Académique Documents

Professionnel Documents

Culture Documents

Commissioner of Customs Vs Oilink

Transféré par

zahreenamolinaDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Commissioner of Customs Vs Oilink

Transféré par

zahreenamolinaDroits d'auteur :

Formats disponibles

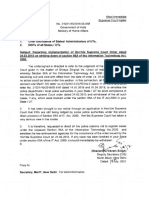

Title Commisioner of Customs vs Oilink Int´l Later on, Co, URC´s President, agreed to pay only

GR 161759 P94M+ in installment basis but Commissioner made a

Date July 2 2014 final demand for the total liability of P138M+ and if this

will not be paid he will not be able to issue clearance

unless the liability had been paid.

KEYWORDS

Oilink appealed to CTA: declared null and void the

assessments of the Commissioner of Customs. CTA

denied MR.

CA decision: concurred with the CTA in which it was

mentioned that the said wrongdoing was not clearly

established by petitioner.

DOCTRINE

In applying the instrumentality or alter ego doctrine, Issue: WoN Commissioner of Customs could not pierce

the courts are concerned with reality, not form, and the veil of corporate fiction.

with how the corporation operated and the individual

defendant´s relationship to the operation. Held: There was no ground to pierce the veil of

Consequently, the absence of any one of the corporate fiction. The separate and distinct personality of

foregoing elements prevents the piercing of the the corporation is, however, a mere fiction established

corporate veil. by law for convenience and to promote the ends of

justice.

CASE: It may not be used or invoked for ends that subvert the

policy and purpose behind its establishment, or intended

URC was established under the CCP. In the course of its by law to which the corporation owes its being. This is

business undertakings, URC imported oil products into true particularly when the fiction is used to defeat public

the country from 1991- 1994. After that, Oilink was convenience, to justify wrong, to protect fraud, to defend

incorporated for the primary purpose of manufacturing crime, to confuse legitimate legal or judicial issues, to

and selling oil and petroleum products. URC and Oilink perpetrate deception or otherwise to circumvent the law.

had interlocking directors when Oilink started its This is likewise true where the corporate entity is being

business. used as an alter ego, adjunct, or business conduit for the

sole benefit of the stockholders or of another corporate

The general manager of URC sent a letter to manifest entity.

that URC and Oilink had the same Board of Directors

and that Oilink was 100% owned by URC. Indeed, the doctrine of piercing the corporate veil has no

application here because the Commissioner of Customs

District Collector of the Port of Manila demanded that did not establish that Oilink had been set up to avoid the

URC pay the taxes on its oil imports that had arrived at payment of taxes or duties, or for purposes that would

the Port of Bataan. He made another demand letter to defeat public convenience, justify wrong, protect fraud,

URC for the payment of the reduced sum of P289M+ for defend crime, confuse legitimate legal or judicial issues,

the VAT, special duties and excise taxes for the years perpetrate deception or otherwise circumvent the law.

1991-1995.

The Court AFFIRMS the decision promulgated by the

URC responded to the demands by seeking the landed Court of Appeals

computations of the assessments, so, Commissioner of

Customs directed URC to pay the amount of P119M+

representing URC´s special duties, VAT, and Excise

Taxes that it had failed to pay at the time of the release

17 oil shipments. Thereafter, Customs Commissioner

wrote again to require URC to pay deficiency taxes but

in the reduced sum of P99M+.

The general manager of URC replied by letter to

Commissioner denying liability and insisting that only

P28M+ should be paid by way of compromise. However,

Commisioner insisted that they should pay P99M+.

