Académique Documents

Professionnel Documents

Culture Documents

Bir Tax Deadlines

Transféré par

Jomar VillenaCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Bir Tax Deadlines

Transféré par

Jomar VillenaDroits d'auteur :

Formats disponibles

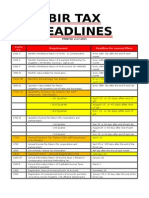

BIR TAX DEADLINES

Form No. Requirement Deadline for manual filers

1601-C Monthly Remittance Return of W/Tax on Every 10th day after the end of each month

Compensation

1601-E Monthly Remittance Return of Expanded Every 10th day after the end of each month

Withholding Tax

(together with Monthly Summary Alpha List)

1601-F Monthly Remittance Return of Final Income Tax Every 10th day after the end of each month

Withheld

2550-M Monthly Value Added Tax Declaration Every 20th day after the end of each month

2551-M Monthly Percentage Tax Return Every 20th day after the end of each month

2550-Q Quarterly Value Added Tax Return Every 25th day after the end of each qtr.

(together with Quarterly List of Sales and

Purchases)

1701-Q Quarterly Income Tax Return (for self-

employed individuals)

- 1st Quarter April 15 or 15 days after end of qtr.

- 2nd Quarter August 15 or 45 days after end of qtr.

- 3rd Quarter Nov. 15 or 45 days after end of qtr.

1701 Annual Income Tax Return (for self- pril 15

employed individuals)

0605 Payment Form - Annual Registration Fee January 31

Vous aimerez peut-être aussi

- ESubmission Validation ReportDocument2 pagesESubmission Validation ReportJomar Villena100% (1)

- AFAR 2018 FOREX and Translation of FSDocument5 pagesAFAR 2018 FOREX and Translation of FSMikko RamiraPas encore d'évaluation

- Taxation 1Document54 pagesTaxation 1JaylordPataotaoPas encore d'évaluation

- Deductions From Gross EstateDocument16 pagesDeductions From Gross EstateJebeth RiveraPas encore d'évaluation

- Audit Report Real Property TaxDocument6 pagesAudit Report Real Property TaxJomar Villena0% (1)

- Francis Pamintuan VatDocument3 pagesFrancis Pamintuan VatJomar VillenaPas encore d'évaluation

- 4Document51 pages4John Philip De GuzmanPas encore d'évaluation

- Aai 2 Part 4 Psa 220 PSQCDocument92 pagesAai 2 Part 4 Psa 220 PSQCJewel MandayaPas encore d'évaluation

- BIR eSubmission receipts for 3 clientsDocument13 pagesBIR eSubmission receipts for 3 clientsJomar VillenaPas encore d'évaluation

- TX 34PW-1-merged PDFDocument22 pagesTX 34PW-1-merged PDFcamille supermas100% (1)

- Non Deductability of Mandatory ContributionsDocument1 pageNon Deductability of Mandatory ContributionsJomar VillenaPas encore d'évaluation

- Study Break Audit UASDocument5 pagesStudy Break Audit UASCharis SubiantoPas encore d'évaluation

- FUNAC TheoriesDocument5 pagesFUNAC TheoriesAlvin QuizonPas encore d'évaluation

- Unit variable costs change proportionally to activityDocument2 pagesUnit variable costs change proportionally to activityJasmin Artates Aquino100% (1)

- Illustrative Entries For Regular Agency FundDocument24 pagesIllustrative Entries For Regular Agency FundYixing XingPas encore d'évaluation

- 1.7 FA 2 - Reasons Why Man Creates ArtDocument3 pages1.7 FA 2 - Reasons Why Man Creates ArtSharmaine Delos ReyesPas encore d'évaluation

- IAS 34 Interim Financial Reporting StandardsDocument12 pagesIAS 34 Interim Financial Reporting StandardsJenne LeePas encore d'évaluation

- Problem Set 1 2nd Year PDFDocument2 pagesProblem Set 1 2nd Year PDFApple AterradoPas encore d'évaluation

- Taxation: Multiple ChoiceDocument16 pagesTaxation: Multiple ChoiceJomar VillenaPas encore d'évaluation

- Kings Company Has Two Decentralized DivisionsDocument3 pagesKings Company Has Two Decentralized DivisionsMeghan Kaye LiwenPas encore d'évaluation

- Zamboanga net income accrual basisDocument5 pagesZamboanga net income accrual basisBabylyn NavarroPas encore d'évaluation

- Taxation OutlineDocument6 pagesTaxation OutlineClariña VirataPas encore d'évaluation

- Chapter 2 Cost Terminology and BehaviorDocument40 pagesChapter 2 Cost Terminology and BehaviorAtif Saeed100% (4)

- 1st Exam RestrictionDocument2 pages1st Exam RestrictionDale TizonPas encore d'évaluation

- MANACCDocument22 pagesMANACCNadine KyrahPas encore d'évaluation

- 2020 T3 GSBS6410 Lecture Notes For Week 1 IntroductionDocument35 pages2020 T3 GSBS6410 Lecture Notes For Week 1 IntroductionRenu JhaPas encore d'évaluation

