Académique Documents

Professionnel Documents

Culture Documents

Reliance Vision Fund

Transféré par

Yogi173Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Reliance Vision Fund

Transféré par

Yogi173Droits d'auteur :

Formats disponibles

Report as of 22 Dec 2017

Reliance Vision Fund - Bonus

Morningstar® Category Morningstar® Benchmark Fund Benchmark Morningstar Rating™

Flexicap S&P BSE 500 India INR S&P BSE 100 India INR QQ

Used throughout report

Investment Objective Performance

The primary investment objective of the Scheme is to

30,000

achieve long term growth of capital by investing in

25,000

equity and equity related securities through a research

based investment approach. However, there can be no 20,000

assurance that the investment objective of the Scheme 15,000

will be realized, as actual market movements may be 10,000

at variance with anticipated trends.

2012 2013 2014 2015 2016 2017-11

29.96 -0.32 60.52 -2.19 3.95 36.85 Fund

31.20 3.25 36.96 -0.82 3.78 31.32 Benchmark

31.79 2.19 53.87 3.91 5.38 32.67 Category

Risk Measures Trailing Returns % Fund Bmark Cat Quarterly Returns % Q1 Q2 Q3 Q4

3Y Alpha 0.85 3Y Sharpe Ratio 0.50 3 Months 8.71 5.21 6.28 2017 12.25 7.08 4.27 -

3Y Beta 1.03 3Y Std Dev 14.93 6 Months 16.55 11.26 12.69 2016 -2.08 5.43 5.39 -4.46

3Y R-Squared 90.22 3Y Risk Avg 1 Year 41.05 36.09 37.51 2015 5.20 -4.00 -3.86 0.73

3Y Info Ratio 0.21 5Y Risk abv avg 3 Years Annualised 13.37 12.02 15.04 2014 10.30 25.47 5.51 9.93

3Y Tracking Error 4.70 10Y Risk Avg 5 Years Annualised 18.46 14.65 18.81 2013 -11.98 4.07 -8.08 18.37

Calculations use S&P BSE 500 India INR (where applicable)

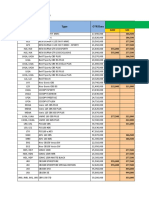

Portfolio 30/11/2017

Asset Allocation % Net Equity Style Box™ Mkt Cap % Fund America Europe Asia

Stocks 97.26 Giant 46.40

Large Mid

Size

Bonds 0.00 Large 38.48

Cash 2.74 Medium 10.79

Other 0.00 Small 4.32

Small

Value Blend Growth Micro 0.00

Style

Average Mkt Cap Fund

(Mil)

Ave Mkt Cap INR 759,966. <25 25-50 50-75 >75

47

Top Holdings Stock Sector Weightings % Fund World Regions % Fund

Holding Name Sector %

h Cyclical 63.87 Americas 0.00

State Bank of India y 9.87 r Basic Materials 13.45 United States 0.00

Tata Steel Ltd r 8.50 t Consumer Cyclical 21.01 Canada 0.00

TVS Motor Co Ltd t 8.25 y Financial Services 29.42 Latin America 0.00

ICICI Bank Ltd y 7.70 u Real Estate - Greater Europe 0.00

Tata Motors Ltd t 6.00

j Sensitive 29.25 United Kingdom 0.00

Infosys Ltd a 5.74 i Communication Services 4.42 Eurozone 0.00

HDFC Bank Ltd y 5.48 o Energy 1.80 Europe - ex Euro 0.00

Honeywell Automation India Ltd p 4.72 p Industrials 14.48 Europe - Emerging 0.00

Bharti Airtel Ltd i 4.21 a Technology 8.55 Africa 0.00

Bharat Forge Ltd t 4.01 Middle East 0.00

k Defensive 6.87

Assets in Top 10 Holdings % 64.49 s Consumer Defensive 2.64 Greater Asia 100.00

Total Number of Equity Holdings 32 d Healthcare 2.76 Japan 0.00

Total Number of Bond Holdings 0 f Utilities 1.47 Australasia 0.00

Asia - Developed 0.00

Asia - Emerging 100.00

Operations

Fund Company Reliance Nippon Life Asset Share Class Size (mil) - Minimum Initial Purchase 5,000 INR