Vous aimerez peut-être aussi

- Commissioner of Cutoms VS Oilink InternationalDocument2 pagesCommissioner of Cutoms VS Oilink InternationalcarloPas encore d'évaluation

- Digests S0720Document12 pagesDigests S0720Gianina AndesPas encore d'évaluation

- Succession CaseDocument4 pagesSuccession Caseknicky FranciscoPas encore d'évaluation

- 302 SCRA 241 - Philippine Bank of Communications Vs Commissioner of Internal RevenueDocument9 pages302 SCRA 241 - Philippine Bank of Communications Vs Commissioner of Internal RevenueFran SuarezPas encore d'évaluation

- Aznar Brothers Realty Company vs. AyingDocument12 pagesAznar Brothers Realty Company vs. AyingAngelica AbalosPas encore d'évaluation

- University of The Philippines College of Law: Natcher Vs CA, Heirs of Del RosarioDocument3 pagesUniversity of The Philippines College of Law: Natcher Vs CA, Heirs of Del RosarioSophiaFrancescaEspinosaPas encore d'évaluation

- Visayan Cebu Terminal Vs CirDocument2 pagesVisayan Cebu Terminal Vs CirylainePas encore d'évaluation

- 1 CIR V Hambrecht - QuistDocument2 pages1 CIR V Hambrecht - Quistaspiringlawyer1234Pas encore d'évaluation

- Documentary Evidence Rule 130b No. 2 Imani Vs MetrobankDocument2 pagesDocumentary Evidence Rule 130b No. 2 Imani Vs MetrobankRepolyo Ket CabbagePas encore d'évaluation

- Wood Technology v. Equitable BankingDocument3 pagesWood Technology v. Equitable Bankingav783Pas encore d'évaluation

- Union Bank of The Philippines vs. SantibañezDocument9 pagesUnion Bank of The Philippines vs. SantibañezArjay PuyotPas encore d'évaluation

- 136-New York Marine Managers, Inc. vs. CA 249 Scra 416 (1995)Document3 pages136-New York Marine Managers, Inc. vs. CA 249 Scra 416 (1995)Jopan SJPas encore d'évaluation

- Probate of Oliva Villapaña's will upheld by Supreme CourtDocument2 pagesProbate of Oliva Villapaña's will upheld by Supreme CourtJacqueline Carlotta SydiongcoPas encore d'évaluation

- Provrem NotesDocument14 pagesProvrem NotesBazel GuesePas encore d'évaluation

- Taxation Case DigestDocument4 pagesTaxation Case DigestArden KimPas encore d'évaluation

- Interlink Vs CADocument4 pagesInterlink Vs CABenz Clyde Bordeos TolosaPas encore d'évaluation

- REMO Vs IAC - FERNANDEZDocument1 pageREMO Vs IAC - FERNANDEZemmanuel fernandezPas encore d'évaluation

- Cases - BankingDocument52 pagesCases - Bankingjared gaelPas encore d'évaluation

- Duty Free vs. COA: Government Employees Subject To The SSL (Salary Standardization Law) PTA, A Government-Owned andDocument1 pageDuty Free vs. COA: Government Employees Subject To The SSL (Salary Standardization Law) PTA, A Government-Owned andAnonymous MikI28PkJc100% (1)

- In The Matter of The Petition For The Probate of The Will of Consuelo Santiago GarciaDocument2 pagesIn The Matter of The Petition For The Probate of The Will of Consuelo Santiago GarciaEdel VillanuevaPas encore d'évaluation

- Bertillo - Phil. Guaranty Co. Inc. Vs CIR and CTADocument2 pagesBertillo - Phil. Guaranty Co. Inc. Vs CIR and CTAStella BertilloPas encore d'évaluation

- 3 Phil American Life Insurance Vs Sec of Finance DIGESTDocument2 pages3 Phil American Life Insurance Vs Sec of Finance DIGESTMa Gabriellen Quijada-Tabuñag75% (4)

- GR 168557Document1 pageGR 168557Crestu JinPas encore d'évaluation

- Chevron Vs CIRDocument2 pagesChevron Vs CIRKim Lorenzo CalatravaPas encore d'évaluation

- Parole Evidence CasesDocument25 pagesParole Evidence CasesJose Mari Angelo DionioPas encore d'évaluation

- Source of Obligation in Jose Cangco vs. Manila Railroad CoDocument6 pagesSource of Obligation in Jose Cangco vs. Manila Railroad CordPas encore d'évaluation

- Calalang Vs CADocument2 pagesCalalang Vs CAAnn Alejo-Dela TorrePas encore d'évaluation

