Académique Documents

Professionnel Documents

Culture Documents

Tax 2 Notes

Transféré par

JoyceCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Tax 2 Notes

Transféré par

JoyceDroits d'auteur :

Formats disponibles

November 29, 2017

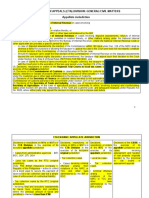

12. Court of Tax Appeals

Jurisdiction: See: Sec 7, RA 9282

a. Exclusive appellate jurisdiction to review by appeal, as herein provided:

"1. Decisions of the Commissioner of Internal Revenue in cases involving

disputed assessments, refunds of internal revenue taxes, fees or other charges,

penalties in relation thereto, or other matters arising under the National Internal

Revenue or other laws administered by the Bureau of Internal Revenue;

"2. Inaction by the Commissioner of Internal Revenue in cases involving disputed

assessments, refunds of internal revenue taxes, fees or other charges, penalties

in relations thereto, or other matters arising under the National Internal Revenue

Code or other laws administered by the Bureau of Internal Revenue, where the

National Internal Revenue Code provides a specific period of action, in which

case the inaction shall be deemed a denial;

"3. Decisions, orders or resolutions of the Regional Trial Courts in local tax cases

originally decided or resolved by them in the exercise of their original or appellate

jurisdiction; (Here - No specific threshold for amount)

- These are cases elevated to RTC then elevated to CTA

o READ!

"4. Decisions of the Commissioner of Customs in cases involving liability for

customs duties, fees or other money charges, seizure, detention or release of

property affected, fines, forfeitures or other penalties in relation thereto, or other

matters arising under the Customs Law or other laws administered by the Bureau

of Customs;

"5. Decisions of the Central Board of Assessment Appeals in the exercise of its

appellate jurisdiction over cases involving the assessment and taxation of real

property originally decided by the provincial or city board of assessment appeals;

"6. Decisions of the Secretary of Finance on customs cases elevated to him

automatically for review from decisions of the Commissioner of Customs which

are ADVERSE to the Government under Section 2315 of the Tariff and

Customs Code;

"7. Decisions of the Secretary of Trade and Industry, in the case of

nonagricultural product, commodity or article, and the Secretary of Agriculture in

the case of agricultural product, commodity or article, involving dumping and

countervailing duties under Section 301 and 302, respectively, of the Tariff and

Customs Code, and safeguard measures under Republic Act No. 8800, where

either party may appeal the decision to impose or not to impose said duties.

b. Jurisdiction over cases involving criminal offenses as herein provided:

"1. Exclusive original jurisdiction over all criminal offenses arising from violations

of the National Internal Revenue Code or Tariff and Customs Code and other

laws administered by the Bureau of Internal Revenue or the Bureau of Customs:

Provided, however, That offenses or felonies mentioned in this paragraph where

the principal amount o taxes and fees, exclusive of charges and penalties,

claimed is less than One million pesos (P1,000,000.00) or where there is no

specified amount claimed shall be tried by the regular Courts and the

jurisdiction of the CTA shall be appellate. Any provision of law or the Rules of

Court to the contrary notwithstanding, the criminal action and the corresponding

civil action for the recovery of civil liability for taxes and penalties shall at all times

be simultaneously instituted with, and jointly determined in the same proceeding

by the CTA, the filing of the criminal action being deemed to necessarily carry

with it the filing of the civil action, and no right to reserve the filling of such civil

action separately from the criminal action will be recognized.

- If taxes claimed is less than 1M = regular courts; CTA has appellate

jurisdiction

- If > 1M ; file with CTA

"2. Exclusive appellate jurisdiction in criminal offenses:

"a. Over appeals from the judgments, resolutions or orders of the

Regional Trial Courts in tax cases originally decided by them, in their

respected territorial jurisdiction.

"b. Over petitions for review of the judgments, resolutions or orders of the

Regional Trial Courts in the exercise of their appellate jurisdiction over

tax cases originally decided by the Metropolitan Trial Courts, Municipal

Trial Courts and Municipal Circuit Trial Courts in their respective

jurisdiction.

