Académique Documents

Professionnel Documents

Culture Documents

Before You Begin:: Earned Income Credit

Transféré par

stylenzTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Before You Begin:: Earned Income Credit

Transféré par

stylenzDroits d'auteur :

Formats disponibles

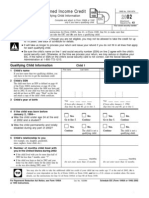

SCHEDULE EIC Earned Income Credit 1040A ◀

OMB No. 1545-0074

(Form 1040A or 1040)

Qualifying Child Information

2015

..........

1040

▶ Complete and attach to Form 1040A or 1040 only if you have a qualifying child.

Department of the Treasury ▶ EIC Attachment

Information about Schedule EIC (Form 1040A or 1040) and its instructions is at www.irs.gov/scheduleeic.

Internal Revenue Service (99) Sequence No. 43

Name(s) shown on return Your social security number

• See the instructions for Form 1040A, lines 42a and 42b, or Form 1040, lines 66a and 66b, to make

Before you begin: sure that (a) you can take the EIC, and (b) you have a qualifying child.

• Be sure the child’s name on line 1 and social security number (SSN) on line 2 agree with the child’s social security card.

Otherwise, at the time we process your return, we may reduce or disallow your EIC. If the name or SSN on the child’s

social security card is not correct, call the Social Security Administration at 1-800-772-1213.

▲

!

CAUTION

• You can't claim the EIC for a child who didn't live with you for more than half of the year.

• If you take the EIC even though you are not eligible, you may not be allowed to take the credit for up to 10 years. See the instructions for details.

• It will take us longer to process your return and issue your refund if you do not fill in all lines that apply for each qualifying child.

Qualifying Child Information Child 1 Child 2 Child 3

1 Child’s name First name Last name First name Last name First name Last name

If you have more than three qualifying

children, you have to list only three to get

the maximum credit.

2 Child’s SSN

The child must have an SSN as defined in

the instructions for Form 1040A, lines 42a

and 42b, or Form 1040, lines 66a and 66b,

unless the child was born and died in

2015. If your child was born and died in

2015 and did not have an SSN, enter

“Died” on this line and attach a copy of

the child’s birth certificate, death

certificate, or hospital medical records.

3 Child’s year of birth

Year Year Year

If born after 1996 and the child is If born after 1996 and the child is If born after 1996 and the child is

younger than you (or your spouse, if younger than you (or your spouse, if younger than you (or your spouse, if

filing jointly), skip lines 4a and 4b; filing jointly), skip lines 4a and 4b; filing jointly), skip lines 4a and 4b;

go to line 5. go to line 5. go to line 5.

4 a Was the child under age 24 at the end of

2015, a student, and younger than you (or Yes. No. Yes. No. Yes. No.

your spouse, if filing jointly)?

Go to Go to line 4b. Go to Go to line 4b. Go to Go to line 4b.

line 5. line 5. line 5.

b Was the child permanently and totally

disabled during any part of 2015?

Yes. No. Yes. No. Yes. No.

Go to The child is not a Go to The child is not a Go to The child is not a

line 5. qualifying child. line 5. qualifying child. line 5. qualifying child.

5 Child’s relationship to you

(for example, son, daughter, grandchild,

niece, nephew, foster child, etc.)

6 Number of months child lived

with you in the United States

during 2015

• If the child lived with you for more than

half of 2015 but less than 7 months,

enter “7.”

• If the child was born or died in 2015 and months months months

your home was the child’s home for more

than half the time he or she was alive Do not enter more than 12 Do not enter more than 12 Do not enter more than 12

during 2015, enter “12.” months. months. months.

For Paperwork Reduction Act Notice, see your tax Cat. No. 13339M Schedule EIC (Form 1040A or 1040) 2015

return instructions.

