Académique Documents

Professionnel Documents

Culture Documents

Taxation Trends in The European Union - 2012 109

Transféré par

d05registerTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Taxation Trends in The European Union - 2012 109

Transféré par

d05registerDroits d'auteur :

Formats disponibles

Part II Developments in the Member States

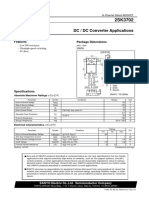

ITALY 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2010

1)

A. Structure of revenues % of GDP Ranking € bn

I Indirect taxes 15.1 14.6 14.6 14.2 14.3 14.4 15.0 14.9 14.0 13.8 14.2 10 220.4

t VAT

Excise duties and consumption taxes

6.5

2.6

6.2

2.4

6.2

2.3

5.9

2.4

5.8

2.2

5.9

2.2

6.2

2.2

6.2

2.1

5.9

1.9

5.7

2.1

6.2

2.0

25

27

96.8

31.7

a Other taxes on products (incl. import duties) 2.7 2.5 2.6 2.5 2.9 2.7 3.0 3.0 2.9 3.0 2.9 2 45.6

Other taxes on production 3.4 3.5 3.5 3.4 3.3 3.5 3.6 3.6 3.2 3.0 3.0 4 46.3

l Direct taxes 14.4 14.7 14.0 14.7 13.9 13.3 14.3 15.0 15.2 15.4 14.7 6 229.4

y Personal income 11.4 11.0 10.6 10.5 10.4 10.4 10.9 11.3 11.7 11.7 11.7 5 182.4

Corporate income 2.4 3.2 2.7 2.3 2.4 2.3 2.9 3.3 3.1 2.4 2.3 14 36.3

Other 0.6 0.6 0.7 1.8 1.1 0.6 0.5 0.5 0.5 1.3 0.7 13 10.7

Social contributions 11.9 11.8 11.9 12.1 12.3 12.3 12.3 12.8 13.4 13.6 13.4 8 208.3

Employers´ 8.3 8.3 8.3 8.6 8.6 8.6 8.5 8.8 9.2 9.3 9.1 4 142.2

Employees´ 2.3 2.3 2.3 2.2 2.2 2.2 2.2 2.3 2.4 2.5 2.4 20 37.8

Self- and non-employed 1.4 1.2 1.3 1.3 1.4 1.5 1.6 1.7 1.8 1.8 1.8 7 28.3

Less: amounts assessed but unlikely to be collected n.a. n.a. n.a. n.a. n.a. n.a. n.a. n.a. n.a. n.a. n.a.

TOTAL 41.5 41.1 40.5 41.0 40.4 40.1 41.7 42.7 42.7 42.8 42.3 5 658.2

Cyclically adjusted total tax to GDP ratio 41.0 40.4 40.2 41.2 40.2 39.8 40.6 41.0 41.7 44.3 43.1

B. Structure by level of government % of total taxation

Central government 55.7 55.2 54.3 53.7 53.2 52.7 54.3 53.6 52.5 53.4 53.3 16 350.9

2)

State government n.a. n.a. n.a. n.a. n.a. n.a. n.a. n.a. n.a. n.a. n.a. n.a. n.a.

Local government 14.4 14.9 15.5 16.1 15.8 15.9 15.6 15.8 15.4 14.2 14.5 5 95.2

Social security funds 28.7 28.6 29.3 29.5 30.3 30.8 29.5 30.0 31.4 31.8 31.6 12 208.2

