Académique Documents

Professionnel Documents

Culture Documents

Dafn HW1

Transféré par

Aadarsh SaxenaDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Dafn HW1

Transféré par

Aadarsh SaxenaDroits d'auteur :

Formats disponibles

DAFN – 2018, Term 7, Group HW 1

-- (due Monday, Jan 29 by 11:59 PM IST)

Multivariate Simulation

Prepare a five-year time series of monthly price data from Dec 2012 through Dec 2017 for each

of the following ticker symbols: KO, ^GSPC (i.e., Coca Cola and the S&P500 index,

respectively). Be sure to submit your code along with your answers to the questions below.

Please organize your code so that it is easy to follow and so that it is clear which question/portion

the code is designed to address. Be sure to include comments where appropriate.

To start, estimate a regression of excess KO returns on excess market returns:

§ !! =∝ +! ∙ !!,! + !! (Eq. 1)

For simplicity, you can just assume that the riskless rate rf = 0 throughout our sample period, and

simply estimate a regression of stock returns on market returns. Use returns on the S&P 500

index (^GSPC) to proxy market returns.

Ø Q1. Create a table of key information for your results.

Ø Q2. What can you say about the alpha of KO during this time frame?

Ø Q3. Identify and explain any statistical assumptions you’ve made.

Now using coefficient estimate ! and residual vector ! from this first pass, simulate 10,000

∗

return paths for KO under the null hypothesis of ! = 0. That is: !!"#,! = ! ∙ !!,! + !!"#,! where

∗

each !!"#,! is drawn, with replacement and with equal probability, from residual vector !. That

∗

is, !!"#,! ~!"#(!) where !"#(!) represents the empirical distribution function that assigns

equal probability, 1/T, to each !! in residual vector !.1

Ø Q4. Present in a single plot: (i) the actual time series of KO stock returns; (ii) the average

simulated KO returns (across all 10,000 simulations) over time; and (iii) the 5th and 95th

percentiles of simulated KO returns over time.

Now using your simulated returns, re-estimate the previous regression across all 10,000

simulations: !!"#,! = ! + ! ∙ !!,! + !!

Ø Q5. Create a table conveying the key information from your simulations. For instance,

what is the average ! and ! across all simulations? And how often do you get statistically

significant alphas?

Ø Q6. In building our simulated return series above, why did we omit ! ?

1

Just a technical FYI: to be precise, we should actually scale the residual vector by a factor of [T / (T -2)]½, because

the empirical distribution of the residuals from equation (1) has variance T-1Σ εˆ t2 = T-1(T – 2)ŝ2, in which ŝ2 is the

unbiased estimator of σε2.

Vous aimerez peut-être aussi

- Homework Solutions 4Document4 pagesHomework Solutions 4Minh HoangPas encore d'évaluation

- 446A1Document4 pages446A1San LiPas encore d'évaluation

- Monte Carlo SimulationDocument5 pagesMonte Carlo SimulationIulia Roman GaroafaPas encore d'évaluation

- Econ424 HWK2Document6 pagesEcon424 HWK2Chris SaechaoPas encore d'évaluation

- 00 Lab NotesDocument10 pages00 Lab Notesreddykavya2111Pas encore d'évaluation

- Reg. No.: Name:: Q.No. Sub - Sec. Question Description MarksDocument3 pagesReg. No.: Name:: Q.No. Sub - Sec. Question Description MarksNikhilesh PrabhakarPas encore d'évaluation

- Boun Cmpe 150 2023 Spring MidtermDocument5 pagesBoun Cmpe 150 2023 Spring MidtermegemnPas encore d'évaluation

- 2012 Math Studies Exam PaperDocument41 pages2012 Math Studies Exam PaperTifeny Seng100% (1)

- Group A (Any Four: Answer Questions From Q. No. 1 To 6)Document2 pagesGroup A (Any Four: Answer Questions From Q. No. 1 To 6)red sparrowPas encore d'évaluation