"c. Jurisdiction over tax collection cases as herein provided:

"1. Exclusive original jurisdiction in tax collection cases involving final and

executory assessments for taxes, fees, charges and penalties: Provided,

however, That collection cases where the principal amount of taxes and fees,

exclusive of charges and penalties, claimed is less than One million pesos

(P1,000,000.00) shall be tried by the proper Municipal Trial Court, Metropolitan

Trial Court and Regional Trial Court.

"2. Exclusive appellate jurisdiction in tax collection cases:

"a. Over appeals from the judgments, resolutions or orders of the

Regional Trial Courts in tax collection cases originally decided by them,

in their respective territorial jurisdiction.

"b. Over petitions for review of the judgments, resolutions or orders of the

Regional Trial Courts in the Exercise of their appellate jurisdiction over

tax collection cases originally decided by the Metropolitan Trial Courts,

Municipal Trial Courts and Municipal Circuit Trial Courts, in their

respective jurisdiction."

** Remember Reconsideration vs Reinvestigation ; Prescription

Cases:

- Surigao v CTA: used a letter they filed re recomputation to extend the period to file

PET FOR REVIEW TO CTA; Sc: letter clear and definite. Letter did not toll running

- Advertising Assoc: Date of denial is reckoning not the issuance of warrant of distraint/

levy

- What are FINAL DECISIONS appealable to CTA?

Letter indicating that it is the final decision even if wala pang decision talaga from

CIR treated as final decision for appeal to CTA – Allied Banking v CIR

If commissioner denies – go to CTA na

BIR Issuances: RMO / RMC/ BIR Ruling

Secretary of Finance, higher than BIR: Revenue Regulation

Assessment What is on board

If Ruling Process for remedies To Secretary of Finance

Philam Case: Petitioner says under SoF; Respondnet must be reviewed by OP then go to

court; CA: subject to review by CTA; SC: Wide scope to cover other matters; CTA ALSO

HAS POWER OF CERTIORARI, appellate courts also has power to exercise

jurisdiction on certiorari cases

NOTE:

Final Decision: Assessment

If RMC basis for final decision: what is remedy? Go to CTA or go to RTC; go to CTA if

based on assessment

- Can you go to RTC if you have an assessment?

- If you don’t have an assessment? If you question validity and constitutionality go to

RTC

REMEMBER FOR FINALS:

1. CTA Jurisdiction – civil/ criminal – MEMORIZE!

2. Remedies

3. “Other matters”

a. when does it fall under power of the BIR to administer tax ewan

4. RTC

a. Exericise of appellate jurisdiction

b. Constitutionality

c. Ordered pertaining to grave abuse of discretion

Tuesday

Local Tax

Vous aimerez peut-être aussi

- California Supreme Court Petition: S173448 – Denied Without OpinionD'EverandCalifornia Supreme Court Petition: S173448 – Denied Without OpinionÉvaluation : 4 sur 5 étoiles4/5 (1)

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeD'Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeÉvaluation : 1 sur 5 étoiles1/5 (1)

- Taxation Review Notes 2018 20191Document57 pagesTaxation Review Notes 2018 20191Grace Fenilda Jaradal100% (8)

- CTA Jurisdiction SummaryDocument3 pagesCTA Jurisdiction SummaryKevin Patrick Magalona DegayoPas encore d'évaluation

- Dishonour of Cheques in India: A Guide along with Model Drafts of Notices and ComplaintD'EverandDishonour of Cheques in India: A Guide along with Model Drafts of Notices and ComplaintÉvaluation : 4 sur 5 étoiles4/5 (1)

- Notes On Jurisdiction and CTA Proceedings by Prof. Eric RecaldeDocument14 pagesNotes On Jurisdiction and CTA Proceedings by Prof. Eric RecaldeDaisyDianeDeGuzmanPas encore d'évaluation

