Académique Documents

Professionnel Documents

Culture Documents

Lrog 990 2016

Transféré par

Teddy Wilson0 évaluation0% ont trouvé ce document utile (0 vote)

20 vues14 pagesLife Resources of Georgia - 990 (2016)

Titre original

LROG-990-2016

Copyright

© © All Rights Reserved

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentLife Resources of Georgia - 990 (2016)

Droits d'auteur :

© All Rights Reserved

0 évaluation0% ont trouvé ce document utile (0 vote)

20 vues14 pagesLrog 990 2016

Transféré par

Teddy WilsonLife Resources of Georgia - 990 (2016)

Droits d'auteur :

© All Rights Reserved

Vous êtes sur la page 1sur 14

oe Short Form

ram990-EZ] Return of Orga

P Do not enter soc

ation Exempt From Income Tax

Under section S01), 627, oF 404711) of the Internal Revenue Code (except private foundation)

curity numbers on this form as it may be made public.

> Information about Form 990-EZ and its instructions is at www.irs.gov/form 990.

2016

pento Public

Inspection

‘For the 2016 calendar year, or tye beginning nd ening

8 geet. [Name oforgancaton iD Employer dena aumber

Ices enrol

lime change | LIFE RESOURCES OF GA_INC 26-0541427

ln un | Humber and tet or P.0. ox, ma not delved to eat are) Toonvbuie JE Telephone nurber

Jamesve’ | PO BOX 2323 678-622-5947

Crm Gi orton, sie or prove coun, and ZP or argh posta code F Group Exemoton

CFluseinepein| DAC GA__30019 Number

sonnet oh

G Accounting Method: ‘cash [_JAccrual Other speci) >. Check BCX] ithe organizations

| Weta: b Witt. LIFEREEOURCESGA . COM

‘J_Taxcexempt status (check only one) — [CT so1{ey(3)L J 50146) ys4insert no) FT 4947(a)(1) oe LT 827]

KC Form of organcation: CX] Corporaton [_] Trust (Jassocaton Other

{L_Adgins 5,6, and 70 to ine 90 determine gross recaps I goss recep are $200,000 or mare, o ttl assets Part

fot equred to attach Schedule B

(orm 990, 990-7, or 990).

elu (8 below) are $50,000 mare, te Fox 960 stad of Ferm 00-2 48,84:

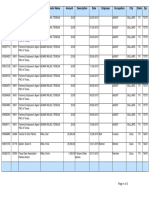

Revenue, Expenses, and Changes in Net Assots or Fund Balances (sie naiustons fora)

hacks he eganzaton used Scheu to respond to any question ths Pat iba

1 Controutons, gts, grants, and srr amounts ecved 1 48,843.

me | 2 Prowam sec revenue ntuin goverment es and contacts 2

$= | 3 memaesnp cues and assessments 3

| « imestment income 4

2 | 52 ceossamount rm sl of asst ter han ventory sa

S| b Less:costor citer tas an sls menses Cae

S| camer (oss) tom ae of assets ner tan entry Subrct ne 8 om ine 6) se

| 6 camng and uncrasing evens

© g | & eossincome rom gaming (tach Schedule treater nan

We | siso

& 3 |» ceoss income rom tundrang evens (ot meuding S of connoutons|

&* | __ rom ncresing vers repre on te 1) aac nee Giles of

g ‘ossincome and contbutens exceeds $15,000) mn

Less rect emenses tom gaming an fundasing events fe

4 tice (ee) rom paring an undrating events (add nes ean an subact nee)

7a Gross als of entry, ss ets and alowances ma

1 Lesscos of goods sls 7

Gross pot ors) Hom sas of ventory (Subathe7 om ie 78) te

Ofer revenue(esrben Stee 0) ‘

8 Total revenue. Add lines 1,2, 3, 4, Sc, 6d, 7c, and 8 Plo 48,843.

1 rans nd sir erunis pd (stn Sched 0) 10

11 epets pad to ror mamoars it

4g | 12 sata, ome conpersabon, and employe berets 12 24,500.

B [13 Protessonal tees and other payments to mdependent contactors 13

E |s« oczpiny, outs ana manoarce 4 600.

ahs Printing, publications, postage, and stepping 18 806.

16. ter exeses fesse Scale 0) SEE SCHEDULE 0 16 25,845.

__|17 Total expenses. Add tines 10 through 16 ml ere

gq. |18 Excess or (dehat) for the year (Subtract ine 17 trom Hine 8) 18 -2,908.

§ |19netases or tnd bases at begnnng of year (rom he 27, coum ()

< (must agree with end-of-year figure reported on prior year’s return) 19 71,241

|20 omer tunes etasns rund bans (lan m Sohal 0) 70 oe

121__ Net assets or fund balances at end of year. Combine ines 18 through 20 Pi 2 68,333.

LHA For Paperwork Reduction Act Notice, vee the separate instruct Form 990-EZ (2016)

2 ao

10460616 145309 260541427 2016.03020 LIFE RESOURCES OF GA INC 26054141 Xx

foxm soe 20 JE 26-0541427

[Part]

Balance Sheets (see the instructions for Part ih)

Page2

Check if the organization used Schedule O to respond to any question in this Part IL oo

(8) Begriang of year WEN over

22 Cash, songs, and vesimets 72, 481.[2 69,462.

23 Land andbutings 28

24 Other ases(deseein Schedule 0} 24

25. Total aseets 72, 481.\2 69,462.

26 Toa faites (descibe m Schesule0) SEE SCHEDULE 0 1,240 .|26 1,129.

27 _Netaset or fund balances fine 27 of column (8) must agree wth ine 21) 71,241.|27 68,333.

Part Ill | Statement of Program Service Accomplishments (see the instructions for Part Il

Check if the organization used Schedule O to respond to any question in this Part Ili(X]|

‘Whats the oganzaton's prnary exempt pupose?SEE SCHEDULE O.

