Académique Documents

Professionnel Documents

Culture Documents

TP1 W3 R3

Transféré par

givi87Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

TP1 W3 R3

Transféré par

givi87Droits d'auteur :

Formats disponibles

NAMA : M.

MOGI LEOVIANSYAH

NIM : 1901526911

Tugas Individu ke 1

Minggu 3

Tugas 1

The following risk factors were identified by various audit teams during the audit of their clients.

1. The client has a strong control environment and good controls over the existence of inventory.

2. The client is in an industry that has both significant regulatory oversight and complex regulations.

3. The client has recently experienced turnover in it's information technology group, resulting in

decreased segregation of duties and a deterioration of computer general controls.

4. The client is a private university with primarily full-time students, a small amount of receivables at

year-end, and good internal controls over revenues.

5. A company’s business plans are dependent on the success of entering new foreign markets with

existing products.

6. The client has used significant borrowing to fund expansion in a competitive industry and has a

narrow tolerance range regarding debt covenants.

7. Analytical procedures for a manufacturer show significant increases in both profit margins and

inventory turn days.

8. Inventory items are small in size and high in value.

9. The telecommunications client is in a capital-intensive industry, and fixed assets additions involve

complex accounting issues.

10. The audit team has experienced several attempts by management to justify marginal or

inappropriate accounting on the basis of immateriality.

11. Analytical procedures for a manufacturer show significant increases in both revenue growth and

accounts receivable turn days.

1024F – Audit Keuangan II

Required

For each risk factor (a) identify the type of misstatement that can occur and (b) an audit strategy that is

relevant to the risk factor.

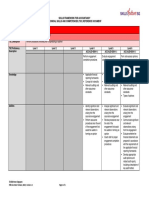

Example Type of Potential Misstatement (a) Audit Strategy

Risk Factor (b)

1 Pengendalian yang dimiliki klien sudah bagus Pengendalian resiko

dilakukan di bagian paling

rendah

2 Bisa salah saji pada beberapa akun Memakai pengujian

substantif

3 Mungkin salah saji pada beberapa akun Memakai pengujian

substantif

4 Dapat terjadi pendapatan yang menjadi Memakai prosedur analitis

piutang

5 Dapat terjadi pendapatan yang menjadi Memakai pengujian

piutang substantif

6 Dipengaruhi oleh perjanjian itu Memakai pengujian

substantif

7 Berdasarkan eksistensi persediaan Memakai pengujian

substantif

8 Berdasarkan eksistensi persediaan Memakai pengujian

substantif

9 Adanya valuasi alokasi untuk asset lancar Memakai pengujian

substantif

1024F – Audit Keuangan II

10 Adanya valuasi alokasi dari tim audit Memakai pengujian

substantif

11 Dapat terjadi pendapatan yang menjadi Memakai pengujian

piutang substantif

Tugas 2

In designing the audit program for substantive tests of account receivable and plant assets in the Abbott

Company, the auditor identified the following audit objectives:

1. Accounts receivable include all claims on customers at the balance sheet date.

2. Recorded plant assets represent assets that are in use at the balance sheet date.

3. Accounts receivable are properly identified and classified in the balance sheet.

4. Plant assets are stated at cost less accumulated depreciation.

5. The allowance for uncollectible accounts is a reasonable estimate of future bad debts.

6. The entity has ownership rights to all plant assets at the balance sheet date.

7. Accounts receivable represent legal claims on customer for payment.

8. Plant assets balances include the effects of all transactions and events that occurred during the

period.

9. Accounts receivable represent claims on customers at the balance sheet date.

1024F – Audit Keuangan II

10. Depreciation methods used by the client are adequately disclosed in the notes to the financial

statements.

11. The account receivable balance represents gross claims on customers and agrees with the sum of the

account receivable subsidiary ledger.

12. Capital lease agreements are disclosed in accordance with GAAP.

13. Appropriate disclosures are made about accounts receivable that are assigned or pledged at the

balance sheet date.

