Académique Documents

Professionnel Documents

Culture Documents

Accounting Adjusting Entries

Transféré par

Chin-Chin SantiagoDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Accounting Adjusting Entries

Transféré par

Chin-Chin SantiagoDroits d'auteur :

Formats disponibles

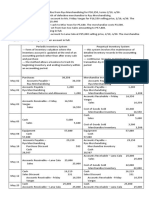

ADJUSTING AND CLOSING ENTRIES - ACCRUALS

The transactions for the year 2000 for Anderson Architects have already been recorded. This problem

shows how to prepare adjusting entries for December 2000.

Dec. 31 A note payable of $6,000 has been outstanding since September 1, 2000. Under the

terms of the note, the note plus interest (12%) is to be paid on March 1, 2001. No interest

has been recorded on the note.

Dec. 31 Wages of $650 for December will be paid in January.

Dec. 31 Services were performed for a client for $800. The client has not been billed yet.

Dec. 31 Advertising costs of $105 for December will be paid in January.

DATE ACCOUNT DEBIT CREDIT

2000

Dec. 31 Interest Expense 240

Interest Payable 240

Dec. 31 Wages Expense 650

Wages Payable 650

Dec. 31 Accounts Receivable 800

Service Revenue 800

Dec. 31 Advertising Expense 105

Accounts Payable 105

The transactions for the year 2000 for Comfort Furniture Co. have been recorded in the accounting

system. This assignment requires you to prepare adjusting entries for Comfort Furniture Co. for

December 2000.

Dec. 31 Wages owed but unpaid at the end of December were $5,000.

Dec. 31 The company signed a 12%, six-month note for $6,000 on November 1, 2000.

No interest has been recorded for November and December.

Dec. 31 Service provided to a customer for $350 has not been recorded.

Dec. 31 Advertising cost of $90 for December has not been recorded.

DATE ACCOUNT DEBIT CREDIT

2000

Dec. 31 Wages Expense 5,000

Wages Payable 5,000

Dec. 31 Interest Expense 120

Interest Payable 120

Dec. 31 Accounts Receivable 350

Service Revenue 350

Dec. 31 Advertising Expense 90

Accounts Payable 90

The transactions for Conway Floor Covering Inc. for the year 2000 have been recorded in the accounting

system. This assignment requires you to record the adjusting entries for December 2000.

Dec. 31 Performed services for a client for $850. The customer will be billed in January.

Dec. 31 $15,000 was borrowed by signing a 10%, 2 year note on September 1, 2000.

Record the interest on the note.

Dec. 31 Employee wages of $950 for December will be paid in January.

Dec. 31 Advertising costs of $95 for December will be paid in January.

DATE ACCOUNT DEBIT CREDIT

2000

Dec. 31 Accounts Receivable 850

Service Revenue 850

Dec. 31 Interest Expense 500

Interest Payable 500

Dec. 31 Wages Expense 950

Wages Payable 950

Dec. 31 Advertising Expense 95

Accounts Payable 95

Gym on Wheels provides gymnastics lessons at various daycare centers. The transactions for the year

2000 have been recorded in the accounting system. This assignment requires you to prepare adjusting

entries for December 2000.

Dec. 31 The note payable of $8,000 has been outstanding since July 1, 2000. Under the terms of

the note, the note plus interest (12%) is to be paid on July 1, 2001. No interest has been

recorded on the note.

Dec. 31 Instructors salaries of $2,000 for December will be paid in January.

Dec. 31 December fees of $160 will be collected in January.

Dec. 31 $85 will be paid in January for advertising in December.

DATE ACCOUNT DEBIT CREDIT

2000

Dec. 31 Interest Expense 480

Interest Payable 480

Dec. 31 Salaries Expense 2,000

Salaries Payable 2,000

Dec. 31 Accounts Receivable 160

Service Revenue 160

Dec. 31 Advertising Expense 85

Accounts Payable 85

The transactions for Borden Realty for the year 2000 have been recorded in the accounting system. This

assignment requires you to prepare adjusting entries for December 2000.