- Econometrics IiDocument5 pagesEconometrics IiRorisangPas encore d'évaluation

- StatisticaDocument10 pagesStatisticaTibyan MustafaPas encore d'évaluation

- CIS 160 - Spring 2016 Final Exam Review: Posted Friday, April 29Document12 pagesCIS 160 - Spring 2016 Final Exam Review: Posted Friday, April 29lynxPas encore d'évaluation

- Markowitz WhitepaperDocument10 pagesMarkowitz WhitepaperWen BinPas encore d'évaluation

- Digital and Logic Design: Lab-5 Karnaugh-Map, POS & SOPDocument9 pagesDigital and Logic Design: Lab-5 Karnaugh-Map, POS & SOPsaadPas encore d'évaluation

- POGIL FOR LoopsDocument7 pagesPOGIL FOR Loopsidkspam100% (1)

- 2 ProbabilityDocument59 pages2 ProbabilityLanestosa Ernest Rey B.Pas encore d'évaluation

- Mid2 SOLUTIONDocument11 pagesMid2 SOLUTIONFarrukh AbbasPas encore d'évaluation

- Unit3 Assgt Spring 2020Document3 pagesUnit3 Assgt Spring 2020Sohaib ChoudharyPas encore d'évaluation

- Prep For Fe Sol Qr15Document5 pagesPrep For Fe Sol Qr15chumnhomauxanhPas encore d'évaluation

- AB1202 Quiz 3 Prep Special R-Skills v1 Nov'20oubhjnlDocument2 pagesAB1202 Quiz 3 Prep Special R-Skills v1 Nov'20oubhjnlTrash BinPas encore d'évaluation

- Matematica A 1997 1998Document57 pagesMatematica A 1997 1998Fernando SolanaPas encore d'évaluation

- Drink: Maxbox Starter 92 How To DemystifyDocument5 pagesDrink: Maxbox Starter 92 How To DemystifyMax Kleiner100% (1)

- Institute of Actuaries of India: ExaminationsDocument7 pagesInstitute of Actuaries of India: Examinationspallab2110Pas encore d'évaluation

- ME - PGP Exam Last YearDocument3 pagesME - PGP Exam Last Yearvijay2293Pas encore d'évaluation

- Spe 1936 PaDocument2 pagesSpe 1936 PaIzzatullah NewtonPas encore d'évaluation

- STAT7055 Spring Session 2017 Topic 1 Tutorial QuestionsDocument4 pagesSTAT7055 Spring Session 2017 Topic 1 Tutorial QuestionsCallum LowePas encore d'évaluation

- ESO207 Programming Assignment 3 Semester II, 2016-17Document2 pagesESO207 Programming Assignment 3 Semester II, 2016-17ShubhamHuddaPas encore d'évaluation

- 20SC1101 - End Sem Question PaperDocument4 pages20SC1101 - End Sem Question PapersokkuPas encore d'évaluation

- Major Assignment 2 GuidelinesDocument4 pagesMajor Assignment 2 Guidelinesmadam iqraPas encore d'évaluation

- 914201799chapter 4, 5 and 6 Practice Questions PDFDocument9 pages914201799chapter 4, 5 and 6 Practice Questions PDFAmisha Jethmalani67% (3)

- 6.5 Monte Carlo SimulationDocument4 pages6.5 Monte Carlo SimulationBelal AhmadPas encore d'évaluation

- THE SOLOW MODEL (Ghulam Samad)Document19 pagesTHE SOLOW MODEL (Ghulam Samad)tskokoPas encore d'évaluation

- Radioactivity Required LabDocument12 pagesRadioactivity Required LabKIANNA FLORESPas encore d'évaluation

- Your Name: Your ID:: Lab 4 - Introduction To C/C++ ProgrammingDocument5 pagesYour Name: Your ID:: Lab 4 - Introduction To C/C++ ProgrammingTrương Quang TườngPas encore d'évaluation

- Using and Managing Data and Information November Cohort (2021 - 2022) BA3020QADocument6 pagesUsing and Managing Data and Information November Cohort (2021 - 2022) BA3020QANavya VinnyPas encore d'évaluation

- ISC Computer Science - Official Specimen Paper 2013Document9 pagesISC Computer Science - Official Specimen Paper 2013Guide For SchoolPas encore d'évaluation

