Académique Documents

Professionnel Documents

Culture Documents

QNo 16

Transféré par

Rashid JalalTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

QNo 16

Transféré par

Rashid JalalDroits d'auteur :

Formats disponibles

Fama and French started with the observation that two classes of stocks have tended to do better

than the market as a whole: (i) small caps and (ii) stocks with a high book-value-to-price ratio

(customarily called "value" stocks; their opposites are called "growth" stocks). They then added two

factors to CAPM to reflect a portfolio's exposure to these two classes:

Here, in the above equation, Ri is the different of “Portfolio’s return rate (r) and Risk free return (Rf).

Here, Rm is market return on stock and Beta1 is analogous to the classical beta but not equal to it,

since, there are additional two factors which will do some of the works. Further, Size and Values are

"small [cap] minus big" and "high [book/price] minus low"; they measure the historic excess returns

of small caps and "value" stocks over the market as a whole. By the way Size and Value are defined,

the corresponding coefficients Beta2 and b3 take values on a scale of roughly 0 to 1: bs = 1 would be

a small cap portfolio, b2 = 0 would be large cap, b3 = 1 would be a portfolio with a high book/price

ratio.

Vous aimerez peut-être aussi

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Chemical - Covering LetterDocument1 pageChemical - Covering LetterRashid JalalPas encore d'évaluation

- Registration - No Name Total Assessment Marks Assessment Questions Total Question Marks Mapping ClosDocument2 pagesRegistration - No Name Total Assessment Marks Assessment Questions Total Question Marks Mapping ClosRashid JalalPas encore d'évaluation

- FN281 Financial Management QuestionsDocument10 pagesFN281 Financial Management QuestionsRashid JalalPas encore d'évaluation

- Laser Jet Pro PrinterDocument1 pageLaser Jet Pro PrinterRashid JalalPas encore d'évaluation

- References FileDocument3 pagesReferences FileRashid JalalPas encore d'évaluation

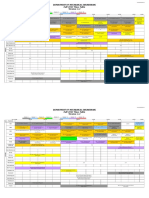

- Time Table v-1.0 UpdatedDocument10 pagesTime Table v-1.0 UpdatedRashid JalalPas encore d'évaluation

- Section Course OutlineDocument1 pageSection Course OutlineRashid JalalPas encore d'évaluation

- As It Happened", The Guardian Business News, 11SEP17Document2 pagesAs It Happened", The Guardian Business News, 11SEP17Rashid JalalPas encore d'évaluation

- Performa For Teacher's Preference of Courses For SPRING 2018 SemesterDocument3 pagesPerforma For Teacher's Preference of Courses For SPRING 2018 SemesterRashid JalalPas encore d'évaluation

- Time Table v-1.2 UpdatedDocument10 pagesTime Table v-1.2 UpdatedRashid JalalPas encore d'évaluation

- Time Table-ME-1st Semester (Session 2017)Document1 pageTime Table-ME-1st Semester (Session 2017)Rashid JalalPas encore d'évaluation

- Time Table-ME-1st Semester (Session 2017)Document1 pageTime Table-ME-1st Semester (Session 2017)Rashid JalalPas encore d'évaluation

- Time Table-ME-3rd Semester (Session 2016)Document1 pageTime Table-ME-3rd Semester (Session 2016)Rashid JalalPas encore d'évaluation

- Time Table-ME-5th Semester (Session 2015)Document1 pageTime Table-ME-5th Semester (Session 2015)Rashid JalalPas encore d'évaluation

- Time Table-ME-3rd Semester (Session 2016)Document1 pageTime Table-ME-3rd Semester (Session 2016)Rashid JalalPas encore d'évaluation

- Test Physics Ch#1+2 1st YearDocument2 pagesTest Physics Ch#1+2 1st YearRashid JalalPas encore d'évaluation

- Time Table-ME-7th Semester (Session 2014)Document1 pageTime Table-ME-7th Semester (Session 2014)Rashid JalalPas encore d'évaluation

- Test Physics Ch#13 Test SeesDocument2 pagesTest Physics Ch#13 Test SeesRashid JalalPas encore d'évaluation

- 1st Year Test PHYDocument2 pages1st Year Test PHYRashid JalalPas encore d'évaluation

- Test Ch#3 1st YearDocument3 pagesTest Ch#3 1st YearRashid Jalal100% (1)

- Physics 1st YearDocument2 pagesPhysics 1st YearRashid JalalPas encore d'évaluation

- Physics 1st Year TestDocument3 pagesPhysics 1st Year TestRashid JalalPas encore d'évaluation

- Physics 1st YearDocument2 pagesPhysics 1st YearRashid JalalPas encore d'évaluation

- Physics 2nd Year TestDocument3 pagesPhysics 2nd Year TestRashid JalalPas encore d'évaluation

- 1st Year Test PHYDocument2 pages1st Year Test PHYRashid Jalal100% (2)

- Physics 1st YearDocument2 pagesPhysics 1st YearRashid Jalal100% (1)

- Physics 1st YearDocument2 pagesPhysics 1st YearRashid JalalPas encore d'évaluation

- Chemistry 1st Year TestDocument3 pagesChemistry 1st Year TestRashid JalalPas encore d'évaluation

- Physics 1st YearDocument2 pagesPhysics 1st YearRashid Jalal100% (1)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)