Dec. 31 Services provided to customers for $2,600 were unrecorded at the end of December.

Dec. 31 $115 will be paid in January for advertising in December.

Dec. 31 $1,080 of salaries earned by employees during December will be paid in January.

Dec. 31 The note payable of $12,000 has been outstanding since September 1, 2000. Under the

terms of the note, the note plus interest (10%) is to be paid on September 1, 2001. No

interest has been recorded on the note.

DATE ACCOUNT DEBIT CREDIT

2000

Dec. 31 Accounts Receivable 2,600

Service Revenue 2,600

Dec. 31 Advertising Expense 115

Accounts Payable 115

Dec. 31 Salaries Expense 1,080

Salaries Payable 1,080

Dec. 31 Interest Expense 400

Interest Payable 400

Homework Problem 3

Party Town Incorporated

The transactions for Party Town Inc. for the year 2000 have been recorded in the accounting system. This

assignment requires you to prepare adjusting entries for December 2000.

Dec. 31 A birthday party was arranged in December. The customer will pay $200 in January.

Dec. 31 Party Town Inc. borrowed $20,000 by signing a 12%, 2 year note on July 1, 2000.

Record the interest on the note.

Dec. 31 Employee wages of $750 for December will be paid in January.

Dec. 31 Advertising costs of $135 for December will be paid in January.

DATE ACCOUNT DEBIT CREDIT

2000

Dec. 31 Accounts Receivable 200

Service Revenue 200

Dec. 31 Interest Expense 1,200

Interest Payable 1,200

Dec. 31 Salaries Expense 750

Salaries Payable 750

Dec. 31 Advertising Expense 135

Accounts Payable 135

The transactions for Star Interior Designs for the year 2000 have been recorded in the accounting system.

This assignment requires you to prepare adjusting entries for December 2000.

Dec. 31 Performed services for a client for $1,250. The customer will be billed in January.

Dec. 31 $10,000 was borrowed by signing a 12%, two year note on October 1, 2000.

Record the interest on the note.

Dec. 31 Employee wages of $1,150 for December will be paid in January.

Dec. 31 Advertising costs of $115 for December will be paid in January.

DATE ACCOUNT DEBIT CREDIT

2000

Dec. 31 Accounts Receivable 1,250

Service Revenue 1,250

Dec. 31 Interest Expense 300

Interest Payable 300

Dec. 31 Salaries Expense 1,150

Salaries Payable 1,150

Dec. 31 Advertising Expense 115

Accounts Payable 115

ADJUSTING AND CLOSING ENTRIES - DEFERRALS

The transactions for the year 2000 for Anderson Architects have already been recorded. This problem

shows how to prepare adjusting entries for Anderson Architects for December 2000.

Dec. 31 A computer was purchased on January 1, 1998 for $1,600. The useful life of the

computer is 4 years.

Dec. 31 On October 1, 2000, Anderson Architects had paid $4,800 as rent for a six month period.

This had been recorded as prepaid rent.

Dec. 31 The amount of supplies available at the end of December was $200. The amount of

supplies at the beginning of the period was $450. $250 of supplies were purchased

during the year.

Dec. 31 Furniture costing $3,000 was purchased on Jan 1, 1997. The useful life of the furniture is

estimated to be 5 years.

Dec. 31 Services were provided to a customer for $450. The cash was collected in advance on

November 28, 2000.

DATE ACCOUNT DEBIT CREDIT

2000

Dec. 31 Depreciation Expense 400

Accumulated Depreciation 400

Dec. 31 Rent Expense 2,400

Prepaid Rent 2,400

Dec. 31 Supplies Expense 500

Supplies 500

Dec. 31 Depreciation Expense 600

Accumulated Depreciation 600

Dec. 31 Unearned Revenue 450

Service Revenue 450

The transactions for the year 2000 for Comfort Furniture Co. have been recorded in the accounting

system. This assignment requires you to prepare adjusting entries for Comfort Furniture for December

2000.

