Académique Documents

Professionnel Documents

Culture Documents

Daily Tbills Rate Quotation 11.06.2017 p25m

Transféré par

Eric MandiitDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Daily Tbills Rate Quotation 11.06.2017 p25m

Transféré par

Eric MandiitDroits d'auteur :

Formats disponibles

CLASS B

Deal Date: November 6, 2017 Monday

PLACEMENT

Settlement Date:

November 7, 2017 Tuesday

Subject : INDICATIVE QUOTATION - GOVERNMENT SECURITIES Time Mapped:

Date : November 6, 2017

Good day. Below are our indicative quotations in secondary market value 7-Nov-17 *: 25,000,000.00

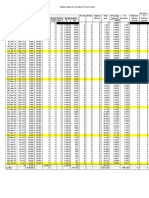

Treasury Bills - negotiable, non-interest bearing securities with original maturities of 3 months, 6 months and 1 year; are issued at a discount from face value and redeemed at par value

Fees and Charges Total Selling Net Interest to

Term Selling Rate Face Selling Price be earned/

Security Type ISIN Issue Date Maturity Date LBP Broker's PDEx Mapping Fee

(In Days) (gross) 2/ Value 3/ Price 4/ (Total Cash Out) Total Discount

Fee 5/ 6/ 7/ 11/

T-BILL PIBL0317H113 22 30-Aug-17 29-Nov-17 2.00000% 25,000,000.00 24,975,585.40 1,527.78 37.67 24,977,150.84 22,849.16

T-BILL PIBL0317J148 64 11-Oct-17 10-Jan-18 2.08000% 25,000,000.00 24,926,316.91 4,444.44 109.59 24,930,870.94 69,129.06

T-BILL PIBL0317J157 78 01-Feb-17 24-Jan-18 2.05000% 25,000,000.00 24,911,559.49 5,416.67 133.56 24,917,109.72 82,890.28

T-BILL PIBL1217B021 85 15-Feb-17 31-Jan-18 2.10000% 25,000,000.00 24,901,322.61 5,902.78 145.55 24,907,370.93 92,629.07

T-BILL PIBL0617D065 155 27-Sep-17 11-Apr-18 2.47500% 25,000,000.00 24,789,122.17 10,763.89 265.41 24,800,151.47 199,848.53

T-BILL PIBL1217D074 169 12-Apr-17 25-Apr-18 2.17500% 25,000,000.00 24,797,855.64 11,736.11 289.38 24,809,881.14 190,118.86

T-BILL PIBL1217F107 211 07-Jun-17 06-Jun-18 2.55000% 25,000,000.00 24,705,485.10 14,652.78 361.30 24,720,499.18 279,500.82

T-BILL PIBL1217G133 253 19-Jul-17 18-Jul-18 2.65000% 25,000,000.00 24,634,337.73 17,569.44 433.22 24,652,340.39 347,659.61

T-BILL PIBL1217H141 267 02-Aug-17 01-Aug-18 2.80000% 25,000,000.00 24,593,116.29 18,541.67 457.19 24,612,115.14 387,884.86

T-BILL PIBL1217H150 281 16-Aug-17 15-Aug-18 2.82500% 25,000,000.00 24,568,500.96 19,513.89 481.16 24,588,496.02 411,503.98

T-BILL PIBL1217H169 295 30-Aug-17 29-Aug-18 2.82550% 25,000,000.00 24,547,410.92 20,486.11 505.14 24,568,402.17 431,597.83

T-BILL PIBL1217I186 323 13-Sep-17 26-Sep-18 2.82500% 25,000,000.00 24,505,600.75 22,430.56 553.08 24,528,584.39 471,415.61

T-BILL PIBL1217I194 337 11-Oct-17 10-Oct-18 2.82500% 25,000,000.00 24,484,723.77 23,402.78 577.05 24,508,703.61 491,296.39

T-BILL PIBL1217J201 351 11-Oct-17 24-Oct-18 2.85000% 25,000,000.00 24,459,275.39 24,375.00 601.03 24,484,251.41 515,748.59

*Rates are as of November 06, 2017 9:30 AM Please note that the rates and availability are subject to change .