Management Ltd Domicile India Minimum Additional Purchase 1,000 INR

Phone +91 22 Currency INR Exit Load - - > years

30994600/30301111 UCITS - Expense Ratio 2.02%

Website www.reliancemutual.com Inc/Acc Inc

Inception Date 08/10/1995 ISIN INF204K01398

Manager Name Ashwani Kumar

Manager Start Date 01/06/2003

NAV (21/12/2017) INR 104.03

Total Net Assets (mil) 35,936.30 INR

(30/11/2017)

© 2017 Morningstar. All Rights Reserved. The information, data, analyses and opinions (“Information”) contained herein: (1) include the proprietary information of Morningstar and Morningstar’s third party licensors; (2) may ®

not be copied or redistributed except as specifically authorised;(3) do not constitute investment advice;(4) are provided solely for informational purposes; (5) are not warranted to be complete, accurate or timely; and (6) may

be drawn from fund data published on various dates. Morningstar is not responsible for any trading decisions, damages or other losses related to the Information or its use. Please verify all of the Information before using it

ß

and don’t make any investment decision except upon the advice of a professional financial adviser. Past performance is no guarantee of future results. The value and income derived from investments may go down as well

as up.

Vous aimerez peut-être aussi

- Morningstarreport Quant ActiveDocument1 pageMorningstarreport Quant Activeritvik singh rautelaPas encore d'évaluation

- Morning Star Report 20190726102505Document1 pageMorning Star Report 20190726102505YumyumPas encore d'évaluation

- Axis Bluechip FundDocument1 pageAxis Bluechip Fundarian2026Pas encore d'évaluation

- Quant Focused Fund Growth Option Direct Plan: H R T y UDocument1 pageQuant Focused Fund Growth Option Direct Plan: H R T y UYogi173Pas encore d'évaluation

- Morningstarreport 20230114061338Document1 pageMorningstarreport 20230114061338hkratheePas encore d'évaluation

- ICICI Prudential Value Discovery Fund GrowthDocument1 pageICICI Prudential Value Discovery Fund GrowthYogi173Pas encore d'évaluation

- Morning Star Report 20190720091758Document1 pageMorning Star Report 20190720091758YumyumPas encore d'évaluation

- UTI Equity Fund Growth: y y y y y H R T y UDocument1 pageUTI Equity Fund Growth: y y y y y H R T y UYogi173Pas encore d'évaluation

- Morningstarreport20230426061738 PDFDocument1 pageMorningstarreport20230426061738 PDFmaahirPas encore d'évaluation

- Morning Star Report 20190726102131Document1 pageMorning Star Report 20190726102131YumyumPas encore d'évaluation

- Morning Star Report 20230811063830Document1 pageMorning Star Report 20230811063830ishaniagheraPas encore d'évaluation

- Morning Star Report 20190726102102Document1 pageMorning Star Report 20190726102102YumyumPas encore d'évaluation

- Morningstarreport20221024033540 PGIMINDIA MIDOPPDocument2 pagesMorningstarreport20221024033540 PGIMINDIA MIDOPPNiaz Abdul KarimPas encore d'évaluation

- Morning Star Report 20190726101827Document1 pageMorning Star Report 20190726101827SunPas encore d'évaluation

- Morning Star Report 20190726102823Document1 pageMorning Star Report 20190726102823YumyumPas encore d'évaluation

- Morning Star Report 20190726102049Document1 pageMorning Star Report 20190726102049YumyumPas encore d'évaluation

- DSP Smallcap Closed Morningstarreport20180402100029Document1 pageDSP Smallcap Closed Morningstarreport20180402100029shareonline2010Pas encore d'évaluation

