Académique Documents

Professionnel Documents

Culture Documents

P2 103 Special Revenue Recognition Installment Sales Construction Contracts Franchise 1

Transféré par

Kate AlvarezTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

P2 103 Special Revenue Recognition Installment Sales Construction Contracts Franchise 1

Transféré par

Kate AlvarezDroits d'auteur :

Formats disponibles

POLYTECHNIC UNIVERSITY OF THE PHILIPPINES

PRACTICAL ACCOUNTING 2

2013-2014

SPECIAL REVENUE RECOGNITION P2 - 103

INSTALLMENT SALES

Problem 1. Hulugan Enterprises appropriately uses the installment sales method. Its gross profit rates were 30%, 25%, and 20%

of cost for 2011, 2012, and 2013, respectively. The following account balances are available at the end of 2013:

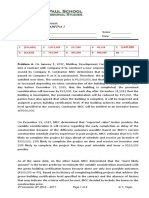

Year of Sale IAR DGP (before adjustment)

2011 P 2,400 P 2,892

2012 24,600 24,300

2013 78,000 48,060

Calculate the total cash collections during 2013 .

a. P 242,140 b. P 526,148 c. P 317,392 d. P 42,894

Problem 2. Paiyakan Corporation, which began operations on January 1, 2012, appropriately uses the installment method of

accounting for revenues. The following information is available for the years ended December 31, 2012 and 2013.

2012 2013

Cost of installment sale P 600,000 P 1,200,000

Gross profit realized on sales made in:

2012 90,000 54,000

2013 - 120,000

Gross profit rate, cost based 30% 40%

Calculate the ending balance of installments accounts receivable on December 31, 2013

a. P 1,416,000 b. P 1,020,000 c. P 1,065,000 d. P 735,000

Problem 3. On October 1, 2013, Instagram Company sold Article One costing P270,000 for P400,000. Article Two, a used article

was accepted as down payment and the balance on monthly installments for two years that include both principal and interest

at 15% per year, starting October 31, 2013, as evidenced by a note. P120,000 was allowed on the article traded-in. The company

estimates reconditioning cost of P8,000 on this article and a sales price of P110,000 after reconditioning. The company normally

expects 20% gross profit on sale of used article.

Questions:

1. How much is the realized gross profit in 2013? (Round of PV factors to 4 decimal places)

2. Assume that there is a very high degree of uncertainty about the collectability of the note, thus, Instagram opted to use the

cost recovery method. How much is the increase in profit or loss related to interest income in 2014? (Round of PV factors to

4 decimal places)

Problem 4. Viber Company uses installment accounting and has the following data on its financial statements at year end:

Gross margin on cost 66 2/3 %

Unrealized gross profit P192,000

Cash collection including down payment 360,000

Questions:

1. What was the amount of sale on installment basis?

2. What was the amount of sale on installment basis assuming the unrealized gross profit is before adjustment?

PARTNERSHIP ACCOUNTING - P2 103 Page 1

Problem 5. Expedition Motors sells automobiles on installment basis. On May 30, 2013, Mr. Montenegro bought a car for

P1,125,000, terms: 25% down payment and the balance is payable in 48 months starting June 30, 2013. The cost of the car is

P800,625. In lieu of the down payment, Expedition Motors accepted the buyers slightly used pick up which has a resale value of

P300,000 after reconditioning at a cost of P127,500. After paying the October 2013 installment, Mr. Montenegro met an

accident which incapacitates him to meet his liabilities. After 3 notices, Expedition Motors repossessed the car. The repossessed

car has a resale value of P496,875 after incurring reconditioning costs of P180,000. What is the cancelled profit due to

repossession?

a. P 160,393 b. P 193,143 c. P 200,958 d. P 226,758

Problem 6. Abensons Company sells home theater set both on installment and cash basis. Mr. Aquino purchased a set from

Abensons Company on March 30, 2013 for P367,500 which has a cost of P289,800. A used set is accepted as down payment,

P89,600 being allowed on the trade in and the balance is payable 10 months starting May 1, 2013. The used set can be resold

for P112,140 after reconditioning cost of P5,362. The company expects to make 20% gross profit on the sale of used sets. Mr.

Aquino defaulted payment starting Nov. 1, 2013 and the set was repossessed. Abensons Company had to incur additional cost

of repairs amounting to P6,475 before the car was subsequently sold for P90,125 on December 1, 2013. What is the net income

to be recognized for the year 2013 in relation to the above transactions?

a. P 44,940 b. P 51,415 c. P 68,243 d. P 69,293

Problem 7. On January 1, 2013, Tom Brands sells 200 acres of farmland for P30,000,000, taking in exchange a 10% interest

bearing note. Tom Brands purchased the farmland in 2008 at a cost of P25,000,000. The note will be paid in three installments

of P12,063,450 each on December 31, 2013, 2014, and 2015. Collectability of the note is highly uncertain; Tom, therefore, uses

the cost recovery method applied in US GAAP.

Questions:

1. What is the installment receivable balance at December 31, 2013 ?

a. P 17,936,550 b. P 30,000,000 c. P 20,936,550 d. P 25,000,000

2. What is the balance of the Deferred Gross Profit account as of December 31, 2013 ?

a. P 5,000,000 b. P -0- c. P 3,489,400 d. P 1,510,578

Problem 8. Confidence Corporation sells goods on the installment basis. For the year just ended, the following were reported:

Cost of installment sales – P8,400,000; Loss on repossession – P202,500; Wholesale value of the repossessed merchandise –

P1,687,500; Repossessed account – P2,700,000; Deferred gross profit after adjustment – P1,620,000. How much was the

collections for the year?

Problem 9. Twitter Corporation, which began business on January 1, 2013, appropriately uses the installment sales method of

accounting for tax purposes, but records net income under the accrual method. The following data were obtained for the years

2013 and 2014:

2013 2014

Installment sales P 7,500,000 P 8,400,000

Cost of installment sales 5,250,000 6,048,000

General & administrative expenses 700,000 840,000

Outstanding accounts on sales of 2013 4,400,000 1,400,000

Outstanding accounts on sales of 2014 -0- 4,000,000

A 2013 sale resulted in a default in 2014. At the date of default, the balance on the installment receivable was P120,000, and

the repossessed merchandise had a fair value of P80,000.

