Académique Documents

Professionnel Documents

Culture Documents

Wealth Academy Quick & Easy Chapter Summaries Chapter 3 - Fund Distribution and Sales Practices

Transféré par

Anand KumarDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Wealth Academy Quick & Easy Chapter Summaries Chapter 3 - Fund Distribution and Sales Practices

Transféré par

Anand KumarDroits d'auteur :

Formats disponibles

Wealth Academy

Quick & Easy Chapter Summaries

Chapter 3 - Fund Distribution and Sales Practices

Here are the key points you must remember in this chapter :

» Traditionally, transactions in units of mutual fund schemes have been effected as:

o -New Fund offer: Investor submits the application for purchase along with cheque/demand draft to the AMC or authorised banker of AMC or a distributor or RTA

o -Post NFO transactions in open end schemes: sale or repurchase requests would be submitted to the AMC, distributor or RTA

o -Post NFO Transactions in closed end schemes: Investors would need to go to a stock exchange to sell or buy more units as schemes are listed on exchange

o -ETF: ETF combines features of both open end and closed end schemes

» Dematerialisation has eliminated the need for unit certificates to be issued to the investor. Instead, an electronic record of the unit holding is maintained with the depository

» Unit holders can hold their mutual fund units in either physical form or demat form.

» The existing folio holders can now buy new units or redeem their units through the AMC website

» For transacting on AMC website, the investor needs to establish physical contact with the AMC, distributor or RTA to sign forms for the first transaction. Future transactions

can happen over internet. However, some AMCs have eliminated the need of that too.

» Payment for fresh purchases from AMC website can be made through payment gateway on the website (unit holder's application and money transfer are directly linked),

NEFT/RTGS or small value investments through credit cards

» AMC website allows transaction in only its schemes

» The investors can also transact in mutual fund schemes through the websites of distributors which allows the unit holders to transact in units of several AMCs, with whom the

distributor has tied up

» Internet, smartphones and Wireless Access protocol are the modes of transacting in mutual fund units

» The investor can trade online in stock exchanges by having an online trading account and a demat account. Having an internet enabled banking account makes the process

easier

» Besides offering a platform for trading in listed units, BSE and NSE have also developed transaction engines for mutual funds

» Transaction engines help stock brokers in managing mutual fund applications.

» While transacting through transaction engines, the units/money are credited to the broker's pool account, from which the broker transfers to the investor's DP account/bank

account

» In case of debt schemes, transactions for subscription of Rs.1 crore and above are not allowed in transaction engine

» Since the stock exchange is only a facilitator, while AMC is the counter party for the investor's transactions, the transactions are not protected by the settlement guarantee

fund

Vous aimerez peut-être aussi

- NISM PRE READ Chapter 6Document7 pagesNISM PRE READ Chapter 6rockrock747582Pas encore d'évaluation

- Review of Some Online Banks and Visa/Master Cards IssuersD'EverandReview of Some Online Banks and Visa/Master Cards IssuersPas encore d'évaluation

- Chapter 4 - Secondary MarketsDocument29 pagesChapter 4 - Secondary MarketsAMAL P VPas encore d'évaluation

- E TradingDocument19 pagesE TradingBharti SharmaPas encore d'évaluation

- Security Analysis Write Up Arnab GangopadhyayDocument10 pagesSecurity Analysis Write Up Arnab GangopadhyayholyvagabondPas encore d'évaluation

- Payment Split 1708432992Document16 pagesPayment Split 1708432992waqar.asgharPas encore d'évaluation

- Electronic - IPODocument18 pagesElectronic - IPOLilly Geddam100% (1)

- BennieDocument3 pagesBennieaPas encore d'évaluation

- FIN-310 Report PDFDocument15 pagesFIN-310 Report PDFHusen AliPas encore d'évaluation

- IBFS Notes Unit 2 PDFDocument15 pagesIBFS Notes Unit 2 PDFPramod ReddyPas encore d'évaluation

- EPIS Merchant AcquiringDocument3 pagesEPIS Merchant AcquiringyadbhavishyaPas encore d'évaluation

- Over-The-Counter Exchange of India - OTCEIDocument7 pagesOver-The-Counter Exchange of India - OTCEISunil KumarPas encore d'évaluation