- Axis Focused 25 FundDocument1 pageAxis Focused 25 FundYogi173Pas encore d'évaluation

- HDFC Fact SheetDocument1 pageHDFC Fact SheetAdityaPas encore d'évaluation

- Morning Star Report 20190726102322Document1 pageMorning Star Report 20190726102322YumyumPas encore d'évaluation

- Aditya Birla Sun Life Short Term Fund Regular Plan Growth: Interest Rate SensitivityDocument1 pageAditya Birla Sun Life Short Term Fund Regular Plan Growth: Interest Rate SensitivityVijay ChandranPas encore d'évaluation

- Morningstarreport20221024033734 Canara Robeco SmallDocument1 pageMorningstarreport20221024033734 Canara Robeco SmallNiaz Abdul KarimPas encore d'évaluation

- Morning Star Report 20190726102634Document1 pageMorning Star Report 20190726102634YumyumPas encore d'évaluation

- Morning Star Report 20190726102710Document1 pageMorning Star Report 20190726102710YumyumPas encore d'évaluation

- Morningstarreport 20231123045134Document1 pageMorningstarreport 20231123045134SHUBHAM STAR PatilPas encore d'évaluation

- Nippon India Low Duration FundDocument1 pageNippon India Low Duration FundYogi173Pas encore d'évaluation

- Kotak Bond Growth Direct: Interest Rate SensitivityDocument1 pageKotak Bond Growth Direct: Interest Rate SensitivityYogi173Pas encore d'évaluation

- L&T Equity Fund GrowthDocument1 pageL&T Equity Fund GrowthYogi173Pas encore d'évaluation

- HDFC Children Gift FundDocument1 pageHDFC Children Gift FundYogi173Pas encore d'évaluation

- BOI AXA Equity FundDocument1 pageBOI AXA Equity FundYogi173Pas encore d'évaluation

- SundaramDocument1 pageSundaramYogi173Pas encore d'évaluation

- Axis Long Term Equity Fund Direct Plan Growth Option: y y y R y T y T y H R T y UDocument1 pageAxis Long Term Equity Fund Direct Plan Growth Option: y y y R y T y T y H R T y Ukishore13Pas encore d'évaluation

- Essel Regular Savings Fund GrowthDocument1 pageEssel Regular Savings Fund GrowthYogi173Pas encore d'évaluation

- Morning Star Report 20190725103353Document1 pageMorning Star Report 20190725103353SunPas encore d'évaluation

- Morning Star Report 20190725103333Document1 pageMorning Star Report 20190725103333SunPas encore d'évaluation

- Morningstarreport 20230812042222Document1 pageMorningstarreport 20230812042222Anal ShahPas encore d'évaluation

- BOI AXA Equity Fund Regular BonusDocument1 pageBOI AXA Equity Fund Regular BonusYogi173Pas encore d'évaluation

- Morningstarreport 20231222043231Document1 pageMorningstarreport 20231222043231vinodPas encore d'évaluation

- Morningstarreport 20230327061731Document1 pageMorningstarreport 20230327061731arian2026Pas encore d'évaluation

- Parag Parikh Long TermDocument1 pageParag Parikh Long TermYogi173Pas encore d'évaluation

- Morning Star Report 20190720091802Document1 pageMorning Star Report 20190720091802Chaitanya VyasPas encore d'évaluation

- Aditya Birla DigitalDocument1 pageAditya Birla DigitalankitPas encore d'évaluation

- Morning Star Report 20190726102135Document1 pageMorning Star Report 20190726102135YumyumPas encore d'évaluation

- Morning Star Report 20190726102715Document1 pageMorning Star Report 20190726102715YumyumPas encore d'évaluation

- Morning Star Report 20190726102724Document1 pageMorning Star Report 20190726102724YumyumPas encore d'évaluation

