Académique Documents

Professionnel Documents

Culture Documents

Amex WS PIP Terminal Interface Spec ISO Apr2011 PDF

Transféré par

Luis F JaureguiTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Amex WS PIP Terminal Interface Spec ISO Apr2011 PDF

Transféré par

Luis F JaureguiDroits d'auteur :

Formats disponibles

PLURAL INTERFACE PROCESSING (PIP)

TERMINAL INTERFACE SPECIFICATION

(ISO 8583 FORMAT) — APRIL 2011

GLOBAL MERCHANT SERVICES

POS020055, v3.2, April 22, 2011

Copyright © 2006-2011 American Express Travel Related Services Company, Inc. All rights re-

served. This document contains sensitive, confidential and trade secret information; and no part

of it shall be disclosed to third parties or reproduced in any form or by any electronic or me-

chanical means, including without limitation information storage and retrieval systems, without

the express prior written consent of American Express Travel Related Services Company, Inc.

American Express Proprietary & Confidential PIP Terminal Interface Spec (ISO 8583)

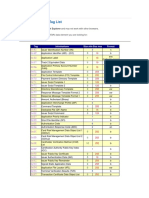

Revision Log

Version Date | Content Owner | Prepared By | Description

3.2 04/22/11 | J. Cheney | R. Wong | See Below

• Cover: Changed title from “OCTOBER 2010” to “APRIL 2011”.

• Page 63: Changed text, as indicated, “American Express limits the maximum allowable value that can be

approved in this field. While most entries must not exceed “000009999999”, some locations may submit

based on the US Dollar equivalent calculated by American Express. Transmitted transaction amounts in specific

currencies up to “000999999999”. However, please note that a transaction amount greater than the max-

imum allowed will result in an “invalid amount” edit error. For more information on maximum allowable

values, see Currency Codes on page 196.”

• Page 64 & 99: The available balance is returned in response message Field 54 (Amounts, Additional) of the

Authorization Response (0110) message.”

• Page 80: Added Note 1, “All Approval Codes are numeric for American Express Transactions”.

• Pages 196-201: Changed Note 4 text, as indicated, “Maximum Value allowed is the equivalent to either

“000009999999”, unless otherwise indicated.” ($99,999.99 USD) or “000999999999” ($9,999,999.99 USD)”.

Also, updated most Maximum Value entries; and added, deleted or changed the following Currency Codes:

– Changed, as indicated “Estonia Kroon Euro | Estonia | 233 978 | 2”

– Changed, as indicated “Malagasy Ariary | Madagascar | 969 | 2 0”

– Deleted “Netherlands Antillian Guilder | Netherland Antilles | 532 | 2”

– Added “Netherlands Antillian Guilder | Curaçao | 532 | 2”

– Added “Netherlands Antillian Guilder | Sint Maarten | 532 | 2”

– Added “New Manat | Turkmenistan | 934 | 2”

– Added “Panama Balboa | Panama | 590 | 2”

– Added “U.S. Dollar | Bonaire | 840 | 2”

– Added “U.S. Dollar | Saba | 840 | 2”

– Added “U.S. Dollar | St. Eustatius | 840 | 2”

3.1 10/22/10 | J. Cheney | R. Wong | See Below

• Added new cover and modified format of Revision Log.

• Page 63: Added paragraph beginning “American Express limits the maximum value that can be approved in

this field”.

• Page 77: Changed last five digits in Expresspay Pseudo-Magnetic Stripe example from “00200” to “12345”.

• Page 92: In ISO 7813 Format explanatory text, changed VLI from “60” to “76” bytes, changed total length

from “61” to “77” and appended “6789012345678901” (16 bytes) to end of example in diagram.

• Page 93: Changed Expresspay Pseudo-Magnetic Stripe Format example, relative positions 40-44 from

“~~012” to “12345”.

• Page 153, ISO 7813 Standard, Track 1: Changed Discretionary Data from 5 to 21 bytes, and deleted Unused

subfield, which was 16 bytes. Total (length) unchanged.

• Pages 155-168: Appended “6789012345678901” (16 bytes) to end of sample data in diagrams.

• Pages 162, 174: Changed text, as indicated, “Currently, American Express has no definite plans to require

USA does not expect Merchants to interrogate…”

• Page 166: Changed Length of Field from “5 bytes” to “5 bytes – ANSI X4.16” and “21 bytes – ISO 7813”.

Also changed ISO 7813 Approximate Position from “57-61” to “57-77”.

• Page 167: Changed ISO 7813 Approximate Position from “62” to “78”.

• Page 168: Changed ISO 7813 Approximate Position from “63” to “79”.

• Page 169: Deleted references to ISO 7813 (3 places), added “Note: This field applies only to ANSI X4.16

Standard Track 1 and is not applicable to ISO 7813” and deleted diagram containing sample data.

• Pages 183-184: Revised Expresspay Pseudo-Magnetic Stripe Formats explanatory text and Track 1 & Track 2

Subfields, as follows: Changed “ATC” to “Application Transaction Counter (ATC)”. Changed Track 1, Card-

member Name length from 23 to 21 bytes. Changed Track 1 and Track 2 ATC lengths from 3 to 5 bytes. And,

deleted Track 2 Language Code subfield.

April 22, 2011 POS020055 i

This document contains sensitive, confidential and trade secret information, and must not be disclosed to third parties

without the express prior written consent of American Express Travel Related Services Company, Inc.

PIP Terminal Interface Spec (ISO 8583) American Express Proprietary & Confidential

Revision Log

Version Date | Content Owner | Prepared By | Description

• Pages 196-201: Added Notes 3 and 4, inserted Maximum Value column in Currency Code tables and added

“000999999999” for approved countries.

• Page 197: Added Congolese Franc to Currency Code Table.

3.0 04/23/10 | J. Cheney | R. Wong | See Below

• Global: Removed “Advance Copy” watermark.

• Page 61: Added to footnote, sentence beginning “Also, please note that code ‘31 40 0X’ can…”

• Page 64: Added “Note: Balance Inquiry is only available via the Web Services IP Payments…”

• Page 87: Added Note 2 “CID Response Codes are only available via Web Services IP Payments…”

• Page 94: Added “Note: Data Field 47 is only available via Web Services IP Payments Gateway…”

• Page 107: Added Note 2 “The Available Amount remaining on Prepaid Cards is only available…”

• Currency Code Table: Changed Swaziland currency name from Lilangeni to Emalengeni.

3.0 10/26/09 | J. Cheney | R. Wong | See Below

Advance • Pages 5, 96 & 102: Deleted references to third party processors and/or added “terminal and software vendors”

Copy • Pages 4-5: Added section entitled Prepaid Card Partial Auth & Auth with Balance Return.

• Pages 50, 55, 94-102 & 131-134: Added Field 47 to support Keyed CID and Prepaid Card functions.

• Page 61: For MTI=0100 and 0200, added code “31 40 0X” and footnote.

• Page 64: Added explanation entitled Balance Inquiry – Prepaid Cards Only.

• Page 81: Added Response Code “06”.

• Pages 86-89, Field 44: Added Field Requirement “C1 = Mandatory – Amex Keyed CID program & GAN auth

response messages only. Optional – Travelers Cheque”. Also, expanded Response Source Code and added CID

Response Code descriptions, and added examples.

• Pages 94-102 & 131-135: Added Field 47.

• Page 103: Added paragraph beginning: “Note: Merchants certified for the Amex Keyed CID…”

• Page 106: Added Field Requirement “C2 = Mandatory if Field 47 = 181 or 182…”

• Page 107: Added paragraph and Note beginning “For MTI = 110 & 0210 – For Response Message on Prepaid

Card Auth Requests…”

• Pages 185-195: Added subsection entitled Typical Prepaid Card Partial Authorization & Authorization with

Balance Return Process Flows.

