Académique Documents

Professionnel Documents

Culture Documents

Accounting PDF

Transféré par

KiranKumarTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Accounting PDF

Transféré par

KiranKumarDroits d'auteur :

Formats disponibles

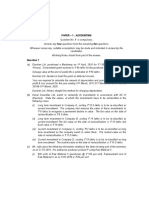

PAPER – 1 : ACCOUNTING

Question No. 1 is compulsory.

Answer any five questions from the remaining six questions.

Wherever necessary, suitable assumptions should be made and disclosed

by way of note forming part of the answer.

Working Notes should form part of the answer.

Question 1

(a) Uday Constructions undertake to construct a·bridge for the Government of Uttar

Pradesh. The construction commenced during the financial year ending 31.03.2016 and

is likely to be completed by the next financial year. The contract is for a fixed price of

` 12 crores with an escalation clause. The costs to complete the whole contract are

estimated at ` 9.50 crores of rupees. You are·given the following information for the

year ended 31.03.2016:

Cost incurred upto 31.03.2016 ` 4 crores

.Cost estimated to complete the contract ` 6 crores

Escalation in cost by 5% and accordingly the contract price· is increased by 5%.

You are required to ascertain the state of completion and state the revenue and profit to

be recognized for the year as per AS-7.

(b) M/s Active Builders Ltd. invested in the shares of another company on 31 st October, 2015

at a cost of ` 4,50,000. It also earlier purchased Gold of ` 5,00,000 and Silver of

` 2,25,000 on 31 st March, 2013.

Market values as on 31 st March, 2016 of the above investments are as follows:

Shares ` 3,75,000; Gold ` 7,50,000 and Silver ` 4,35,000

How will the above investments be shown in the books of account of M/s Active Builders

Ltd. for the year ending 31 st March, 2016 as per the provision of AS-13?

(c) Argon Ltd. purchased a shop on 1 st January, 2001 at a cost of ` 8,50,000. The useful life

of the shop is estimated as 30 years with residual value of ` 25,000 and depreciation is

provided on a straight line basis. The shop was revalued on 30th June, 2015 for

` 19,50,000 and the revaluation was incorporated in the accounts.

Calculate:

(i) The surplus on revaluation;

(ii) Depreciation to be charged in the Profit and Loss account for the year ended on 31st

December, 2015.

(d) Z Limited ordered 13,000 kg. of chemicals at ` 90 per kg. The purchase price includes

excise duty of ` 5 per kg, in respect of which full CENVAT credit is admissible. Further,

© The Institute of Chartered Accountants of India

2 INTERMEDIATE (IPC) EXAMINATION: MAY, 2016

State VAT is leviable at ` 2.5 per kg on purchase price. Freight incurred amounted to

` 30,000.

Normal transit loss is 4%. The company actually received 12,400 kg and consumed

10,000 kg. The company has received trade discount in the form of cash amounting to

` 1 per kg. The chemicals were delivered in containers. The containers were not

reusable, hence sold for ` 500. The administrative expenses incurred to bring the

chemicals were ` 10,000.

Compute the value of inventory and allocate the material cost as per AS-2. (4 x 5 = 20 Marks)

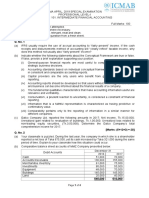

Answer

(a)

` in crore

Cost of construction of bridge incurred 31.3.16 4.00

Add: Estimated future cost 6.00

Total estimated cost of construction 10.00

Contract Price (12 crore x 1.05) 12.60 crore

Stage of completion

Percentage of completion till date to total estimated cost of construction

= (4/10)100 = 40%

Revenue and Profit to be recognized for the year ended 31 st March, 2016 as per AS 7

Proportion of total contract value recognized as revenue = Contract price x percentage of

completion

=` 12.60 crore x 40% =` 5.04 crore

Profit for the year ended 31 st March, 2016 = ` 5.04 crore less ` 4 crore = 1.04 crore

(b) As per AS 13 „Accounting for Investments‟, if the shares are purchased with an intention

to hold for short-term period then investment will be shown at the realizable value.

If equity shares are acquired with an intention to hold for long term period then it will

continue to be shown at cost in the Balance Sheet of the company. However, provision

for diminution shall be made to recognize a decline, if other than temporary, in the value

of the investments. In the given case, shares purchased on 31 st October, 2015, will be

valued at ` 3,75,000 as on 31st March, 2016.

Gold and silver are generally purchased with an intention to hold it for long term period

until and unless given otherwise. Hence, the investment in gold and silver (purchased on

31st March, 2013) shall continue to be shown at cost as on 31 st March, 2016 i.e.,

` 5,00,000 and ` 2,25,000 respectively, though their realizable values have been

increased.

© The Institute of Chartered Accountants of India

PAPER – 1 : ACCOUNTING 3

Thus the shares, gold and silver will be shown at ` 3,75,000, ` 5,00,000 and ` 2,25,000

respectively and hence, total investment will be valued at ` 11,00,000 in the books of account

of M/s Active Builders for the year ending 31st March, 2016 as per provisions of AS 13.

(c) As per AS 6 “Depreciation Accounting”, where the depreciable assets are revalued, the

provision for depreciation should be based on the revalued amount and on the estimate

of the remaining useful lives of such assets.

Surplus on revaluation

Depreciation provided upto 30th June, 2015 ` 27,500 [(` 8,50,000 – ` 25,000)/30] p.a.]

Total depreciation ` 3,98,750 (` 27,500 p.a. for 14.5 years)

W.D. V of shop on 30 th June, 2015 (a) ` 4,51,250

[` 8,50,000 less ` 3,98,750]

Revalued value (b) ` 19,50,000

Surplus [(b) less (a)] ` 14,98,750

Depreciation to be charged in the profit and loss account for the year ended

31st Dec., 2015

Depreciation for Jan. to June 15 (before revaluation) ` 13,750 (` 27,500 /2)

Remaining useful life 15.5 years

Depreciation for July to Dec. 15(after revaluation) ` 62,097

[` 19,25,000 (19,50,000 less

25,000) / 15.5 x 1/2]

Total Depreciation for the year ended 31 st Dec., 2015 ` 75,847[` 13,750 + ` 62,097]

Note:

Depreciation for the year ended 31 st Dec., 2015 has been computed on the basis of

assumption that there is no change in residual value and the remaining useful life after

revaluation of the shop

(d) Cost of inventory and allocation of material cost

`

Purchase price (13,000 Kg. x ` 89) 11,57,000

Less: CENVAT Credit (13,000 Kg. x ` 5) (65,000)

10,92,000

Add: Freight 30,000

Allocated Administrative expenses 10,000

A. Total material cost 11,32,000

© The Institute of Chartered Accountants of India

4 INTERMEDIATE (IPC) EXAMINATION: MAY, 2016

B. Number of units to be normally received = 96% of 13,000 Kg. Kg. 12,480

C. Normal cost per Kg. (A/B) 90.705

Allocation of material cost

Kg. `/Kg. `

Materials consumed 10,000 9,07,050

Cost of inventory (12,400- 10,000) 2,400 90.705(approx.) 2,17,692

Abnormal loss 80 7,258*

Total material cost 12,480 11,32,000

*The difference due to rounding off of normal cost per Kg has been adjusted.

Thus the inventory will be valued at ` 2,17,692.

Note:

1. The Company has received trade discount in the form of cash. This discount has

been treated as trade discount in the given answer.

2. Abnormal losses are recognized as separate expenses.

3. Containers are used for delivery of the chemicals and are not reusable. Cost of

these containers is treated as selling and distribution expense. The sale value of

these containers will be credited to Profit and Loss Account and shall not be

considered for the purpose of valuation of inventory.