- Ramnani vs. CADocument1 pageRamnani vs. CALePas encore d'évaluation

- 01-07 RCBC Vs BDODocument4 pages01-07 RCBC Vs BDOhoney2suzanne2gilPas encore d'évaluation

- Team Energy Vs CirDocument1 pageTeam Energy Vs CirHarold EstacioPas encore d'évaluation

- Diangka v. COMELECDocument1 pageDiangka v. COMELECRaymond RoquePas encore d'évaluation

- Digests For TaxDocument12 pagesDigests For TaxFender BoyangPas encore d'évaluation

- CIR's Right to Collect Tax Not Barred by PrescriptionDocument1 pageCIR's Right to Collect Tax Not Barred by PrescriptionHollyhock Mmgrzhfm100% (1)

- City of Iriga Vs CASURECODocument2 pagesCity of Iriga Vs CASURECOGarp BarrocaPas encore d'évaluation

- Taxation CasesDocument353 pagesTaxation Casesjojazz74Pas encore d'évaluation

- Teng V SECDocument2 pagesTeng V SECPrincess Kimberly Ubay-ubayPas encore d'évaluation

- Churchill v. ConcepcionDocument6 pagesChurchill v. ConcepcionUnis BautistaPas encore d'évaluation

- Ching V RodriguezDocument3 pagesChing V RodriguezJani MisterioPas encore d'évaluation

- Singson v. CADocument3 pagesSingson v. CAAbigayle RecioPas encore d'évaluation

- LZK Holdings and Development Corporation Vs Planters Development BankDocument2 pagesLZK Holdings and Development Corporation Vs Planters Development BankThomas Vincent O. PantaleonPas encore d'évaluation

- Araneta V TuasonDocument1 pageAraneta V TuasonYang D. F.Pas encore d'évaluation

- Vidal de Roces vs. PosadasDocument2 pagesVidal de Roces vs. PosadasArdy Falejo FajutagPas encore d'évaluation

- RTC's Authority to Issue Injunction Against Collection of Local TaxesDocument3 pagesRTC's Authority to Issue Injunction Against Collection of Local TaxesMarife MinorPas encore d'évaluation

- VAT refund claims and the 120-day ruleDocument5 pagesVAT refund claims and the 120-day ruleJemima FalinchaoPas encore d'évaluation

- Republic Planters Bank vs. Court of AppealsDocument6 pagesRepublic Planters Bank vs. Court of AppealsaudreyracelaPas encore d'évaluation

- Spec Pro Apr 25 Case Digest on Appointment and Removal of ExecutorDocument16 pagesSpec Pro Apr 25 Case Digest on Appointment and Removal of ExecutorDianne ComonPas encore d'évaluation

- Pfda Vs NavotasDocument1 pagePfda Vs NavotasbaijamPas encore d'évaluation

- Margarita David estate donationDocument5 pagesMargarita David estate donationEarlPas encore d'évaluation

- CIR, vs. THE ESTATE OF BENIGNO P. TODA, JR., G.R. No. 147188. September 14, 2004 FactsDocument1 pageCIR, vs. THE ESTATE OF BENIGNO P. TODA, JR., G.R. No. 147188. September 14, 2004 Factsian ballartaPas encore d'évaluation

- PNB V SPs PEREZDocument2 pagesPNB V SPs PEREZIvy Clarize Amisola BernardezPas encore d'évaluation

- CIR v. TMX Sales Inc.Document2 pagesCIR v. TMX Sales Inc.Lucifer MorningPas encore d'évaluation

- 02 Optima Realty vs. Hertz Phil. GR No. 183035Document4 pages02 Optima Realty vs. Hertz Phil. GR No. 183035Annie Bag-aoPas encore d'évaluation

- DBP V CADocument2 pagesDBP V CACPBA LawPas encore d'évaluation

- 1 - My DigestDocument3 pages1 - My DigestPrudencio Ruiz AgacitaPas encore d'évaluation

- Fourth Week Case DigestsDocument28 pagesFourth Week Case DigestsKhun The GreatPas encore d'évaluation