2.8 10/01/09 | J. Cheney | R. Wong | See Below

• Pages 3, 15, 74, 90, 120 & 152: Deleted references to third party processors and/or added “terminal and

software vendors”.

• Page 53 and throughout document: Changed from “BN/binary numeric” to “BCD/ binary coded decimal”

(multiple occurrences).

• Page 54 and throughout document: Changed from “BH/binary hexadecimal” to “H/hexadecimal” (multiple

occurrences).

• Pages 59 & 68: Changed Field Requirement “C2” from “Mandatory – Debit/credit adjustments and voids” to

“Mandatory - All, if Amex Cardmember Account Number is manually entered”.

• Page 68: Changed 0320 Field Requirement from “C2” to “M” and deleted “C3”.

• Page 81: Added code “06”.

• Page 120: In paragraph beginning “During certification…”, deleted “Similarly, Amex strongly recommends

that vendors use the certification process to confirm that their software, devices and systems are capable of

populating and transmitting appropriate information”.

• Page 103: In Field Requirement, changed from “C1” to “C”.

• Pages 132 & 134: Added Field 54 to 0110 & 0210.

• Page 137: Changed Bit 14 Field Requirement from “C/C” to “M/M”.

ii POS020055 April 22, 2011

This document contains sensitive, confidential and trade secret information, and must not be disclosed to third parties

without the express prior written consent of American Express Travel Related Services Company, Inc.

American Express Proprietary & Confidential PIP Terminal Interface Spec (ISO 8583)

Revision Log

Version Date | Content Owner | Prepared By | Description

2.7 06/18/09 | J. Cheney | R. Wong | See Below

• Global: Merged contents of POS010005, v5.4, with POS020055, v2.6 (this spec); and removed all generic

references to “Web Services”, as this version replaces both.

• Global: Revised message names to align with ISO 8583.

• Page xi, Preface: Deleted stricken text: “…and settled with American Express, and with other card acquirers.”

• Page xii: Deleted PIP Spec Expresspay Addendum (POS020055-EP) and added Dial-Up Communication

Guide (POS020086).

• Page 4: Revised Expresspay requirements and added Magstripe Mode details.

• Page 12: Added underlined text “Important Note for Web Services IP Payments Gateway Users”.

• Page 20: In bullet for 0330 response, changed from “upload batch from terminal to host” to “response

message contains a processing code…”

• Page 24: Merged High-Speed Internet and Dial-Up info in Recommended Time-Out Values section.

• Pages 49-50: Reduced “Max Field Length” bytes to reflect binary coded decimal entries.

• Page 53: Added “Important Note for Web Services IP Payments Gateway Users…”

• Page 59: Deleted stricken text: “The VLI must indicate the exact length of the account number without

padding.”

• Page 63: Deleted “or US Dollars, if Field 49 is omitted” and added, “Merchants must certify for each currency

submitted”.

• Pages 63, 105, 106, 123 & 127: Changed from “only US Dollars” to “US Dollars and select global currencies”

and added, “For more info please contact your American Express representative”.

• Pages 60-129 — Made the following changes to Data Field Descriptions:

– In fields with BCD entries, changed VLI and Length of Field, as necessary, to reflect shorter, packed

bits/BCD value.

– Changed references from “bytes” to “digits” or “characters”, as applicable, when “bytes” actually refers to

4-bit nibbles.

– Replaced “Example 1/2” text and diagrams with new “Sample Data”, which more accurately describes

proper field layout.

• Page 74: Deleted stricken text: “The VLI must indicate the exact length of the Track 2 data actually

transmitted without padding.” Also, relocated notes 1 & 2 from the page that follows.

• Pages 74, 90 & 150: Added references to “Expresspay Pseudo-Mag Stripe Formats…”

• Pages 77 & 93 (Fields 35 & 45): Added Expresspay Pseudo-Mag Stripe Format descriptions and Sample Data.

• Page 79: Combined Auth Code and Referral Queue Field Requirement tables, and revised/added notes C1, C2

and C3.

• Page 80: Changed from “international” to “regional”, two places.

• Page 86: Added paragraphs beginning “For an (MTI) 0220 request submitted to void an Off-Line Sale

transaction…” thru end of Field 44 Description, including Sample Data.

• Page 90: Relocated notes 1 & 2 from a page that follows.

• Page 105: Changed all Field Requirements from “C1” to “M” and deleted Note C1.

• Page 108: Deleted stricken text: “…(USA ZIP or international Postal code)…”

• Pages 108-129, Private Use Data Fields 60-63: Extensively revised/expanded detailed descriptions and Sam-

ple Data to clarify MTI-specific layouts.

• Pages 131-144: Updated tables to reflect changes in Field Descriptions.

• Pages 183-184: Added Expresspay Pseudo-Mag Stripe Formats section.

• Pages 196-201: Deleted Country Codes (not used in this spec) and added global currencies (previously, US

Dollars only).

• Pages 211-218: Added EBCDIC & ASCII Code Translation Table.

April 22, 2011 POS020055 iii

This document contains sensitive, confidential and trade secret information, and must not be disclosed to third parties

without the express prior written consent of American Express Travel Related Services Company, Inc.

PIP Terminal Interface Spec (ISO 8583) American Express Proprietary & Confidential

Revision Log

Version Date | Content Owner | Prepared By | Description

2.6 11/26/07 | J. Cheney | R. Wong | See Below

• Page 15: Changed Note from “…Lodging and Auto Rental applications…” to “Lodging, Auto Rental and

eCommerce/Mail Order applications…”

• Pages 114 & 116: In Fields 61 and 62, changed from “C” to “C2” and added “C1”.

• Page 115: Changed Example 2 from “00 08 31 31 32 32 33 33 34 34” to “… 20 20”.

2.5 09/25/07 | J. Cheney | R. Wong | See Below

• Pages 114 & 116: In both Fields 61 and 62, deleted Field Requirements “C1” and “C3”; changed from “C2” and

“C4” to “C”; deleted Cx = Optional; and added Auth and Auth Void to N/A.

• Pages 131 & 140: Deleted Bits 61 and 62.

• Page 139, Bits 61 & 62: Changed Auth Void from “O” to “–”.

• Page 141, Bits 61 & 62: Changed Auth and Auth Void from “O” to “–”.

• Pages 153-182: Corrected subfield names, lengths, positions and diagrams in Magnetic Stripe Formats section,

in Appendix.

• Pages 75 & 91-92: Corrected magnetic stripe sample data used in examples.

2.4 07/16/07 | J. Cheney | R. Wong | See Below

• Page xii, Related Documents: Added Expresspay Addendum and HTTPS Communication Guide.

• Page 4: Added Expresspay section.

• Pages 35, 36, 37, 39, 41, 43 & 78: Changed incorrect references from “Authorization Identification Response

(Field 38)” to “Additional Response Data (Field 44)”.

• Page 62: Added explanatory text in paragraphs entitled “For MTI=0400 & 0420”.

• Page 65: Added Note beginning “For Reversal Request (0400) and Reversal Advice Request…”

• Magnetic Stripe Formats Section: Added LRC to ANSI X4.16 Track 1 and Track 2 Formats.

2.3 06/28/07 | J. Cheney | R. Wong | See Below

• Page 79: For Authorization Code, changed from “0220=M” to “…=C1” and added Note C1.

2.3 06/15/07 | J. Cheney | R. Wong | See Below

• Pages 25-45: Added “Disconnect” bar between transactions in process flow diagrams.

• Page 59: Changed from “0200=C” to “…=C1”, from “0220=C” to “…=C2”, from “0320=C” to “…=M” and

added Note C2.

• Page 63: Added Note 2 “For Void transactions…”

• Page 65: Added Note 2 “This field is…”

• Page 68: Changed from “0220=C” to “…=C2”, from “0320=C” to “…=C3”, added Notes C2 and C3, and

added paragraph beginning “Note for C2 & C3: Date, Expiration must be submitted…”

• Pages 74 & 90: Changed from “0320=C” to “0320 = — ”.