- Presentation To The CFTC Technology Advisory Committee (TAC)Document7 pagesPresentation To The CFTC Technology Advisory Committee (TAC)kambi78Pas encore d'évaluation

- Online TrainingDocument57 pagesOnline Trainingvinayagrawal86Pas encore d'évaluation

- Chapter 3 Securities Operations and Risk ManagementDocument88 pagesChapter 3 Securities Operations and Risk ManagementMRIDUL GOELPas encore d'évaluation

- Module 3.2 Clearing and SettlementDocument37 pagesModule 3.2 Clearing and SettlementsateeshjorliPas encore d'évaluation

- Discussion Paper: Risk Management - Safer Markets For InvestorsDocument10 pagesDiscussion Paper: Risk Management - Safer Markets For Investorsvaish2u6263Pas encore d'évaluation

- Xii Commercs Secretrial PracticeDocument9 pagesXii Commercs Secretrial PracticeSakshi JeswaniPas encore d'évaluation

- Project On Demat OperationsDocument57 pagesProject On Demat Operationsvijee_877Pas encore d'évaluation

- Dematerialisation Is The Process of Converting The Physical Form of Shares Into Electronic FormDocument15 pagesDematerialisation Is The Process of Converting The Physical Form of Shares Into Electronic FormNitin KanojiaPas encore d'évaluation

- CH 2 - E-Banking ServicesDocument20 pagesCH 2 - E-Banking Serviceschintan vadgamaPas encore d'évaluation

- Q1: Explain in Detail The Different Ways Companies Use To Speed Up Their Cash Collections (Receipts) Now A DaysDocument5 pagesQ1: Explain in Detail The Different Ways Companies Use To Speed Up Their Cash Collections (Receipts) Now A DaysRameen AyubPas encore d'évaluation

- Unit 4 BDocument47 pagesUnit 4 Bketan dontamsettiPas encore d'évaluation

- Chap 5 Note Roy SirDocument70 pagesChap 5 Note Roy SirJannatul FardusPas encore d'évaluation

- Depositaries and Mutual Funds: MBA III Semester Finance Elective Merchant Banking and Financial Services Ranjani JDocument36 pagesDepositaries and Mutual Funds: MBA III Semester Finance Elective Merchant Banking and Financial Services Ranjani Jwelcome2junglePas encore d'évaluation

- Wealth and InsurtechDocument41 pagesWealth and InsurtechROHIT CHANDRA MBA W 2021-24Pas encore d'évaluation

- Chapter 5 Securities Operations and Risk ManagementDocument27 pagesChapter 5 Securities Operations and Risk ManagementMRIDUL GOELPas encore d'évaluation

- Banking ProductsDocument11 pagesBanking ProductsRadhi BalanPas encore d'évaluation

- Cash ManagementDocument49 pagesCash ManagementM. Faisal WaleedPas encore d'évaluation

- Depository SystemDocument36 pagesDepository SystemRabia PearlPas encore d'évaluation

- Index: Contains Page NoDocument49 pagesIndex: Contains Page Nokavita23aPas encore d'évaluation

- Depository and Custodial Services Notes M.Com Sem-IV - Sukumar PalDocument25 pagesDepository and Custodial Services Notes M.Com Sem-IV - Sukumar PalRiya Das RdPas encore d'évaluation

- Swot and ProductDocument5 pagesSwot and ProductavinishPas encore d'évaluation

- Banking Practice and Procedure Chapter EightDocument9 pagesBanking Practice and Procedure Chapter EightDEREJEPas encore d'évaluation

- MIS Assignment: Submitted by Group 6Document16 pagesMIS Assignment: Submitted by Group 6Deepankur MalikPas encore d'évaluation

- Chapter-2 Review of LiteratureDocument54 pagesChapter-2 Review of Literaturebalki123Pas encore d'évaluation

- Equity and Debt Market ProjectDocument14 pagesEquity and Debt Market ProjectBeeru NayakPas encore d'évaluation

- A Study OnDocument64 pagesA Study OnforwastePas encore d'évaluation

- Demat Refers To A Dematerialised AccountDocument9 pagesDemat Refers To A Dematerialised AccountPreetam KothariPas encore d'évaluation

- MF IntroductionDocument21 pagesMF Introductionutsav mandalPas encore d'évaluation

