Académique Documents

Professionnel Documents

Culture Documents

Form No. 10C: (Now Redundant) Audit Report Under Section 80HH of The Income-Tax Act, 1961

Transféré par

Anonymous 2evaoXKKdTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Form No. 10C: (Now Redundant) Audit Report Under Section 80HH of The Income-Tax Act, 1961

Transféré par

Anonymous 2evaoXKKdDroits d'auteur :

Formats disponibles

1

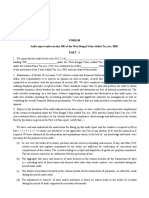

FORM NO. 10C

[See rule 18B]

[Now redundant]

Audit report under section 80HH of the Income-tax Act, 1961

*I/We have examined the balance sheet of the * industrial undertaking/business of hotel styled ** . .and

belonging to M/s as at and the profit and loss account of the said * industrial

undertaking/business of hotel for the year ended on that date which are in agreement with the books of account

maintained at the head office at and branches at

* I/We have obtained all the information and explanations which to the best of * my/our knowledge and belief were

necessary for the purposes of the audit. In * my/our opinion proper books of account have been kept by the head office

and the branches of the * industrial undertaking/business of hotel aforesaid visited by * me/us so far as appears from *

my/our examination of books, and proper returns adequate for the purposes of audit have been received from branches not

visited by * me/us, subject to the comments given below:-

In * my/our opinion and to the best of * my/our information and according to explanations given to * me/us, the said

accounts give a true and fair view __

(i) in the case of the balance sheet of the state of affairs of the abovenamed * industrial undertaking/business of hotel

a s

at ; and

(ii) in the case of the profit and loss account, of the profit or loss of the * industrial undertaking/business of hotel for

the accounting year ending on

Place

Date Signed

Accountant

Notes :

1 *Delete whichever is not applicable.

2 **Here give name and address of the industrial undertaking/business of hotel.

3 This report is to be given by __

(i) a chartered accountant within the meaning of the Chartered Accountants Act, 1949 (38 of 1949); or

(ii) any person who, in relation to any State, is, by virtue of the provisions in sub-section (2) of section 226 of the

Companies Act, 1956 (1 of 1956), entitled to be appointed to act as an auditor of companies registered in that

State.

4. Where any of the matters stated in this report is answered in the negative or with a qualification, the report shall

state the reasons therefor.

Printed from incometaxindia.gov.in

Vous aimerez peut-être aussi

- Form No. 10Cc: (Now Redundant) Audit Report Under Section 80HHA of The Income-Tax Act, 1961Document1 pageForm No. 10Cc: (Now Redundant) Audit Report Under Section 80HHA of The Income-Tax Act, 1961Anonymous 2evaoXKKdPas encore d'évaluation

- Form 10 CDocument1 pageForm 10 CPulkit DhingraPas encore d'évaluation

- Form No. 10ccaa: (Now Redundant) Audit Report Under Section 80HHBA of The Income-Tax Act, 1961Document1 pageForm No. 10ccaa: (Now Redundant) Audit Report Under Section 80HHBA of The Income-Tax Act, 1961busuuuPas encore d'évaluation

- (Now Redundant) : Report Under Section 80HHD of The Income-Tax Act, 1961Document1 page(Now Redundant) : Report Under Section 80HHD of The Income-Tax Act, 1961busuuuPas encore d'évaluation

- Form No. 3aaa (Now Redundant) Audit Report Under Section 32ABDocument4 pagesForm No. 3aaa (Now Redundant) Audit Report Under Section 32ABAnonymous 2evaoXKKdPas encore d'évaluation

- Audit Report Under Section 80HHA of The Income-Tax Act, 1961Document1 pageAudit Report Under Section 80HHA of The Income-Tax Act, 1961Amit BhatiPas encore d'évaluation

- Form No. 3ba: Report Under Section 36 (1) (Xi) of The Income-Tax Act, 1961Document2 pagesForm No. 3ba: Report Under Section 36 (1) (Xi) of The Income-Tax Act, 1961rajdeeppawarPas encore d'évaluation

- Form 3ad: Audit Report Under Section 33ABADocument3 pagesForm 3ad: Audit Report Under Section 33ABARajshree GuptaPas encore d'évaluation

- txtn502 Part2Document21 pagestxtn502 Part2Sandra Mae Cabuenas100% (1)

- Form No. 3ac: Audit Report Under Section 33ABDocument3 pagesForm No. 3ac: Audit Report Under Section 33ABAnonymous 2evaoXKKdPas encore d'évaluation