- PCMR Electronics Implements ABC Costing for Two Calculator ModelsDocument1 pagePCMR Electronics Implements ABC Costing for Two Calculator ModelsOrduna Mae Ann0% (1)

- I. Distribution of Profits: RequiredDocument3 pagesI. Distribution of Profits: RequiredJennette ToPas encore d'évaluation

- CH 10 AnswersDocument3 pagesCH 10 AnswersEl YangPas encore d'évaluation

- Banco CooperativaDocument2 pagesBanco CooperativaNeeria AmadoPas encore d'évaluation

- Bac Elims: Effortless RoundDocument3 pagesBac Elims: Effortless RoundTracy Miranda BognotPas encore d'évaluation

- Case Study On Absorption CostingDocument12 pagesCase Study On Absorption CostingTushar BallabhPas encore d'évaluation

- Module 6 Packet: College OF CommerceDocument18 pagesModule 6 Packet: College OF CommerceCJ GranadaPas encore d'évaluation

- Pentacapital V MahinayDocument3 pagesPentacapital V MahinayHector Mayel Macapagal0% (1)

- Kinney 8e - CH 05Document16 pagesKinney 8e - CH 05Ashik Uz ZamanPas encore d'évaluation

- Chapter13-B A. Special Allowable DeductionsDocument1 pageChapter13-B A. Special Allowable DeductionsAnne Nicolas100% (1)

- Drill Business CombinationDocument4 pagesDrill Business CombinationPrankyJellyPas encore d'évaluation

- Extra Credit Renee AronhaltDocument12 pagesExtra Credit Renee Aronhaltapi-240550329Pas encore d'évaluation

- Review TestDocument1 pageReview TestKristine Joy Mendoza InciongPas encore d'évaluation

- VAT Drill Exercises and AnswersDocument34 pagesVAT Drill Exercises and AnswersXyrene Keith MedranoPas encore d'évaluation

- TRAIN LAW - 3.9.18 - Laguna ChapterDocument408 pagesTRAIN LAW - 3.9.18 - Laguna ChapterDeoshel AlagonPas encore d'évaluation

- Module 1 - Topic No. 1 - Part9Document10 pagesModule 1 - Topic No. 1 - Part9Limuel MacasaetPas encore d'évaluation

- Income Taxation Term Assessment 2 SEM SY 2019 - 2020: Coverage: Chapter 8 - 11Document4 pagesIncome Taxation Term Assessment 2 SEM SY 2019 - 2020: Coverage: Chapter 8 - 11Nhel AlvaroPas encore d'évaluation

- BL of SorianoDocument185 pagesBL of SorianoAllanis SolisPas encore d'évaluation

- NON Beneficiality ArgumentDocument2 pagesNON Beneficiality ArgumentSonia MaalaPas encore d'évaluation

- Lumban ProbsDocument3 pagesLumban ProbsShinjiPas encore d'évaluation

- Study Guide for OBLICON Course Summer 2020Document2 pagesStudy Guide for OBLICON Course Summer 2020Cess ChanPas encore d'évaluation

- International Business: ST ND, TH, PDocument2 pagesInternational Business: ST ND, TH, PKalpita Kotkar100% (1)

- Cost-Volume-Profit Analysis: 2,000 Units and $100,000 of RevenuesDocument14 pagesCost-Volume-Profit Analysis: 2,000 Units and $100,000 of RevenuesMa. Alexandra Teddy BuenPas encore d'évaluation

- 4 Heirs of Sofia Quirong vs. DBPDocument11 pages4 Heirs of Sofia Quirong vs. DBPSittie Norhanie Hamdag LaoPas encore d'évaluation

- AaaaDocument11 pagesAaaaJessica JaroPas encore d'évaluation

- FS Mapping FLE02-1Document29 pagesFS Mapping FLE02-1Lenielyn UbaldoPas encore d'évaluation

- DLSL CPA Board Operation – Practical Accounting OneDocument2 pagesDLSL CPA Board Operation – Practical Accounting Onelouise carino100% (1)

- 2019 Level 1 CFASDocument8 pages2019 Level 1 CFASMary Angeline LopezPas encore d'évaluation

- SAP Workbook 03Document53 pagesSAP Workbook 03Morphy GamingPas encore d'évaluation

- MAS - 22806765-0505-MAS-PreweekDocument32 pagesMAS - 22806765-0505-MAS-PreweekClarisse PoliciosPas encore d'évaluation

- Chapter 2 - Intro To ITDocument12 pagesChapter 2 - Intro To ITMakiri Sajili IIPas encore d'évaluation

- All About CASHDocument18 pagesAll About CASHAshley Levy San Pedro100% (1)

- QUIZ1PRAC1Document23 pagesQUIZ1PRAC1Marinel Felipe0% (1)

- Introduction to OR TechniquesDocument50 pagesIntroduction to OR Techniquessharif tahlilPas encore d'évaluation