1024F – Audit Keuangan II

14. Plant assets are properly identified and classified in the balance sheet.

Required

Identify the financial statement assertion to which each objective relates. Use the following format for

your answers:

Objective Assertion

1 Kelengkapan

2 Keterjadian atau keberadaan

3 Penilaian dan alokasi

4 Penilaian dan alokasi

5 Penilaian dan alokasi

6 Hak dan kewajiban

7 Hak dan kewajiban

8 Kelengkapan

9 Keterjadian atau keberadaan

10 Penyajian dan pengungkapan

11 Keterjadian atau keberadaan

12 Penyajian dan pengungkapan

13 Penyajian dan pengungkapan

14 Kelengkapan

Tugas 3

Audit procedures used in performing substantive tests during the audit of the Harris Company are as

follows:

1. Count cash on hand.

1024F – Audit Keuangan II

2. Confirm account receivable.

3. Vouch plant asset additions to purchase documents.

4. Recalculate accrued interest on notes payable.

5. Inquire of management about pledging of plant assets as security for long-term debt.

6. Compute inventory turnover ratio.

7. Vouch ending inventory pricing to purchase invoices.

8. Review client-prepared bank reconciliation.

9. Verify accuracy of accounts receivable balance and agreement with subsidiary ledger.

10. Obtain details of accounts receivable subsidiary ledger and reconcile to the general ledger.

11. Compare statement disclosures for leases with GAAP.

12. Review adequacy of client’s provision for uncollectible accounts.

13. Examine certificates of title for delivery equipment.

14. Confirm receivables.

1024F – Audit Keuangan II

15. Trace bad-debt write-off authorizations to accounts receivable.

16. Observe client’s inventory taking.

17. Trace unpaid vendors’ invoices to account payable at year-end.

18. Compare pension disclosures to a disclosure checklist.

Required

For each of the audit procedures, identify (a) the type of substantive test (1-initial procedures, 2-analytical

procedures, 3-test of details of transactions, 4-test of details of balances, 5-tests of accounting estimates,

or 6-test of details of disclosures), and (b) one audit objective to which the test relates. Present your

answer in columnar form using the following headings:

Audit Type of Substantive Test Audit Objective

Procedure

1 Pengujian rinci atas detail saldo Penilaian dan alokasi,

Kelengkapan

2 Pengujian rinci atas detail saldo Keterjadian atau keberadaan

3 Pengujian rinci atas detail transaksi Tingkat keakurasian

4 Pengujian rinci atas detail pengungkapan Kelengkapan

5 Pengujian rinci atas detail saldo Penilaian dan alokasi

6 Prosedur analitis Keterjadian atau keberadaan

7 Pengujian rinci atas detail saldo Penilaian dan alokasi

8 Pengujian rinci atas detail saldo Hak dan kewajiban

9 Prosedur inisial Penilaian dan alokasi

10 Prosedur inisial Penilaian dan alokasi

11 Pengujian rinci atas detail pengungkapan Hak dan kewajiban

12 Uji estimasi akuntansi Penilaian dan alokasi

13 Pengujian rinci atas detail saldo Hak dan kewajiban

1024F – Audit Keuangan II

14 Prosedur analitis Kelengkapan, Keterjadian

atau keberadaan

15 Pengujian rinci atas detail transaksi Tingkat keakurasian

16 Pengujian rinci atas detail saldo Keterjadian atau

keberadaan,

Penilaian dan alokasi

17 Pengujian rinci atas detail transaksi Kelengkapan

18 Pengujian rinci atas detail pengungkapan Hak dan kewajiban

1024F – Audit Keuangan II

Vous aimerez peut-être aussi

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Certified Information Systems Auditor (CISA) - Mock Exam 3Document8 pagesCertified Information Systems Auditor (CISA) - Mock Exam 3Nishant KulshresthaPas encore d'évaluation

- BibliographyDocument5 pagesBibliographyKen PimenteroPas encore d'évaluation

- Wolfe & Hermanson 2004 - The Fraud Diamond - Considering The Four Elements of Fraud - The CPA Journal Vol 74 PP 38-42Document6 pagesWolfe & Hermanson 2004 - The Fraud Diamond - Considering The Four Elements of Fraud - The CPA Journal Vol 74 PP 38-42ANNISAPas encore d'évaluation