- Bir Atp MemoDocument10 pagesBir Atp Memobge5Pas encore d'évaluation

- Form 3ad: Audit Report Under Section 33ABADocument3 pagesForm 3ad: Audit Report Under Section 33ABAAnonymous 2evaoXKKdPas encore d'évaluation

- Registration criteria for Virginia tobacco manufacturersDocument2 pagesRegistration criteria for Virginia tobacco manufacturerssriangineyamPas encore d'évaluation

- Report Under Secion 80HHC (4), 80HHC (4a) of The Income-Tax Act, 1961Document2 pagesReport Under Secion 80HHC (4), 80HHC (4a) of The Income-Tax Act, 1961kinnari bhutaPas encore d'évaluation

- Understanding On: Tax Audit U/s 44AB of I.T. ActDocument29 pagesUnderstanding On: Tax Audit U/s 44AB of I.T. Actspchheda4996Pas encore d'évaluation

- Chapter 2 Compliance of Contract Labour Regulation and Abolition Act, 1970 Contract Labour Regulation and Abolition Central Rules 1971 Minimum Wages ADocument17 pagesChapter 2 Compliance of Contract Labour Regulation and Abolition Act, 1970 Contract Labour Regulation and Abolition Central Rules 1971 Minimum Wages APatel BadrishPas encore d'évaluation

- Form No. 3ae: Audit Report Under Section 35D (4) /35E (6) of The Income-Tax Act, 1961Document2 pagesForm No. 3ae: Audit Report Under Section 35D (4) /35E (6) of The Income-Tax Act, 1961Anonymous 2evaoXKKdPas encore d'évaluation

- Manual Book 1770 PDFDocument46 pagesManual Book 1770 PDFHafiedz SPas encore d'évaluation

- 1form No. IoccadDocument1 page1form No. Ioccadkinnari bhutaPas encore d'évaluation

- SEMINAR ON TAX AUDITDocument59 pagesSEMINAR ON TAX AUDITMahendra Kumar SoniPas encore d'évaluation

- Registration, Taxation & Accounting Compliance of Construction IndustryDocument52 pagesRegistration, Taxation & Accounting Compliance of Construction IndustryJohn Erick FernandezPas encore d'évaluation

- For Amo WebinarsDocument79 pagesFor Amo WebinarsLiezl Tizon ColumnasPas encore d'évaluation

- BIR RR 12-2011 Reportorial Requirements For Commercial Leasing BusinessesDocument5 pagesBIR RR 12-2011 Reportorial Requirements For Commercial Leasing BusinessesPilosopo LivePas encore d'évaluation

- BIR Webinar on Primary Registration and Bookkeeping for New Business RegistrantsDocument107 pagesBIR Webinar on Primary Registration and Bookkeeping for New Business RegistrantsEdward Gan100% (1)

- Form No. 10ccaba: Necessary Particulars Are Given HereunderDocument2 pagesForm No. 10ccaba: Necessary Particulars Are Given HereunderbusuuuPas encore d'évaluation

- Tax AuditDocument3 pagesTax AuditForam ShahPas encore d'évaluation

- Revenue Regulations No. 34-2020Document3 pagesRevenue Regulations No. 34-2020zelaynePas encore d'évaluation

- 23aca XBRL CostDocument2 pages23aca XBRL Costcrabrajesh007Pas encore d'évaluation

- Title IxDocument9 pagesTitle IxErica Mae GuzmanPas encore d'évaluation

- New VAT Audit FormatDocument12 pagesNew VAT Audit FormatparulshinyPas encore d'évaluation

- BIR Ruling No. 634-19Document5 pagesBIR Ruling No. 634-19SGPas encore d'évaluation

- 2 Tips & Tricks For MSMEs Tax Compliance Handouts PDFDocument79 pages2 Tips & Tricks For MSMEs Tax Compliance Handouts PDFGetty Reagan DyPas encore d'évaluation

- Audit under Fiscal Laws: Key SectionsDocument17 pagesAudit under Fiscal Laws: Key SectionsabhiPas encore d'évaluation

- Republic of The Philippines Department of FinanceDocument3 pagesRepublic of The Philippines Department of FinanceYna YnaPas encore d'évaluation

- 3CD Ready ReckonerDocument39 pages3CD Ready ReckonerTaxation TaxPas encore d'évaluation

- Rmo 1981Document228 pagesRmo 1981Mary gracePas encore d'évaluation

- Audit Under Fiscal Laws E3Document87 pagesAudit Under Fiscal Laws E3Manogna PPas encore d'évaluation

- Audit Report Form 88Document12 pagesAudit Report Form 88TarifPas encore d'évaluation

