Académique Documents

Professionnel Documents

Culture Documents

Accounts From Incomplete Records

Transféré par

leenajaiswal0 évaluation0% ont trouvé ce document utile (0 vote)

589 vues3 pagesSingle-entry bookkeeping system is a method of bookkeeping relying on a one sided accounting entry to maintain financial information. It is usually adopted by small business concern like sole trader and partnership firms whose volume of business and financial resources do not warrant the elaborate and costly double-entry system.

Description originale:

Copyright

© Attribution Non-Commercial (BY-NC)

Formats disponibles

DOC, PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentSingle-entry bookkeeping system is a method of bookkeeping relying on a one sided accounting entry to maintain financial information. It is usually adopted by small business concern like sole trader and partnership firms whose volume of business and financial resources do not warrant the elaborate and costly double-entry system.

Droits d'auteur :

Attribution Non-Commercial (BY-NC)

Formats disponibles

Téléchargez comme DOC, PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

589 vues3 pagesAccounts From Incomplete Records

Transféré par

leenajaiswalSingle-entry bookkeeping system is a method of bookkeeping relying on a one sided accounting entry to maintain financial information. It is usually adopted by small business concern like sole trader and partnership firms whose volume of business and financial resources do not warrant the elaborate and costly double-entry system.

Droits d'auteur :

Attribution Non-Commercial (BY-NC)

Formats disponibles

Téléchargez comme DOC, PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 3

ACCOUNTS FROM INCOMPLETE RECORDS

OR

SINGLE-ENTRY BOOKKEEPING SYSTEMS:

Single-entry bookkeeping system means any accounting records which

do not contain a complete record (i.e. a record of both the debit and credit

aspects) of each and every transaction.

Single-entry bookkeeping system also known as Single-entry

accounting system is a method of bookkeeping relying on a one sided

accounting entry to maintain financial information.

FEATURES OF SINGLE-ENTRY SYSTEM:

1. Incompleteness of accounting records is the most important feature of

the single-entry system.

2. Under this system, no hard and fast rules are observed for recording

business transaction.

3. There is no uniformity under this system as regards the recording of

business transactions.

4. Under this system, all accounts are not maintained.

5. The cash book, maintained under this system, usually, mixes up the

business transaction as well the private transaction of the proprietor.

6. As a complete record of each and every transaction is not maintained

under this system, this system gives only partial information, not full

information of the business.

7. As the full information about the business is not given by this system,

this system is an incomplete, unscientific, unsatisfactory and unreliable

system of bookkeeping.

8. It is a simple and economical system of bookkeeping, as it needs less

number of books of account.

9. It is, usually, adopted by small business concern like sole trader and

partnership firms whose volume of business and financial resources do

not warrant the elaborate and costly double-entry system.

ADVANTAGES SINGLE-ENTRY SYSTEM:

1. This system is easy to understand.

2. It is a simple method of recording business transactions, because an

elaborate accounting procedure is not involved in this system.

3. It is less costly when compared the double-entry system because fewer

books of account are maintained under this system.

4. As this system is simple and less costly, it is suitable for small

concerns.

DISADVANTAGES SINGLE-ENTRY SYSTEM:

1. Data may not be available to management for effectively planning

and controlling the business.

2. Lack of systematic and precise bookkeeping may lead to inefficient

administration and reduced control over the affairs of the business.

3. Single-entry records do not provide a check against clerical error,

as does a double-entry system. This is one of the most serious

defects of single-entry systems.

4. Single-entry records seldom make provision for recording all

transactions. In addition, many internal transactions, such

as adjusting entries are often not recorded.

5. Because no accounts are provided for many of the items appearing

in both the Income Statement and Balance Sheet, omission of

important data is possible.

6. In the absence of detailed records of all assets, lax administration

of those assets may occur.

7. Theft and other losses are less likely to be detected.

TYPES OF SINGLE-ENTRY SYSTEM:

1.Pure Single-Entry System

2.Simple Single-Entry System

3.Quasi Single-Entry System

Pure Single-Entry System: is a system under which no

subsidiary books are maintained. Only a ledger, containing only the personal

accounts of debtors and creditors is kept.