Alternatively, the sales value of container amount of ` 500 may be deducted, while

computing material cost. In that case the material cost will be computed as

` 11,31,500 (11,32,000-500) instead of ` 11,32,000. Accordingly the allocation of

material cost will get changed.

4. State VAT has not been included in the cost of materials in the above answer as

VAT is generally credited in the later course of time.

Question 2

Given below are the Balance Sheet of two companies as on 31st December, 2015.

A Limited

Liabilities ` Assets `

Share Capital: Patent 1,00,000

Issued and fully paid up Building 5,40,000

50,000 8% Cumulative Plant and Machinery 15,10,000

Preference Shares of ` 10 each 5,00,000 Furniture 75,000

© The Institute of Chartered Accountants of India

PAPER – 1 : ACCOUNTING 5

1,50,000 Equity shares of ` 10 15,00,000 Investment 1,55,000

each

General Reserve 7,65,000 Stock 3,58,000

Profit and Loss account 1,25,000 Sundry Debtors 72,000

Sundry Creditors 60,000 Cash and Bank 1,40,000

29,50,000 29,50,000

B Limited

Liabilities ` Assets `

Share Capital: Goodwill 62,000

Issued and fully paid Motor Car 1,26,000

50,000 Shares of ` 10 each 5,00,000 Furniture 58,000

Profit and Loss Account 45,000 Stock 2,40,000

Sundry Creditors 31,000 Sundry Debtors 70,000

Cash and Bank 20,000

5,76,000 5,76,000

It has been agreed that both these companies should be wound up and a new company AB

Ltd. should be formed to acquire the assets of both the companies on the following terms and

conditions:

(i) AB Ltd. is to have an authorized capital of ` 36,00,000 divided into 60,000, 8%

cumulative preference shares of ` 10 each and 3,00,000 equity shares of ` 10 each.

(ii) AB Ltd. to purchase the whole of the assets of A Ltd. (except cash and Bank balances)

for ` 28,25,000 to be settled as to ` 5,75,000 in cash and as to the balance by issue of

1,80,000 equity shares, credited as fully paid, to be treated as valued at ` 12.50 each.

(iii) AB Ltd. is to purchase the whole of the assets of B Ltd. (except cash and bank balances)

for ` 4,91,000 to be settled as to ` 16,000 in cash and as to the balance by issue of

38,000 equity shares, credited as fully paid, to be treated as valued at ` 12.50 each.

(iv) A Ltd. and B Ltd. both are to be wound up, the two liquidators distributing the shares in

AB Ltd. in kind among the equity shareholders of the respective companies.

(v) The liquidator of A Ltd. is to pay the preference shareholders ` 12 in cash for every

share held in full satisfaction of their claims.

© The Institute of Chartered Accountants of India

6 INTERMEDIATE (IPC) EXAMINATION: MAY, 2016

(vi) AB Ltd. is to make a public issue of 60,000, 5% cumulative preference shares at a

premium of 10% and 30,000 equity shares at the issue price of ` 12.50 per share, all

amount payable in full on application.

It is estimated that the cost of liquidation (including the liquidators' remuneration) will be

` 10,000 in case of A Ltd. and ` 5,000 in case of B Ltd. and that the preliminary expenses of

AB Ltd. will amount to ` 24,000· exclusive of the underwriting commission of ` 38,900 payable

on the public issue.

You are required to prepare the initial Balance Sheet of AB Ltd. on the basis that all assets

other than goodwill are taken over at the book value. (16 Marks)

Answer

Balance Sheet of AB Ltd.

Particulars Notes `

Equity and Liabilities

1 Shareholders' funds

a Share capital 1 30,80,000

b Reserves and Surplus 2 6,17,100

2 Current liabilities

a Other liabilities 38,900

Total 37,36,000

Assets

1 Non-current assets

a Fixed assets

Tangible assets 3 23,09,000

Intangible assets 4 1,12,000

b Non-current investments 1,55,000

2 Current assets

a Inventories (3,58,000 + 2,40,000) 5,98,000

b Trade receivables (72,000 +70,000) 1,42,000

c Cash and cash equivalents 4,20,000

Total 37,36,000

To be read as 8%

© The Institute of Chartered Accountants of India

PAPER – 1 : ACCOUNTING 7

Notes to accounts

`

1 Share Capital

Authorized share capital

3,00,000 equity shares of ` 10 each 30,00,000

60,000, 8% cumulative Preference Shares of `10 each 6,00,000 36,00,000

Equity share capital

2,48,000 equity shares of ` 10 each

(Of the above shares, 2,18,000 shares have been 24,80,000

issued for consideration other than cash)

Preference share capital

60,000, 8% cumulative Preference Shares of `10 each 6,00,000

Total 30,80,000

2 Reserves and Surplus

Debit balance of Profit and Loss Account

Underwriting commission 38,900

Preliminary expenses 24,000 (62,900)

Securities Premium A/c

(2,48,000 equity shares x 2.50) 6,20,000

(60,000 Preference shares x ` 1 ) 60,000 6,80,000

6,17,100

3 Tangible assets

Building 5,40,000

Motor car 1,26,000

Plant & machinery 15,10,000

Furniture 1,33,000 23,09,000

4 Intangible assets

Goodwill (W.N. 4) (15,000 +62,000-65,000) 12,000

Patents 1,00,000 1,12,000

© The Institute of Chartered Accountants of India

8 INTERMEDIATE (IPC) EXAMINATION: MAY, 2016

Working Notes:

1. Mode of discharge of Purchase Consideration of A Ltd.

`

Cash payment 5,75,000

Equity shares (1,80,000 Shares x ` 12.5) 22,50,000

Total Purchase consideration 28,25,000

2. Mode of discharge of Purchase Consideration of B Ltd.

`

Cash payment 16,000

Equity shares (38,000 shares x ` 12.5) 4,75,000

Total Purchase consideration 4,91,000

3. Cash at bank balance in the initial balance sheet of AB Ltd.

Cash and Bank Account

` `

To Issue of preference shares By Payment to A ltd. 5,75,000

(60,000 x 11) 6,60,000 By Payment to B ltd. 16,000

To Equity shares By Preliminary expenses 24,000

(30,000 x 12.50) 3,75,000 By Balance c/d 4,20,000

10,35,000 10,35,000

4. Calculation of goodwill/ capital reserve of A Ltd. & B Ltd.

Particulars A Ltd. B Ltd.

Business Purchase A/c 28,25,000 4,91,000

Less: Goodwill 62,000

Patent A/c 1,00,000 -

Building A/c 5,40,000 -

Plant & Mach. A/c 15,10,000 -

Motor car A/c - 1,26,000

Furniture A/c 75,000 58,000

Investment A/c 1,55,000 -

Stocks A/c 3,58,000 2,40,000

Debtors A/c 72,000 (28,10,000) 70,000 (5,56,000)

Goodwill / Capital reserve (Bal. fig.) 15,000 (65,000)

Net goodwill (15,000 +62,000 -65,000) = 12,000

© The Institute of Chartered Accountants of India

PAPER – 1 : ACCOUNTING 9

Note:

1. As per the information given in the question, only the assets of A Ltd. and B Ltd. are

taken over by AB Ltd. Thus the creditors are considered to be paid by the liquidators of

the respective companies and hence being not taken over by AB Ltd.

2. As per the information given in the second last para of the question, it is stated that the

preliminary expenses of AB Ltd. will amount to ` 24,000 exclusive of the underwriting

commission of ` 38,900 payable on the public issue. It has been assumed that ` 24,000

has been paid and underwriting commission is still payable in the balance sheet of the

amalgamated company. Alternatively, any other reasonable assumption about this may

be considered.

3. Preliminary expenses and underwriting commission have been written off as per the

provisions of Accounting standards.

