Académique Documents

Professionnel Documents

Culture Documents

10 Days Research and Valuation Programme' - : Training The Capital Markets and

Transféré par

AKSHAY SINGHDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

10 Days Research and Valuation Programme' - : Training The Capital Markets and

Transféré par

AKSHAY SINGHDroits d'auteur :

Formats disponibles

India office of

Training the Capital Markets Aspirants and Participants®

10 Days ‘Research and Valuation Programme’ – 18 July 2010

(Programme runs from 1000 hrs to 1700 hrs) (Training based on MS Excel and MS PowerPoint)

About The Programme ☞ Personal attention to every delegate

The 10 days ‘Research and Valuation ☞ Weekend Programmes model suitable for all – professionals or students

Programme’ is designed to provide

delegates with a comprehensive ☞ Intensive step-by-step classroom training programmes to understand capital markets

understanding of investment banking and its diversified domains

techniques, equity research, and capital

markets. Designed by Investment ☞ Dynamic, highly practical & interactive training programmes with real life case studies

bankers and industry experts, this

☞ Decode Financial jargon and uncover popular misconception

programme plugs the gap between

theoretical concepts learned during ☞ Over 130 hours of training including +75 hours in classroom

academic degrees/diplomas and on-the-

job application of those concepts. During ☞ Be Competitive and differentiate yourself in the world of competition

the 10 days delegates will learn

☞ Get Certified from ARC Academia – Wall St. Training

Valuation techniques used to value a

public and private company

Fee: USD 550 / INR 25,000*

Preparation of pitch books for Buy Duration: 10 Days / 5 Weekends (Saturdays and Sundays)

side/Sell side and IPOs

Starting Date: 18th July 2010 (Sunday)

How to write equity research reports Time: 10 a.m. to 5 p.m.

and sector reports

Venue: Hotel Spice Art, PrabhatKiran Building, Rajendra Place, New Delhi

Mergers and Acquisitions, and

* USD 500 / INR 22,500 for registration before 30th June 2010

Restructuring activities

* Plus Taxes as applicable

+91 11 4562 2127 +91 99 5372 9651 arc.india@wallst-training.com www.arc-academia.com

India office of

Training the Capital Markets Aspirants and Participants®

Programme Structure and Training Methodology

The program is structured to make the delegates well versed with the fundamentals before moving on to Valuation

Presentation and Interviews

Basics and Essentials Excel Based Training

Report Writing Preparations

10% 50% 30% 10%

Excel Shortcuts Trading Comps Company Profiles Mock Interviews with

Financial Statement Analysis Deal / Transaction Comps Equity Research Report Investment Bankers

Ratios Analysis Financial Modeling Sector Analysis Resume Preparation

DCF Valuation Pitch Book

Merger Models Buy Side

Sell Side

IPO and PE

Sample Templates we use for training programmes

Excel Template 1 Excel Template 2 PowerPoint Template 1 PowerPoint Template 2

+91 11 4562 2127 +91 99 5372 9651 arc.india@wallst-training.com www.arc-academia.com

India office of

Training the Capital Markets Aspirants and Participants®

Past delegates from

Programme Directors

ABN Amro

Barclays Tapan Jindal Manoj Goel

Capital IQ Expertise in Equity Research, Valuation and Equity Expertise in Corporate Valuation, Financial Modeling

Citi Group Fund Raising & Investment Banking

Ernst & Young Prior experience: Fidelity Investments, and iGATE Prior experience: Goldman Sachs, and Time Private

EXL Services Global Solutions Equity

GMR Infra Youngest author in history of ICAI for his book on

auditing

Jubilant Energy

Morning Star

McKinsey & Co. Himanshu Jain David Kovacs

Onicra Exquisite experience in financial research, consulting Vast experience in Mergers and Acquisitions, PE and

Real Growth and private equity VC Fund raising activities

Reliance Infrastructure Prior experience: McKinsey & Co. Expertise in Real Estate, Entertainment, Energy and

Reliance Life Insurance Healthcare Sectors

RR Investors

Sobhagya Capital

Solitaire Capital

Standard Chartered

Who Can Benefit

On the successful completion of our class

UBS room training programmes, get a worldwide Current finance professionals looking to advance career

recognised certification from Professionals looking to career transition into finance

Anyone interested in finance & looking to learn analysis

ARC Academia – Wall St. Training

College or business school students

Corporations and employees

+91 11 4562 2127 +91 99 5372 9651 arc.india@wallst-training.com www.arc-academia.com