Simple Single-Entry System: is a system under which a

subsidiary book, viz., the cash book, and ledger, containing only the personal

accounts of debtors and creditors are maintained.

Quasi Single-Entry System: is a system under which more than

one subsidiary book (usually, the cash book, the purchase book, the sales

book, the purchases returns book and the sales returns book) and ledger are

maintained.

Vous aimerez peut-être aussi

- Unit 11Document20 pagesUnit 11ratna12340% (1)

- Types of Operating System SchedulersDocument26 pagesTypes of Operating System SchedulersVa SuPas encore d'évaluation

- Accounts From Incomplete RecordsDocument38 pagesAccounts From Incomplete Recordsdebashis1008100% (4)

- Databases and Compiler Lab DatabasesDocument4 pagesDatabases and Compiler Lab DatabasesKiran Kumar MPas encore d'évaluation

- TreesDocument35 pagesTreesvijayaraj rPas encore d'évaluation

- Access FM For A3 and b1Document1 pageAccess FM For A3 and b1feyrePas encore d'évaluation

- Is Ys 1142014 Exam SolutionDocument22 pagesIs Ys 1142014 Exam Solutionalbi0% (1)

- Indifference CurveDocument16 pagesIndifference Curveএস. এম. তানজিলুল ইসলামPas encore d'évaluation

- MB0033 Project Management - Model Question PaperDocument18 pagesMB0033 Project Management - Model Question PaperAlarkan PoothencheryPas encore d'évaluation

- Memory Management: Virtual MemoryDocument50 pagesMemory Management: Virtual MemoryrvalethPas encore d'évaluation

- 473-NAL Computer Ethics & SocietyDocument48 pages473-NAL Computer Ethics & SocietyHumera GullPas encore d'évaluation

- Introduction To UMLand OODDocument48 pagesIntroduction To UMLand OODArun NairPas encore d'évaluation

- Product Analysis: ACCESS FM Method of Analysing A ProductDocument1 pageProduct Analysis: ACCESS FM Method of Analysing A ProductD M Shawkot HossainPas encore d'évaluation

- Kcse Prediction 2 Class of March 2022Document207 pagesKcse Prediction 2 Class of March 2022Jeddah TroyPas encore d'évaluation

- Economics A Level - Chapter 6 - Basic Economic Ideas and Resource Allocation - HandoutDocument19 pagesEconomics A Level - Chapter 6 - Basic Economic Ideas and Resource Allocation - Handoutdenny_sitorusPas encore d'évaluation

- Analysing and Evaluating Government Intervention - Economics - Tutor2uDocument14 pagesAnalysing and Evaluating Government Intervention - Economics - Tutor2uSaloni Jain 1820343Pas encore d'évaluation

- Virtual Memory Management-Operating SystemsDocument72 pagesVirtual Memory Management-Operating SystemsSanket Chavan100% (1)

- Principles of Economics Chapter 13Document47 pagesPrinciples of Economics Chapter 13Louie Guese MangunePas encore d'évaluation

- 11 Economics - Presentation of Data - NotesDocument15 pages11 Economics - Presentation of Data - NotesDheepika KPas encore d'évaluation

- The Structure and Features of A Book Review and An Article Critique. The Feature and Structure of A Book ReviewDocument2 pagesThe Structure and Features of A Book Review and An Article Critique. The Feature and Structure of A Book ReviewDiana CustodioPas encore d'évaluation

- CH 9.1 Computational Thinking and Alogrithm DesigningDocument86 pagesCH 9.1 Computational Thinking and Alogrithm DesigningPrayrit JainPas encore d'évaluation

- Chap 3 AnswersDocument3 pagesChap 3 Answersnarender_singh_62100% (2)

- Classical Theory of InterestDocument9 pagesClassical Theory of InterestJasmine KaurPas encore d'évaluation

- UML NotesDocument14 pagesUML NotesBuddhika PrabathPas encore d'évaluation

- Chapter One: Server Side Scripting BasicDocument122 pagesChapter One: Server Side Scripting BasicBirhanu AberaPas encore d'évaluation

- Information Technology in A Global Society - Stuart Gray - 2011Document376 pagesInformation Technology in A Global Society - Stuart Gray - 2011Rodrigo NegroPas encore d'évaluation

