation had 43 plans.

DISTRIBUTION CHANNELS IN LIC

In marketing of insurance products effectively, field personnel play a pivotal role. The corporation has been

developed alternative distribution channels along with channels to increase its business volume.

1. Agents

2. Micro Insurance Plans

3. Bank assurance and Alternate Channels; and

4. Foreign branches

ICICI PRUDENTIAL LIFE INSURANCE

A successful product or service means nothing unless the benefit of such a service can be communicated

clearly to the target market . An organizations promotional strategy can consist of:

1. Public Relations;

2. Advertising;

3. Sales Promotion;

4. Personal Selling;

5. Direct Mail-Message and Media Strategy and Effective Communication Strategy.

LATEST NEW PROMOTIONAL STRATEGIES ADOPTED

1. PUSH OR PULL STRATEGY

Marketing theory distinguishes between two main kinds of promotional strategy - push and pull.

Push

A push promotional strategy makes use of a companys sales force and trade promotion activities to create

consumer demand for a product. A push strategy tries to sell directly to the consumer, by passing other

distribution channels (e.g. selling insurance or holidays directly). With this type of strategy, consumer

promotions and advertising are the most likely promotional tools.

Pull

A pull selling strategy is one that requires high spending on advertising and consumer promotion to build

up consumer demand for a product. If the strategy is successful, consumers will ask their retailers for the

product, the retailers will ask the wholesalers, and the wholesalers will ask the producers.

2. COMMUNICATION MODEL: AIDA

AIDA is a communication model which can be used by firms to aid them in selling their product or services.

AIDA is an Acronym for Attention, Interest, Desire, and Action.

3. PROMOTION THROUGH PRODUCT LIFE CYCLE

As products move through the four stages of the product Lifecycle different promotional strategies should be

employed at these stages to ensure the healthy success and life of the product. The Four stages are :

Introduction

Growth

Maturity

Decline

4. INTERNET PROMOTION

Marketing of Life Insurance Products through Internet via Web, and E-Mail.

MAX NEW YORK LIFE INSURANCE

This would definitely be the Karo Zyada Ka Irada campaign for Max New York Life. We decided to adopt

a challenger brand strategy, based on an ambition to own a differentiated

position in the marketplace with innovative marketing programs. We took life insurance to a higher level

financial planning for a better future. Life insurance has traditionally been sold on the plank of duty and

responsibility. It has been about Jeevan, Zindagi and Suraksha. But a resurgent India was rewriting the

rules of living in its mission to create, indulge and celebrate. Earnings, savings, investment and consumption

where the force multipliers that would feed this virtuous cycle of need and want as people moved from

denial to desire. That was the basis of the Karo Zyada Ka Irada campaign. It was an integrated launch

across multiple consumer touch points. Its efficacy was proved with the brand awareness moving upwards

by 25 points in just 18 months.

As Per her Life Insurance are Business of Life and Not Finance. It touches the most memorable and

emotional milestones of ones life from marriage, to childbirth to childrens education, and so on. People

also have to be prepared for sudden accidents and eventualities. At each stage there is a different need that

arises. The marketing strategy, therefore, has to emanate from a deeper understanding of this entire journey.

MAX LIFE INSURANCE MARKETING STRATEGY:

MNYL has mainly used ZERO Level Channels to sell the products to its customers.

Zero Level Channel of Distribution: It consists of a manufacturer directly selling to the end consumer. This

might mean door to door sales, direct mails or telemarketing. Zero Level Channel of distribution is giving

the manufactured products directly to consumers with

any intermediaries.

The other various Channels employed are:

1. Insurance Agents.

2. Direct Selling Agents.

3. Internet.

4. Banc-Assurance (First Level) Product Strategy

The MNYL Industry exhibits the following Four Product Levels:

1. The core benefit: Security.

2. Basic Product: Health, Child, Life, Pension and Growth.

3. Expected Product: Claim Settlement.

4. Augmented Product: Electronic Fund Transfer for Claim Settlement.

IN MAX NEW YORK LIFE CULTURE IS ABOUT:

1. The Customer Comes First.

2. Do it right the first time.

3. Bias for result oriented action.

4. Financial strength and discipline.

5. Clarity of Purpose.

6. International Quality Standards.

7. Inclusive Meritocracy.

8. Learning Opportunities.

9. Fun at Work.

10. Commitment to Published value system.

MNYL adopted different Organizational chart compared with traditional one where top management comes

first. But here for them Customer Comes First.