- Morning Star Report 20190726102609Document1 pageMorning Star Report 20190726102609YumyumPas encore d'évaluation

- Morning Star Report 20190726102118Document1 pageMorning Star Report 20190726102118YumyumPas encore d'évaluation

- Morning Star Report 20190726102105Document1 pageMorning Star Report 20190726102105YumyumPas encore d'évaluation

- Morning Star Report 20190726102621Document1 pageMorning Star Report 20190726102621YumyumPas encore d'évaluation

- Morning Star Report 20190726102150Document1 pageMorning Star Report 20190726102150YumyumPas encore d'évaluation

- Morning Star Report 20190720091713Document1 pageMorning Star Report 20190720091713SunPas encore d'évaluation

- Morning Star Report 20190726101759Document1 pageMorning Star Report 20190726101759SunPas encore d'évaluation

- BNP Paribas Short Term Fund Direct Plan Weekly Dividend Payout OptionDocument1 pageBNP Paribas Short Term Fund Direct Plan Weekly Dividend Payout OptionSunPas encore d'évaluation

- Morning Star Report 20190725103110Document1 pageMorning Star Report 20190725103110SunPas encore d'évaluation

- Morning Star Report 20190720091725Document1 pageMorning Star Report 20190720091725SunPas encore d'évaluation

- Morning Star Report 20190725103125Document1 pageMorning Star Report 20190725103125SunPas encore d'évaluation

- Morning Star Report 20190720091722Document1 pageMorning Star Report 20190720091722SunPas encore d'évaluation

- Morning Star Report 20190726102129Document1 pageMorning Star Report 20190726102129YumyumPas encore d'évaluation

- Quant Multi Asset FundDocument1 pageQuant Multi Asset Fundarian2026Pas encore d'évaluation

- The Basel Ii "Use Test" - a Retail Credit Approach: Developing and Implementing Effective Retail Credit Risk Strategies Using Basel IiD'EverandThe Basel Ii "Use Test" - a Retail Credit Approach: Developing and Implementing Effective Retail Credit Risk Strategies Using Basel IiPas encore d'évaluation

- Nippon India Silver ETF Fund of Fund (FOF) Direct GrowthDocument1 pageNippon India Silver ETF Fund of Fund (FOF) Direct GrowthYogi173Pas encore d'évaluation

- Kotak Global Innovation Fund of Fund Direct Growth: H R T y UDocument2 pagesKotak Global Innovation Fund of Fund Direct Growth: H R T y UYogi173Pas encore d'évaluation

- Anchor Intimation-LetterDocument6 pagesAnchor Intimation-LetterManthan PatelPas encore d'évaluation

- Aditya Birla Sun Life Silver ETF Fund of Fund Direct GrowthDocument1 pageAditya Birla Sun Life Silver ETF Fund of Fund Direct GrowthYogi173Pas encore d'évaluation

- ICICI Prudential NASDAQ 100 Index Fund Direct Growth: H R T y UDocument1 pageICICI Prudential NASDAQ 100 Index Fund Direct Growth: H R T y UYogi173Pas encore d'évaluation

- Shipham Special Alloy ValvesDocument62 pagesShipham Special Alloy ValvesYogi173Pas encore d'évaluation

- Morningstarreport 20220317032219Document1 pageMorningstarreport 20220317032219Yogi173Pas encore d'évaluation

- Morningstarreport 20220317031934Document1 pageMorningstarreport 20220317031934Yogi173Pas encore d'évaluation

- Morningstarreport 20220317034508Document1 pageMorningstarreport 20220317034508Yogi173Pas encore d'évaluation

- Red Herring ProspectusDocument351 pagesRed Herring ProspectusYogi173Pas encore d'évaluation

- Morningstarreport 20220317034204Document1 pageMorningstarreport 20220317034204Yogi173Pas encore d'évaluation

- Morningstarreport 20220317030236Document1 pageMorningstarreport 20220317030236Yogi173Pas encore d'évaluation