Notes:

1/ Feature of the bond and the basis of interest 7/ Total selling price = selling price + fees & charges

2/ Prevailing Market Rate 8/ Coupon payment to be credited (FXTN = semi-annual; RTB = quarterly), computed as:

3/ To be credited upon maturity date a. FXTN = Face Value x Coupon rate x 180/360 x .80

4/ Selling price at given market rate b. RTB = Face Value x Coupon rate x 90/360 x .80

5/ LBP Broker's Fee = '0.10% computed as follows: 9/ Total Coupon payments: Coupon payment x no. of remaining coupon payments

a. For securities with remaining term of 360 days or less: Face value x 0.001 x Term / 360 or Php200, whichever is higher 10/ Total Net Interest Earned: Total coupon payments - (Total Selling Price-Face Value)

b. For securities with remaining term of more than 1 year: Face value x 0.001 or Php 200, whichever is higher 11/ For Treasury Bills: Total Discount = Face Value - Total Selling Price

6/ PDEx Mapping Fee = 0.0025% computed as follows:

a. For securities with remaining term of 365 days or less: Face value x 0.000025x Term/365

b. For securities with remaining term of more than 1 year: Face x 0.000025

Please contact ISDD - Pampanga Treasury Hub at (045)624-2128 for your further inquiries.

ISDD Isabela Treasury Hub Rate Bulletin - Government Securities - 11/6/2017

Page 1 of 1

Vous aimerez peut-être aussi

- Perhitungan Harga Wajar Bank Bca Tahun 2017 - 2018Document3 pagesPerhitungan Harga Wajar Bank Bca Tahun 2017 - 2018Jamaludin sihagPas encore d'évaluation

- SPHDocument38 pagesSPHMaulana AzizPas encore d'évaluation

- The Gordon Model Cost of EquityDocument35 pagesThe Gordon Model Cost of EquityMahmood AhmadPas encore d'évaluation

- JawabanDocument12 pagesJawaban15AriemahardikaAPPas encore d'évaluation

- Investment Memo 2022112 1559Document7 pagesInvestment Memo 2022112 1559hoiPas encore d'évaluation

- AndresDocument1 pageAndresQueenzel SaggotPas encore d'évaluation

- Account Statement From 3 Nov 2017 To 23 May 2018: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument4 pagesAccount Statement From 3 Nov 2017 To 23 May 2018: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceUMESH KUMAR YadavPas encore d'évaluation

- ADM TrackerDocument9 pagesADM TrackerEdward PagayonaPas encore d'évaluation

- Company Name Ticker Free Float Volume Traded Share Outstandin G Average Closing PriceDocument23 pagesCompany Name Ticker Free Float Volume Traded Share Outstandin G Average Closing PricenkmpatnaPas encore d'évaluation

- Liquidacion Del CreditoDocument1 pageLiquidacion Del CreditoJesus OrtegaPas encore d'évaluation

- LPCKDocument3 pagesLPCKPrasetyo Indra SuronoPas encore d'évaluation

- Details of Cheque Collections Cheque Remittance Particulars PMS COLLECTIONS (Counter Id Wise Breakup) Collection Date Challan Amount (13 10)Document17 pagesDetails of Cheque Collections Cheque Remittance Particulars PMS COLLECTIONS (Counter Id Wise Breakup) Collection Date Challan Amount (13 10)SDE PONNERIPas encore d'évaluation

- Date Check No. Amount Particulars Liquidation Date Amount STFDocument22 pagesDate Check No. Amount Particulars Liquidation Date Amount STFjjPas encore d'évaluation