- CSC203 - Operating System ConceptsDocument55 pagesCSC203 - Operating System ConceptsMohd KhairiPas encore d'évaluation

- Costing Methods ExplainedDocument4 pagesCosting Methods ExplainedMehar BhagatPas encore d'évaluation

- ITGS SyllabusDocument2 pagesITGS SyllabusDaniel LuckPas encore d'évaluation

- Ms ExcelDocument66 pagesMs ExcelRommel DorinPas encore d'évaluation

- 4 Classical Approaches of ManagementDocument36 pages4 Classical Approaches of Managementhoney guptaPas encore d'évaluation

- Economics Today MagazineDocument44 pagesEconomics Today MagazineLeng RyanPas encore d'évaluation

- Javascript ValidationDocument2 pagesJavascript ValidationBrenda CoxPas encore d'évaluation

- Mbo MbeDocument5 pagesMbo MbeHareesh ChowtipalliPas encore d'évaluation

- All Sessions of EcoDocument235 pagesAll Sessions of EcoNishtha GargPas encore d'évaluation

- Macroeconomics Anforme TextbookDocument64 pagesMacroeconomics Anforme TextbookScott Jefferson100% (1)

- 14 Principles of ManagementDocument5 pages14 Principles of ManagementSangam PandeyPas encore d'évaluation

- Converting An E-R Diagram To A Relational SchemaDocument4 pagesConverting An E-R Diagram To A Relational SchemaChris WilliamsPas encore d'évaluation

- Managerial Economics MeaningDocument41 pagesManagerial Economics MeaningPaul TibbinPas encore d'évaluation

- 12 Economics Notes Macro Ch02 Money and BankingDocument6 pages12 Economics Notes Macro Ch02 Money and BankingRitikaPas encore d'évaluation

- Final AccountDocument47 pagesFinal Accountsakshi tomarPas encore d'évaluation

- Unit-1 Scope of Economics Mechanism of Supply and DemandDocument34 pagesUnit-1 Scope of Economics Mechanism of Supply and DemandsrivaruniPas encore d'évaluation

- Micro-Economics - IDocument147 pagesMicro-Economics - IWamek NuraPas encore d'évaluation

- Reverse Polish NotationDocument3 pagesReverse Polish NotationShakila Shaki100% (2)

- Rectification of Accounting ErrorsDocument21 pagesRectification of Accounting ErrorsSami AhmadPas encore d'évaluation

- School of Distance Education Economics ModuleDocument325 pagesSchool of Distance Education Economics ModuleAnil Kumar SudarsiPas encore d'évaluation

- ERPDocument49 pagesERPDeep MalaniPas encore d'évaluation

- DBA MathsDocument98 pagesDBA Mathsvictor chisengaPas encore d'évaluation

- Economic Development and GlobalizationDocument5 pagesEconomic Development and GlobalizationNapoleon MpofuPas encore d'évaluation

- Session 1 - Introduction To JavaDocument36 pagesSession 1 - Introduction To Javat0eberriesPas encore d'évaluation

- Determination of Equilibrium Price Through Interaction of Demand and SupplyDocument2 pagesDetermination of Equilibrium Price Through Interaction of Demand and SupplyMahendra Chhetri100% (1)

- Accounting Concepts and Conventions ExplainedDocument8 pagesAccounting Concepts and Conventions ExplainedAkash Malik100% (1)

- Business Communication Models & ProcessesDocument58 pagesBusiness Communication Models & Processesneha sharmaPas encore d'évaluation

- Break Even ChartDocument20 pagesBreak Even ChartKarim ManjiyaniPas encore d'évaluation

- Submitted By: Biki Das Class - XI Stream - Commerce Roll No. - 5Document42 pagesSubmitted By: Biki Das Class - XI Stream - Commerce Roll No. - 5Biki DasPas encore d'évaluation

- Ict 113 AssignmentDocument11 pagesIct 113 AssignmentTomi Wayne Malenga100% (1)

- Entrepreneurial Skills NotesDocument4 pagesEntrepreneurial Skills Notesnp opPas encore d'évaluation