• Page 78: Changed from “0230=M” to “…=C2” and added Note C2.

• Page 86: Note C1, added “Mandatory - Voids of Off-Line Sale…” and deleted “N/A - Off-Line Sale, Debit

Adjust/Void and Credit Adjust/Void”. Also, deleted “For 220 requests, this field contains a code that indicates

the source of the 0210 response that generated the 0220 message”; and changed from “06=Off-line approval”

to “sale”.

• Page 103: Deleted stricken text “Special certification is required, and use in specific messages (as determined

by Message Type Identifier) varies by merchant”.

• Pages 152-181: Updated Mag Stripe Formats.

2.2 04/23/07 | J. Cheney | R. Wong | See Below

• Page 15: In note, deleted “Purchasing Card”.

• Pages 118, 123-126: For Lodging & Auto Rental, deleted 0200 & 0220 references to Bit 63 (unused).

iv POS020055 April 22, 2011

This document contains sensitive, confidential and trade secret information, and must not be disclosed to third parties

without the express prior written consent of American Express Travel Related Services Company, Inc.

American Express Proprietary & Confidential PIP Terminal Interface Spec (ISO 8583)

Revision Log

Version Date | Content Owner | Prepared By | Description

2.1 04/05/07 | J. Cheney | R. Wong | See Below

• Page 9: Added second example to Invalid Card Capture Type.

• Page 62: Added paragraph beginning “Note: ‘92 00 0X’ is entered in this field…”

• Pages 108-109: Changed from “For MTI=0100, 0200 & 0220” to “For MTI=0100 & 0200” and from

“Examples of 0100, 0200 & 0220 Request…” to “...0100 & 0200 Request…”

• Pages 110: Changed from “For MTI=0110, 0210 & 0230” to “For MTI=0110 & 210” and from “Examples of

0110, 0210 & 0230 AVS…” to “…0110 & 0210 AVS…”

• Page 117: Changed from “Batch Identification” to “Invoice/ROC/SOC” (number), two places.

• Page 127-128: Added (previously omitted) 6-byte “Reserved (zeros)” subfield, two places.

• Pages 130-144: Changed format of Data Field/ Message Usage Tables to improve readability.

2.0 03/28/07 | J. Cheney | R. Wong | See Below

• Global modifications: Converted all field descriptions and examples from ASCII to BCD and hexadecimal.

Also, made the following additional changes:

• Page 53: Added new subsections explaining BCD and hexadecimal formats.

• Page 74-75 & 91: Changed sample data to match examples in Amex Mag Stripe Formats section and corrected

field formats for Track 1 & 2 data.

• Page 84: Added backslash as subfield separator.

• Page 103: Added (previously omitted) Data Type Definition Code.

• Page 151: Added Amex Card examples that show CID/4DBC/4CSC locations.

1.4 01/31/07 | J. Cheney | R. Wong | See Below

• Page 63: For USD/840 transactions only, changed “000009999999” to “000999999999”. Also, added “For

other currencies, the USD equivalent…must not exceed $99,999.99 USD.”

• Page 103: Changed requirement for 0100, 0200 & 0220 from “–” to “C1”; and added sentence beginning “C1 =

Cond. – Merchants transmitting…”.

• Page 108: Changed requirement for 0220 from “–” to “O”, and 0230 from “–” to “C1”. Changed “For

MTI=0100 & 0200” to “…0100, 0200 & 0220”.

• Page 109: Changed from “For MTI=0110 & 0210” to “…0110, 0210 & 0230”, and “Example of 0110 &

0210” to “…0110, 0210 & 0230”; and added above changes to Message Usage Table.

1.3 11/15/06 | J. Cheney | R. Wong | See Below

• Pages 118-126 & Message Usage Table: Changed requirement for 0220 from “–” to “C”; changed all

references from “0200 & 0320” to “0200, 0220 & 0320”; updated 0220 entries for Bit 63 in summary table.

1.2 08/28/06 | J. Cheney | R. Wong | See Below

• Page 11: Deleted introductory paragraph beginning “The American Express PIP Interface uses two…”

• Pages 12-13: Added “Important Note” and expanded explanation of ISO 8583 messages.

• Pages 61-62: Added descriptions for MTI 0200, 0220, 0320 & 0500, inadvertently omitted in previous releases.

• Page 110: Added code “R=AVS Unavailable” and “Note: The AVS response (which is used to help validate

the identity of the Cardholder)…”

• Pages 118-126 & Message Usage Table: Added Field 63 Requirement for MTI 0200 = “C2”, changed each

instance of MTI “0320” to “0200 and 0320” (eight places), and updated Data Field/Message Usage Table.

1.1 08/07/06 | J. Cheney | R. Wong | See Below

• Pages 108-110: Added AVS requirements to 0100/0200 & 0110/0210 messages.

1.0 05/05/06 | J. Cheney | R. Wong | See Below

• Initial release. Created by removing XML references from POS020050, v1.0 and adding ISO 8583

information from POS010005, v5.4.

April 22, 2011 POS020055 v

This document contains sensitive, confidential and trade secret information, and must not be disclosed to third parties

without the express prior written consent of American Express Travel Related Services Company, Inc.

PIP Terminal Interface Spec (ISO 8583) American Express Proprietary & Confidential

This page is intentionally left blank.

vi POS020055 April 22, 2011

This document contains sensitive, confidential and trade secret information, and must not be disclosed to third parties

without the express prior written consent of American Express Travel Related Services Company, Inc.

American Express Proprietary & Confidential PIP Terminal Interface Spec (ISO 8583)

Table of Contents

Preface .................................................................................................................................................. xi

Organization .......................................................................................................................................... xi

Related Documents............................................................................................................................... xii

1.0 Introduction to Credit Authorization ................................................................................. 1

1.1 Overview ................................................................................................................................ 1

1.2 Shadow File Processing ......................................................................................................... 1

1.3 Industry-Specific Special Processing ..................................................................................... 2

1.4 Card Acceptance Guidelines .................................................................................................. 3

1.5 Prepaid Card Partial Authorization & Authorization with Balance Return ........................... 4

1.5.1 Partial Authorization .............................................................................................................. 4

1.5.2 Authorization with Balance Return ........................................................................................ 5

1.6 Expresspay ............................................................................................................................. 6

2.0 Introduction to Plural Interface Processing (PIP) ............................................................ 7

2.1 Overview ................................................................................................................................ 7

2.2 American Express Capture Host ............................................................................................ 8

3.0 Express 3000 PIP Interface Messages............................................................................... 11

3.1 Overview of ISO 8583 Messages ......................................................................................... 12

3.2 Terminal Identification Data Fields ..................................................................................... 14

3.3 Authorization Only Messages .............................................................................................. 15

3.4 Financial Capture Messages ................................................................................................. 17

3.5 File Update Messages .......................................................................................................... 20

3.6 Reversal Messages ............................................................................................................... 21

3.7 Reconciliation Messages ...................................................................................................... 23

3.8 Recommended Time-Out Values ......................................................................................... 24

3.8.1 Web Services IP Payments Gateway, High-Speed Internet Connection .............................. 24

3.8.2 Dial-Up Communications .................................................................................................... 24

April 22, 2011 POS020055 vii

This document contains sensitive, confidential and trade secret information, and must not be disclosed to third parties

without the express prior written consent of American Express Travel Related Services Company, Inc.