‘esron hepato rogam eres scape sew age pagan eevee ae ound exeraes ain ance

Expenses

(Reguredtr section

Botley) and 9010) 4)

‘sxganzators; optional or

ones)

2s PROVIDED GRANTS FOR TRAINING AND EDUCATION FOR PREGNANCY

CENTERS INGA

(Grants $ ||Ifthis amount inchides foreign grants, check here. p> Tien

2

(Grants $ If thus amount inckides foreign grants, check here __> TC) hess! =

»

Gans ifthe amount noudes foremn grants, heck here Boo

31 the pra secs Goorbe m Schein O)

{Grants $ | If this amount includes foreign grants, check here. p Cs

32_Total program service expenses (add lines 28a through 31a) P| 32) oO.

Part IV | List of Officers, Directors, Trustees, and Key Employees 1 az ene wen not corpencate - ae te ratvctons or Pat)

Check if the organization used Schedule O to respond to any question in this Part IV eae

oy average in (ch epee {(4) Hain berwsia,| (e) Estimated

fa) Name and cweekcevoladto | oqpriaten tom] selene, | amount of ater

aaa mes Sosten eaten, |b Ear |‘compenaton

DONNA PERRY.

EXECUTIVE DIRECTOR 32.00 24,500.) 0. O.

JIM_GLOVER

CHAIRMAN 10.00 0. 0. oO.

JAN _HOLT

SECRETARY / TREASURER. 10.00 0. 0. Oo.

LORA GONZALES

PROGRAM SUPPORT 10.00 0. 0. 0.

JOHN MCGEE

BOARD MEMBER 5.00 0. Oo. oO.

3

10460616 145309 260541427 2016.03020 LIFE RESOURCES OF GA INC

Form 990-EZ (2016)

26054141

fomsa'ez 016) __LIFE RESOURCES OF GA INC 26-0541427 Pages

Part V | Other Information (Note the Schedule A and personal benefit contract statement requirements in the

instructions for Part V) Check if the organization used Sch. O to respond to any question in this Part V_ [3].

[Yes] No

{330d oranwaton engage m any sgnticant acy not previously eperted tothe IRS? "Yes; prove a detaed descrgtin ofeach

acy m eneduleO 33 x

4 Were any sgnicant changes mage tothe organzng oF governing documents? "Yes, atacha conformed copy ofthe amended

ocuments they reflect change to te organuzatons name. Otherwise expan the chang on Schedule O (ste strucbons) 4

358 Od th oganwaton have unrelated busines gross coma of $1,000 or mare during the year from busess ates (such a those reported

‘on ines 2, 6, and 7a among ots)? 358

UYes ton 35a, has the organzaion He a Frm 980-1 er the year? I No," prow an explanation n Schedule O 360 |W,

Was he oxganzation a secon 801(c),4),$01(eXS), of $01(e(6)organaaton subject osechon 6933()nobee, report, and proxy tk

requrements durieg the year? Yes; complete Schedule, Parti 360

{96 01d the ocanwaton undergo a iquedaton, isoluten termination, or sgntcant posibon of net asets during the year? "Yes

complete aplcable pars of Schedule N 36

{374 Enter amount of politica expenditures, director maect, as desenbed the mstuctons > Ly

‘Did the exganzation te Form 1120-POL for ths yea? a

‘884 isthe oeganzation bara rm, or make any cans to, any ofr, decor, truste, or key employe or were any such loans made

sma pnr year and sil oustanding atthe end of the tax yar covered by ths vtur?| sa

tes, complete Schedule Par Il and enter the totaamount votes ab N/A

88 Secton 501(¢)(7organaavons. Enter

Inatonfes and capa contrdubors nuded on ne 9 302 N/A

Gross ree uded on ie 9, for publ use of cb facies 300 N/A.

408. Secbon 60'(0\,)exaanzatios, Ener amount ot tximposed onthe oganzston dung the year under:

schon 4911 Oe ;secton 4812 De 0. section 4955 be

‘Secon £01( 3}, 501044), and 8016}29)organcatons. Did te eganwation engage i any section 496@ excess Benet

transaction during the year, c id it engage m an excess bene ansscon ma prior year that as not been reported onary

of prox Farms 890 or 990-€27 "Yes complete Schedule L, Pat 40 x

Seaton 801(¢K3),501(¢4), and 50(¢},29) arganzatins. Ere amount of tax mposed on

‘xganzaon managers or esqualfied persons dung te year under sectons 4912, 4955, and 4958, > 0

‘Secton $0(28}, 5014), and $01(¢),28)organzatons. Enter amount of tax on ine 40crebursed

by the organzation > 0

‘Alloganzatons. ALany te durmg the tax yar, was the organzaton a party fo prohited tax shelter

transaction Yes complete Fm 8886-7 aoe x

41st states wt wich copy of ts return sted > _NONE.

42a The organzaton's books are ncare ot P» ANGIE ROBINSON Teephone no. 7708680878

loutedat 124 BORDEAUX WAY, BRASELTON, GA ze +4 30046

‘Atay tne ducing he calendar year, did te oroarwaton have an mteestn ora sgnatre or aher ahonty

‘vera tancal account m2 fregn county (suchas a bank account, secures account, or other nancial [Yes] No

account? my =

Ite, enter he name of the feign country,

See the structions for exceptions an ling rquremants fx FNGEN Form 114, Ropert of Faregn Bank and nancial Aecounts(FHAR),

‘Aan tne curing the calendar yen, dhe organcaton marian an oftce ouside the Unted Sates? ae x

In¥es; enter he rame ofthe reg country: Be

43 Secton 494721) nonexaptchartable ust ng Form S80-€Zn he of Form 1041 -Gheak here

and eter the aout of tax-exempt interest receved or acrued during the tx year

be

be fe be

be

‘44a. the oranwatonmamtan any donor advised funds dng the year? t"Yes* Fem 960 most be completed stead of

Form 980-82 Ma x

' Ox te acgancaton operate one or more hospital facies during the yar? WYes; Form 980 must be completed instead

ofFom 990-€2 mm x

‘ide exganaaton rece any payments for indoor annng serves dutng the year? ae x

ltYes"t in 44, asthe organzaton fe @Form 720 to repo these payments? If "No," prowe an explanation