EU institutions 1.2 1.3 0.9 0.7 0.7 0.7 0.6 0.6 0.8 0.6 0.6 20 3.9

C. Structure by type of tax base % of GDP

Consumption 10.9 10.3 10.1 9.9 10.0 9.9 10.3 10.2 9.8 9.7 10.2 23 159.4

Labour 19.7 20.0 20.0 20.1 20.0 20.2 20.3 20.8 21.5 21.8 21.8 7 339.6

Employed 17.7 17.9 18.0 18.1 17.9 18.1 18.1 18.6 19.2 19.3 19.3 7 299.6

Paid by employers 9.9 10.0 10.1 10.3 10.3 10.4 10.3 10.6 10.7 10.8 10.7 4 165.9

Paid by employees 7.8 7.9 7.9 7.7 7.6 7.7 7.7 8.0 8.5 8.5 8.6 13 133.7

Non-employed 2.0 2.1 2.1 2.1 2.1 2.2 2.2 2.2 2.3 2.5 2.6 3 40.0

Capital 10.9 10.8 10.3 11.0 10.4 9.9 11.1 11.8 11.3 11.2 10.2 2 159.2

Capital and business income 8.3 8.3 7.5 8.4 7.6 7.3 8.4 9.1 8.9 8.3 7.7 3 120.5

Income of corporations 2.9 3.7 3.1 3.5 3.1 2.9 3.5 4.0 3.7 3.4 3.0 7 46.8

Income of households 2.1 1.4 1.3 1.1 1.1 1.2 1.4 1.4 1.5 1.4 1.2 4 18.8

Income of self-employed (incl. SSC) 3.3 3.2 3.1 3.8 3.4 3.2 3.5 3.7 3.7 3.5 3.5 1 55.0

Stocks of capital / wealth 2.6 2.5 2.8 2.6 2.8 2.6 2.7 2.7 2.5 2.8 2.5 8 38.7

D. Environmental taxes % of GDP

Environmental taxes 3.2 3.0 2.9 3.0 2.8 2.8 2.8 2.7 2.5 2.7 2.6 12 40.4

Energy 2.6 2.4 2.3 2.4 2.2 2.2 2.2 2.0 1.9 2.1 2.0 11 31.2

Of which transport fuel taxes : : : 1.8 1.7 1.6 1.6 1.5 1.5 1.5 1.5 15

Transport (excl. fuel) 0.6 0.6 0.6 0.6 0.6 0.6 0.6 0.6 0.6 0.6 0.6 12 8.8

Pollution/resources 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 17 0.5

E. Implicit tax rates %

Consumption 17.8 17.2 17.0 16.5 16.8 16.6 17.2 17.2 16.4 16.1 16.8 25

Labour employed 41.8 41.9 41.8 41.6 41.5 41.1 40.8 42.2 42.8 42.3 42.6 1

Capital 29.5 28.8 28.8 31.4 29.7 29.3 33.8 36.0 35.7 38.4 34.9

Capital and business income 22.4 22.2 20.9 24.0 21.7 21.5 25.5 27.7 28.0 28.7 26.4

Corporations 19.2 23.6 21.0 24.7 21.4 20.8 27.1 30.6 32.2 33.4 27.4

Households 16.7 14.2 13.7 15.9 14.9 14.8 16.5 17.4 17.7 18.3 18.0

Real GDP growth (annual rate) 3.7 1.9 0.5 0.0 1.7 0.9 2.2 1.7 -1.2 -5.1 1.5

See Annex B for explanatory notes. For classification of taxes please visit: http://ec.europa.eu/taxtrends

1) The ranking is calculated in descending order. A "1" indicates this is the highest value in the EU-27. No ranking is given if more than 10 % of data points are missing.

2) This level refers to the Länder in AT and DE, the gewesten en gemeenschappen / régions et communautés in BE and comunidades autónomas in ES.

n.a. not applicable, : not available

Date of extraction: 13/01/2012

Source: Commission Services and Eurostat (online data code gov_a_tax_ag)

108 Taxation trends in the European Union

Vous aimerez peut-être aussi

- Airport TaxesDocument10 pagesAirport TaxesAYPas encore d'évaluation

- Dangerous Goods Segregation and Storage RequirementsDocument1 pageDangerous Goods Segregation and Storage Requirementsxibs2009Pas encore d'évaluation

- Taxation Trends in The European Union - 2012 153Document1 pageTaxation Trends in The European Union - 2012 153d05registerPas encore d'évaluation

- Taxation Trends in The European Union - 2012 129Document1 pageTaxation Trends in The European Union - 2012 129d05registerPas encore d'évaluation

- IndianOil AR 2022-23_1Document9 pagesIndianOil AR 2022-23_1pgpm2024.asafPas encore d'évaluation

- FOR-ELECTRICAL-Electrical-Plan-Page-1Document1 pageFOR-ELECTRICAL-Electrical-Plan-Page-1NinyasumergidoPas encore d'évaluation

- FW_EXPANSION_BAY_PCB_0807Document3 pagesFW_EXPANSION_BAY_PCB_0807wibowit428Pas encore d'évaluation

- Aecom 23-Nov-23 Ccs123 DraftDocument33 pagesAecom 23-Nov-23 Ccs123 DraftakshayPas encore d'évaluation

- Housing Inventory JuneDocument9 pagesHousing Inventory JuneChris CoPas encore d'évaluation