- Press Release Dhampur Sugar Mills Limited: Details of Instruments/facilities in Annexure-1Document5 pagesPress Release Dhampur Sugar Mills Limited: Details of Instruments/facilities in Annexure-1Yogi173Pas encore d'évaluation

- V-Guard Industries - R - 10052019Document8 pagesV-Guard Industries - R - 10052019Yogi173Pas encore d'évaluation

- Aries Agro Ratings Reaffirmed and Withdrawn at RequestDocument4 pagesAries Agro Ratings Reaffirmed and Withdrawn at RequestYogi173Pas encore d'évaluation

- ERIS LIFESCIENCES Q1 EARNINGS REVIEWDocument6 pagesERIS LIFESCIENCES Q1 EARNINGS REVIEWYogi173Pas encore d'évaluation

- Jyothy Labs Limited: Rating Reaffirmed: Summary of Rating ActionDocument7 pagesJyothy Labs Limited: Rating Reaffirmed: Summary of Rating ActionYogi173Pas encore d'évaluation

- Alkali Metals Limited: Instrument Amount in Rs. Crore Rating ActionDocument3 pagesAlkali Metals Limited: Instrument Amount in Rs. Crore Rating ActionYogi173Pas encore d'évaluation

- Climate Change and Extreme Weather Events - Implications For FoodDocument16 pagesClimate Change and Extreme Weather Events - Implications For FoodYogi173Pas encore d'évaluation

- Alkali Metals Limited - R - 26112020Document7 pagesAlkali Metals Limited - R - 26112020Yogi173Pas encore d'évaluation

- ASM Technologies Limited-R-30082019Document7 pagesASM Technologies Limited-R-30082019Yogi173Pas encore d'évaluation

- Covid-19 Related Item - : - Inj. Itolizumab (100mg)Document50 pagesCovid-19 Related Item - : - Inj. Itolizumab (100mg)Yogi173Pas encore d'évaluation

- Corporate Banking TipsDocument1 pageCorporate Banking TipsYogi173Pas encore d'évaluation

- Piston ValvesDocument20 pagesPiston ValvesYogi173Pas encore d'évaluation

- PermenPUPR27 2016 Penyelenggraan SPAMDocument3 pagesPermenPUPR27 2016 Penyelenggraan SPAMferry ferdiansyah pradanaPas encore d'évaluation

- Toothbrushes - Covid 19 April 2020Document2 pagesToothbrushes - Covid 19 April 2020Yogi173Pas encore d'évaluation

- Axis Special Situations Fund Direct GrowthDocument1 pageAxis Special Situations Fund Direct GrowthYogi173Pas encore d'évaluation

- Citizen Registration and Appointment For Vaccination User ManualDocument14 pagesCitizen Registration and Appointment For Vaccination User ManualSahilPas encore d'évaluation

- 1 PDFDocument9 pages1 PDFYogi173Pas encore d'évaluation

- Yoga Class PrayerDocument1 pageYoga Class PrayerChandu KanthPas encore d'évaluation

- Solved MCQ of Computer Security Set - 1Document4 pagesSolved MCQ of Computer Security Set - 1MohammedPas encore d'évaluation

- Basic Writing Skills ModuleDocument77 pagesBasic Writing Skills ModuleDaniel HailuPas encore d'évaluation

- Spray Dryer ExperimentDocument17 pagesSpray Dryer Experimentdrami94100% (7)

- Process Maps and Turtle DiagramsDocument1 pageProcess Maps and Turtle Diagramskyle1991100% (1)

- LAB REPORT 2-HINGED ARCH (Reference)Document11 pagesLAB REPORT 2-HINGED ARCH (Reference)jajenPas encore d'évaluation

- DRT, Drat & Sarfaesi Act (2002Document17 pagesDRT, Drat & Sarfaesi Act (2002Mayank DandotiyaPas encore d'évaluation