Schedule EIC (Form 1040A or 1040) 2015 Page 2

Purpose of Schedule

After you have figured your earned income credit EIC rules, you will not be allowed to take the credit for 2

(EIC), use Schedule EIC to give the IRS information years even if you are otherwise eligible to do so. If you

about your qualifying child(ren). fraudulently take the EIC, you will not be allowed to take

the credit for 10 years. You may also have to pay

To figure the amount of your credit or to have the IRS

penalties.

figure it for you, see the instructions for Form 1040A,

lines 42a and 42b, or Form 1040, lines 66a and 66b. Future developments. For the latest information about

developments related to Schedule EIC (Form 1040A or

Taking the EIC when not eligible. If you take the EIC

1040) and its instructions, such as legislation enacted after

even though you are not eligible and it is determined that

they were published, go to www.irs.gov/scheduleeic.

your error is due to reckless or intentional disregard of the

You may also be able to take the additional child tax credit if your child was your dependent and under age 17 at the end of 2015.

TIP For more details, see the instructions for line 43 of Form 1040A or line 67 of Form 1040.

Qualifying Child

A qualifying child for the EIC is a child who is your . . .

Son, daughter, stepchild, foster child, brother, sister, stepbrother, stepsister, half brother, half sister, or

a descendant of any of them (for example, your grandchild, niece, or nephew)

AND

▼

was . . .

Under age 19 at the end of 2015 and younger than you (or your spouse, if filing jointly)

or

Under age 24 at the end of 2015, a student, and younger than you (or your spouse, if filing jointly)

or

Any age and permanently and totally disabled

AND

▼

Who is not filing a joint return for 2015

or is filing a joint return for 2015 only to claim

a refund of withheld income tax or estimated tax paid

AND

▼

Who lived with you in the United States for more than half

of 2015.

You can't claim the EIC for a child who didn't live with

▲

!

CAUTION

you for more than half of the year, even if you paid most

of the child's living expenses. The IRS may ask you for

documents to show you lived with each qualifying child.

Documents you might want to keep for this purpose

include school and child care records and other records

that show your child's address.

If the child didn't live with you for more than half of the

TIP year because of a temporary absence, birth, death, or

kidnapping, see Exception to time lived with you in the

instructions for Form 1040A, lines 42a and 42b, or Form

1040, lines 66a and 66b.

▲

If the child was married or meets the conditions to be a

!

CAUTION

qualifying child of another person (other than your

spouse if filing a joint return), special rules apply. For

details, see Married child or Qualifying child of more

than one person in the instructions for Form 1040A, lines

42a and 42b, or Form 1040, lines 66a and 66b.

Vous aimerez peut-être aussi

- US Internal Revenue Service: F1040sei - 2002Document2 pagesUS Internal Revenue Service: F1040sei - 2002IRSPas encore d'évaluation

- Family Money, Family Values, and Your Family Legacy.D'EverandFamily Money, Family Values, and Your Family Legacy.Pas encore d'évaluation

- US Internal Revenue Service: F1040sei - 2004Document2 pagesUS Internal Revenue Service: F1040sei - 2004IRSPas encore d'évaluation

- 2007 Schedule EICDocument2 pages2007 Schedule EICFileYourTaxesNow100% (3)

- US Internal Revenue Service: F1040sei - 1994Document2 pagesUS Internal Revenue Service: F1040sei - 1994IRSPas encore d'évaluation

- US Internal Revenue Service: F1040sei - 1999Document2 pagesUS Internal Revenue Service: F1040sei - 1999IRSPas encore d'évaluation

- US Internal Revenue Service: F1040sei - 1991Document2 pagesUS Internal Revenue Service: F1040sei - 1991IRS100% (1)

- In Year Application Form.221647658Document3 pagesIn Year Application Form.221647658vikashpradhanPas encore d'évaluation

- Child Tax Credit: (For Individuals Sent Here From The Form 1040 or 1040A Instructions)Document12 pagesChild Tax Credit: (For Individuals Sent Here From The Form 1040 or 1040A Instructions)IRSPas encore d'évaluation