- Practical Accounting Problems SolutionsDocument11 pagesPractical Accounting Problems SolutionsjustjadePas encore d'évaluation

- Partnership Formation and Operations Exercises and Problems1,670,000518,0001,152,0001,792,000256,000160,000198,000(16,000)(120,000)2,270,000Document21 pagesPartnership Formation and Operations Exercises and Problems1,670,000518,0001,152,0001,792,000256,000160,000198,000(16,000)(120,000)2,270,000Jayson Villena Malimata100% (2)

- Philippine Tax Form Requirements and DeadlinesDocument1 pagePhilippine Tax Form Requirements and DeadlinesLhyraPas encore d'évaluation

- Bir Tax Deadlines 2015Document2 pagesBir Tax Deadlines 2015Mary Grace BanezPas encore d'évaluation

- BIR Tax Deadlines: Home About Us Services Clientele Contact UsDocument2 pagesBIR Tax Deadlines: Home About Us Services Clientele Contact UsNICKOL NAMOCPas encore d'évaluation

- Letter of RequestDocument1 pageLetter of RequestJomar VillenaPas encore d'évaluation

- Lorilei Avian Mark Jane Glenice Adrian Alfred Christine Jarriane AngelicaDocument5 pagesLorilei Avian Mark Jane Glenice Adrian Alfred Christine Jarriane AngelicaJomar VillenaPas encore d'évaluation

- Schedule of PaymentDocument1 pageSchedule of PaymentJomar VillenaPas encore d'évaluation

- Francis Pamintuan 3rd Quarter VatDocument1 pageFrancis Pamintuan 3rd Quarter VatJomar VillenaPas encore d'évaluation

- Bir PenaltiesDocument4 pagesBir PenaltiesJomar Villena100% (1)

- Request for copy of SSS, Pag-ibig, Philhealth contributions as AISAT employeeDocument1 pageRequest for copy of SSS, Pag-ibig, Philhealth contributions as AISAT employeeJomar VillenaPas encore d'évaluation

- Ebirforms-Noreply@bir - Gov.ph: 14 May at 12:53 PMDocument1 pageEbirforms-Noreply@bir - Gov.ph: 14 May at 12:53 PMJomar VillenaPas encore d'évaluation

- Bir Tax DeadlinesDocument1 pageBir Tax DeadlinesJomar VillenaPas encore d'évaluation

- Memory: Asian Institute of Science and Technology Psy101: General Psychology Jomar V. Villena, CpaDocument1 pageMemory: Asian Institute of Science and Technology Psy101: General Psychology Jomar V. Villena, CpaJomar VillenaPas encore d'évaluation

- BukluRun 2017Document1 pageBukluRun 2017Jomar VillenaPas encore d'évaluation

- Revenue District Office No. 21B - City of San Fernando, South PampangaDocument2 pagesRevenue District Office No. 21B - City of San Fernando, South PampangaJomar VillenaPas encore d'évaluation

- Narrative Report T DayDocument2 pagesNarrative Report T DayJomar VillenaPas encore d'évaluation

- First Sem Awardees AbmDocument3 pagesFirst Sem Awardees AbmJomar VillenaPas encore d'évaluation

- AISAT Finals Exam Covers General Psychology, Stress, TraumaDocument1 pageAISAT Finals Exam Covers General Psychology, Stress, TraumaJomar VillenaPas encore d'évaluation

- Under Practical Philosophy Are The FollowingDocument10 pagesUnder Practical Philosophy Are The FollowingJomar VillenaPas encore d'évaluation

- Jaime Trinidad Percentage TaxDocument3 pagesJaime Trinidad Percentage TaxJomar VillenaPas encore d'évaluation

- Practical Accounting 1Document11 pagesPractical Accounting 1Jomar VillenaPas encore d'évaluation

- SHS Class Record SummaryDocument22 pagesSHS Class Record SummaryJomar VillenaPas encore d'évaluation

- Francis Pamintuan Value Added Tax / Quarterly / Income Tax: JMV Accounting Services Filing of Tax ReturnsDocument3 pagesFrancis Pamintuan Value Added Tax / Quarterly / Income Tax: JMV Accounting Services Filing of Tax ReturnsJomar VillenaPas encore d'évaluation

- Second Quarter Distribution of CardDocument2 pagesSecond Quarter Distribution of CardJomar VillenaPas encore d'évaluation

- Rank Name Signature of Parents General AverageDocument2 pagesRank Name Signature of Parents General AverageJomar VillenaPas encore d'évaluation

- 3rd Quarter 1701q Jimmy TrinidadDocument1 page3rd Quarter 1701q Jimmy TrinidadJomar VillenaPas encore d'évaluation

- List of Students Who Failed in Act 01 Name SectionDocument1 pageList of Students Who Failed in Act 01 Name SectionJomar VillenaPas encore d'évaluation

- COGSDocument4 pagesCOGSJomar VillenaPas encore d'évaluation