Questions:

1. Determine the net income for the year 2014 under installment method.

PARTNERSHIP ACCOUNTING - P2 103 Page 2

2. Determine the net income for the year 2014 under full accrual method.

Problem 10. The following accounts were taken from the trial balance of Survival Company as of December 31, 2013:

Accounts Receivable – P750,000; Installment Receivable (2011) – P150,000; Installment Receivable (2012) – P450,000;

Installment Receivable (2013) – P2,700,000; Merchandise Inventory – P525,000; Purchases – P3,900,000; Freight-in – P30,000;

Repossessed Merchandise – P150,000; Repossession Loss – P240,000; Cash Sales – P900,000; Charge Sales – P1,800,000;

Installment Sales – P4,460,000; Deferred Gross Profit (2011) – P222,000; Deferred Gross Profit (2012) – P393,600; Operating

Expenses – P150,000; Shipment on Installment Sales – P2,787,500.

Additional Information:

Gross profit rates for 2011 and 2012 installment sales were 30% and 32%, respectively.

The entry for repossessed goods was:

Repossessed Merchandise 150,000

Repossession Loss 240,000

Installment Receivables (2011) 180,000

Installment Receivables (2012) 210,000

Merchandise on hand at the end of 2013 (new & repossessed) was P282,000.

Questions:

1. Determine the Total Realized Gross Profit in 2013.

2. Determine the balance of Deferred Gross Profit as of December 31, 2013.

3. Determine the Net Income in 2013.

Problem 11. Achievement Company which began operations on January 1, 2013 appropriately uses the installment method of

accounting. The following data pertain to Achievement’s operations for year 2013:

Installment sales (before over/under-allowance) P 3,150,000

Operating expenses 367,500

Regular Sales 1,312,500

Total collections for the year (both cash and non-cash, excluding interest of P84,000) 2,088,000

Cost of regular sales 752,500

Cost of installment sales 2,205,000

Accounts receivable – 12/31/2013 512,500

Installment receivable written-off (no provision was made in prior year) 154,000

Estimated resale value of repossessed merchandise 290,000

Profit usual on the sale of repossessed merchandise 15%

Repossessed accounts 350,000

Actual value of the trade-in merchandise 280,000

Trade-in allowance 490,000

Reconditioning cost of the repossessed merchandise 57,500

Questions:

1. Determine the deferred gross profit at 12/31/2013.

2. Determine the net income for the year ended 12/31/2013.

Problem 12. On January 1, 2013, Liberty Realty Corporation sold property carried in inventory at a cost of P840,000 for

P1,400,000. A 10% down payment was made and the balance is payable in 4 equal installments of P363,625, inclusive of 12%

interest, payable every June 30 and December 31.

Questions:

1. How much is the realized gross profit in 2013 assuming the installment method is used?

a. P 237,332.60 b. P 293,332.60 c. P 308,000 d. P 346,900

2. How much is the total collection in 2013 applied to interest?

PARTNERSHIP ACCOUNTING - P2 103 Page 3

a. P 0 b. P 133,918.50 c. P 151,200 d. P 168,000

Problem 13. The following account balances appear on the books of Fulfillment Company as of December 31, 2013:

Cash P 150,000

Receivables 800,000

Merchandise Inventory 75,000

Accounts Payable 30,000

Deferred Gross Profit – 2011 261,250

Sales 1,250,000

Purchases 640,000

Expenses 425,000

The Receivables account is a controlling account for three subsidiary ledgers which shows the following:

2012 Installment contracts P150,000

2013 Installment contracts 600,000

Charge accounts (terms, 30 days, net) 50,000

The gross profit on sales on installment contracts for 2012 and 2013 was 55% and 50%, respectively.

Collections on installment contracts for 2012, 2013 and charge accounts were P300,000, P400,000 and P200,000,

respectively, for the year just closed.

Account balances from installment sales made prior to 2012 were also collected.

Repossession for the year was on installment contracts for 2012 on which the uncollected balance at the time of

repossession amounted to P50,000.

Merchandise repossessed was erroneously debited as newly acquired merchandise equal to the amount defaulted by the

customer.

Appraisal reports show that this repossessed merchandise has a true worth of P20,000 at the time of repossession and

remain unsold at year end.

The final inventory of the merchandise (new) valued at cost amounted to P45,000.

Sales account is also a controlling account for all the sales of the Company.

Questions:

1. Compute for the total realized gross profit in 2013

a. P756,250 b. P626,250 c. P495,000 d. P365,000

2. Determine the Net Income in 2013.

a. P331,250 b. P301,250 c. P328,750 d. P382,500

Problem 14.The Kimmy Dora Company has regular and installment sales. On December 31, 2013, the following unadjusted

balances were taken from the general ledger:

Installment receivables – 2012 P 40,000

Installment receivables – 2013 160,000

Unrealized gross profit – 2012 42,000

Unrealized gross profit – 2013 74,000

Sales – regular 250,000

Cost of sales – regular 167,500

Every year the gross profit rate on installment sales are 4% higher than that on regular sales. The gross profit rate on 2013

installment sales is 2% higher than that of 2012.

The total realized gross profit on installment sales to be recognized on December 31, 2013 is

PARTNERSHIP ACCOUNTING - P2 103 Page 4

a. P 42,800 b. P 75,000 c. P 125,300 d. P 100,000

Problem 15. Walang Hanggan Corporation has been using the cash method to account for income since its first year of

operations in 2012. All sales are made on credit with notes receivable given by the customers. The statement of comprehensive

income for 2012 and 2013 included the following amounts:

2012 2013

Revenues – collection on principal P 32,000 P 50,000

Revenues – interest 3,600 5,500

Cost of goods purchased * 45,200 52,020

* Includes increase in inventory of goods on hand of P 2,000 in 2011 and P 8,000 in 2012

The balances due on the notes at the end of each year were as follows:

2012 2013

Notes receivable – 2011 P 62,000 P 36,000

Notes receivable – 2012 60,000

Discount on notes receivable – 2011 7,167 5,579

Discount on notes receivable – 2012 8,043

(Round-off gross profit rate in two decimal percentage and round of balances in nearest peso)

Questions:

1. Under installment method, how much is the amount recognized in profit and loss for 2012 ?

a. P 14,164 b. P 16,080 c. P 17,764 d. P 19,680

2. Under installment method, how much is the realized gross profit in 2013 ?

a. P 12,267 b. P 21,615 c. P 23,329 d. P 26,806

Problem 16. THE IMMORTALS Store accounts for its sales on the installment basis. At the beginning of 2012, ledger accounts

include the following balances: Installment contracts receivable, 2010 - P 30,000; Installment contracts receivable,

2011 - P 96,000; Deferred gross profit, 2010 - P 12,600; Deferred gross profit, 2011 - P 36,000.