- BOGFWApp 0809Document2 pagesBOGFWApp 0809DVCfinaidPas encore d'évaluation

- 2324 SFE PFF2 FormDocument20 pages2324 SFE PFF2 FormMarioPas encore d'évaluation

- Bog FW Form English AccessibleDocument4 pagesBog FW Form English AccessiblecarlosPas encore d'évaluation

- US Internal Revenue Service: F1040sei - 1992Document2 pagesUS Internal Revenue Service: F1040sei - 1992IRSPas encore d'évaluation

- Child Benefit Claim Form: Who Should Fill in This FormDocument9 pagesChild Benefit Claim Form: Who Should Fill in This FormNabeel MerchantPas encore d'évaluation

- f8901 AccessibleDocument2 pagesf8901 AccessibleAbhishekPas encore d'évaluation

- Sure Start Maternity Grant: From The Social FundDocument11 pagesSure Start Maternity Grant: From The Social FundKenya GrigorePas encore d'évaluation

- CH2 EnglishDocument9 pagesCH2 EnglishamjadbonusPas encore d'évaluation

- Sfe Application For Dependants Grants Form 1819 oDocument5 pagesSfe Application For Dependants Grants Form 1819 omatuskova.lucie012Pas encore d'évaluation

- Child Benefit Claim Form : Who Should Fill in This FormDocument9 pagesChild Benefit Claim Form : Who Should Fill in This Formஅருண் குமார் விPas encore d'évaluation

- Application Form - One Ilocos SurDocument2 pagesApplication Form - One Ilocos SurPhauline Mhae Sinco BacligPas encore d'évaluation

- Application Child Benefit: WWW - Kela.fi/omakela WWW - Fpa.fi/mittfpa WWW - Kela.fi/familyDocument2 pagesApplication Child Benefit: WWW - Kela.fi/omakela WWW - Fpa.fi/mittfpa WWW - Kela.fi/familypoonampr012Pas encore d'évaluation

- CH2 CH3 Combined For Web English PDFDocument9 pagesCH2 CH3 Combined For Web English PDFLuca CameliaPas encore d'évaluation

- Information To Claim Certain Credits After DisallowanceDocument4 pagesInformation To Claim Certain Credits After DisallowanceJane DoePas encore d'évaluation

- CSO-2399B Benefit Screen ToolDocument3 pagesCSO-2399B Benefit Screen ToolMichelle Morgan100% (1)

- Multi Agency Refferal FormDocument8 pagesMulti Agency Refferal Formphoebe_62002239Pas encore d'évaluation

- 2013-Appendix-2 1-Child-Enrolment-FormDocument15 pages2013-Appendix-2 1-Child-Enrolment-Formapi-311470786Pas encore d'évaluation

- US Internal Revenue Service: p524 - 1995Document12 pagesUS Internal Revenue Service: p524 - 1995IRSPas encore d'évaluation

- Get Ready To File Fafsa-Checklist-2024-25Document2 pagesGet Ready To File Fafsa-Checklist-2024-25api-704591583Pas encore d'évaluation

- US Internal Revenue Service: f8901 AccessibleDocument2 pagesUS Internal Revenue Service: f8901 AccessibleIRSPas encore d'évaluation

- Federal Information Worksheet 2018: Jerry Pryde J JR 570-86-7356 DisabledDocument1 pageFederal Information Worksheet 2018: Jerry Pryde J JR 570-86-7356 Disabledsherrif douchebagPas encore d'évaluation

- T778 Child Care Expenses DeductionDocument4 pagesT778 Child Care Expenses DeductionbatmanbittuPas encore d'évaluation

- Child Benefit - Getting Your Claim Right: Use These Notes To Help YouDocument8 pagesChild Benefit - Getting Your Claim Right: Use These Notes To Help YouolusapPas encore d'évaluation

- Student FinanceDocument50 pagesStudent Financeydhd9nkkfrPas encore d'évaluation