- The Commercial Credit Circuit - C3: Step by StepDocument4 pagesThe Commercial Credit Circuit - C3: Step by StepsinnombrepuesPas encore d'évaluation

- Comtrack FaqDocument20 pagesComtrack FaqEmily ByrdPas encore d'évaluation

- Lecture 4 International Commercial Banking ShortenedDocument26 pagesLecture 4 International Commercial Banking ShortenedQuỳnh Trần Ngọc XuânPas encore d'évaluation

- Depositorysystems 140119120308 Phpapp01Document12 pagesDepositorysystems 140119120308 Phpapp01rachealllPas encore d'évaluation

- Chapter-I: DefinitionDocument36 pagesChapter-I: Definitionajay_sanala100% (1)

- Corporate BankingDocument56 pagesCorporate Bankingsujata_patil11214405Pas encore d'évaluation

- Project On E-Broking Related TO Indian BullmarketDocument71 pagesProject On E-Broking Related TO Indian BullmarketSharma PradeepPas encore d'évaluation

- 1.liquidity, Cash & Marketable SecuritiesDocument19 pages1.liquidity, Cash & Marketable SecuritiesSuja mkPas encore d'évaluation

- Real Estate Exchange Using EthereumDocument13 pagesReal Estate Exchange Using EthereumVarsha ShirsatPas encore d'évaluation

- Regulatory Framework For Branch Less BankingDocument8 pagesRegulatory Framework For Branch Less BankingkbboakyePas encore d'évaluation

- Accounting For Cash & Short-Term InvestmentDocument2 pagesAccounting For Cash & Short-Term InvestmentZeshan ChPas encore d'évaluation

- L5 Electronic Payment SystemsDocument28 pagesL5 Electronic Payment SystemsKenneth Kibet NgenoPas encore d'évaluation

- PPB Module 4Document38 pagesPPB Module 4RAJPas encore d'évaluation

- Ecomerce NotesDocument28 pagesEcomerce NotesManageITafricaPas encore d'évaluation

- ICL AssignmentDocument6 pagesICL Assignmentachal.yadav125Pas encore d'évaluation

- Top 50 Banking Interview Questions & Answers: 1) What Is Bank? What Are The Types of Banks?Document11 pagesTop 50 Banking Interview Questions & Answers: 1) What Is Bank? What Are The Types of Banks?Rahul mitraPas encore d'évaluation

- 1 - 2018 Introduction To Banking Operations UBA-Day 1 PDFDocument111 pages1 - 2018 Introduction To Banking Operations UBA-Day 1 PDFAustinPas encore d'évaluation

- In The Subject Research Methodology in CommerceDocument30 pagesIn The Subject Research Methodology in CommerceDigambar HalgePas encore d'évaluation

- Securities and Exchange Board of India: CircularDocument5 pagesSecurities and Exchange Board of India: CircularSwapnil JagatiPas encore d'évaluation

- Cash Flow Management PDFDocument366 pagesCash Flow Management PDFTijanaKnezevic85100% (1)

- BBA Major ProjectDocument40 pagesBBA Major ProjectDeepak Bhatia100% (5)

- WORKDocument7 pagesWORKzekariasPas encore d'évaluation

- Dir DepDocument1 pageDir Depfazlah8106Pas encore d'évaluation

- 02-Introduction To The GPON OLTDocument36 pages02-Introduction To The GPON OLTMohammad MohammadPas encore d'évaluation

- Impact of E-BankingDocument6 pagesImpact of E-Bankingaryaa_statPas encore d'évaluation

- GCAP - EnglishDocument2 pagesGCAP - EnglishJITENDRAPas encore d'évaluation

- Huawei SPS Convergent Solution For IPSTP and DA v1.0Document53 pagesHuawei SPS Convergent Solution For IPSTP and DA v1.0aranibarmPas encore d'évaluation

- RBFDocument8 pagesRBFPankaj KamraPas encore d'évaluation

- Affiliate MarketingDocument13 pagesAffiliate MarketingMainak RanjanPas encore d'évaluation

