Académique Documents

Professionnel Documents

Culture Documents

F12ba 1005009 2016

Transféré par

Nikhil121314Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

F12ba 1005009 2016

Transféré par

Nikhil121314Droits d'auteur :

Formats disponibles

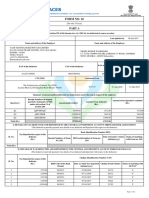

Cert No:1617/2235 FORM NO.

12BA Employee Code : 1005009

{See Rule 26A (2)(b)}

Statement showing particulars of perquisites, other fringe benefits or amenities

and profits in lieu of salary with value thereof

1) Name and address of employer : YASH TECHNOLOGIES PRIVATE LIMITED

201-205

BANSI TRADE CENTRE 581/5, M.G. ROAD

INDORE 452001

2) TAN : BPLY00049A

3) TDS assessment range of the employer :

4) Name, Designation and PAN of employee : Nikhil Kishor Waghmare

Sr. Test Engineer

ABFPW1788F

5) Is the employee a director or a person with No

substantial interest in the company

(where the employer is a company)

6) Income under the head "Salaries" of the 717133.00

employee (other than from perquisites) 7) Financial Year 2016 - 2017

8) Valuation of Perquisites

S. No Nature of perquisite Value of Amount, if any Amount of

(see rule 3) perquisite recovered from perquisite charge-

as per rules the employee able to tax

(Rs.) (Rs.) (3)-(4) (Rs.)

(1) (2) (3) (4) (5)

1 Accommodation 0.00 0.00 0.00

2 Cars/Other automotive 0.00 0.00 0.00

3 Sweeper/Gardener/Watchman or personal attendant 0.00 0.00 0.00

4 Gas/Electricity/Water 0.00 0.00 0.00

5 Interest free or concessional loans 0.00 0.00 0.00

6 Holiday expenses 0.00 0.00 0.00

7 Free or concessional travel 0.00 0.00 0.00

8 Free Meal 0.00 0.00 0.00

9 Free Education 0.00 0.00 0.00

10 Gifts/vouchers etc. 0.00 0.00 0.00

11 Credit card expenses 0.00 0.00 0.00

12 Club expenses 0.00 0.00 0.00

13 Use of movable assets by employees 0.00 0.00 0.00

14 Transfer of assets to employees 0.00 0.00 0.00

15 Value of any other benefit/amenity/service/privilege 0.00 0.00 0.00

16 Stock options (non-qualified options) 0.00 0.00 0.00

17 Other benefits or amenities 0.00 0.00 0.00

18 Taxable Medical 15000.00 0.00 15000.00

19 Total value of perquisites 15000.00 0.00 15000.00

20 Profits in lieu of salary as per 17(3) 0.00 0.00 0.00

9) Details of Tax :

(a) Tax deducted from salary of the employee u/s 192(1) 17122.00

(b) Tax paid by employer on behalf of the employee u/s 192(1A) 0.00

(b2) TDS On Other Income Reported By Employee 0.00

(c) Total tax paid 17122.00

(d) Date of payment into Government treasury As per Form16

DECLARATION BY EMPLOYER

I Ashish Kabra Son of Shri Devendra Kabra working as Dy. General Manager do hereby declare

on behalf of YASH TECHNOLOGIES PRIVATE LIMITED that the information given above is based on the books of account,

documents and other relevant records or information available with us and the details of value of each such perquisite

are in accordance with section 17 and rules framed there under and that such information is true and correct.

For YASH TECHNOLOGIES PRIVATE LIMITED

Signature of the person responsible for deduction of tax

Place Indore Full Name Ashish Kabra

Date 31/05/2017 Designation Dy. General Manager

ASHISH

KABRA

2017.06.15

17:12

I am

approving this

document

Indore

Vous aimerez peut-être aussi

- Form No.12Ba: Savan Gurudas Anvekar Development Manager AAOPA9108A NODocument3 pagesForm No.12Ba: Savan Gurudas Anvekar Development Manager AAOPA9108A NOsavan anvekarPas encore d'évaluation

- R17 Acepa6021b 20-21Document1 pageR17 Acepa6021b 20-21rajeshre2Pas encore d'évaluation

- Annexure To Form 16 - TCSDocument3 pagesAnnexure To Form 16 - TCSRupini RavichandranPas encore d'évaluation