SBI LIFE INSURANCE

SBI Life Insurance came with an Innovative Strategy to promote the product by asking why they should

have to buy SBI Life Insurance.

Why Buy SBI LIFE:

1. Customer Satisfaction-Many of our Customers who have bought an Insurance policy with us have bought

Second One!

2. Financially Sound with over 100 Years of Banking Experience, When you trusted us with your money,

why would you trust somebody else with your protection needs.

3. Affordability.

4. Easy to Buy (Accessibility)

5. Trust and Reliability.

6. With us youre sure.

SBI Life Tops Private Insurance List Next To LIC SBI Life Insurance got more percentage of market

shares.

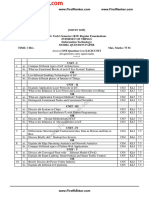

Table 1 Comparative Study of marketing strategies adopted by Insurance Companies

(Top Players)

Table 2: Channels of Distribution of Products by Insurance Companies

CHALLENGING SCENARIO IN INSURANCE INDUSTRY:

It is evident that Marketing Strategy adopted by Insurance Industries has changed a lot. i.e. at present

Private Insurance Industry has started to pull up the market share from LIC and it is evident that from the

annual reports submitted by IRDA that Market share of LIC is came down from 81.92% to 69.78%.

STRATEGIES ON MARKETING OF LIFE ASSURANCE PRODUCTS

In Previous era adoption of one method of strategy has yielded good results to obtain the market share. But

now the current scenario is that the Focus of Insurance Industry is to market the product through various

distribution channels such as Agents, Banc assurance, Internet, and to come up with new Ideas and

initiatives. With the opening up of Insurance Sector, more private players started entering the Industry with

new products and new

marketing strategies. So at present to Increase or hold up the current market share

in the Insurance Industry the following should have to be followed:

1. Well establish Infrastructure facilities.

2. Call- Centre Facilities.

3. Different New Product development.

4. Studying Market segmentation before introducing the new product

MARKET SEGMENTATION:

In Insurance Industry currently there is no separate plan for very low income group / daily wage earner

group. They should have to think and adopt a very good and innovative

policy for daily earner and also to provide them with good policy. Studying Market Segmentation such as

Low Income and High Income people hold the line between them. Because in India Low Income groups are

more compared to High Income therefore the Insurance Industry should have to come with new products

which will attract the low Income group people.

Therefore in order to enhance customer engagement the insurance companies should

primarily focus on marketing mix .

MARKETING MIX is a planned mix of the controllable elements of a products marketing plan

commonly termed as 4PS:

PRODUCT

PRICE

PLACE

PROMOTION

These four elements are adjusted until the right combination is found that serves the needs of the products

customer , while generating optimum income. Sometimes Product is substituted by presentation.

MARKETING MIX FOR INSURANCE COMPANIES:

The Insurance business deals in selling services and therefore due weight age in the formation of marketing

mix for the Insurance business is needed. The marketing mix includes sub-mixes of the 7 Ps of marketing

i.e. the product, its price, place, promotion, people, process & physical attraction. The above mentioned 7

Ps can be used for marketing of Insurance products, in the following manner:

PRODUCT:

A product means what we produce. If we produce goods, it means tangible product and when we produce or

generate services, it means intangible service product. A product is both what a seller has to sell and a buyer

has to buy. Thus, an Insurance company sells services and therefore services are their product. In India, the

Life Insurance Corporation of India (LIC) and the General Insurance Corporation (GIC) are the two leading

companies offering insurance services to the users. Apart from offering life insurance policies, they also

offer underwriting and consulting services.