India office of

Training the Capital Markets Aspirants and Participants®

Basic Concepts Company Profiles Equity Research Sector Research

Financial Statement Corporate Overview Initiating Coverage Overview

Analysis Reports

Segment Analysis Geographical

Ratio Analysis Operating Metrics

• Investment Thesis concentration ☞ Training modules

Different Company Filings • Target Price Industry Evolution replicate exactly how it

Market Performance

• Recommendations Key Players is done by analysts

Enterprise Value (EV) Competitive Landscape

• Business Analysis Trends

across the Globe

Last Twelve Months SWOT Analysis

• Financial Analysis Sector Analysis

Diluted Shares Key Financial Numbers

Equity Flash Notes

☞ Excel training is not a

one-time event but an

Trading Comps Transaction Comps Financial Modeling - DCF Financial Modeling - 2 ongoing process

Choosing right peer group Choosing right set of Overview of Modeling SOTP Valuation throughout the

deals programme

Adjusted / clean numbers Forecast of Financials DDM Valuation

Transaction Value vs.

Diluted Shares Free Cash Flows

EV

Key multiples WACC ☞ Build and create your

Key multiples

Application of multiples Terminal Value own financial models

Application of multiples

Sector specific multiples Fair Value Calculation

Clean/Adjusted

Sensitivity analysis

☞ Top-down approach

Numbers

for financial

Mergers and Acquisitions Pitch Books and IM Fund Raising Activities Others statements and

Steps involved Information IPOs MS-Excel analysis

memorandum

Synergy analysis Private Equity (PE) MS-Power Point

Buy/Sell side Pitch Book

Accretion/Dilution model Venture Capital (VC) Mock Interviews

Resume

Preparation

+91 11 4562 2127 +91 99 5372 9651 arc.india@wallst-training.com www.arc-academia.com

India office of

Training the Capital Markets Aspirants and Participants®

Basic Financial Concepts – Financial Statements and Ratio Analysis

Format: 100% Excel

This is not an Accounting class, but rather, is a customized refresher to the basics of financial statements – income statement, balance

sheet and cash flow statements. This is equally fit for people coming from non-commerce backgrounds. It starts with different types of

company filings and ends up with learning the relevant sections to be used for analysing a company. This session is must before one can

move to valuation methodologies.

What Delegates learn

What are the different types of company filings in different countries (Annual or half yearly or quarterly) and how to analyse them

What all sources to be used for analysing a company (investors presentations, earnings transcripts etc)

Key Items of financial statements like Revenues, Operating Profits (EBIT), EBITDA, Net Profits, Cash & Cash Equivalents, Total Debt

etc

What are the operating metrics for a particular company like ARPU and No. of subscribers for a telecom company

Overview and explanation of major financial ratios including Return on Equity, Debt to Equity, Price to Earnings, Earnings Per Share

Can Debt to Equity ratio be calculated on market values and not book value

Why ‘Trailing Twelve Months’ play an important role in analyzing a company

Excel Training (Basic and Advanced like V-lookup, array functions, pivot tables)

+91 11 4562 2127 +91 99 5372 9651 arc.india@wallst-training.com www.arc-academia.com

India office of

Training the Capital Markets Aspirants and Participants®

Relative Valuation – Analysis of Selected Publicly Trading Companies

Format: 100% Excel

Company Comparable Analysis / Trading Comps analysis is one of the most critical functions of any financial analyst. This method utilizes

benchmark multiples based on publicly traded companies. It is important to note that trading multiples do not reflect control premiums or potential

synergies from a buyer. Mastering thisjob is crucial to success in capital markets, whether you are in investment banking, equity research, or

asset management. This excel-based hands-on teaches you to analyze and compare publicly traded companies from a relative valuation

perspective, focusing on current market valuation and trading multiples.

What Delegates learn

How to choose right set of peers; comparing ‘apples to apples’

Normalizing financials for extraordinary items, non-recurring and restructuring charges

What is Enterprise Value (EV) and how it is different from Equity Value

Can EV be negative; if yes then how do I value a company

Treasury Method of calculating diluted shares outstanding (dilution impact of ESOPs, Convertible bonds / debentures etc)

Analyzing multiples (Trading and market based) (e.g. why EV/EBITDA is preferred over P/E)

+91 11 4562 2127 +91 99 5372 9651 arc.india@wallst-training.com www.arc-academia.com

India office of

Training the Capital Markets Aspirants and Participants®

Financial Modeling & DCF Valuation

Format: 100% Excel

Excel based Financial Modeling starts with creation of a top-down income statement projection model. Then, construct a basic discounted cash

flow analysis on top of your projection model. This Excel-based class provides a non-academic, real-world, hands-on primer to the quantitative

and technical aspects of financial modeling. The DCF approach is among the most scientific and theoretically precise valuation methodologies

because it relates specifically to the profitability and growth of the business being valued.