- 1563470470430iGymZrii86pAaf8p PDFDocument2 pages1563470470430iGymZrii86pAaf8p PDFPreeti SinghPas encore d'évaluation

- Pembahasan Latihan - TM1Document2 pagesPembahasan Latihan - TM1AnnidaPas encore d'évaluation

- Island Homes Sold - 2017Document4 pagesIsland Homes Sold - 2017cutty54Pas encore d'évaluation

- 24cfin-Equity - Share & Commodity Tips - Stock Market - SEBIDocument19 pages24cfin-Equity - Share & Commodity Tips - Stock Market - SEBISiddharth PatelPas encore d'évaluation

- Review Project RRL 2017Document2 pagesReview Project RRL 2017DadanPas encore d'évaluation

- Rangkuman Analisis Laporan KeuanganDocument3 pagesRangkuman Analisis Laporan KeuanganAndre HendrawanPas encore d'évaluation

- Budz Computer Center: September Sales ReportDocument42 pagesBudz Computer Center: September Sales Reportjumel blandoPas encore d'évaluation

- Hba Interest Calculator ShareDocument1 pageHba Interest Calculator ShareMANOJ KUMARPas encore d'évaluation

- Quiz 11 - Audit of Investment (STRAIGHT PROB - KEY)Document6 pagesQuiz 11 - Audit of Investment (STRAIGHT PROB - KEY)Kenneth Christian WilburPas encore d'évaluation

- Account Statement From 1 Sep 2017 To 15 Jan 2018: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument7 pagesAccount Statement From 1 Sep 2017 To 15 Jan 2018: TXN Date Value Date Description Ref No./Cheque No. Debit Credit Balancevandv printsPas encore d'évaluation

- Island Homes Sold - 2017Document2 pagesIsland Homes Sold - 2017cutty54Pas encore d'évaluation

- Island Homes Sold - 2017Document2 pagesIsland Homes Sold - 2017cutty54Pas encore d'évaluation

- Island Homes Sold - 2017Document2 pagesIsland Homes Sold - 2017cutty54Pas encore d'évaluation

- Island Homes Sold - 2017Document2 pagesIsland Homes Sold - 2017cutty54Pas encore d'évaluation

- Island Homes Sold - 2017Document2 pagesIsland Homes Sold - 2017cutty54Pas encore d'évaluation

- Island Homes Sold - 2017Document2 pagesIsland Homes Sold - 2017cutty54Pas encore d'évaluation

- AP QUIZ 2 Inventories InvestmentsDocument13 pagesAP QUIZ 2 Inventories InvestmentsRobinOralloPilar25% (4)

- Lippo Cikarang TBK.: Company Report: January 2019 As of 31 January 2019Document3 pagesLippo Cikarang TBK.: Company Report: January 2019 As of 31 January 2019Denny SiswajaPas encore d'évaluation

- Island Homes Sold - 2017Document4 pagesIsland Homes Sold - 2017cutty54Pas encore d'évaluation

- Island Homes Sold - 2017Document4 pagesIsland Homes Sold - 2017cutty54Pas encore d'évaluation

- Island Homes Sold - 2017Document4 pagesIsland Homes Sold - 2017cutty54Pas encore d'évaluation

- Island Homes Sold - 2017Document4 pagesIsland Homes Sold - 2017cutty54Pas encore d'évaluation

- 2017 Mid - Year ReportDocument9 pages2017 Mid - Year ReportSamuel OjeneyePas encore d'évaluation

- Island Homes Sold - 2017Document4 pagesIsland Homes Sold - 2017cutty54Pas encore d'évaluation

- Island Homes Sold - 2017Document4 pagesIsland Homes Sold - 2017cutty54Pas encore d'évaluation

- Date OB Plan Actual Ach (%) Daily MTD Daily MTD Daily MTDDocument6 pagesDate OB Plan Actual Ach (%) Daily MTD Daily MTD Daily MTDChanz RaflezzPas encore d'évaluation