- SLIHM vs DGCI trademark disputeDocument2 pagesSLIHM vs DGCI trademark disputeDudly RiosPas encore d'évaluation

- Bloomberry Resorts vs. Cir 2016Document2 pagesBloomberry Resorts vs. Cir 2016Anny YanongPas encore d'évaluation

- COC v. OIlink InternationalDocument1 pageCOC v. OIlink InternationaljoyiveeongPas encore d'évaluation

- 10 Comm of Customs V OilinkDocument14 pages10 Comm of Customs V Oilinkeieipayad100% (1)

- CIR vs Oilink Int'l CorpDocument3 pagesCIR vs Oilink Int'l CorpErinPas encore d'évaluation

- 18 Tenchavez Vs EscanoDocument1 page18 Tenchavez Vs EscanozahreenamolinaPas encore d'évaluation

- Republic VS Albios Molina G02 DlsuDocument1 pageRepublic VS Albios Molina G02 DlsuzahreenamolinaPas encore d'évaluation

- 20 IDEAL Vs PSALMDocument2 pages20 IDEAL Vs PSALMzahreenamolinaPas encore d'évaluation

- Remedies Notes LTDDocument4 pagesRemedies Notes LTDzahreenamolinaPas encore d'évaluation

- GARCIA Vs RECIO Molina G02 DLSUDocument1 pageGARCIA Vs RECIO Molina G02 DLSUzahreenamolinaPas encore d'évaluation

- Module 8B Compromise AbatementDocument10 pagesModule 8B Compromise AbatementzahreenamolinaPas encore d'évaluation

- Ongsiako-Reyes Vs ComelecDocument1 pageOngsiako-Reyes Vs Comeleczahreenamolina100% (1)

- 47 Grande Vs AntonioDocument1 page47 Grande Vs AntoniozahreenamolinaPas encore d'évaluation

- Refusal to Consummate Marriage Sign of Psychological IncapacityDocument1 pageRefusal to Consummate Marriage Sign of Psychological IncapacityzahreenamolinaPas encore d'évaluation

- COMELEC Ruling on Dual CitizenshipDocument3 pagesCOMELEC Ruling on Dual CitizenshipzahreenamolinaPas encore d'évaluation

- LTD - Compilation (Midterms)Document50 pagesLTD - Compilation (Midterms)zahreenamolinaPas encore d'évaluation

- LTD ReviewerDocument9 pagesLTD ReviewerzahreenamolinaPas encore d'évaluation

- 00 Labor2 Feb. 21Document25 pages00 Labor2 Feb. 21zahreenamolinaPas encore d'évaluation

- Labor Law 2 SyllabusDocument28 pagesLabor Law 2 SyllabuszahreenamolinaPas encore d'évaluation

- Union Representation StatusDocument36 pagesUnion Representation StatuszahreenamolinaPas encore d'évaluation

- Labor Law 2 SyllabusDocument28 pagesLabor Law 2 SyllabuszahreenamolinaPas encore d'évaluation

- 4 Part 3 F-GDocument39 pages4 Part 3 F-GzahreenamolinaPas encore d'évaluation

- 00 Labor2 Feb. 14Document18 pages00 Labor2 Feb. 14zahreenamolinaPas encore d'évaluation

- 7 Part V (6, D-F)Document21 pages7 Part V (6, D-F)zahreenamolinaPas encore d'évaluation

- 8 Part VIDocument43 pages8 Part VIzahreenamolinaPas encore d'évaluation

- 1 Labor Part 1Document11 pages1 Labor Part 1zahreenamolinaPas encore d'évaluation

- 5 Part IVDocument10 pages5 Part IVzahreenamolinaPas encore d'évaluation

- Kopya NG 56. Del Prado vs. CaballeroDocument1 pageKopya NG 56. Del Prado vs. CaballeroZahreena MolinaPas encore d'évaluation