What Delegates learn

Preparation of a top down income statement based on historical numbers with data flowing to cash flow statement and balance sheet

automatically

How to project financials for next 5 years of a company

How to calculate Free cash flows to firm

How to calculate Weighted average cost of capital (WACC) and CAPM (Capital Asset Pricing Model)

Calculation of Terminal Value

How to calculate Present value of forecasted numbers in excel

How to drive Intrinsic value per share; intrinsic value is not the target price per share

Sensitivity Analysis and why it is important

+91 11 4562 2127 +91 99 5372 9651 arc.india@wallst-training.com www.arc-academia.com

India office of

Training the Capital Markets Aspirants and Participants®

Company Profile

Format: 100% PowerPoint

Most of the delegates aspire to work in research houses, investment banks, PE firms, consulting firms, as an analyst etc. Whether any

professional works in a research houses, investment banks, PE firms, consulting firm, they ought to be comfortable with preparation of a

company profile which could be as small as one pager or as detailed as a 20-25 pager. This is a work which corporate expect delegates to

be comfortable right from the time they are onboard. So it’s paramount that delegates learn making it. Session starts with discussing about

contents of a company profile and ends with a real time case study of preparation of a company profile in a template.

What Delegates learn

What are the key sections in a company profile

Where all to find information for those sections in company profile

Common templates which are used in preparation of a company profile and otherwise

How to analyze the competition and conduct competitive benchmarking

What is an operating matrix and what information should be captured in it

How to do the SWOT for a company

Getting comfortable with preparing graphs and tables in a PowerPoint , how to rebase the data and how to analyze them

What are company’s strategy and how to incorporate that in a profile

A real time practical assignment is given to the delegates for them to prepare a company profile within the deadline specified

+91 11 4562 2127 +91 99 5372 9651 arc.india@wallst-training.com www.arc-academia.com

India office of

Training the Capital Markets Aspirants and Participants®

Sector Analysis

Format: 100% PowerPoint

The next level to company profiles is sector analysis. Once, delegates have grasped the intricacies of a company, one has to go more

granular understanding about an industry in which a company operates. This is essential to do a holistic analysis because it is critical for

any research to see how the industry behaves and what all factors influence it. Based on their domain knowledge, delegates aspire to

become knowledge experts in a particular sector in their career(s). Session starts with discussing about contents of a sector analysis and

ends with a real time case study of preparation of a sector in an independent template.

What Delegates learn

What are the different parameters for a sector analysis

Where all to find information about different parameters

How to analyze a particular sector

What all is covered in an operating matrix and how to do operational benchmarking

Discussing 3 sectors with inputs from delegates

Discussing a complete report on a particular sector

A real time practical assignment is given to the delegates to prepare a sector report within the deadline specified

+91 11 4562 2127 +91 99 5372 9651 arc.india@wallst-training.com www.arc-academia.com

India office of

Training the Capital Markets Aspirants and Participants®

Mergers and Acquisitions

Format: 50% Excel and 50% PowerPoint

This session focuses on the mergers and acquisitions process, the basics of deal structures and covers the main tools and analysis that

M&A Investment bankers use. Session start with common structural issues, crucial merger consequence analysis, structures,

methodologies and accelerates by creating a merger model.

What Delegates learn

Common structural issues in a transaction

Review of various deal considerations and deal structuring options (cash vs. stock)

Merger consequence analysis including accretion / dilution and financial implications of a deal

How to sensitize financial projections and the financial impact on a transaction

Merger consequence analysis including accretion / dilution and financial implications of a deal

Delegates build a fully functional accretion / dilution model that accounts for different transaction structures

+91 11 4562 2127 +91 99 5372 9651 arc.india@wallst-training.com www.arc-academia.com

India office of

Training the Capital Markets Aspirants and Participants®

Transaction Comps

Format: 100% Excel

Transaction / Deal Comps is another critical function an analyst should master. Deal Comps or Analysis of Selected Acquisitions are very

similar to trading comps except deal comps multiples are based on the transactions happened in past compared to trading comps where

the multiples are calculated based on current trading price of publicly traded companies. This hands-on, Excel-based class teaches you to

analyze and compare the transactions happened in the industry in past to aid the future transactions.