- Single Entry SystemDocument16 pagesSingle Entry Systemmmuneebsda67% (9)

- Single Entry SystemDocument15 pagesSingle Entry Systemmdhanjalah08Pas encore d'évaluation

- Single Entry and Incomplete Records - NotesDocument3 pagesSingle Entry and Incomplete Records - NotesBamidele Adegboye100% (1)

- Jaiswal Final ReportDocument115 pagesJaiswal Final ReportleenajaiswalPas encore d'évaluation

- VDocument8 pagesVleenajaiswalPas encore d'évaluation

- X yDocument4 pagesX yleenajaiswalPas encore d'évaluation

- S SA Saif SAR Saturns SB SBD SC Scap SCR SD SDD SDR SE Seaq SEC SED Sehk SEK SHP Siac SIC SimexDocument64 pagesS SA Saif SAR Saturns SB SBD SC Scap SCR SD SDD SDR SE Seaq SEC SED Sehk SEK SHP Siac SIC SimexleenajaiswalPas encore d'évaluation

- TDocument37 pagesTleenajaiswalPas encore d'évaluation

- WDocument11 pagesWleenajaiswalPas encore d'évaluation

- UDocument11 pagesUleenajaiswalPas encore d'évaluation

- QDocument4 pagesQleenajaiswalPas encore d'évaluation

- JDocument4 pagesJleenajaiswalPas encore d'évaluation

- ODocument21 pagesOleenajaiswalPas encore d'évaluation

- RDocument37 pagesRleenajaiswalPas encore d'évaluation

- Nasdaq IssueDocument4 pagesNasdaq IssueleenajaiswalPas encore d'évaluation

- NDocument23 pagesNleenajaiswalPas encore d'évaluation

- PDocument50 pagesPleenajaiswalPas encore d'évaluation

- MDocument34 pagesMleenajaiswalPas encore d'évaluation

- EDocument33 pagesEleenajaiswalPas encore d'évaluation

- LDocument25 pagesLleenajaiswalPas encore d'évaluation

- IDocument33 pagesIleenajaiswalPas encore d'évaluation

- Acceptance The DraweeDocument74 pagesAcceptance The DraweeleenajaiswalPas encore d'évaluation

- HDocument12 pagesHleenajaiswalPas encore d'évaluation

- GDocument18 pagesGleenajaiswalPas encore d'évaluation

- Corporate Finance Formula SheetDocument9 pagesCorporate Finance Formula SheetWilliamPas encore d'évaluation

- BDocument36 pagesBleenajaiswalPas encore d'évaluation

- FDocument40 pagesFleenajaiswalPas encore d'évaluation

- DDocument38 pagesDleenajaiswalPas encore d'évaluation

- CDocument70 pagesCleenajaiswalPas encore d'évaluation

- AdministrationDocument2 pagesAdministrationleenajaiswalPas encore d'évaluation

- Chapter 5 - Information For Decision MakingDocument12 pagesChapter 5 - Information For Decision MakingleenajaiswalPas encore d'évaluation

- ADocument46 pagesAleenajaiswalPas encore d'évaluation

- Financial, Managerial Accounting and ReportingDocument29 pagesFinancial, Managerial Accounting and ReportingleenajaiswalPas encore d'évaluation

- For The Families of Some Debtors, Death Offers No RespiteDocument5 pagesFor The Families of Some Debtors, Death Offers No RespiteSimply Debt SolutionsPas encore d'évaluation

- OWNERISSUE110106IDocument16 pagesOWNERISSUE110106ISamPas encore d'évaluation

- Deloitte AnalyticsDocument5 pagesDeloitte Analyticsapi-89285443Pas encore d'évaluation

- Allison Faye C. Fernandez FM 1B: 1. LiberalizationDocument2 pagesAllison Faye C. Fernandez FM 1B: 1. LiberalizationKae SvetlanaPas encore d'évaluation

- Importance of Market Research in Marketing ProgramsDocument10 pagesImportance of Market Research in Marketing ProgramsPrincessqueenPas encore d'évaluation

- Sales Budget PlanningDocument18 pagesSales Budget PlanninganashussainPas encore d'évaluation