The Life Insurance Corporation has intensified efforts to promote urban savings, but as far as rural savings

are concerned, it is not that impressive. The introduction of Rural Career Agents Scheme has been found

instrumental in inducing the rural prospects but the process is at infant stage and requires more professional

excellence. The policy makers are required to activate the efforts. It would be prudent that the LIC is

allowed to pursue a policy of direct investment for rural development.

PRICING:

In the insurance business the pricing decisions are concerned with:

i) The premium charged against the policies,

ii) Interest charged for defaulting the payment of premium and credit facility. With a view of influencing the

target market or prospects the formulation of pricing strategy becomes significant. In a developing country

like India where the disposable income in the hands of prospects is low, the pricing decision also governs the

transformation of potential policyholders into actual policyholders. The pricing in insurance is in the form of

premium rates. The three main factors used for determining the premium rates under a life insurance plan are

mortality, expense and interest. The premium rates are revised if there are any significant changes in any of

these factors.

Mortality(deaths in a particular area): When deciding upon the pricing strategy the average rate of

mortality is one of the main considerations. In a country like South Africa the threat to life is very important

as it is played by host of diseases.

Expenses: The cost of processing, commission to agents, reinsurance companies as well as registration are

all incorporated into the cost of installments and premium sum and forms the integral part of the pricing

strategy.

Interest: The rate of interest is one of the major factors which determines peoples willingness to invest in

insurance. People would not be willing to put their funds to invest in insurance business if the interest rates

provided by the banks or other financial instruments are much greater than the perceived returns from the

insurance premiums.

PLACE:

This component of the marketing mix is related to two important facets

Managing the insurance personel, and

Locating a branch.

The management of agents and insurance personnel is found significant with the viewpoint of maintaining

the norms for offering the services. This is also to process the services to the end user in such a way that a

gap between the services- promised and services offered is bridged over. In a majority of the service

generating organizations, such a gap is found existent which has been instrumental in making worse the

image problem.

It is also essential that they have rural orientation and are well aware of the lifestyles of the prospects or

users. They are required to be given adequate incentives to show their excellence. While recruiting agents,

the branch managers need to prefer local persons and provide them training and conduct seminars. In

addition to the agents, the front-line staff also needs an intensive training programme to focus mainly on

behavioral management. Another important dimension to the Place Mix is related to the location of the

insurance branches. While locating branches, the branch manager needs to consider a number of factors,

such as smooth accessibility, availability of infrastructural facilities and the management of branch offices

and premises. In addition it is also significant to provide safety measures and also factors like office

furnishing, civic amenities and facilities, parking facilities and interior office decoration should be given

proper attention.

PROMOTION:

The insurance services depend on effective promotional measures. In a country like India, the rate of

illiteracy is very high and the rural economy has dominance in the national economy. It is essential to have

both personal and impersonal promotion strategies. In promoting insurance business, the agents and the rural

career agents play an important role. Due attention should be given in selecting the promotional tools for

agents and rural career agents and even for the branch managers and front line staff. They also have to be

given proper training in order to create impulse buying. Advertising and Publicity, organisation of

conferences and seminars, incentive to policyholders are impersonal communication. Arranging Kirtans,

exhibitions, participation in fairs and festivals, rural wall paintings and publicity drive through the mobile

publicity van units would be effective in creating the impulse buying and the rural prospects would be easily

transformed into actual policyholders.

PEOPLE:

Understanding the customer better allows to design appropriate products. Being a service industry which

involves a high level of people interaction, it is very important to use this resource efficiently in order to

satisfy customers. Training, development and strong relationships with intermediaries are the key areas to be

kept under consideration. Training the employees, use of IT for efficiency, both at the staff and agent level,

is one of the important areas to look into.

PROCESS:

The process should be customer friendly in insurance industry. The speed and accuracy of payment is of

great importance. The processing method should be easy and convenient to the customers. Installment

schemes should be streamlined to cater to the ever growing demands of the customers. IT & Data

Warehousing will smoothen the process flow. IT will help in servicing large no. of customers efficiently and

bring down overheads. Technology can either complement or supplement the channels of distribution cost

effectively. It can also help to improve customer service levels. The use of data warehousing management

and mining will help to find out the profitability and potential of various customers product segments.