What Delegates learn

How to choose right set of transactions; comparing ‘apples to apples’

Calculate transaction value (purchase price), premiums and multiples in past deals

Enterprise Value vs Transaction Value

SOTP Valuation

Format: 100% Excel

SOTP valuation technique is used to value a conglomerate where a group is involved in different line of business activities. In this case we

value different part of group separately and then sum those valuation at arrive at the group valuation.

What Delegates learn

How to bifurcate the group in different segments/businesses

How to value each part of group separately

How to consolidate the valuation of different part to arrive at group valuation

+91 11 4562 2127 +91 99 5372 9651 arc.india@wallst-training.com www.arc-academia.com

India office of

Training the Capital Markets Aspirants and Participants®

Pitch Book

Format: 100% PowerPoint

The delegates have learnt all about sectors, industry, financial modeling so far. What is the next step? Ultimately, it all boils down to making

sales. So, delegates have to learn how to pitch to prospective clients and how the knowledge gained so far is ultimately applied. Session

starts with discussing about pitch book contents and ends with a real time case study of preparation of a pitch book in an independent

template.

What Delegates learn

How to prepare a pitch book (Buy side, Sell side) and what all is covered in the same

What all discussions take place during a pitch and how these are addressed

A real time practical assignment is given to the delegates for them to prepare a pitch book

Mock Interviews

Format: N/A

A real time environment of an actual interview is created and delegates are subjected to the rigors of one to one personal interview for

them to have hands on live experience . This is a real ‘Trial by fire’ for them. A personal one to one feedback and a group feedback is

given to all the delegates post the interview

What Delegates learn

How to prepare and appear for an interview and what all it takes to crack it

How to use the mix of soft and hard skills and what should be your key selling points to an interviewer

How to duck tricky questions and how to maintain your composure in a grueling interview

+91 11 4562 2127 +91 99 5372 9651 arc.india@wallst-training.com www.arc-academia.com

India office of

Training the Capital Markets Aspirants and Participants®

Equity Research

Format: 100% PowerPoint /MS Word

All the learning over the classes be it financial modeling, transaction comps, valuation, profiling, competitive benchmarking etc ultimately

culminate into preparation of an equity research report. Preparing, collating, analyzing and putting together all the stuff will prepare ground

for preparation of an equity research report. Session starts with discussing about equity research report contents and ends with an

assignment of preparation of an equity research report at home.

What Delegates learn

How to prepare an equity research report

How to build Investment Thesis (Positives and negatives)

Fair value of a stock

Rational for Buy/Sell/Hold recommendation

How to conduct business and financial analysis

How to prepare equity flash notes

A real time equity research report is given to the delegates. On successful completion of the same and after a rigorous quality check

and desired changes if any, the same is uploaded on research databases as Thomson, Bloomberg, Reuters, ISI etc for a global

viewing by analysts across the world

+91 11 4562 2127 +91 99 5372 9651 arc.india@wallst-training.com www.arc-academia.com

India office of

Training the Capital Markets Aspirants and Participants®

Fund Raising Activities

Format: 100% PowerPoint

This session is for learning the various options available for fund raising activities, be it private equity, Initial Public Offering, etc. The

session explores various funding options a angle investing, debt syndication, private equity funding, seed capital, venture capitalist funding.

This session is essential for delegates seeking to explore a career in finance.

What Delegates learn

Various funding options available

What procedures are followed for IPO/Private equity funding

CV Structure and Final Round of Interviews

Format: N/A

We help structure your resume in a professional manner and conduct a final round of interviews. After the rigorous 10 day workshop,

delegates are equipped and imparted with the skill sets and the requisite aptitude . The final round of interviews is a test of their

credentials and learning

What Delegates learn

How to structure their CV

How to take the flow of their interview

It is a test of the skill sets which delegates have learnt over the period of the workshop

How to emerge triumphant in an interview

How to build a successful career

+91 11 4562 2127 +91 99 5372 9651 arc.india@wallst-training.com www.arc-academia.com

India office of

Training the Capital Markets Aspirants and Participants®

10 Days 5 Days - ‘Corporate Valuation &

‘Research and Valuation’ Financial Modeling’