- Stewart Paul Lucky Luke and Other Very Short Stories With ExDocument111 pagesStewart Paul Lucky Luke and Other Very Short Stories With ExЕлена Сидлаковская100% (1)

- List of CasesDocument7 pagesList of CasesKersey BadocdocPas encore d'évaluation

- 0273C1 PDFDocument2 pages0273C1 PDFLe Thanh HaiPas encore d'évaluation

- Biology of KundaliniDocument591 pagesBiology of KundaliniMaureen Shoe100% (24)

- Glenn GreenbergDocument3 pagesGlenn Greenbergannsusan21Pas encore d'évaluation

- McKinsey & Company Managing Knowledge & LearningDocument3 pagesMcKinsey & Company Managing Knowledge & LearningWidya Wardani100% (2)

- Benefits of Group Discussion as a Teaching MethodDocument40 pagesBenefits of Group Discussion as a Teaching MethodSweety YadavPas encore d'évaluation

- Software House C CURE 9000 v2.90: - Security and Event Management SystemDocument5 pagesSoftware House C CURE 9000 v2.90: - Security and Event Management SystemANDRES MORAPas encore d'évaluation

- Reciprocating - Pump - Lab Manual Ms WordDocument10 pagesReciprocating - Pump - Lab Manual Ms WordSandeep SainiPas encore d'évaluation

- Manual Crestere Capre PDFDocument161 pagesManual Crestere Capre PDFMarian MihalachePas encore d'évaluation

- Heat Round Grade 2 HKIMO: Part I: Logical ThinkingDocument6 pagesHeat Round Grade 2 HKIMO: Part I: Logical ThinkingThu Thủy NguyễnPas encore d'évaluation

- ACEE 7: Logic Circuits and Switching Theory: Logic Circuit Design On NI MultisimDocument7 pagesACEE 7: Logic Circuits and Switching Theory: Logic Circuit Design On NI MultisimJaypee100% (1)

- PYZ IT StrategyDocument56 pagesPYZ IT StrategyBen Van Neste100% (1)

- Asmo Kilo - PL Area BPP Juni 2023 v1.0 - OKDocument52 pagesAsmo Kilo - PL Area BPP Juni 2023 v1.0 - OKasrulPas encore d'évaluation

- 2008-09 Mapex Marching DrumsDocument12 pages2008-09 Mapex Marching DrumsAlberto MarasmaPas encore d'évaluation

- Hubungan Kelimpahan Dan Keanekaragaman Fitoplankton Dengan Kelimpahan Dan Keanekaragaman Zooplankton Di Perairan Pulau Serangan, BaliDocument12 pagesHubungan Kelimpahan Dan Keanekaragaman Fitoplankton Dengan Kelimpahan Dan Keanekaragaman Zooplankton Di Perairan Pulau Serangan, BaliRirisPas encore d'évaluation

- Leadership EPaper 6th December 2023Document40 pagesLeadership EPaper 6th December 2023yasabtech.ngPas encore d'évaluation

- 20 - Technical Data & FormulationsDocument11 pages20 - Technical Data & FormulationsSnzy DelPas encore d'évaluation

- Our Solar System Lesson PlanDocument20 pagesOur Solar System Lesson PlanDean EqualPas encore d'évaluation

- 978 0 387 95864 4Document2 pages978 0 387 95864 4toneiamPas encore d'évaluation

- BMM Cements LTD., Bharat Mines & Minerals, Gudipadu Cement Plant, GudipaduDocument2 pagesBMM Cements LTD., Bharat Mines & Minerals, Gudipadu Cement Plant, GudipaduDeepak Kumar PalPas encore d'évaluation

- Germination DiscussionDocument3 pagesGermination DiscussionMay Lacdao100% (1)

- TemperatureDocument5 pagesTemperatureEltierry SoaresPas encore d'évaluation

- Regional Rural Banks RRBsDocument11 pagesRegional Rural Banks RRBsChintan PandyaPas encore d'évaluation