- Iecmd - February 2023Document104 pagesIecmd - February 2023zak sutomoPas encore d'évaluation

- Spending On Private Health insurance-OECD-2022Document6 pagesSpending On Private Health insurance-OECD-2022Swapna NixonPas encore d'évaluation

- Topic Main Sub Sub-Sub General 1 1.1Document12 pagesTopic Main Sub Sub-Sub General 1 1.1Sarveshrau SarveshPas encore d'évaluation

- First TT TTTTTDocument1 pageFirst TT TTTTTAbdirizak HusseinPas encore d'évaluation

- First TT TTTTTDocument1 pageFirst TT TTTTTAbdirizak HusseinPas encore d'évaluation

- Borang Transit Sains THN 5Document1 pageBorang Transit Sains THN 5Anonymous G87ICzzJmNPas encore d'évaluation

- BP Stats Review 2019 Full Report 43Document1 pageBP Stats Review 2019 Full Report 43Sakaros BogningPas encore d'évaluation

- Detailed Building Renovation Cost BreakdownDocument12 pagesDetailed Building Renovation Cost BreakdownSarveshrau SarveshPas encore d'évaluation

- Taxation Trends in The European Union - 2012 125Document1 pageTaxation Trends in The European Union - 2012 125d05registerPas encore d'évaluation

- Beyond The Crisis Building For The Future: Michael Geoghegan, Group Chief ExecutiveDocument20 pagesBeyond The Crisis Building For The Future: Michael Geoghegan, Group Chief ExecutiveAbhilash SharmaPas encore d'évaluation

- 1 MergedDocument4 pages1 MergedNagamani ManiPas encore d'évaluation

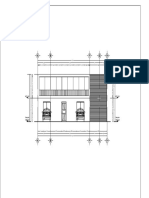

- Wohnen/Essen: Gas-Brennwert - Therme Kontrollierte Wohnraum - Lü Ftu N GDocument1 pageWohnen/Essen: Gas-Brennwert - Therme Kontrollierte Wohnraum - Lü Ftu N GSergio A. MedinaPas encore d'évaluation

- Staple Holder Top DimensionsDocument1 pageStaple Holder Top DimensionsZiba BarootiPas encore d'évaluation

- Developments in Member State Tax Systems: LithuaniaDocument1 pageDevelopments in Member State Tax Systems: Lithuaniad05registerPas encore d'évaluation

- Money & Credit - FED's QE Programs 10oct2022Document16 pagesMoney & Credit - FED's QE Programs 10oct2022scribbugPas encore d'évaluation

- Document ratings summary under 40 charsDocument1 pageDocument ratings summary under 40 charsDoni MuharomPas encore d'évaluation

- Developments in Luxembourg Tax Revenue 2000-2010Document1 pageDevelopments in Luxembourg Tax Revenue 2000-2010d05registerPas encore d'évaluation

- File 20230518105622Document1 pageFile 20230518105622thamotharanPas encore d'évaluation

- Ageing Different in AseanDocument29 pagesAgeing Different in AseanXaidi axrinPas encore d'évaluation

- PlaaaaaaDocument1 pagePlaaaaaaAbdirizak HusseinPas encore d'évaluation

- SCR 005047Document1 pageSCR 005047jeplgpbmcPas encore d'évaluation

- Kondisi KapalDocument6 pagesKondisi KapalThe AzmodeusPas encore d'évaluation

- FOOD TREAT-Layout3Document1 pageFOOD TREAT-Layout3Kevin PolePas encore d'évaluation

- Borang Transit Mate THN 2 2019Document6 pagesBorang Transit Mate THN 2 2019sara0% (1)

- ETABS 18.1 Structural Analysis Software Release NotesDocument1 pageETABS 18.1 Structural Analysis Software Release Notestimur sibaevPas encore d'évaluation

- Indian Economy - Nuvama - 280223 - EBRDocument7 pagesIndian Economy - Nuvama - 280223 - EBRSavan MehtaPas encore d'évaluation

- Aviation For Business 2016Document1 pageAviation For Business 2016The Independent MagazinePas encore d'évaluation

- Borang Transit Pendidikan Moral (Semakan) Tahun 3Document6 pagesBorang Transit Pendidikan Moral (Semakan) Tahun 3Sukanya SomasundaramPas encore d'évaluation

- Chart Title: CynthiaDocument1 pageChart Title: CynthiaJaqueline VazquezPas encore d'évaluation

