Académique Documents

Professionnel Documents

Culture Documents

Methods of Lending

Transféré par

muditagarwal72Description originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Methods of Lending

Transféré par

muditagarwal72Droits d'auteur :

Formats disponibles

Methods of lending

Like many other activities of the banks, method and quantum of short-term finance

that can be granted to a corporate was mandated by the Reserve Bank of India till

1994. This control was exercised on the lines suggested by the recommendations

of a study group headed by Shri Prakash Tandon.

The study group headed by Shri Prakash Tandon, the then Chairman of Punjab

National Bank, was constituted by the RBI in July 1974 with eminent personalities

drawn from leading banks, financial institutions and a wide cross-section of the

Industry with a view to study the entire gamut of Bank's finance for working capital

and suggest ways for optimum utilisation of Bank credit. This was the first

elaborate attempt by the central bank to organise the Bank credit. The report of

this group is widely known as Tandon Committee report. Most banks in India

even today continue to look at the needs of the corporates in the light of

methodology recommended by the Group.

As per the recommendations of Tandon Committee, the corporates should be

discouraged from accumulating too much of stocks of current assets and should

move towards very lean inventories and receivable levels. The committee even

suggested the maximum levels of Raw Material, Stock-in-process and Finished

Goods which a corporate operating in an industry should be allowed to accumulate

These levels were termed as inventory and receivable norms. Depending on the

size of credit required, the funding of these current assets (working capital needs)

of the corporates could be met by one of the following methods:

• First Method of Lending:

Banks can work out the working capital gap, i.e. total current assets less

current liabilities other than bank borrowings (called Maximum Permissible

Bank Finance or MPBF) and finance a maximum of 75 per cent of the gap;

the balance to come out of long-term funds, i.e., owned funds and term

borrowings. This approach was considered suitable only for very small

borrowers i.e. where the requirements of credit were less than Rs.10 lacs

• Second Method of Lending:

Under this method, it was thought that the borrower should provide for a

minimum of 25% of total current assets out of long-term funds i.e., owned

funds plus term borrowings. A certain level of credit for purchases and

other current liabilities will be available to fund the build up of current

assets and the bank will provide the balance (MPBF). Consequently, total

current liabilities inclusive of bank borrowings could not exceed 75% of

current assets. RBI stipulated that the working capital needs of all

borrowers enjoying fund based credit facilities of more than Rs. 10 lacs

should be appraised (calculated) under this method.

• Third Method of Lending: Under this method, the borrower's

contribution from long term funds will be to the extent of the entire CORE

CURRENT ASSETS, which has been defined by the Study Group as

representing the absolute minimum level of raw materials, process stock,

finished goods and stores which are in the pipeline to ensure continuity of

production and a minimum of 25% of the balance current assets should be

financed out of the long term funds plus term borrowings.

(This method was not accepted for implementation and hence is of only

academic interest).

As can be seen above, the basic foundation of all banks' appraisal of the needs of

creditors is the level of current assets. The classification of assets and balance

sheet analysis, therefore, assumes a lot of importance. RBI has mandated a

certain way of analysing the balance sheets. The requirements of this break-up of

assets and liabilities differs slightly from that mandated by the Company Law

Board (CLB). The analysis of balance sheet in CMA data is said to give a more

detailed and accurate picture of the affairs of a corporate. The corporates are

required by all banks to analyse their balance sheet in this specific format called

CMA data format and submit to banks. While most qualified accountants working

with the firms are aware of the method of classification in this format, professional

help is also available in the form of Chartered Accountants, Financial Analysts for

this analysis.

Vous aimerez peut-être aussi

- Methods of LendingDocument2 pagesMethods of LendingilovesomeonePas encore d'évaluation

- Methods of Lending Tandon CommiteeDocument2 pagesMethods of Lending Tandon CommiteeKinjal ThakkarPas encore d'évaluation

- Methods of Lending - Tandon CommitteDocument2 pagesMethods of Lending - Tandon CommitteGeetika TharejaPas encore d'évaluation

- Methods of LendingDocument1 pageMethods of LendingankitkharkiaPas encore d'évaluation

- Methods of Short-Term LendingDocument2 pagesMethods of Short-Term LendingPradeep ShawPas encore d'évaluation