In Schedule 0

452 Od th ogancaton have a controled entity wth th meaning of section $120) 3)?

Ord organcaton rece any payment rom or engage any tansacton wth a controled entity wan the meaning of Secbon

512(0 13)? H'Yes, Form 990 and Schedule may ned tobe completed stead of Form 990-£2 (see structions) 450

Form 990-€2 (2016)

4

10460616 145309 260541427 2016.03020 LIFE RESOURCES OF GA INC 26054141

Fomss0:€2(20'6) _ LIRE RESOURCES OF GA INC 26-0541427 Pages

[Yes| No

45 Did the organzatan engage, rectly or det, n pote camgargn acts on behalf ot oppositon o candidates fo pube oie?

Yes: complete Schedule Par 46 x

Part Vi] Section 501(c)(@) organizations only

‘All section 501(2)(3) organaations must answer questions 47-49b and 52, and compete the tabes fr ines 60 and 51

_____crwckt tne erganzaton used Scheie O to respond to any question ts Pat VI o

No

47 Oidthe xgancaton engage ieboyng acts havea seco D'() eecton mefet dung the axyearH-Yes‘ ome seh. c,ranit[ar | |X

48 tse owencaon ston as deserted secon S7HOK NA)? "es compe SehedleE | [x

498 Did ie egencaton mak ay anf tan exp non chartered ergancaton? wa | x

0 Ves" asthe rested arganzabon secon 527 oxanzator? “00

50 Competes table forte organzaton's ve hghest compensates employees (other than oficers,dxectors, utes, and key employees) who each rcened more

than $100,000 of compensaton trom he organcabon, theres. none, enter None”

(2) Name andi ofeach employee (WyAveragehous | (6) reper (e)Esimaied

perweekdevotedio | semen ame ammount of ener

NONE postion ers | compensation

1 Total numberof oer employes pad over $100,000 >

51 Complete ts table forthe argnizabon's ve highest compensated independent contractors wno each recaved more ran $100,000 of compensanon frm the

organzaton, hare none, enter‘None_ NONE

(a Name ane busmess address of each independent contactor b) Type of service (Compensation

(Total numberof ter independent contactors each recewng oer $100,000 >

‘52 Od te organzaton complete Schedule A? Note: Al secton501(c)(3) ogancatons must atach

completed Schedule A > (Xlve N

‘Under penates of perry, | decare that have xamaed this return, ncudng accompanying Schedules and Statements and othe best of my knowledge and Bee, ts

7 than etoe)s based on a nfrmauon of which preparer Nas any knowledge

A —— 1

Sign 5 ad

Here |p 2c KE CUPS icecty~

Pave preparers ame apres sate Tae Gee TPT

sel-emplved

P:

Preparer ORY ROBINSON CPA o-/b-17 200969584

Use Only > CORY L ROBINSON CPA PC mst > 454793260

SUITE 200 ane no. 770-614-4014

DACULA, GA _30019"1663

iy doves tr th te prep shown above? See msuctons be [xlves (In

Foxe 98022016)

5

10460616 145309 260541427 2016.03020 LIFE RESOURCES OF GA INC 26054141

SCHEDULE A OM No 1548-0067

Public Charity Status and Public Support

erence ‘Complete it the organization i a section 801(6V9) organization oF a section 2016

os7laK) nonexernptchantable Wut

Crow fn ey Piatt to Form 000 or Form 02. pen to Putte

Ininatfiren Saver "|p information about Schedule A Form 990 or 990-£2) and ts Instructons is at www.ts.gov/form990. Inspection

Tame of he organization Employer ientiiaton number

LIFE RESOURCE; \F_GA_Il 26-0541427

wT [Reason for Public Charity Status ai organzatons must caries tha pan)Seenatuctons

‘The ergandaton snot private foundation because ti, (For ines 1 through 12, check only one 60x)

1 [1] Achurch, convention of churches, or association of churches described in section 170(bX 1X0.

2 [J schoo! desenbed in section 17010) tMAMli. (Attach Schedule E (Form 990 or 990€Z)))

2 (] Anospital ora cooperatwe hosptal service organcation desenbed in section 170(0) 114)

4 (5) Amedical research organzation operated in conjunction with a hospital descnbed in section 170(b\ 1MAKIl) Enter the hospital's name,

coy, and state

6 [1] Ancrganizaton operated fr the benafit ofa colege ar university owned or operated by a governmental unt descrbed

‘ection 170(0) 1HAKIv}. (Complete Part!)

6 1] Atederal, state, or local goverment or governmental unit descnbed in seetion 170(b) 1KAN.

7 (C1) Anerganzaton that normaly receives a substantial part of ts support from a governmental unit or from the general publc described in

section 170(6) NK). (Complete Part I)

8] Acommunity ist descnbed in section 170(b4 1AM. (Complete Part il)

9 [1] Amagneuttural research organizaton descnbed in section 170{oX 1KAXix) operated in conjunction with a land-grant college:

or unwersty or @ nontand grant cotege of agnculture (see struction}. Enter the name, cy, and state ofthe college oF

‘uawersty:

10 CX] An organization that normally receives: (1) more than 33 1/8% of ts support from contnbutions, membership fees, and gross recorpts from

‘ctw related tots exempt tunctons- subject to certan exceptions, and (2)no more than 33 1/3% offs support from gross investment

Income and unrelated business taxable ncome (ss section 511 tax) fom businesses acqured by the organzaton after une 30, 1975,

See section 509(a)2) (Complete Part Il)

11 [1 Anceganzation organized and operated excluswvely to test for public safety. See section 509(aN4),

12 [7] Anorganzation organized and operated exclusively for the benefit of, to perform the functions of, or to carry out the purposes of one or

‘more publicly supported organizations descnbed in section S0Q(aK,t} or section 60G(aK2) See section 609{a)3}. Check the box in

lines 12a through 12d that desenbes the type of supporting organuzation and complete ines 12e, 121, and 12g,

a (7) Type. A supporting organization operated, supervised, or controlied by its supported organization(s), typically by giving

the supported organzation(s) the power to reguary apport or elect a majonty ofthe directors or trustees of the supporting

cerganzation You must complete Part IV, Sections A and B.