18 July 2010 18 July 2010

22 August 2010 22 August 2010

New Delhi

Mumbai

2 Days ‘Financial Modeling’

19 – 20 June 2010 Mumbai

07 – 08 August 2010 Mumbai

2 Days ‘Financial Modeling’

Bangalore

17 – 18 July 2010 Bangalore

+91 11 4562 2127 +91 99 5372 9651 arc.india@wallst-training.com www.arc-academia.com

India office of

Training the Capital Markets Aspirants and Participants®

Upcoming Training Programmes

10 days ‘Research and Valuation’ – New Delhi 5 days ‘Corporate Valuation and Financial Modeling’ – New Delhi

Starting Date Discount if registered by Starting Date Discount if registered by

18th July 2010 30 June 2010 18th July 2010 30 June 2010

22ndAugust 2010 06 August 2010 22ndAugust 2010 06 August 2010

2 days ‘Financial Modeling’ - Mumbai 2 days ‘Financial Modeling’ - Bangalore

Dates Discount if registered by Dates Discount if registered by

19th and 20th June 30th May 2010 17th and 18th July 2010 30th June 2010

7th and 8th August 20th July 2010

Fee* After Discount*

10 Days USD 550 / INR 25,000 USD 500 / INR 22,500

5 Days USD 315 / INR 14,000 USD 285 / INR 12,600

2 Days USD 180 / INR 8,000 USD 160 / INR 7,200

* Plus taxes as applicable

+91 11 4562 2127 +91 99 5372 9651 arc.india@wallst-training.com www.arc-academia.com

India office of

Training the Capital Markets Aspirants and Participants®

13% 19%

32% 64% 36%

48% 19% 68%

Salaried Entreprenuers

Professionals Pursuing Professionals Commerce Non Commerce

Non Working Students

Employment Status Qualification Graduation Stream

A total of 32% are pursuing for CFA from USA

+91 11 4562 2127 +91 99 5372 9651 arc.india@wallst-training.com www.arc-academia.com

India office of

Training the Capital Markets Aspirants and Participants®

“We Bridge the gap between

Academic Theory and Concepts

&

Real World, On-The-Job

Application”

+91 11 4562 2127 +91 99 5372 9651 arc.india@wallst-training.com www.arc-academia.com

India office of

Training the Capital Markets Aspirants and Participants®

India office of

stands for quality and innovation

in professional education and training,

providing a service to support

businesses and career aspirations

+91 11 4562 2127 +91 99 5372 9651 arc.india@wallst-training.com www.arc-academia.com

India office of

Training the Capital Markets Aspirants and Participants®

India office of

Gateway “to” India, Mumbai Gateway to Investment Banking & Financial

(Mumbai - Financial Capital of India) Markets across the Globe

Your Journey to Wall Street (Investment Banking) begins…

+91 11 4562 2127 +91 99 5372 9651 arc.india@wallst-training.com www.arc-academia.com

Vous aimerez peut-être aussi

- 6 Weeks Investment Banking Training (11 October 2010)Document19 pages6 Weeks Investment Banking Training (11 October 2010)triptinavaniPas encore d'évaluation

- Stock Market BrochureDocument8 pagesStock Market BrochureDevansh AgarwalPas encore d'évaluation

- PGP IB Capital MarketsDocument20 pagesPGP IB Capital MarketsrahulnationalitePas encore d'évaluation

- PGP IB Capital Markets PDFDocument20 pagesPGP IB Capital Markets PDFMeet BhattiPas encore d'évaluation

- Financial Modeling Brochure - F 2021Document5 pagesFinancial Modeling Brochure - F 2021Ayush UpadhyayPas encore d'évaluation

- Domain Organization Benefits Key ExpertiseDocument5 pagesDomain Organization Benefits Key Expertisesaurabh patankarPas encore d'évaluation

- Nishant Deshmukh-1 PDFDocument3 pagesNishant Deshmukh-1 PDFSamar SinghPas encore d'évaluation

- The Complete Guide To Business and Finance CareersDocument40 pagesThe Complete Guide To Business and Finance CareersOleg KrasovPas encore d'évaluation

- Post Graduate Certificate Program in Investment Banking in Collaboration With LGCADocument17 pagesPost Graduate Certificate Program in Investment Banking in Collaboration With LGCAsanket shikharPas encore d'évaluation