Question 3

(a) The following is the Balance Sheet of Manish and Suresh as on 1st April, 2015:

Liabilities ` Assets `

Capital: Building 1,00,000

Manish 1,50,000 Machinery 65,000

Suresh 75,000 Stock 40,000

Creditors for goods 30,000 Debtors 50,000

Creditors for expenses 25,000 Bank 25,000

2,80,000 2,80,000

They give you the following additional information:

(i) Creditors' Velocity 1.5 month & Debtors' Velocity 2 months.

(ii) Stock level is maintained uniformly in value throughout all over the year.

(iii) Depreciation on machinery is charged @ 10%, Depreciation on building @ 5% in

the current year.

(iv) Cost price will go up 15% as compared to last year and also sales in the current

year will increase by 25% in volume.

(v) Rate of gross profit remains the same.

(vi) Business Expenditures are ` 50,000 for the year. All expenditures are paid off in

cash.

(vii) Closing stock is to be valued on LIFO Basis.

© The Institute of Chartered Accountants of India

10 INTERMEDIATE (IPC) EXAMINATION: MAY, 2016

Prepare Trading, Profit and Loss Account, Trade Debtors A/c and Trade Creditors A/c for

the year ending 31.03.2016.

(b) Following information has been given for Bharat Sports Club, Delhi for the year ending

31.12.2014 and 31.12.2015.

31.12.2014 31.12.2015

Building (subject to 10% depreciation for the current year) 60,000 ?

Furniture (subject to 10% depreciation for the current year) - 20,000

Stock of Sports Materials 5,000 2,000

Prepaid Insurance 3,000 6,000

Outstanding Subscription 12,000 8,000

Advance Subscription 6,000 4,000

Outstanding Locker Rent - 6,000

Advance Locker Rent received - 2,000

Outstanding Rent for Godown 6,000 3,000

12% General Fund Investments 2,00,000 2,00,000

Accrued Interest on above - 4,000

Cash Balance 1,000 64,000

Bank Balance 2,000 -

Bank Overdraft - 2,000

Additional Information:

(i) Entrance fees received ` 20,000, Life membership fees received ` 20,000 during

the year.

(ii) Surplus from Income and Expenditure Account ` 60,000.

(iii) It is the policy of the club to treat 60% of entrance fees and 40% of life membership

fees as revenue nature.

(iv) The furniture was purchased on 01.01.2015.

Prepare Opening and Closing Balance Sheet of Bharat Sports Club as on 31st December,

2014 and 31 st December, 2015 respectively. (8 + 8 = 16 Marks)

Answer

(a) Trading and Profit and Loss account

(for the year ending 31st March, 2016)

Particulars ` Particulars `

To Opening Stock 40,000 By Sales 4,31,250

© The Institute of Chartered Accountants of India

PAPER – 1 : ACCOUNTING 11

To Purchases (Working Note) 3,45,000 By Closing Stock 40,000

To Gross Profit c/d (20% on

sales) 86,250

4,71,250 4,71,250

To Business Expenses 50,000 By Gross Profit b/d 86,250

To Depreciation on :

Machinery 6,500

Building 5,000 11,500

To Net profit 24,750

86,250 86,250

Trade Debtors Account

Particulars ` Particulars `

To Balance b/d 50,000 By Bank (bal.fig.) 4,09,375

To Sales 4,31,250 By Balance c/d (1/6 of 4,31,250) 71,875

4,81,250 4,81,250

Trade Creditors Account

Particulars ` Particulars `

To Bank (Balancing figure) 3,31,875 By Balancing b/d 30,000

To Balance c/d/ (1/8 of ` 3,45,000) 43,125 By Purchases 3,45,000

3,75,000 3,75,000

Working Note:

`

(i) Calculation of Rate of Gross Profit earned during previous year

A Sales during previous year (` 50,000 x 12/2) 3,00,000

B Purchases (` 30,000 x 12/1.5) 2,40,000

C Cost of Goods Sold (` 40,000 + ` 2,40,000 – ` 40,000) 2,40,000

D Gross Profit (A-C) 60,000

E ` 60,000 20%

Rate of Gross Profit x 100

` 3,00,000

(ii) Calculation of sales and Purchases during current year `

A Cost of goods sold during previous year 2,40,000

© The Institute of Chartered Accountants of India

12 INTERMEDIATE (IPC) EXAMINATION: MAY, 2016

B Add: Increases in volume @ 25 % 60,000

3,00,000

C Add: Increase in cost @ 15% 45,000

D Cost of Goods Sold during Current Year 3,45,000

E Add: Gross profit @ 25% on cost (20% on sales) 86,250

F Sales for current year [D+E] 4,31,250

Note: It has been considered that all sales and purchases are on credit basis only and

there are no cash purchases and sales.

(b) Balance Sheet of Bharat sports club as at 31 st December, 2014

Liabilities ` Assets `

Outstanding Rent 6,000 Building 60,000

Advance Subscription 6,000 Stock of Sports materials 5,000

Capital Fund 2,71,000 Prepaid Insurance 3,000

(balancing Figure ) Outstanding subscription 12,000

12% General Fund Investments 2,00,000

Cash Balance 1,000

Bank Balance 2,000

2,83,000 2,83,000

Balance Sheet of Bharat Sports club as at 31st December, 2015

Liabilities ` Assets `

Outstanding Rent 3,000 Building

Advance Subscription 4,000 Book Value 60,000

Advance Locker Rent 2,000 Less: Depreciation 6,000 54,000

Bank Overdraft 2,000 Furniture Cost 20,000

Capital Fund: Less: Depreciation 2,000 18,000

Opening Balance 2,71,000 Stock of sports materials 2,000

Add: Entrance Fees 8,000 Prepaid Insurance 6,000

[20,000 x 40%] Outstanding Subscription 8,000

Add: Life Membership 12,000 Outstanding Locker Rent 6,000

fee

[` 20,000 x 60%] 12% General 2,00,000

Add: Surplus 60,000 3,51,000 Fund Investments

Accrued Interest on 12%

© The Institute of Chartered Accountants of India

PAPER – 1 : ACCOUNTING 13

General Fund 4,000

Investments

Cash Balance 64,000

3,62,000 3,62,000

Question 4

(a) Girish Transport Ltd. purchased from NCR Motors 3 electric rickshaws costing ` 60,000

.

each on the hire purchase system on 1.1.2013. Payment was to be made `' 30,000 down

and the remainder in 3 equal installments payable on 31.12.2013, 31.12.2014 and

31.12.2015 together with interest @ 10% p.a. Girish Transport Ltd. writes off depreciation

@ 20% p.a. on the reducing balance. It paid the installment due at the end of 1st year i.e.

31.12.2013 but could not pay next on 31.12.2014. NCR Motors agreed to leave one

e-rickshaw with the purchaser on 31.12.2014 adjusting the value of the other two

e-rickshaws against the amount due on 31.12.2014. The e-rickshaws were valued on the

basis of 30% depreciation annually on WDV basis.

.

Show the necessary Ledger accounts in the books of Girish Transport Ltd. for the year

2013, 2014, and 2015.

(b) A Ltd. purchased on 1st April, 2015 8% convertible debenture in C Ltd. of face value of

` 2,00,000 @ ` 108. On 1st July, 2015 A Ltd. purchased another ` 1,00,000 debenture

@ ` 112 cum interest.

On 1st October, 2015 ` 80,000 debenture was sold @ ` 105. On 1st December, 2015, C

Ltd. give option for conversion of 8% convertible debentures into equity share of ` 10

each. A Ltd. receive 5,000 equity share in C Ltd. in conversion of 25% debenture held on

that date. The market price of debenture and equity share in C Ltd. at the end of year

2015 is ` 110 and ` 15 respectively.