- US - SEC v. Howey Co., (Full Text) - 328 U.S. 293 (1946) - Justia US Supreme Court CenterDocument9 pagesUS - SEC v. Howey Co., (Full Text) - 328 U.S. 293 (1946) - Justia US Supreme Court CenterJoycePas encore d'évaluation

- Tax ReviewerDocument68 pagesTax Reviewerviva_33Pas encore d'évaluation

- Bar Review Companion: Taxation: Anvil Law Books Series, #4D'EverandBar Review Companion: Taxation: Anvil Law Books Series, #4Pas encore d'évaluation

- Taxation Law - CTADocument7 pagesTaxation Law - CTARia Kriselle Francia PabalePas encore d'évaluation

- RA 9282 Amending RA 1125Document4 pagesRA 9282 Amending RA 1125edwardmlimPas encore d'évaluation

- TAX Remedies (Jurisdiction of Courts, Prescription, Remedies Against Assessment Notice)Document11 pagesTAX Remedies (Jurisdiction of Courts, Prescription, Remedies Against Assessment Notice)KAREENA AMEENAH ACRAMAN BASMANPas encore d'évaluation

- SRC DigestDocument5 pagesSRC DigestJoycePas encore d'évaluation

- AM No 03 1 09 SCDocument4 pagesAM No 03 1 09 SCYour Public Profile100% (2)

- First Batch of Case Digests CIVPRODocument73 pagesFirst Batch of Case Digests CIVPROMiguel ManzanoPas encore d'évaluation

- Saudi Arabian Airlines v. Court of AppealsDocument2 pagesSaudi Arabian Airlines v. Court of AppealsMark Genesis RojasPas encore d'évaluation

- 405 Northwest Airlines vs. CADocument2 pages405 Northwest Airlines vs. CALolit CarlosPas encore d'évaluation

- Rachel C. Celestial V. Jesse Cachopero: FactsDocument4 pagesRachel C. Celestial V. Jesse Cachopero: FactsjuhrizPas encore d'évaluation

- City of Manila vs. Hon. Caridad Grecia-Cuerdo, RTC Pasay Et AlDocument6 pagesCity of Manila vs. Hon. Caridad Grecia-Cuerdo, RTC Pasay Et AlAP CruzPas encore d'évaluation

- Local Taxation RemediesDocument16 pagesLocal Taxation RemediesJordan TumayanPas encore d'évaluation

- Jurisdiction of Cta Enbanc and DivisionDocument12 pagesJurisdiction of Cta Enbanc and DivisionJune Karl CepidaPas encore d'évaluation

- Powers and Duties of The BIRDocument7 pagesPowers and Duties of The BIROliveros DMPas encore d'évaluation

- The Court of Tax AppealsDocument41 pagesThe Court of Tax Appealsmaster386Pas encore d'évaluation

- 1040 Exam Prep Module XI: Circular 230 and AMTD'Everand1040 Exam Prep Module XI: Circular 230 and AMTÉvaluation : 1 sur 5 étoiles1/5 (1)

- Exclusive Appellate Jurisdiction To Review by Appeal, As Herein ProvidedDocument6 pagesExclusive Appellate Jurisdiction To Review by Appeal, As Herein ProvidedMhatz MatienzoPas encore d'évaluation

- Sony Computer Entertainment, Inc. vs. SupergreenDocument3 pagesSony Computer Entertainment, Inc. vs. SupergreenAurea Mhay CallanganPas encore d'évaluation

- In-N-Out Burger Inc. Vs Sehwani, Incorporated and or Benita's Frites Inc.Document17 pagesIn-N-Out Burger Inc. Vs Sehwani, Incorporated and or Benita's Frites Inc.Ron TeodoricoPas encore d'évaluation

- MANACOP V EquitablePCIBank Case DigestDocument4 pagesMANACOP V EquitablePCIBank Case DigestMaria Cristina MartinezPas encore d'évaluation

- 06 Bildner-Vs-Ilusorio PDFDocument12 pages06 Bildner-Vs-Ilusorio PDFFatzie MendozaPas encore d'évaluation