- Icici MF Capitalgain 2021FYDocument3 pagesIcici MF Capitalgain 2021FYvinay44106Pas encore d'évaluation

- Capital Gains Statement: Nippon India Credit Risk Fund - Growth Plan Growth Option (Inf204K01Fq3)Document3 pagesCapital Gains Statement: Nippon India Credit Risk Fund - Growth Plan Growth Option (Inf204K01Fq3)kulwinder singhPas encore d'évaluation

- Island Homes Sold - 2017Document4 pagesIsland Homes Sold - 2017cutty54Pas encore d'évaluation

- Total Funded Current Stocks Total # of SharesDocument6 pagesTotal Funded Current Stocks Total # of SharesRuff CanalesPas encore d'évaluation

- Island Homes Sold - 2017Document4 pagesIsland Homes Sold - 2017cutty54Pas encore d'évaluation

- The Gordon Model Cost of EquityDocument165 pagesThe Gordon Model Cost of EquitySyed Ameer Ali ShahPas encore d'évaluation

- CabusaoDocument4 pagesCabusaoruelcabusao1Pas encore d'évaluation

- Island Homes Sold - 2017Document4 pagesIsland Homes Sold - 2017cutty54Pas encore d'évaluation

- Data Land, Inc.: The Silk Residences Tower 1 Unit 3803Document1 pageData Land, Inc.: The Silk Residences Tower 1 Unit 3803Prince MagallanesPas encore d'évaluation

- Analisis Restrukturisasi RahayuDocument8 pagesAnalisis Restrukturisasi RahayuRiyan RanggaPas encore d'évaluation

- Rincian PaninDocument2 pagesRincian PaninDeni HerdinPas encore d'évaluation

- Island Homes Sold - 2017Document4 pagesIsland Homes Sold - 2017cutty54Pas encore d'évaluation

- Island Homes Sold - 2017Document1 pageIsland Homes Sold - 2017cutty54Pas encore d'évaluation

- Rekapan Pembayaran Alam RayaDocument3 pagesRekapan Pembayaran Alam RayaSpv LouisPas encore d'évaluation

- Financial Report (Toyota) Balance SheetDocument9 pagesFinancial Report (Toyota) Balance SheetShreya AgrahariPas encore d'évaluation

- QM Assignment Group 1Document23 pagesQM Assignment Group 1vijay bhardwajPas encore d'évaluation

- Alinabon, Jeninnie de Chavez, Baby Ciel R. Dela Cruz, Almera DDocument4 pagesAlinabon, Jeninnie de Chavez, Baby Ciel R. Dela Cruz, Almera DMATREO, JUNELLAHPas encore d'évaluation

- Synergy ExchangeDocument6 pagesSynergy ExchangeAnuj Tomer100% (1)

- Barito Pacific TBKDocument3 pagesBarito Pacific TBKTaufik Hidayat LubisPas encore d'évaluation

- Domestic Markets & Monetary Management DepartmentDocument1 pageDomestic Markets & Monetary Management DepartmentZubayrPas encore d'évaluation

- Affidavit of Service NewDocument1 pageAffidavit of Service NewEric MandiitPas encore d'évaluation

- UFRAN - Shawarma ShackDocument13 pagesUFRAN - Shawarma ShackEric Mandiit100% (1)

- Vaccination Program: Day 1 Mareks NCD (B1B1) + Ib Live Ibd (Gumboro)Document1 pageVaccination Program: Day 1 Mareks NCD (B1B1) + Ib Live Ibd (Gumboro)Eric MandiitPas encore d'évaluation

- MarkingsDocument5 pagesMarkingsEric MandiitPas encore d'évaluation

- Promissory Note With TermsDocument2 pagesPromissory Note With TermsEric MandiitPas encore d'évaluation

- UFRAN - Shawarma ShackDocument13 pagesUFRAN - Shawarma ShackEric Mandiit100% (1)