- IAT-II Question Paper With Solution of 15EC53 Verilog HDL Nov-2017 - Sunil Kumar K.H PDFDocument10 pagesIAT-II Question Paper With Solution of 15EC53 Verilog HDL Nov-2017 - Sunil Kumar K.H PDFKavyashreeMPas encore d'évaluation

- Homework 1Document2 pagesHomework 1touseefpatel0% (1)

- Fat G2 Cse2003 50201Document4 pagesFat G2 Cse2003 50201vit1234Pas encore d'évaluation

- 20201116215131YWLEE003Production SolutionDocument5 pages20201116215131YWLEE003Production SolutionDương DươngPas encore d'évaluation

- Igcse Sample 1fDocument18 pagesIgcse Sample 1fviclenPas encore d'évaluation

- Edexcel s1 Mixed QuestionDocument78 pagesEdexcel s1 Mixed QuestionStylianos_C100% (1)

- Mid2 2022 November SolutionDocument11 pagesMid2 2022 November SolutionSameer UddinPas encore d'évaluation

- Midterm Exam SolutionsDocument4 pagesMidterm Exam SolutionsMinh HoangPas encore d'évaluation

- AnswersDocument6 pagesAnswerssaumyamerchPas encore d'évaluation

- Homework 2 MATH2411 Fall 2022Document1 pageHomework 2 MATH2411 Fall 2022Owen ChungPas encore d'évaluation

- Applied Project s2007Document3 pagesApplied Project s2007anon-810002Pas encore d'évaluation

- Edexcel S1 Mixed Question PDFDocument78 pagesEdexcel S1 Mixed Question PDFDanPas encore d'évaluation

- Matlab Lab3aDocument4 pagesMatlab Lab3akaramPas encore d'évaluation

- Bba Prof 2010Document2 pagesBba Prof 2010সাঈদ আহমদPas encore d'évaluation

- QueueingDocument65 pagesQueueingShivam Daryanani100% (1)

- Chapter No: 07: Cost Theory & AnalysisDocument4 pagesChapter No: 07: Cost Theory & AnalysisDileepHaraniPas encore d'évaluation

- ECON1203-2292 Final Exam S212 PDFDocument13 pagesECON1203-2292 Final Exam S212 PDFGorge SorosPas encore d'évaluation

- Monte Carlo SimulationDocument55 pagesMonte Carlo SimulationAndrew Lee100% (1)

- AssignmentDocument2 pagesAssignmentnavneet26101988Pas encore d'évaluation

- Important Instructions:: (A, B, C, D)Document2 pagesImportant Instructions:: (A, B, C, D)prerak guptaPas encore d'évaluation

- 209 RMO 2016 Goa Maharashtra SolutionDocument8 pages209 RMO 2016 Goa Maharashtra SolutionJanaki KrishnanPas encore d'évaluation

- Elliott Wave Timing Beyond Ordinary Fibonacci MethodsD'EverandElliott Wave Timing Beyond Ordinary Fibonacci MethodsÉvaluation : 4 sur 5 étoiles4/5 (21)

- The Volatility Surface: A Practitioner's GuideD'EverandThe Volatility Surface: A Practitioner's GuideÉvaluation : 4 sur 5 étoiles4/5 (4)

- Cheatsheet Machine Learning Tips and Tricks PDFDocument2 pagesCheatsheet Machine Learning Tips and Tricks PDFAshwini NatesanPas encore d'évaluation

- MTH302 McqsDocument5 pagesMTH302 McqsTaimoor Sultan100% (1)

- K-Nearest Neighbour (KNN)Document14 pagesK-Nearest Neighbour (KNN)Muhammad HaroonPas encore d'évaluation

- PP-312 Method of Least SquaresDocument28 pagesPP-312 Method of Least SquaresSunit AroraPas encore d'évaluation

- Efa ManualDocument11 pagesEfa ManualJun Virador MagallonPas encore d'évaluation