Interest on debenture is payable each year on 31st March, and 30th September.

The accounting year of A Ltd. is calendar year.

Prepare investment account in the books of A Ltd. on average cost basis.

(8 + 8 = 16 Marks)

Answer

(a) Ledger Accounts in the books of Girish Transport Ltd.

E-Rickshaws Account

Year ` Year `

1.1.13 To NCR Motors A/c 1,80,000 31.12.13 By Depreciation A/c 36,000

By Balance c/d 1,44,000

1,80,000 1,80,000

1.1.14 To Balance b/d 1,44,000 31.12.14 By Depreciation 28,800

© The Institute of Chartered Accountants of India

14 INTERMEDIATE (IPC) EXAMINATION: MAY, 2016

By NCR Motors

(value of 2 E-

Rickshaw after

depreciation for 2

years @ 30%) 58,800

By P & L A/c (bal.fig.) 18,000

By Balance c/d (one

E-Rickshaw less

depreciation for 2

years) @ 20% 38,400

1,44,000 1,44,000

1.1.15 To Balance b/d 38,400 31.12.15 By Deprecation A/c 7,680

By Balance c/d 30,720

38,400 38,400

NCR Motors Account

Year ` Year `

1.1.13 To Bank A/c 30,000 1.1.13 By E-Rickshaws A/c 1,80,000

31.12.13 To Bank A/c 65,000 By Interest @ 10% on

` 1,50,000 15,000

To Balance c/d 1,00,000

1,95,000 1,95,000

31.12.14 To E-Rickshaws A/c 58,800 1.1.14 By Balance b/d 1,00,000

To Balance c/d 51,200 By Interest @ 10% on

` 1,00,000 10,000

1,10,000 1,10,000

31.12.15 To Balance c/d 56,320 1.1.15 By Balance b/d 51,200

By Interest @ 10% on

` 51,200 5,120

56,320 56,320

Note:

In the absence of any information regarding payment of the balance amount of ` 56,320

by Girish Transport Ltd. to NCR Motors Ltd., it has been assumed in the above solution

that the balance payment amounting ` 56,320 had not been made till 31st Dec. 2015.

© The Institute of Chartered Accountants of India

(b) Investment Account for the year ending on 31 st December, 2015

Scrip : 8% Convertible Debentures in C Ltd.

[Interest Payable on 31 st March and 30 th September]

Date Particulars Nominal Interest Cost ` Date Particulars Nominal Interest Cost (`

value ` ` Value (`) (`

1.4.15 To Bank A/c 2,00,000 - 2,16,000 30.09.15 By Bank A/c - 12,000 -

1.7.15 To Bank A/c 1,00,000 2,000 1,10,000 [`3,00,000 x 8% x (6/12]

(W.N.1)

31.12.15 To P & L A/c - 14,033 - 1.10.15 By Bank A/c 80,000 84,000

[Interest] 1.10.15 By P&L A/c (loss) 2,933

(W.N.1)

© The Institute of Chartered Accountants of India

1.12.15 By Bank A/c (Accrued 733

interest)

(` 55,000 x .08x 2/12)

1.12.15 By Equity shares in C 55,000 59,767

Ltd. (W.N. 3 and 4)

PAPER – 1 : ACCOUNTING

31.12..15 By Balance c/d (W.N.5) 1,65,000 3,300 1,79,300

3,00,000 16,033 3,26,000 3,00,000 16,033 3,26,000

15

16 INTERMEDIATE (IPC) EXAMINATION: MAY, 2016

SCRIP: Equity Shares in C LTD.

Date Particulars Cost ( `) Date Particulars Cost (`)

1.12.15 To 8 % debentures 59,767 31.12.15 By balance c/d 59,767

Working Notes:

(i) Cost of Debenture purchased on 1 st July = `1,12,000 – `2,000 (Interest)

= `1,10,000

(ii) Cost of Debentures sold on 1 st Oct.

= (`2,16,000 + `1,10,000) x 80,000/3,00,000 = ` 86,933

(iii) Loss on sale of Debentures = ` 86,933– `84,000 = `2,933

Nominal value of debentures converted into equity shares =` 55,000

[(` 3,00,000 – 80,000) x.25]

Interest received before the conversion of debentures

Interest on 25% of total debentures = 55,000 x 8% x 2/12 = 733

(iv) Cost of Debentures converted = (` 2,16,000 + `1,10,000) x 55,000/3,00,000

= ` 59,767

(v) Cost of closing balance of Debentures = (` 2,16,000 + `1,10,000) x

1,65,000 / 3,00,000

= ` 1,79,300

(vii) Closing balance of Debentures has been valued at cost being lower than the market

value i.e. ` 1,81,500 (` 1,65,000 @ ` 110)

(viii) 5,000 equity Shares in C Ltd. will be valued at cost of ` 59,767 being lower than the

market value ` 75,000 (` 15 x5,000)

Note: It is assumed that interest on debentures, which are converted into cash, has been

received at the time of conversion.

Question 5

(a) A firm has decided to take out a loss of profit policy for the year 2016 and given the

following information for the last accounting year 2015.

Variable manufacturing expenses ` 14,20,000, Standing charges ` 1,50,000, Net Profits

` 80,000, Non-operating income ` 2,500, Sales ` 18,00,000.

Compute the sum to be insured in each of the following alternative cases showing the

anticipation for the year 2016:

© The Institute of Chartered Accountants of India

PAPER – 1 : ACCOUNTING 17

(i) If sales will increase by 15%.

(ii) If sales will increase by 15% and only 50% of the present standing charges are to

be insured.

(iii) If sales and variable expenses will increase by 15% and standing charges will

increase by 10%.

(iv) If sales will increase by 15% and variable expenses will decrease by 5%.

(v) If sales will increase by 10% and standing charges will increase by 15%.

(vi) If the turnover and standing charges will increase by 15% and variable expenses

will decrease by 10%·but only 50% of the present standing charges are to be

insured.

(b) Rahim has a current account with partnership firm. It has debit balance of ` 2,40,000 as

on 1.04.2015. He has further deposited the following amounts:

Date Amount (`)

14/04/2015 1,20,000

30/04/2015 3,00,000

18/05/2015 1,23,000

He withdrew the following amounts:

Date Amount ( ` )

29/04/2015 97,000

09/05/2015 1,71,000

t .

Show Rahim’s A/c in the ledger of the firm. Interest is to be calculated at 10% on debit

balance and 8% on credit balance. You are required to prepare current account as on

31st May, 2015 by means of product of balance method. (8 + 8 = 16 Marks)

Answer

(a) Statement showing computation of sum insured under various cases

(i) (ii) (iii) (iv) (v) (vi)

Sales 20,70,000 20,70,000 20,70,000 20,70,000 19,80,000 20,70,000

Less: Variable 16,33,000 16,33,000 18,77,950 15,51,350 15,62,000 14,69,700

exp

Gross profit 4,37,000 4,37,000 1,92,050 5,18,650 4,18,000 6,00,300

Add: increase in - - 15,000 - 22,500 11,250*

Insured standing

charges

© The Institute of Chartered Accountants of India

18 INTERMEDIATE (IPC) EXAMINATION: MAY, 2016

Less: uninsured

standing charges - (75,000) - - - (75,000)

Sum insurable 4,37,000 3,62,000 2,07,050 5,18,650 4,40,500 5,36,550

Note:

1. The above solution is based on the assumption that increase in sale is due to

increase in volume of sales. Alternatively, it may be assumed that this increase is

because of rise in selling price. In that case, there will be no proportionate increase

in variable expenses and the answer will get changed accordingly.

2. *In case (vi), it is given in the question that 50% of the present standing charges are

to be insured. It is assumed in the above answer that 50% of the increased standing

charges are insured.