Dec. 31 The amount of supplies available at the end of December was $500. The amount of

supplies at the beginning of the period was $1,100.

Dec. 31 On January 1, 1998, Comfort Furniture purchased a computer for $2,400. The estimated

useful life of the computer is 4 years. Record the depreciation for the year 2000.

Dec. 31 On November 1, 2000, Comfort Furniture paid $2,400 as rent for a three month period.

This had been recorded as prepaid rent.

DATE ACCOUNT DEBIT CREDIT

2000

Dec. 31 Supplies Expense 600

Supplies 600

Dec. 31 Depreciation Expense 600

Accumulated Depreciation 600

Dec. 31 Rent Expense 1,600

Prepaid Rent 1,600

The transactions for Conway Floor Covering Inc. for the year 2000 have been recorded in the accounting

system. This assignment requires you to prepare adjusting entries for December 2000.

Dec. 31 Services were provided to a customer for $550. The cash was collected in advance on

December 10, 2000.

Dec. 31 On September 1, 2000, Conway Floor Covering Inc. had paid $5,400 as rent for a six

month period. This had been recorded as prepaid rent.

Dec. 31 The amount of supplies available at the end of December was $400. The amount of

supplies at the beginning of the period was $260. $350 of supplies were purchased

during the year.

Dec. 31 A computer was purchased on January 1, 1998, for $2,400. The useful life of the

computer is 4 years.

DATE ACCOUNT DEBIT CREDIT

2000

Dec. 31 Unearned Revenue 550

Service Revenue 550

Dec. 31 Rent Expense 3,600

Prepaid Rent 3,600

Dec. 31 Supplies Expense 210

Supplies 210

Dec. 31 Depreciation Expense 600

Accumulated Depreciation 600

Gym on Wheels provides gymnastics lessons at various daycare centers. The transactions for the year

2000 have been recorded in the accounting system. This assignment requires you to prepare adjusting

entries for December 2000.

Dec. 31 A number of children registered on December 1 and paid the month's fees in advance.

These fees totaled $500 and unearned revenue was credited when the fees were paid.

Dec. 31 The amount of supplies available at the end of December was $500. The amount of

supplies at the beginning of the period was $1,500.

Dec. 31 On January 1, 1998, Gym on Wheels had purchased a computer for $2,000. The

estimated useful life of the computer is 4 years. Record the depreciation for 2000.

Dec. 31 On December 1, 2000, Gym on Wheels had paid $2,400 as rent for a three month period.

This had been recorded as prepaid rent.

DATE ACCOUNT DEBIT CREDIT

2000

Dec. 31 Unearned Revenue 500

Service Revenue 500

Dec. 31 Supplies Expense 1,000

Supplies 1,000

Dec. 31 Depreciation Expense 500

Accumulated Depreciation 500

Dec. 31 Rent Expense 800

Prepaid Rent 800

The transactions for Borden Realty for the year 2000 have been recorded in the accounting system. This

assignment requires you to prepare adjusting entries for December 2000.

Dec. 31 A computer was purchased for $1,600 on January 1, 1998. The useful life of the

computer is 4 years.

Dec. 31 Furniture costing $4,800 was purchased on January 1, 2000. The useful life of the

furniture is estimated to be 10 years and the salvage value is $800.

Dec. 31 The amount of supplies available at the end of December was $850. The amount of

supplies at the beginning of the period was $1,000. $1,850 of supplies were purchased

during 2000.

Dec. 31 On September 1, 2000, Borden Realty had paid $6,600 as rent for a six month period.

This had been recorded as prepaid rent.

DATE ACCOUNT DEBIT CREDIT

2000

Dec. 31 Depreciation Expense 400

Accumulated Depreciation 400

Dec. 31 Depreciation Expense 400

Accumulated Depreciation 400

Dec. 31 Supplies Expense 2,000

Supplies 2,000

Dec. 31 Rent Expense 4,400

Prepaid Rent 4,400

The transactions for Party Town Inc. for the year 2000 have been recorded in the accounting system.