- Investment Banking & Capital Markets: Post Graduation Program inDocument8 pagesInvestment Banking & Capital Markets: Post Graduation Program inRose martinPas encore d'évaluation

- FM Ebook EmailDocument13 pagesFM Ebook EmailVvb SatyanarayanaPas encore d'évaluation

- Equity Research Financial ModelingDocument6 pagesEquity Research Financial Modelingdevansh raghuwanshiPas encore d'évaluation

- Alternative Investments WorkshopDocument3 pagesAlternative Investments WorkshopansarialiPas encore d'évaluation

- Financial Modeling ProgramDocument8 pagesFinancial Modeling ProgramShashank MoroliaPas encore d'évaluation

- Upgrad Campus - Financial Modelling & Analysis Program With PWC IndiaDocument11 pagesUpgrad Campus - Financial Modelling & Analysis Program With PWC Indiarakesh naskarPas encore d'évaluation

- Financial Modeling Elearning TrainingDocument8 pagesFinancial Modeling Elearning TrainingRishabh TalwarPas encore d'évaluation

- Resume CFA PDFDocument2 pagesResume CFA PDFgaurav mehraPas encore d'évaluation

- Financial Modeling 5 Jan 2023Document5 pagesFinancial Modeling 5 Jan 2023Archit SharmaPas encore d'évaluation

- CSR Program Certificate in Financial Markets and FintechDocument6 pagesCSR Program Certificate in Financial Markets and FintechKhan Shadab -27Pas encore d'évaluation

- IIM Ahmedabad FII PDFDocument20 pagesIIM Ahmedabad FII PDFnamgapPas encore d'évaluation

- Investment Banking Institute Brochure - 1Document9 pagesInvestment Banking Institute Brochure - 1MEGPas encore d'évaluation

- Sample Resume For Students With Previous ExperienceDocument3 pagesSample Resume For Students With Previous ExperienceAakash AakashPas encore d'évaluation

- Financial Modeling: It'S Easier To Save Paper Than Planting TreesDocument8 pagesFinancial Modeling: It'S Easier To Save Paper Than Planting TreesAbhishek GuptaPas encore d'évaluation

- ABHINAV JAIN'S RESUMEDocument2 pagesABHINAV JAIN'S RESUMEAbhinav JainPas encore d'évaluation

- Asta kariDocument1 pageAsta karivishwanath286699Pas encore d'évaluation

- UntitledDocument32 pagesUntitledUrban Monkey 2Pas encore d'évaluation

- Resume 20 - 20dev 20koyaDocument1 pageResume 20 - 20dev 20koyaVaibhav VermaPas encore d'évaluation

- Senryaku - Research 0 Advisory - Introduction DocumentDocument31 pagesSenryaku - Research 0 Advisory - Introduction Documentsingh.shivshanker3645Pas encore d'évaluation

- CFX Orientation Presentation 17 August 2023Document30 pagesCFX Orientation Presentation 17 August 2023poojasoni2015gtPas encore d'évaluation

- ValueAdd - Sell-Side Equity Research (June 2017)Document13 pagesValueAdd - Sell-Side Equity Research (June 2017)Valueadd ResearchPas encore d'évaluation

- Resume of Niladri Chakraborty-5Document1 pageResume of Niladri Chakraborty-5Aakansha DPas encore d'évaluation

- Information Sheet 2019Document4 pagesInformation Sheet 2019shalini priyaPas encore d'évaluation

- Mba Finance BrochureDocument14 pagesMba Finance BrochureMANISH KUMARPas encore d'évaluation

- Stock Pitch InformationDocument30 pagesStock Pitch InformationBudhil KonankiPas encore d'évaluation

- Corporate Overview - Oxane PartnersDocument12 pagesCorporate Overview - Oxane PartnersUtkarsh RastogiPas encore d'évaluation

- AXIS-BANKWealth-management - EDIT G9Document119 pagesAXIS-BANKWealth-management - EDIT G9AnupPas encore d'évaluation

- The Complete Guide To Careers in Business & FinanceDocument37 pagesThe Complete Guide To Careers in Business & FinanceJakePas encore d'évaluation

- Annual Placement Report 2020 2021Document12 pagesAnnual Placement Report 2020 2021shoba harikrishnaPas encore d'évaluation

- Graduate CV Template1Document2 pagesGraduate CV Template1mihir joshiPas encore d'évaluation