PIP Terminal Interface Spec (ISO 8583) American Express Proprietary & Confidential

Table of Contents

4.0 Standard Process Flow Diagrams (Capture Host) ........................................................... 25

4.1 Authorizations — Normal Processing .................................................................................. 26

4.2 Authorizations — Reversal Processing ................................................................................ 26

4.3 Financial Transactions — Normal Processing...................................................................... 27

4.4 Financial Transactions — Referral Processing ..................................................................... 28

4.5 Financial Transactions — Advice Processing (Normal) ...................................................... 29

4.6 Financial Transactions — Advice Processing (Time-Out) ................................................... 30

4.7 Financial Transactions — Reversal Processing .................................................................... 31

4.8 File Updates — Time-Out Processing .................................................................................. 33

4.9 Reconciliation Messages ......................................................................................................33

4.10 Reconciliation Time-Out Processing .................................................................................... 33

4.11 Close Batch — Normal Processing ...................................................................................... 33

4.12 Close Batch — Error Processing .......................................................................................... 34

5.0 Stand-In Process Flow Diagrams (GAN) .......................................................................... 35

5.1 Authorizations — GAN Normal Processing ........................................................................ 36

5.2 Authorizations — GAN Reversal Processing....................................................................... 37

5.3 Financial Transactions — GAN Normal Processing ............................................................ 39

5.4 Financial Transactions — GAN Referral Processing ........................................................... 40

5.5 Financial Transactions — GAN Advice Processing (Normal) ............................................. 41

5.6 Financial Transactions — GAN Advice Processing (Time-Out) ......................................... 42

5.7 Financial Transactions — GAN Reversal Processing .......................................................... 43

5.8 Other Message Formats ........................................................................................................ 45

6.0 ISO 8583 Message Formats................................................................................................ 47

6.1 Guidelines for Using the ISO 8583 Format .......................................................................... 47

6.2 Variations from ISO 8583 .................................................................................................... 48

6.3 ISO 8583 Message Bit Map Table........................................................................................ 48

viii POS020055 April 22, 2011

This document contains sensitive, confidential and trade secret information, and must not be disclosed to third parties

without the express prior written consent of American Express Travel Related Services Company, Inc.

American Express Proprietary & Confidential PIP Terminal Interface Spec (ISO 8583)

Table of Contents

7.0 PIP Terminal Interface Data Fields .................................................................................. 51

7.1 Data Field Descriptions ........................................................................................................ 52

7.2 Data Field/Message Usage Tables ..................................................................................... 130

7.2.1 0100 — Authorization Request .......................................................................................... 131

7.2.2 0110 — Authorization Response........................................................................................ 132

7.2.3 0200 — Financial Transaction Request (Auth & Capture) ................................................ 133

7.2.4 0210 — Financial Transaction Response ........................................................................... 134

7.2.5 0220 — Financial Transaction Advice Request (Capture) ................................................. 135

7.2.6 0230 — Financial Transaction Advice Response ............................................................... 136

7.2.7 0320 — Transaction Upload Advice Request (Terminal-to-Host) ..................................... 137

7.2.8 0330 — Transaction Upload Advice Response .................................................................. 138

7.2.9 0400 — Reversal Request .................................................................................................. 139

7.2.10 0410 — Reversal Response ............................................................................................... 140

7.2.11 0420 — Reversal Advice Request...................................................................................... 141

7.2.12 0430 — Reversal Advice Response ................................................................................... 142

7.2.13 0500 — Reconciliation Request......................................................................................... 143

7.2.14 0510 — Reconciliation Response ...................................................................................... 144

8.0 Edit Tests on Data Input .................................................................................................. 145

8.1 Cardmember Account Number Check Digit Computation* ............................................... 146

8.2 Expiration Date Edit Test ................................................................................................... 148

8.3 Transaction Amount Edit Test ........................................................................................... 148

8.4 ROC Number Edit Test ...................................................................................................... 148

8.5 SOC Number Edit Test ...................................................................................................... 149

8.6 Batch Number Edit Test ..................................................................................................... 149

8.7 Total Amount Edit Test...................................................................................................... 149

8.8 Business Date Edit Test ..................................................................................................... 149

8.9 Tip or Tax Information Edit Test ....................................................................................... 150

8.10 Track 1 or Track 2 Data ..................................................................................................... 150

April 22, 2011 POS020055 ix

This document contains sensitive, confidential and trade secret information, and must not be disclosed to third parties

without the express prior written consent of American Express Travel Related Services Company, Inc.

PIP Terminal Interface Spec (ISO 8583) American Express Proprietary & Confidential

Table of Contents

9.0 Appendix............................................................................................................................ 151

9.1 American Express Cards — Typical Examples .................................................................. 151

9.2 American Express Magnetic Stripe Formats ...................................................................... 152

9.2.1 ANSI X4.16 Standard ......................................................................................................... 153

9.2.2 ISO 7813 Standard.............................................................................................................. 153

9.2.3 New Definitions and Values ............................................................................................... 154

9.2.4 ANSI X4.16 / ISO 7813Track 1 Message Formats ............................................................ 155

9.2.5 ANSI X4.16 / ISO 7813Track 2 Message Formats ............................................................ 170

9.3 Expresspay Pseudo-Magnetic Stripe Formats .................................................................... 183

9.4 Typical Prepaid Card Partial Authorization & Authorization with Balance Return

Process Flows ..................................................................................................................... 185

9.4.1 Partial Authorization Scenarios .......................................................................................... 186

9.4.2 Authorization with Balance Return Scenarios .................................................................... 191

9.5 Currency Codes .................................................................................................................. 196

9.6 Street Codes ........................................................................................................................ 202

9.7 ISO Account Number Ranges ............................................................................................ 205

10.0 Glossary ............................................................................................................................. 207

11.0 EBCDIC & ASCII Code Translation Table .................................................................... 211

x POS020055 April 22, 2011

This document contains sensitive, confidential and trade secret information, and must not be disclosed to third parties

without the express prior written consent of American Express Travel Related Services Company, Inc.

American Express Proprietary & Confidential PIP Terminal Interface Spec (ISO 8583)

Preface

This document is addressed to systems programmers and terminal engineers who design data capture

systems to be used with the American Express PIP terminal interface. This document defines the re-

quirements of the American Express terminal-to-host interface for non-American Express POS data

capture terminals. The term PIP (Plural Interface Processing) implies that transactions can be captured

and settled with American Express.

American Express will certify non-American Express owned POS terminals that conform to this speci-

fication, and allow those terminals to access the American Express network for capturing American

Express charges, and other charges as opted for by the Merchant.

To be certified, you must request the certification script from the Manager of the POS Engineering

Department. This script contains the instructions for conducting the test. Once you have passed, you

will be certified on the American Express system. Subsequent revised terminal versions may be sub-

mitted for retesting. Revisions that are not submitted for retesting may be decertified if they do not

conform to this specification.

Organization

This document contains the following sections:

1.0 Introduction to Credit Authorization

2.0 Introduction to Plural Interface Processing (PIP)

3.0 Express 3000 PIP Interface Messages

4.0 Standard Process Flow Diagrams (Capture Host)

5.0 Stand-In Process Flow Diagrams (GAN)

6.0 ISO 8583 Message Formats

7.0 PIP Terminal Interface Data Fields

8.0 Edit Tests on Data Input

9.0 Appendix

10.0 Glossary

11.0 EBCDIC & ASCII Code Translation Table

April 22, 2011 POS020055 xi

This document contains sensitive, confidential and trade secret information, and must not be disclosed to third parties

without the express prior written consent of American Express Travel Related Services Company, Inc.

PIP Terminal Interface Spec (ISO 8583) American Express Proprietary & Confidential

Related Documents

• Web Services IP Payments Gateway HTTPS Communication Guide (POS020052)

• American Express Dial-Up Communication Guide (POS020086)

• International Standard ISO 8583:1987, Financial Transaction Card Originated Interchange

Messages — Interchange Message Specifications

• International Standard ISO/IEC 7813, Identification Cards — Financial Transaction Cards

(Track I and Track II Specifications)

• American National Standards Institute ANSI X4.16, Financial Transaction Cards — Magnetic

Stripe Encoding

xii POS020055 April 22, 2011

This document contains sensitive, confidential and trade secret information, and must not be disclosed to third parties

without the express prior written consent of American Express Travel Related Services Company, Inc.