- FAFSA Completion Checklist 2024 - 2025 2Document3 pagesFAFSA Completion Checklist 2024 - 2025 22024masonj05Pas encore d'évaluation

- US Internal Revenue Service: f8814 - 2000Document2 pagesUS Internal Revenue Service: f8814 - 2000IRSPas encore d'évaluation

- US Internal Revenue Service: f8814 - 2001Document2 pagesUS Internal Revenue Service: f8814 - 2001IRSPas encore d'évaluation

- F 1040 NRDocument5 pagesF 1040 NRRobertoGuevaraPas encore d'évaluation

- Request For Fee WaiverDocument11 pagesRequest For Fee WaiverWilma OcampoPas encore d'évaluation

- Description: Tags: 0203ISIRguideapdxADocument4 pagesDescription: Tags: 0203ISIRguideapdxAanon-479415Pas encore d'évaluation

- FEEE Claim FormDocument5 pagesFEEE Claim FormSuresh VadiveluPas encore d'évaluation

- Su717 2004en F PDFDocument5 pagesSu717 2004en F PDFIrene ChrimesPas encore d'évaluation

- 2324 SFE PFF2 Form - 1Document20 pages2324 SFE PFF2 Form - 1MarioPas encore d'évaluation

- STUDENT FINANCE Applcation FormDocument32 pagesSTUDENT FINANCE Applcation FormsachiniePas encore d'évaluation

- Individuals Tax Return - US 2016Document2 pagesIndividuals Tax Return - US 2016Yousef M. AqelPas encore d'évaluation

- CH2 Child Benefit Claim Form Internet 05 17Document9 pagesCH2 Child Benefit Claim Form Internet 05 17i1963877Pas encore d'évaluation

- Format For Enrollment of SponsorshipDocument3 pagesFormat For Enrollment of SponsorshipABHITHA ASHITHA CREATION100% (1)

- Sfe pn1 Form 1415 DDocument36 pagesSfe pn1 Form 1415 DjonPas encore d'évaluation

- Child Reapply App 2011Document2 pagesChild Reapply App 2011Jen Terrian SeidelPas encore d'évaluation

- Secondary Travel Form 2022 2023Document4 pagesSecondary Travel Form 2022 2023Mohammed AnsarPas encore d'évaluation

- Birth Registration - Province of British ColumbiaDocument1 pageBirth Registration - Province of British ColumbiaantonPas encore d'évaluation

- Belval Part 1Document335 pagesBelval Part 1David DworkPas encore d'évaluation

- PN1 Form Student Fiance PDFDocument36 pagesPN1 Form Student Fiance PDFLaviniaPas encore d'évaluation

- TaxReturn PDFDocument24 pagesTaxReturn PDFga80% (5)

- Belval Part 2Document44 pagesBelval Part 2David DworkPas encore d'évaluation

- Doc05 Form 1040aDocument2 pagesDoc05 Form 1040aChandrasekhara Reddy TPas encore d'évaluation

- US Internal Revenue Service: p524 - 1994Document12 pagesUS Internal Revenue Service: p524 - 1994IRSPas encore d'évaluation

- Description: Tags: AppaDocument3 pagesDescription: Tags: Appaanon-630229Pas encore d'évaluation

- Details of Your Child's Care Arrangements: When To Use This FormDocument12 pagesDetails of Your Child's Care Arrangements: When To Use This FormDavidPas encore d'évaluation

- Financial Aid Appeal 1516Document7 pagesFinancial Aid Appeal 1516Dylan AshburnPas encore d'évaluation

- Nepal Binding Constraings Bishwambhar PyakurelDocument16 pagesNepal Binding Constraings Bishwambhar PyakurelAdrian MatssonPas encore d'évaluation

- Master Budget AssignmentDocument11 pagesMaster Budget AssignmentShivam Dhawan0% (1)