At the end of 2012, account balances before adjustment for realized gross profit on installment sales are:

Installment contracts receivable, 2010 - P 0; Installment contracts receivable, 2011 - P 24,000; Installment contracts receivable,

2012 - P 130,000; Deferred gross profit, 2010 - P 12,600; Deferred gross profit, 2011 - P 34,350; Deferred gross profit, 2012 -

P 60,000.

Installment sales in 2012 are made at 25% above cost of merchandise sold. During 2012 upon default in payment by the

customer, the company repossessed the merchandise with an estimated market value of P 2,000. The sales was in 2011 for P

10,800, and P 6,400 had been collected prior to repossession.

Questions:

1. Compute the gain or (loss) on repossession assuming that Profit is recognized when sale is made:

a. (P 2,400) b. P -0- c. (P 750) d. (P 750)

2. Compute the gain or (loss) on repossession assuming that Profit is in proportion to periodic collection (IS method):

a. (P 2,400) b. P -0- c. (P 750) d. (P 750)

3. The net realized gross profit on December 31, 2012 is:

a. P 73,600 b. P 71,950 c. P 71,200 d. P 34,000

PARTNERSHIP ACCOUNTING - P2 103 Page 5

LONG-TERM CONSTRUCTION CONTRACTS

Problem 1. On July 1, 2013, Janet Construction Corp. contracted to build an office building for Napoles Inc. for a total contract

price of P2,950,000. Estimated total contract costs is P2,600,000.

Costs incurred to date are as follows related to the project were as follows:

Cost of direct materials used P200,000

Cost direct labor (includes labor cost of site supervision) 150,000

Cost of indirect materials used 55,000

Cost incurred in securing the contract* 70,000

Annual depreciation of plant and equipment used on the contract 240,000

Payroll of design and technical department allocated to the contract 80,000

Insurance costs (2/3 for other contracts) 180,000

Costs of contracted research and development activities 105,000

Depreciation of idle equipment that is not used on a particular contract 60,000

Selling costs 45,000

General & administration costs expenses specifically included under the

terms of the contract 30,000

Borrowing cost incurred during the construction period 130,000

Costs of labor for site supervision 50,000

Advances made to subcontractors 100,000

* expensed in prior year although the contract was obtained in 2013

Using cost-to-cost method in determining the stage of completion, what is the realized gross profit for the period 2013? (Round-

off stage of completion to 2 decimal percentage)

a. P 111,055 b. P 125,195 (x) c. P 134,610 d. P 141,330

Problem 2. Mediocre Builders, Inc. recognized a gross loss of P78,000 on its long term project which has accumulated costs of

P595,000 at December 31, 2013. To finish the project, the company estimates that it has to incur additional costs of

P820,000. The company uses percentage of completion method and thus noted that the project was about 42%

completed at this point. Calculate the contract price that was agreed upon by both parties.

a. P 1,415,000 b. P 1,337,000 c. P 1,383,800 d. P 1,183,000

Problem 3. On January 1, 2013, Fast Builders, Inc. began constructing a P3,500,000 contract. As of years-end, the

following are relevant information provided by the corporation.

2013 2014 2015

Construction in progress P 735,000 P2,248,750 ?

Estimated cost to complete 2,666,250 1,251,250 -

Costs incurred P 708,750 P 1,615,000 P1,126,250

Questions:

1. How much is the (1) RGP (loss) in 2014 using the percentage of completion method?

2. How much is the (2) RGP (loss) in 2015 using zero-profit method?

Problem 4. On January 1, 2013, ALI, a real estate company, entered into a contract to construct a building on a piece of land it

has acquired and, when construction is complete, to deliver the entire property to a customer. The following information

pertains to the said contract: Total cost of land – P2M; Estimated total cost of construction – P8M; Estimated total cost of

contract – P10M; Agreed purchase price – P11M. In CY 2013, total construction cost incurred amount to P2M while the fair

value of the land is P2.5M.

Questions:

1. Assume the contract is considered single contract and the POC rate is billed, determine the amount of revenues, contract

expenses, and gross amount due from customer recognized in the financial statements of ALI.

2. Assume the contract is considered multiple element contract and the POC rate is billed, determine the amount of revenues,

contract expenses, and gross amount due from customer recognized in the financial statements of ALI.

PARTNERSHIP ACCOUNTING - P2 103 Page 6

3. Determine amount included as current asset in the financial statements of ALI related to the above information under zero

profit method.

Problem 5. Guagua Boatbuilders was recently awarded a P28,000,000 contract to construct a luxury liner for Cruiseliners Inc.

Guagua estimates it will take 42 months to complete the contract. The company uses the cost-to-cost method to estimate

profits.

The following information details the actual and estimated costs for the years 2012-2015:

2012 2013 2014 2015

Actual cost incurred current year P13,000,000 P6,600,000 P4,800,000 P3,400,000

Estimated cost to complete 13,600,000 7,800,000 3,800,000 -0-

How much revenue, cost, and gross profit is to be recognize in 2014 under the percentage of completion method?

Problem 6. On July 1, 2012, GB Construction Corp. contracted to build an office building for RX, Inc. for a total contract price of

P1,825,000

2012 2013 2014

Contract costs incurred P 350,000 P 930,000 P 670,000

Estimated cots to complete the contract 1,050,000 685,000 ---

Billings to RX, Inc. 192,500 1,420,000 212,500

Which of the following statements is true?

a. The Inventory account, net at December 31, 2013, assuming no dependable estimate are available amount to

P386,250 due to customer.

b. The Inventory account balance at December 31, 2013, using the cost to cost method is P1,140,000.

c. The recognized loss in 2013 using zero profit method is P246,250

d. The realized gross profit in 2014 using percentage of completion method is P15,000 and the recognized loss in

2014 using zero profit method is P125,000.

Problem 7. DM, Inc. works on a P10,500,000 contract in 2013 to construct an office building. During 2013, DM, Inc. uses the

cost to cost method. At December 31, 2013, the balances in certain accounts were: Construction in Progress – P3,780,000;

Accounts Receivable – P360,000; and Billings on Construction in process – P1,800,000; contract retention – P180,000;

Mobilization fee – P140,000. At December 31, 2013, the estimated cost at completion is P7,350,000. Determine the realized

gross profit in 2013.

Problem 8. In 2013, Roar, Inc. was contracted to build the private road network of Alabang Subdivision for P350 million. The

product is expected to be finished in 2 years, and the contract provided for:

A 5% mobilization fee (to be deducted from the last billing), payable within 15 days from the contract signing.

A retention provision of 10% on all billings, payable with the final bill after the completed contract is accepted.

Payment of progress billings within 30 days from acceptance.