> [1 Typen.A supporting organization supervised or controlled in connection with its supported organization(s), by having

Control or management of the supporting organcation vested i the same persons that contol or manage the supported

‘organcaton(s) You must complete Part 1V, Sections A and C.

¢ [1] Type functionally integrated. A supporting organation operated in connection with, and functionally integrated wath,

its supported erganzations) (00 nstructons}. You must complete Part IV, Sections A, D, and E.

4 1 Type ttinon-tunctionally integrated. A supporting organzation operated n connection with ts supported organaton(s)

thatis not functionally integrated. The organczation generally must satsty a dstnbuton requirement and an attentiveness

requirement (see instructions). You must complete Part WV, Sections A and, and Part V.

© (1 Check this box i the organaation received a wntten determination from the IRS that its a Type J, Type ll, Type I!

functonally integrated, or Type Il nor functionally integrated supporting organization

1 tert uber of supported rpanabon |

2_Provide the fotowng nformation about the supported organization(s)

oes Seen a arm _ TIT

“vec * (Grete ones 15 ARRON enroute nyo corsets

| shove see nstructors |_ Yes No

Total I

Lik For Paperwork Reducon hat Noo, ssh rowucions or Farm GH0 or OEE. wai osiceGoheaeAFarm 0 or BOEE) 26

6

10460616 145309 260541427 2016.03020 LIFE RESOURCES OF GA INC 26054141

{Compete ony you checked the box en ine 6, 7,08 of Pat rf the erganzatn aed te quay uncer Parl te erganzabon

{als to quality under the tests sted below, pleaso complete Part Il)

Section A. Public Support

Calendar year (or fiscal year beginning i) |_(a) 2012 (02013 jajzo14 1a)2015 qos [a Totat

1 Gifts, grants, contributions, and

membership fees recewed (Do not

include any “unusual grants")

2 Tax revenues leved forthe organ

1zabon's benefit and ether ard to

orexpended on ts behalf!

8. The value of services or facies

fumished by a governmental unt to

the organzation without charge

4 Total, Add ines 1 through 3

5. The porton of total contributions

by each porson other than a

‘govemmental unt or publicly

supported organzation) included

Con ine 1 that exceeds 296 ofthe

amount shown on ine 11,

column (9

Pubic support, syesatis tan

Section 8. Total Support

Calendar year (or fiscal year beginning in| _(a)2012 ()2018 cey20r4 12015 | _(0) 2076 (Total

7. Amounts from ine 4

8 Gross income from interest,

tdends, payments received on

secures loans, rents, royaties

‘and mcome trom similar sources

9 Netincome from unrelated business

actoties, whether oF not the

business is regularly carned on

10 Other ncome, Do not ineude gain

‘orloss trom the sale of captal

_assots (Explan mn Part Vt)

114 Total support, Ad nes 7 though 10

42. Gross recep trom related actwbes, etc (Gee structions) 2

18. First five years. if tne Form 980s forthe organzatlon's rst, second, thd, fourth, or ith tax year as a section 601{6))

‘organzaven, chock ths box

‘Section C. Computation of Public Support Percentage

“V4 PUbIe support percentage for 2016 (ie 6, column () dived By bne 17, eolumn () [aa] %

16 Pubc support percentage from 2015 Schedule A, Part I ino 14 ra %

1168.35 1/9% support test - 2016. If the organcation did not check the box on ne 13, and ine 1418 35 1/3% or more, check tis Box ard

‘stop here. The organization qualifies as a publicly supported organization -O

1b 20 1/0% support test - 2016. Ifthe organzation didnot check a box on line 13 oF 16a, and line 15 8 331/94 or more, check ths box

ad stop here The opancaton ques an a publ upporied orancaten oO

170 10% sacts-and-crcumstances tet - 2018 the organization cnt check a box on ine 19, YE oF 16, and ine 148 10% or more,

and the organcaton meets the acts and oreumstances est, check ts box and stop here. Expan Par Vi how the organzaton

‘moet th fact and-orounstances test. The organza qualifies as publ supported ocanzaton oO

10% -acte-and circumstances test- 2016. he organzaton didnot check a box on ine 13, 1,16, 179, and he 1518 1096 or

moro, and tho organzaton moet he “acts andercumstance" test chock ths box and sap here. Explan n Part Vi how the

Crganzaton mest the Yate-andcrcumstances test, The oranation quale asa publicly supported organization >o

18. Private foundation, Ifthe organization did not check a box on line 13, 163, 16b, 17a, of 17b, check this box and see mstructos pl

‘Schedule A (Form 900 or 890-E2) 2016

U

10460616 145309 260541427 2016.03020 LIFE RESOURCES OF GA INC 26054141

Schedule A om’ 960 or 99067)2018 LT ES_OF GA INC 541427 p:

art lil | Support jule for Organizations Described in Section S05(a)(2)

(Complete onty you checked the box on ine 10 of Part or the organization fated to qualty under Pat IH the organization fais to

quay under the tstsIsted below, please complete Part IL)

Section A. Public Support

Caton seal year bepinningin)P>]__ (a) 2072 w)2013 qeq2oig H2015 (208 io Tota

11 its, grants, contnbutions, and

mamborshp foes recawed. (Do not

include any “unusual grants.") 75,209.| _52,946.| 55,708.| 59,812. 243,675.

2 Gross receipts from admissions,

‘merchandise sold or services

formed, or facies furished in

any actirty that related 1 the

‘organzation’s taxexempt purpose

3. Gross recopts trom acti that

‘are not an unrelated rade or Bue

mets under section 513

4. Tax revenues feved forthe organ.

‘zaton’s benefit and either pad to

for expended on ts behalf

15 The valve of services or facies

furnished by a governmental unt to

the organization without charge

6 Total, Add tnes 1 through 5 75,209.| 52,946.| 55,708.| 59,812 243,67

‘7a Amounts mcludad on ines 1,2, and

3 recved from dssquatiied persons.

{acannon ened

0.

Add ines 7a and 7b T 0.

<2 Public support screed) Te 45,6715.