PHYSICAL DISTRIBUTION:

Distribution is a key determinant of success for all insurance companies. Today, the nationalized insurers

have a large reach and presence in India. Building a distribution network is very expensive and time

consuming. If the insurers are willing to take advantage of Indias large population and reach a profitable

mass of customers, then new distribution avenues and alliances will be necessary.

CONCLUSION:

The financial services industries have successfully used remote distribution channels such as telephone or

internet so as to reach more customers, avoid intermediaries, bring down overheads and increase

profitability. A good example is UK insurer Direct Line. It relied on telephone sales and low pricing. Today,

it is one of the largest motor insurance operator. Technology will not replace a distribution network though it

will offer advantages like better customer service. Finance companies and banks can emerge as an attractive

distribution channel for insurance in India. In Netherlands, financial services firms provide an entire range of

products including bank accounts, motor, home and life insurance and pensions. In France, half of the life

insurance sales are made through banks. In India also, banks hope to maximize expensive existing networks

by selling a range of products. It is anticipated that rather than formal ownership arrangements, a loose

network of alliance between insurers and banks will emerge, popularly known as banc assurance. Another

innovative distribution channel that could be used are the non-financial organisations. For an example,

insurance for consumer items like fridge and TV can be offered at the point of sale. This increases the

likelihood of insurance sales. Alliances with manufacturers or retailers of consumer goods will be possible

and insurance can be one of the various incentives offers.

Vous aimerez peut-être aussi

- Asterisk-Free Checking AccountDocument2 pagesAsterisk-Free Checking AccountViktoria DenisenkoPas encore d'évaluation

- 06 Chapter 1 MARKETING STRATEGIES IN LIFE INSURANCE BUSINESSDocument61 pages06 Chapter 1 MARKETING STRATEGIES IN LIFE INSURANCE BUSINESSrahulhaldankarPas encore d'évaluation

- 412 33 Powerpoint-Slides Chapter-3Document14 pages412 33 Powerpoint-Slides Chapter-3Kartik KaushikPas encore d'évaluation

- Credit CardDocument32 pagesCredit CardMasih Saab100% (2)

- Insurence IndDocument21 pagesInsurence IndPradeep KumarPas encore d'évaluation

- Marketing Strategies of LICDocument20 pagesMarketing Strategies of LICsuparswa50% (2)

- Marketing Strategies of Insurance Companies in Us, Uk, India EtcDocument15 pagesMarketing Strategies of Insurance Companies in Us, Uk, India EtclegendarystuffPas encore d'évaluation

- Chapter 1 Page NoDocument70 pagesChapter 1 Page NoKaran PandeyPas encore d'évaluation

- Marketing Mix Insurance SectorDocument4 pagesMarketing Mix Insurance SectorSantosh Pradhan100% (1)

- Strategic Analysis of Indian Life Insurance IndustryDocument40 pagesStrategic Analysis of Indian Life Insurance IndustryPunit RaithathaPas encore d'évaluation

- A Study On The Growth of Indian Insurance SectorDocument16 pagesA Study On The Growth of Indian Insurance SectorIAEME Publication100% (1)

- 1.1 Overview of The Insurance Industry 1.2 Profile of The Organization 1.3 Problems of HDFC SLICDocument54 pages1.1 Overview of The Insurance Industry 1.2 Profile of The Organization 1.3 Problems of HDFC SLICTejas GaubaPas encore d'évaluation

- Devika A V InsuranceDocument19 pagesDevika A V InsuranceSasi KumarPas encore d'évaluation

- Emerging Tool of Marketing in Modern Times"Document44 pagesEmerging Tool of Marketing in Modern Times"Virendra Kumar SharmaPas encore d'évaluation

- Brief Overview: Sameer BugnaitDocument3 pagesBrief Overview: Sameer BugnaitBuddyPas encore d'évaluation

- Section I: Knowledge of The Insurance Industry: Service Sector Management Financial Services - InsuranceDocument27 pagesSection I: Knowledge of The Insurance Industry: Service Sector Management Financial Services - InsuranceYugandhar SivaPas encore d'évaluation

- Top Bulk SMS Service ProviderDocument9 pagesTop Bulk SMS Service ProviderGovind kumarPas encore d'évaluation