- 12BADocument1 page12BAmanas022Pas encore d'évaluation

- 2 (F) Amount of Any Other Exemption Under Section 10: Annexure To Form 16 Part BDocument3 pages2 (F) Amount of Any Other Exemption Under Section 10: Annexure To Form 16 Part BAnonymous IIj5AOPas encore d'évaluation

- Place Mumbai: Annexure To Form 16 Part BDocument3 pagesPlace Mumbai: Annexure To Form 16 Part BVikram RaiPas encore d'évaluation

- 2020 - Form16 - PART B AnnexureDocument3 pages2020 - Form16 - PART B AnnexureUtkarsh KadamPas encore d'évaluation

- FY2022 23 Annexure To Form16Document3 pagesFY2022 23 Annexure To Form16Joydip MukhopadhyayPas encore d'évaluation

- Place Mumbai: Annexure To Form 16 Part BDocument3 pagesPlace Mumbai: Annexure To Form 16 Part BsivaPas encore d'évaluation

- Annexure To Form 16 - TCS - 20202021Document3 pagesAnnexure To Form 16 - TCS - 20202021Kritansh BindalPas encore d'évaluation

- Annexure To Form 16 Part B (2019)Document3 pagesAnnexure To Form 16 Part B (2019)Dharmendra ParmarPas encore d'évaluation

- Bob Form12baDocument1 pageBob Form12baruchi561Pas encore d'évaluation

- Annexure To Form 16Document3 pagesAnnexure To Form 16mohitverma.840Pas encore d'évaluation

- Ay2021-22 12baDocument2 pagesAy2021-22 12bazaffsanPas encore d'évaluation

- Form No. 12ba: Declaration by EmployerDocument1 pageForm No. 12ba: Declaration by EmployerVaibhav Sharad DhandePas encore d'évaluation

- 2023-24 12baDocument3 pages2023-24 12baiammouliPas encore d'évaluation

- Akcpm0324m 12ba 2023-24Document2 pagesAkcpm0324m 12ba 2023-24Indra Nath MishraPas encore d'évaluation

- 22 GST Council MeetDocument2 pages22 GST Council Meetkumar45caPas encore d'évaluation

- British American Tobacco Bangladesh: Internal Credit Risk Scoring SystemDocument4 pagesBritish American Tobacco Bangladesh: Internal Credit Risk Scoring SystemSadia HossainPas encore d'évaluation

- Model Raport Financiar Cooperativa AgricolaDocument4 pagesModel Raport Financiar Cooperativa AgricolalorenapallPas encore d'évaluation

- Financial Statement For PcabDocument5 pagesFinancial Statement For Pcabma ana hiponiaPas encore d'évaluation

- Icrrs 2Document3 pagesIcrrs 2Sadia HossainPas encore d'évaluation

- 1701 Annual Income Tax Return: Individuals (Including MIXED Income Earner), Estates and TrustsDocument1 page1701 Annual Income Tax Return: Individuals (Including MIXED Income Earner), Estates and Trustsmelanie vistalPas encore d'évaluation

- Annexure To Form 16 Part B (2020)Document3 pagesAnnexure To Form 16 Part B (2020)Dharmendra ParmarPas encore d'évaluation

- Invetech Lighting PVT LTD Form 16Document5 pagesInvetech Lighting PVT LTD Form 16Saikiran SharonPas encore d'évaluation

- 2f10k 2022-23 1Document3 pages2f10k 2022-23 1Md shamirPas encore d'évaluation

- Eicher Motors: PrintDocument3 pagesEicher Motors: PrintAryan BagdekarPas encore d'évaluation

- Meghmani Organics: PrintDocument3 pagesMeghmani Organics: PrintmilanPas encore d'évaluation

- Payslip Alight ConsultantsDocument1 pagePayslip Alight ConsultantsLalit JainPas encore d'évaluation

- Bose Payslip FebDocument1 pageBose Payslip FebThammineni Vishwanath Naidu100% (1)

- Pay Slip May Indian Bhushan NathDocument1 pagePay Slip May Indian Bhushan Nathralesh694Pas encore d'évaluation