American Express Proprietary & Confidential PIP Terminal Interface Spec (ISO 8583)

1.0 Introduction to Credit Authorization

1.1 Overview

The American Express PIP Capture Host is a sophisticated system that provides two methods of proc-

essing. Shadow file processing is used for retail and restaurant applications, which incorporates the

best features of host- and terminal-based EDC processing. Primarily, this allows the system to perform

host-based processing, in which the terminal is always assumed financially correct. This means that at

settlement time, if the Capture Host’s batch balances with the terminal’s reconciliation, then the shadow

file is submitted for payment. If the terminal does not balance with the Capture Host, then the shadow

file is replaced with the terminal’s batch.

Store and forward processing is used for Lodging, Purchasing Card, Travel (Sign & Travel) and Auto

Rental applications, and is a typical, terminal-based capture system. This method of processing allows

the establishment to perform authorizations as needed, and then settle the batch later.

1.2 Shadow File Processing

The Capture Host maintains a copy of the batch by recording each transaction that is processed by the

terminal. When transactions are approved, they are recorded and may be used for settlement, when

the terminal has successfully reconciled with the Capture Host. The terminal is responsible for updating

the Capture Host of all financial transactions including off-line sales, adjustments and voids.

Retail minimum transaction set:

• Close Batch

• Off-Line Sale

• Refund

• Sale

• Void

Restaurant minimum transaction set:

• Close Batch

• Debit Adjustment

• Off-Line Sale

• Refund

• Sale

• Void

April 22, 2011 POS020055 1

This document contains sensitive, confidential and trade secret information, and must not be disclosed to third parties

without the express prior written consent of American Express Travel Related Services Company, Inc.

PIP Terminal Interface Spec (ISO 8583) American Express Proprietary & Confidential

1.3 Industry-Specific Special Processing

1.3.1 Lodging Processing

Lodging processing is supported by the American Express Capture Host and uses a simple store and

forward method for submitting batches. Authorization transactions are allowed from a Lodging termi-

nal. Sales and other 02x0 message type transactions are not allowed.

1.3.2 Purchase Card Processing

The American Express Capture Host supports Purchasing Card applications. These applications are

intended for Merchants who supply goods and services for companies. This allows companies to issue

cards to their employees who purchase small dollar items, and allows them to circumvent the lengthy,

paper process associated with POS.

Like the Lodging application, Purchasing Card uses a similar store and forward method.

1.3.3 Auto Rental Processing

Auto Rental Processing is supported by the American Express Capture Host, and it uses a simple store

and forward method for submitting batches. Authorization transactions are allowed from an Auto Rental

terminal. Sales and other 02x0 message type transactions are not allowed.

Note: This application may only be used when the rental and return locations are the same.

1.3.4 Travel (Sign & Travel) Processing

The American Express Capture Host supports the American Express Travel (Sign & Travel) application,

which allows Cardmembers to request extended payments for Travel purchases.

Like the Lodging application, Travel uses a similar store and forward method.

2 POS020055 April 22, 2011

This document contains sensitive, confidential and trade secret information, and must not be disclosed to third parties

without the express prior written consent of American Express Travel Related Services Company, Inc.

American Express Proprietary & Confidential PIP Terminal Interface Spec (ISO 8583)

1.4 Card Acceptance Guidelines

American Express Card creation standards for magnetic stripe layouts may include additional data

undefined in currently published American Express implementations of ANSI X4.16 and ISO 7813

formats. Magnetic stripe data fields in current use will not be moved; however, discretionary or

unused fields may be redefined for use with future American Express Card products. Therefore, the

subfield definitions referenced in Section 8.1 are for reference only and may not reflect all American

Express Card variations that may be encountered. For this reason, when Track 1 or Track 2 data is

read from a magnetic stripe, the acquirer, their devices, systems, software, and terminal and software

vendors should capture all characters between the start and end sentinels, strip off the sentinels and

LRC, and forward the remainder to American Express in the appropriate ISO 8583 Track 1 Data or

Track 2 Data field, without regard to the specific lengths referenced in Section 8.1. For more infor-

mation, see American Express Magnetic Stripe Formats and Expresspay Pseudo-Magnetic Stripe

Formats beginning on pages 152 and 183.

If the Merchant’s system supports capture of both Track 1 and Track 2, both tracks should be forwarded.

If only one track is captured, Track 1 is preferred (see page 90). For systems that capture only Track 2,

this less desirable alternative may be supplied in lieu of Track 1 (see page 74). American Express

security requirements prohibit the storage of track data within Merchant or processor systems. Character

spaces should not be stripped. In addition, data should not be padded to standardize track lengths, and

it should be transmitted as read.

The Authorization Request Message contains the Point of Service Entry Mode (Field 22) that describes

point-of-service processing capabilities (see page 70). Merchants, and terminal and software vendors,

are strongly advised to ensure that authorization data is accurate.

For more information, please contact your American Express representative.

April 22, 2011 POS020055 3

This document contains sensitive, confidential and trade secret information, and must not be disclosed to third parties

without the express prior written consent of American Express Travel Related Services Company, Inc.

PIP Terminal Interface Spec (ISO 8583) American Express Proprietary & Confidential

1.5 Prepaid Card Partial Authorization & Authorization with

Balance Return

The Prepaid Card Partial Authorization and Authorization with Balance Return programs are designed

to help Merchants provide Card balance information to American Express Prepaid Cardholders at the

point of sale. ISO 8583 formatted messages are exchanged to determine available funds and help the

Merchant successfully complete Prepaid Card transactions in a timely manner.

Please note that the Partial Authorization and Authorization with Balance Return programs only apply

to American Express Prepaid Cards. Merchants that participate are not required to know which

American Express products are prepaid. Instead, their authorization systems are modified using this

specification to indicate their ability to support these features. American Express returns specified

information for transactions that qualify. Otherwise, responses will be the same as those received

today.

American Express strongly recommends Partial Authorization; because a request is approved for the

remaining balance, rather than declined, when insufficient funds remain to cover the original amount.

Note: For typical process flows and examples see page 185.

1.5.1 Partial Authorization

The Partial Authorization program allows American Express to authorize a transaction for a value

less than the original, Merchant-requested amount. Partial Authorization is used when a Prepaid Card

has insufficient funds to cover the original amount of the request. And, rather than receiving a denial

message, the transaction is approved for the balance remaining on the Card.

An approved Authorization Response includes two separate amount fields — one that shows the value

actually approved, and another that echoes the original amount requested. These values allow the

Merchant to determine how much must be collected from the customer to complete the transaction.

The Merchant can then collect the outstanding amount of the transaction from the Cardholder, via

another form of payment. The advantage of this function is that all of this information is provided to

the Merchant and Cardholder in one authorization request/response message exchange.

In addition, the remaining-balance is returned, which allows the Merchant to print or display the

amount remaining on the prepaid Card product (if any).

In 0100 and 0200 messages, Function Code “181” is transmitted in Field 47 (Additional Data -

National) to indicate that a Merchant accepts Partial Authorizations. The approved amount is returned

in Field 4 (Amount, Transaction) of the 0110 or 0210 response message. The original requested

authorization amount is returned in Field 47 (Additional Data - National); and the available amount

remaining on the Card (including a zero balance) is returned in Field 54 (Amounts, Additional).

4 POS020055 April 22, 2011

This document contains sensitive, confidential and trade secret information, and must not be disclosed to third parties

without the express prior written consent of American Express Travel Related Services Company, Inc.