Roar, Inc. estimated a gross margin of 25% on the project. By the end of the year, Roar had presented progress billings

corresponding to 50% completion. Alabang accepted all the bills presented, except one for 10% which was accepted on January

7 of the next year. With the exception of the second to the last billing for 8% which was due January 13 of the next year, all

accepted billings were settled. As of December 31, 2013, Roar, Inc. construction in progress, net of billings from the project

under the percentage of completion method amounted to:

Problem 8. On January 1, 2015, a fire destroyed the office building of Conjuring Company and destroyed all the files in the

accountant’s desk. The president of the company contracted you to help reconstruct the contract information. The following

data were taken from salvage files:

12/31/13 12/31/14

Estimated cost to complete P 1,556,250 P 1,000,000

Costs incurred 462,500

Percentage of completion 60%

Realized profit to date 62,500 150,000

What is the estimated total gross profit as of 2013 for this contract?

PARTNERSHIP ACCOUNTING - P2 103 Page 7

a. P 156,250 b. P 208,333 c. P 250,000 d. P 312, 500

Problem 9. In 2013, Insidious Constructions began construction work under a three year contract. The contract price was

P700,000. Insidious uses the percentage of completion method for financial accounting purposes. The financial statement

presentation relating to this contract at December 31, 2013 is presented below:

Statement of Financial Position

Accounts receivables – construction billings P 26,250

Construction in progress P 87,500

Less: contract billings 82,250

Costs of uncompleted contract in excess of billings 5,250

Statement of Comprehensive Income

Gross profit (before tax) recognized in 2013 P 17,500

The total estimated cost is:

a. P 140,000 b. P 490,000 c. P 560,000 d. P 656,250

Problem 10. On January 1, 2012, Brave Construction Corp. began constructing a P2,100,000 contract. The following are relevant

information provided by the corporation: Brave uses percentage of completion method. For the year ended December 31, 2013,

Brave Construction billed its client an additional 55% of the contract price.

2012 2013 2014

Construction in Progress (CIP) P 441,000 ? ?

Estimated costs to complete ? ? -

Costs Incurred 425,250 P 969,000 P 675,750

Excess of CIP over Billings P84,000 current liability P330,750 current liability -

Questions:

1. How much is the estimated remaining cost in 2012?

2. How much is the realized gross profit (loss) in 2013?

3. How much is the balance of CIP in 2013?

Problem 11. On July 1, 2012, Great Corp. obtained a contract to construct a building. The building was estimated to be built at a

total of P5,250,000 and is scheduled for completion on October 2014. The construct contains a penalty clause to the effect that

the other party was to deduct P17,500 from the contract price each week of delay. Completion was delayed for three weeks.

Below are the data pertaining to the construction period. In 2013, there was an increase in the contract price in the amount of

P200,000 per cost escalation clause. Great Corp. uses percentage of completion method.

2012 2013 2014

Costs incurred P 525,000 P 1,932,000 P 325,500

Estimated cots to complete 2,100,000 273,000 -

Billings to customers 420,000 4,567,500 1,260,000

Questions:

1. How much is the excess of construction in progress over progress billings or progress billings over construction in progress in

2012? (current asset or current liability)

a. P 840,000 current asset b. P 840,000 current liability c. P 800,000 current asset d. P 800,000 current liability

2. How much is the excess of construction in progress over progress billings or progress billings over construction in progress

in 2013? (current asset or current liability)

a. P 682,500 current asset b. P 682,500 current liability c. P 635,250 current asset d. P 635,250 current liability

PARTNERSHIP ACCOUNTING - P2 103 Page 8

Problem 12. Applause Corporation entered in a long term project in 2012 and continued through 2013. Applause

Corp. presently has available dependable and reliable estimates. As of 2013, Applause billed 2/5 of the total contract

price. Some other information about the project were as follows:

2012 2013

Construction cost to date P 148,500 P 420,000

Excess of CIP over Billings – due from (due to) 38,750 (62,250)

Contract billings 105,000 612,500

Collection from the contract 97,500 537,500

Compute the estimated cost to complete in 2012:

a. P 746,667 b. P 1,089,000 c. P 1,387,500 d. P 1,650,000

Problem 11. On July 1, 2012, Hoops Construction Corp. contracted to build an office building for Kiri, Inc. for a total

contract price of P975,000.

2012 2013 2014

Contract cost incurred to date P 75,000 P 600,000 P 1,050,000

Estimated cost to complete the contract 675,000 400,000 -

Billings to Kiri, Inc. 150,000 550,000 275,000

How much is the Construction in Progress account balance at December 31, 2013, using the percentage of

completion method?

a. P 350,000 b. P 575,000 c. P 825,000 d. P 900,000

FRANCHISE

Problem 1. Castle Company sells a franchise that requires an initial franchise fee of P7,000,000. A down payment of P2,000,000

cash is required the balance covered by the issuance of a P5,000,000, 10% note payable by the franchisee in 5 equal annual

installments. How much must be the franchise revenue earned under the following assumptions.

1. If all material services have been substantially performed by a franchisor, the refund period has expired, and the

collectability of the note is reasonably assured.

2. If the refund period has expired and the collectability of the note is reasonably assured, but all material services have not

been substantially performed by the franchisor.

3. If all material services have been substantially performed by the franchisor and the collectability of the note is reasonably

assured, but the period of refund has not expired.

4. If the refund period has expired, but all material services have not been substantially performed by the franchisor and there

is no basis for estimating the collectability of the note and the note is not recognized as an asset. Instead, a form of deposit

method is used.

Problem 2. The ST Company sells a franchise that requires an initial franchise fee of P500,000. A P100,000 down payment is

required with the balance in 4 equal monthly installments of P100,000. All material services have been substantially performed

by ST Company, the refund period has expired, and the collectability of the note is reasonably assured. The interest rate for this

type of loan is 12%.

The unearned franchise revenue earned during the period must be:

PARTNERSHIP ACCOUNTING - P2 103 Page 9

Problem 3. Spiral Restaurant sold a fine dining restaurant franchise to Circles Hotel. The sale agreement signed on January 1,

2013 called for a P875,000 down payment plus P437,500 annual payments (covered by a non-interest bearing note)

representing the value of initial services rendered by Spiral restaurant. In addition, the agreement required the franchisee to pay

6% of its gross sales to the franchisor. The restaurant opened in July and its sales for the year amounted to P6,562,500.