- Payslip TS11702.Document1 pagePayslip TS11702.Sandy MPas encore d'évaluation

- LG PayslipDocument1 pageLG PayslipDipendra TOMARPas encore d'évaluation

- Budget Totals Estimated Actual Difference: Personnel ExpensesDocument1 pageBudget Totals Estimated Actual Difference: Personnel ExpensesMarco Thaddeus AlabaPas encore d'évaluation

- Mahamaya Project V2Document6 pagesMahamaya Project V2Sumit AhujaPas encore d'évaluation

- A2508-Salary Slip-MayDocument1 pageA2508-Salary Slip-MayCAT ClusterPas encore d'évaluation

- Pay Slip For June - 2021: EarningsDocument2 pagesPay Slip For June - 2021: EarningsBagadi AvinashPas encore d'évaluation

- My - Statement - 17 Oct, 2018 - 15 Nov, 2018 - 6302470395Document17 pagesMy - Statement - 17 Oct, 2018 - 15 Nov, 2018 - 6302470395bharath sambojuPas encore d'évaluation

- Account Usage and Recharge Statement From 01-Apr-2019 To 30-Apr-2019Document3 pagesAccount Usage and Recharge Statement From 01-Apr-2019 To 30-Apr-2019Yash MittalPas encore d'évaluation

- Payslip Feb2022Document2 pagesPayslip Feb2022MaruthiPas encore d'évaluation

- EW17593 NovDocument2 pagesEW17593 Novfaraz.ahmad.rosePas encore d'évaluation

- Daily Activity Statement: Mohammad Azam Bin MustapaDocument5 pagesDaily Activity Statement: Mohammad Azam Bin MustapaAzri LunduPas encore d'évaluation

- Ndsu Cares ReportDocument15 pagesNdsu Cares ReportMatt BrownPas encore d'évaluation

- Payslip Aug2021Document1 pagePayslip Aug2021Umesh BabuPas encore d'évaluation

- My - Statement - 17 Jun, 2018 - 23 Jun, 2018 - 6302470395Document7 pagesMy - Statement - 17 Jun, 2018 - 23 Jun, 2018 - 6302470395bharath sambojuPas encore d'évaluation

- Account Usage and Recharge Statement From 13-Dec-2021 To 19-Dec-2021Document6 pagesAccount Usage and Recharge Statement From 13-Dec-2021 To 19-Dec-2021Faridul HosenPas encore d'évaluation

- Adani Green Energy Limited: PrintDocument3 pagesAdani Green Energy Limited: PrintBijal DanichaPas encore d'évaluation

- Bureau of Local Government Finance Department of FinanceDocument4 pagesBureau of Local Government Finance Department of FinanceAnn LiPas encore d'évaluation

- 10011488Document1 page10011488Anonymous BtiQTJz00% (1)

- Project at A GlanceDocument1 pageProject at A GlanceGangaprasad KarPas encore d'évaluation

- 5338 - August 2021 - 50GKBP45RLOWBH55BIZOX4Y54993178471246260287021635Document1 page5338 - August 2021 - 50GKBP45RLOWBH55BIZOX4Y54993178471246260287021635Shreyash SahayPas encore d'évaluation

- 5338 - September 2021 - P33MK3ZQEFJQM1AFODHYA3BR5477351240762656333113912Document1 page5338 - September 2021 - P33MK3ZQEFJQM1AFODHYA3BR5477351240762656333113912Shreyash SahayPas encore d'évaluation

- 1701 Annual Income Tax Return: Individuals (Including MIXED Income Earner), Estates and TrustsDocument1 page1701 Annual Income Tax Return: Individuals (Including MIXED Income Earner), Estates and TrustsJheza Mae PitogoPas encore d'évaluation

- Cartradeexchange Solutions Private LimitedDocument2 pagesCartradeexchange Solutions Private LimitedAJEET KUMARPas encore d'évaluation

- Account Usage and Recharge Statement From 01-May-2021 To 30-May-2021Document6 pagesAccount Usage and Recharge Statement From 01-May-2021 To 30-May-2021Mahesh KumarPas encore d'évaluation

- Tahun Anggaran 2017: Page 1/2Document2 pagesTahun Anggaran 2017: Page 1/2MusliadiPas encore d'évaluation