- MPBFDocument6 pagesMPBFhiteshgauranaPas encore d'évaluation

- SummaryDocument3 pagesSummaryankitkharkiaPas encore d'évaluation

- Tandon Committe & Tarapore Committee SuggestionDocument6 pagesTandon Committe & Tarapore Committee SuggestionAmar SinhaPas encore d'évaluation

- Y First Method of LendingDocument2 pagesY First Method of LendingNisha MozaPas encore d'évaluation

- Tandon Committee Report On Working CapitalDocument4 pagesTandon Committee Report On Working CapitalMohitAhujaPas encore d'évaluation

- Tandon Committee's recommendations for bank lending normsDocument17 pagesTandon Committee's recommendations for bank lending normsGayathri TPas encore d'évaluation

- Tandon & Chore CommitteeDocument2 pagesTandon & Chore CommitteeCfhunSaatPas encore d'évaluation

- Tandon Committee Report On Working CapitalDocument4 pagesTandon Committee Report On Working CapitalPranav BhattPas encore d'évaluation

- INSTITUTE OF MANAGEMENT STUDIES, DAVV, INDORE CREDIT MANAGEMENT AND RETAIL BANKINGDocument4 pagesINSTITUTE OF MANAGEMENT STUDIES, DAVV, INDORE CREDIT MANAGEMENT AND RETAIL BANKINGSPas encore d'évaluation

- Methods of LendingDocument4 pagesMethods of LendingGaurav GuptaPas encore d'évaluation

- Credit Monitoring ArrangementDocument15 pagesCredit Monitoring ArrangementAbhi_IMK100% (1)

- Teaching Note - Group 4Document20 pagesTeaching Note - Group 4SHASHANK JAINPas encore d'évaluation

- Assessment of Working Capital LimitDocument4 pagesAssessment of Working Capital LimitKeshav Malpani100% (8)

- Working capital requirements and assessment methodsDocument100 pagesWorking capital requirements and assessment methodsperkin kothariPas encore d'évaluation

- Working Capital Assessment: by Prof. Divya GuptaDocument13 pagesWorking Capital Assessment: by Prof. Divya GuptaArun SinghPas encore d'évaluation

- 10 - Chapter 4 PDFDocument17 pages10 - Chapter 4 PDFkartheek1989Pas encore d'évaluation

- Tandon Committee's Working Capital NormsDocument20 pagesTandon Committee's Working Capital NormsPrashant SharmaPas encore d'évaluation

- Maximum Permissible BankingDocument4 pagesMaximum Permissible BankingPrashant AroraPas encore d'évaluation

- Tandon Committee Recommendations on Corporate Working Capital NormsDocument2 pagesTandon Committee Recommendations on Corporate Working Capital NormsAnkita SharmaPas encore d'évaluation

- RBI's Credit Monitoring Arrangement and Tandon Committee recommendationsDocument4 pagesRBI's Credit Monitoring Arrangement and Tandon Committee recommendationsAbhi_IMK100% (1)

- Working Capital Finance-Recommendations of Various Committees.Document33 pagesWorking Capital Finance-Recommendations of Various Committees.Ranaque JahanPas encore d'évaluation

- Working Capital Finance GuidelinesDocument2 pagesWorking Capital Finance GuidelinesOngwang KonyakPas encore d'évaluation

- Financing Working Capital by Banks: 6 Committees: 1. Dehejia Committee ReportDocument5 pagesFinancing Working Capital by Banks: 6 Committees: 1. Dehejia Committee ReportMurali DharanPas encore d'évaluation

- Impact of nationalisation on Indian banking sectorDocument4 pagesImpact of nationalisation on Indian banking sectorAryan DevPas encore d'évaluation

- Tandon Committee PresentationDocument13 pagesTandon Committee PresentationNitharshini Kannan0% (1)

- CAF Individual Assignment - Vedantam Gupta - 20152095Document4 pagesCAF Individual Assignment - Vedantam Gupta - 20152095Vedantam GuptaPas encore d'évaluation

- Research Paper On Npa ManagementDocument8 pagesResearch Paper On Npa Managementd1fytyt1man3100% (1)

- Abhi Tandon CommiteeDocument1 pageAbhi Tandon CommiteeAbhishek KumarPas encore d'évaluation