Assuming a 15% interest rate is appropriate. How much is the franchisors total income/revenue for the year ended 2013 profit

or loss? (Round of PV factors into 2 decimal places)

Problem 4. On August 1, 2013, Holiday Inc. entered into a franchise agreement with Intense franchisee. The initial franchise fees

agreed upon is P246,900, of which P46,900 is payable upon signing and the balance to be covered by a non-interest bearing

note payable in four equal annual installments. The down payment is refundable within 75 days. Intense Inc. has a high credit

rating, thus, collection of the note is reasonably assured. Out of pocket costs of p125,331 and P12,345 were incurred for direct

and indirect expenses, respectively. Prevailing market rate is 9%. On the FY ended September 30, 2013, how much revenue from

franchise fee will the franchisor recognize? (Round PV factors into 4 decimal places)

Problem 5. Crab Claw Co. charges P90,000 for a franchise, with P18,000 paid when the agreement is signed and the balance in

four annual payments. The present value of the annual payments, discounted at 9% is P58,315. The franchisee has the right to

purchase P20,000 of equipment for P16,000. If the collectability of the payments is reasonably assured and substantial

performance by Crab Claw has occurred, what is the amount of revenue from franchise fee that should be recognized?

Problem 6. Casio Co. charges new franchisees an initial fee of P3,500,000. Of this amount, P1,000,000 is payable in cash when

the agreement is signed, and the remainder is to be paid in four equal annual installments which are evidenced by 12%

promissory notes. In consideration therefore, Casio Co. will assist in locating the business site, conduct a market

study to estimate earnings potential, supervise construction of a building, and provide initial training to employees.

On December 3, 2013, Casio Co. entered into a franchising agreement with Corolla, Inc. By the end of the year, Casio

Co. has completed about 25% of the initial services at a cost of P250,000 and it has ascertained that collection of the

notes is reasonably assured. For 2013, Casio Co. should recognize unearned franchise revenue of:

a. P -0- b. P 3,500,000 c. P 1,000,000 d. P 2,500,000

Problem 7. On January 1, 2012, Mr. DJ entered into a franchise agreement with GB to market their products. The

agreement provides for an initial fee of P12.5m payable as follows: P3,500,000 to be paid upon signing of the

contract and the balance in five equal annual payments every end of the year starting December 31, 2012. Mr. DJ

signs a non-interest-bearing note for the balance. His credit rating indicates that he can borrow money at 15%

interest for a loan of this type. The present value of an annuity of P1 at 15% for 5 periods is 3.352. The agreement

further provides that the franchisee must pay a continuing franchise fee equal to 3% of the monthly gross sales. On

August 31, the franchisor completed the initial services required in the contract at a cost of P4,290,120 and incurred

indirect costs of P175,000. The franchise outlet commenced business operations on November 30, 2012. The gross

sales reported to the franchisor were P1,800,000 for December, 2012. The first installment payment was made in

due date, but further collection of the balance was not reasonably assured. Calculate the net income for 2012 that

the franchisor will report in its income statement.

a. P 3,126,268 b. P 3,201,268 c. P 2,417,268 d. P 3,072,268

Problem 8. On December 31, 2011, JKL, a franchisor, entered into a franchising agreement with GMD charging GMD a franchise

fee of P400,000. Upon signing of the contract, a down payment of P100,000 is paid with the balance payable in four equal

annual installments starting 2012. JKL had already performed 99.9% of the services as of February 1, 2012 at a total cost of

P140,000. JKL was able to collect the first installment payment in 2012 but the collecta bility of the remaining balance is still

doubtful. Calculate the profit to be recognized by JKL in its 2012 income statement.

a. P 260,000 b. P 48,750 c. P 65,000 d. P 113,750

Problem 9. On April 30, 2013, Mike Inc. entered into a franchise agreement with Ross Co. to sell their products. The agreement

provides for an initial franchise fee of P1.20M which is payable as follows: P400,000 cash to be paid upon signing the contract,

and the balance in five equal annual installments every December 1, starting in 2013 as evidenced by a noninterest bearing note

for the said balance signed by Mike Inc. Prevailing market rate is 10% on April 30, 2013.The agreement further provides that

Mike Inc. must pay a continuing franchise fee equal to 5% of its monthly gross sales. Ross Co. incurred direct cost of P540,000,

of which P170,000 is related to continuing services and indirect costs of P72,000, of which P18,000 is related to continuing

services. Mike Inc. started operations on September 2, 2013 and was able to generate sales of P950,000 for 2013. The first

PARTNERSHIP ACCOUNTING - P2 103 Page 10

installment payment was made in due date. Assuming collectability of the note is not reasonably assured, how much is the net

income of the franchisor as of December 1, 2013? (Round off PV factors to 4 decimal places and GP % to whole %)

a. P 254,935 b. P 177,610 c. P 174,508 d. P 172,650

Problem 10. On December 31, 2013, BonChon Inc. authorized ZubuChon to operate as a franchisee for an initial franchise fee of

P3.40M. Upon signing the contract, P0.90M was received and the balance is paid by a note, due in 5 equal annual installments

that include 12% interest, beginning December 31, 2014. The down payment is nonrefundable and it represents a fair measure

of the services already performed by BonChon and substantial future services are still required. How much is the unearned

revenue to be recognized as of December 31, 2013? (Round off PV factors to 5 decimal places)

a. P 1,802,390 b. P 2,702,390 c. P 2,500,000 d. P 3,400,000

Problem 11. On January 2, 2013, CeCe Co. entered into franchise agreement with Drake Inc., franchisee. The sale agreement

was to make a P60,000 down-payment plus two P20,000 annual payments, representing the value of initial franchise services

rendered by CeCe. In addition, the agreement required Drake to make an annual fixed payment of P36,000 to CeCe. CeCe

estimates that continuing services will cost P40,000 per year (actualized in 2013). A reasonable profit from such services is

estimated at 7.5% of cost (or P3,000/year). Drake commenced operations on March 1, 2013. Assuming a 10% interest rate is

appropriate, CeCe’s CY 2013 total income/revenue: (Round off PV factors to 4 decimal places)

a. P 127,181 b. P 134,710 c. P 144,181 d. P 98,181

Problem 12. On December 1, 2012, Gamble, Inc. authorized Cedar Company to operate as a franchise for an initial

franchise free of P1,000,000. On this amount, P600,000 was received upon signing the agreement and the balance,

represented by a note, is due in four annual payments of P100,000 each beginning December 31, 21012. Those

present value on December 31, 2012, for four annual payments appropriately discounted a P303,740. According to

the agreements the non-refundable down payment represents a fair measure of the services already performed by

Gamble and substantial future service are still to be rendered. However, collectability of the note is reasonably

certain. Gamble’s December 31, 2012 income statement should report earned franchise fee from Cedar Company in

the amount of

a. P 600,000 b. P 903,470 c. P 903,740 d. P 1,000,000

Problem 13. On January 1, 2013, Little Co. granted franchise right to Liars Inc. for a nonrefundable initial franchise fee of

P400,000, of which 20% was collected upon signing of the contract and the remaining 80% is represented by a note receivable

in 4 equal annual installments starting December 31, 2013. The prevailing market rate on January 1, 2013 is 12%. All of the

initial services and conditions required under the franchise agreement were substantially performed and satisfied on March 1,

2013. On July 1, 2013, Liars Inc. decided not to pursue the franchise business. Accordingly, Little Co. repossessed the franchise.

