Académique Documents

Professionnel Documents

Culture Documents

Taxation Law

Transféré par

Monique Acosta0 évaluation0% ont trouvé ce document utile (0 vote)

38 vues2 pagesAteneo table of contents

Titre original

taxation law

Copyright

© © All Rights Reserved

Formats disponibles

RTF, PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentAteneo table of contents

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme RTF, PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

38 vues2 pagesTaxation Law

Transféré par

Monique AcostaAteneo table of contents

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme RTF, PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 2

ATENEO CENTRAL BAR OPERATIONS 2007

Taxation Law

SUMMER REVIEWER

Chapter I - Additions to the Tax

Chapter II - Crimes, Other Offenses and Forfeitures

Chapter III - Penalties Imposed on Public Officers

Head: Chapter IVJulie Ann

- Other B. Provisions

Penal Domino, Juan J. P. Enriquez III

Part III. Local Government Code of 1991 (R.A. 7160) .......................................................................................90

Understudies: Rachelle T. Sy, Aldwin Mendoza, Timothy John Batan

Part IV. Real Property Taxation ........................................................................................................................101

VALUE-ADDED

Advisers: TAX...........................................................................................................................................107

Atty. Serafin Salvador, Atty. Michael Dana Montero, Atty. Gaudencio

Mendoza

COURT OF TAX APPEALS ................................................................................................................................120

TARRIFS AND CUSTOMS CODE ......................................................................................................................121

TABLE OF CONTENTS

Part I: General Principles ......................................................................................................................................1

Part II: National Internal Revenue Code of 1997 .................................................................................................8

TITLE I: Organization and Function of the Bureau of Internal Revenue ................................................8

TITLE II: Tax on Income.............................................................................................................................11

Chapter I - Definitions

Chapter II - General Principles

Chapter III - Tax on Individuals

Chapter IV - Tax on Corporations

Chapter V - Computation of Taxable Income

Chapter VI - Computation of Gross Income

Chapter VII - Allowable Deductions

Chapter VIII - Accounting Periods and Methods of Accounting

Chapter IX - Returns and Payment of Tax

Chapter X - Estates and Trusts

Chapter XI - Other Income Tax Requirements

Chapter XII - Quarterly Corporate Income Tax

Chapter XIII - Withholding on Wages

TITLE III: Estate and Donor's Taxes .........................................................................................................53

Chapter I - Estate Tax

Chapter II - Donor's Taxes

TITLE VIII: Remedies..................................................................................................................................67

QuickTime and a

QuickTime and

a TIFF (Uncompressed) decompressor

are needed

TIFF (Uncompressed) Chapter I - Remedies in Generalare needed to see this picture.

to see this picture.

decompressor

Chapter II - Civil Remedies for Collection of Taxes

Chapter III - Protesting an Assessment, Refund, etc.

TITLE IX: Compliance Requirements .......................................................................................................85

Chapter I - Keeping Books of Accounts and Records

Chapter II - Administrative Provisions

Chapter III - Rules and Regulations

TITLE X: Statutory Offenses and Penalties .............................................................................................86

Vous aimerez peut-être aussi

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

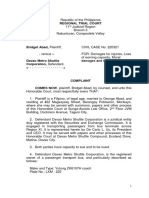

- Complaint For DamagesDocument8 pagesComplaint For DamagesMonique AcostaPas encore d'évaluation

- Writ of HC and AmparoDocument17 pagesWrit of HC and AmparoMonique Acosta100% (1)

- Joint Affidavit of Legitimation: IN WITNESS WHEREOF, We Have Hereunto Set Our Hands This 4th Day of MayDocument2 pagesJoint Affidavit of Legitimation: IN WITNESS WHEREOF, We Have Hereunto Set Our Hands This 4th Day of MayMonique AcostaPas encore d'évaluation

- Contracts Articles 1317-1328Document5 pagesContracts Articles 1317-1328Monique AcostaPas encore d'évaluation

- Internship Confidentiality AgreementDocument5 pagesInternship Confidentiality AgreementMonique AcostaPas encore d'évaluation

- Number Coding Scheme in Baguio CityDocument1 pageNumber Coding Scheme in Baguio CityMonique AcostaPas encore d'évaluation

- Voluntary Blood Donation FinalDocument27 pagesVoluntary Blood Donation FinalMonique AcostaPas encore d'évaluation

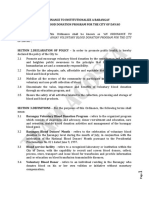

- Resolution For Blood OrdinanceDocument3 pagesResolution For Blood OrdinanceMonique Acosta100% (1)

- Reso For Davao ChamberDocument1 pageReso For Davao ChamberMonique AcostaPas encore d'évaluation

- EO 297 Manufacture of UniformsDocument3 pagesEO 297 Manufacture of UniformsMonique AcostaPas encore d'évaluation

- Halal OrdinanceDocument2 pagesHalal OrdinanceMonique Acosta100% (2)

- Asilo Vs PeopleDocument2 pagesAsilo Vs PeopleMonique AcostaPas encore d'évaluation

- Davao Code of Ordinances PDFDocument242 pagesDavao Code of Ordinances PDFMonique AcostaPas encore d'évaluation

- Ordinance No. 25 Series of 2014-Ordinance Prohibiting Drinking of Alcoholic Beverages in Public Streets Parks and Plazas in ViganDocument2 pagesOrdinance No. 25 Series of 2014-Ordinance Prohibiting Drinking of Alcoholic Beverages in Public Streets Parks and Plazas in ViganMonique Acosta100% (1)