- Corporate Banking: 11/04/21 Om All Rights Reserved. 1Document180 pagesCorporate Banking: 11/04/21 Om All Rights Reserved. 1Pravah ShuklaPas encore d'évaluation

- Credit Appraisla and Analysis ReportDocument7 pagesCredit Appraisla and Analysis ReportharryPas encore d'évaluation

- PNBDocument20 pagesPNBShuchita BhutaniPas encore d'évaluation

- Tandon Committee Recommendations on Bank Credit NormsDocument6 pagesTandon Committee Recommendations on Bank Credit NormsSakthi Priyadharshini MPas encore d'évaluation

- RBI Master CircularDocument42 pagesRBI Master CircularDeep Singh PariharPas encore d'évaluation

- SFM AssignmentDocument6 pagesSFM Assignmentjohn doePas encore d'évaluation

- A Study On Management of Non Performing Assets in District Central Cooperative Bank PDFDocument5 pagesA Study On Management of Non Performing Assets in District Central Cooperative Bank PDFDevikaPas encore d'évaluation

- Management of Advance by RBI 2005Document53 pagesManagement of Advance by RBI 2005Ramkumar SankerPas encore d'évaluation

- A Project Report HDFC BANKDocument48 pagesA Project Report HDFC BANKVikas SinghPas encore d'évaluation

- Indian financial reforms focused on banking sectorDocument10 pagesIndian financial reforms focused on banking sectornagendra yanamalaPas encore d'évaluation

- Short Term LoansDocument4 pagesShort Term LoansHarsh MehtaPas encore d'évaluation

- Cash Credit System of HDFC BankDocument38 pagesCash Credit System of HDFC Bankloveleen_mangatPas encore d'évaluation

- Banking NewsDocument22 pagesBanking Newsyerra likhitaPas encore d'évaluation

- Fund based working capital assessment with MPBF methodDocument28 pagesFund based working capital assessment with MPBF methodAbinash BiswalPas encore d'évaluation

- Banking UpdatesDocument96 pagesBanking UpdatesanuragenextPas encore d'évaluation

- Credit Authorizatio N Scheme: Presented By:-Sheenu AroraDocument18 pagesCredit Authorizatio N Scheme: Presented By:-Sheenu AroraSheenu AroraPas encore d'évaluation

- Banking policy and structural changes e-magazineDocument22 pagesBanking policy and structural changes e-magazineApurva JhaPas encore d'évaluation

- Commercial Banking Management: Working Capital Requirement and Financing For Manufacturing CompanyDocument32 pagesCommercial Banking Management: Working Capital Requirement and Financing For Manufacturing CompanySHASHANK JAINPas encore d'évaluation

- Corporate Debt RestructuringDocument20 pagesCorporate Debt RestructuringAparna Thakur100% (1)

- Interim Report ModifiedDocument37 pagesInterim Report ModifiedsrikanthkgPas encore d'évaluation

- New Trends in Financing Working Capital by BanksDocument9 pagesNew Trends in Financing Working Capital by BanksAparna Karuvallil100% (1)

- Chapter 12 - Business Financing Including Venture Capital FDocument28 pagesChapter 12 - Business Financing Including Venture Capital FjtpmlPas encore d'évaluation

- Working Capital RequirementDocument6 pagesWorking Capital RequirementChaitanya PandayPas encore d'évaluation

- Autoparts India Pvt. LTD, Standalone. With An Aim To Learn How Wonjin Manage TheirDocument2 pagesAutoparts India Pvt. LTD, Standalone. With An Aim To Learn How Wonjin Manage TheirVimal MorkelPas encore d'évaluation

- How To Download Gateways To Democracy An Introduction To American Government Book Only 3Rd Edition Ebook PDF Ebook PDF Docx Kindle Full ChapterDocument36 pagesHow To Download Gateways To Democracy An Introduction To American Government Book Only 3Rd Edition Ebook PDF Ebook PDF Docx Kindle Full Chapterandrew.taylor131100% (22)

- Epq JDocument4 pagesEpq JMatilde CaraballoPas encore d'évaluation

- Schematic Electric System Cat D8T Vol1Document33 pagesSchematic Electric System Cat D8T Vol1Andaru Gunawan100% (1)