Section B. Total Support

(Calendar yea (rte yar begining i) >] —wy20r2 | wey2013 _[reya0ia (2015 ae [Toa

9 Amounts from hne 6 75,209.| 52,946.| 55,708.| 59,812, *

243, 67.

‘10a Gross income from mterest, 1

‘dividends, payments recewed on

Secures loans, rents, yates,

‘and come trom smlar sources

b Uncelated busines table come [

(ess secon 511 tars) rom busnesses

segue ter Sine 30, 1975, |

‘© Add lines 10a and 105 |

11° Netincome fom unrelated busess

cts not nekuded nine 100,

‘tothe’ or not the busmess i

‘guar carmed'on

12 Other ncome, Donat tude gan

Stloss rom te sale of capa :

‘ssets Explan n Part Vi).

a asdinee wanes} [75,209] 52,946.| 55,708.| 59,812. 243,675.

13 To!

14 First five years. Ifthe Form 990 is forthe organization's frst, second, third, fourth, or fifth tax year as a section 501(¢}() erganizaton,

check this box and stop here _ pC

Section C. Computation of Public Support Percentage

415. Pubbe support percentage for 2016 (ine 8, column (9 dived by ne 1, columa (0) 16 100.00 %

16_Pubte support percentage from 2015 Schedule A, Part il, ine 15. 16 100.00 %

Section D. Computation of investment income Percentage

17 Investment come percentage for 2016 ine TOe, cok (divided by tne 13, column (i)

18 investment ncome percentage tom 2015 Schedule A. Pr I, ine 17

49839 (/% support tests - 2016 the organization dd not check the box an ine 14, and ine 15¢ more than 231/856, and knw 17 nok

more than 331%, check ts box nd stop here. The organzaton quae as a publicly supported organzaton

1.93 170% eupport tests - 2015. Ifthe organzaton ch not check a box on ine Té or ine Ba, and ine 16 = more than 39 1/9%, and

tne 18 8 nat more than 331/39, check ths box and stop here. The organization quale 38 a pubtclyeuppertes organization

20. Private foundation he organzaton cid not check a boxon ine 14, 198,or 190, check ths box and soe nsructons

‘sma onas8 Schedule A (Form 960 6 890-EZ) 2016

8

10460616 145309 260541427 2016.03020 LIFE RESOURCES OF GA INC 26054141

‘Supporting Organizations

(Comalate ony you checked aboxim ne 12on Pat. you checked 1230 Par |. compete Sectons A

and 8 Hyoucheckad 120 o Par complete Sactons Aan C. I you checked 12c of Par, compte

Sectons A 0, and. you checked ¥24 of Pa | complete Sections A and D, and compat Pat V)

Section A. All Supporting Organizations

Yes we

1. Areal of the erganzation’s supported organizations listed by name inthe organzation's governing

documents? i"No,* desenbe mn Part VI how the supported organcations are designated. designated by

class or purpose, descnbe the designation. histone and contiung relatonship, explan. 1

2. Did the organization have any supported organzation that does not have an IRS determination of status

Under section S09) or (2)7 If "Yes," explan in Pert VI how the organization determined that the supported

‘organzation was desenbed section 509/41) oF (2). 2

38 Od the organcation have a supported organzation described in section 501(eX.), (5), o(6)? If "Yes," answer

) and (e) below. 3a

'b_Did the organization confirm that each supported organcaton qualited under section S01(0K, (5), oF (6 and

satshed the publ support tests under section 509(a2)? I *Yes,* descnbe in Part V when and how the

‘organaaton made the determination 3b

{© Dad the organization ensure that all support to such organizations was used exclusively for section 170(cK2}@)

purposes? If "Yes," expla i Part VI what controls the arganzatton put m place fo ensure such use. ae

4a Wes ay supported orgenzaton not erganzed nthe Unted States ("orogn supported organza’? I

* and you checked 12a or 126 n Part |. answer @) and () below aa

'b Os the erganzation have ultmate control and discretion in deciding whether to make grant tothe foregn

‘supported organzaton? If "Yes," descnbe n Part VI how the organization had such control and cscretion

sorte beng controlled or syperused by orin connecion with its supported erganations. 4b

{© Did the organization suppor any foreign supported organzation that dogs not have an IRS doterminaton

Under sectons 601(6)3) and 609{a)() or (2/71 *Yes,* expla in Part I what controls the organization used

to1ensure that al support tothe foregn supported organzation was used exclusively or section 17O(0V2)B)

purposes. 4c

‘Sa Did the orgencation add, substtute, or remove any supported organizations dung the tax year? I *Yes,*

‘answer (and (below (if applicable) Also, prowde deta n Part VI, including () the names and EIN

numbers ofthe supported organcations added, substituted, or removed; i) the reasons for each such action;

(a) the eutnonty under the orgenization’s organizing document authonang such action, and (v) how the action

was accomplshed (xch as by amendment tothe organizng document) 5a

'b Type | or Type only. Was any added or substituted euppartad organcation part ofa class already

designated i the ocganzavon's organizing document?

© Substitutions only. Was the substtuton the result of an event beyond the organization's contro!?

6 Dad the ganization prowde support (whether inthe form of grants or the provision of services or facies) to

anyone other than () #8 supported organizations i) mdiviuas that are part ofthe chantable class

benetted by one or more of ts supported organzations, or (a) other supporting organations that also

“support or Benefit one or more of the fing organization's supported organcations? If Yes," provde detain

Part Vi.