This assignment requires you to prepare adjusting entries for December 2000.

Dec. 31 Depreciation on the building owned by Party Town Inc. is estimated to be $12,500 for the

period.

Dec. 31 Party Town Inc. purchased furniture for $4,200 on January 1, 1997. The estimated useful

life of the furniture is seven years. Record the depreciation for 2000.

Dec. 31 Excess space in the building was rented to another business on October 1, 2000, and six

months' rent of $7,200 was collected in advance.

Dec. 31 The amount of party supplies available at the end of December was $150. The amount of

supplies at the beginning of the period was $200. $550 of supplies were purchased

during 2000.

DATE ACCOUNT DEBIT CREDIT

2000

Dec. 31 Depreciation Expense 12,500

Accumulated Depreciation 12,500

Dec. 31 Depreciation Expense 600

Accumulated Depreciation 600

Dec. 31 Unearned Rent Revenue 3,600

Rent Revenue 3,600

Dec. 31 Supplies Expense 600

Supplies 600

The transactions for Star Interior Designs for the year 2000 have been recorded in the accounting system.

This assignment requires you to record the adjusting entries for December 2000.

Dec. 31 Depreciation on a truck owned by Star Interior Designs is estimated to be $1,250 for the

period.

Dec. 31 Furniture costing $3,600 was purchased on January 1, 1997. The estimated useful life of

the furniture is six years. Record the depreciation for 2000.

Dec. 31 Six months' rent of $7,200 was paid in advance on October 1, 2000.

Dec. 31 The amount of supplies available at the end of December was $250. The amount of

supplies at the beginning of the period was $200. $550 of supplies were purchased

during the year.

DATE ACCOUNT DEBIT CREDIT

2000

Dec. 31 Depreciation Expense 1,250

Accumulated Depreciation 1,250

Dec. 31 Depreciation Expense 600

Accumulated Depreciation 600

Dec. 31 Rent Expense 3,600

Prepaid Rent 3,600

Dec. 31 Supplies Expense 500

Supplies 500

Vous aimerez peut-être aussi

- 2 How To Prepare A Statement of OwnerDocument4 pages2 How To Prepare A Statement of Ownerapi-299265916Pas encore d'évaluation

- Fundamentals of Accounting 2 Draft PDFDocument123 pagesFundamentals of Accounting 2 Draft PDFCzaeshel Edades100% (5)

- Accounting For Merchandising OperationsDocument5 pagesAccounting For Merchandising OperationsatoydequitPas encore d'évaluation

- Santa Rosa Campus City of Santa Rosa, Laguna: Polytechnic University of The PhilippinesDocument19 pagesSanta Rosa Campus City of Santa Rosa, Laguna: Polytechnic University of The PhilippinesareumPas encore d'évaluation

- Adj. EntriesDocument41 pagesAdj. EntriesElizabeth Espinosa Manilag100% (2)

- 8 Adjusted Trial BalanceDocument3 pages8 Adjusted Trial Balanceapi-299265916100% (1)

- Adjusting Journal EntriesDocument11 pagesAdjusting Journal EntriesGianna PeñalosaPas encore d'évaluation

- ACC 103 Conceptual Framework & Accounting Stds OBE SyllabusDocument7 pagesACC 103 Conceptual Framework & Accounting Stds OBE SyllabusMarco Gabriel Resñgit BeninPas encore d'évaluation

- Accounting: Adjusting EntriesDocument11 pagesAccounting: Adjusting EntriesCamellia100% (2)

- Adjusting EntriesDocument2 pagesAdjusting Entriesitsayuhthing100% (1)

- 2016 14 PPT Acctg1 Adjusting EntriesDocument20 pages2016 14 PPT Acctg1 Adjusting Entriesash wu100% (3)

