Académique Documents

Professionnel Documents

Culture Documents

Answers of Sheet Two: Answer 1

Transféré par

musicslave960 évaluation0% ont trouvé ce document utile (0 vote)

4 vues4 pagesThe document contains answers to questions on a sheet. Answer 3 calculates the weighted average cost of capital (WACC) for a company with different capital structures, finding a WACC of 10.13% for existing common stock and 10.715% for new issues of common stock. Answer 4 calculates WACC based on the market value of different sources of capital, finding a WACC of 10.8437%.

Description originale:

Finance

Titre original

Answer of Sheet 2

Copyright

© © All Rights Reserved

Formats disponibles

DOCX, PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentThe document contains answers to questions on a sheet. Answer 3 calculates the weighted average cost of capital (WACC) for a company with different capital structures, finding a WACC of 10.13% for existing common stock and 10.715% for new issues of common stock. Answer 4 calculates WACC based on the market value of different sources of capital, finding a WACC of 10.8437%.

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme DOCX, PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

4 vues4 pagesAnswers of Sheet Two: Answer 1

Transféré par

musicslave96The document contains answers to questions on a sheet. Answer 3 calculates the weighted average cost of capital (WACC) for a company with different capital structures, finding a WACC of 10.13% for existing common stock and 10.715% for new issues of common stock. Answer 4 calculates WACC based on the market value of different sources of capital, finding a WACC of 10.8437%.

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme DOCX, PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 4

Answers of sheet two

Answer 1

Answer 2

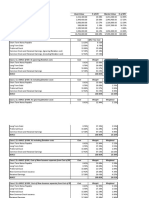

Answer 3

After Tax Cost of Debt (ri) = 8.56% (1-40%) = 5.14%

d) In Case of Existing Common Stock

Source of Capital Target Capital Cost of Capital Source Weighted Cost

Structure

Long Term Debt 0.30 5.14% 1.542%

Preferred Stock 0.20 8.44% 1.69%

Common Stock 0.50 13.78% 6.89%

WACC= (1.542 + 1.69

+ 6.89) = 10.13 %

In Case of New Issues of Common Stock

Source of Capital Target Capital Structure Cost of Capital Source Weighted Cost

Long Term Debt 0.30 5.14% 1.542%

Preferred Stock 0.20 8.44% 1.69%

Common Stock 0.50 14.97% 7.48%

WACC= (1.542 + 1.69 +

7.48) = 10.715 %

Answer 4

Sources of Capital Market value weight Individual Cost Weighted Average

Cost

Long term Debt 3,840,000 55.65% 6% 3.339

Proffered Stock 60,000 0.87% 13% 0.1131

Common Stock 3,000,000 43.48% 17% 7.3916

Equity

Total 6,900,000 100% 10.8437%

c. The WACC calculated using the Market value is higher because it is calculated with recent values not

historical ones.

Vous aimerez peut-être aussi

- Nike WACC CalculationDocument2 pagesNike WACC CalculationHumphrey OsaigbePas encore d'évaluation

- 5111 Written Assignment Unit 7Document6 pages5111 Written Assignment Unit 7Rachell Ann UsonPas encore d'évaluation

- 7 Cost of Capital CTDI October 2013Document85 pages7 Cost of Capital CTDI October 2013Diane SerranoPas encore d'évaluation

- Soln Cost of CapitalDocument11 pagesSoln Cost of Capitalanshul dyundiPas encore d'évaluation

- Case 19 General Electric CompanyDocument2 pagesCase 19 General Electric Companymusicslave96Pas encore d'évaluation

- Par Value Coupon Interest N Avrage Discount Flotation Cost TaxDocument13 pagesPar Value Coupon Interest N Avrage Discount Flotation Cost TaxGhina NabilaPas encore d'évaluation

- LCC Current Cost of CapitalDocument2 pagesLCC Current Cost of CapitalRyan AgcaoiliPas encore d'évaluation

- LCC Current Cost of CapitalDocument2 pagesLCC Current Cost of CapitalRyan AgcaoiliPas encore d'évaluation

- K (D1/P0) + G: WockhardtDocument2 pagesK (D1/P0) + G: WockhardtYYASEER KAGDIPas encore d'évaluation

- LCC Current Cost of CapitalDocument2 pagesLCC Current Cost of CapitalRyan AgcaoiliPas encore d'évaluation

- Solution To Case 12: What Are We Really Worth?Document4 pagesSolution To Case 12: What Are We Really Worth?khalil rebato100% (1)

- Problem Set 4 GroupDocument7 pagesProblem Set 4 GroupRuiyu YangPas encore d'évaluation

- Solved Problem 14.1: The Above Is Obtained Using The Following StepsDocument3 pagesSolved Problem 14.1: The Above Is Obtained Using The Following StepsArjun Jaideep BhatnagarPas encore d'évaluation

- Project Management Chapter 10 THE COST OF CAPITAL Math SolutionsDocument4 pagesProject Management Chapter 10 THE COST OF CAPITAL Math Solutionszordan rizvyPas encore d'évaluation