Questions:

1. No refund was made and the entire balance of the note was forfeited. Franchise fee revenue recognized in 2013 is

a. P -0- b. P 80,000 c. P 162,988 d. P 322,988

2. Assume 50% of collection was refunded and 50% was forfeited. Franchise revenue recognized in 2013 is

a. P -0- b. P 80,000 c. P 162,988 d. P 322,988

Problem 14. On January 1, 2013, Kamiseta, Inc. signed an agreement authorizing Mr. Geri de Castro to operate as a

franchisee for an initial franchise fee of P5,000,000. Of this amount, P2,000,000 was received upon signing of the

agreement and the balance evidenced by a 16% promissory note which is due in three annual installments of

P1,000,000 each beginning December 31, 2013. Mr. de Castro started franchise operations on September 1, 2013

after Kamiseta rendered initial services required at a total cost of P1,500,000. The first installment was collected on

due date. The collectibility of the note is not reasonably assured. How much net income is to be recognized on

December 31, 2013?

a. P 2,100,000 b. P 2,580,000 c. P 3,980,000 d. P 1,080,000

Problem 15. On January 2, 2013, Magnolia Ice Cream signed an agreement authorizing Jomari to operate as

franchisee for an initial franchise fee P500,000 received upon signing of the agreement. Jomari commenced

operations on August 1, 2013, at which date all of the initial services required of Magnolia Ice Cream had been

performed at a cost of P100,000. The franchise agreement further provides that Jesse must pay a 10% monthly

PARTNERSHIP ACCOUNTING - P2 103 Page 11

continuing franchising fee. Sales reported from August 1 to December 31, 2013 amounts to P400,000. How much is

the initial franchise fee to be recognized in 2013?

a. P 380,000 b. P 500,000 c. P 420,000 d. P 440,000

Problem 16. On December 31, 2012, Noynoy Company authorized Mar to operate as a franchisee for an initial

franchise fee of P3,000,000. Of this amount, P1,200,000 was received upon signing of the contract, and the balance

payable by a non-interest bearing note, due in three annual payments of P600,000, beginning December 31, 2013.

The collectibility of the note is not reasonably assured. The market rate of interest is 18%. (Use two decimal places

for present value factor.) How much is the interest revenue on December 31, 2013?

a. P 498,000 b. P -0- c. P 234,360 d. P 263,640

PARTNERSHIP ACCOUNTING - P2 103 Page 12

Vous aimerez peut-être aussi

- Revaluation in Ebs General Ledger R12: Author: Mădălina RusuDocument18 pagesRevaluation in Ebs General Ledger R12: Author: Mădălina RusuSachin AhujaPas encore d'évaluation

- 09 Additional NotesDocument4 pages09 Additional NotesMelody GumbaPas encore d'évaluation

- 01 - Preweek Lecture and ProblemsDocument15 pages01 - Preweek Lecture and ProblemsMelody GumbaPas encore d'évaluation

- Sample Problems For Joint Venture and ConsignmentDocument1 pageSample Problems For Joint Venture and ConsignmentChristine Jane RamosPas encore d'évaluation

- Ho BRDocument3 pagesHo BRSummer Star33% (3)

- Chapter 9Document13 pagesChapter 9Yenelyn Apistar Cambarijan75% (4)

- Installment Sales & Long-Term ConsDocument6 pagesInstallment Sales & Long-Term ConsSirr JeyPas encore d'évaluation

- Cash FlowDocument6 pagesCash Flowsilvia indahsariPas encore d'évaluation

- Segment ReportingDocument2 pagesSegment ReportingNicole Chenper ChengPas encore d'évaluation

- Identify The Choice That Best Completes The Statement or Answers The QuestionDocument5 pagesIdentify The Choice That Best Completes The Statement or Answers The QuestionErwin Labayog MedinaPas encore d'évaluation

- ADV2 Chapter12 QADocument4 pagesADV2 Chapter12 QAMa Alyssa DelmiguezPas encore d'évaluation

- Pak Enings HTDocument15 pagesPak Enings HTVincent SampianoPas encore d'évaluation

- Audit of SHE 1Document2 pagesAudit of SHE 1Raz MahariPas encore d'évaluation

- Activity 1 Home Office and Branch Accounting - General ProceduresDocument4 pagesActivity 1 Home Office and Branch Accounting - General ProceduresDaenielle EspinozaPas encore d'évaluation

- Branches and Agencies - OdtDocument9 pagesBranches and Agencies - OdtEunice BernalPas encore d'évaluation

- YowDocument35 pagesYowJane Michelle Eman100% (1)

- 8506 - Installment SalesDocument4 pages8506 - Installment SalesAnonymous iNRMC4mgORPas encore d'évaluation

- Construction Contracts PAS 11 Afar Michael B.Bongalonta, Cpa, Micb, MbaDocument3 pagesConstruction Contracts PAS 11 Afar Michael B.Bongalonta, Cpa, Micb, MbaTine GriegoPas encore d'évaluation

- ConsignmentDocument2 pagesConsignmentJenica Joyce BautistaPas encore d'évaluation

- Quiz Bee4thyrDocument5 pagesQuiz Bee4thyrlalala010899Pas encore d'évaluation

- Ge Acctg 7Document5 pagesGe Acctg 7ezraelydanPas encore d'évaluation

- Csa 10Document2 pagesCsa 10Von Andrei MedinaPas encore d'évaluation

- Advacc 1 Quiz VIIIDocument4 pagesAdvacc 1 Quiz VIIIJason GubatanPas encore d'évaluation

- HOBADocument4 pagesHOBAHannah YnciertoPas encore d'évaluation

- 12 - Cost and Equity MethodDocument2 pages12 - Cost and Equity MethodregenPas encore d'évaluation

- Chapter 7Document18 pagesChapter 7Yenelyn Apistar CambarijanPas encore d'évaluation

- Forex - Transaction and TranslationDocument13 pagesForex - Transaction and TranslationJoyce Anne MananquilPas encore d'évaluation

- Chapter 10Document9 pagesChapter 10chan.charanchan100% (1)