- 8 Part VIDocument43 pages8 Part VIzahreenamolinaPas encore d'évaluation

- Legal OpinionDocument6 pagesLegal OpinionzahreenamolinaPas encore d'évaluation

- Manila Market Stall Fees Upheld for Public PurposeDocument1 pageManila Market Stall Fees Upheld for Public PurposezahreenamolinaPas encore d'évaluation

- 2 Labor Part 2Document16 pages2 Labor Part 2zahreenamolinaPas encore d'évaluation

- Deed of Conditional SaleDocument4 pagesDeed of Conditional SalezahreenamolinaPas encore d'évaluation

- Heirs of Juan Pinez vs. Dayrit dispute over land titleDocument3 pagesHeirs of Juan Pinez vs. Dayrit dispute over land titlezahreenamolinaPas encore d'évaluation

- Counsel For Ma. Jeanette S. Cervantes - AraoDocument1 pageCounsel For Ma. Jeanette S. Cervantes - AraoZahreena MolinaPas encore d'évaluation

- REVUP Notes in Criminal LawDocument28 pagesREVUP Notes in Criminal LawAndrea Klein LechugaPas encore d'évaluation

- IsmailJafferAlibhai NandlalHarjivanKariaDocument46 pagesIsmailJafferAlibhai NandlalHarjivanKariaReal Trekstar80% (5)

- CHAPTER 4 - Basic Numbering System of Police ReportsDocument4 pagesCHAPTER 4 - Basic Numbering System of Police ReportsAilyne CabuquinPas encore d'évaluation

- Echeverria Motion For Proof of AuthorityDocument13 pagesEcheverria Motion For Proof of AuthorityIsabel SantamariaPas encore d'évaluation

- Churchill v Concepcion: Philippine Supreme Court upholds tax on billboardsDocument2 pagesChurchill v Concepcion: Philippine Supreme Court upholds tax on billboardsKent A. AlonzoPas encore d'évaluation

- OSHA Complaint Regarding Oakdale Federal Correctional ComplexDocument4 pagesOSHA Complaint Regarding Oakdale Federal Correctional ComplexmcooperkplcPas encore d'évaluation

- Nab McqsDocument23 pagesNab McqsIzzat FatimaPas encore d'évaluation

- S.Govinda Menon v. Union of India AIR 1967 SC 1274 SummaryDocument2 pagesS.Govinda Menon v. Union of India AIR 1967 SC 1274 SummaryPrateek duhanPas encore d'évaluation

- Bedding F-702 NEWDocument2 pagesBedding F-702 NEWBADIGA SHIVA GOUDPas encore d'évaluation

- Consitution - Meaning, Need, TypesDocument20 pagesConsitution - Meaning, Need, TypesJoseph MondomaPas encore d'évaluation

- RA 10927 An Act Designating Casinos As Covered Persons Under RA 9160 Anti Money Laundering ActDocument4 pagesRA 10927 An Act Designating Casinos As Covered Persons Under RA 9160 Anti Money Laundering ActRMN Rommel DulaPas encore d'évaluation

- CAREC Corridor 1 Procurement PlanDocument5 pagesCAREC Corridor 1 Procurement Planabuelazm2132100% (1)

- Constantino V CuisiaDocument2 pagesConstantino V Cuisiaatoydequit100% (1)

- LIABILITYDocument8 pagesLIABILITYkaviyapriyaPas encore d'évaluation

- Social Security System v. Moonwalk Development and Housing CorporationDocument6 pagesSocial Security System v. Moonwalk Development and Housing CorporationRimvan Le SufeorPas encore d'évaluation

- What's Happening in Zimbabwe?: Important Elections Took Place in Zimbabwe in Southern Africa On 30 July 2018Document6 pagesWhat's Happening in Zimbabwe?: Important Elections Took Place in Zimbabwe in Southern Africa On 30 July 2018EriqPas encore d'évaluation

- Matibag Vs BenipayoDocument7 pagesMatibag Vs BenipayoMichael DonascoPas encore d'évaluation

- EPacific Vs CabansayDocument2 pagesEPacific Vs CabansayStephanie Valentine100% (1)