3. In case (iii), 15% increase in variable expenses has been calculated after

considering proportionate increase in variable expenses due to increase in turnover.

(b) Rahim’s Current Account with Partnership firm (as on 31.5.15)

Date Particulars Dr Cr Balance Dr. Days Dr Cr

or Product Product

(` ) (`) (`) Cr. (` ) (` )

1.4.15 To Bal b/d 2,40,000 2,40,000 Dr. 13* 31,20,000

14.4.15 By Cash A/c 1,20,000 1,20,000 Dr. 15 18,00,000

29.4.15 To Self 97,000 2,17,000 Dr. 1 2,17,000

30.4.15 By Cash A/c 3,00,000 83,000 Cr. 9 7,47,000

9.5.15 To Self 1,71,000 88,000 Dr. 9 7,92,000

18.5.15 By Cash A/c 1,23,000 35,000 Cr. 14* 4,90,000

31.5.15 To Interest A/c 1,361 Dr.

31.5.15 By Bal. c/d 33,639

5,43,000 5,43,000 59,29,000 12,37,000

Interest Calculation:

On ` 59,29,000x 10% x 1/365 = ` 1,624

On ` 12,37,000 x 8% x 1/365 = (` 271)

Net interest to be debited = (`1,353)

Note: *In the given answer, starting/transaction date has been considered and the date

of next transaction has been ignored for the purpose of calculation of number of days.

© The Institute of Chartered Accountants of India

PAPER – 1 : ACCOUNTING 19

Question 6

Ajay, Vijay and Sanjay are partners sharing Profit & Loss in the ratio of 2:3:1. The Balance

Sheet of the firm as on 31.03.2015 is as follows:

Liabilities ` Assets `

Capital A/c: Furniture & Fixture 30,000

Vijay’s Capital 85,000 Office equipment 20,000

Sanjay’s Capital 68,000 Motor Car 60,000

General Reserve A/c 30,000 Stock 40,000

Sundry Creditors 25,000 Sundry Debtors 20,000

Cash at Bank 18,000

Ajay’s Capital 20,000

2,08,000 2,08,000

Kamal is admitted as· a new. partner with effect from 1 st April, 2015 by receiving 1/4 share in

the profit & loss of the firm. The· profit or loss sharing .ratios between other partners remain

same as before. It was agreed that Kamal would bring. some private furniture worth ` 3,000

and private stock worth ` 5,000 and balance in cash towards his capital.

The following adjustments are to be made prior to Kamal admission:

1. Goodwill of the firm is to be valued at 2 years purchase of the average profit of last 3

years. The profits for the last 3 years were ` 35,900, ` 38,200 and ` 31,500. However on

checking of the past records it was noticed that on 01.04.11 a new furniture costing,

` 8,000 was purchased but wrongly debited to revenue and also in year 2012-13, a

purchase invoice for ` 4,000 has been omitted in the book. The firm charged

depreciation on furniture @ 10% on original cost. Your calculation of goodwill is to be

made on the basis of correct profits. It is agreed among existing partners that Sanjay ’s

interest in the goodwill of the firm is only up to value of ` 42,000.

2. Motor Car is taken over by Vijay at ` 70,000.

3. Office equipment is revalued at ` 25,000.

4. Expenses incurred but not paid of ` 6,500 are provided for. ·

5. Value of the stock is to be reduced by 5%.

6. Kamal is to bring proportionate capital. Capital of Vijay, Ajay and Sanjay are also to be

adjusted in profit sharing ratio.

© The Institute of Chartered Accountants of India

20 INTERMEDIATE (IPC) EXAMINATION: MAY, 2016

Assuming the above mentioned adjustments are duly carried out, show the revaluation

account, partner's capital accounts and the Balance Sheet of the firm after Kamal’s admission.

(16 Marks)

Answer

Revaluation Account

` `

To Stock 2,000 By Motor car 10,000

To Expenses 6,500 By Office equipment 5,000

To Purchases Omitted 4,000

To Capital A/c

Ajay 833

Vijay 1,250

Sanjay 417 2,500

15,000 15,000

© The Institute of Chartered Accountants of India

Partners’ Capital Accounts

Particulars Ajay Vijay Sanjay Kamal Particulars Ajay Vijay Sanjay Kamal

Before admission

To Balance b/d 20,000 - - - By bal b/d - 85,000 68,000 -

To Motor Car - 70,000 - - By Reserve 10,000 15,000 5,000

To Balance c/d 16,087 69,130 81,127 - By Furniture 1,600 2,400 800

By Revaluation A/c 833 1,250 417 -

By Goodwill 23,654 35,480 7,000 -

Total 36,087 1,39,130 81,217 36,087 1,39,130 81,217

At the time of admission

© The Institute of Chartered Accountants of India

To Goodwill 17,395 26,094 5,250 17,395 By Balance b/d 16,087 69,130 81,127 -

To Balance c/d - 43,036 75,967 - By assets - - - 8,000

By bal c/d 1,308 - - 9,395

Total 17,395 69,130 81,217 17,395 17,395 69,130 81,217 17,395

PAPER – 1 : ACCOUNTING

Adjustments to make Capital proportionate

To balance b/d 1,308 - - 9,395 By bal b/d - 43,036 75,967 -

To Bank (bal. fig.) - - 56,351 -

To balance c/d 39,232 58,847 19,616 39,232 By Bank (bal. fig.) 40,540 15,811 - 48,627

(WN 4)

Total 40,540 58,847 75,967 48,627 40,540 58,847 75,967 48,627

21

22 INTERMEDIATE (IPC) EXAMINATION: MAY, 2016

Balance Sheet of the Firm (after Kamal’s admission)

Equity & Liabilities ` Assets `

Capital Account: Furniture& fixture 37,800

Ajay 39,232 (30,000 +3,000+4,800)

Vijay 58,847 Office equipment 25,000

Sanjay 19,616 Stock (38,000 +5,000) 43,000

Kamal 39,232 Debtors 20,000

Creditors (25,000 +4,000) 29,000 Cash at Bank (W. N. 5) 66,627

Outstanding Expenses 6,500

1,92,427 1,92,427

Working Notes:

1. Computation of New Profit sharing ratio

Since Kamal‟s Share= 1/4 th, Balance 3/4 th to be shared by Ajay, Vijay and Sanjay in the

ratio 2:3:1

Ajay Vijay Sanjay Kamal Total

New Ratio 2 3 2 3 3 3 1 3 1 1 2 2:3:1:2

6 4 8 6 4 8 6 4 8 4 8

2. Computation of Goodwill

Year 12-13 13-14 14-15 Total

Profit 35,900 38,200 31,500

Less: Depreciation (800) (800) (800)

Purchase invoice omitted (4,000) _ _

31,100 37,400 30,700 99,200

Average Profit 99,200/3 ` 33,067

Goodwill at 2 years purchase ` 33,067 2 ` 66,134

3. (i) Distribution of Goodwill to be credited to Ajay, Vijay and Sanjay

Particulars Ajay Vijay Sanjay Total

First – ` 42,000 to be distributed among all 14,000 21,000 7,000 42,000

the Partners in the ratio of 2:3:1

Balance - ` 24,134 to be distributed

between Ajay and Vijay in the ratio 2:3 9,654 14,480 - 24,134

Total 23,654 35,480 7,000 66,134

© The Institute of Chartered Accountants of India

PAPER – 1 : ACCOUNTING 23

(ii) Writing off of Goodwill

Particulars Ajay Vijay Sanjay Kamal Total

First – ` 42,000 to be debited 10,500 15,750 5,250 10,500 42,000

among all the Partners in the

ratio of 2:3:1:2

Balance- ` 24,134 to be

distributed between Ajay,Vijay

and kamal in the ratio 2:3:2 6,895 10,344 - 6,895 24,134

Total 17,395 26,094 5,250 17,395 66,134

4. Computation of proportionate Capital of Partners

`

Combined Capital of Ajay, Vijay, Sanjay (Existing partners) – as per 1,17,695

balance derived in partners‟ Capital Account = ` 43,036+ ` 75,967 -

1,308= 1,17,695

Share of Ajay, Vijay and Sanjay in the new firm after deducting Kamal‟s 3/4th

1/4th share

Total Capital of the Firm after Kamal‟s admission = ` 1,17,695÷ 3/4th 1,56,927

Apportionment of Capital in New Profit Sharing Ratio i.e. Proportionate Capital of

partners

Partners Ajay Vijay Sanjay Kamal

Ratio 2 3 1 2

Proportionate Capital of partners (1,56,927) 39,232 58,847 19,616 39,232

5. Cash at Bank

= Given ` 18,000 +40,540+ 15,811+ 48,627– 56,351 = ` 66,627

Note:

1. In the above solution, adjustment of furniture for ` 4,800 has been routed through

Partners‟ capital accounts. Alternatively, it may also be routed through Revaluation A/c.