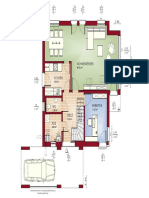

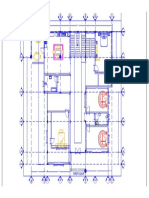

- Architectural floor plan dimensions and areasDocument1 pageArchitectural floor plan dimensions and areasRoberto TsoPas encore d'évaluation

- Lac - OutlookDocument55 pagesLac - OutlookDanny Jose Torres JoaquinPas encore d'évaluation

- Table 3.1 Lifespan of Lighting A Diode (3V) Using Series Circuit of A Pulverized Mung Beans As Alternative Potassium Battery (50% Solution)Document1 pageTable 3.1 Lifespan of Lighting A Diode (3V) Using Series Circuit of A Pulverized Mung Beans As Alternative Potassium Battery (50% Solution)Belac ZepolPas encore d'évaluation

- Assignment 5Document1 pageAssignment 5KAPITALHEADSPas encore d'évaluation

- Miscellaneous SectionsDocument6 pagesMiscellaneous SectionsMohammed AlryaniPas encore d'évaluation

- Asphalt PercentDocument1 pageAsphalt PercentAbdullah HaroonPas encore d'évaluation

- Sheet ModelDocument1 pageSheet Modelvishal kalePas encore d'évaluation

- Practica 1a-2Document1 pagePractica 1a-2AlxsAnderPas encore d'évaluation

- Mobile Phones (Philippine Retail Audit - December 2010)Document83 pagesMobile Phones (Philippine Retail Audit - December 2010)Alora Uy GuerreroPas encore d'évaluation

- South Africa 2021 Budget ReviewDocument253 pagesSouth Africa 2021 Budget ReviewReynold HopePas encore d'évaluation

- Fortimanager-Compatibility - CaveatsDocument1 pageFortimanager-Compatibility - CaveatsMithunPas encore d'évaluation

- 4597 AAB SC 07 Addendum 2 R0v0 49Document1 page4597 AAB SC 07 Addendum 2 R0v0 49danieldumapitPas encore d'évaluation

- Wedge Graph - Expected Levels of Text Reading, National Standards 2010 School: DateDocument1 pageWedge Graph - Expected Levels of Text Reading, National Standards 2010 School: Dateapi-26776334Pas encore d'évaluation

- Session8 ScenarioDocument1 pageSession8 ScenariorichsmartPas encore d'évaluation

- 2022 Annual Borrowing Plan Executive SummaryDocument21 pages2022 Annual Borrowing Plan Executive SummaryDossier RabagoPas encore d'évaluation

- Materi Pak YunartoDocument13 pagesMateri Pak YunartoAsiska SiswiyonoPas encore d'évaluation

- Evolution of web browsers from 1990-2019Document1 pageEvolution of web browsers from 1990-2019Ferreira RochaPas encore d'évaluation

- Fortimanager Support For Fortios: Fortinet Document LibraryDocument1 pageFortimanager Support For Fortios: Fortinet Document Libraryagung saputraPas encore d'évaluation

- CORTEDocument1 pageCORTEELIHU MARCOS ESPEJOPas encore d'évaluation

- Datasheet - HK k3702 3696473Document4 pagesDatasheet - HK k3702 3696473Leoned Cova OrozcoPas encore d'évaluation

- Fortianalyzer Support For Fortios: Fortinet Document LibraryDocument1 pageFortianalyzer Support For Fortios: Fortinet Document LibrarybakacpasaPas encore d'évaluation

- Microsoft SharePoint 2007 Technologies: Planning, Design and ImplementationD'EverandMicrosoft SharePoint 2007 Technologies: Planning, Design and ImplementationÉvaluation : 5 sur 5 étoiles5/5 (1)

- Corporate Portals Empowered with XML and Web ServicesD'EverandCorporate Portals Empowered with XML and Web ServicesÉvaluation : 4 sur 5 étoiles4/5 (1)

- Taxation Trends in The European Union - 2012 223 PDFDocument1 pageTaxation Trends in The European Union - 2012 223 PDFd05registerPas encore d'évaluation

- Taxation Trends in The European Union - 2012 212Document1 pageTaxation Trends in The European Union - 2012 212d05registerPas encore d'évaluation

- Taxation Trends in The European Union - 2012 225Document1 pageTaxation Trends in The European Union - 2012 225d05registerPas encore d'évaluation