- My - Statement - 24 Jun, 2020 - 12 Jul, 2020 - 7980675573 PDFDocument7 pagesMy - Statement - 24 Jun, 2020 - 12 Jul, 2020 - 7980675573 PDFSubhamoy DeyPas encore d'évaluation

- My - Statement - 22 Jul, 2018 - 20 Aug, 2018 - 6302470395Document21 pagesMy - Statement - 22 Jul, 2018 - 20 Aug, 2018 - 6302470395bharath sambojuPas encore d'évaluation

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineD'EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LinePas encore d'évaluation

- Xy Chart TestsDocument7 pagesXy Chart TestsNikhil121314Pas encore d'évaluation

- Time Series Chart TestsDocument4 pagesTime Series Chart TestsNikhil121314Pas encore d'évaluation

- Time Series Chart TestsDocument4 pagesTime Series Chart TestsNikhil121314Pas encore d'évaluation

- Visual Time Series Chart TestsDocument3 pagesVisual Time Series Chart TestsNikhil121314Pas encore d'évaluation

- Visual Xy Chart TestsDocument3 pagesVisual Xy Chart TestsNikhil121314Pas encore d'évaluation

- Visual Time Series Chart TestsDocument3 pagesVisual Time Series Chart TestsNikhil121314Pas encore d'évaluation

- Visual Check Box TestsDocument3 pagesVisual Check Box TestsNikhil121314Pas encore d'évaluation

- Visual Check Box TestsDocument3 pagesVisual Check Box TestsNikhil121314Pas encore d'évaluation

- Contained Mashup TestsDocument4 pagesContained Mashup TestsNikhil121314Pas encore d'évaluation

- Check Box TestsDocument3 pagesCheck Box TestsNikhil121314Pas encore d'évaluation

- Visual Contained Mashup TestsDocument2 pagesVisual Contained Mashup TestsNikhil121314Pas encore d'évaluation

- Employment AlignmentDocument1 pageEmployment AlignmentNikhil121314Pas encore d'évaluation

- Label Chart TestsDocument5 pagesLabel Chart TestsNikhil121314Pas encore d'évaluation

- Check Box TestsDocument3 pagesCheck Box TestsNikhil121314Pas encore d'évaluation

- Goals DeletedDocument1 pageGoals DeletedNikhil121314Pas encore d'évaluation

- Label Chart TestsDocument5 pagesLabel Chart TestsNikhil121314Pas encore d'évaluation

- Visual Label Chart TestsDocument5 pagesVisual Label Chart TestsNikhil121314Pas encore d'évaluation

- Bubble Chart TestsDocument5 pagesBubble Chart TestsNikhil121314Pas encore d'évaluation

- Visual Bubble Chart TestsDocument3 pagesVisual Bubble Chart TestsNikhil121314Pas encore d'évaluation

- Visual Label Chart TestsDocument5 pagesVisual Label Chart TestsNikhil121314Pas encore d'évaluation

- Appium Syllabus ModificationDocument1 pageAppium Syllabus ModificationNikhil121314Pas encore d'évaluation

- Locaters Child ParentDocument1 pageLocaters Child ParentNikhil121314Pas encore d'évaluation

- Abfpw1788f 2017-18 PDFDocument2 pagesAbfpw1788f 2017-18 PDFNikhil121314Pas encore d'évaluation

- Visual Blog TestsDocument14 pagesVisual Blog TestsNikhil121314Pas encore d'évaluation

- Its The Economy, Student! by Gloria Macapagal ArroyoDocument9 pagesIts The Economy, Student! by Gloria Macapagal ArroyodabomeisterPas encore d'évaluation

- Yong Le: Beijing Huaxia Yongleadhesive Tape Co., LTDDocument9 pagesYong Le: Beijing Huaxia Yongleadhesive Tape Co., LTDColors Little ParkPas encore d'évaluation

- Markets and Commodity Figures: Total Market Turnover StatisticsDocument6 pagesMarkets and Commodity Figures: Total Market Turnover StatisticsTiso Blackstar GroupPas encore d'évaluation

- Revised Withholding Tax TablesDocument2 pagesRevised Withholding Tax TablesReylan San PascualPas encore d'évaluation

- Responsive Essay 1 ATM 634Document2 pagesResponsive Essay 1 ATM 634Aditi BakshiPas encore d'évaluation