- Accounts 2Document25 pagesAccounts 2Kartik PanwarPas encore d'évaluation

- Transportation: An Project by Group C (Rohan Madi Shrestha, Rijan Maharjan, Niva Shrestha, Eva Shrestha)Document10 pagesTransportation: An Project by Group C (Rohan Madi Shrestha, Rijan Maharjan, Niva Shrestha, Eva Shrestha)AnimeWeebs foreverPas encore d'évaluation

- Cis Mirya Trading Co LTD - Bangkok 0105528001187+Document3 pagesCis Mirya Trading Co LTD - Bangkok 0105528001187+SergePas encore d'évaluation

- Assessing Cycle Lanes Using The Bicycle CompatibilDocument16 pagesAssessing Cycle Lanes Using The Bicycle CompatibilKashfia Tasnim NishthaPas encore d'évaluation

- Naufal Faruq - 2106753675 - PBPI - KUIS 01Document1 pageNaufal Faruq - 2106753675 - PBPI - KUIS 01Naufal FaruqPas encore d'évaluation

- Influenta Ajustarilor Propuse de Auditorul Independent Asupra Opiniei Exprimate in Raportul de AuditDocument7 pagesInfluenta Ajustarilor Propuse de Auditorul Independent Asupra Opiniei Exprimate in Raportul de AuditVlad TudorPas encore d'évaluation

- 20 - Fuentes Letras 1-764Document1 page20 - Fuentes Letras 1-764shenPas encore d'évaluation

- Policy Loans Including Foreclosure Revival Alteration Duplicate Policy RepositoryDocument23 pagesPolicy Loans Including Foreclosure Revival Alteration Duplicate Policy Repositorykushal patilPas encore d'évaluation

- KM123619222 StatementDocument31 pagesKM123619222 StatementrocksebuPas encore d'évaluation

- T3TLC - Letters of CreditDocument181 pagesT3TLC - Letters of CreditZia Uz Zahideen50% (2)

- S.No. Customer Circle Reason For Delay Due Date Sales Order DateDocument366 pagesS.No. Customer Circle Reason For Delay Due Date Sales Order DatePriya SawantPas encore d'évaluation

- The Impact of Credit Cards On HDFC Bank Customers in Shimoga - An Evaluative StudyDocument9 pagesThe Impact of Credit Cards On HDFC Bank Customers in Shimoga - An Evaluative StudyankitPas encore d'évaluation

- Construct and Ticket Domestic Airfares: D2.TTA - CL2.06 Trainee ManualDocument31 pagesConstruct and Ticket Domestic Airfares: D2.TTA - CL2.06 Trainee ManualEdwin LolowangPas encore d'évaluation

- Position Paper About Implementing Cable CarsDocument2 pagesPosition Paper About Implementing Cable CarsJosh ArafolxdaPas encore d'évaluation

- Casos de Ajuste.Document9 pagesCasos de Ajuste.Alguien algunoPas encore d'évaluation

- Sme BookDocument397 pagesSme BookVivek Godgift J0% (1)

- 10 Fastest Growing Industries 2013 FinalDocument4 pages10 Fastest Growing Industries 2013 FinalMuhammad ImranPas encore d'évaluation

- Course Syllabus IN BASIC LEGAL ETHICS PART 1Document2 pagesCourse Syllabus IN BASIC LEGAL ETHICS PART 1Chrizie A. LeynesPas encore d'évaluation

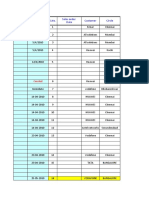

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument39 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceVishal BhosalePas encore d'évaluation

- The Evolution To Digital TransformationDocument28 pagesThe Evolution To Digital TransformationAnh Bao Tran DuongPas encore d'évaluation

- John D. Rockefeller on Making Money: Advice and Words of Wisdom on Building and Sharing WealthD'EverandJohn D. Rockefeller on Making Money: Advice and Words of Wisdom on Building and Sharing WealthÉvaluation : 4 sur 5 étoiles4/5 (20)

- These are the Plunderers: How Private Equity Runs—and Wrecks—AmericaD'EverandThese are the Plunderers: How Private Equity Runs—and Wrecks—AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (14)

- These Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaD'EverandThese Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaÉvaluation : 3.5 sur 5 étoiles3.5/5 (8)

- 2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSND'Everand2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNÉvaluation : 4.5 sur 5 étoiles4.5/5 (3)