- Taxation Trends in The European Union - 2012 224Document1 pageTaxation Trends in The European Union - 2012 224d05registerPas encore d'évaluation

- Taxation Trends in The European Union - 2012 211Document1 pageTaxation Trends in The European Union - 2012 211d05registerPas encore d'évaluation

- Taxation Trends in The European Union - 2012 217Document1 pageTaxation Trends in The European Union - 2012 217d05registerPas encore d'évaluation

- Taxation Trends in The European Union - 2012 221Document1 pageTaxation Trends in The European Union - 2012 221d05registerPas encore d'évaluation

- Taxation Trends in The European Union - 2012 223Document1 pageTaxation Trends in The European Union - 2012 223d05registerPas encore d'évaluation

- Taxation Trends in The European Union - 2012 222Document1 pageTaxation Trends in The European Union - 2012 222d05registerPas encore d'évaluation

- Taxation Trends in The European Union - 2012 216Document1 pageTaxation Trends in The European Union - 2012 216d05registerPas encore d'évaluation

- Taxation Trends in The European Union - 2012 219Document1 pageTaxation Trends in The European Union - 2012 219d05registerPas encore d'évaluation

- Taxation Trends in The European Union - 2012 210Document1 pageTaxation Trends in The European Union - 2012 210d05registerPas encore d'évaluation

- Taxation Trends in The European Union - 2012 220Document1 pageTaxation Trends in The European Union - 2012 220d05registerPas encore d'évaluation

- Taxation Trends in The European Union - 2012 218Document1 pageTaxation Trends in The European Union - 2012 218d05registerPas encore d'évaluation

- Taxation Trends in The European Union - 2012 215Document1 pageTaxation Trends in The European Union - 2012 215d05registerPas encore d'évaluation

- Taxation Trends in The European Union - 2012 214Document1 pageTaxation Trends in The European Union - 2012 214d05registerPas encore d'évaluation

- Taxation Trends in The European Union - 2012 204Document1 pageTaxation Trends in The European Union - 2012 204d05registerPas encore d'évaluation

- Taxation Trends in The European Union - 2012 213Document1 pageTaxation Trends in The European Union - 2012 213d05registerPas encore d'évaluation

- Taxation Trends in The European Union - 2012 204Document1 pageTaxation Trends in The European Union - 2012 204d05registerPas encore d'évaluation

- Taxation Trends in The European Union - 2012 203Document1 pageTaxation Trends in The European Union - 2012 203d05registerPas encore d'évaluation

- Taxation Trends in The European Union - 2012 204Document1 pageTaxation Trends in The European Union - 2012 204d05registerPas encore d'évaluation

- Taxation Trends in The European Union - 2012 203Document1 pageTaxation Trends in The European Union - 2012 203d05registerPas encore d'évaluation

- Taxation Trends in The European Union - 2012 203Document1 pageTaxation Trends in The European Union - 2012 203d05registerPas encore d'évaluation

- Taxation Trends in The European Union - 2012 203Document1 pageTaxation Trends in The European Union - 2012 203d05registerPas encore d'évaluation

- Taxation Trends in The European Union - 2012 196Document1 pageTaxation Trends in The European Union - 2012 196d05registerPas encore d'évaluation

- Taxation Trends in The European Union - 2012 196Document1 pageTaxation Trends in The European Union - 2012 196d05registerPas encore d'évaluation

- Taxation Trends in The European Union - 2012 195Document1 pageTaxation Trends in The European Union - 2012 195d05registerPas encore d'évaluation

- Taxation Trends in The European Union - 2012 195Document1 pageTaxation Trends in The European Union - 2012 195d05registerPas encore d'évaluation

- Taxation Trends in The European Union - 2012 196Document1 pageTaxation Trends in The European Union - 2012 196d05registerPas encore d'évaluation

- Taxation Trends in The European Union - 2012 198Document1 pageTaxation Trends in The European Union - 2012 198d05registerPas encore d'évaluation

- Tally InvoiceDocument1 pageTally InvoiceAlok S YadavPas encore d'évaluation

- Bohol Limestone Corporation - Quick FactsDocument5 pagesBohol Limestone Corporation - Quick FactsJana Mae Catot AcabalPas encore d'évaluation

- 5.1.0 Tax Capital AllowanceDocument8 pages5.1.0 Tax Capital AllowanceshaunPas encore d'évaluation

- Sap Bydesign 1702 Product Info Product DataDocument116 pagesSap Bydesign 1702 Product Info Product DataMohammed DobaiPas encore d'évaluation