- Tax Audit - Sec.44abDocument82 pagesTax Audit - Sec.44absathya300Pas encore d'évaluation

- 1902 For Employee'sDocument8 pages1902 For Employee'sbirtaxinfoPas encore d'évaluation

- PVAT Rules, 2007 With Gazette NotificationDocument54 pagesPVAT Rules, 2007 With Gazette NotificationsaaisunilPas encore d'évaluation

- Income Under The Head Profits and Gains of BusinessDocument4 pagesIncome Under The Head Profits and Gains of Businessatul.maurya0290Pas encore d'évaluation

- Independent Certified Public AccountantDocument10 pagesIndependent Certified Public Accountantmiss independentPas encore d'évaluation

- Circular 12 2019Document3 pagesCircular 12 2019gnmanoj86Pas encore d'évaluation

- Atlas Consolidated Mining v. CirDocument2 pagesAtlas Consolidated Mining v. CirImmah Santos100% (1)

- Checklist Department of Labour LawDocument19 pagesChecklist Department of Labour LawPrateek VermaPas encore d'évaluation

- Taxation Laws - Ms. de CastroDocument54 pagesTaxation Laws - Ms. de CastroCC100% (1)

- Government Accounting ManualDocument10 pagesGovernment Accounting ManualRyan DberkyPas encore d'évaluation

- RMC No. 24-2022Document13 pagesRMC No. 24-2022arnulfojr hicoPas encore d'évaluation

- (VAT) in To: Clarifying (RR) No. The The Tax of (TaxDocument13 pages(VAT) in To: Clarifying (RR) No. The The Tax of (TaxShiela Marie Maraon100% (1)

- Who Are Not Required To File Income Tax ReturnsDocument2 pagesWho Are Not Required To File Income Tax ReturnsCarolina VillenaPas encore d'évaluation

- FORM - 704: Audit Report Under Section 61 of The Maharashtra Value Added Tax Act, 2002, Part - 1Document26 pagesFORM - 704: Audit Report Under Section 61 of The Maharashtra Value Added Tax Act, 2002, Part - 1S Kumar SharmaPas encore d'évaluation

- Form A Capital Gains Account Scheme ApplicationDocument4 pagesForm A Capital Gains Account Scheme ApplicationPrajesh SrivastavaPas encore d'évaluation

- Revenue Memorandum 23-2012Document2 pagesRevenue Memorandum 23-2012Ruth CepePas encore d'évaluation

- Manual Return Ty 2017Document56 pagesManual Return Ty 2017Muhammad RizwanPas encore d'évaluation

- Income-Tax Rules, 1962: Form No.29BDocument5 pagesIncome-Tax Rules, 1962: Form No.29Bjack sonPas encore d'évaluation

- Provisions of Companies Act 1956 FinalDocument9 pagesProvisions of Companies Act 1956 FinalDiwahar Sunder100% (1)

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisD'EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisPas encore d'évaluation

- Sem 3 Malacca Itinerary - W Tutorial HoursDocument1 pageSem 3 Malacca Itinerary - W Tutorial HoursAnonymous 2evaoXKKdPas encore d'évaluation

- May05 121 Musick Air AsiaDocument6 pagesMay05 121 Musick Air AsiaAnonymous 2evaoXKKdPas encore d'évaluation

- Itr62form 64dDocument2 pagesItr62form 64dAnonymous 2evaoXKKdPas encore d'évaluation

- Itr62form 64cDocument1 pageItr62form 64cAnonymous 2evaoXKKdPas encore d'évaluation

- Income tax form for individuals without PANDocument5 pagesIncome tax form for individuals without PANHarit KumarPas encore d'évaluation

- Itr 62 Form 64 BDocument2 pagesItr 62 Form 64 BAnonymous 2evaoXKKdPas encore d'évaluation

- Volume 2 - Supply Chain Management PDFDocument18 pagesVolume 2 - Supply Chain Management PDFAnonymous 2evaoXKKdPas encore d'évaluation

- The Big Brown Fox Jumps Over The Lazy DogDocument1 pageThe Big Brown Fox Jumps Over The Lazy DogAnonymous 2evaoXKKdPas encore d'évaluation

- 2016 APAC Fit-Out Cost Guide - Occupier ProjectsDocument26 pages2016 APAC Fit-Out Cost Guide - Occupier ProjectsSkywardFire100% (1)

- Itr62form 64cDocument1 pageItr62form 64cAnonymous 2evaoXKKdPas encore d'évaluation

- Itr62form 64c PDFDocument1 pageItr62form 64c PDFAnonymous 2evaoXKKdPas encore d'évaluation