- 02 Veterans Federation of The Philippines V ReyesDocument4 pages02 Veterans Federation of The Philippines V ReyesKako Schulze CojuangcoPas encore d'évaluation

- Financial Modelling in Excel - Budgeting and Forecasting BrochureDocument1 pageFinancial Modelling in Excel - Budgeting and Forecasting BrochureSyd Dube100% (1)

- CL2013 16A ExmdpsDocument3 pagesCL2013 16A ExmdpsDadoy AlugrivPas encore d'évaluation

- CA Ipc Most Important Costing TheoryDocument52 pagesCA Ipc Most Important Costing TheoryAnupam BaliPas encore d'évaluation

- Residential Security Coordinator QualificationsDocument1 pageResidential Security Coordinator QualificationsAnonymous 97dbabE5Pas encore d'évaluation

- John K. Hollmann, PE CCE: 2002 AACE International TransactionsDocument7 pagesJohn K. Hollmann, PE CCE: 2002 AACE International TransactionslalouniPas encore d'évaluation

- Use of Correct Budgetary and Expenditure AccountsDocument16 pagesUse of Correct Budgetary and Expenditure AccountsArzo QaderiPas encore d'évaluation

- (2013) Abdel-Kader - What Are Structural Policies PDFDocument2 pages(2013) Abdel-Kader - What Are Structural Policies PDF0treraPas encore d'évaluation

- Lecture 5-6 BudgetingDocument15 pagesLecture 5-6 BudgetingAfzal AhmedPas encore d'évaluation

- Introduction To Cost AccountingDocument4 pagesIntroduction To Cost AccountingNeelabh KumarPas encore d'évaluation

- DBM Circ 2018 8 PDFDocument6 pagesDBM Circ 2018 8 PDFNel HPas encore d'évaluation

- Unidad 1 Presentacion Ley 24156Document41 pagesUnidad 1 Presentacion Ley 24156Lean BaPas encore d'évaluation

- ScavengeDocument162 pagesScavengeIvan GeiryPas encore d'évaluation

- Nifm ProjectDocument34 pagesNifm ProjectDC TPas encore d'évaluation

- Project (IBM Nitu)Document85 pagesProject (IBM Nitu)Nandan JhaPas encore d'évaluation

- FRBM ActDocument12 pagesFRBM ActjashuramuPas encore d'évaluation

- Capital Budgeting Techniques Capital Budgeting TechniquesDocument58 pagesCapital Budgeting Techniques Capital Budgeting TechniquesMuhammad ZeeshanPas encore d'évaluation

- Budget Assignment Template-2Document6 pagesBudget Assignment Template-2WINSTON YATICHPas encore d'évaluation

- Iloilo City Investment CodeDocument8 pagesIloilo City Investment CodeIloilo City Council100% (3)

- T10 - Government AccountingDocument9 pagesT10 - Government AccountingAl Cariaga VelascoPas encore d'évaluation

- Venu (Project)Document5 pagesVenu (Project)Umamaheswara ReddyPas encore d'évaluation

- Defence Account Code 2014 150714 PDFDocument315 pagesDefence Account Code 2014 150714 PDFGaurav Sunny SharmaPas encore d'évaluation

- M250 Total CareDocument6 pagesM250 Total CareAhmad Haziq RamliPas encore d'évaluation

- Budget Operations ManualDocument115 pagesBudget Operations ManualFrank Udinabe SanjaPas encore d'évaluation

- Public Finance AndTaxation R.kitDocument282 pagesPublic Finance AndTaxation R.kitKenyan GPas encore d'évaluation

- FY19 Budget PresentationDocument15 pagesFY19 Budget Presentation13WMAZPas encore d'évaluation

- Goldman Sachs Economic Research - 5 Sept 2018Document9 pagesGoldman Sachs Economic Research - 5 Sept 2018Laely Dian MarlindawatiPas encore d'évaluation

- Bauxite Transfert PricingDocument21 pagesBauxite Transfert PricingEyock PierrePas encore d'évaluation