- What If I Die Without A Business PartnerDocument2 pagesWhat If I Die Without A Business PartnerDave SeemsPas encore d'évaluation

- General InsruanceDocument53 pagesGeneral InsruanceDeep LathPas encore d'évaluation

- A Report On: Customer Relationship Management of Idbi Federal Life InsuranceDocument95 pagesA Report On: Customer Relationship Management of Idbi Federal Life InsuranceamitPas encore d'évaluation

- Recruitment of Advisors For Bharti Axa Life InsuranceDocument63 pagesRecruitment of Advisors For Bharti Axa Life InsuranceMohit kolliPas encore d'évaluation

- Marketing Strategies of HDFC Standard Life InsuranceDocument2 pagesMarketing Strategies of HDFC Standard Life InsuranceMehak LIfez TrailingPas encore d'évaluation

- Comparative Study of Services Provided by LIC ICICI Prudential Life InsuranceDocument94 pagesComparative Study of Services Provided by LIC ICICI Prudential Life InsuranceSimran SomaiyaPas encore d'évaluation

- A Study On Awareness Towards Life Insurance PolicyDocument94 pagesA Study On Awareness Towards Life Insurance PolicykanujkohliPas encore d'évaluation

- Promotion Mix of LicDocument5 pagesPromotion Mix of LicRohitBhatiaPas encore d'évaluation

- Housewife Questionnaire PDFDocument1 pageHousewife Questionnaire PDFAman TrivediPas encore d'évaluation

- Insurance Awareness PDF For NICL AO 2017Document16 pagesInsurance Awareness PDF For NICL AO 2017Yash SinghPas encore d'évaluation

- Report On Sms MarketingDocument36 pagesReport On Sms MarketingFahad NasirPas encore d'évaluation

- Ikf Introduction To Web Based Sms InterfaceDocument3 pagesIkf Introduction To Web Based Sms InterfaceYogesh JajuPas encore d'évaluation

- Marketing Channels For Insurance IndustryDocument12 pagesMarketing Channels For Insurance Industrygautamcool2002Pas encore d'évaluation

- Asgard Personal Protection PDSDocument68 pagesAsgard Personal Protection PDSLife Insurance AustraliaPas encore d'évaluation

- Activities of Delta Life Insurance Company LimitedDocument42 pagesActivities of Delta Life Insurance Company LimitedrayhanrabbiPas encore d'évaluation

- Indian Financial System PDFDocument16 pagesIndian Financial System PDFANCHAL SINGHPas encore d'évaluation

- Indian Financial SystemDocument52 pagesIndian Financial SystemHardik ShahPas encore d'évaluation

- Health Insurance PresentationDocument31 pagesHealth Insurance PresentationHirak Chatterjee100% (1)

- IciciDocument8 pagesIcicidhanushPas encore d'évaluation

- To Compare The Products of HDFC Standard Life Insurance Company Limited and Tata AIG Life Insurance Company LimitedDocument59 pagesTo Compare The Products of HDFC Standard Life Insurance Company Limited and Tata AIG Life Insurance Company LimitedMayank SharmaPas encore d'évaluation

- A Customer Satisfaction With The Marketing Strategies of Reliance Life InsuranceDocument82 pagesA Customer Satisfaction With The Marketing Strategies of Reliance Life InsuranceArman TanejaPas encore d'évaluation

- Life Insurance ProductsDocument60 pagesLife Insurance Productsvikash007pPas encore d'évaluation

- Insurance Industry: Product ClassificationDocument16 pagesInsurance Industry: Product Classificationsadafkhan21Pas encore d'évaluation

- Icici Life Insurance Recruitment of Advisers For Selling The Financial ProductsDocument103 pagesIcici Life Insurance Recruitment of Advisers For Selling The Financial Productschinu1988Pas encore d'évaluation

- Final Lead GenerationDocument100 pagesFinal Lead Generationmanishverma5647Pas encore d'évaluation

- Insurance Capsule Part IIDocument11 pagesInsurance Capsule Part IIGagan PreetPas encore d'évaluation