- Mind over Money: The Psychology of Money and How to Use It BetterD'EverandMind over Money: The Psychology of Money and How to Use It BetterÉvaluation : 4 sur 5 étoiles4/5 (24)

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialD'EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialPas encore d'évaluation

- Summary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisD'EverandSummary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisÉvaluation : 5 sur 5 étoiles5/5 (6)

- Creating Shareholder Value: A Guide For Managers And InvestorsD'EverandCreating Shareholder Value: A Guide For Managers And InvestorsÉvaluation : 4.5 sur 5 étoiles4.5/5 (8)

- The Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingD'EverandThe Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingÉvaluation : 4.5 sur 5 étoiles4.5/5 (17)

- The 17 Indisputable Laws of Teamwork Workbook: Embrace Them and Empower Your TeamD'EverandThe 17 Indisputable Laws of Teamwork Workbook: Embrace Them and Empower Your TeamPas encore d'évaluation

- Ready, Set, Growth hack:: A beginners guide to growth hacking successD'EverandReady, Set, Growth hack:: A beginners guide to growth hacking successÉvaluation : 4.5 sur 5 étoiles4.5/5 (93)

- An easy approach to trading with bollinger bands: How to learn how to use Bollinger bands to trade online successfullyD'EverandAn easy approach to trading with bollinger bands: How to learn how to use Bollinger bands to trade online successfullyÉvaluation : 3 sur 5 étoiles3/5 (1)

- Mastering the VC Game: A Venture Capital Insider Reveals How to Get from Start-up to IPO on Your TermsD'EverandMastering the VC Game: A Venture Capital Insider Reveals How to Get from Start-up to IPO on Your TermsÉvaluation : 4.5 sur 5 étoiles4.5/5 (21)

- Product-Led Growth: How to Build a Product That Sells ItselfD'EverandProduct-Led Growth: How to Build a Product That Sells ItselfÉvaluation : 5 sur 5 étoiles5/5 (1)

- Applied Corporate Finance. What is a Company worth?D'EverandApplied Corporate Finance. What is a Company worth?Évaluation : 3 sur 5 étoiles3/5 (2)

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialD'EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialÉvaluation : 4.5 sur 5 étoiles4.5/5 (32)

- Warren Buffett Book of Investing Wisdom: 350 Quotes from the World's Most Successful InvestorD'EverandWarren Buffett Book of Investing Wisdom: 350 Quotes from the World's Most Successful InvestorPas encore d'évaluation

- Buffett's 2-Step Stock Market Strategy: Know When To Buy A Stock, Become A Millionaire, Get The Highest ReturnsD'EverandBuffett's 2-Step Stock Market Strategy: Know When To Buy A Stock, Become A Millionaire, Get The Highest ReturnsÉvaluation : 5 sur 5 étoiles5/5 (1)

- Value: The Four Cornerstones of Corporate FinanceD'EverandValue: The Four Cornerstones of Corporate FinanceÉvaluation : 5 sur 5 étoiles5/5 (2)

- Venture Deals: Be Smarter Than Your Lawyer and Venture CapitalistD'EverandVenture Deals: Be Smarter Than Your Lawyer and Venture CapitalistÉvaluation : 4 sur 5 étoiles4/5 (32)

- Finance Secrets of Billion-Dollar Entrepreneurs: Venture Finance Without Venture Capital (Capital Productivity, Business Start Up, Entrepreneurship, Financial Accounting)D'EverandFinance Secrets of Billion-Dollar Entrepreneurs: Venture Finance Without Venture Capital (Capital Productivity, Business Start Up, Entrepreneurship, Financial Accounting)Évaluation : 4 sur 5 étoiles4/5 (5)

- The Wall Street MBA, Third Edition: Your Personal Crash Course in Corporate FinanceD'EverandThe Wall Street MBA, Third Edition: Your Personal Crash Course in Corporate FinanceÉvaluation : 4 sur 5 étoiles4/5 (1)

- Venture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistD'EverandVenture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistÉvaluation : 4.5 sur 5 étoiles4.5/5 (73)

- The Value of a Whale: On the Illusions of Green CapitalismD'EverandThe Value of a Whale: On the Illusions of Green CapitalismÉvaluation : 5 sur 5 étoiles5/5 (2)