7. Dd the exganaston provide a grant, oan, compensation, or other simiar payment toa substantial contabutor

(otined n section 4958(c)2NC), a farnly member ofa substantial contnbutor, or a.25% controlled entity wth

togard 1a substantia contrbutor? If Yes,” complete Part of Schedule L (Form 990 or 990-E2)

8 Did the organzation make a loan to a disqualified porson (as defned in section 4988) not descnbed in tno 7?

"Yes," complete Part | of Schedule L (Form 990 or 990-2). 8

28. Was the organization controled directly or ndractly at any tne dunng tha tax yaar by one oF more

isqualied persons as defined m section 4946 (other than foundation managers and orgarvzations desorbed

im section 509(aK1) or (2)? I "Yes," prowde detal n Part sa

'b Did one or more dequaltied persons (as defined m ine 9a) hold a controling interest m any entity in which

the supporting organization had an interest? if Yes,” provde detain Part Vi

‘© Did a disqualified person (as defined in ine 9a) have an ownership interest mn, or denve any personal benoit

from, assets n which the supporting organzation also had an interest? I *Yes," prow detain Part VI 90

40a Was the organzaton subject tothe excess business holdings rules of section 4943 because of section

494940 (regarding certan Type Il supporting organzations, and al Type Il non unctionalyntograted

aie

supporing organcations) if "Yes," answer 100 below. : toa

'b Dic the organcation have any excess business holdings inthe tax year? (Use Schedule C, Form 4720, fo

determine whether the oranation bad excess business holdings) . 10»

(etme oe ‘Schedule A (Form 990 or 890-E2) 2016

9

10460616 145309 260541427 2016.03020 LIFE RESOURCES OF GA INC 26054141

Schedule A orn 990 or 990712018 LT] SOURCES OF GA INC 26-0541427 pa

‘Supporting Organizations continued)

1 Has the organizaton accepted a it or contribution trom any of the folowing persons?

‘4A person who directly or ndrectly contros, ether alone or together wih persons described in () and (c)

‘boiow, the governng body ofa supported organzation?

'b A famiy member of a person descnbed in (a) above?

2 A.359% controled ant ofa person described m (a) or (0) sbove?if*Yas" toa b oe, provide detain Part VA

Section B. Type | Supporting Organizations

Yes | No

1 Did the directors, trustees, or membership of one or more supported organizations have the power to

‘ogularty appont or elect atleast a mayonty ofthe organczaton’s directors or trustees at all mes dunng the

tax year? I"No," desenbe.n Pert VI how the supported erganation(s effectively operated, supervised, or

controled the organtzation's actives. If the organzation had more than one supported organizatin,

desenbe how the powers fo appoint andlor remove directors o trustees were alocated among the; supported

‘organzatons and what conditons or restrictions, if any, applied to such powers dung the tax year 1

2. Dd the organization operate forthe benefit of any supported organization othor than the supported

‘organcation(s that operated, supersed, or controlled the supporing oxganizaton? I "Yes," expla in

Part) how proving such benefit camed out the purposes ofthe supported organization(s) that operated,

upenized, or controled the supporting omanation 2

Section C. Type ll Supporting Organizations.

[wo

1 Were a majonty ofthe organization's directors or trusteas during the tax year alo a majonty of the drectors

‘or trustees of each ofthe organzaton's supported organization(s}? f "No," descnbe in Part I how contro!

‘or management ofthe supporting erganczation was vested in the same persons that controled or managed

__the supported organzaton(s) 4

‘Section D. All Type ill Supporting Organizations

Yee.

No.

1 Did the organzation provide to each of ts supported organtations, by the last day of the fith month ofthe

‘organization's tax year, () a written notice descnbing the type and amount of support provided during the prior tax

year, (a copy of the Form 990 that was most racentl tied as of the date of notation, and (e) copies ofthe

‘organization's governing documents in fect on the date of notieation, tothe extent not previously proved? 1

2 Were any of the organization's offcer, directors, or trustees exher (appointed or elected by the supported

cxganaation() oF i) serving on the governing body of a supported erganration? if ‘No, explain Part VI how

the organization mantained a close and continuous working alatonship with the supported organtzations). 2

3 By eason ofthe relationship described m (2), did the organaation’s supported organizations have a

signicant voce m the organzaton’s investment pokcies and in drectng the use ofthe rgarvzation’s

income or assets at all umes dunng the tax year? If "Yes," desenbe n Part V. the role the organzation's

supported amancatons pleyed inthis regard 3

Section E. Type ii! Functionally integrated Supportin; nizations:

1 Check the box nex tothe method thatthe organization used to satsythe Integral Part Test dunng the yeafeee intuctons)

a [_] Tre organzation satished the Activties Test. Complete ne 2. below.

» [) The organzation is the parent of each of its supported organizations. Complete tne 3 below.

¢ [_) The organization supported a governmental entity. Describe in Part Vi how you supported a government entity (see instructions

2 Actes Test. Answer (a) and ()botow.

No.

‘9 Dud substantaly all ofthe organzation’s actives dunng the tax year directly further the exempt purposes of

the supported organzaton() to which the organzation was responsive? if "Ye," then n Part VI Kianthy

those supported organizations and explain how these actuties dvecty furthered ther exempt purposes,

hhow the organzation was responsive to those supported organzatons, and how the organization determined

that thare actubes constituted substantially al oft actwtes. 2a

bb 04d the actwties descnbed 1 (a) conetrute actus that, but forthe organaation’s mvalvement, one or more

‘ofthe organization's supported organization(s) would have been engaged n?If"Yos," explain Part VI the

reasons othe orgunaaton’s poston thats supported organzatons) woul have engaged these

_actnbes but forthe organtaton's involvement, 2

3. Parent of Supported Organizations Answer () and (2) below.

‘2 Did the organization have the power to regularly appoint or elect a majonty of the oftcer, directors, oF

trustees ofeach ofthe supported organizations? Provide detais in Part VI. 3a

bb id the organization exerese a substantial degree of daction over the poli, programs, and activites ofeach

of is supported ocganzatons? i "Yes, Jo. Part the role played by the organcaton n this regard 3

teams epaie ‘Schedule A (Form 990 or 990-E2) 2016

10

10460616 145309 260541427 2016.03020 LIFE RESOURCES OF GA INC 26054141

1 [J check here a the organzation satisfied the

‘Type Ill Non-Functionally integrated 509(a)(3) Supporting Organizations

/Quaifying trust on Nov.20, 1970 (explan m Part Vi) See instructions, All

Integral Part Tost

ther Type lit non functionally mtegrated supporting organzations must compete Sections A tough.