- External Auditors' Reliance On Internal Audit in Sri LankaDocument83 pagesExternal Auditors' Reliance On Internal Audit in Sri Lankadilu_0002100% (2)

- 1) Code of Ethics For AuditorsDocument29 pages1) Code of Ethics For Auditorsrajes wari50% (2)

- Chapter 2 The Risk of FraudDocument49 pagesChapter 2 The Risk of FraudcessbrightPas encore d'évaluation

- PDF Memo 5a and 5b Ocean Manufacturing Inc DLDocument5 pagesPDF Memo 5a and 5b Ocean Manufacturing Inc DLnaura syahdaPas encore d'évaluation

- HSE MS Audit / Review Document ListDocument4 pagesHSE MS Audit / Review Document ListAmb Patrick OghatePas encore d'évaluation

- KPMG Special Audit On WirecardDocument58 pagesKPMG Special Audit On WirecardJamie Powell100% (4)

- In Fa Deloitte India Banking Fraud Survey Edition IV NoexpDocument24 pagesIn Fa Deloitte India Banking Fraud Survey Edition IV NoexpishwarcPas encore d'évaluation

- Decision 766 Concerning Approval of Regulations Concerning Construction QualityDocument35 pagesDecision 766 Concerning Approval of Regulations Concerning Construction QualityvcraciunaPas encore d'évaluation

- Audit Check List 9thDocument6 pagesAudit Check List 9thTrieuLuongHaiPas encore d'évaluation

- Assessor Report JanMitram Kalyan SamitiDocument21 pagesAssessor Report JanMitram Kalyan SamitiManish SinghPas encore d'évaluation

- CANDO Pillar Audit Check SheetDocument2 pagesCANDO Pillar Audit Check SheetharpreetmuditPas encore d'évaluation

- Isr Iso 9001 Upgrade Planner Delta ChecklistDocument10 pagesIsr Iso 9001 Upgrade Planner Delta ChecklistDelcio MinossoPas encore d'évaluation

- Hse PlanDocument206 pagesHse PlanSidharth VijayPas encore d'évaluation

- BA 5019 SHRM Question BankDocument9 pagesBA 5019 SHRM Question BankDEAN RESEARCH AND DEVELOPMENTPas encore d'évaluation

- All CHAPTER 8 ANS PDFDocument118 pagesAll CHAPTER 8 ANS PDFUNATHI SIZWE MAKHOKHOBAPas encore d'évaluation

- Audit Risk and Internal ControlDocument17 pagesAudit Risk and Internal ControlAlexandru VasilePas encore d'évaluation

- Engagement Completion and ReportingDocument1 pageEngagement Completion and ReportingWilbur LamPas encore d'évaluation

- Indra Philippines CSR AssessmentDocument8 pagesIndra Philippines CSR AssessmentAgatta ArcePas encore d'évaluation

- NBM No. 120Document96 pagesNBM No. 120herbertjohn24Pas encore d'évaluation

- Official IIA Glossary SpanishDocument12 pagesOfficial IIA Glossary SpanishOrlando Pineda VallarPas encore d'évaluation

- Holcim AFR Directive 2008Document23 pagesHolcim AFR Directive 2008Safrin SangiaPas encore d'évaluation

- Integrated Business Management System Manual (PDFDrive)Document18 pagesIntegrated Business Management System Manual (PDFDrive)mn1938Pas encore d'évaluation

- Coal Verification and NormalizationDocument41 pagesCoal Verification and Normalizationsrinivas gillalaPas encore d'évaluation

- Auditing Theory: CPA ReviewDocument12 pagesAuditing Theory: CPA ReviewThan TanPas encore d'évaluation

- SfaDocument22 pagesSfaborzunnnPas encore d'évaluation

- Convert Client Data Into A Common FormatDocument4 pagesConvert Client Data Into A Common FormatAgung FebriPas encore d'évaluation

- P of AccDocument98 pagesP of Accdejen mengstiePas encore d'évaluation