- The Accounting CycleDocument34 pagesThe Accounting CycleMarriel Fate CullanoPas encore d'évaluation

- Module 3 Accounting For Raw MaterialsDocument42 pagesModule 3 Accounting For Raw MaterialsColeng RiveraPas encore d'évaluation

- Computerised Accounting Practice Set Using Xero Online Accounting: Australian EditionD'EverandComputerised Accounting Practice Set Using Xero Online Accounting: Australian EditionPas encore d'évaluation

- Acctg Closing Entries, Post Closing Trial Balance and Reversing EntriesDocument21 pagesAcctg Closing Entries, Post Closing Trial Balance and Reversing EntriesDaisy Marie A. Rosel100% (1)

- Merchandising - Journal EntriesDocument3 pagesMerchandising - Journal EntriesBhea Ballesteros CabasanPas encore d'évaluation

- Journalizing, Posting, Preparing Trial Balance Week 2 CheckPointDocument6 pagesJournalizing, Posting, Preparing Trial Balance Week 2 CheckPointmrnick1102Pas encore d'évaluation

- Comprehensive ProblemDocument2 pagesComprehensive ProblemCeline Floranza100% (1)

- Special Journals Accounting)Document15 pagesSpecial Journals Accounting)Ardialyn100% (3)

- Analysis of Corporate Valuation Theories and A Valuation of ISSDocument112 pagesAnalysis of Corporate Valuation Theories and A Valuation of ISSJacob Bar100% (2)

- Simple and Compound EntryDocument4 pagesSimple and Compound EntryJezeil DimasPas encore d'évaluation

- Journal Entry ExampleDocument52 pagesJournal Entry Examplesriram998983% (6)

- University of Caloocan City: College of Business & Accountancy Quiz # 3-ACC 211Document4 pagesUniversity of Caloocan City: College of Business & Accountancy Quiz # 3-ACC 211Patricia Camille Austria50% (2)

- FABM 2 HANDOUTS 1st QRTRDocument17 pagesFABM 2 HANDOUTS 1st QRTRDanise PorrasPas encore d'évaluation

- Adjusting Entries Exercises LandscapeDocument3 pagesAdjusting Entries Exercises LandscapeTatyanna Kaliah100% (3)

- Chapter 5 Accounting For Merchandising OperationsDocument15 pagesChapter 5 Accounting For Merchandising OperationsSantun Pi TOen100% (2)

- Chapter 11 Adjusting EntriesDocument91 pagesChapter 11 Adjusting EntriesMelessa Pescador100% (1)

- Adjusting Entries ExerciseDocument2 pagesAdjusting Entries ExerciseMarc Eric RedondoPas encore d'évaluation

- Accounting For Merchandising Operations LongDocument32 pagesAccounting For Merchandising Operations Longgk concepcionPas encore d'évaluation

- Chapter 6 Win Ballada 2019Document7 pagesChapter 6 Win Ballada 2019Rea Mariz JordanPas encore d'évaluation

- Adjusting Entries ActivitiesDocument2 pagesAdjusting Entries ActivitiesJessa Mae Banse Limosnero100% (1)

- Journalizing Transactions (Review) - 9.5.17Document13 pagesJournalizing Transactions (Review) - 9.5.17Jessa Beloy100% (1)

- Accounting For Merchandising Operations LongDocument2 pagesAccounting For Merchandising Operations Longgk concepcionPas encore d'évaluation

- Activity 6 - Adjusting Entries - Depreciation (Ans)Document5 pagesActivity 6 - Adjusting Entries - Depreciation (Ans)angela flores100% (1)

- PretestDocument4 pagesPretestRaul Soriano CabantingPas encore d'évaluation

- The Accounting Process: Adjusting The Accounts Cash Versus Accrual Basis of AccountingDocument12 pagesThe Accounting Process: Adjusting The Accounts Cash Versus Accrual Basis of AccountingKim Patrick Victoria100% (1)