- Overview of Financial SystemDocument50 pagesOverview of Financial SystemshahyashrPas encore d'évaluation

- Strategie - Admiralmarkets - The MACD Indicator in DepthDocument41 pagesStrategie - Admiralmarkets - The MACD Indicator in Deptheugenp100% (2)

- The Market Facilitation Index: Novice TraderDocument8 pagesThe Market Facilitation Index: Novice TraderHassan DMPas encore d'évaluation

- The Philippine Stock MarketDocument6 pagesThe Philippine Stock MarketxstreetlightsPas encore d'évaluation

- 2009 ArDocument220 pages2009 ArjennabushPas encore d'évaluation

- Ba&a - MCQ4Document11 pagesBa&a - MCQ4Aniket PuriPas encore d'évaluation

- MortgageDocument12 pagesMortgageSabya Sachee RaiPas encore d'évaluation

- Interim Order in The Matter of Vishwamitra International Infra LimitedDocument29 pagesInterim Order in The Matter of Vishwamitra International Infra LimitedShyam SunderPas encore d'évaluation

- Resolution by Circulation - ArticleDocument4 pagesResolution by Circulation - Articlenancy mandholiaPas encore d'évaluation

- Mba Finance Project Topics12345 PDFDocument4 pagesMba Finance Project Topics12345 PDFssanjitkumarPas encore d'évaluation

- Japanese CandlestickDocument29 pagesJapanese CandlestickPrateekAhuja100% (2)

- Box Spread Arbitrage Efficiency of Nifty Index OptionsDocument20 pagesBox Spread Arbitrage Efficiency of Nifty Index OptionsVignesh_23Pas encore d'évaluation

- Chart of Accounts (As of July 6,2018)Document382 pagesChart of Accounts (As of July 6,2018)prince pacasumPas encore d'évaluation

- International Business and TerrorismDocument4 pagesInternational Business and TerrorismGregory George NinanPas encore d'évaluation

- Investment Law SyllabusDocument4 pagesInvestment Law SyllabusMayank Shekhar (B.A. LLB 16)Pas encore d'évaluation

- Security MarketDocument30 pagesSecurity Marketashish_k_srivastavaPas encore d'évaluation

- Afar FCDocument2 pagesAfar FCRyan Julius RullanPas encore d'évaluation

- Arbitrage Pricing TheoryDocument7 pagesArbitrage Pricing TheoryShradha SaxenaPas encore d'évaluation

- BIR Ruling No 274-87Document3 pagesBIR Ruling No 274-87Peggy SalazarPas encore d'évaluation

- PSE Disclosure RulesDocument31 pagesPSE Disclosure RulesLeolaida AragonPas encore d'évaluation

- Efx2.0 White PaperDocument13 pagesEfx2.0 White PaperThatOneRichGuyPas encore d'évaluation

- US Internal Revenue Service: Irb03-52Document41 pagesUS Internal Revenue Service: Irb03-52IRSPas encore d'évaluation

- Ethics in FinanceDocument34 pagesEthics in FinanceAllen Joy Pazhukkathara100% (1)

- CH 14Document52 pagesCH 14jaymark canayaPas encore d'évaluation

- Steampunk Settlement: Cover Headline Here (Title Case)Document16 pagesSteampunk Settlement: Cover Headline Here (Title Case)John DeePas encore d'évaluation

- US Internal Revenue Service: ffc107Document5 pagesUS Internal Revenue Service: ffc107IRSPas encore d'évaluation

- RSI Strategy Guide PDFDocument7 pagesRSI Strategy Guide PDFcoachbiznesuPas encore d'évaluation

- SFO Feb11Document96 pagesSFO Feb11AbgreenPas encore d'évaluation

- Study of Commodity MarketDocument83 pagesStudy of Commodity MarketAmit Yadav100% (1)

- KeyBank ReportDocument53 pagesKeyBank ReporttayshtePas encore d'évaluation