2. Since goodwill is not a purchased goodwill, it has been written off in the above solution,

in accordance with the AS 10.

3. As per the requirement given in the question, it is agreed among existing partners that

Sanjay‟s interest in the goodwill of the firm is only upto the value of ` 42,000. It has been

assumed in the above solution that Sanjay is credited at the time of raising of goodwill as

well as debited only to the extent of ` 42,000 at the time of writing off of goodwill.

© The Institute of Chartered Accountants of India

24 INTERMEDIATE (IPC) EXAMINATION: MAY, 2016

Question 7

Answer any four from the following:

(a) Anjana Ltd. is absorbed by Sanjana Ltd.; the consideration being the takeover of

liabilities, the payment of cost of absorption not exceeding ` 10,000 (actual cost ` 9,000)

the payment of the 9% debentures of ` 50,000 at a premium of 20% in 8% debentures

issued at a premium of 25% at face value and the payment of ` 15 per share in cash and

allotment of three 11% preference share of ` 10 each at a discount of 10% and four

equity share of ` 10 each. at a premium of 20% fully paid for every five shares in Anjana

Ltd. The number of share of the vendor company are 1,50,000 of ` 10 each fully paid.

Calculate purchase consideration as per Accounting Standard 14.

(b) What are the disadvantages of a spreadsheet as an accounting tool ?

(c) X owes Y the following sums of money due on the dates started :

` 400 due on 5th January, 2016

` 200 due on 20th January; 2016

` 800 due on 4th February, 2016

` 100 due on 26th February, 2016

` 50 due on 10th March, 2016

Calculate such a date when payment may be made by X in one installment resulting in no

loss of interest to either party. Assume base date as 5th January, 2016.

(d) Classify the following activities as per AS 3 Cash Flow Statement:

(i) Interest paid by financial enterprise

(ii) Dividend paid

(iii) Tax deducted at source on interest received from subsidiary company

(iv) Deposit with Bank for a term of two years

(v) Insurance claim received towards loss of machinery by fire

(vi) Bad debts written off

Which activity does the purchase of business falls under and whether netting off of

aggregate cash flows from disposal and acquisition of business units is possible ?

(e) From the following information available from the books of a trader from 01/01/2015 to

31/03/2015, you are required to draw up the Debtors Ledger Adjustment Account in the

General Ledger :

i. Total sales amounted to ` 2,00,000 including the sale of machine for ` 6,800 (book

value ` 12,000). The total cash sales were 85% Iess than the total credit sales.

© The Institute of Chartered Accountants of India

PAPER – 1 : ACCOUNTING 25

ii. Cash collections from debtors amounted to 70% of the aggregate of the opening

debtors and credit sales for the period. Debtors were allowed a cash discount of

` 20,000.

iii. Bills receivable drawn during the three months totalled ` 45,000 of which bills

amounting to ` 20,000 were endorsed in favour of suppliers. Out of the endorsed

bills, one bill for ` 6,000 was dishonoured for non-payment as the party became

insolvent, his estate realized nothing.

iv. Cheque received from debtors ` 15,000 were dishonoured, a sum of ` 3,500 was

irrecoverable, Bad debts written off in the earlier year's realized ` 15,000.

v. Sundry debtors as on 01/01/2015 stood at ` 1,50,000. (4 × 4 = 16 Marks)

Answer

(a) As per AS 14 on Accounting for Amalgamations, the term „consideration‟ has been

defined as the aggregate of the shares and other securities issued and the payment

made in the form of cash or other assets by the transferee company to the shareholders

of the transferor company

The payment made by transferee company to discharge the Debenture holders and

outside liabilities and cost of winding up of transferor company shall not be considered as

part of purchase consideration

Computation of Purchase Consideration

`

Cash payment [`15 x 1,50,000] 22,50,000

11% Preference Shares of ` 10 each @ 10% discount 8,10,000

[(1,50,000 x 3/5) x ` 9]

Equity shares of ` 10 each @ 20% premium

[(1,50,000 x 4/5) x ` 12] 14,40,000

Total Purchase consideration 45,00,000

For every 5 shares Anjana Ltd. will receive (i) 4 equity shares @ ` 12 per share and (ii) 3

11% Preference Shares shares @ ` 9 per share.

(b) Disadvantages of a spreadsheet as an accounting tool are as follows:

1. Spreadsheet has data limitations. Depending upon the package, it can accept data

only up to a specified limit.

2. Simultaneous access on a network may not be possible. Many of the modern

softwares allow locking of the table when updation is taking place. This is not

possible in a spread sheet.

© The Institute of Chartered Accountants of India

26 INTERMEDIATE (IPC) EXAMINATION: MAY, 2016

3. Double entry is not automatically completed in Spread Sheet. Formulas or other

means have to be adopted to complete the double entry.

4. Reports are not automatically formatted and generated but have to be user

controlled. Each time a report has to be printed, settings have to be checked and

data range has to be set. In many accounting softwares this is automatically taken

care of by the program.

(c) Calculation of the average due date

Taking 5th January as the base date

Amount No. of days from the base date i.e. 5th Product

Due date

` January, 2016 `

2016

5th January, 2016 400 0 0

20th January, 2016 200 15 3,000

4th February, 2016 800 30 24,000

26th February, 2016 100 52 5,200

10th March, 2016 50 65 3,250

1,550 35,450

Total of products

Average due date=Base date+ Days equal to

Total amount

35,450

= 5th January, 2016+

1,550

= 5th January, 2016 + 22.8 days

= 5th January, 2016 + 23 days

=28th January, 2016

If the payment is made by X in one installment on 28 th January, 2016, no loss of interest

would arise to any of the parties.

(d) (i) Interest paid by financial enterprise

Cash flows from operating activities

(ii) Dividend paid

Cash flows from financing activities

(iii) TDS on interest received from subsidiary company

Cash flows from investing activities

(iv) Deposit with bank for a term of two years

© The Institute of Chartered Accountants of India

PAPER – 1 : ACCOUNTING 27

Cash flows from investing activities

(v) Insurance claim received against loss of fixed asset by fire

Extraordinary item to be shown as a separate heading under „Cash flow from

investing activities‟

(vi) Bad debts written off

It is a non-cash item which is adjusted from net profit/loss under indirect method, to

arrive at net cash flow from operating activity.

Purchase of business falls under Investing Activities as per AS 3 “ Cash Flow Statement ”.

The aggregate cash flows arising from acquisitions and from disposals of other business

units should be presented separately and classified as investing activities. Thus netting

of aggregate cash flows from disposal and acquisition of business units is not possible.