- Company Member Details and Lean Management ReportDocument17 pagesCompany Member Details and Lean Management ReportAritra BanerjeePas encore d'évaluation

- Invitation To Attend COSH Seminar WorkshopDocument1 pageInvitation To Attend COSH Seminar WorkshopOliver Sumbrana100% (1)

- Financial Statement Analysis of Lakshmigraha Worldwide IncDocument77 pagesFinancial Statement Analysis of Lakshmigraha Worldwide IncSurendra SkPas encore d'évaluation

- 6.1 Improper Accounting Procedures: Module 6: Avoiding Illegal AccountingDocument12 pages6.1 Improper Accounting Procedures: Module 6: Avoiding Illegal AccountingMartina MartinaPas encore d'évaluation

- Corporate Social Responsibility of NestléDocument4 pagesCorporate Social Responsibility of NestléMary Quezia AlferezPas encore d'évaluation

- Analysis of Methods That Enhance Sustainable Waste Management in Construction Process To Ensure Sustainable Living in Nigeria - Chapter 1Document13 pagesAnalysis of Methods That Enhance Sustainable Waste Management in Construction Process To Ensure Sustainable Living in Nigeria - Chapter 1Customize essayPas encore d'évaluation

- MQ3 Spr08gDocument10 pagesMQ3 Spr08gjhouvanPas encore d'évaluation

- ch18 ANALYZING FINANCIAL STATEMENTSDocument67 pagesch18 ANALYZING FINANCIAL STATEMENTSUpal MahmudPas encore d'évaluation

- Who Blows The Whistle On Corporate FraudDocument41 pagesWho Blows The Whistle On Corporate FraudDebPas encore d'évaluation

- Assignment5 HW5Document9 pagesAssignment5 HW5RUPIKA R GPas encore d'évaluation

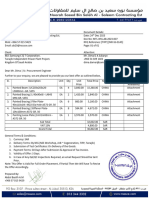

- 007.MTL-NSS-AB-2023-007 - Quotation For SS Fabrication & Coating - MR-SS-0145Document1 page007.MTL-NSS-AB-2023-007 - Quotation For SS Fabrication & Coating - MR-SS-0145abasithamPas encore d'évaluation

- Initial and Subsequent Measurement of Investment PropertyDocument2 pagesInitial and Subsequent Measurement of Investment PropertydorpianabsaPas encore d'évaluation

- DI Chapter 5 - CaseletsDocument4 pagesDI Chapter 5 - CaseletsDibyendu RoyPas encore d'évaluation

- Excel Construction Budget TemplateDocument4 pagesExcel Construction Budget TemplateMohamedPas encore d'évaluation

- Test Bank Chapter 2Document31 pagesTest Bank Chapter 2Hala TarekPas encore d'évaluation

- SOP - HOtel Credit Policy and PRoceduresDocument4 pagesSOP - HOtel Credit Policy and PRoceduresImee S. YuPas encore d'évaluation

- The Financial Statements of Banks and Their Principal CompetitorsDocument30 pagesThe Financial Statements of Banks and Their Principal CompetitorsMahmudur Rahman100% (4)

- Monopoly AnswersDocument4 pagesMonopoly AnswersRyanPas encore d'évaluation

- Fishbone DiagramDocument1 pageFishbone DiagramAsri Marwa UmniatiPas encore d'évaluation

- Afonso 2012Document33 pagesAfonso 2012Nicolas CopernicPas encore d'évaluation

- Test 1 Ma2Document15 pagesTest 1 Ma2Waseem Ahmad Qurashi63% (8)

- P1-1a 6081901141Document2 pagesP1-1a 6081901141Mentari AnggariPas encore d'évaluation

- CFAS - Prelims Exam With AnsDocument12 pagesCFAS - Prelims Exam With AnsAbarilles, Sherinah Mae P.Pas encore d'évaluation

- Chief Engineer IBIS-Indus Telemetry - HP SJ 2600f1 Scaner - Q051223 - NomanDocument3 pagesChief Engineer IBIS-Indus Telemetry - HP SJ 2600f1 Scaner - Q051223 - NomanMumtaz Ali QaziPas encore d'évaluation