- Digital Marketing: Submitted By: Rakesh Kumar Raushan REG. NO. - 1233300006/12Document100 pagesDigital Marketing: Submitted By: Rakesh Kumar Raushan REG. NO. - 1233300006/12Vipul DesaiPas encore d'évaluation

- General InsuranceDocument100 pagesGeneral InsuranceShivani YadavPas encore d'évaluation

- How To Give Sales Report in Memo FormDocument1 pageHow To Give Sales Report in Memo Formlucapennazzi101Pas encore d'évaluation

- Report On BhartiDocument57 pagesReport On BhartiWendy CannonPas encore d'évaluation

- Introduction of Insurance (In India)Document10 pagesIntroduction of Insurance (In India)Aman AmuPas encore d'évaluation

- ICICI - Sales Process & CRMDocument117 pagesICICI - Sales Process & CRMAnubha GuptaPas encore d'évaluation

- A Study On Effective Marketing Strategies of Max Life Insurance With Reference To Bilaspur DistrictDocument5 pagesA Study On Effective Marketing Strategies of Max Life Insurance With Reference To Bilaspur DistrictSunita SharmaPas encore d'évaluation

- Factors Affecting Buying Behaviour of Customers of Life Insurance PDFDocument47 pagesFactors Affecting Buying Behaviour of Customers of Life Insurance PDFAkshay Akki Gupta100% (1)

- Principles of Life InsuranceDocument63 pagesPrinciples of Life InsuranceKanishk GuptaPas encore d'évaluation

- Royal Sundaram General InsuranceDocument22 pagesRoyal Sundaram General InsuranceVinayak BhardwajPas encore d'évaluation

- Lic Final ReportDocument109 pagesLic Final ReportAbhisek BanerjeePas encore d'évaluation

- Project ReportDocument37 pagesProject ReportAshu SharmaPas encore d'évaluation

- Summer InternDocument36 pagesSummer InternnehaPas encore d'évaluation

- Chapter-1 Introduction - Role of Advertising in InsuranceDocument57 pagesChapter-1 Introduction - Role of Advertising in InsuranceManasvi Darshan Tolia100% (2)

- UntitledDocument6 pagesUntitledHarit RustagiPas encore d'évaluation

- 1:-Introduction 1.1: - Importance of The TopicDocument62 pages1:-Introduction 1.1: - Importance of The TopicRICHA mehtaPas encore d'évaluation

- Term Strat MiduDocument10 pagesTerm Strat MiduspinnthemuzikPas encore d'évaluation

- Rough MKTNG Insrnce PRCT FinalDocument68 pagesRough MKTNG Insrnce PRCT Finalmrchavan143Pas encore d'évaluation

- Embryogeny in DicotyledonsDocument2 pagesEmbryogeny in DicotyledonsHimanshu PaliwalPas encore d'évaluation

- ImtDocument80 pagesImtHimanshu PaliwalPas encore d'évaluation

- CB 1Document12 pagesCB 1Himanshu PaliwalPas encore d'évaluation

- Projects Management: Komal GangiDocument3 pagesProjects Management: Komal GangiHimanshu PaliwalPas encore d'évaluation

- Research On Lifestyles, Societal Values and EnvironmentDocument23 pagesResearch On Lifestyles, Societal Values and EnvironmentHimanshu PaliwalPas encore d'évaluation

- Consumer BehaviourDocument15 pagesConsumer BehaviourHimanshu PaliwalPas encore d'évaluation

- Elasticity of Demand (E) Elasticity Measures The Extent To Which Demand Will ChangeDocument17 pagesElasticity of Demand (E) Elasticity Measures The Extent To Which Demand Will ChangeHimanshu PaliwalPas encore d'évaluation

- Working Capital Mangament FM AssignmntDocument11 pagesWorking Capital Mangament FM AssignmntHimanshu PaliwalPas encore d'évaluation

- Assignment 1 HRM HIMANSHUDocument20 pagesAssignment 1 HRM HIMANSHUHimanshu PaliwalPas encore d'évaluation

- Crosstalk JournalDocument1 pageCrosstalk JournalHimanshu PaliwalPas encore d'évaluation