(e) In General Ledger

Debtors Ledger Adjustment Account

2015 ` 2015 `

Jan. 1 To Balance b/d 1,50,000 Jan. 1 By General ledger

Jan. 1 to To General ledger to adjustment

Mar.31 adjustment account: Mar.31 account:

Sales 1,68,000 Collection-cash

[(100/115) x and bank[70 % of

(2,00,000-6,800)] (1,50,000+ 2,22,600

1,68,000)]

Creditors-bill Discount 20,000

receivable 6,000 Bills receivable 45,000

dishonoured

Bank-cheques 15,000 Bad debts 9,500

dishonoured (6,000+3,500)

March By Balance c/d

_______ 31 41,900

3,39,000 3,39,000

Note: If credit sales is ` 100, cash sales will be ` 15. Total credit sales shall be 100/115

of ` 1,93,200, i.e., ` 1,68,000.

© The Institute of Chartered Accountants of India

Vous aimerez peut-être aussi

- Get More Updates on CA Inter Group I AccountingDocument16 pagesGet More Updates on CA Inter Group I AccountingMahavir ShahPas encore d'évaluation

- 2015 Bba109 Fa-1 PDFDocument2 pages2015 Bba109 Fa-1 PDFTrisha SharmaPas encore d'évaluation

- 51074bos40771 cp5Document28 pages51074bos40771 cp5Himanshu SainiPas encore d'évaluation

- Advanced Accounts MERGED May '18 To Nov '22 PYQDocument290 pagesAdvanced Accounts MERGED May '18 To Nov '22 PYQHanna GeorgePas encore d'évaluation

- 1 20MAY201420ACCOUNTS20 (420files20merged) Mtps PDFDocument45 pages1 20MAY201420ACCOUNTS20 (420files20merged) Mtps PDFDipen AdhikariPas encore d'évaluation

- AS Financial Corporate Reporting May Jun 2016Document5 pagesAS Financial Corporate Reporting May Jun 2016swarna dasPas encore d'évaluation

- Nov 16 AccountsDocument25 pagesNov 16 AccountsAmit RanaPas encore d'évaluation

- Caf-8 Cma PDFDocument5 pagesCaf-8 Cma PDFMuqtasid AhmedPas encore d'évaluation

- REVISED SS CT FAR270 May 2021 With ExplanationDocument4 pagesREVISED SS CT FAR270 May 2021 With Explanationsharifah nurshahira sakinaPas encore d'évaluation

- Ca 1Document4 pagesCa 1VaibhavrvPas encore d'évaluation

- Final Examination: Suggested Answer - Syllabus 2016 - Jun2017 - Paper 17Document21 pagesFinal Examination: Suggested Answer - Syllabus 2016 - Jun2017 - Paper 17shettymihir9Pas encore d'évaluation

- Cfr Handmade ScannerDocument272 pagesCfr Handmade Scannerrehaliya15Pas encore d'évaluation

- Inter - Nov 2023 Exam - Acc Test 1 - QueDocument3 pagesInter - Nov 2023 Exam - Acc Test 1 - QueSrushti AgarwalPas encore d'évaluation

- 8Document26 pages8harshrathore17579Pas encore d'évaluation

- 71480bos57500 p1 PDFDocument33 pages71480bos57500 p1 PDFParmeet NainPas encore d'évaluation

- IAS 16 - PPE - Supp Questions-AnswersDocument5 pagesIAS 16 - PPE - Supp Questions-Answerskevin digumberPas encore d'évaluation

- Intermediate Exam Suggested Answers Dec 2015 Paper 5Document25 pagesIntermediate Exam Suggested Answers Dec 2015 Paper 5Muhammed Nuz-hadPas encore d'évaluation

- Extra Questions For AsDocument35 pagesExtra Questions For AsAmish DebPas encore d'évaluation

- PL M17 Far Uk GaapDocument8 pagesPL M17 Far Uk GaapIssa BoyPas encore d'évaluation

- Hba 2401 Advanced Financial Reporting Cat March 2024Document5 pagesHba 2401 Advanced Financial Reporting Cat March 2024PhilipPas encore d'évaluation

- Test Series: November, 2021 Mock Test Paper - 2 Intermediate (New) : Group - I Paper - 1: AccountingDocument8 pagesTest Series: November, 2021 Mock Test Paper - 2 Intermediate (New) : Group - I Paper - 1: Accountingsunil1287Pas encore d'évaluation

- Paper - 1: Accounting: © The Institute of Chartered Accountants of IndiaDocument110 pagesPaper - 1: Accounting: © The Institute of Chartered Accountants of IndiaP.Vishnu VardhiniPas encore d'évaluation

- 71480bos57500 p1Document33 pages71480bos57500 p1Lost OnePas encore d'évaluation

- 36571suggans Ipcc Nov14-P5 PDFDocument25 pages36571suggans Ipcc Nov14-P5 PDFAvinash GanesanPas encore d'évaluation

- BF 220 Assignment 2 FTDocument4 pagesBF 220 Assignment 2 FTEmmanuel MwapePas encore d'évaluation

- © The Institute of Chartered Accountants of IndiaDocument7 pages© The Institute of Chartered Accountants of IndiaJayaprakash VenkatesanPas encore d'évaluation

- Financial Accounting and Reporting: IFRS - 2017 June QPDocument8 pagesFinancial Accounting and Reporting: IFRS - 2017 June QPMarchella LukitoPas encore d'évaluation

- Icandocumentsnovemebr 2017 Pathfinder Skills PDFDocument179 pagesIcandocumentsnovemebr 2017 Pathfinder Skills PDFDaniel AdegboyePas encore d'évaluation

- Università Bocconi Financial Reporting AnalysisDocument7 pagesUniversità Bocconi Financial Reporting AnalysisLuigi NocitaPas encore d'évaluation

- FSRA Question Bank - MBA Sem 1Document98 pagesFSRA Question Bank - MBA Sem 1Ankush NimjePas encore d'évaluation

- ITFAQuestion June 2018 ExamDocument4 pagesITFAQuestion June 2018 ExamF A Saffat RahmanPas encore d'évaluation

- Non Current Asset Questions For ACCADocument11 pagesNon Current Asset Questions For ACCAAiril RazaliPas encore d'évaluation

- Problem 1: Machinery Original Cost Date of Useful Life Salvage Value Depreciation Purchase MethodDocument1 pageProblem 1: Machinery Original Cost Date of Useful Life Salvage Value Depreciation Purchase Methodleshz zynPas encore d'évaluation

- BAMA 1101, CH5, DepreciationDocument26 pagesBAMA 1101, CH5, DepreciationWijdan Saleem EdwanPas encore d'évaluation

- Revaluation Problems Part 2Document32 pagesRevaluation Problems Part 2XPas encore d'évaluation

- (L1) Financial Reporting PDFDocument25 pages(L1) Financial Reporting PDFCasius MubambaPas encore d'évaluation

- 69796bos55750 p1Document34 pages69796bos55750 p1Dj babuPas encore d'évaluation

- AIOU Financial Reporting Checklist and AssignmentsDocument9 pagesAIOU Financial Reporting Checklist and AssignmentsSyedPas encore d'évaluation

- Accounts Ans Jan 2021Document25 pagesAccounts Ans Jan 2021Hemant AherPas encore d'évaluation

- BF 220 Assignment 2 2020 EvDocument5 pagesBF 220 Assignment 2 2020 EvEmmanuel MwapePas encore d'évaluation

- Accounting for Depreciation, Investments and Foreign ExchangeDocument25 pagesAccounting for Depreciation, Investments and Foreign ExchangeAditya PrajapatiPas encore d'évaluation

- Cycle 2 CagDocument6 pagesCycle 2 CagFleo GardivoPas encore d'évaluation

- M - Limited Companies (After Edit)Document41 pagesM - Limited Companies (After Edit)PublicEnemy007Pas encore d'évaluation