American Express Proprietary & Confidential PIP Terminal Interface Spec (ISO 8583)

1.5.2 Authorization with Balance Return

As an alternative to the Partial Authorization program, American Express offers the Authorization

with Balance Return program.

The Authorization with Balance Return program allows Merchants that choose not to use the Partial

Authorization Program to receive the Prepaid Card balance on the 0110 or 0210 response message.

Field 47 (Additional Data - National) of the 0100 or 0200 message is used to identify an Authori-

zation with Balance Return request. The available balance is returned to the Merchant in Field 54

(Amounts, Additional) in the 0110 or 0210 response message, even if the transaction is denied. Trans-

actions that are denied for insufficient funds can be resubmitted for an amount equal to or less than

the remaining balance provided in the 0110 or 0210 response message.

Merchants should develop internal instructions for using the Prepaid Card Partial Authorization or

Authorization with Balance Return Programs at their point of sale. American Express will allow

authorized Merchants that conform to this specification and pass our certification tests to access the

American Express network to acquire Partial Authorization or Authorization with Balance Return.

Terminal and software vendors must develop support for both Partial Authorization and Authorization

with Balance Return functionalities in order to provide the ability for their Merchants to utilize either

program. Additional information may be obtained from your American Express representative.

Note: Prepaid Card Balance Inquiry may also be performed utilizing either the Partial Authorization

or the Authorization with Balance Return program. This can be done by simply entering an amount of

zero in the Field 4 (Amount, Transaction). The transaction will be approved, and the available balance

is returned in Field 54 (Amounts, Additional). A new authorization request can then be created for an

amount equal to or less than the remaining balance.

April 22, 2011 POS020055 5

This document contains sensitive, confidential and trade secret information, and must not be disclosed to third parties

without the express prior written consent of American Express Travel Related Services Company, Inc.

PIP Terminal Interface Spec (ISO 8583) American Express Proprietary & Confidential

1.6 Expresspay

If supporting Expresspay, Merchants and vendor software must support Magstripe Mode.

It is mandatory for US Software and Terminal Vendors to certify they can pass Expresspay data.

In order to submit transactions from Expresspay Cards for authorization and settlement, the Merchant or

US Software and Terminal Vendors must submit data to American Express in the formats prescribed

in this guide.

Expresspay Requirements

Magstripe Mode

• Track 1 (Field 45) and/or Track 2 (Field 35) must be present. For information on Expresspay Pseudo-Magnetic Stripe Formats, see

page 183.

• POS Data Code (Field 22)

– Position 1 = “0” (Contactless transactions, including American Express Expresspay)

– Position 2 = “2” (Magnetic strip read; Track 1 and/or Track 2)

Notes:

1. Expresspay transactions must originate at a contactless reader and cannot be manually keyed.

2. It is important to note that pseudo-magnetic stripe data from a chip card contactless reader differs slightly from track data obtained

from a magnetic stripe read. For this reason, when Magstripe Mode, Track 1 and/or Track 2 pseudo-magnetic stripe data is supplied

intact, the start and end sentinels should be stripped off; and all remaining characters between the sentinels (including the Interchange

Designator and Service Code) should be forwarded to American Express without alteration, in the appropriate ISO 8583 Track 1

and/or Track 2 field (Data Fields 45 and/or 35, respectively). For complete lists of allowable Interchange Designator/Service Code

combinations, see pages 162 and 174, respectively.

6 POS020055 April 22, 2011

This document contains sensitive, confidential and trade secret information, and must not be disclosed to third parties

without the express prior written consent of American Express Travel Related Services Company, Inc.

American Express Proprietary & Confidential PIP Terminal Interface Spec (ISO 8583)

2.0 Introduction to Plural Interface Processing (PIP)

2.1 Overview

The primary function of a Plural Interface Processing (PIP) terminal is to interface with American

Express and other card acquirers. PIP capability allows the terminal to transmit transaction data

directly to American Express (or other card acquirers) for authorizations and financial settlement

between the Merchant, card acquirers and Cardmembers. PIP terminals may also have access to other

transaction services such as check guarantee services.

The benefits realized by a Merchant that uses a PIP terminal or device include:

• Only one terminal is needed to authorize and settle transactions with American Express and other

card acquirers.

• The Merchant may qualify for reduced transaction costs and a better discount rate by transmitting

directly to card acquirers.

Message types processed and/or captured through the American Express PIP Interface include:

• Authorizations

• Sales

• Refunds

• Voids

• Debit and Credit Adjustments

• Debit and Credit File Updates

• Reversals

• Financial Reconciliation (Settlement)

The messages used to process these transactions are described in Section 3.0, Express 3000 PIP

Interface Messages. The logical processing flows for these messages are illustrated in Section 4.0,

Standard Process Flow Diagrams (Capture Host) and Section 5.0, Stand-In Process Flow Diagrams

(GAN). For more information on the American Express GAN, see page 35.

April 22, 2011 POS020055 7

This document contains sensitive, confidential and trade secret information, and must not be disclosed to third parties

without the express prior written consent of American Express Travel Related Services Company, Inc.

PIP Terminal Interface Spec (ISO 8583) American Express Proprietary & Confidential

2.2 American Express Capture Host

The American Express Capture Host receives and processes message transmitted from the Merchant’s

terminal. If the Capture Host is unavailable, the American Express Global Authorization Network

(GAN) system may substitute for the Capture Host and respond to the terminal. For more information

on the American Express GAN, see page 35.

The Capture Host performs several interface activities:

• Approves or refers authorization requests.

• Maintains a transaction shadow file for the terminal.

• Adds and updates terminal problems to a trouble list.

• Reconciles and closes batches from the terminal.

• Supports suspended batches.

• Settles batches with the financial settlement and payment systems.

2.2.1 Authorization Requests

The terminal transmits authorization requests to the Capture Host. The Capture Host performs a check

digit computation on the account number to verify that the number is a valid American Express account

number. (For check-digit computation instructions, see page 146).

2.2.2 Transaction Shadow Files

The Capture Host maintains and stores a shadow file that contains all transactions processed through

American Express for each terminal. All the transactions stored in a terminal at any one time are called

a batch of transactions. The shadow file plays an active role when closing a terminal’s batch.

When a terminal’s batch is closed, the terminal transaction count, and sales and refund totals must

match the Capture Host shadow file totals. If the totals do not match, the Capture Host transmits a

request for the terminal to upload all transactions stored in the terminal, and it places them in a new

shadow file, thus overwriting the original shadow file.

8 POS020055 April 22, 2011

This document contains sensitive, confidential and trade secret information, and must not be disclosed to third parties

without the express prior written consent of American Express Travel Related Services Company, Inc.

American Express Proprietary & Confidential PIP Terminal Interface Spec (ISO 8583)

2.2.3 Terminal Problem Trouble List

When placed on the trouble list, a terminal appears to be operational to the Merchant; but it cannot

process American Express transactions, until the problem is cleared from the list.

Some typical problems that may appear on the trouble list include the following:

• Invalid Card Capture Type — The types of message requests that can be transmitted from a

terminal to the Capture Host are assigned to the terminal, specific to card type. See below:

– Example 1 — If the terminal is set up to transmit sale capture requests on American Express

Cards, and an authorization-only request for an American Express Card is sent; the card

capture type is invalid, and the terminal is placed on the trouble list.

– Example 2 — If the terminal is set up to transmit authorization-only requests (non-capture),

and a sale capture request is sent; the card capture type is invalid, and the terminal is placed

on the trouble list.

• Unrecognized Descriptor Code(s) in Private Use Data (Field 61) — American Express assigns a

series of two-digit, Item Descriptor Codes to each terminal. These codes describe the merchandise

or services purchased using a specific terminal. If a code is transmitted that American Express

does not recognize, the terminal is placed on the trouble list.