- Sanchit Mehrotra: Work Experience SkillsDocument1 pageSanchit Mehrotra: Work Experience SkillsSanchit MehrotraPas encore d'évaluation

- 'Annexure-14 Report On Summer Training A Study On Employee Welfare in The KitesDocument52 pages'Annexure-14 Report On Summer Training A Study On Employee Welfare in The KitesRamneet kaur (Rizzy)Pas encore d'évaluation

- Brochure PGCPIBDocument8 pagesBrochure PGCPIBRuhani RathorePas encore d'évaluation

- IT Consultant Seeking New OpportunitiesDocument2 pagesIT Consultant Seeking New OpportunitiesAmitPas encore d'évaluation

- Data Analytics v2 Brochure SkillovillaDocument40 pagesData Analytics v2 Brochure Skillovillarishabh vermaPas encore d'évaluation

- Firebird Student Brochure Batch 2 - Final - PDFDocument64 pagesFirebird Student Brochure Batch 2 - Final - PDFJc Duke M EliyasarPas encore d'évaluation

- Project Report On EquityDocument77 pagesProject Report On Equityaashish vermaPas encore d'évaluation

- Financial Modeling & Equity Valuation - FinaticsDocument3 pagesFinancial Modeling & Equity Valuation - Finaticsrslamba1Pas encore d'évaluation

- 7+ Years P&C Insurance Business AnalystDocument3 pages7+ Years P&C Insurance Business AnalystSashank VarmaPas encore d'évaluation

- LD Axis BankDocument14 pagesLD Axis BankZenish KhumujamPas encore d'évaluation

- RBV-VRIO - v1.0 - Share-2021Document30 pagesRBV-VRIO - v1.0 - Share-2021Adithya MPas encore d'évaluation

- Bharat Final CVDocument1 pageBharat Final CV2087 BHARAT SHARMAPas encore d'évaluation

- Financial Analytics, Valuation and Risk ManagementDocument16 pagesFinancial Analytics, Valuation and Risk ManagementMayank KhuranaPas encore d'évaluation

- Synergy - IIM Calcutta Job Description FormDocument2 pagesSynergy - IIM Calcutta Job Description FormAnanya DevPas encore d'évaluation

- Sakshi Luthra CVDocument2 pagesSakshi Luthra CVSakshi GuptaPas encore d'évaluation

- Risk Management by Protiviti X MentorKartDocument14 pagesRisk Management by Protiviti X MentorKartShubam VermaPas encore d'évaluation

- ACUITE RATINGS AND RESEARCH - PowerPoint PresentatonDocument28 pagesACUITE RATINGS AND RESEARCH - PowerPoint Presentatonmpk srihariPas encore d'évaluation

- Ambit - IIM Calcutta Job Description FormDocument2 pagesAmbit - IIM Calcutta Job Description Formdeepakcool208Pas encore d'évaluation

- Ultra HNI clients and senior management for banking servicesDocument5 pagesUltra HNI clients and senior management for banking servicessourav84Pas encore d'évaluation

- The Enterprise Business Analyst: Developing Creative Solutions to Complex Business ProblemsD'EverandThe Enterprise Business Analyst: Developing Creative Solutions to Complex Business ProblemsPas encore d'évaluation

- Agile and Business Analysis: Practical guidance for IT professionalsD'EverandAgile and Business Analysis: Practical guidance for IT professionalsPas encore d'évaluation

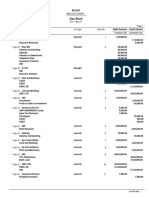

- Model 1391767983115 PDFDocument104 pagesModel 1391767983115 PDFAKSHAY SINGHPas encore d'évaluation

- DocumentDocument53 pagesDocumentAKSHAY SINGHPas encore d'évaluation

- Cap Brok QueryDocument4 pagesCap Brok QueryAKSHAY SINGHPas encore d'évaluation

- CmonthlyDocument4 pagesCmonthlyAKSHAY SINGHPas encore d'évaluation

- 4 Days Equity - Analyst - BrochureDocument3 pages4 Days Equity - Analyst - BrochureAKSHAY SINGHPas encore d'évaluation

- Election Result 2012Document9 pagesElection Result 2012Anil Hightech TitanPas encore d'évaluation

- Applied Mathematical Finance Engineers BrochureDocument12 pagesApplied Mathematical Finance Engineers BrochureAKSHAY SINGHPas encore d'évaluation