- Business Economics - Neil Harris - Summary Chapter 3Document2 pagesBusiness Economics - Neil Harris - Summary Chapter 3Nabila HuwaidaPas encore d'évaluation

- List of High, Middle and Low Income CountriesDocument4 pagesList of High, Middle and Low Income CountriesMei-Lanny MancillaPas encore d'évaluation

- Notice 11120 02 Apr 2024Document669 pagesNotice 11120 02 Apr 2024bhattacharya.devangana2Pas encore d'évaluation

- Checklist For Dividend Distribution Companies (Declaration & Dividend Payment) Regulations 2017 Dated 06-11-2017 by SECPDocument2 pagesChecklist For Dividend Distribution Companies (Declaration & Dividend Payment) Regulations 2017 Dated 06-11-2017 by SECPKhalid Mahmood SialPas encore d'évaluation

- GSTR1 Stupl 08ABFCS1229J1Z9 November 2021 BusyDocument92 pagesGSTR1 Stupl 08ABFCS1229J1Z9 November 2021 BusyYathesht JainPas encore d'évaluation

- TCSDocument4 pagesTCSjayasree_reddyPas encore d'évaluation

- Brief For UolDocument66 pagesBrief For UolNadeem AnsariPas encore d'évaluation

- Unclaimed Deposit List 2008Document51 pagesUnclaimed Deposit List 2008Usman MajeedPas encore d'évaluation

- $Ffhvvwr6Dih:Dwhu: Charting The Progress of PopulationsDocument5 pages$Ffhvvwr6Dih:Dwhu: Charting The Progress of PopulationskatoPas encore d'évaluation

- Financial and Physical Performance Report FORMATDocument9 pagesFinancial and Physical Performance Report FORMATJeremiah TrinidadPas encore d'évaluation

- Origin and Theoretical Basis of The New Public Management (NPM)Document35 pagesOrigin and Theoretical Basis of The New Public Management (NPM)Jessie Radaza TutorPas encore d'évaluation

- Invitation To Bid: Dvertisement ArticularsDocument2 pagesInvitation To Bid: Dvertisement ArticularsBDO3 3J SolutionsPas encore d'évaluation

- Downtown Design ExhibitorsDocument21 pagesDowntown Design ExhibitorsIan DañgananPas encore d'évaluation

- 6 Zimbabwean DollarDocument32 pages6 Zimbabwean DollarArjun Nayak100% (1)

- Macro Unit 2 WorksheetDocument5 pagesMacro Unit 2 WorksheetSeth KillianPas encore d'évaluation

- La Part 3 PDFDocument23 pagesLa Part 3 PDFShubhaPas encore d'évaluation

- Chapter 6 - Product and Service StrategiesDocument32 pagesChapter 6 - Product and Service StrategiesralphalonzoPas encore d'évaluation

- ICSB Mexico MSMEs Outlook Ricardo D. Alvarez v.2.Document4 pagesICSB Mexico MSMEs Outlook Ricardo D. Alvarez v.2.Ricardo ALvarezPas encore d'évaluation

- Indian Real Estate SectorDocument8 pagesIndian Real Estate SectorSumit VrmaPas encore d'évaluation

- List of TSD Facilities July 31 2019Document15 pagesList of TSD Facilities July 31 2019Emrick SantiagoPas encore d'évaluation

- Global Trade War and Its Impact On Trade and Growth: War Between USA, China and EUDocument9 pagesGlobal Trade War and Its Impact On Trade and Growth: War Between USA, China and EUBashir Ahmad DuraniPas encore d'évaluation

- Study On The Dynamics of Shifting Cultivation Areas in East Garo HillsDocument9 pagesStudy On The Dynamics of Shifting Cultivation Areas in East Garo Hillssiljrang mcfaddenPas encore d'évaluation

- Buyer Questionnaire: General QuestionsDocument3 pagesBuyer Questionnaire: General Questionsshweta meshramPas encore d'évaluation

- Ethics Assignment 1 - Dedglis DuarteDocument6 pagesEthics Assignment 1 - Dedglis DuarteAnonymous I03Wesk92Pas encore d'évaluation

- Collection of Pitch Decks From Venture Capital Funded StartupsDocument22 pagesCollection of Pitch Decks From Venture Capital Funded StartupsAlan Petzold50% (2)