- AFAR Final Preboard 2018 PDFDocument22 pagesAFAR Final Preboard 2018 PDFcardos cherryPas encore d'évaluation

- Advanced Accounting Drill ProblemsDocument6 pagesAdvanced Accounting Drill ProblemsiajycPas encore d'évaluation

- P2 Branch Accounting M2020Document6 pagesP2 Branch Accounting M2020Charla SuanPas encore d'évaluation

- AFAR 01 Partnership AccountingDocument6 pagesAFAR 01 Partnership AccountingAriel DimalantaPas encore d'évaluation

- Afar 2Document7 pagesAfar 2Diana Faye CaduadaPas encore d'évaluation

- Hoba 2019 QuizDocument10 pagesHoba 2019 QuizJo Montes0% (1)

- Prequalifying ExaminationDocument6 pagesPrequalifying ExaminationVincent Villalino LabrintoPas encore d'évaluation

- Advanced Accounting Part 1 Dayag 2015 Chapter 6Document19 pagesAdvanced Accounting Part 1 Dayag 2015 Chapter 6trisha sacramentoPas encore d'évaluation

- Advanced Accounting1Document8 pagesAdvanced Accounting1precious mlb100% (1)

- P2 MaterialsDocument9 pagesP2 MaterialsmarygraceomacPas encore d'évaluation

- AainvtyDocument4 pagesAainvtyRodolfo SayangPas encore d'évaluation

- Installmen Sales ProblemsDocument10 pagesInstallmen Sales ProblemsKristine GoyalaPas encore d'évaluation

- Solution Chapter 18Document61 pagesSolution Chapter 18xxxxxxxxx100% (3)

- A. B. 2. A. B. 3. A. B. C. D. 4.: Profit Loss Profit LossDocument13 pagesA. B. 2. A. B. 3. A. B. C. D. 4.: Profit Loss Profit LossDanielle Nicole MarquezPas encore d'évaluation

- Advacc Midterm ExamDocument13 pagesAdvacc Midterm ExamJosh TanPas encore d'évaluation

- Business Com Chapter 23Document5 pagesBusiness Com Chapter 23Nino Joycelee TuboPas encore d'évaluation

- Auditing Appplications PrelimsDocument5 pagesAuditing Appplications Prelimsnicole bancoroPas encore d'évaluation

- Module 7 NPO Colleges and Universities - Ngovacc PDFDocument8 pagesModule 7 NPO Colleges and Universities - Ngovacc PDFvum preePas encore d'évaluation

- Advanced Accounting Home Office, Branch and Agency TransactionsDocument7 pagesAdvanced Accounting Home Office, Branch and Agency TransactionsMajoy Bantoc100% (1)

- Final Exam in Advanced Financial Accounting IDocument6 pagesFinal Exam in Advanced Financial Accounting IYander Marl BautistaPas encore d'évaluation

- Seatwork - Advacc1Document2 pagesSeatwork - Advacc1David DavidPas encore d'évaluation

- D5Document12 pagesD5Mark Lord Morales BumagatPas encore d'évaluation

- Cost To CostDocument1 pageCost To CostAnirban Roy ChowdhuryPas encore d'évaluation

- Installment, Home-Branch, Liquidation, LT Constn ContractsDocument47 pagesInstallment, Home-Branch, Liquidation, LT Constn ContractsArianne Llorente83% (6)

- p2 103 Special Revenue Recognition Installment Sales Construction Contracts Franchise 1Document12 pagesp2 103 Special Revenue Recognition Installment Sales Construction Contracts Franchise 1AGNES CASTILLOPas encore d'évaluation

- Local Media3172437425380563588Document20 pagesLocal Media3172437425380563588Candy SchrendiPas encore d'évaluation

- Integrated Review Ii: Advanced Financial Accounting and Reporting Module 3: Special Revenue Recognition I. Installment SalesDocument18 pagesIntegrated Review Ii: Advanced Financial Accounting and Reporting Module 3: Special Revenue Recognition I. Installment SalesDarren Joy CoronaPas encore d'évaluation

- AdvaccDocument3 pagesAdvaccRarajPas encore d'évaluation

- Installment Sales - Quiz2Document7 pagesInstallment Sales - Quiz2Cattleya0% (2)

- Revenue RecognitionDocument6 pagesRevenue RecognitionnaserPas encore d'évaluation

- Revenue Recognition: Installment ContractDocument11 pagesRevenue Recognition: Installment ContractJean Ysrael MarquezPas encore d'évaluation

- Basic Accounting ReviewerDocument11 pagesBasic Accounting ReviewerandreamriePas encore d'évaluation

- Installment Sales - PretestDocument2 pagesInstallment Sales - PretestCattleyaPas encore d'évaluation

- p1 ADocument8 pagesp1 Aincubus_yeahPas encore d'évaluation

- ACC16 - HO 2 Installment Sales 11172014Document7 pagesACC16 - HO 2 Installment Sales 11172014Marvin James Cho0% (2)

- CG Guidelines For Listed Companies Nov2010Document13 pagesCG Guidelines For Listed Companies Nov2010Raymond ChengPas encore d'évaluation

- Read Gap Case - 2007 Case of Fred David's Strategic ManagementDocument10 pagesRead Gap Case - 2007 Case of Fred David's Strategic ManagementKate AlvarezPas encore d'évaluation

- Chapter 2: IT GovernanceDocument33 pagesChapter 2: IT GovernanceKate AlvarezPas encore d'évaluation

- CLV Handout PDFDocument21 pagesCLV Handout PDFKate AlvarezPas encore d'évaluation

- Possible Solutions To Manila's IssuesDocument2 pagesPossible Solutions To Manila's IssuesKate AlvarezPas encore d'évaluation

- Document Incorporated by Reference 2010 03 16 PDFDocument152 pagesDocument Incorporated by Reference 2010 03 16 PDFKate AlvarezPas encore d'évaluation

- Tesla PESTELDocument3 pagesTesla PESTELJinal GanatraPas encore d'évaluation

- CLV Handout PDFDocument21 pagesCLV Handout PDFKate AlvarezPas encore d'évaluation

- Financial Management For Non-ProfitsDocument8 pagesFinancial Management For Non-ProfitsErric19900% (1)

- Implementing Strategies: Management & Operations Issues: Strategic Management: Concepts & Cases 13 Edition Fred DavidDocument32 pagesImplementing Strategies: Management & Operations Issues: Strategic Management: Concepts & Cases 13 Edition Fred DavidKate AlvarezPas encore d'évaluation

- 10 Year Life PlanDocument2 pages10 Year Life PlanKate AlvarezPas encore d'évaluation