- Unimaster Conglomeration Inc. vs. Court of AppealsDocument3 pagesUnimaster Conglomeration Inc. vs. Court of AppealsDaisyKeith VinesPas encore d'évaluation

- Exceptions To Hearsay RuleDocument2 pagesExceptions To Hearsay RuleJoycePas encore d'évaluation

- Exceptions To Hearsay RuleDocument2 pagesExceptions To Hearsay RuleJoycePas encore d'évaluation

- Course Syllabus in LEA 212Document6 pagesCourse Syllabus in LEA 212Melcon S. Lapina80% (10)

- Ermitano V Paglas G.R. No. 174436Document5 pagesErmitano V Paglas G.R. No. 174436JoycePas encore d'évaluation

- Cases For PrelimDocument49 pagesCases For PrelimDILG XIII- Atty. Robelen CallantaPas encore d'évaluation

- TAX 038 - Jurisdiction of The CTADocument2 pagesTAX 038 - Jurisdiction of The CTAPaul Conrad C. SisicanPas encore d'évaluation

- Republic Act No. 1125 June 16, 1954 An Act Creating The Court of Tax AppealsDocument4 pagesRepublic Act No. 1125 June 16, 1954 An Act Creating The Court of Tax AppealsLj Montina Bontia ShesuMaruPas encore d'évaluation

- Taxation Law Review 21-22Document3 pagesTaxation Law Review 21-22yannie isananPas encore d'évaluation

- A. Jurisdiction of The Court of Tax Appeals: 1. Civil CasesDocument7 pagesA. Jurisdiction of The Court of Tax Appeals: 1. Civil CasesRovi Anne IgoyPas encore d'évaluation

- Civil Cases Court Powers CompositionDocument10 pagesCivil Cases Court Powers Compositionmarrion783Pas encore d'évaluation

- Ii - Iii The Judicial Branch: Rules and ProceduresDocument5 pagesIi - Iii The Judicial Branch: Rules and ProceduresCyril JeannePas encore d'évaluation

- Supreme Court JusrisdictionDocument12 pagesSupreme Court JusrisdictionMaisie ZabalaPas encore d'évaluation

- CTA Jurisdiction.01Document3 pagesCTA Jurisdiction.01kriziagwapoPas encore d'évaluation

- Judicial RemediesDocument37 pagesJudicial RemediesIc San PedroPas encore d'évaluation

- General Rule: Exclusive Original Jurisdiction Over All Criminal Offenses Arising From Violations of TheDocument2 pagesGeneral Rule: Exclusive Original Jurisdiction Over All Criminal Offenses Arising From Violations of TheLoisse VitugPas encore d'évaluation

- Definitions: 6. Transitional Input VATDocument8 pagesDefinitions: 6. Transitional Input VATFenina ReyesPas encore d'évaluation

- Judiciary: Hierarchy of Courts Jurisdiction Jurisdiction and Venue Jurisdiction ofDocument23 pagesJudiciary: Hierarchy of Courts Jurisdiction Jurisdiction and Venue Jurisdiction ofPaulino Belga IIIPas encore d'évaluation

- Taxation Law ReviewerDocument2 pagesTaxation Law ReviewerGolden LightphPas encore d'évaluation

- G.R. No. 168498 April 24, 2007 Rizal Commercial Banking Corporation, Petitioner, Commissioner of Internal Revenue, Respondent. FactsDocument3 pagesG.R. No. 168498 April 24, 2007 Rizal Commercial Banking Corporation, Petitioner, Commissioner of Internal Revenue, Respondent. FactsjoiPas encore d'évaluation

- Jurisdiction of The Courts That Try Criminal Cases 1. Sandigan Bayan PD 1606 (As Amended by R.A. No. 8249) Section 4. JurisdictionDocument6 pagesJurisdiction of The Courts That Try Criminal Cases 1. Sandigan Bayan PD 1606 (As Amended by R.A. No. 8249) Section 4. JurisdictionambonulanPas encore d'évaluation