- Web Design Course PPTX Diana OpreaDocument17 pagesWeb Design Course PPTX Diana Opreaapi-275378856Pas encore d'évaluation

- USP 11 ArgumentArraysDocument52 pagesUSP 11 ArgumentArraysKanha NayakPas encore d'évaluation

- A Christmas Carol AdaptationDocument9 pagesA Christmas Carol AdaptationTockington Manor SchoolPas encore d'évaluation

- Mexican Immigrants and The Future of The American Labour Market (Schlossplatz3-Issue 8)Document1 pageMexican Immigrants and The Future of The American Labour Market (Schlossplatz3-Issue 8)Carlos J. GuizarPas encore d'évaluation

- Instant Ear Thermometer: Instruction ManualDocument64 pagesInstant Ear Thermometer: Instruction Manualrene_arevalo690% (1)

- The Wavy Tunnel: Trade Management Jody SamuelsDocument40 pagesThe Wavy Tunnel: Trade Management Jody SamuelsPeter Nguyen100% (1)

- Booklet - CopyxDocument20 pagesBooklet - CopyxHåkon HallenbergPas encore d'évaluation

- Soap - WikipediaDocument57 pagesSoap - Wikipediayash BansalPas encore d'évaluation

- Hume's Standard TasteDocument15 pagesHume's Standard TasteAli Majid HameedPas encore d'évaluation

- 9 Specific Relief Act, 1877Document20 pages9 Specific Relief Act, 1877mostafa faisalPas encore d'évaluation

- Critical Growth StagesDocument3 pagesCritical Growth StagesSunil DhankharPas encore d'évaluation

- Operative ObstetricsDocument6 pagesOperative ObstetricsGrasya ZackiePas encore d'évaluation

- Israel Bible MapDocument1 pageIsrael Bible MapMoses_JakkalaPas encore d'évaluation

- Cycling Coaching Guide. Cycling Rules & Etiquette Author Special OlympicsDocument20 pagesCycling Coaching Guide. Cycling Rules & Etiquette Author Special Olympicskrishna sundarPas encore d'évaluation

- Miriam Garcia Resume 2 1Document2 pagesMiriam Garcia Resume 2 1api-548501562Pas encore d'évaluation

- Food and ReligionDocument8 pagesFood and ReligionAniket ChatterjeePas encore d'évaluation

- (Section-A / Aip) : Delhi Public School GandhinagarDocument2 pages(Section-A / Aip) : Delhi Public School GandhinagarVvs SadanPas encore d'évaluation

- Bajaj Allianz General Insurance Company LimitedDocument9 pagesBajaj Allianz General Insurance Company LimitedNaresh ChanchadPas encore d'évaluation

- MadBeard Fillable Character Sheet v1.12Document4 pagesMadBeard Fillable Character Sheet v1.12DiononPas encore d'évaluation

- Chapter 8 - Field Effect Transistors (FETs)Document23 pagesChapter 8 - Field Effect Transistors (FETs)CHAITANYA KRISHNA CHAUHANPas encore d'évaluation

- Methodology Statement - MicropilingDocument5 pagesMethodology Statement - MicropilingRakesh ReddyPas encore d'évaluation

- KaphDocument7 pagesKaphFrater MagusPas encore d'évaluation

- Costco Case StudyDocument3 pagesCostco Case StudyMaong LakiPas encore d'évaluation

- GeM Bidding 2920423 - 2Document4 pagesGeM Bidding 2920423 - 2Sulvine CharliePas encore d'évaluation

- BAFINAR - Midterm Draft (R) PDFDocument11 pagesBAFINAR - Midterm Draft (R) PDFHazel Iris Caguingin100% (1)

- AOM NO. 01-Stale ChecksDocument3 pagesAOM NO. 01-Stale ChecksRagnar Lothbrok100% (2)

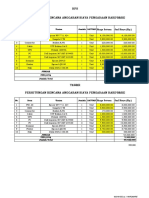

- HPS Perhitungan Rencana Anggaran Biaya Pengadaan Hardware: No. Item Uraian Jumlah SATUANDocument2 pagesHPS Perhitungan Rencana Anggaran Biaya Pengadaan Hardware: No. Item Uraian Jumlah SATUANYanto AstriPas encore d'évaluation