- Income-Tax Rules, 1962Document2 pagesIncome-Tax Rules, 1962Anonymous 2evaoXKKdPas encore d'évaluation

- "Formno.64A Statementofincomedistributed by A Business Trust Tobefurnishedundersection115Uaoftheincome-Taxact, 1961 1. 2. 3. 4. 5. 6Document3 pages"Formno.64A Statementofincomedistributed by A Business Trust Tobefurnishedundersection115Uaoftheincome-Taxact, 1961 1. 2. 3. 4. 5. 6Anonymous 2evaoXKKdPas encore d'évaluation

- Income-Tax Rules APA ApplicationDocument8 pagesIncome-Tax Rules APA ApplicationAnonymous 2evaoXKKdPas encore d'évaluation

- Printed From WWW - Incometaxindia.gov - in Page 1 of 2Document2 pagesPrinted From WWW - Incometaxindia.gov - in Page 1 of 2gupta_gk4uPas encore d'évaluation

- Place - Signature of The Principal Officer of The Recognised Association - Date - Name and DesignationDocument2 pagesPlace - Signature of The Principal Officer of The Recognised Association - Date - Name and DesignationAnonymous 2evaoXKKdPas encore d'évaluation

- Income-tax rules form for tax payment requestDocument1 pageIncome-tax rules form for tax payment requestAnonymous 2evaoXKKdPas encore d'évaluation

- Place - Signature of The Principal Officer of The Recognised Association - Date - Name and DesignationDocument2 pagesPlace - Signature of The Principal Officer of The Recognised Association - Date - Name and DesignationAnonymous 2evaoXKKdPas encore d'évaluation

- Place - Signature of The Principal Officer of The Recognised Association - Date - Name and DesignationDocument2 pagesPlace - Signature of The Principal Officer of The Recognised Association - Date - Name and DesignationAnonymous 2evaoXKKdPas encore d'évaluation

- Form No. 3ac: Audit Report Under Section 33ABDocument3 pagesForm No. 3ac: Audit Report Under Section 33ABAnonymous 2evaoXKKdPas encore d'évaluation

- Form No. 3ba: Report Under Section 36 (1) (Xi) of The Income-Tax Act, 1961Document2 pagesForm No. 3ba: Report Under Section 36 (1) (Xi) of The Income-Tax Act, 1961rajdeeppawarPas encore d'évaluation

- Section 32 Deduction Claim FormDocument2 pagesSection 32 Deduction Claim FormAnonymous 2evaoXKKdPas encore d'évaluation

- Form No. 3ae: Audit Report Under Section 35D (4) /35E (6) of The Income-Tax Act, 1961Document2 pagesForm No. 3ae: Audit Report Under Section 35D (4) /35E (6) of The Income-Tax Act, 1961Anonymous 2evaoXKKdPas encore d'évaluation

- Document 3456789 summaryDocument3 pagesDocument 3456789 summaryJoão Israel FerreiraPas encore d'évaluation

- Form 3ad: Audit Report Under Section 33ABADocument3 pagesForm 3ad: Audit Report Under Section 33ABAAnonymous 2evaoXKKdPas encore d'évaluation

- For Persons: (See Rule 12 (1) (D) of Income-Tax Rules, 1962)Document4 pagesFor Persons: (See Rule 12 (1) (D) of Income-Tax Rules, 1962)Anonymous 2evaoXKKdPas encore d'évaluation

- (See Rule 12 (1A) of Income-Tax Rules, 1962) : Form No. 2B Return of Income For Block Assessment ITS-2BDocument14 pages(See Rule 12 (1A) of Income-Tax Rules, 1962) : Form No. 2B Return of Income For Block Assessment ITS-2BDaniel C MohanPas encore d'évaluation

- l4 U3 GR 4 Math Subtract With Standard Algorithm 1718 FinalDocument18 pagesl4 U3 GR 4 Math Subtract With Standard Algorithm 1718 Finalapi-377862928Pas encore d'évaluation

- Alasdair MacIntyre, Daniel Callahan, H. Tristram Engelhardt Jr. (Eds.) - The Roots of Ethics. Science, Religion and Values. (1981) PDFDocument452 pagesAlasdair MacIntyre, Daniel Callahan, H. Tristram Engelhardt Jr. (Eds.) - The Roots of Ethics. Science, Religion and Values. (1981) PDFCastulinCastulin100% (6)

- L3 Blooms TaxonomyDocument29 pagesL3 Blooms TaxonomyDhanya.S.LakshmiPas encore d'évaluation