• Invalid Batch Number in Private Use Data (Field 60) — A unique batch number must be assigned

to each batch. This entry must be all numerals and cannot be “000000” or “999999”. If the batch

number is invalid, the terminal is placed on the trouble list.

• Incorrectly Formatted Message — If mandatory data is missing or a field is incorrectly formatted,

the terminal is placed on the trouble list. Some examples are:

– Alpha characters present in a numeric-only field.

– Data length is not the specified size.

– Mandatory field is missing.

• Invalid Batch Request — If the terminal attempts to close a batch when none is open, it is placed

on the trouble list.

• Terminal and Shadow File Totals Do Not Match — When a terminal attempts to close a batch,

the Capture Host compares the totals at the terminal with those in its shadow file. If they do not

match, the terminal will be placed on the trouble list. On the next attempt to reconcile, the Capture

Host will request that the terminal upload all transactions to a new shadow file.

April 22, 2011 POS020055 9

This document contains sensitive, confidential and trade secret information, and must not be disclosed to third parties

without the express prior written consent of American Express Travel Related Services Company, Inc.

PIP Terminal Interface Spec (ISO 8583) American Express Proprietary & Confidential

2.2.4 Reconciling and Closing Batches at the Terminal

The POS operator at the establishment initiates the procedure to close (settle) a batch at the terminal.

The terminal notifies the Capture Host that it is closing the batch, and that the totals reflect the debits

and credits for the current batch.

When the Capture Host receives the close batch request, it compares the totals in the terminal’s request

to those in the shadow file. If the figures agree, the batch in the Capture Host is marked as closed, and

a close batch response is sent to the terminal. A text message is also sent from the Capture Host to the

terminal’s display.

If the figures do not agree, the terminal will be placed on the trouble list. On the next attempt to recon-

cile, the Capture Host instructs the terminal to upload all the details for the batch. The Capture Host

compares the figures received during the upload request with the totals transmitted by the terminal

during the original close request. If those totals match, the Capture Host overlays its current batch

figures in the shadow file with all the transaction details received during the upload. The terminal

transmits another close request, and the Capture Host compares the totals in the close request to the

new uploaded totals. If those figures match, the Capture Host closes the batch.

Once the batch is closed at the terminal, it must be deleted from the terminal’s memory.

If the uploaded details do not balance with the totals sent from the terminal in the original request, the

Capture Host automatically blocks any activities for that batch. In addition, any errors received during

the entire settlement process will result in the Capture Host blocking out terminal activities and notify-

ing American Express.

2.2.5 Financial Settlement

The Capture Host settles its closed batches with one of the various systems used for financial settle-

ment and payment to Merchants. The closed batches are sent for settlement via a submission file.

10 POS020055 April 22, 2011

This document contains sensitive, confidential and trade secret information, and must not be disclosed to third parties

without the express prior written consent of American Express Travel Related Services Company, Inc.

American Express Proprietary & Confidential PIP Terminal Interface Spec (ISO 8583)

3.0 Express 3000 PIP Interface Messages

This section contains the following topics:

3.1 Overview of ISO 8583 Messages

3.2 Terminal Identification Data Fields

3.3 Authorization Only Messages

3.4 Financial Capture Messages

3.5 File Update Messages

3.6 Reversal Messages

3.7 Reconciliation Messages

3.8 Recommended Time-Out Value

April 22, 2011 POS020055 11

This document contains sensitive, confidential and trade secret information, and must not be disclosed to third parties

without the express prior written consent of American Express Travel Related Services Company, Inc.

PIP Terminal Interface Spec (ISO 8583) American Express Proprietary & Confidential

3.1 Overview of ISO 8583 Messages

Important Note for Web Services IP Payments Gateway Users: ISO 8583 messages created per

this specification must be converted to binary coded decimal (BCD) and hexadecimal configura-

tion before being transmitted as an ASCII string to the American Express IP Payments Gateway.

Similarly, ASCII files returned from American Express will be in binary coded decimal (BCD)

and hexadecimal configuration and may require conversion to a format compatible with the

Merchant’s terminal/system.

The ISO 8583 standard defines a bit-mapped message format. The first ten bytes of a message are

composed of a four-byte message type code that identifies the type of transaction being transmitted

and an eight-byte bit map that indicates the data fields that immediately follow. These two fields

always precede the transaction data in each message.

Each digit of the message type code identifies a message attribute. Definitions of the attributes are:

• First position / Version Number — This number is always “0” (zero).

• Second position / Message Class — The message classes used by the American Express PIP

interface are:

1 = Authorization

2 = Financial Capture

3 = File Update

4 = Reversals

5 = Reconciliation

8 = Maintenance

• Third position / Message Function

0 = Request

1 = Response to a Request

2 = Advice

3 = Response to an Advice

4 = Notification

5-9 = Reserved for ISO use

• Fourth position / Transaction Originator — This digit is always “0” (zero) for American

Express PIP interface requests and responses.

12 POS020055 April 22, 2011

This document contains sensitive, confidential and trade secret information, and must not be disclosed to third parties

without the express prior written consent of American Express Travel Related Services Company, Inc.

American Express Proprietary & Confidential PIP Terminal Interface Spec (ISO 8583)

3.1 Overview of ISO 8583 Messages (Continued)

The bit map (which indicates the data fields used in a message) is eight bytes (64 bits) long. Each bit

represents a data field defined in this specification, and contains either the value “1” to indicate the

presence of the field or a “0” (zero) to indicate its absence. The binary indicators are then translated

to hexadecimal notation.

The first ten bytes of a typical message are shown below. Message type code “0200” (in binary coded

decimal [BCD] format) appears in the first two bytes (highlighted in positions 1 and 2), and indicates

that this is a financial capture request (a.k.a., sale transaction). The remaining 8 bytes contain the

primary bit map (in hexadecimal notation). For details on how to populate a bit map, see page 57.

Message: 02 00 30 20 05 80 20 C8 80 00

Position: 1 2 3 4 5 6 7 8 9 10

This specification contains information on each transaction used by the American Express PIP inter-

face, and only those fields used by American Express are included. Additional information on the ISO

standard and/or ISO field definitions is available in International Standard ISO 8583.

In addition to ISO 8583-defined, standard data fields, several Private Use fields are used to transport

unique, American Express requirements. Also, some Private Use fields may be redefined for different

transactions, depending on the message type specified. For example, Private Use Data, Field 63 may

contain batch count and amount subfields for some message types and industry-specific transaction

information subfields for others.

For more information, see PIP Terminal Interface Data Fields section, beginning on page 51.

April 22, 2011 POS020055 13

This document contains sensitive, confidential and trade secret information, and must not be disclosed to third parties

without the express prior written consent of American Express Travel Related Services Company, Inc.

PIP Terminal Interface Spec (ISO 8583) American Express Proprietary & Confidential

3.2 Terminal Identification Data Fields

American Express assigns the identification data fields, listed below, to each terminal and/or Merchant/

Service Establishment.

3.2.1 Field 41 — Card Acceptor Terminal Identification

American Express assigns an eight-digit, Card Acceptor Terminal Identification code (a.k.a., Terminal

ID) to every terminal that accesses the American Express PIP Interface. The Terminal ID uniquely

identifies the terminal to the Capture Host and must appear in the Field 41 of all messages. For details,

see page 82.

3.2.2 Field 42 — Card Acceptor Identification Code

American Express assigns a Card Acceptor Identification Code (a.k.a., Merchant ID, which is typically

the 10-digit, American Express Service Establishment/SE Number) to every Merchant that accepts

American Express Cards. This number must appear in Field 42 of all Merchant-generated request

messages sent to American Express. For details, see page 83.

3.2.3 Field 61 — Private Use Data

American Express assigns a series of two-digit, Transaction Item Descriptor Codes to each terminal.