- BuyDocument3 pagesBuyAKSHAY SINGHPas encore d'évaluation

- Double VisionDocument6 pagesDouble VisionKeshav AgarwalPas encore d'évaluation

- Tom English Accounts PDFDocument8 pagesTom English Accounts PDFSuttonFakesPas encore d'évaluation

- PHA Training - Day 2Document75 pagesPHA Training - Day 2ahmad jamalPas encore d'évaluation

- TERM DEPOSIT ADVICEDocument1 pageTERM DEPOSIT ADVICEamirunnbegamPas encore d'évaluation

- Umang UG Fest Brochure PDFDocument8 pagesUmang UG Fest Brochure PDFDebarshee MukherjeePas encore d'évaluation

- Scribd Robert KuokDocument3 pagesScribd Robert KuokRavi Kumar Nadarashan0% (2)

- Sbi Code of ConductDocument5 pagesSbi Code of ConductNaved Shaikh0% (1)

- Inc 33 MOADocument6 pagesInc 33 MOASuryaChummaPas encore d'évaluation

- SMART DISHA ACADEMY CAPITAL MARKET AND DERIVATIVE MARKET MODULE TESTDocument7 pagesSMART DISHA ACADEMY CAPITAL MARKET AND DERIVATIVE MARKET MODULE TESTVaghela RavisinhPas encore d'évaluation

- EconomicsDocument10 pagesEconomicsSimon ShPas encore d'évaluation

- Day Book 2Document2 pagesDay Book 2The ShiningPas encore d'évaluation

- Opportunity Cost For Decision MakingDocument5 pagesOpportunity Cost For Decision MakingAthar AhmadPas encore d'évaluation

- Operational Effectiveness + StrategyDocument7 pagesOperational Effectiveness + StrategyPaulo GarcezPas encore d'évaluation

- Test Bank For Accounting Principles 12th Edition WeygandtDocument37 pagesTest Bank For Accounting Principles 12th Edition Weygandtdupuisheavenz100% (13)

- Risk Management Learning DiaryDocument27 pagesRisk Management Learning DiaryUbed AhmedPas encore d'évaluation

- Saint GobainDocument85 pagesSaint Gobainkannankavin100% (2)

- Workmen's Compensation Act 1923 (HR)Document18 pagesWorkmen's Compensation Act 1923 (HR)Rahul AcharyaPas encore d'évaluation

- Differences Between Sole ProprietorshipDocument5 pagesDifferences Between Sole ProprietorshipUsman KhalidPas encore d'évaluation

- Software Asssociates11Document13 pagesSoftware Asssociates11Arslan ShaikhPas encore d'évaluation

- Para ImprimirDocument2 pagesPara ImprimirZymafayPas encore d'évaluation

- IATF Internal Auditor 2019Document1 pageIATF Internal Auditor 2019Prakash kumarTripathiPas encore d'évaluation

- Cayetano vs. Monsod - G.R. No. 100113 September 3, 1991Document21 pagesCayetano vs. Monsod - G.R. No. 100113 September 3, 1991Cyna Marie A. Franco100% (2)

- International Journal of Euro-Mediterranean Studies, Volume 3, 2010, Number 1Document164 pagesInternational Journal of Euro-Mediterranean Studies, Volume 3, 2010, Number 1goblin1313Pas encore d'évaluation

- Golden Era May Arrive Soon For Indian Oil RefinersDocument2 pagesGolden Era May Arrive Soon For Indian Oil RefinersAnil SelarkaPas encore d'évaluation

- Cobb-Douglas Production Function ExplainedDocument8 pagesCobb-Douglas Production Function ExplainedMgmtScieEco WPas encore d'évaluation

- QA System KMC AS7Document76 pagesQA System KMC AS7Rayudu VVSPas encore d'évaluation

- Form 6 (Declaration of Compliance)Document1 pageForm 6 (Declaration of Compliance)Zaim AdliPas encore d'évaluation

- Ias8 PDFDocument3 pagesIas8 PDFNozipho MpofuPas encore d'évaluation

- Oligopoly For MPADocument41 pagesOligopoly For MPAAshraf Uz ZamanPas encore d'évaluation

- Ghaziabad Development Authority Vs Balbir SinghDocument2 pagesGhaziabad Development Authority Vs Balbir SinghHimanshu KanaujiaPas encore d'évaluation

- Agora - Managing Supply ChainDocument25 pagesAgora - Managing Supply Chainabid746Pas encore d'évaluation