- Whole Cycle - Accounting Act.Document26 pagesWhole Cycle - Accounting Act.IL MarePas encore d'évaluation

- Adjusting EntriesDocument23 pagesAdjusting EntriesMarie Ann JoPas encore d'évaluation

- Adjusting EntriesDocument32 pagesAdjusting EntriesAyniNuyda100% (1)

- CH 3 Handout 1 Adjusting Entries Overview InkedDocument1 pageCH 3 Handout 1 Adjusting Entries Overview Inkedapi-387778696Pas encore d'évaluation

- T04 - Long-Term Construction-Type ContractsDocument11 pagesT04 - Long-Term Construction-Type Contractsjunlab0807Pas encore d'évaluation

- MerchandisingDocument11 pagesMerchandisingAIRA NHAIRE MECATE100% (1)

- ACCTG 1 Week 2-3 - Accounting in BusinessDocument13 pagesACCTG 1 Week 2-3 - Accounting in BusinessReygie FabrigaPas encore d'évaluation

- The Need For AdjustmentDocument5 pagesThe Need For AdjustmentAnna CharlottePas encore d'évaluation

- Financial Accounting Ii Sample QuizDocument2 pagesFinancial Accounting Ii Sample QuizThea FloresPas encore d'évaluation

- Test Bank 4Document5 pagesTest Bank 4Jinx Cyrus RodilloPas encore d'évaluation

- Accounting For Sole Proprietorship Problem3-6Document3 pagesAccounting For Sole Proprietorship Problem3-6Rocel Domingo100% (1)

- Moises Dondoyano Information Systems Company Trial Balance: Accounts Dr. CRDocument5 pagesMoises Dondoyano Information Systems Company Trial Balance: Accounts Dr. CR버니 모지코Pas encore d'évaluation

- Tesorero, Princess Kelly V, HRM 1-4 Baen m9Document6 pagesTesorero, Princess Kelly V, HRM 1-4 Baen m9Kelly TesoreroPas encore d'évaluation

- CLUB MEDICA Practice Set 2 1Document74 pagesCLUB MEDICA Practice Set 2 1Robhy SorianoPas encore d'évaluation

- CHP 2 Exam Preparation ProblemsDocument3 pagesCHP 2 Exam Preparation ProblemsShawn JohnstonPas encore d'évaluation

- Journalizing To Adjusting Entries QuizDocument3 pagesJournalizing To Adjusting Entries QuizNemar Jay Capitania100% (1)

- Assignment November11 KylaAccountingDocument2 pagesAssignment November11 KylaAccountingADRIANO, Glecy C.Pas encore d'évaluation

- Unadjusted Trial BalanceDocument4 pagesUnadjusted Trial BalanceJemma Rose BagalacsaPas encore d'évaluation

- FABM1 ModuleDocument7 pagesFABM1 ModuleKylie Nadine De Roma50% (2)

- Group 6Document8 pagesGroup 6Parkiee JamsPas encore d'évaluation

- Activity 1: Recording Transactions in The JournalDocument2 pagesActivity 1: Recording Transactions in The JournalSieadel Dalumpines50% (2)

- Section 1: Accrued Revenue: Mastering Adjusting EntriesDocument4 pagesSection 1: Accrued Revenue: Mastering Adjusting EntriesMarc Eric Redondo50% (2)

- Financial Accounting and Reporting AssignmentDocument5 pagesFinancial Accounting and Reporting AssignmentMia Casas80% (5)

- Module 1 Review of The Accounting Cycle For A Service Business by Marivic ManaloDocument28 pagesModule 1 Review of The Accounting Cycle For A Service Business by Marivic ManaloChing ChongPas encore d'évaluation

- Page 75Document3 pagesPage 75Aya AlayonPas encore d'évaluation

- Accounting ExerciseDocument40 pagesAccounting ExerciseAsri Marwa UmniatiPas encore d'évaluation