- Jurisdiction of The CourtsDocument14 pagesJurisdiction of The CourtsCaleb Josh PacanaPas encore d'évaluation

- Mediation - Am No 11-1-5-Sc-PhiljaDocument11 pagesMediation - Am No 11-1-5-Sc-PhiljaAlPas encore d'évaluation

- Notes 1.7Document9 pagesNotes 1.7leshz zynPas encore d'évaluation

- Chapter 9: Court Tax Appeals: Tax Reviewer: Law of Basic Taxation in The PhilippinesDocument4 pagesChapter 9: Court Tax Appeals: Tax Reviewer: Law of Basic Taxation in The PhilippinesMino GensonPas encore d'évaluation

- Excel Professional Services, Inc.: Management Firm of Professional Review and Training Center (PRTC)Document25 pagesExcel Professional Services, Inc.: Management Firm of Professional Review and Training Center (PRTC)TatianaPas encore d'évaluation

- Development Bank of The Philippines vs. CADocument2 pagesDevelopment Bank of The Philippines vs. CAJANNPas encore d'évaluation

- Finals Personal Study Guide Tax2Document116 pagesFinals Personal Study Guide Tax2TeacherEliPas encore d'évaluation

- Court of Tax AppealsDocument3 pagesCourt of Tax AppealsReniel Belle AgregadoPas encore d'évaluation

- Jurisdiction of The CourtsDocument4 pagesJurisdiction of The CourtsJuan VillanuevaPas encore d'évaluation

- Answer: D Reference - Section 7 (A), Republic Act No. 1125, As Amended by Re Ublic Act No. 9282Document5 pagesAnswer: D Reference - Section 7 (A), Republic Act No. 1125, As Amended by Re Ublic Act No. 9282Jer RamaPas encore d'évaluation

- BP 129, As Amended "An Act Reorganizing The Judiciary, Appropriating Funds Therefor, and For Other Purposes" Preliminary ChapterDocument9 pagesBP 129, As Amended "An Act Reorganizing The Judiciary, Appropriating Funds Therefor, and For Other Purposes" Preliminary ChapterJasmine TorioPas encore d'évaluation

- Court of Tax Appeals (Cta) Division: General/Civil Matters Appellate JurisdictionDocument7 pagesCourt of Tax Appeals (Cta) Division: General/Civil Matters Appellate JurisdictionClarisse ZaplanPas encore d'évaluation

- Tax Report HandoutDocument4 pagesTax Report HandoutJune FourPas encore d'évaluation

- Taxation Law Court of Tax Appeals: en Banc DivisionDocument9 pagesTaxation Law Court of Tax Appeals: en Banc DivisionJaime Dadbod NolascoPas encore d'évaluation

- Court of Tax AppealsDocument5 pagesCourt of Tax AppealsEverly RañaPas encore d'évaluation

- Chapter 9: Court Tax Appeals: Tax Reviewer: Law of Basic Taxation in The PhilippinesDocument3 pagesChapter 9: Court Tax Appeals: Tax Reviewer: Law of Basic Taxation in The PhilippinesBuenavista Mae BautistaPas encore d'évaluation

- 2016 Bar Exam Suggested AnswersDocument17 pages2016 Bar Exam Suggested AnswersAnonymous WJT0oARK5Pas encore d'évaluation

- Rules and Procedures For Appeals On Assessment To Be Filed Before The Local Board of Assessment Appeals and The Central Board of Assessement AppealsDocument6 pagesRules and Procedures For Appeals On Assessment To Be Filed Before The Local Board of Assessment Appeals and The Central Board of Assessement AppealsArchie RobillosPas encore d'évaluation

- Tax 2 Finals ReviewerDocument19 pagesTax 2 Finals Reviewerapi-3837022100% (2)

- Jurisdiction of The CTADocument2 pagesJurisdiction of The CTAkeiPas encore d'évaluation