seston A- Ade et neon wrrever | een

1 te rtm canta i

3 neces err aca A

2 ome: go ece ee esi 3

a aides ha «

actin nd as 5 L

¢- Rotel peg operas pad weed pooner

coca gon xf ange craton

cenunguescioupetndtrpdiciaincanetersansion) | 6

ec espe ee arr A

Adhd et income (a 5,8 i nl eal

Secon Mini Ase Aunt were | _ gsreuree

7 faa ha oar a

satura tonto erent tba Yo)

hese enya cata rm

‘eae ey csc r

ara af er onesie Ta te

ota dss. 201d rm

Bsc ced br cage So

fara ta Pa

Acquistion ndebtedness apptoable to nor-exemptuse assets 2 {

Scbtectie stone A f

‘Cash deemed hed for exempt use Enter 1-1/2% of ine 3 (for greater amount. |

ensue ‘

3th na i ae a =

igi 008 =n

eset pays Sas feria

“a Mr set at i 7 a

Se =

1 Aan tec rf econ A a, Can =}

2 Entor 85% of ino 1 21

‘3. Minemym asset amount for paor year (rom Section B, tne 8, Colurm A) at

tera inte “1

5 neoms tax mips m poor yoar et

6 Distributable Amount. Subtract line 5 from line 4, unless subject to |

feng try ten saa ‘

7 [J creck here the current years the organzation’s fist as a non functionally integrated Type Il supporting organaton (280

smetruenons

10460616 145309 260541427

an

2016.03020 LIFE RESOURCES OF GA INC

‘Schedule A Form 900 or 960-E2)2016

26054141

(Organizations (continued)

Section D -Diswibutions ‘Curent Year

{Amounts paid to supported organzatons to accompigh exempt purposes

"2 Amounts paid to perform actvty tat circtl furthers exempt purposes of supported

‘orgariations, mn excess of income from activity

3_Adminstratve expenses pad to accomplish exempt purposea of supported erganaations

4 Amounts paid to acquire exemptuse assets

‘5 Oualfed set-aside amounts (pnor IRS approval requed)

‘6 Other eisnbutons [describe mn Part VI) See structions.

7 Total annwal disvibutions, Add ines 1 trough 6

'8_Distrbutons to attentive supported organzations 1o which the organization is eeponsive

(provide detas in Part V) Soe mstructons

‘@_Dstnbutabie amount fr 2016 from Saction G, ne 6

10 Line 8 amount doaded by Line 9 amount

o @ w,

cess Distributions | Underdistibutions Distributab

Section E- Distribution Allocations (see instructions) | Sxonns Dtetributl peony _aDisotbutable

‘3096s dstnbutons caryover, any, to 2016:

b

From20i3

(J From 20141

fe From 2015; {

{Total of ines Sa through ©

‘9 Applied to underdstributons of pror years

h_Appled to 2016 cetnbutabie amount

{_Canryover from 2011 not applied (so0 struction)

{_ Remander. Subtract ines 39, 3h, and 31 from 3

“__Dstrbutions for 2016 from Section D,

ine 7 s

2 Aopled to underdistibutons of pror years

Tb Appled to 2076 astnbutabie amount

¢ Remander. Subset ines 4a ang 4b fom 4

'S Remanng underdistibutions for years prior to 2076, #

any Subtract Ines 3g and 4a from ine 2. For result greater

‘than zero, explain m Part VI. See structions

{© Remanng underdstrbutions for 2016. Subtract lines 3h

‘and 4b rom ne For result greater than zero, expan in

Part Vi Soe nstructons,

7 Excess distributions carryover to 2017. Add ines 8

and de

B_Breakiown of ine 7

bb Bicess rom 2013

2 Excoss rom 2014

Excess trom 2015.

0 Excess trom 2016

‘Schedule A (Form 990 or 890-EZ) 2016

12

10460616 145309 260541427 2016.03020 LIFE RESOURCES OF GA INC 26054141

Pat IV, Section A, ines 1,2, 3b, 86, 4b, 4c, 5a, 6, Sa, 8b, 8c, 11a, 11D, and 11c; Part V, Sacton 8, ines 1 and 2; Pat iV, Sacion ©,

line 1; Part iv, Section D, ines 2 and 8, Part WV, Section €, ines 16, 2a, 20, 3a, and 3b; Part V, tne 1; Part V, Section B, ine Te, Part V,

‘Section D, Ines 5,6, and 8, and Part V, Secton E, ines 2,5, and 6, Alco complete ts part for any additonal mformaton.

{Seemstucton:

‘aaome nae ‘Schedule A (Form 990 or 990-E2) 2016

13

10460616 145309 260541427 2016.03020 LIFE RESOURCES OF GA INC 26054141

‘SCHEDULE 0

(Form 990 o 990-2)

Supplemental Information to Form 990 or 990-EZ

‘Complete to provide information for responses to specific questions on

"Form 990 oF 960-E2 or to provide any accitional information.

oermmtt ne aary tach E90 a ova pent Pubtc

Name ofthe exganizaion Employer identification number

LIFE RESOURCES OF GA INC 26-0541427

FORM 990-EZ, PART I, LINE 16, OTHER EXPENSES:

DESCRIPTION OF OTHER EXPENSES: : AMOUNT :

OFFICE SUPPLIES 7 128.

‘TRAVEL 2,607.

MARKETING/BRANDING EXPENSE 10,637.

WEBSITE EXPENSE 541.

STAFF DEVELOPMENT 1,043.

CELL PHONE 825.

BOOKKEEPING FEES 2,400.

PAYROLL TAX 1,874.

SMALL EQUIPMENT 52.

EQUIPMENT RENTAL ae

MISC_EXPENSE gid.

INSURANCE 1,375.

RENEWAL FEES 20.

PROFESSIONAL & CONSULTING FEES. 1,326.

RVT_MEALS 1,538.

TOTAL TO FORM 990-EZ, LINE 16 25,845.

FORM 990-EZ, PART IT, LINE 26, OTHER LIABILITIES:

DESCRIPTION BEG. OF YEAR END OF YEAR

PAYROLL TAX LIABILITY 1,240. 1,129.

FORM 990-EZ, PART II, PRIMARY EXEMPT PURPOSE - TO PROVIDE EDUCATIONAL.