- Quiz ReviewerDocument1 pageQuiz ReviewerKate AlvarezPas encore d'évaluation

- History of LendingDocument7 pagesHistory of LendingKate AlvarezPas encore d'évaluation

- Case On GAP Inc.Document21 pagesCase On GAP Inc.Kate AlvarezPas encore d'évaluation

- Chapter17 - AnswerDocument5 pagesChapter17 - AnswerGon FreecsPas encore d'évaluation

- RevlonDocument12 pagesRevlonKate AlvarezPas encore d'évaluation

- The Hershey Company: United States Securities and Exchange Commission FORM 10-KDocument114 pagesThe Hershey Company: United States Securities and Exchange Commission FORM 10-KndirangjPas encore d'évaluation

- Option Contract - DayagDocument5 pagesOption Contract - DayagKate AlvarezPas encore d'évaluation

- Twice BlessedDocument4 pagesTwice BlessedKate AlvarezPas encore d'évaluation

- Twice BlessedDocument4 pagesTwice BlessedKate AlvarezPas encore d'évaluation

- Chapter20 - AnswerDocument7 pagesChapter20 - AnswerRicgie ManaladPas encore d'évaluation

- The Philippine Stock Exchange, IncDocument21 pagesThe Philippine Stock Exchange, IncKate AlvarezPas encore d'évaluation

- Financial Ratio AnalysisDocument14 pagesFinancial Ratio AnalysisPrasanga WdzPas encore d'évaluation

- Accounting For SMEs Illustrative ProblemsDocument5 pagesAccounting For SMEs Illustrative ProblemsKate AlvarezPas encore d'évaluation

- THE REVISED OECD PRINCIPLES OF CORPORATE GOVERNANCE AND THEIR RELEVANCE TO NON-OECD COUNTRIES by Fianna Jesover and Grant Kirkpatrick1Document31 pagesTHE REVISED OECD PRINCIPLES OF CORPORATE GOVERNANCE AND THEIR RELEVANCE TO NON-OECD COUNTRIES by Fianna Jesover and Grant Kirkpatrick1Kate AlvarezPas encore d'évaluation

- Arbitrage Pricing TheoryDocument6 pagesArbitrage Pricing TheoryKate AlvarezPas encore d'évaluation

- Arbitrage Pricing TheoryDocument6 pagesArbitrage Pricing TheoryKate AlvarezPas encore d'évaluation

- 33333331Document219 pages33333331Kate AlvarezPas encore d'évaluation

- The National EconomyDocument17 pagesThe National EconomyKate AlvarezPas encore d'évaluation

- Quiz ReviewerDocument1 pageQuiz ReviewerKate AlvarezPas encore d'évaluation

- Feasibility Study-New Company - Rev.0Document9 pagesFeasibility Study-New Company - Rev.0carlomaderazoPas encore d'évaluation

- GeoQlik For Qlik Sense - Demo ApplicationsDocument12 pagesGeoQlik For Qlik Sense - Demo Applicationsflorin251Pas encore d'évaluation

- Asset Turnover Ratio Definition - InvestopediaDocument4 pagesAsset Turnover Ratio Definition - InvestopediaBob KanePas encore d'évaluation

- Principles of Accounting Chapter 1 QuestionsDocument45 pagesPrinciples of Accounting Chapter 1 Questionsahmed156039Pas encore d'évaluation

- Fito Company Frutarom Company OverviewDocument40 pagesFito Company Frutarom Company OverviewprocopiodelllanoPas encore d'évaluation

- Modern Advanced Accounting in Canada Canadian 8th Edition Hilton Solutions Manual DownloadDocument76 pagesModern Advanced Accounting in Canada Canadian 8th Edition Hilton Solutions Manual DownloadHassan Mccoy100% (17)

- FABM 1 Week 3 4Document20 pagesFABM 1 Week 3 4RD Suarez67% (6)

- Hero MotocorpDocument27 pagesHero MotocorpDipesh Mehta0% (1)

- Cabaron, P - Module#1 - Fabm1 - Week3Document9 pagesCabaron, P - Module#1 - Fabm1 - Week3Jeje BalsotePas encore d'évaluation

- Submitted By: Sibeesh Sreenivasan 200700091: Case Study: Continental AirlinesDocument45 pagesSubmitted By: Sibeesh Sreenivasan 200700091: Case Study: Continental AirlinesSibeeshCSree67% (6)

- Managerial Accounting in Apple IncDocument21 pagesManagerial Accounting in Apple IncVruhali Soni100% (2)

- Intimation Regarding Investors Meetings of The Company and Submission of Presentation To Be Made To The Investors (Company Update)Document37 pagesIntimation Regarding Investors Meetings of The Company and Submission of Presentation To Be Made To The Investors (Company Update)Shyam SunderPas encore d'évaluation

- Notes On Adjusting EntriesDocument6 pagesNotes On Adjusting EntriesRedPas encore d'évaluation

- AcknowledgmentDocument44 pagesAcknowledgmentJagadish Kumar Bobbili100% (1)

- PWC Aussie Mine Nov12Document64 pagesPWC Aussie Mine Nov12Nicholas AngPas encore d'évaluation

- CNAE CodesDocument58 pagesCNAE CodesA GPas encore d'évaluation

- Chapter 9 2Document34 pagesChapter 9 2Genie MaePas encore d'évaluation

- Financial AccountingDocument135 pagesFinancial AccountingAkshita Jain100% (1)

- (Rahul) Project ReportDocument58 pages(Rahul) Project Reportrahul mehtaPas encore d'évaluation

- GSK Report 2008 FullDocument212 pagesGSK Report 2008 FullSerhat ERTANPas encore d'évaluation

- Grameen PhoneDocument37 pagesGrameen PhoneSK Nasif HasanPas encore d'évaluation

- Khandelwal CmaDocument40 pagesKhandelwal CmaraviPas encore d'évaluation

- Accounting Assignment cpt-1Document9 pagesAccounting Assignment cpt-1Parvez RahmanPas encore d'évaluation

- Chapter 21 - Advacc Solman Chapter 21 - Advacc SolmanDocument12 pagesChapter 21 - Advacc Solman Chapter 21 - Advacc SolmanDrew BanlutaPas encore d'évaluation

- Ratio AnalysisDocument81 pagesRatio AnalysisamitsinghslidesharePas encore d'évaluation

- Working Capital GapDocument10 pagesWorking Capital GapMilos StojakovicPas encore d'évaluation

- Safal Niveshak Stock Analysis Excel Version 5 0Document47 pagesSafal Niveshak Stock Analysis Excel Version 5 0Yati GargPas encore d'évaluation