- Week 3Document11 pagesWeek 3srideviPas encore d'évaluation

- Modelos Lineales Generalizados Con Ejemplos en RDocument573 pagesModelos Lineales Generalizados Con Ejemplos en RJuan Manuel AntónPas encore d'évaluation

- QM For Business MIDTERM EXAMINATION REVIEW Apr 23 2020 BULLSHIT CONTENTDocument10 pagesQM For Business MIDTERM EXAMINATION REVIEW Apr 23 2020 BULLSHIT CONTENTArgen GrzesiekPas encore d'évaluation

- Tabel R Product Moment Big SampleDocument4 pagesTabel R Product Moment Big SampleRieneke KusmawaningtyasPas encore d'évaluation

- Analysis Analysis of Variance One Way AnovaDocument3 pagesAnalysis Analysis of Variance One Way AnovamaiPas encore d'évaluation

- RELIABILIT2Document6 pagesRELIABILIT2hello ssPas encore d'évaluation

- Pengaruh Pengalaman Kerja, Independensi, Integritas, Kompetensi Dan Etika Auditor Kualitas AuditDocument13 pagesPengaruh Pengalaman Kerja, Independensi, Integritas, Kompetensi Dan Etika Auditor Kualitas AuditsaridPas encore d'évaluation

- Output GWRDocument6 pagesOutput GWRerikaPas encore d'évaluation

- Parametric & Non Parametric TestDocument8 pagesParametric & Non Parametric TestAngelica Alejandro100% (1)

- Box's M: Open Sex Role InventoryDocument3 pagesBox's M: Open Sex Role InventoryAndris C BeatricePas encore d'évaluation

- Business Statistic-Correlation and RegressionDocument30 pagesBusiness Statistic-Correlation and RegressionBalasaheb ChavanPas encore d'évaluation

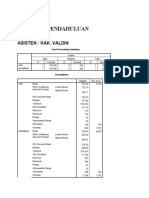

- Tugas Pendahuluan: Korelasi Asisten: Kak. ValdinDocument19 pagesTugas Pendahuluan: Korelasi Asisten: Kak. ValdinSilvana papoiwoPas encore d'évaluation

- 3 Way ANOVADocument4 pages3 Way ANOVAvinxincPas encore d'évaluation

- A Guide To Machine Learning Algorithms 100+Document49 pagesA Guide To Machine Learning Algorithms 100+Muhammad AndiPas encore d'évaluation

- Design and Analysis of ExperimentsDocument25 pagesDesign and Analysis of ExperimentsDan ARikPas encore d'évaluation

- ARCH For IPython Notebook - Kevin Sheppard (2021)Document470 pagesARCH For IPython Notebook - Kevin Sheppard (2021)Vũ ChiếnPas encore d'évaluation

- QT Project Report Group 9C PDFDocument20 pagesQT Project Report Group 9C PDFgeorgeavadakkelPas encore d'évaluation

- Regression AnalysisDocument19 pagesRegression AnalysisPRANAYPas encore d'évaluation

- Stock and Watson - Slides For Chapter 4Document43 pagesStock and Watson - Slides For Chapter 4Bruno CapuzziPas encore d'évaluation

- 4 - Simple Linear Regression I 2022-23Document25 pages4 - Simple Linear Regression I 2022-23tedPas encore d'évaluation

- Chap 011Document183 pagesChap 011BG Monty 1Pas encore d'évaluation

- Ujian Kepercayaan Alpha Cronbach Soal Selidik: Case Processing SummaryDocument6 pagesUjian Kepercayaan Alpha Cronbach Soal Selidik: Case Processing SummarypunithaPas encore d'évaluation

- Spearman's Rank Correlation Coefficient: Pages 28 To34Document4 pagesSpearman's Rank Correlation Coefficient: Pages 28 To34umangPas encore d'évaluation

- Classification of Underdeveloped Areas in Indonesia Using The SVM and K-NN AlgorithmsDocument8 pagesClassification of Underdeveloped Areas in Indonesia Using The SVM and K-NN AlgorithmsfirdausPas encore d'évaluation

- WinterDocument1 pageWinterGaurav KamathPas encore d'évaluation