- ACC1100 S1 2018 Exam SolutionDocument15 pagesACC1100 S1 2018 Exam SolutionFarah PatelPas encore d'évaluation

- Audit Property, Plant and Equipment AssignmentDocument2 pagesAudit Property, Plant and Equipment AssignmentDan Andrei BongoPas encore d'évaluation

- Afa 1 Icmab QuestionsDocument65 pagesAfa 1 Icmab QuestionsKamrul HassanPas encore d'évaluation

- P5 FAC RTP June2013Document105 pagesP5 FAC RTP June2013AlankritaPas encore d'évaluation

- AFA End Examination 2021-2022Document6 pagesAFA End Examination 2021-2022sebastian mlingwaPas encore d'évaluation

- Question CMA April 2019 SP Exam.Document4 pagesQuestion CMA April 2019 SP Exam.F A Saffat RahmanPas encore d'évaluation

- SA Syl12 Jun2014 P5Document20 pagesSA Syl12 Jun2014 P5Vandana GuptaPas encore d'évaluation

- CA IPCC Accounts Group I Nov 14 Guideline Answers 08.11.2014Document16 pagesCA IPCC Accounts Group I Nov 14 Guideline Answers 08.11.2014anupPas encore d'évaluation

- Test 4Document8 pagesTest 4govarthan1976Pas encore d'évaluation

- Ca Q&a Dec 2017Document101 pagesCa Q&a Dec 2017Bruce GomaPas encore d'évaluation

- Intercompany Transactions- Plant Assets ConsolidationDocument4 pagesIntercompany Transactions- Plant Assets ConsolidationJohn JackPas encore d'évaluation

- First Time Login Guide MsDocument6 pagesFirst Time Login Guide MskonosubaPas encore d'évaluation

- Advanced Accounts 1 PDFDocument304 pagesAdvanced Accounts 1 PDFJohn Louie NunezPas encore d'évaluation

- Adv Acc Old M 18Document27 pagesAdv Acc Old M 18OkkkPas encore d'évaluation

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2016 EditionD'EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2016 EditionPas encore d'évaluation

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionD'EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionPas encore d'évaluation

- Guidelines for the Economic Analysis of ProjectsD'EverandGuidelines for the Economic Analysis of ProjectsPas encore d'évaluation

- Benefits of Training and Development ForDocument18 pagesBenefits of Training and Development ForKiranKumarPas encore d'évaluation

- Aguinis & Kraiger (2009) ARPDocument27 pagesAguinis & Kraiger (2009) ARPKhushbu Tewari0% (1)

- A Study On Job Satisfaction Among EmployDocument52 pagesA Study On Job Satisfaction Among EmployKiranKumarPas encore d'évaluation

- Managing Family BusinessDocument10 pagesManaging Family BusinessKiranKumarPas encore d'évaluation

- Research Washing Machine BuyingDocument9 pagesResearch Washing Machine BuyingSunny DeolPas encore d'évaluation

- Market FinalDocument32 pagesMarket FinalKiranKumarPas encore d'évaluation

- Income Tax Project ReportDocument9 pagesIncome Tax Project ReportKiranKumarPas encore d'évaluation

- IAS at A Glance - BDODocument28 pagesIAS at A Glance - BDONaim AqramPas encore d'évaluation

- DFS AgMechanization Aug2017Document69 pagesDFS AgMechanization Aug2017KaziNasirUddinOlyPas encore d'évaluation

- BUS 206 Final Project Guidelines and Rubric PDFDocument7 pagesBUS 206 Final Project Guidelines and Rubric PDFTrish FranksPas encore d'évaluation

- CA+ is a comprehensive mall management suite, giving shopping centre operators the toolset to better control, manage and improve their returnsDocument8 pagesCA+ is a comprehensive mall management suite, giving shopping centre operators the toolset to better control, manage and improve their returnsOla1Pas encore d'évaluation

- Porter's Generic Competitive Strategies and Its Influence On The Competitive AdvantageDocument10 pagesPorter's Generic Competitive Strategies and Its Influence On The Competitive AdvantageKomal sharmaPas encore d'évaluation

- A literature review of maintenance performance measurementDocument32 pagesA literature review of maintenance performance measurementm sai ravi tejaPas encore d'évaluation

- Fast Track To PRPC v5 5-09-21-09 FinalDocument2 pagesFast Track To PRPC v5 5-09-21-09 FinalfuckreshukrePas encore d'évaluation

- Auditors Have A Role in Cyberresilience Joa Eng 1119Document6 pagesAuditors Have A Role in Cyberresilience Joa Eng 1119WPJ AlexandroPas encore d'évaluation

- The British Computer Society: The Bcs Professional Examinations BCS Level 5 Diploma in ITDocument4 pagesThe British Computer Society: The Bcs Professional Examinations BCS Level 5 Diploma in ITOzioma IhekwoabaPas encore d'évaluation

- ZaraDocument25 pagesZarakarish_sadaranganiPas encore d'évaluation

- CiplaDocument19 pagesCiplaTulika AggarwalPas encore d'évaluation

- CRM AssignmentDocument5 pagesCRM Assignmentmalobika chakravartyPas encore d'évaluation

- Staisch Brand 2007Document113 pagesStaisch Brand 2007chengehPas encore d'évaluation

- Managerial Accounting 10th Edition Crosson Test Bank 1Document80 pagesManagerial Accounting 10th Edition Crosson Test Bank 1casey100% (49)

- Organizational Skills: Keterampilan BerorganisasiDocument13 pagesOrganizational Skills: Keterampilan BerorganisasiMohd NajibPas encore d'évaluation

- Role of the Sleeping PartnerDocument15 pagesRole of the Sleeping PartnerKhalid AsgherPas encore d'évaluation

- Payroll ProjectDocument16 pagesPayroll ProjectKatrina Rardon-Swoboda68% (25)

- Sample Quiz QuestionsDocument2 pagesSample Quiz QuestionsSuperGuyPas encore d'évaluation

- Tender B1 Aluminium Glazing WorksDocument114 pagesTender B1 Aluminium Glazing WorksDaliPotter100% (1)

- Qualifying Examination ReviewerDocument6 pagesQualifying Examination ReviewerAira Kaye MartosPas encore d'évaluation

- Project Management PDFDocument228 pagesProject Management PDFNitin SharmaPas encore d'évaluation

- Sean Vosler Matt Clark (PDFDrive)Document80 pagesSean Vosler Matt Clark (PDFDrive)RadwinPas encore d'évaluation

- HRM Chapter 6Document42 pagesHRM Chapter 6AgatPas encore d'évaluation

- Chapter 3 - Problem SetDocument14 pagesChapter 3 - Problem SetNetflix 0001Pas encore d'évaluation

- Atul Auto LTD.: Ratio & Company AnalysisDocument7 pagesAtul Auto LTD.: Ratio & Company AnalysisMohit KanjwaniPas encore d'évaluation

- A Study On Working Capital Management With Special Reference To Steel Authority of India Limited, SalemDocument19 pagesA Study On Working Capital Management With Special Reference To Steel Authority of India Limited, SalemCHEIF EDITORPas encore d'évaluation

- Ease of Doing BusinessDocument16 pagesEase of Doing BusinessNathaniel100% (1)

- Financial and Non Financial MotivationDocument40 pagesFinancial and Non Financial MotivationSatya Chaitanya Anupama KalidindiPas encore d'évaluation

- Vakrangee LimitedDocument3 pagesVakrangee LimitedSubham MazumdarPas encore d'évaluation

- Journal of Business Valuation 2016 Final PDFDocument93 pagesJournal of Business Valuation 2016 Final PDFOren BouzagloPas encore d'évaluation