These values are entered in Private Use Data, Field 61. These codes, when cross-referenced to

American Express descriptor tables, describe the merchandise or services purchased using a specific

terminal. Descriptor codes are approved by American Express before the terminal is permitted to

access the American Express PIP Interface, and must be provided in Field 61 in every Financial

Capture, Batch Upload and Financial Reversal message, as stipulated in the Field Requirement table

on page 114.

14 POS020055 April 22, 2011

This document contains sensitive, confidential and trade secret information, and must not be disclosed to third parties

without the express prior written consent of American Express Travel Related Services Company, Inc.

American Express Proprietary & Confidential PIP Terminal Interface Spec (ISO 8583)

3.3 Authorization Only Messages

An authorization is defined as an approval of a transaction, given by the card or check issuer. The

terminal does not capture approval authorizations, only transactions for settlement.

Transactions processed using authorization-only messages are:

• Authorizations

• American Express Travelers Cheque Verifications

• Authorization Voids

3.3.1 Authorizations

An authorization is a transaction approval from the card issuer to a Merchant/Service Establishment

(SE). An approval code is provided as proof of authorization. Authorization type transactions are not

captured for settlement (see Sale Transaction on page 17). Therefore, this message-type cannot be

assigned (in the terminal) to card-types that rely on the Capture Host to capture and settle the infor-

mation. For example, within the same terminal, American Express Cards cannot be processed using

both authorization and sale transactions.

Note: Authorization messages are supported for Lodging, Auto Rental and eCommerce/Mail

Order applications only.

3.3.2 American Express Travelers Cheque Verifications

American Express Travelers Cheques can be verified using the American Express PIP Interface. This

verification reduces the fraudulent use of Travelers Cheques.

3.3.3 Authorization Voids

The Authorization Void is used to reverse an authorization-only transaction that was previously

processed through the terminal.

April 22, 2011 POS020055 15

This document contains sensitive, confidential and trade secret information, and must not be disclosed to third parties

without the express prior written consent of American Express Travel Related Services Company, Inc.

PIP Terminal Interface Spec (ISO 8583) American Express Proprietary & Confidential

3.3.4 Message Formats

The American Express PIP Interface utilizes Authorization Request (0100) and Authorization Response

(0110) Messages. Different fields and data may be required in each message, depending on the type of

transaction authorized.

• Authorization Request (0100) Message

– Authorization Request

– American Express Travelers Cheque Authorization Request

– Authorization Void Request

• Authorization Response (0110) Message

– Authorization Response

– American Express Travelers Cheque Authorization Response

– Authorization Void Response

Note: See Data Field/Message Usage Tables beginning on page 130.

16 POS020055 April 22, 2011

This document contains sensitive, confidential and trade secret information, and must not be disclosed to third parties

without the express prior written consent of American Express Travel Related Services Company, Inc.

American Express Proprietary & Confidential PIP Terminal Interface Spec (ISO 8583)

3.4 Financial Capture Messages

Financial capture messages are stored (captured) in the terminal and at the Capture Host. These

messages are later used by the Merchant/Service Establishment to settle with card issuer or acquirer

and receive payment. An explanation of transaction types that are captured appears below.

3.4.1 Sale Transaction

A sale is a transaction that is transmitted for authorization and, if approved, is captured for settlement.

An approval code is provided, if the transaction is authorized/approved.

3.4.2 Refund Transaction

A refund is a credit transaction that is captured and (later) posted for settlement.

3.4.3 Void Transaction

A void is used to cancel a sale or refund transaction within the current batch in the terminal. A void

cannot be used to cancel a transaction in a closed batch.

3.4.4 Sale Completion

A sale completion is commonly used in an authorization voice referral, where the terminal directs the

POS operator at the Merchant location to call the card issuer for authorization. If the transaction is

authorized during that call, the terminal automatically prompts the POS operator to enter the approval

code manually. The entire transaction, including the new approval code, is transmitted later as a sale

completion, in conjunction with an on-line sale or authorization.

April 22, 2011 POS020055 17

This document contains sensitive, confidential and trade secret information, and must not be disclosed to third parties

without the express prior written consent of American Express Travel Related Services Company, Inc.

PIP Terminal Interface Spec (ISO 8583) American Express Proprietary & Confidential

3.4.5 Off-Line Sale Transaction

An off-line sale transaction is normally used by a Merchant/Service Establishment that has already

obtained an authorization for a transaction, but is accumulating transactions for reconciliation and

posting. Each off-line sale transaction can later be transmitted to the host in conjunction with an

approved on-line sale or authorization. The benefit is that two transactions (one on-line and one

off-line) are sent to the host in one call.

3.4.6 Debit Adjustment

A debit adjustment is an additional charge associated with an existing transaction in the terminal. For

example, when a restaurant charge is first authorized, it may not include the tip. The tip is processed

later as a debit adjustment. The transmission scheme of debit adjustments is identical to off-line sale

transactions, where the message is later transmitted with an approved on-line sale or authorization.

3.4.7 Off-Line Void Transaction

An off-line void transaction is processed and transmitted in the same manner as a debit adjustment,

except that the transaction amount in the Amount, Transaction (Field 4) is set to zero (0).

3.4.8 Credit Adjustment

A credit adjustment is an additional credit associated with an existing transaction in the batch. A credit

adjustment uses the same transmission scheme as a debit adjustment.

3.4.9 Off-Line Refund Transaction

A refund may be entered off-line to accumulate refund transactions. The terminal can transmit each

refund in conjunction with an approved on-line sale or authorization request to the host.

18 POS020055 April 22, 2011

This document contains sensitive, confidential and trade secret information, and must not be disclosed to third parties

without the express prior written consent of American Express Travel Related Services Company, Inc.

American Express Proprietary & Confidential PIP Terminal Interface Spec (ISO 8583)

3.4.10 Message Formats

The American Express PIP Interface utilizes four financial capture messages:

• Financial Transaction Request (0200) Message

– Sale

• Financial Transaction Response (0210) Message

– Sale

• Financial Transaction Advice Request (0220) Message

– Sale Completion

– Off-Line Sale

– Debit Adjustment/Void

– Credit Adjustment/Void

– Off-Line Refund

• Financial Transaction Advice Response (0230) Message

– Sale Completion

– Off-Line Sale

– Debit Adjustment/Void

– Credit Adjustment/Void

– Off-Line Refund

Note: See Data Field/Message Usage Tables beginning on page 130.

April 22, 2011 POS020055 19

This document contains sensitive, confidential and trade secret information, and must not be disclosed to third parties

without the express prior written consent of American Express Travel Related Services Company, Inc.

PIP Terminal Interface Spec (ISO 8583) American Express Proprietary & Confidential

3.5 File Update Messages

The American Express PIP Interface uses file update messages to upload transactions from the terminal

to the Capture Host shadow file, when the terminal’s transactions balance properly with the Merchant/

Service Establishment, but not with the Capture Host’s shadow file.

3.5.1 Message Formats

• Transaction Upload Advice Request (0320) Message (upload batch request, terminal to host)

– Debit

– Credit

• Transaction Upload Advice Response (0330) Message (response message contains a processing

code that prompts the terminal to transmit the next transaction, if another exists)

– Debit

– Credit

The terminal initiates all request messages. The Capture Host transmits all response messages to the

terminal.

Note: See Data Field/Message Usage Tables beginning on page 130.

20 POS020055 April 22, 2011

This document contains sensitive, confidential and trade secret information, and must not be disclosed to third parties

without the express prior written consent of American Express Travel Related Services Company, Inc.

American Express Proprietary & Confidential PIP Terminal Interface Spec (ISO 8583)

3.6 Reversal Messages

The terminal uses a reversal message to nullify the effects of a previous, incomplete financial or

authorization transaction. A reversal message prevents accidental duplication of financial or

authorization transactions in the Capture Host, and it is always used when a time-out occurs at the

terminal during the transmission of a financial or authorization request.