- Second Division: Republic of The Philippines Court of Tax Appeals Quezon CityDocument9 pagesSecond Division: Republic of The Philippines Court of Tax Appeals Quezon CityNash LedesmaPas encore d'évaluation

- General Instructions for the Guidance of Post Office Inspectors in the Dominion of CanadaD'EverandGeneral Instructions for the Guidance of Post Office Inspectors in the Dominion of CanadaPas encore d'évaluation

- An Overview of Compulsory Strata Management Law in NSW: Michael Pobi, Pobi LawyersD'EverandAn Overview of Compulsory Strata Management Law in NSW: Michael Pobi, Pobi LawyersPas encore d'évaluation

- Property & Taxation: A Practical Guide to Saving Tax on Your Property InvestmentsD'EverandProperty & Taxation: A Practical Guide to Saving Tax on Your Property InvestmentsPas encore d'évaluation

- Section 7. Evidence Admissible When Original Document Is A Public RecordDocument1 pageSection 7. Evidence Admissible When Original Document Is A Public RecordJoycePas encore d'évaluation

- CIAC List of Qualified Sole Arbitrators As of 14 December 2018Document1 pageCIAC List of Qualified Sole Arbitrators As of 14 December 2018Halila SudagarPas encore d'évaluation

- Us - CFTC Wins Trial Ag Aainst Virtual Currency Fraudster - U.S. Commodity Futures Trading CommissionDocument2 pagesUs - CFTC Wins Trial Ag Aainst Virtual Currency Fraudster - U.S. Commodity Futures Trading CommissionJoycePas encore d'évaluation

- Crimes Against Chastity NotesDocument2 pagesCrimes Against Chastity NotesJoycePas encore d'évaluation

- Rule 62Document1 pageRule 62JoycePas encore d'évaluation

- 3 CIAC F SVD 004a Mediation Agreement One RespondentDocument2 pages3 CIAC F SVD 004a Mediation Agreement One RespondentJoycePas encore d'évaluation

- My Big PayDocument11 pagesMy Big PayAnonymous Jxt4FXD5Pas encore d'évaluation

- JAR Section 4 - 7Document1 pageJAR Section 4 - 7JoycePas encore d'évaluation

- Tax NotesDocument2 pagesTax NotesJoycePas encore d'évaluation

- A.M. No. 12-8-8-SC Judicial Affidavit RuleDocument1 pageA.M. No. 12-8-8-SC Judicial Affidavit RuleJoycePas encore d'évaluation

- Judicial Affidavit RuleDocument2 pagesJudicial Affidavit RuleJoycePas encore d'évaluation

- ComplaintDocument10 pagesComplaintWiredEnterprisePas encore d'évaluation

- 25 Teves V PeopleDocument6 pages25 Teves V PeopleJoycePas encore d'évaluation

- Vintola V Insular BankDocument5 pagesVintola V Insular BankJoycePas encore d'évaluation

- 2016 Decision 0115353 Victorias MilingDocument19 pages2016 Decision 0115353 Victorias MilingJoycePas encore d'évaluation

- 1 JarDocument1 page1 JarJoycePas encore d'évaluation

- A.M. No. 12-8-8-SC Judicial Affidavit RuleDocument1 pageA.M. No. 12-8-8-SC Judicial Affidavit RuleJoycePas encore d'évaluation

- Section 6. When Original Document Is in Adverse Party's Custody or ControlDocument1 pageSection 6. When Original Document Is in Adverse Party's Custody or ControlJoycePas encore d'évaluation

- Notebook Paper - FormatDocument2 pagesNotebook Paper - FormatJoycePas encore d'évaluation

- R130 1-4Document1 pageR130 1-4JoycePas encore d'évaluation

- Secondary Evidence Section 5. When Original Document Is UnavailableDocument1 pageSecondary Evidence Section 5. When Original Document Is UnavailableJoycePas encore d'évaluation

- Family Code Part 1 CodalDocument8 pagesFamily Code Part 1 CodalJoycePas encore d'évaluation