OPPORTUNITIES AND TRAINING FOR PREGNANCY CENTERS IN THE STATE OF GA

{THA For Paperwork Reduction Act Notice, se the instructions for Form 990 or 890-EZ. ‘Schedule O (Form 090 or 960-EZ)(2016)

14

10460616 145309 260541427 2016.03020 LIFE RESOURCES OF GA INC 26054141

2016

‘Open to Public

Inspection.

SCHEDULE 0

(Form 990 or 990-€2)

Supplemental Information to Form 990 or 990-EZ

‘Complete to provide information for responses to specific questions on

orm 980 or 990-E2 oto provide any addtional information.

Attach to Form 800 or 800-€2.

Name of the organzaton "| Employer identification number

LIFE RESOURCES OF GA_INC 26-0541427

FORM _990-EZ, PART V, INFORMATION REGARDING PERSONAL BENEFIT CONTRACTS:

THE ORGANIZATION DID NOT, DURING THE YEAR, RECEIVE ANY FUNDS, DIRECTLY

OR INDIRECTLY, TO PAY PREMIUMS ON A PERSONAL BENEFIT CONTRACT.

THE ORGANIZATION, DID NOT, DURING THE YEAR, PAY ANY PREMIUMS, DIRECTLY,

OR INDIRECTLY, ON A PERSONAL BENEFIT CONTRACT.

LAA For Paperwork Reduction Act Notice, see the Instructions for Form 090 or 990-EZ. ‘Schedule O (Form 990 or 990-£7) (2016)

15

10460616 145309 260541427 2016.03020 LIFE RESOURCES OF GA INC 26054141

Vous aimerez peut-être aussi

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

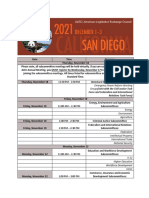

- 2021 States and Nation Policy Summit AgendaDocument4 pages2021 States and Nation Policy Summit AgendaTeddy WilsonPas encore d'évaluation

- Texas HHSC Request For ApplicationDocument104 pagesTexas HHSC Request For ApplicationTeddy WilsonPas encore d'évaluation

- WWHA V PaxtonDocument43 pagesWWHA V PaxtonTeddy WilsonPas encore d'évaluation

- Human Coalition - Texas Grant ContractDocument455 pagesHuman Coalition - Texas Grant ContractTeddy Wilson100% (1)

- PP v. JegleyDocument148 pagesPP v. JegleyTeddy WilsonPas encore d'évaluation

- DFPC Prayer List UpdatedDocument1 pageDFPC Prayer List UpdatedTeddy WilsonPas encore d'évaluation

- Capitol Riot Map 1.11.21Document1 pageCapitol Riot Map 1.11.21Teddy WilsonPas encore d'évaluation

- Wilks Family Campaign Contributions - Texas (2015)Document3 pagesWilks Family Campaign Contributions - Texas (2015)Teddy WilsonPas encore d'évaluation

- Wilks Family Campaign Contributions - Texas (2018)Document3 pagesWilks Family Campaign Contributions - Texas (2018)Teddy WilsonPas encore d'évaluation

- Return of Private FoundationDocument40 pagesReturn of Private FoundationTeddy WilsonPas encore d'évaluation

- Wilks Family Campaign Contributions - Texas (2016)Document9 pagesWilks Family Campaign Contributions - Texas (2016)Teddy WilsonPas encore d'évaluation

- PF Return of Private Foundation: ExpensesDocument20 pagesPF Return of Private Foundation: ExpensesTeddy WilsonPas encore d'évaluation

- Wilks Family Campaign Contributions - Texas (2017)Document7 pagesWilks Family Campaign Contributions - Texas (2017)Teddy WilsonPas encore d'évaluation

- HFF 990 2013Document124 pagesHFF 990 2013Teddy WilsonPas encore d'évaluation

- TTF 990 2012Document39 pagesTTF 990 2012Teddy WilsonPas encore d'évaluation

- HFF 990 2012Document35 pagesHFF 990 2012Teddy WilsonPas encore d'évaluation

- HFF 990 2015Document21 pagesHFF 990 2015Teddy WilsonPas encore d'évaluation

- HFF 990 2016Document22 pagesHFF 990 2016Teddy WilsonPas encore d'évaluation

- TTF 990 2015Document25 pagesTTF 990 2015Teddy WilsonPas encore d'évaluation

- HFF 990 2014Document22 pagesHFF 990 2014Teddy WilsonPas encore d'évaluation

- Form 990-PF Return of Private FoundationDocument18 pagesForm 990-PF Return of Private FoundationTeddy WilsonPas encore d'évaluation

- TTF 990 2013Document127 pagesTTF 990 2013Teddy WilsonPas encore d'évaluation

- TTF 990 2011Document43 pagesTTF 990 2011Teddy WilsonPas encore d'évaluation

- TTF 990 2014Document29 pagesTTF 990 2014Teddy WilsonPas encore d'évaluation

- Texas A2A Program FY2018 Q2 (Pregnancy Help Center of Lufkin Annual Monitoring)Document4 pagesTexas A2A Program FY2018 Q2 (Pregnancy Help Center of Lufkin Annual Monitoring)Teddy WilsonPas encore d'évaluation

- Texas A2A Program FY2018 Q1 (Pregnancy Care Center Huntsville - Facility Tour)Document2 pagesTexas A2A Program FY2018 Q1 (Pregnancy Care Center Huntsville - Facility Tour)Teddy WilsonPas encore d'évaluation

- Texas A2A Program FY2017 Q4 (Foundation For Life Facility Tour)Document3 pagesTexas A2A Program FY2017 Q4 (Foundation For Life Facility Tour)Teddy WilsonPas encore d'évaluation

- TTF 990 2016Document25 pagesTTF 990 2016Teddy WilsonPas encore d'évaluation

- Texas A2A Program FY2018 Q2 (Foundation For Life Annual Monitoring)Document3 pagesTexas A2A Program FY2018 Q2 (Foundation For Life Annual Monitoring)Teddy WilsonPas encore d'évaluation

- Texas A2A Program FY2017 Q1 (Facility Tours)Document2 pagesTexas A2A Program FY2017 Q1 (Facility Tours)Teddy WilsonPas encore d'évaluation

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)