- Name-Dipesh Bhattacharyya Roll No-03 Course-BBA LLB Subject-Accountancy Topic-Goods and Service Tax (GST) Adamas University DatedDocument12 pagesName-Dipesh Bhattacharyya Roll No-03 Course-BBA LLB Subject-Accountancy Topic-Goods and Service Tax (GST) Adamas University DatedDIPESH BHATTACHARYYAPas encore d'évaluation

- Ajit Kumar JhaDocument2 pagesAjit Kumar Jhadr_shaikhfaisalPas encore d'évaluation

- Business Expenses - InvestopediaDocument3 pagesBusiness Expenses - InvestopediaBob KanePas encore d'évaluation

- Vat Refund Leaflet - ENDocument8 pagesVat Refund Leaflet - ENjacklable5657Pas encore d'évaluation

- Tax InvoiceDocument1 pageTax InvoiceSanjay KumarPas encore d'évaluation

- India OCT 2021Document1 pageIndia OCT 2021Sunil YadavPas encore d'évaluation

- Experienced CA seeking job in audit and taxationDocument1 pageExperienced CA seeking job in audit and taxationBhanu NagpalPas encore d'évaluation

- Macro Cheat SheetDocument3 pagesMacro Cheat Sheetwerbestuff7054Pas encore d'évaluation

- 1098-T Copy B: 12,589.34 University of Oklahoma 1000 ASP AVE ROOM 105 Norman OK 73019 (405) 325-9000Document2 pages1098-T Copy B: 12,589.34 University of Oklahoma 1000 ASP AVE ROOM 105 Norman OK 73019 (405) 325-9000Lane ElliottPas encore d'évaluation

- BIR Form No. 0605 (2021)Document1 pageBIR Form No. 0605 (2021)Nathan Veracruz100% (1)

- Taxatio MCQDocument10 pagesTaxatio MCQAtif KhanPas encore d'évaluation

- College For Research & Technology of Cabanatuan: VisionDocument8 pagesCollege For Research & Technology of Cabanatuan: VisionAnn De GuzmanPas encore d'évaluation

- Income Tax PracticalsDocument20 pagesIncome Tax Practicalsshatrughan lovePas encore d'évaluation

- Property Twins Cashflow Spreadsheet - v0.5Document7 pagesProperty Twins Cashflow Spreadsheet - v0.5Vivek HandaPas encore d'évaluation

- Business Tax Reviewer IDocument5 pagesBusiness Tax Reviewer IMariefel Irish Jimenez KhuPas encore d'évaluation

- Islamabad Electric Supply Company: Say No To CorruptionDocument1 pageIslamabad Electric Supply Company: Say No To CorruptionxaviPas encore d'évaluation

- CIR Vs Sony PhilippinesDocument1 pageCIR Vs Sony PhilippinesLouie SalladorPas encore d'évaluation

- Atlas Consolidated Mining and Development Corporation vs. Commissioner of Internal Revenue, 524 SCRA 73, June 08, 2007Document3 pagesAtlas Consolidated Mining and Development Corporation vs. Commissioner of Internal Revenue, 524 SCRA 73, June 08, 2007idolbondocPas encore d'évaluation

- Notice Concerning Fiduciary Relationship: IdentificationDocument2 pagesNotice Concerning Fiduciary Relationship: IdentificationMaryUmbrello-DresslerPas encore d'évaluation

- Tax Invoice - MEAL CARD: For Sodexo SVC India Private Lim ItedDocument1 pageTax Invoice - MEAL CARD: For Sodexo SVC India Private Lim ItedElakkiyaPas encore d'évaluation

- 2551QDocument3 pages2551QJerry Bantilan JrPas encore d'évaluation

- CTA upholds prescription of EWT, WTC assessments for 2005Document1 pageCTA upholds prescription of EWT, WTC assessments for 2005John Kenneth Jacinto0% (1)

- Model Questions Fundamentals of Taxation and Auditing BBS 3rd Year PDFDocument5 pagesModel Questions Fundamentals of Taxation and Auditing BBS 3rd Year PDFShah SujitPas encore d'évaluation

- In Voice MouseDocument1 pageIn Voice Mousegiri_placidPas encore d'évaluation

- Essar Steel India Limited: Work OrderDocument4 pagesEssar Steel India Limited: Work OrderMythri Metallizing Pvt Ltd ProjectsPas encore d'évaluation