- Amour-Propre (Self-Love That Can Be Corrupted) : Student - Feedback@sti - EduDocument3 pagesAmour-Propre (Self-Love That Can Be Corrupted) : Student - Feedback@sti - EduFranchezka Ainsley AfablePas encore d'évaluation

- 5.2 Hedstrom & Ylikoski (2010), Causal Mechanisms in The Social SciencesDocument22 pages5.2 Hedstrom & Ylikoski (2010), Causal Mechanisms in The Social SciencesBuny2014Pas encore d'évaluation

- Understanding Social Enterprise - Theory and PracticeDocument8 pagesUnderstanding Social Enterprise - Theory and PracticeRory Ridley Duff100% (5)

- Se QBDocument6 pagesSe QBpriyajv14Pas encore d'évaluation

- Artigo 1 - XavierDocument16 pagesArtigo 1 - XavierAndre TramontinPas encore d'évaluation

- PGD 102Document8 pagesPGD 102Nkosana NgwenyaPas encore d'évaluation

- Proceedings Atee 2008 FinalDocument350 pagesProceedings Atee 2008 FinalRuel LlagosoPas encore d'évaluation

- Chapter I The Self From Various PersDocument45 pagesChapter I The Self From Various PersMavyPas encore d'évaluation

- Phrasal VerbsDocument4 pagesPhrasal VerbsAnonymous Ix2FQhPas encore d'évaluation

- 2009 - Ingrid Johanne Moen - Marriage and Divorce in The Herodian Family. A Case Study of Diversity in Late Second Temple JudaismDocument385 pages2009 - Ingrid Johanne Moen - Marriage and Divorce in The Herodian Family. A Case Study of Diversity in Late Second Temple Judaismbuster301168Pas encore d'évaluation

- Audit Report Summary and ConclusionDocument13 pagesAudit Report Summary and ConclusionSunday OluwolePas encore d'évaluation

- Does Death Provide Meaning to Life? Exploring the Role of MortalityDocument20 pagesDoes Death Provide Meaning to Life? Exploring the Role of MortalityValeriu GherghelPas encore d'évaluation

- Salon Business Lesson PlanDocument3 pagesSalon Business Lesson Planapi-305903882100% (2)

- Organisational Justice Climate, Social Capital and Firm PerformanceDocument16 pagesOrganisational Justice Climate, Social Capital and Firm PerformanceAnonymous YSA8CZ0Tz5Pas encore d'évaluation

- Darfting and Pleading SlidesDocument29 pagesDarfting and Pleading Slidesbik11111Pas encore d'évaluation

- Boling - Literary Analysis of Judges 13Document9 pagesBoling - Literary Analysis of Judges 13Michael Boling100% (1)

- Presuppositional Apologetics Paper 2412Document4 pagesPresuppositional Apologetics Paper 2412Amy Green BradleyPas encore d'évaluation

- Ancient Civilization Brochure RubricDocument1 pageAncient Civilization Brochure Rubricapi-359761811Pas encore d'évaluation

- Reactivate Test Book Answers KeyDocument2 pagesReactivate Test Book Answers KeyCintia Andreea100% (1)

- Author's Accepted Manuscript: Journal of BiomechanicsDocument11 pagesAuthor's Accepted Manuscript: Journal of BiomechanicsseyedmohamadPas encore d'évaluation

- Sanskrit Vol1Document203 pagesSanskrit Vol1ngc1729100% (7)

- Session 1 Session 2 Session 3 Session 4: School Grade Level Teacher Learning Area Teaching Dates and Time QuarterDocument4 pagesSession 1 Session 2 Session 3 Session 4: School Grade Level Teacher Learning Area Teaching Dates and Time QuarterValerie Cruz - Ocampo100% (1)

- (Posco) The Protection of Children From Sexual Offences Act, 2012.Document34 pages(Posco) The Protection of Children From Sexual Offences Act, 2012.anirudha joshiPas encore d'évaluation

- Safety Management and Risk Modelling in AviationDocument254 pagesSafety Management and Risk Modelling in AviationSp AndaPas encore d'évaluation

- Middle Managers Role in Strategy ImplementationDocument20 pagesMiddle Managers Role in Strategy Implementationrajivsharma79Pas encore d'évaluation

- A Sample Case Analysis For OB-IDocument3 pagesA Sample Case Analysis For OB-IKunal DesaiPas encore d'évaluation

- Vilfredo Pareto - The Mind and Society. 2-Jonathan Cape Ltd. (1935) PDFDocument392 pagesVilfredo Pareto - The Mind and Society. 2-Jonathan Cape Ltd. (1935) PDFAnonymous r3ZlrnnHcPas encore d'évaluation