- Russell Stanley Geron, 11/1/14 1:10 PM: Comment (1) : Enumerate All MattersDocument1 pageRussell Stanley Geron, 11/1/14 1:10 PM: Comment (1) : Enumerate All MattersAnonymous Q0KzFR2iPas encore d'évaluation

- Republic V JabsonDocument2 pagesRepublic V JabsonJoycePas encore d'évaluation

- HSF NUJS Moot Problem 2021Document7 pagesHSF NUJS Moot Problem 2021Aakash ChauhanPas encore d'évaluation

- Nigeria's Sexual Offences Bill 2013, Matters ArisingDocument35 pagesNigeria's Sexual Offences Bill 2013, Matters ArisingOladele OsinugaPas encore d'évaluation

- Noveras V NoverasDocument13 pagesNoveras V Noverasbrida athenaPas encore d'évaluation

- 14 PhilippineAmericanManagement Company v. Philippine American Management Employees AssociationDocument18 pages14 PhilippineAmericanManagement Company v. Philippine American Management Employees AssociationVianice BaroroPas encore d'évaluation

- 203 Torres v. GonzalesDocument3 pages203 Torres v. GonzalesAngela ConejeroPas encore d'évaluation

- Fifa Pocket CardDocument24 pagesFifa Pocket CardAmit SrivastavaPas encore d'évaluation

- Smithers v. Smith, 204 U.S. 632 (1907)Document9 pagesSmithers v. Smith, 204 U.S. 632 (1907)Scribd Government DocsPas encore d'évaluation

- Ethics Cases Part 2Document112 pagesEthics Cases Part 2Adri MillerPas encore d'évaluation

- ESCRA - Malayan Insurance vs. St. FrancisDocument72 pagesESCRA - Malayan Insurance vs. St. FrancisGuiller MagsumbolPas encore d'évaluation

- Nda Dispute - Resolution - in - IndiaDocument58 pagesNda Dispute - Resolution - in - IndiaaltmashPas encore d'évaluation

- Strick MotionDocument18 pagesStrick MotionSharonWaxmanPas encore d'évaluation

- Sawadjaan vs. Court of AppealsDocument18 pagesSawadjaan vs. Court of Appealspoiuytrewq9115Pas encore d'évaluation

- Sanho Corporation v. Kaijet Tech. - ComplaintDocument27 pagesSanho Corporation v. Kaijet Tech. - ComplaintSarah BursteinPas encore d'évaluation

- 2018 (172) DRJ9, ILR2018 (3) Kerala181, 2018 (4) JC C 2127, 2018 (3) N.C .C .145, 2018 (8) SC ALE557, (2018) 8SC C 149, 2019 (1) SC J 624Document12 pages2018 (172) DRJ9, ILR2018 (3) Kerala181, 2018 (4) JC C 2127, 2018 (3) N.C .C .145, 2018 (8) SC ALE557, (2018) 8SC C 149, 2019 (1) SC J 624PUNYASHLOK PANDAPas encore d'évaluation

- We The People Eleventh Essentials Edition 11th PDFDocument41 pagesWe The People Eleventh Essentials Edition 11th PDFjulie.dobson170100% (34)

- Tayag vs. CaDocument6 pagesTayag vs. CaNikko AzordepPas encore d'évaluation

- G.R. No. 189874 Jurisdiction of DARDocument15 pagesG.R. No. 189874 Jurisdiction of DARJulo R. TaleonPas encore d'évaluation

- Valdez v. Republic G.R. No. 180863, 8 September 2009Document4 pagesValdez v. Republic G.R. No. 180863, 8 September 2009Joshua CamachoPas encore d'évaluation

- People of The Philippines, Respondent. de Leon, JR., J.:: 1âwphi1.nêtDocument5 pagesPeople of The Philippines, Respondent. de Leon, JR., J.:: 1âwphi1.nêtSandra DomingoPas encore d'évaluation

- Sandoval vs. Cañeba 90503 27 September 1990Document2 pagesSandoval vs. Cañeba 90503 27 September 1990Laurente JessicaPas encore d'évaluation