- Olaf Peter Juda v. Dennis Michael Nerney, Assistant U.S. Attorney, Northern District of California Stephen R. Kotz, Assistant U.S. Attorney, Albuquerque, New Mexico John J. Kelly, U.S. Attorney, Albuquerque, New Mexico Michael Yamaguchi, U.S. Attorney, San Francisco, California Robert L. Holler, District Director, U.S. Customs Service, El Paso, Texas Leonard S. Walton, Acting Assistant Commissioner, U.S. Customs Service, Washington, D.C. Bonnie L. Gay, Foia Unit, Attorney-In-Charge, Washington, D.C. John and Jane Does 1-25 United States of America, Olaf Peter Juda v. United States Customs Service, Robert L. Holler, Joy M. Hughan, Daniel Luar, Rita Alfaro, Dolores Payan, Gina E. Fuentes, Internal Revenue Service, George Terpack, Carolyn Leonard, Timothy A. Towns, John Does, Jane Does, 149 F.3d 1190, 10th Cir. (1998)Document13 pagesOlaf Peter Juda v. Dennis Michael Nerney, Assistant U.S. Attorney, Northern District of California Stephen R. Kotz, Assistant U.S. Attorney, Albuquerque, New Mexico John J. Kelly, U.S. Attorney, Albuquerque, New Mexico Michael Yamaguchi, U.S. Attorney, San Francisco, California Robert L. Holler, District Director, U.S. Customs Service, El Paso, Texas Leonard S. Walton, Acting Assistant Commissioner, U.S. Customs Service, Washington, D.C. Bonnie L. Gay, Foia Unit, Attorney-In-Charge, Washington, D.C. John and Jane Does 1-25 United States of America, Olaf Peter Juda v. United States Customs Service, Robert L. Holler, Joy M. Hughan, Daniel Luar, Rita Alfaro, Dolores Payan, Gina E. Fuentes, Internal Revenue Service, George Terpack, Carolyn Leonard, Timothy A. Towns, John Does, Jane Does, 149 F.3d 1190, 10th Cir. (1998)Scribd Government DocsPas encore d'évaluation

- Chapter 18 Section 3Document8 pagesChapter 18 Section 3api-206809924Pas encore d'évaluation

- Arthur Leroy Horton v. Joseph R. Blalock, M.D., Supreintendent, Southwestern State Hospital, Marion, Virginia, 282 F.2d 782, 4th Cir. (1960)Document2 pagesArthur Leroy Horton v. Joseph R. Blalock, M.D., Supreintendent, Southwestern State Hospital, Marion, Virginia, 282 F.2d 782, 4th Cir. (1960)Scribd Government DocsPas encore d'évaluation

- Amgen Inc. v. F. Hoffmann-LaRoche LTD Et Al - Document No. 496Document3 pagesAmgen Inc. v. F. Hoffmann-LaRoche LTD Et Al - Document No. 496Justia.comPas encore d'évaluation

- Mapalo vs. MapaloDocument12 pagesMapalo vs. MapaloRoizki Edward MarquezPas encore d'évaluation

- Sem-III Political Science - Minor - PDFDocument2 pagesSem-III Political Science - Minor - PDFNaveen SiharePas encore d'évaluation

- Microsoft Collaborate Terms of UseDocument6 pagesMicrosoft Collaborate Terms of UseZeeshan OpelPas encore d'évaluation

- Mha Advisory 396650Document1 pageMha Advisory 396650Qwerty541Pas encore d'évaluation

- Should Business Lobbying Be Legalized in India - Implication On Business?Document6 pagesShould Business Lobbying Be Legalized in India - Implication On Business?Divyank JyotiPas encore d'évaluation

- Citibank V.dinopol, GR 188412Document7 pagesCitibank V.dinopol, GR 188412vyllettePas encore d'évaluation

- United States Court of Appeals, Eleventh CircuitDocument52 pagesUnited States Court of Appeals, Eleventh CircuitScribd Government DocsPas encore d'évaluation

- Regeln Biblothek ENDocument2 pagesRegeln Biblothek ENMarta AlmeidaPas encore d'évaluation