- PayTM FinancialsDocument43 pagesPayTM FinancialststPas encore d'évaluation

- CH 9 Problems-1Document16 pagesCH 9 Problems-1Çisem HakyimezPas encore d'évaluation

- CheggDocument1 pageCheggShivansh DwivediPas encore d'évaluation

- Cost ofDocument14 pagesCost ofrajjoPas encore d'évaluation

- ASSIGNMENT 2 - FIN 6000 GROUPS 5 - Attempt - 2022-07-19-20-37-46 - GROUP 5 FIN 6000 - ASSIGNMENT 2Document8 pagesASSIGNMENT 2 - FIN 6000 GROUPS 5 - Attempt - 2022-07-19-20-37-46 - GROUP 5 FIN 6000 - ASSIGNMENT 2Bellindah wPas encore d'évaluation

- Wacc 4Document10 pagesWacc 4Rita NyairoPas encore d'évaluation

- Answer 1. The Correct Answers Are A and BDocument9 pagesAnswer 1. The Correct Answers Are A and BBadihah Mat SaudPas encore d'évaluation

- PDFDocument2 pagesPDFHina SaharPas encore d'évaluation

- APC308 Financial Management (SL 1636)Document16 pagesAPC308 Financial Management (SL 1636)MD. SHAKILPas encore d'évaluation

- PL M18 FM Student Mark Plan WebDocument9 pagesPL M18 FM Student Mark Plan WebIQBAL MAHMUDPas encore d'évaluation

- PA 02 - Integrative Case - Eco Plastics CompanyDocument3 pagesPA 02 - Integrative Case - Eco Plastics CompanyFebbie LavariasPas encore d'évaluation

- Beware of Spurious Fraud Phone CallsDocument2 pagesBeware of Spurious Fraud Phone CallsHardik BajajPas encore d'évaluation

- Telus: Source of Finance Market Values Cost MV× Cost $ % $Document2 pagesTelus: Source of Finance Market Values Cost MV× Cost $ % $Humphrey Osaigbe0% (1)

- Session 12 (Chap1, 4, 5 of Titman, 2014)Document14 pagesSession 12 (Chap1, 4, 5 of Titman, 2014)Thu Hiền KhươngPas encore d'évaluation

- General 4-Year DCF Spreadsheet Valuation Model (Dollars Amount in USD Million)Document2 pagesGeneral 4-Year DCF Spreadsheet Valuation Model (Dollars Amount in USD Million)hoifishPas encore d'évaluation

- Long Term Debt: New Common Stock New DebtDocument4 pagesLong Term Debt: New Common Stock New DebtPutri AndiniPas encore d'évaluation

- FM - Lucky-Cement - Cost-of-Capital - Solutions by DeanDocument3 pagesFM - Lucky-Cement - Cost-of-Capital - Solutions by DeanKristine Nitzkie SalazarPas encore d'évaluation

- Midsem Sol - WACC QuestionDocument2 pagesMidsem Sol - WACC QuestionSarthak JainPas encore d'évaluation

- Chapter 5: Cost of Capital Dec 2014Document7 pagesChapter 5: Cost of Capital Dec 2014swarna dasPas encore d'évaluation

- Calculation of Cost of Equity 3. Calculation For Equity CapitalDocument4 pagesCalculation of Cost of Equity 3. Calculation For Equity Capitalshivam chughPas encore d'évaluation

- Sample DCF Valuation TemplateDocument2 pagesSample DCF Valuation TemplateTharun RaoPas encore d'évaluation

- Sample DCF Valuation TemplateDocument2 pagesSample DCF Valuation TemplateTharun RaoPas encore d'évaluation

- Sample DCF Valuation TemplateDocument2 pagesSample DCF Valuation TemplateTharun RaoPas encore d'évaluation

- Comprehensive Spreadsheet Problem 11Document2 pagesComprehensive Spreadsheet Problem 11weeeeeshPas encore d'évaluation

- Determining Optimal Financing Mix: Approaches and AlternativesDocument68 pagesDetermining Optimal Financing Mix: Approaches and AlternativesPavan NagendraPas encore d'évaluation

- WACC NikeDocument5 pagesWACC NikeDevia SuswodijoyoPas encore d'évaluation

- WACC NikeDocument5 pagesWACC Nikenatya lakshitaPas encore d'évaluation

- Solution Murphy PLCDocument1 pageSolution Murphy PLCJames CassidyPas encore d'évaluation

- Managerial Finance Tutorial 2 Model AnswerDocument4 pagesManagerial Finance Tutorial 2 Model Answernourkhaled1218Pas encore d'évaluation

- Business Valuation PDF VersionDocument13 pagesBusiness Valuation PDF VersionIvy SamsonPas encore d'évaluation

- Term Valued CFDocument14 pagesTerm Valued CFEl MemmetPas encore d'évaluation

- Managerial Economics 3rd Assignment Bratu Carina Maria EXCELDocument11 pagesManagerial Economics 3rd Assignment Bratu Carina Maria EXCELCarina MariaPas encore d'évaluation