- Activos FijosDocument28 pagesActivos FijosArelyPas encore d'évaluation

- SOLUTION BRIEF - Siemens & ZscalerDocument4 pagesSOLUTION BRIEF - Siemens & ZscalerAkhilesh SoniPas encore d'évaluation

- Merchant Banking in IndiaDocument51 pagesMerchant Banking in IndiaAadhish PatharePas encore d'évaluation

- The Accounting CycleDocument98 pagesThe Accounting CycleEhsan Sarparah100% (2)

- Vivek 15 BlackDocument1 pageVivek 15 BlackSurya KPas encore d'évaluation

- Fintech in MENAP A Solid Foundation For GrowthDocument11 pagesFintech in MENAP A Solid Foundation For GrowthNeoPas encore d'évaluation

- Sample CTC WorkingDocument2 pagesSample CTC WorkingWall Street Forex (WSFx)Pas encore d'évaluation

- Soal Modul 5 SMT BDocument1 pageSoal Modul 5 SMT BarakPas encore d'évaluation

- SAP S 4 HANA FI 1610 Overview Mindmap Edition PDFDocument2 pagesSAP S 4 HANA FI 1610 Overview Mindmap Edition PDFkamranahmedaslamPas encore d'évaluation

- Final Exam AC 1 2 Answer KeyDocument7 pagesFinal Exam AC 1 2 Answer KeyBill VilladolidPas encore d'évaluation

- Sales and Distribution (SD) : SAP University Alliances Authors Bret Wagner Stefan WeidnerDocument16 pagesSales and Distribution (SD) : SAP University Alliances Authors Bret Wagner Stefan WeidnerobPas encore d'évaluation

- AWS Dumps 2Document7 pagesAWS Dumps 2Krishna DarapureddyPas encore d'évaluation

- Chap 1-4Document20 pagesChap 1-4Rose Ann Robante TubioPas encore d'évaluation

- Online Mcqs Test - Mobile Computing MCQ With AnswersDocument1 pageOnline Mcqs Test - Mobile Computing MCQ With AnswershiPas encore d'évaluation

- ST Asd Cra23 BtaDocument6 pagesST Asd Cra23 BtaFabiola FonsecaPas encore d'évaluation

- FRD A280420 A2141248Document1 pageFRD A280420 A2141248Balakrishna ReddyPas encore d'évaluation

- Final Report: Submitted By: TAIMOOR RIAZ 13044954-030 Submitted ToDocument65 pagesFinal Report: Submitted By: TAIMOOR RIAZ 13044954-030 Submitted ToSherryMirzaPas encore d'évaluation

- Ibs Lahad Datu 1 31/12/23Document4 pagesIbs Lahad Datu 1 31/12/23fidatulsyafikahsamsualam12Pas encore d'évaluation

- 4 Managing Debts Effectively PDFDocument48 pages4 Managing Debts Effectively PDFLawrence CezarPas encore d'évaluation

- Bancassurance in Pakistan M A AhmedDocument39 pagesBancassurance in Pakistan M A AhmedMuzammil HassanPas encore d'évaluation

- Literature Review On M-CommerceDocument8 pagesLiterature Review On M-Commercefohudenyfeh2100% (1)

- Revenue Cycle Conceptual SystemDocument7 pagesRevenue Cycle Conceptual SystemLil ConicPas encore d'évaluation

- ExplanationsDocument2 pagesExplanationsLovely Rose LacuataPas encore d'évaluation

- Kavita 2Document2 pagesKavita 2api-3721187Pas encore d'évaluation

- QNB T P: Innovative E-Trade SolutionDocument22 pagesQNB T P: Innovative E-Trade SolutionSalim Ben hamedaPas encore d'évaluation

- SBSA Statement 2022-10-17Document23 pagesSBSA Statement 2022-10-17Maestro ProsperPas encore d'évaluation

- AccountingDocument15 pagesAccountingRae Steven Saculo100% (1)

- A GIS Approach To The Spatial AssessmentDocument29 pagesA GIS Approach To The Spatial AssessmentAbdulrahman ElwafiPas encore d'évaluation