- Adjusting and Closing Entries - Accruals Demonstration Problem 1 Anderson ArchitectsDocument31 pagesAdjusting and Closing Entries - Accruals Demonstration Problem 1 Anderson ArchitectsFlorenz AmbasPas encore d'évaluation

- WK 4 More Practice Adjusting EntriesDocument8 pagesWK 4 More Practice Adjusting EntriesOsman Bin SaifPas encore d'évaluation

- Tally Notes in Hindi PDFDocument11 pagesTally Notes in Hindi PDFvikee kevat83% (911)

- Unit 3: Bad Debts, Allowance For Doubtful Debts, Accruals and PrepaymentsDocument12 pagesUnit 3: Bad Debts, Allowance For Doubtful Debts, Accruals and Prepaymentsyaivna gopee100% (1)

- CostsDocument54 pagesCostsMahrukh MalikPas encore d'évaluation

- Chapter 5 Adjustments and The WorksheetDocument23 pagesChapter 5 Adjustments and The WorksheetReynaleen Agta100% (1)

- L3.3 - Comparative AdvantageDocument1 pageL3.3 - Comparative AdvantagePhung NhaPas encore d'évaluation

- Chapter 8Document24 pagesChapter 8Shibly SadikPas encore d'évaluation

- IUBAT - International University of Business Agriculture and TechnologyDocument4 pagesIUBAT - International University of Business Agriculture and Technologycreative dudePas encore d'évaluation

- Problem 3.2Document3 pagesProblem 3.2MedicareMinstun ProjectPas encore d'évaluation

- Dann Corporation Working Balance Sheet Decemeber 31, 2016Document12 pagesDann Corporation Working Balance Sheet Decemeber 31, 2016Ne BzPas encore d'évaluation

- Gail India Ltd. ReportDocument8 pagesGail India Ltd. Reportsakshi gulatiPas encore d'évaluation

- Solved ProblemsDocument24 pagesSolved ProblemsSammir MalhotraPas encore d'évaluation

- Acc 308-Week3 - 3-2 Homework Chapter 11Document7 pagesAcc 308-Week3 - 3-2 Homework Chapter 11Lilian LPas encore d'évaluation

- Assignment-2 (New) PDFDocument12 pagesAssignment-2 (New) PDFminnie908Pas encore d'évaluation

- Final Exam - ACCT 5001P - Fall 2022Document23 pagesFinal Exam - ACCT 5001P - Fall 2022shuvorajbhattaPas encore d'évaluation

- Abc-Joint ArrangementsDocument4 pagesAbc-Joint ArrangementsLeonardo MercaderPas encore d'évaluation

- Practice Questions - Eqty1Document17 pagesPractice Questions - Eqty1gauravroongtaPas encore d'évaluation

- Part B: Computerised AccountingDocument6 pagesPart B: Computerised AccountingSonakshi JainPas encore d'évaluation

- Flag Question: Question 2: Expensed Based On Estimate in Year of SaleDocument18 pagesFlag Question: Question 2: Expensed Based On Estimate in Year of SaleAlyssa TordesillasPas encore d'évaluation

- Memorandum To ControllerDocument3 pagesMemorandum To ControllerClyde Ian Brett PeñaPas encore d'évaluation

- MGT201 Formulas From Chapter 1 To 22 (Document11 pagesMGT201 Formulas From Chapter 1 To 22 (Ali IbrahimPas encore d'évaluation

- ModuleDocument8 pagesModuleMARIAPas encore d'évaluation

- Working Capital AnalysisDocument9 pagesWorking Capital AnalysisDr Siddharth DarjiPas encore d'évaluation

- Analyzing Financial Data: Ratio AnalysisDocument12 pagesAnalyzing Financial Data: Ratio AnalysiscpdPas encore d'évaluation

- Balance Sheet Projected 1Document1 pageBalance Sheet Projected 1Fred CastroPas encore d'évaluation

- MFRS 1Document42 pagesMFRS 1hyraldPas encore d'évaluation