- Revised Guidelines On The Naming and RenamingDocument2 pagesRevised Guidelines On The Naming and RenamingMonique Acosta50% (2)

- Barangay Voluntary Blood Donation Program OrdinanceDocument4 pagesBarangay Voluntary Blood Donation Program OrdinanceMonique Acosta100% (3)

- Fisheries Jurisdiction CaseDocument4 pagesFisheries Jurisdiction CaseMonique AcostaPas encore d'évaluation

- Lim Vs QueenslandDocument3 pagesLim Vs QueenslandMonique AcostaPas encore d'évaluation

- Accessories Specialists Vs AlabanzaDocument2 pagesAccessories Specialists Vs AlabanzaMonique AcostaPas encore d'évaluation

- Prescription CasesDocument5 pagesPrescription CasesMonique AcostaPas encore d'évaluation

- Coastal LetterDocument1 pageCoastal LetterMonique AcostaPas encore d'évaluation

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- The Impact of GST On IndiaDocument8 pagesThe Impact of GST On Indiasahil khanPas encore d'évaluation

- Impact of GST On WholesalerDocument20 pagesImpact of GST On Wholesalerjayesh50% (2)

- GST Management System: A Project Report ONDocument5 pagesGST Management System: A Project Report ONRohit GadekarPas encore d'évaluation

- Office Order-Transfer Benefits FTEDocument1 pageOffice Order-Transfer Benefits FTENandan SarkarPas encore d'évaluation

- 10 Easy Steps To Bir Business Registration and A Complete List of Bir Registration RequirementsDocument6 pages10 Easy Steps To Bir Business Registration and A Complete List of Bir Registration RequirementsJohn ManahanPas encore d'évaluation

- Vodafone Case SummaryDocument3 pagesVodafone Case SummaryShubham NathPas encore d'évaluation

- 2307 NEW PLDTDocument2 pages2307 NEW PLDTdayneblazePas encore d'évaluation

- Smi-Ed vs. Cir - 2016Document2 pagesSmi-Ed vs. Cir - 2016Anny Yanong100% (3)

- 12 CIR vs. Phoenix (GR No. L-19727, May 20, 1965)Document13 pages12 CIR vs. Phoenix (GR No. L-19727, May 20, 1965)Alfred GarciaPas encore d'évaluation

- Aec10 - Business Taxation Solution Tabag CH4Document8 pagesAec10 - Business Taxation Solution Tabag CH4EdeksupligPas encore d'évaluation

- CFS FATCA - & - CRS - Declaration - (Individual) - CDSLDocument1 pageCFS FATCA - & - CRS - Declaration - (Individual) - CDSLAkash AgarwalPas encore d'évaluation

- Introduction To Taxation: Don Honorio Ventura State UniversityDocument18 pagesIntroduction To Taxation: Don Honorio Ventura State UniversityJaypee ManiegoPas encore d'évaluation

- Financial Disclosure Report - Ryan ZinkeDocument4 pagesFinancial Disclosure Report - Ryan ZinkeNBC MontanaPas encore d'évaluation

- Module 1 Financial Planning CalculatorDocument8 pagesModule 1 Financial Planning CalculatorFeme SorianoPas encore d'évaluation

- Information About Moving ExpensesDocument6 pagesInformation About Moving ExpensesSebastien OuelletPas encore d'évaluation

- Tax Remedies QuizzerDocument3 pagesTax Remedies QuizzerCharrie Grace Pablo29% (7)

- Government Budget Notes PDFDocument22 pagesGovernment Budget Notes PDFShivam MutkulePas encore d'évaluation

- Form ITR-V and Acknowledgement FinalDocument4 pagesForm ITR-V and Acknowledgement FinalHarish100% (1)

- H02 - Taxes, Tax Laws and Tax AdministrationDocument10 pagesH02 - Taxes, Tax Laws and Tax Administrationnona galidoPas encore d'évaluation

- Domestice Tax Laws of Uganda (2017 Edition)Document422 pagesDomestice Tax Laws of Uganda (2017 Edition)African Centre for Media Excellence100% (2)

- Burgum Hate Rural AmericaDocument4 pagesBurgum Hate Rural AmericaRob PortPas encore d'évaluation

- VAT and SD Act 2012 EnglishDocument91 pagesVAT and SD Act 2012 EnglishMonjurul HassanPas encore d'évaluation

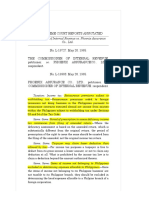

- Revenue Memorandum Circular No. 19-95Document8 pagesRevenue Memorandum Circular No. 19-95Carla GrepoPas encore d'évaluation

- All About Annual Information Statement (AIS)Document79 pagesAll About Annual Information Statement (AIS)NEERAJ MAURYAPas encore d'évaluation

- Z Belay ZewudeDocument102 pagesZ Belay ZewudeamanualPas encore d'évaluation

- Business Taxation - Semester-4Document8 pagesBusiness Taxation - Semester-4Alina ZubairPas encore d'évaluation

- IELTS TASK II Celebrity Earn Too Much MoneyDocument1 pageIELTS TASK II Celebrity Earn Too Much MoneyOo LwinPas encore d'évaluation

- Annexure IV Financial Bid Offer Letter To Be Given by The OwnerDocument2 pagesAnnexure IV Financial Bid Offer Letter To Be Given by The OwneramareshluckyyPas encore d'évaluation

- Employee Details For RazorpayX PayrollDocument8 pagesEmployee Details For RazorpayX PayrollDeepak kumar M RPas encore d'évaluation

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document2 pagesTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Sachin ChadhaPas encore d'évaluation