- BUS670 O'GradyDocument4 pagesBUS670 O'GradyLori HughesPas encore d'évaluation

- Nerolac - On Ratio - SolvedDocument6 pagesNerolac - On Ratio - Solvedricha krishnaPas encore d'évaluation

- December 20 FTFM PracticeDocument54 pagesDecember 20 FTFM PracticerajanikanthPas encore d'évaluation

- Wacc SolutionsDocument8 pagesWacc SolutionssrassmasoodPas encore d'évaluation

- Charlene DulayDocument19 pagesCharlene DulayJerome MontoyaPas encore d'évaluation

- Nike Workings WACC CalculationDocument1 pageNike Workings WACC CalculationHumphrey OsaigbePas encore d'évaluation

- Chapter - 9: Solutions - To - End - of - Chapter - 9 - Problems - On - Estimating - Cost - of - CapitalDocument7 pagesChapter - 9: Solutions - To - End - of - Chapter - 9 - Problems - On - Estimating - Cost - of - CapitalMASPAKPas encore d'évaluation

- Case Study Nike, Inc.: Cost of CapitalDocument14 pagesCase Study Nike, Inc.: Cost of CapitalMuhammad MBA65Pas encore d'évaluation

- BUS670 O GradyDocument5 pagesBUS670 O GradyIndra ZulhijayantoPas encore d'évaluation

- MFA Homework 8 - With With Equity and Multiple DebtDocument3 pagesMFA Homework 8 - With With Equity and Multiple DebtRehan AsifPas encore d'évaluation

- Jumlah Dana Jasa Giro (%) Biaya DanaDocument4 pagesJumlah Dana Jasa Giro (%) Biaya DanaRahmalia FatchiatulPas encore d'évaluation

- Final Excel FileDocument14 pagesFinal Excel FileArif RahmanPas encore d'évaluation

- Cost of Debt - Financial MarketsDocument6 pagesCost of Debt - Financial MarketsJericho DupayaPas encore d'évaluation

- Anticipating Correlations: A New Paradigm for Risk ManagementD'EverandAnticipating Correlations: A New Paradigm for Risk ManagementPas encore d'évaluation

- Tutorial (1) Introduction To Marketing ChannelsDocument10 pagesTutorial (1) Introduction To Marketing Channelsmusicslave96Pas encore d'évaluation

- Tutorial 3 - Mass Fragmentation 2Document17 pagesTutorial 3 - Mass Fragmentation 2musicslave96Pas encore d'évaluation

- Aya's Final Project GroupsDocument2 pagesAya's Final Project Groupsmusicslave96Pas encore d'évaluation

- Ph.D. Student, Faculty of Economics and Business Administration, Department of Marketing, West University of Timisoara, RomaniaDocument9 pagesPh.D. Student, Faculty of Economics and Business Administration, Department of Marketing, West University of Timisoara, Romaniamusicslave96Pas encore d'évaluation

- Lecture5 The Business PlanDocument36 pagesLecture5 The Business Planmusicslave96100% (1)

- Helping MR Earn A Seat at The Table For Decision-MakingDocument13 pagesHelping MR Earn A Seat at The Table For Decision-Makingmusicslave96Pas encore d'évaluation

- Prof. Darius Zlotos Tutorial 4 Organic Chemistry IDocument2 pagesProf. Darius Zlotos Tutorial 4 Organic Chemistry Imusicslave96Pas encore d'évaluation

- Business ModelDocument7 pagesBusiness Modelmusicslave96Pas encore d'évaluation

- Lecture6 The Management TeamDocument38 pagesLecture6 The Management Teammusicslave96Pas encore d'évaluation

- Chapter 8 - Solutions Problem 2:: N Forecast Actual Forecast Actual Forecast ActualDocument5 pagesChapter 8 - Solutions Problem 2:: N Forecast Actual Forecast Actual Forecast Actualmusicslave96Pas encore d'évaluation

- Measuring ConstructsDocument11 pagesMeasuring Constructsmusicslave96Pas encore d'évaluation

- INNO713 - Work Load TableDocument1 pageINNO713 - Work Load Tablemusicslave96Pas encore d'évaluation

- Winter 2017 Mid Term Exam Schedule: (2nd Chance)Document8 pagesWinter 2017 Mid Term Exam Schedule: (2nd Chance)musicslave96Pas encore d'évaluation

- A Strong Brand, Dentonic Loses Its PowerDocument12 pagesA Strong Brand, Dentonic Loses Its Powermusicslave96Pas encore d'évaluation

- Assignment 2: Problem 1Document3 pagesAssignment 2: Problem 1musicslave960% (1)

- Attitudes & Job SatisfactionDocument27 pagesAttitudes & Job Satisfactionmusicslave96Pas encore d'évaluation

- Course Specs - CTRL 606Document7 pagesCourse Specs - CTRL 606musicslave96Pas encore d'évaluation

- Answer of Sheet 6Document4 pagesAnswer of Sheet 6musicslave96Pas encore d'évaluation